France Orano vs. Niger: A Critical Analysis of Mining Arbitration Proceedings

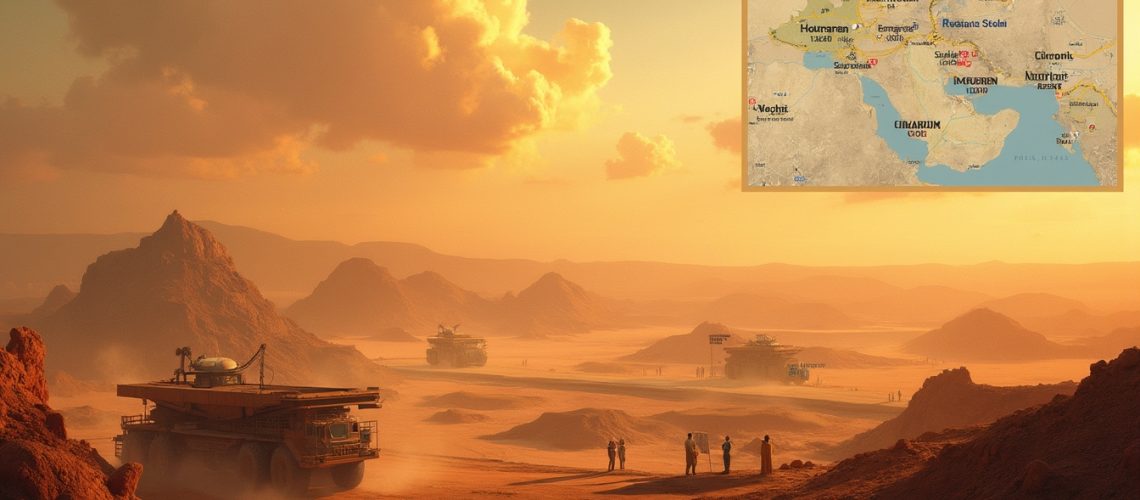

The uranium mining landscape in Niger has recently experienced significant disruption with the ongoing dispute between French mining giant Orano and the Niger government. This complex legal confrontation highlights the intricate challenges facing international mining investments in politically volatile regions.

What Triggered the Orano-Niger Mining Dispute?

Niger's strategic position in the global uranium market cannot be understated. The country accounts for approximately 4% of global uranium supply, making its mining sector critically important for international nuclear energy production.

In June, Niger made a dramatic move by revoking Orano's mining license for the Imouraren project, a decision with substantial implications for both the company and the global uranium market. The Imouraren mine represents one of the world's largest uranium reserves, positioning it as a potential game-changer in uranium production.

An Orano spokesperson highlighted the significance of this development: "The Imouraren mine is one of our most critical assets globally, and its revocation has severe implications for our operations and the local economy." The abrupt license withdrawal signals a broader shift in Niger's approach to foreign mining investments.

What Are the Political Dynamics Behind the License Revocation?

Niger's military-led government has implemented increasingly stringent policies towards foreign investors, demonstrating a robust stance on national resource control. This trend is not isolated; other international mining companies like GoviEx Uranium have also experienced similar challenges, indicating a systematic revaluation of foreign mining rights.

The government's perspective suggests a strategic move to assert greater control over national mineral resources. By implementing stricter regulations and selectively revoking mining licenses, Niger aims to enhance its economic sovereignty and negotiate more favourable terms with international corporations.

Understanding the Arbitration Process

Arbitration represents a critical mechanism for resolving international investment disputes. In this context, it provides a structured legal framework for Orano to challenge Niger's decision through neutral international trade and investment laws.

The process involves multiple stages, including formal proceedings, evidence presentation, and potential negotiations. International arbitration experts emphasize its importance in providing a fair mechanism for resolving complex cross-border commercial conflicts.

Economic and Geopolitical Implications

The dispute extends beyond a simple legal disagreement. It represents a potential watershed moment for international mining investments in resource-rich African nations. The outcome could significantly influence future foreign investment strategies in the region.

Economic analysts predict substantial ramifications for Niger's local economy. The uranium mining sector generates critical employment and revenue, and disrupting these operations could lead to broader economic instabilities.

Strategic Considerations for Orano

Orano's response to the license revocation demonstrates a sophisticated legal and strategic approach. The company has initiated arbitration proceedings to protect its substantial investments and operational rights in Niger.

Beyond the immediate legal battle, Orano must consider diversification strategies. This might involve exploring alternative uranium production sources or negotiating more resilient investment frameworks in politically complex regions.

Future Outlook and Potential Scenarios

Several potential scenarios could emerge from the arbitration process. These range from complete license reinstatement to negotiated settlements or prolonged legal disputes.

The broader implications extend to the global mining sector, signalling potential shifts in how international mining companies approach investments in resource-rich but politically unstable regions.

Key Takeaways for Investors

Investors in the Investing in mining stocks sector must carefully assess geopolitical risks. The Orano-Niger dispute underscores the importance of understanding complex regulatory environments.

The emerging trends suggest a need for more adaptive investment strategies that can navigate rapidly changing political landscapes. Companies engaged in Digital transformation in mining might find more sustainable approaches to managing such risks.

The ongoing arbitration between Orano and Niger serves as a critical case study for international mining investments, highlighting the intricate balance between national sovereignty and foreign corporate interests.

Are You Ready to Discover the Next ASX Breakthrough?

Unlock the potential of real-time insights with Discovery Alert, your gateway to seizing immediate and long-term investing opportunities in the ASX mineral space. Our service uses AI-driven technology to deliver fast, actionable alerts on significant mineral discoveries, ideal for both novice and seasoned investors. Discover how our 30-day free trial can enhance your strategy by visiting Discovery Alert today.