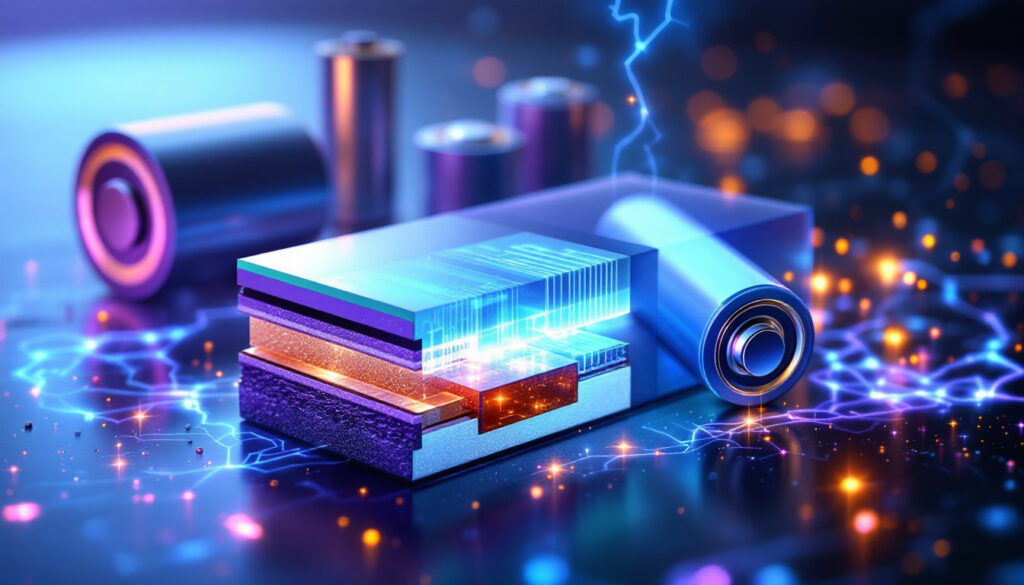

What Are Lithium-Ion Batteries?

Lithium-ion batteries represent the cornerstone of modern portable electronics and electric vehicles, combining sophisticated chemistry with precision engineering. These energy storage powerhouses have revolutionized everything from smartphones to grid storage systems through their unique combination of high energy density, reliability, and increasingly affordable costs.

At their core, lithium-ion batteries consist of several precisely engineered components working in harmony:

- An aluminum foil coated with cathode material (the positive electrode)

- A separator membrane that prevents short circuits while allowing ion flow

- A copper foil coated with anode material (typically graphite)

- Electrolyte solution that enables lithium ion movement between electrodes

Each component must be manufactured to exacting standards, as even microscopic impurities can significantly impact performance and safety.

The Complex Chemistry Behind Battery Technology

The seemingly simple design of lithium-ion batteries masks incredible chemical complexity. Unlike earlier battery technologies, lithium-ion cells rely on the intercalation process—where lithium ions insert themselves into the crystalline structure of electrode materials without fundamentally changing those structures.

This intercalation mechanism enables thousands of charge-discharge cycles without significant degradation, a key advantage over older battery chemistries. The specific materials used in each component dramatically influence performance characteristics including energy density, power output, cycle life, and safety profile.

Modern manufacturing requires cleanroom conditions similar to semiconductor fabrication, highlighting the precision engineering behind these devices. Even microscopic contaminants can trigger side reactions that degrade performance or create safety hazards.

Evolution of Cell Formats

Lithium-ion battery designs have evolved significantly since their commercial introduction by Sony in 1991:

-

Cylindrical cells: The original format with components wound into a cylinder, exemplified by the ubiquitous 18650 (18mm diameter, 65mm height) cells used in everything from laptop batteries to early Tesla vehicles. These cells offer excellent thermal management and structural integrity.

-

Pouch cells: Developed to maximize space efficiency, these flat, flexible packages stack electrode components rather than winding them. Pouch cells eliminate the rigid metal casing, allowing for custom shapes that maximize energy density within confined spaces—ideal for slim devices like smartphones and tablets.

-

Blade cells: A more recent innovation pioneered by BYD and other manufacturers, blade cells represent large-format prismatic designs optimized for automotive applications. These cells often serve as structural elements within battery packs, reducing weight and complexity while enhancing cooling efficiency and energy density.

The evolution of cell formats reflects the diverse applications of lithium-ion technology, from small consumer electronics to massive grid storage installations. Each format offers distinct advantages for specific use cases, demonstrating how battery design continues adapting to meet new challenges.

How Do Lithium-Ion Batteries Work?

The operation of lithium-ion batteries relies on a remarkably elegant electrochemical process that enables their exceptional performance characteristics. Understanding this mechanism helps explain why these batteries have become so ubiquitous in modern technology.

The "Rocking Chair" Mechanism

Lithium-ion batteries operate on what scientists call the "rocking chair" mechanism—a perfect metaphor for how energy storage and release works within these devices:

-

During charging, an external voltage pushes lithium ions from the cathode, through the electrolyte, and into the anode (typically graphite). These ions nestle between layers of graphite in a process called intercalation.

-

During discharging, lithium ions spontaneously move back from the anode to the cathode, creating an electrical imbalance. This forces electrons to flow through the external circuit (your device), producing usable electricity.

-

Throughout this process, the cathode and anode materials maintain their fundamental structure—they simply host the lithium ions temporarily, like a rocking chair moving back and forth.

This shuttling of lithium ions creates minimal physical stress on the electrodes compared to older battery technologies where materials underwent significant physical and chemical changes during cycling. The result is superior cycle life and reliability.

What makes this system particularly efficient is that lithium is the lightest metal on the periodic table and carries a high electrochemical potential, creating an optimal combination of energy density and power delivery capabilities.

The Importance of Material Purity

Battery performance relies critically on material purity—perhaps more than consumers realize:

- Microscopic impurities accelerate side reactions that consume active lithium and degrade capacity over time

- Foreign particles larger than 20µm can penetrate the separator and create micro short circuits

- Electrolyte contamination can trigger gas formation, swelling, and premature aging

Industry experts note that producing battery-grade lithium refinery materials requires significantly higher purity standards than most other industrial applications. For example, battery-grade graphite must achieve 99.99% purity, while many industrial applications require only 95-98%.

Manufacturers utilize cleanroom environments, precision filtering, and sophisticated quality control systems to eliminate contaminants. The extreme sensitivity to impurities explains why battery production requires such specialized equipment and expertise—and why quality can vary significantly between manufacturers using ostensibly similar chemistries.

What Makes the Cathode So Critical?

The cathode represents the most complex, costly, and performance-defining component in lithium-ion batteries. While all battery components matter, industry experts consistently identify cathode technology as the primary differentiator between battery systems.

The Heart of Battery Performance

The cathode directly influences virtually every aspect of battery performance and constitutes approximately 40-50% of a battery cell's total cost. This critical component determines:

- Energy density: The cathode's capacity to host lithium ions largely determines how much energy a battery can store per unit weight or volume

- Durability and cycle life: Structural stability during repeated charge-discharge cycles affects battery longevity

- Power output: How readily the cathode can accept or release lithium ions influences charging speed and power delivery

- Thermal stability: Resistance to overheating and thermal runaway is largely cathode-dependent

- Material sustainability: The minerals required for cathode production impact environmental footprint and supply chain security

The cathode represents the most energy-intensive component to manufacture, requiring precise synthesis conditions, thermal processing, and quality control. Different cathode chemistries create dramatically different performance profiles, allowing manufacturers to optimize batteries for specific applications.

Types of Cathode Active Materials (CAMs)

Two dominant cathode chemistries have emerged as market leaders, each with distinctive advantages for different applications.

NMC (Lithium Nickel Manganese Cobalt Oxide)

NMC cathodes utilize a layered oxide structure containing varying proportions of nickel, manganese, cobalt, and lithium:

- Composition: Typically expressed as LiNixMnyCozO2, where x+y+z=1 (common formulations include NMC 111, 532, 622, and 811, with the numbers representing the ratio of Ni:Mn:Co)

- Energy density: 200-250 Wh/kg at the cell level, enabling longer EV ranges

- Applications: Premium electric vehicles prioritizing maximum range (Lucid Air, BMW iX, Mercedes EQS)

Advantages:

- Higher volumetric and gravimetric energy density

- Better performance in cold weather conditions

- More mature supply chain and manufacturing ecosystem

Disadvantages:

- Reduced structural stability when deeply charged

- Higher raw material costs, particularly for cobalt

- Greater thermal runaway risk at high states of charge

- More sensitive to fast charging stress

- Relies on minerals with supply chain and ethical concerns

LFP (Lithium Iron Phosphate)

LFP cathodes utilize an olivine crystal structure with phosphate bonds:

- Composition: LiFePO4, typically with carbon coating for conductivity enhancement

- Energy density: 150-200 Wh/kg at the cell level

- Applications: Mass-market EVs, grid storage, and applications prioritizing longevity over maximum range (Tesla Model 3 Standard Range, BYD Han)

Advantages:

- Significantly lower materials cost (uses abundant iron and phosphate)

- Superior structural stability through charge-discharge cycles

- Enhanced safety profile with higher thermal runaway threshold

- Exceptional cycle life (often >3,000 cycles to 80% capacity)

- Better tolerance of fast charging and high-current applications

- Uses widely available, ethically sourced materials

Disadvantages:

- Lower energy density requires larger battery packs for equivalent range

- Reduced performance in very cold conditions

- Flatter discharge curve makes state-of-charge estimation more challenging

While other cathode chemistries exist (including LCO, LNMO, and various high-voltage options), NMC and LFP have emerged as the dominant technologies for most large-scale applications due to their balanced performance profiles and increasingly optimized manufacturing processes.

How Do NMC and LFP Compare?

Understanding the fundamental differences between NMC and LFP technologies helps explain their distinct performance characteristics and why manufacturers choose specific chemistries for particular applications.

The Bookshelf Analogy

Battery experts often use a helpful bookshelf analogy to explain the structural differences between these cathode materials:

NMC as a Thin Bookshelf

- Imagine lithium ions as "books" sitting on a layered oxide "bookshelf"

- The books (lithium ions) provide structural support to the shelf

- Removing too many books (charging too deeply) causes the shelves to become unstable

- This compact design allows more books to be stored in less space (higher energy density)

- However, the structure weakens as books are removed and replaced repeatedly (cycling degradation)

LFP as a Sturdy Bookshelf

- The phosphate framework creates a robust, self-supporting "bookshelf"

- Lithium ions (books) can be completely removed without compromising the structure

- The stronger framework requires more material, resulting in fewer books per shelf (lower energy density)

- However, the inherent stability allows for more frequent and complete removal of books (superior cycle life)

This fundamental structural difference explains why LFP batteries can withstand more charge-discharge cycles, tolerate full charging, and resist thermal runaway more effectively than their NMC counterparts.

Performance Differences

The following table illustrates key performance comparisons between NMC and LFP cathodes based on industry benchmarks:

| Characteristic | NMC | LFP |

|---|---|---|

| Energy Density (cell level) | 200-250 Wh/kg | 150-200 Wh/kg |

| Raw Material Cost (2023) | ~$18/kWh | ~$13/kWh |

| Typical Cycle Life to 80% | 1,000-1,500 cycles | 3,000+ cycles |

| Calendar Life | 10-12 years | 15-20+ years |

| Thermal Runaway Onset | 150-200°C | 270-300°C |

| Fast Charging Tolerance | Moderate (limiting factor) | High (typically not limiting) |

| Cold Weather Performance | Better | Reduced |

| Raw Material Availability | More constrained (cobalt, nickel) | More abundant (iron, phosphate) |

These performance differences create natural market segmentation:

- NMC excels in: Luxury vehicles prioritizing maximum range; applications where space and weight constraints are critical; cold-climate usage

- LFP excels in: Mass-market vehicles prioritizing affordability and longevity; energy storage systems requiring frequent cycling; applications in hot climates where thermal safety is paramount

Expert Insight: "Understanding these inherent tradeoffs helps explain why both chemistries continue to coexist in the market. For premium vehicles where consumers prioritize range above all else, NMC remains compelling despite its higher cost. For mass-market vehicles where affordability and longevity matter more, LFP offers the better value proposition." – Denanisha, Nano1 CCO

The market increasingly reflects this segmentation, with LFP now holding approximately 65% of China's EV battery market, while NMC remains dominant in premium European and American electric vehicles.

How Has LFP Technology Evolved?

Despite being perceived primarily as Chinese technology today, LFP batteries have a fascinating global development history that spans multiple continents and decades.

The Global Journey of LFP

The evolution of LFP technology demonstrates how international collaboration drives battery innovation:

-

Born in the USA: The basic lithium iron phosphate cathode chemistry was invented by Nobel Prize-winning scientist Dr. John Goodenough and his team at the University of Texas in the mid-1990s. His groundbreaking work (awarded the 2019 Nobel Prize in Chemistry) laid the foundation for modern LFP technology.

-

Developed in Canada: Hydro-Quebec acquired licensing rights and developed critical improvements through their subsidiary, Research Institute of Hydro-Quebec. Their research teams made several breakthrough modifications to the original formula.

-

Commercialized in Quebec: The first commercial LFP production plants were established in Quebec around 2005 and 2010, proving the technology could scale beyond laboratory conditions.

-

Scaled in China: Chinese manufacturers, recognizing LFP's potential for lower-cost mass production, invested heavily in manufacturing capacity. Companies like BYD and CATL drove large-scale adoption and continuous improvement.

-

Global renaissance: Today, LFP technology is experiencing renewed interest worldwide, with companies like Tesla, Ford and GM incorporating it into mainstream vehicles, and new production capacity being established across North America, Europe, and Asia.

This global development journey illustrates how battery technology typically evolves through international knowledge transfer rather than isolated national efforts.

The Critical Carbon Coating Innovation

A key breakthrough in making LFP commercially viable came from researchers at the Université de Montréal and Hydro-Quebec in the early 2000s:

- Pure LFP material is a poor electrical conductor, severely limiting power capability

- Researchers developed a nano-sized carbon coating process that dramatically improved electron movement

- This carbon coating created conductive pathways that transformed LFP from a laboratory curiosity to a commercial product

- The innovation was protected under US patent US6677082B1 and related intellectual property

- This breakthrough reduced internal resistance and enabled high-power applications

Without this critical innovation, LFP would likely have remained an interesting but commercially impractical technology. The carbon coating process represents a perfect example of how seemingly small technical improvements can transform an entire industry.

Recent innovations continue enhancing LFP performance:

- Advanced doping techniques (adding small amounts of elements like manganese or zinc)

- Nano-structuring methods that optimize particle size and shape

- Cell engineering improvements that maximize energy density at the pack level

- Modified electrolyte formulations that improve low-temperature performance

These ongoing improvements have narrowed the performance gap with NMC while maintaining LFP's inherent cost, safety, and longevity advantages.

Why Are Different Battery Chemistries Needed?

The diversity of battery applications requires different solutions optimized for specific use cases. No single battery chemistry offers the perfect balance of all desirable characteristics, creating natural market segmentation.

Market Segmentation and Application Fit

The automotive industry provides a clear illustration of how different battery chemistries serve distinct market segments:

-

Premium vehicles: High-end electric vehicles like the Lucid Air, Porsche Taycan, and Mercedes EQS prioritize maximum range and performance. These vehicles typically use NMC batteries despite their higher cost, as their target customers value range and performance over economy.

-

Mass-market vehicles: Affordable electric vehicles like the standard-range Tesla Model 3, BYD Dolphin, and many Chinese market vehicles increasingly utilize LFP. These vehicles target cost-conscious consumers who prioritize total ownership cost over maximum range.

-

Commercial applications: Delivery vehicles, buses, and fleet applications often choose LFP for its superior cycle life and reduced total cost of ownership over the vehicle's operational lifetime. These vehicles typically follow predictable routes where maximum range is less critical.

This market segmentation reflects rational economic decisions rather than technological limitations. According to BloombergNEF research, the total cost of ownership for vehicles using LFP batteries is now often lower than NMC alternatives when considering the full lifecycle, including replacement costs.

The current market reflects this segmentation, with LFP now representing 60-70% of the Chinese EV battery market. This dominance in the world's largest EV market demonstrates LFP's compelling value proposition for mass-market applications.

Future Outlook

Both technologies will continue coexisting with complementary roles:

-

NMC development focuses on reducing cobalt content (moving toward nickel-rich formulations like NMC 9.5.5), increasing energy density, and enhancing structural stability at high states of charge.

-

LFP advancement emphasizes improving cold-weather performance, increasing energy density through cell design optimization, and reducing production costs through manufacturing innovations.

-

Emerging alternatives like sodium-ion, lithium-sulfur, and solid-state batteries may eventually complement these technologies but face significant commercialization challenges.

Industry projections suggest LFP could reach 40% global market share by 2030 (Reuters, 2024), primarily driven by mass-market vehicles, energy storage systems, and applications where cost and longevity outweigh maximum energy density requirements.

Disclaimer: Battery technology evolves rapidly, and market projections involve inherent uncertainty. Actual adoption rates depend on raw material costs, technological breakthroughs, regulatory changes, and consumer preferences.

The balance between these technologies will continue shifting based on raw material availability, manufacturing innovations, and evolving application requirements. Recent [lithium mining insights](https://discoveryalert.com.au/news

Ready to Spot Major Mineral Discoveries Before the Market Catches On?

Discovery Alert's proprietary Discovery IQ model instantly identifies significant ASX mineral discoveries, giving you an immediate edge in the lithium and broader mining market. Visit our discoveries page to see how early investors in major mineral findings have achieved exceptional returns and start your 30-day free trial today.