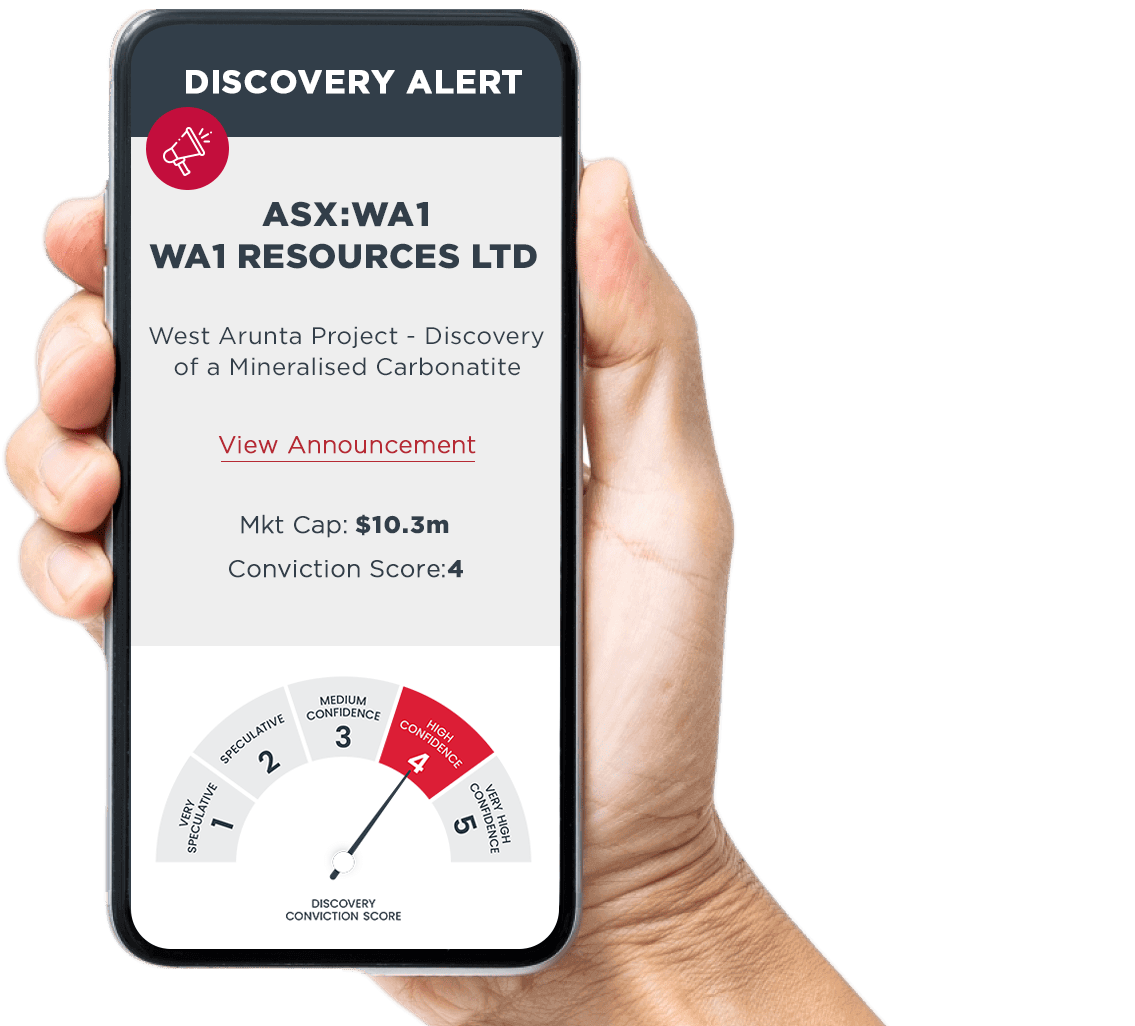

Alerting Subscribers To

The Next Big Discovery

Discovery Alert is a premium subscription service backed by AI technology, Geologists & Analysts designed to give subscribers the early crow on globally significant discoveries within 30-mins of them being announced to the market for their investment purposes.