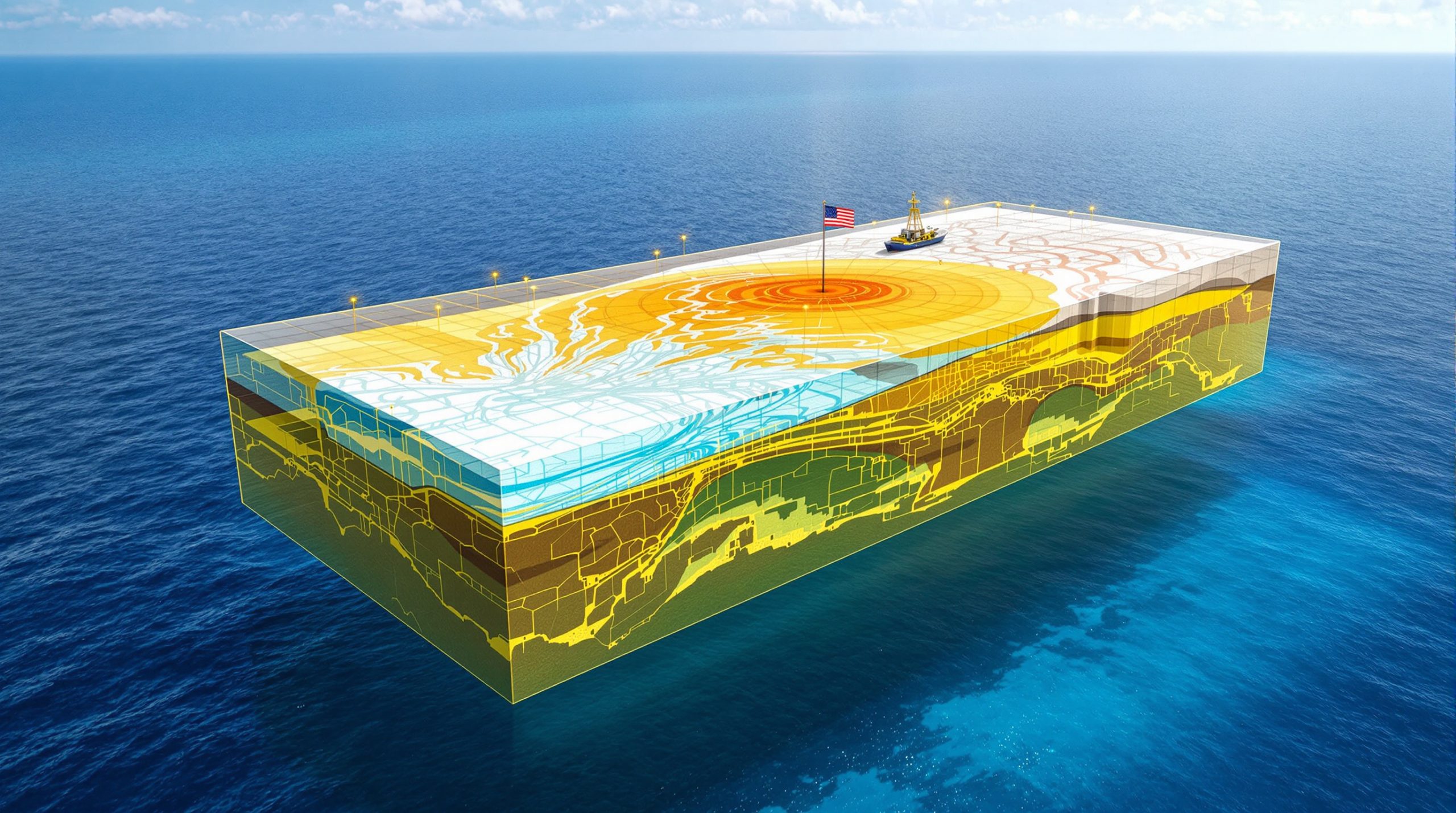

China's rare earth export controls represent a fundamental shift in how critical materials function within global supply chains. The country maintains dominance over approximately 70% of global rare earth element mining production and commands an estimated 85-90% of global rare earth processing capacity, according to data from the U.S. Geological Survey and International Energy Agency. This concentration extends far beyond simple extraction, encompassing the complex technological infrastructure required to transform raw materials into usable industrial inputs. Furthermore, these developments are part of broader concerns about critical minerals energy security that affect nations worldwide.

Rare earth elements comprise 17 lanthanide elements plus scandium and yttrium, forming the backbone of modern technological applications. These materials enable critical functions in permanent magnets for defense systems, phosphors for display technologies, catalysts for chemical processing, and specialised metal alloys for aerospace applications. The strategic value lies not merely in scarcity but in the technical complexity of processing operations, which require specialised environmental remediation capabilities and substantial capital investment.

The transformation from market participant to strategic leveraging tool reflects Beijing's growing confidence in economic statecraft. Morgan Stanley analysts noted in their November 2025 report that Chinese leadership has evolved from hesitation during the early 2018 trade tensions to measured assertiveness in deploying critical material controls as negotiating instruments.

The Legal Architecture Behind Export Restrictions

Chinese policymakers have systematically transformed fragmented export policies into a unified control framework over the past five years. This legal architecture integrates licensing requirements with administrative oversight mechanisms, creating discretionary authority for case-by-case evaluation of export applications. The system operates through 45-day approval processes that generate planning uncertainty for dependent industries, even when ultimate approval occurs.

The regulatory framework represents a deliberate calibration mechanism rather than blanket prohibition. Administrative control tools enable Beijing to distinguish between civilian electronics applications and military systems without implementing broad restrictions across all sectors. This granular approach provides flexibility for offering licensing accommodations as negotiating concessions whilst maintaining strategic pressure on specific allied sectors.

Integration with broader national security legislation suggests alignment with China's 2020 Export Control Law provisions, creating legal precedent for expanding restrictions beyond rare earth elements to other critical materials as geopolitical circumstances evolve. In addition, recent mineral production executive order developments in other nations demonstrate how governments are responding to these challenges.

How China's Export Controls Evolved Throughout 2025

April 2025 Initial Restrictions

The initial framework introduced licensing requirements for seven rare earth elements with global application scope affecting all international destinations. Unlike previous trade restrictions that included geographic carve-outs or preferential treatment for certain nations, these controls applied universally without exemptions. Industry reaction demonstrated immediate market impacts as manufacturers faced supply planning uncertainty despite the absence of outright prohibition.

The licensing mechanism created a 45-day approval window that approximated functional supply interruption for just-in-time manufacturing operations. Even with eventual approval, the administrative delay disrupted production schedules and forced companies to maintain larger inventory buffers, increasing operational costs across affected supply chains.

Global application scope represented a significant policy evolution from China's historical approach of targeting specific countries during bilateral disputes. The universal framework suggested Beijing's intention to reshape international supply chain dependencies rather than address isolated trade conflicts.

October 2025 Expansion and Extraterritorial Reach

The October expansion doubled the number of controlled elements to 12 rare earth materials whilst introducing revolutionary extraterritorial provisions affecting foreign-manufactured products. This legal innovation restricted not only exports of Chinese rare earths but also products manufactured outside China that contained those elements, addressing transshipment avoidance strategies employed by international manufacturers.

Technology transfer restrictions expanded the scope beyond raw materials to include equipment and processing technologies used in rare earth operations. This comprehensive approach targeted the entire value chain, from extraction through final product manufacturing, creating multiple pressure points for countries seeking supply chain independence. Consequently, understanding the broader global mining landscape overview becomes crucial for assessing alternative supply sources.

The extraterritorial framework represents unprecedented assertion of Chinese regulatory authority over global supply chains. Foreign companies manufacturing products containing Chinese rare earths faced compliance requirements with Beijing's export control regime regardless of their geographic location, fundamentally altering traditional concepts of trade jurisdiction.

November 2025 Temporary Suspension and Strategic Flexibility

Following the October meeting between Presidents Xi Jinping and Donald Trump, China announced a one-year suspension agreement that demonstrated Beijing's view of export controls as negotiating leverage rather than permanent policy. The suspension arrangement included unconfirmed general licensing commitments, though specific volume allocations and conditions remained undisclosed.

The temporary nature of the suspension maintains ongoing policy uncertainty whilst providing breathing room for diplomatic negotiations. This strategic flexibility allows Beijing to resume restrictions if bilateral discussions fail to achieve desired outcomes, preserving the credible threat necessary for effective economic leverage.

Morgan Stanley analysts interpreted the restraint shown in the November suspension as evidence that Beijing calibrates controls to achieve negotiating objectives rather than inflict permanent economic damage on global supply chains.

Industries Facing the Greatest Impact from These Controls

Defense and Aerospace Sector Vulnerabilities

Defence applications represent the most strategically critical vulnerability within China's rare earth export controls. The U.S. Department of Defense has identified rare earth elements as essential to over 60 military applications, including precision-guided weapons, radar systems, and communications equipment. These materials enable irreplaceable functions in active phased-array radar systems, which require samarium-cobalt or neodymium magnets for antenna beam steering with no performance-equivalent substitutes currently available.

Defence contractors report 18-24 month lead times for rare earth-dependent component sourcing under normal supply conditions. Export control disruptions extend these timelines significantly, creating program delays for critical military systems. Major defence manufacturers including Northrop Grumman, Lockheed Martin, and Raytheon have identified rare earth supply chain vulnerabilities in SEC filings and Congressional testimony, acknowledging genuine operational risks from Chinese supply restrictions.

Submarine and naval systems demonstrate particular vulnerability through their reliance on rare earth magnets in motor systems and sensor packages with extreme reliability requirements. The specialised nature of these applications makes substitution economically prohibitive and technically challenging within realistic timeframes.

Semiconductor Manufacturing Dependencies

Semiconductor production faces acute vulnerability through its dependence on rare earth polishing compounds, particularly cerium oxide, for wafer finishing processes. Sub-14 nanometer chip production requires these materials with no technically viable substitutes currently available for advanced semiconductor manufacturing. Taiwan Semiconductor Manufacturing Company and Samsung both source rare earth processing chemicals, creating geographic concentration risk that affects global foundry operations.

Memory chip production for DRAM and NAND technologies relies on rare earth materials in manufacturing equipment and chemical processes, creating intermediate dependency through equipment suppliers. Applied Materials and Lam Research, major semiconductor equipment manufacturers, source rare earth components from Asia-Pacific suppliers, meaning export restrictions propagate upstream to affect equipment availability for foundries worldwide.

The semiconductor industry's just-in-time manufacturing model amplifies the impact of supply disruptions. Even temporary licensing delays create production bottlenecks that cascade through global electronics supply chains, affecting everything from consumer devices to industrial automation systems.

Clean Energy Technology Implications

Electric vehicle manufacturing faces significant rare earth dependencies through permanent magnet motors that require 1-2 kg of rare earth elements per vehicle. With global EV production reaching 10.1 million units in 2023, the automotive sector requires approximately 10,000-20,000 metric tons of rare earth elements annually. China rare earth export controls directly impact production schedules for major automakers implementing electrification strategies.

Wind energy systems demonstrate substantial vulnerability through permanent magnet direct-drive turbines that utilise 200-600 kg of rare earth elements per 2-3 MW turbine. As countries accelerate renewable energy deployment to meet climate commitments, Chinese export controls create potential bottlenecks in wind farm development timelines. Vestas Wind Systems and Siemens Gamesa have both diversified rare earth sourcing specifically in response to China supply concentration risks.

Battery energy storage systems require rare earth elements in conversion electronics and thermal management systems, creating additional pressure points for grid-scale renewable energy deployment. The intersection of climate policy objectives with Chinese rare earth controls creates strategic vulnerability for countries pursuing energy transition goals. This contributes to the overall critical minerals demand surge affecting multiple industries simultaneously.

Economic Mechanisms Behind China's Strategy

Licensing as Administrative Control Tool

The 45-day approval process creates predictable decision timelines whilst generating substantial planning uncertainty for dependent industries. Case-by-case evaluation frameworks grant Beijing discretionary authority to approve or deny applications based on unstated criteria, enabling differentiated treatment of export requests without explicit policy announcements. This administrative opacity allows Chinese officials to signal policy preferences through approval patterns rather than formal regulatory changes.

Revenue optimisation through controlled scarcity represents a sophisticated economic mechanism. By restricting supply volumes whilst maintaining market access, Beijing creates short-term monopoly rents for Chinese exporters whilst preserving long-term customer relationships. The licensing system enables fine-tuned supply management that maximises economic leverage without triggering complete market disruption.

Documentation requirements for end-user verification provide transparency into downstream applications, allowing Beijing to monitor how exported materials support allied military and technological capabilities. This intelligence gathering function serves broader strategic objectives beyond immediate economic gains.

Price Leverage and Market Dynamics

Rare earth markets demonstrate highly inelastic demand characteristics with elasticity estimates of 0.3-0.5 over 6-12 month periods. This means supply restrictions generate disproportionate price increases that benefit Chinese exporters whilst imposing severe cost penalties on import-dependent manufacturers. Historical precedent from the 2010-2011 crisis demonstrates the pricing power available through supply controls.

During the 2010-2011 restrictions, neodymium prices spiked from approximately $30/kg to over $130/kg, representing increases exceeding 300%. These price movements forced permanent substitution in some applications whilst generating substantial windfall profits for Chinese rare earth companies. The pricing volatility demonstrated both the immediate economic impact and long-term market restructuring potential of supply controls.

Short-term demand inelasticity creates immediate negotiating leverage, whilst long-term price signals accelerate international substitution research and alternative supply development. Beijing must balance immediate economic gains against the risk of permanently losing market share to newly developed supply sources.

Reciprocal Escalation Framework

The reciprocal escalation mechanism operates through targeted retaliation against specific allied restrictions on Chinese market access. Morgan Stanley analysts describe this as following reciprocal escalation logic: if ally countries restrict chip exports to China, Beijing targets critical inputs like rare earths to those countries' key industries. This approach aims to create internal political pressure within allied nations by concentrating economic pain on politically influential sectors.

The framework's effectiveness depends on asymmetric vulnerability: China's rare earth dominance versus allied technological capabilities creates mutual dependence that Beijing seeks to exploit. By targeting defence contractors and high-technology manufacturers in retaliating countries, export controls generate pressure for policy moderation from economically powerful domestic constituencies. However, this strategy intersects with broader US‑China trade war impact considerations that affect multiple economic sectors.

Deterrent effects extend beyond immediate restrictions to influence allied decision-making regarding future technological cooperation with U.S. policies. The credible threat of escalation encourages countries to weigh the economic costs of full alignment with American technology restrictions against the benefits of maintaining Chinese market access.

Global Market Responses to Supply Chain Risks

Alternative Supply Development Initiatives

International efforts to diversify rare earth supply chains have accelerated significantly since 2020, with multiple countries announcing major investment programmes. Australia represents the most advanced alternative source, with companies like Lynas Corporation expanding processing capabilities beyond traditional Chinese partnerships. The Australian government has provided substantial funding for rare earth processing facility development, recognising the strategic importance of reducing Chinese dependency.

North American initiatives include both mining and processing investments, though timeline constraints present significant challenges. The Mountain Pass mine in California, operated by MP Materials, has resumed production but requires years of additional investment to achieve processing independence from Chinese facilities. Canadian companies including Canada Rare Earths and Medallion Resources are developing projects that could contribute to North American supply security within the next decade.

African partnerships offer long-term potential for alternative supply development, particularly through projects in Tanzania, South Africa, and Madagascar. However, these initiatives require substantial infrastructure investment and technology transfer agreements that may take 10-15 years to achieve meaningful production volumes.

Substitution Research and Development

Corporate research and development spending on alternative materials has increased dramatically across multiple industries. Automotive manufacturers including Tesla and General Motors have invested hundreds of millions of dollars in rare earth-free motor technologies, though commercial viability timelines remain uncertain. These efforts focus on ferrite-based permanent magnets and switched reluctance motor designs that eliminate rare earth dependencies.

Government funding programmes in the United States, Europe, and Japan provide additional resources for substitution research. The U.S. Department of Energy's Critical Materials Institute coordinates research across multiple universities and national laboratories, whilst the European Union's Horizon Europe programme includes substantial funding for critical mineral alternatives.

Timeline challenges for commercial substitution remain formidable. Most alternative technologies require 5-10 years for laboratory development followed by additional years for manufacturing scale-up and market acceptance. Performance trade-offs often accompany substitution, meaning alternatives may require larger volumes or accept reduced efficiency compared to rare earth-based solutions.

Strategic Reserve Building Programmes

National stockpiling initiatives have emerged across developed economies as immediate responses to supply security concerns. The United States has announced plans to establish strategic reserves for critical minerals through both government purchases and private sector partnerships. These reserves aim to provide 6-12 months of supply buffer during disruption scenarios, though funding levels remain below comprehensive coverage requirements.

Private sector inventory management adaptations reflect company-level responses to supply uncertainty. Major electronics manufacturers including Apple and Samsung have increased rare earth inventory levels from typical 30-60 day supplies to 90-180 day reserves. These inventory adjustments require substantial working capital increases and warehouse facility investments.

Cost implications of supply security measures create ongoing financial burdens for dependent industries. Strategic reserves require initial acquisition costs plus ongoing storage and maintenance expenses. Private sector inventory increases tie up working capital that could otherwise support productive investments, creating an economic drag on affected companies.

Geopolitical Implications of Mineral Weaponisation

US-China Trade Relationship Dynamics

China rare earth export controls integrate with broader technological competition between the world's two largest economies. The controls represent Beijing's response to American restrictions on semiconductor exports, artificial intelligence technologies, and advanced manufacturing equipment. This reciprocal dynamic creates escalating cycles where each side responds to the other's restrictions with expanded controls on their own strategic exports.

Negotiation leverage in bilateral discussions now explicitly includes rare earth access as a bargaining chip. The October 2025 Xi-Trump meeting demonstrated how mineral controls function as diplomatic instruments, with China offering temporary suspensions in exchange for reduced American technology restrictions. This weaponisation of trade relationships fundamentally alters traditional concepts of economic interdependence.

Impact on multilateral trade agreements extends beyond bilateral US-China relations to affect global trading systems. Rare earth export controls challenge World Trade Organisation principles of non-discrimination and free trade, potentially encouraging other countries to weaponise their own strategic resources in international disputes.

Allied Coordination Challenges

Divergent national interests in rare earth access create coordination difficulties among traditional allies. Countries with stronger economic ties to China face greater costs from confrontational approaches, whilst those with domestic rare earth resources or alternative suppliers have more flexibility for supporting restrictive policies toward Beijing.

Japan and South Korea demonstrate particular vulnerability due to their advanced manufacturing sectors and geographic proximity to Chinese suppliers. European Union countries show varied responses based on their industrial structures: Germany's automotive industry faces different pressures than France's defence sector. These differences complicate unified allied responses to Chinese mineral leverage.

Individual country vulnerability assessments reveal asymmetric impacts that Beijing can exploit through differentiated treatment. Countries more dependent on Chinese rare earths may receive preferential licensing treatment as incentives for policy moderation, whilst those supporting stronger technology restrictions face more severe supply limitations.

Emerging Market Positioning Opportunities

Non-aligned nations potentially gain advantages through continued Chinese rare earth access during periods of restriction on allied countries. Countries maintaining neutral positions in US-China technological competition may receive preferential treatment from Beijing, creating economic incentives for avoiding alignment with American policy positions.

Diplomatic relationship implications extend beyond economic benefits to broader geopolitical positioning. Countries that maintain positive relations with China during periods of Western confrontation may gain access to Chinese technology transfers and investment opportunities unavailable to allied nations.

Regional bloc formation around mineral access creates new axes of international cooperation. Countries with similar vulnerabilities to Chinese supply restrictions may coordinate joint development of alternative sources or strategic reserve sharing agreements, potentially altering traditional alliance structures based on shared economic interests rather than historical security partnerships.

Effectiveness of China's Export Controls in Practice

Implementation Limitations and Enforcement Challenges

Administrative capacity constraints limit Beijing's ability to comprehensively monitor global rare earth supply chains. With hundreds of downstream applications and thousands of international manufacturers using Chinese rare earth materials, effective enforcement requires resources and technical capabilities that may exceed current Chinese administrative systems. The complexity of tracking rare earth elements through multiple processing stages and final product assembly creates monitoring gaps.

Black market development and transshipment risks emerge as predictable responses to export restrictions. Historical experience with other controlled commodities suggests that significant price premiums encourage smuggling operations and indirect trade routes through third countries. Vietnam, Thailand, and other Southeast Asian nations could serve as transshipment points for Chinese rare earths reaching restricted destinations. According to China Briefing's analysis, these enforcement challenges significantly affect business operations across the region.

Compliance verification difficulties across global supply chains present ongoing challenges for Chinese authorities. Determining the ultimate end-use of exported rare earth elements requires cooperation from importing countries and manufacturers that may not be forthcoming during periods of trade tension. Technical limitations in tracking rare earth materials through complex manufacturing processes reduce enforcement effectiveness.

Economic Trade-offs for Chinese Interests

Domestic industry concerns about reduced export revenues create internal pressure for policy moderation. Chinese rare earth companies depend on international sales for substantial portions of their revenues, meaning export restrictions directly reduce their profitability. Industry lobbying for continued market access may conflict with national security objectives driving export controls.

International reputation costs of weaponising trade relationships affect China's broader economic diplomacy efforts. Countries experiencing rare earth supply disruptions may reduce their overall economic engagement with China, affecting industries beyond the rare earth sector. This reputational damage could undermine Beijing's efforts to position itself as a reliable partner for international investment and trade.

Innovation incentive creation for competing nations represents the most significant long-term risk of export controls. By demonstrating the vulnerability created by Chinese rare earth dependency, export restrictions accelerate international investment in alternative supplies and substitute technologies. Successful development of these alternatives permanently reduces China's leverage whilst creating new competitive pressures for Chinese rare earth producers.

Temporary Suspension Agreements and Future Uncertainty

The November 2025 one-year suspension arrangement provides immediate relief whilst maintaining underlying policy uncertainty. The temporary nature prevents companies from making long-term supply chain investments based on unrestricted access, preserving China's ability to resume restrictions if diplomatic negotiations fail to achieve desired outcomes.

Unconfirmed general licensing commitments create ambiguity about specific volume allocations, pricing terms, and eligibility criteria for continued access. This uncertainty maintains pressure on affected industries whilst providing Beijing flexibility to adjust terms based on evolving bilateral relationships and broader geopolitical circumstances.

Ongoing policy flexibility enables China to calibrate export restrictions based on international responses to its broader strategic objectives. The framework establishes precedents for future escalation whilst maintaining options for de-escalation, creating a sophisticated tool for economic statecraft that can adapt to changing circumstances. Furthermore, recent developments show that CNBC reported on the temporary suspension as trade tensions evolved.

Future Outlook for Global Rare Earth Markets

Supply Chain Diversification Timeline Projections

Investment requirements for meaningful alternative processing capacity reach into the tens of billions of dollars globally. Developing processing capabilities requires not only capital investment but also technical expertise transfer, environmental remediation infrastructure, and regulatory framework development. Conservative estimates suggest 10-15 years for alternative supply chains to achieve sufficient scale to meaningfully reduce Chinese dependency.

Technical expertise development outside China represents a critical bottleneck for supply chain diversification. Rare earth processing requires specialised knowledge accumulated over decades of industrial experience. Training programmes, university partnerships, and technology transfer agreements will require sustained investment and international cooperation to develop competitive alternative capabilities.

Realistic timeframes for supply independence vary significantly by element and application. Light rare earth elements used in lower-value applications may achieve supply diversification within 5-7 years, whilst heavy rare earth elements essential for high-performance applications could require 15-20 years for meaningful alternative sources to reach commercial viability.

Technology Innovation Acceleration Trends

Recycling efficiency improvements offer the most immediate opportunity for reducing primary rare earth demand. Urban mining from electronic waste could potentially supply 20-30% of global rare earth requirements within the next decade, though current recycling rates remain below 5% for most rare earth elements. Investment in recycling infrastructure and technology development could substantially reduce dependency on primary sources.

Material science breakthroughs in permanent magnet design show promise for reducing rare earth content in critical applications. Research into nanostructured materials, composite magnet designs, and alternative magnetic materials could reduce rare earth requirements by 30-50% in some applications within the next 10-15 years, though performance trade-offs may limit applicability in the most demanding uses.

Manufacturing process optimisation reduces consumption requirements through improved yield rates and waste reduction. Advanced manufacturing techniques including additive manufacturing and precision forming could reduce rare earth material waste by 15-25% whilst enabling more efficient product designs that require fewer raw materials per unit of performance.

Policy Response Evolution Expectations

Multilateral coordination framework development will likely emerge from current supply chain vulnerabilities. The United States, European Union, Japan, and other allied nations may establish formal mechanisms for coordinating rare earth procurement, strategic reserve management, and alternative supply development. These frameworks could evolve into broader critical mineral partnerships that reduce individual country vulnerability to supply restrictions.

National security legislation adaptations across multiple countries will expand government authority to manage critical mineral supply chains. Emergency powers for rare earth procurement, mandatory strategic reserve requirements for key industries, and investment screening for critical mineral projects will likely become standard policy tools. These legislative changes represent permanent shifts toward treating mineral security as national defence priorities.

International trade rule modifications addressing mineral weaponisation may emerge through World Trade Organisation reform or new multilateral agreements. Current trade rules provide limited recourse against export controls justified by national security considerations, creating incentives for new frameworks that distinguish between legitimate security measures and economic coercion through resource restrictions.

Disclaimer: This analysis involves forecasts and speculation about future market developments, geopolitical relationships, and technology advancement timelines. Actual outcomes may differ significantly from projections due to unforeseen political developments, technological breakthroughs, or changes in international cooperation patterns. Readers should consider multiple sources and expert opinions when making investment or strategic planning decisions related to rare earth markets and supply chain security.

Looking to Capitalise on Critical Minerals Market Opportunities?

China's rare earth export controls demonstrate how quickly critical mineral supply chains can shift, creating significant opportunities for investors positioned ahead of market developments. Discovery Alert's proprietary Discovery IQ model delivers instant notifications on significant ASX mineral discoveries, helping subscribers identify actionable opportunities in critical minerals and other commodities before broader market awareness develops. Begin your 30-day free trial today to stay ahead of these rapidly evolving markets at Discovery Alert.