Understanding the US Copper Tariff Investigation

The ongoing Section 232 investigation into copper imports represents a pivotal moment in US trade policy, with far-reaching consequences for global supply chains, international relations, and domestic manufacturing. Initiated under the Trump administration, this probe examines whether copper imports threaten national security, potentially leading to tariffs or other trade restrictions. Chile, Canada, and Peru—collectively supplying 94% of US refined copper and copper alloys—have vehemently opposed the investigation, arguing it risks destabilizing established trade relationships while inadvertently strengthening China's position in the global copper supply dispute. Industry stakeholders like Freeport-McMoRan and Trafigura advocate for targeted regulatory reforms over blanket tariffs, emphasizing the need to balance domestic production incentives with the realities of global economic interdependence. As the November 2025 investigation deadline approaches, policymakers face complex trade-offs between protecting strategic industries and maintaining competitive downstream sectors.

What is the Section 232 Investigation on Copper Imports?

The current investigation derives its authority from Section 232 of the Trade Expansion Act of 1962, a Cold War-era provision allowing the executive branch to impose trade restrictions for national security reasons. Unlike previous Section 232 actions targeting steel and aluminum, this marks the first application to copper—a metal critical for electrical infrastructure, renewable energy systems, and defense technologies. The Commerce Department's timeline projects completion by November 2025, with interim phases for public comments and interagency review.

Historically, Section 232 measures have served dual purposes: protecting domestic industries while advancing geopolitical objectives. The US copper tariff probe intersects with broader Trump's trade policies priorities, including reducing dependence on foreign materials and reshoring manufacturing capabilities. However, critics argue that invoking national security for copper—a widely traded commodity with diverse global sources—establishes a dangerous precedent for protectionism. The American Chamber of Commerce in Chile warns that tariffs could increase US manufacturers' costs by 15-20%, potentially making domestic wire and tubing production uncompetitive against Chinese alternatives.

Why Are Top Copper Suppliers Opposing the Investigation?

Chile, Canada, and Peru's coordinated opposition reflects their entrenched position in US copper supply chains. Chile alone accounts for 38% of US refined copper imports, leveraging its vast Escondida and Collahuasi mining operations to maintain price competitiveness. These nations argue their exports pose no security risk, noting decades of stable trade relations and mutual investments in mining infrastructure.

Economic arguments against tariffs emphasize vertical integration: Canadian copper mines supply US brass manufacturers, while Peruvian concentrates feed Arizona smelters. Disrupting these flows could increase costs for defense contractors reliant on specialty alloys. As Rio Tinto's US operations director noted, "Modern fighter jets contain over 4,000 pounds of copper—taxing raw material imports would directly impact weapons system affordability." Diplomatic communications reveal concerns about violating USMCA provisions, with Canada threatening proportional retaliation through critical mineral export controls.

Global Implications of Potential Copper Tariffs

How Would Tariffs Impact the Global Copper Market?

The proposed 25% tariff scenario, modeled after prior Section 232 actions, could reconfigure global trade patterns. Latin American producers might redirect exports to China, which already consumes 54% of global refined copper. This shift would exacerbate existing supply constraints in Europe and Japan, potentially driving copper prices dynamics above $12,000/ton—a 30% increase from current levels.

Retaliatory measures loom large, particularly from Canada, which supplies 22% of US copper imports. Ottawa's draft response includes export duties on rare earth elements used in US wind turbines, creating cross-sector vulnerabilities. Historical parallels with the 2018 steel tariffs suggest downstream industries like construction and electronics manufacturing would absorb most cost increases, with the Congressional Budget Office estimating 45,000 potential job losses in these sectors.

Could China Benefit from US Copper Tariffs?

China's strategic stockpiling of copper—holding 2.1 million metric tons in state reserves as of Q1 2025—positions it to capitalize on market dislocations. By offering favorable financing to South American producers, Chinese smelters could secure long-term supply contracts below global benchmarks. This aligns with Beijing's "Dual Circulation" strategy to dominate strategic resource markets.

The American Chamber of Commerce in Chile warns that tariffs would accelerate China's "Belt and Road" expansion into copper-rich regions like the Atacama Desert. Chinese firms already control 18% of Peru's mining output, with MMG Ltd.'s Las Bambas mine poised to increase production 40% by 2026. Such developments threaten to marginalize US influence in regional trade blocs while strengthening China's position in critical mineral supply chains.

Alternative Approaches Proposed by Industry

What Alternatives to Tariffs Are Being Suggested?

Trafigura's proposal for selective tariffs (15% on wire rod, 10% on tubes) aims to protect finished goods manufacturers without disrupting raw material flows. This tiered approach recognizes that US wire mills operate at 92% capacity, whereas domestic smelting capabilities remain limited. Export controls on copper scrap—6.5 million tons of which were exported in 2024—could simultaneously boost domestic recycling and reduce reliance on foreign concentrates.

Rio Tinto copper investments advocates for streamlined permitting under the FAST-41 Act, projecting that regulatory reforms could bring Resolution Copper Mine online by 2030, adding 500,000 tons/year to domestic supply. Southwire's "Copper Secure" initiative proposes tax credits for manufacturers using ≥75% US-sourced materials, creating market-driven incentives for supply chain localization.

How Could Export Restrictions Support US Copper Production?

Current US smelting capacity constraints—only 3 operational facilities processing 650,000 tons annually—limit the immediate impact of export controls. However, the Department of Energy's Advanced Copper Smelting Program offers $2.1 billion in grants for modular electrolytic refineries, targeting 85% energy efficiency improvements over traditional methods. Economic models suggest these technologies could make domestic processing cost-competitive by 2032, assuming sustained copper prices above $9,500/ton.

Industry leaders emphasize the need for workforce development parallel to capacity expansion. The Copper Development Association's apprenticeship program aims to train 15,000 miners and metallurgists by 2027, addressing a 38% skilled labor shortfall identified in 2024 surveys.

Economic Considerations for US Policy

What Are the Economic Trade-offs of Copper Tariffs?

Tariffs present a classic protectionist dilemma: shielding 12,000 mining jobs while jeopardizing 85,000 positions in fabrication and manufacturing. The Aerospace Industries Association estimates that a 25% copper tariff would add $4.2 billion annually to aircraft production costs, potentially eroding the US's 58% global market share in commercial aviation.

Conversely, the United Steelworkers union argues that strategic tariffs could catalyze $17 billion in mining investments over five years, revitalizing the "Copper Belt" across Arizona and Nevada. Dynamic scoring models suggest a balanced approach—combining 10% tariffs on semi-finished goods with R&D tax credits—could yield net GDP growth of 0.3% annually through 2035.

How Does This Fit into Broader US Trade Strategy?

The copper investigation intersects with April 2025's reciprocal tariffs on critical minerals, reflecting a broader Trump administration strategy of aggressive trade rebalancing. However, the exemption of critical minerals not domestically available—including cobalt and rare earths—highlights the policy's inherent contradictions.

Geopolitical analysts suggest the copper probe serves as leverage in US-China Phase Three trade talks, with potential exemptions for Latin American suppliers tied to technology transfer agreements. This "resource diplomacy" approach mirrors EU critical raw materials alliances but risks alienating traditional allies through coercive tactics.

FAQ: US Copper Tariff Investigation

What is the current status of the copper tariff investigation?

The Commerce Department's Section 232 probe remains in its data-gathering phase, with preliminary findings expected by September 2025. Public comments from 237 stakeholders were submitted by the April 1 deadline, overwhelmingly opposing tariffs.

Which countries would be most affected by potential copper tariffs?

Chile faces the greatest exposure, with 78% of its copper exports destined for US markets. Canada's integrated automotive supply chains and Peru's $3.4 billion copper concentrate trade would also suffer immediate disruptions.

What position are major copper companies taking on the issue?

Freeport-McMoRan and the Copper Development Association advocate for raw material exemptions, while Trafigura and Southwire support targeted tariffs on manufactured products. According to mining industry analysis, most top copper mines insights emphasize long-term solutions through domestic capacity building rather than trade barriers.

This comprehensive analysis demonstrates the US copper tariff probe's complexity, balancing geopolitical imperatives against economic realities. As the November 2025 decision deadline approaches, stakeholders across the value chain must navigate evolving trade dynamics while preparing for multiple contingency scenarios.

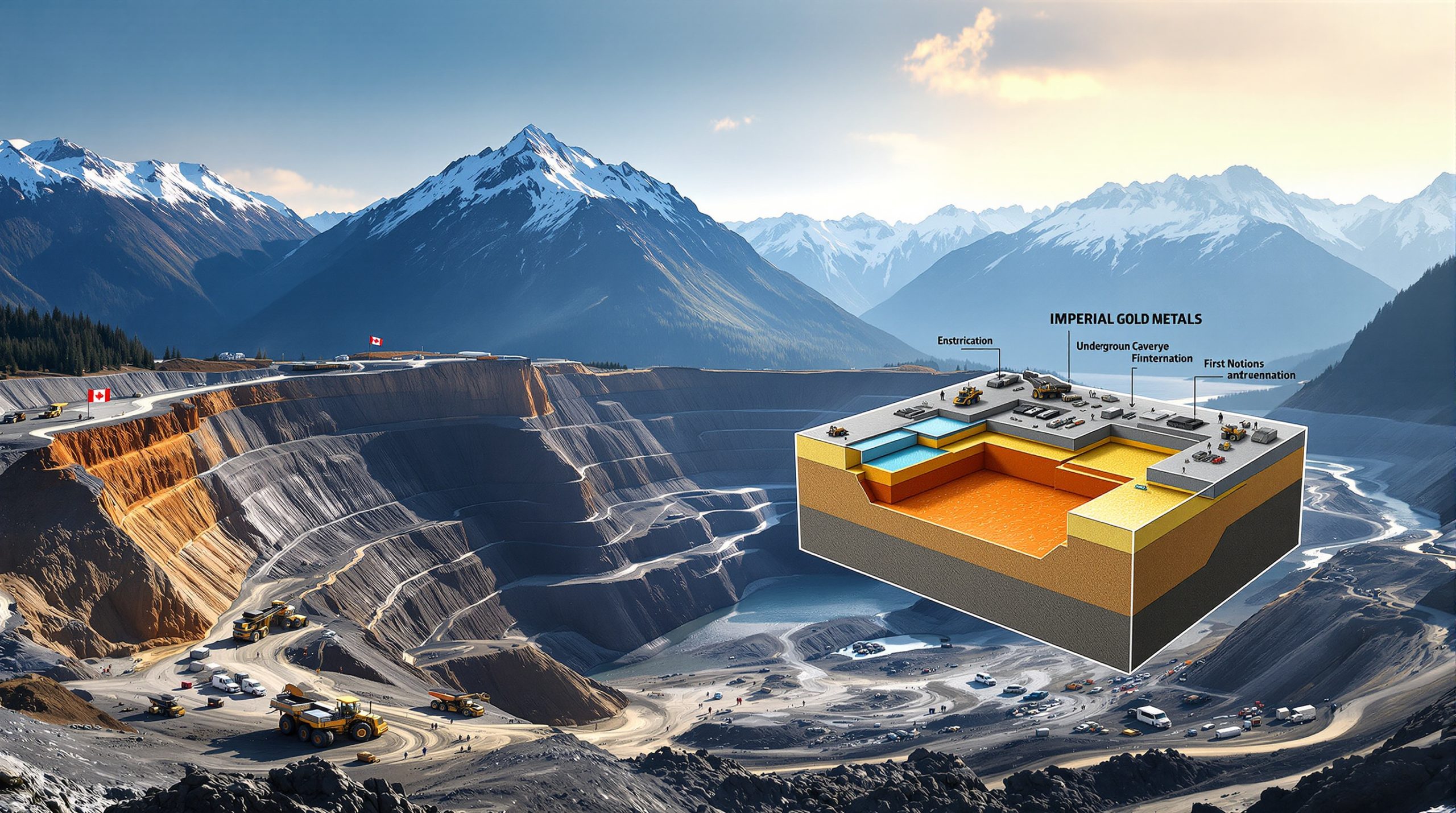

Looking to Invest in Copper Amid Market Uncertainty?

Discovery Alert's proprietary Discovery IQ model delivers real-time notifications on significant ASX copper discoveries, helping you identify actionable opportunities before the broader market reacts to global supply disruptions. Visit our dedicated discoveries page to understand how major mineral discoveries can generate substantial returns for early investors.