Matsa Resources Ltd

- ASX Code: MAT

- Market Cap: A$23.41 million

- Shares on Issue (SOI): 650,237,503

- Cash: A$2.61 million (as of 30 September 2024)

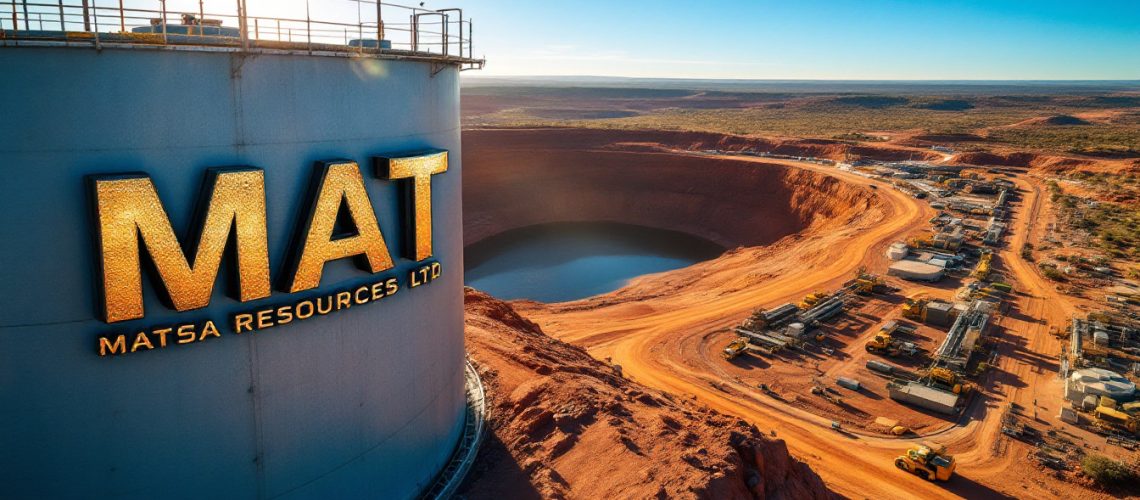

Matsa Resources Ltd (MAT) has recently announced significant developments, particularly concerning the Devon Pit Gold Mine, marking crucial steps towards near-term production. The company’s strategic moves, bolstered by successful capital-raising efforts, underscore a clear progression along its stated goals and enhance its position in the competitive gold market.

Why is the Devon Pit Gold Mine a Strategic Opportunity?

The Devon Pit Gold Mine is integral to the broader Lake Carey Gold Project, playing a pivotal role due to its high-grade gold reserves and imminent production potential. Holding a mineral resource of 82,000 ounces at 5.2g/t Au, Devon’s robust metrics highlight its capacity to generate critical cash flow, improve project valuations, and establish MAT as a cash-generating entity.

Located in Western Australia—a globally renowned mining jurisdiction—the mine benefits from excellent infrastructural and logistical advantages, fostering favourable conditions for economic gold extraction. As part of Lake Carey, which boasts a total mineral resource estimate of 949,000 ounces at 2.5g/t Au, Devon contributes significantly to MAT’s overall value proposition.

Active steps are underway to finalise contracts with mining contractors and processing operators, pivotal in advancing Devon towards production. This decisive move signals MAT’s commitment to achieving near-term revenue generation. Understanding the geology of ore deposits is essential in appreciating the strategic importance of the Devon Pit Gold Mine.

Capital Raising: A Financial Boost for Devon Pit Development

MAT has successfully completed a capital raising, securing A$3.13 million through the issue of shares at A$0.038 per share. This initiative attracted notable institutional and sophisticated investors, marking enhanced confidence in the project’s viability.

Key Highlights

- Market Confidence: The participation of The Flagship Fund, a new institutional investor, along with continued backing from Deutsche Balaton and Bulletin Resources Limited, reflects sustained interest in MAT’s developmental path.

- Supportive Pricing: Issued shares carried zero discount to the prevailing market price, bolstering market sentiment towards valuation strength.

- Strategic Deployment: The A$3.13 million raised will be primarily directed towards expediting Devon’s development and providing flexibility for working capital needs.

Investor support for the placement consolidates operational momentum and reinforces MAT’s financial capacity to bring Devon closer to mining activities. In a sector where the strategic role of cash is paramount, MAT’s strengthened cash position enhances stability and enables seizing opportunities.

Economic Viability of the Devon Pit

Devon’s high-grade resource and operational structure provide favourable project economics. The combination of its resource grade, modest upfront capital demands, and the current gold market environment positions it as an economically compelling venture.

Devon Pit Resource Highlights

- Reserves: 46,000 ounces at 4.6g/t Au

- Resources: 82,000 ounces at 5.2g/t Au

The inclusion of proximal deposits, such as Hill East, which contains 48,000 ounces at 2.0g/t Au, further enhances growth potential. This indicates opportunities to extend mine life and optimise outputs. A relatively low cutoff grade of 1.0g/t Au ensures that a wider volume of material can be economically extracted, even under fluctuating gold prices, mitigating financial risk.

Proximity to established third-party processing facilities offers additional cost efficiencies by reducing the need for significant capital expenditure on standalone refining infrastructure. This aspect augments Devon’s competitiveness compared to other undeveloped assets within the Lake Carey portfolio.

The Importance of High Gold Grades in Project Economics

The resource grade of a gold project is critical to its financial viability. Higher grades translate directly into reduced costs because fewer tonnes of material need to be processed to yield comparable gold outputs.

Contextualising Devon’s High Grades

- At 4.6g/t Au, Devon’s reserve grade positions it well above the industry average of 1.0–2.0g/t observed in many other global gold mining projects.

- Lower-grade projects often require larger-scale mining operations and higher processing capacities to remain viable, thereby increasing operational complexity and cost.

What is “g/t Au”?

The term “g/t Au” (grams per tonne gold) denotes the gold content within ore. A grade of 4.6g/t Au signifies that, on average, each tonne of ore contains 4.6 grams of gold. For gold mining companies, higher grades are advantageous because they result in lower per-unit production costs.

In Devon’s case, the combination of reserve quality and favourable jurisdiction strengthens its potential to generate profitable returns under current market conditions. This is particularly relevant given Australia’s mining sector’s current trends, economic challenges, and future prospects, where projects with strong fundamentals stand out.

Development Timeline and Operational Readiness

The near-term production outlook for Devon remains central to ongoing discussions with mining contractors, processing plant operators, and potential financiers. These agreements are critical to advancing the project, with key milestones projected to be completed within the current quarter.

Key Updates

- Contractor Engagement: Negotiations with mining contractors are close to finalisation, paving the way for operational readiness.

- Processing Partnerships: Agreements with nearby gold processing plants are designed to minimise logistical barriers.

- Mining Launch: Open-pit mining operations, complemented by the site’s streamlined structure, are expected to commence swiftly post-approvals.

MAT’s clear operational timeline and transparent communication of updates will likely appeal to investors seeking clarity on near-term revenue generation. In an industry where precious metals and copper market insights are increasingly vital, MAT’s proactive approach positions it favourably.

Investment Rationale

Several factors position this project as a compelling investment opportunity within Australia’s gold mining landscape. The upcoming production commencement at Devon offers specific appeal due to its high-grade nature, robust project economics, and Western Australian jurisdiction—a region widely regarded for its supportive mining policies and infrastructure access.

Key Features

- Portfolio Strength: The transition to production at Devon is a cornerstone objective; however, growth beyond the site remains supported by Lake Carey’s pipeline of exploration-stage and advanced projects.

- Capital Management: Recent successful fundraising efforts reflect a prudent approach towards maintaining flexibility in financing operational activities.

- Leadership: MAT’s experienced management team provides oversight of technical planning, strategic deployment of funds, and project execution.

- Scalable Growth: While Devon contributes an initial production source, Lake Carey’s total resource base of 949,000 ounces offers scope for scalable development.

Moreover, in light of September’s mining performance and key insights on PGM, chrome, and diamond growth, MAT’s focus on gold aligns with positive trends in the precious metals sector.

Conclusion

The Devon Pit Gold Mine represents a near-term production opportunity supported by strong project fundamentals, high gold grades, and a reputable mining jurisdiction. Recent capital-raising activities have bolstered financial capability, ensuring resources are available to achieve scheduled development goals. This project aligns with broader portfolio ambitions to deliver measurable growth while building a foundation for long-term investor returns.

As MAT advances towards production, the company’s strategic initiatives and operational readiness signal a promising trajectory. Investors seeking exposure to the gold sector may find MAT’s developments noteworthy, given the combination of high-grade resources and proactive management strategies.

Ready to Uncover Hidden Gold Investment Opportunities?

Navigate the complex world of gold mining investments with Discovery Alert’s AI-driven notifications, which provide real-time insights into significant ASX discoveries like Matsa Resources’ Devon Pit Gold Mine. Start your 30-day free trial today and transform your approach to mineral investing with our expert, data-driven alerts that simplify complex geological opportunities.