What Are the New US Copper Tariffs?

In a move that has sent shockwaves through global metal markets, US President Trump announced a 50% tariff on imported copper on July 10, 2025. These tariffs, set to take effect on August 1, 2025, represent one of the most aggressive trade actions in recent US history and have already triggered significant market volatility.

Key Details of the 50% Tariff Announcement

The announcement follows a Section 232 investigation launched in February 2025 that examined national security implications of imported copper semi-finished products. This investigation, similar to those previously conducted for steel and aluminum, provided the legal framework for the administration's decision.

Market reaction was immediate and dramatic – COMEX copper futures surged over 12% in the hours following the announcement, creating one of the largest single-day moves in copper price retreat history.

According to Macquarie's analysis reported by SMM News, "This was likely a follow-up action by the US government in response to the '232' investigation launched earlier this year." The financial institution noted that the timing aligns with the investigation's expected conclusion.

The tariffs will apply to both raw copper and various semi-finished copper products, though specific Harmonized Tariff Schedule (HTS) codes affected are still being clarified by US Customs and Border Protection.

Historical Context of US Metal Tariffs

These copper tariffs represent an extension of the "America First" trade policy that has characterized recent US administrations. While previous metal tariffs focused primarily on steel and aluminum (25% and 10% respectively under the 2018 Section 232 actions), this marks the first major tariff specifically targeting copper.

Previous metal tariffs have typically ranged between 10-25%, making the 50% rate on copper particularly aggressive and signaling a significant escalation in US trade policy.

Industry Context: The copper tariff rate is double what was implemented for steel in 2018, reflecting the strategic importance the administration places on this particular metal for national security and industrial policy.

Why Is the US Implementing These Copper Tariffs?

Strategic and Economic Motivations

The official justification for the tariffs stems from the Section 232 investigation, which allows for trade restrictions when imports are deemed to threaten national security. Copper's critical role in defense applications, electrical infrastructure, and renewable energy technologies makes it particularly sensitive from a national security perspective.

Beyond national security considerations, several economic factors appear to be driving this decision:

- Industrial revitalization: Support for domestic copper producers facing international competition

- Trade deficit reduction: Copper represents a significant import category for the US

- Strategic resource control: Ensuring domestic supply chains for critical minerals

The timing of the announcement, coming during an election year, also suggests potential political motivations to appeal to manufacturing-heavy states where copper production and fabrication contribute significantly to local economies.

Global Trade Tensions and Their Influence

The copper tariffs emerge against a backdrop of escalating global copper supply tensions, particularly between the US and China, which is the world's largest copper consumer. While not explicitly targeted at any single country, the tariffs will disproportionately impact major copper exporters to the US market, including Chile, Peru, and Canada.

Ongoing supply chain disruptions following global events have heightened awareness of mineral resource dependencies, accelerating a trend toward resource nationalism among major economies. The copper tariffs represent part of a broader pattern of countries seeking to secure critical material supply chains through trade policy.

What Will Be the Market Impact of the Copper Tariffs?

Immediate Price Effects and Market Disruption

The initial market reaction—a 12% surge in COMEX copper futures—indicates the significant disruption these tariffs are creating in global copper markets. This price volatility is likely to continue as market participants adjust to the new reality.

According to Macquarie's analysis, "This tariff measure could prevent about 100,000 metric tons of surplus inventory from entering the US each month and redirect it to other markets." This substantial volume represents approximately 5% of global monthly copper trade and will create significant pressure on non-US markets.

Key immediate impacts include:

- Price divergence between US domestic and international markets

- Increased hedging activity as consumers and producers manage new risks

- Liquidity shifts between various copper trading venues globally

- Inventory buildups in warehouses outside US jurisdiction

Trading volume on copper futures contracts has already increased dramatically, with open interest expanding 15% in the days following the announcement.

Long-Term Supply Chain Restructuring

Beyond immediate price effects, the tariffs will likely trigger significant structural changes in global copper supply chains. Industry analysts anticipate several long-term adjustments:

- Relocation of processing facilities to circumvent tariffs or capitalize on new trade patterns

- Investment in domestic US copper production and processing capacity

- Development of alternate export routes for major copper-producing nations

- Increased recycling efforts as higher prices make secondary copper more economically viable

Inventory management strategies will also evolve, with companies likely building larger buffer stocks to hedge against future trade policy changes and price volatility.

How Will Different Regions Be Affected?

Impact on US Copper Market

The US copper market faces a complex mix of opportunities and challenges from these tariffs.

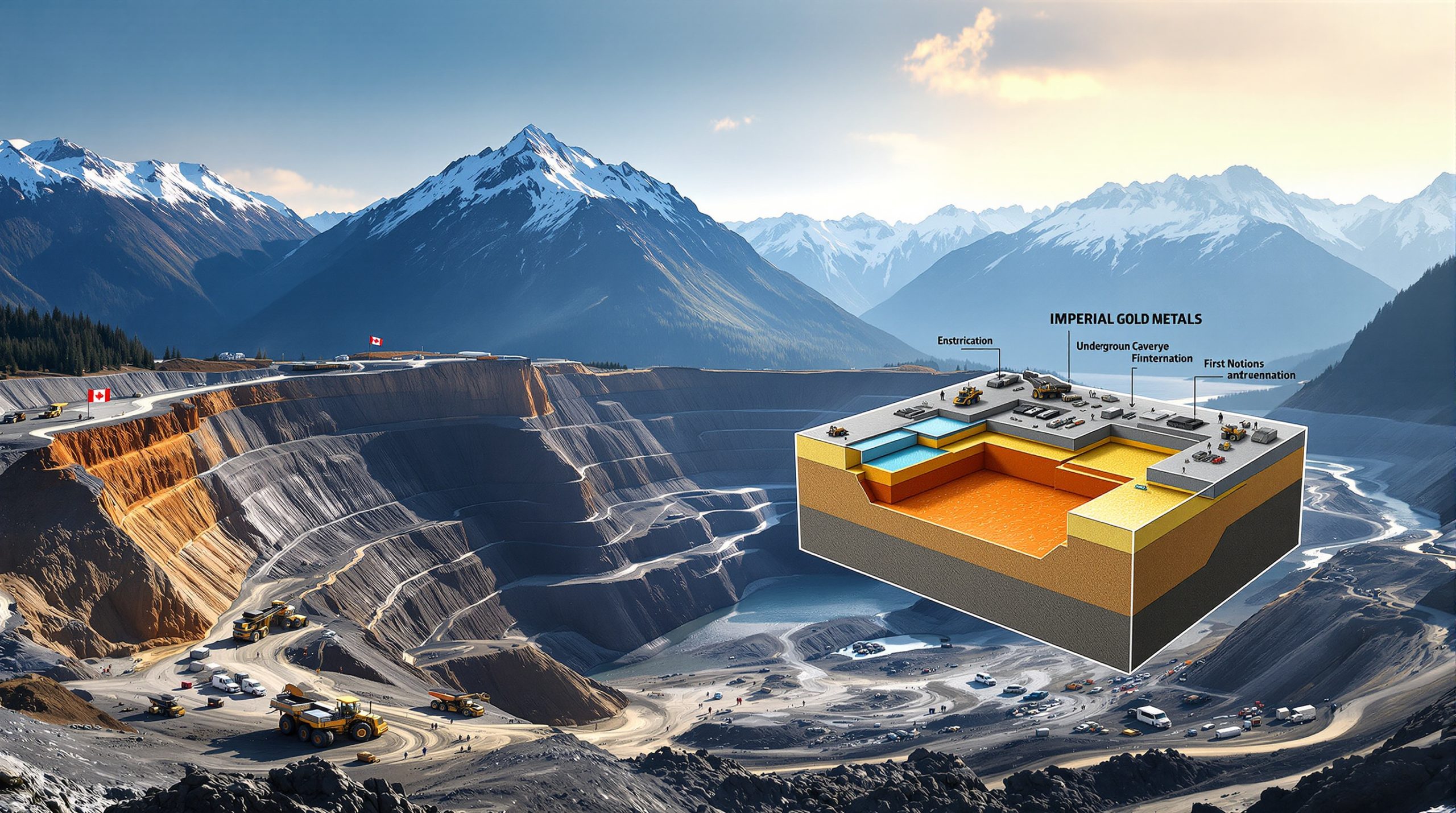

For domestic producers, the tariffs represent a potential windfall, providing significant price advantages over foreign competition. Companies like Freeport-McMoRan and Rio Tinto's US operations stand to benefit substantially, potentially leading to expanded production at existing mines and accelerated development of new projects.

However, downstream industries face increased input costs that may be difficult to pass on to customers. Manufacturers in sectors including:

- Electrical equipment and wiring

- Construction

- Automotive production

- Consumer electronics

will need to absorb higher copper costs or find ways to pass these increases to consumers.

Employment effects will likely be mixed—potentially positive for mining regions in states like Arizona, Utah, and Nevada, but challenging for manufacturing hubs reliant on copper inputs.

Global Market Redistribution Effects

The redirection of approximately 100,000 metric tons of copper monthly will create significant ripple effects throughout global markets.

Countries with major copper consuming industries but no tariffs (particularly in Asia and Europe) may temporarily benefit from increased supply and potentially lower prices as material originally destined for the US seeks new markets.

Market Dynamics: "The displaced volume will create temporary imbalances that will take 6-12 months to fully normalize as supply chains adjust," notes Macquarie's commodity analysis team.

Traditional US copper suppliers will face particular challenges. Chile and Peru, which together account for approximately 40% of global copper production, will need to diversify their export markets rapidly.

Who Are the Winners and Losers?

Beneficiaries of the New Tariff Policy

Several groups stand to benefit from the new copper tariff policy:

US copper miners and producers will see stronger pricing power and improved margins, potentially accelerating copper investment insights and domestic production capacity.

Alternative supplier countries with special trade relationships or exemptions from the tariffs could gain market share in the US market, though such exemptions have not yet been announced.

The recycling industry will receive a significant boost as higher copper prices improve the economics of recovery and reprocessing operations. The US secondary copper market could see growth of 15-20% annually following implementation.

Substitute materials manufacturers producing alternatives like aluminum conductors, engineered polymers, and other materials that can replace copper in certain applications will see increased demand.

Negatively Impacted Stakeholders

The tariffs create clear challenges for several groups:

Major copper exporters to the US market face the most direct impact. Chile, Peru, and Canada, which collectively account for over 60% of US copper imports, will see significant export revenue declines.

US manufacturers using copper as input material will face higher costs and potential supply disruptions during the transition period. Industries particularly affected include wire and cable manufacturers, electrical equipment producers, and construction suppliers.

End consumers of copper-containing products will ultimately bear some portion of the increased costs through higher prices for everything from electrical wiring to air conditioning systems.

Global copper traders and intermediaries face a more complex trading environment with divergent prices and potential liquidity challenges in certain markets.

What Are Industry Experts Saying?

Analysis from Financial Institutions

Financial analysts have provided varied perspectives on the likely impacts of the copper tariffs.

Macquarie's commodities team provided one of the first comprehensive assessments, noting that the tariffs "could disrupt the global copper market" by redirecting approximately 100,000 metric tons of surplus inventory monthly from US markets to other regions.

Other major financial institutions have highlighted:

- Potential for a 15-20% price premium in US domestic markets compared to global benchmarks

- Likelihood of increased price volatility across all copper trading venues

- Opportunities for arbitrage between regional markets during the adjustment period

- Investment implications favoring US producers and recyclers

Trading strategy recommendations have generally focused on regional spread trading and increased hedging requirements for consumers.

Mining Industry Perspectives

The mining industry's response has been divided along predictable lines, with US producers generally supportive while international miners express concern.

Major US producer Freeport-McMoRan called the tariffs "an important step toward recognizing the strategic importance of domestic copper production," while highlighting plans to accelerate investment in existing US operations.

International mining giants have been more measured, with BHP noting that "trade restrictions generally reduce market efficiency and increase costs for consumers," according to analysis in the Sydney Morning Herald. The International Copper Association emphasized that "open markets have historically provided the most stable and efficient means of matching copper supply and demand."

Industry associations representing downstream manufacturers have expressed concern about competitive disadvantages for US producers who will face higher input costs than international competitors.

How Might Companies Respond to the Tariffs?

Strategic Options for Copper Producers

Copper producers face a range of strategic choices in response to the new tariff environment:

Relocation of processing facilities has already begun, with several major producers considering shifting semi-finished processing to locations that might qualify for tariff exemptions.

Price adjustment strategies will vary by producer and market position. US domestic producers can be expected to price at or slightly below the "world price plus tariff" level to maximize revenue while maintaining market share.

Market diversification approaches are accelerating, particularly among producers from Chile and Peru who have historically been heavily dependent on the US market. Asian markets, particularly India and Southeast Asia, are likely targets for redirected exports.

Lobbying and exemption request tactics will be pursued aggressively by affected parties, with particular focus on product-specific exclusions and country exemptions based on national security partnerships.

Downstream Industry Adaptations

Industries that rely on copper as a key input are developing multi-faceted responses:

Material substitution possibilities are being explored more aggressively, including:

- Aluminum for certain electrical applications

- Engineered polymers for plumbing and some electrical components

- Fiber optics in place of copper telecommunications cabling

Supply chain restructuring options include increased inventory holdings, diversification of suppliers, and in some cases, vertical integration through investment in copper production.

Cost pass-through strategies vary by industry, with construction likely able to pass through most increases while more competitive sectors like consumer electronics face margin pressure.

Product redesign considerations to reduce copper content or improve copper efficiency are accelerating, potentially driving innovation in sectors from electrical equipment to heating and cooling systems.

What Are the Potential Economic Consequences?

Inflation and Cost Structure Impacts

The copper tariffs will contribute to inflationary pressures across multiple sectors, though the magnitude will vary significantly:

Construction and infrastructure projects face some of the most direct impacts, with copper typically representing 3-5% of materials costs in commercial construction and up to 15% in certain electrical infrastructure projects.

The electronics sector faces particular challenges, with copper components representing significant cost elements in everything from consumer devices to industrial equipment.

Renewable energy development could see cost increases of 2-4% for solar installations and up to 3% for wind projects, potentially slowing deployment rates despite rising copper demand from these sectors.

Cost Impact Example: A typical 2,000-square-foot home contains approximately 200 pounds of copper in wiring and plumbing. At current prices, the tariff could add $400-600 to construction costs.

While these impacts are significant for specific industries, the broader inflation impact is expected to be modest, likely adding less than 0.1% to overall consumer price inflation.

Trade Balance and International Relations Effects

The tariffs will alter trade patterns and potentially trigger responses from affected partners:

Retaliatory measures are being considered by several trading partners, particularly Chile and Peru, which may target US agricultural exports or mining equipment.

US trade balance effects will be mixed – reduced copper imports will improve the trade balance on paper, but potential retaliation and higher costs for US exporters could offset these gains.

WTO challenges are almost certain, with several countries already consulting with trade attorneys about potential violation of international trade commitments.

Diplomatic relationships with key mineral-producing allies like Chile, Peru, and Canada face strain, potentially complicating cooperation on other strategic priorities.

FAQs About the US Copper Tariffs

Key Questions About Implementation

Will there be country-specific exemptions to the tariffs?

While no exemptions have been announced yet, historical precedent with steel and aluminum tariffs suggests that certain close allies may eventually receive exemptions or quota arrangements.

How will the tariffs apply to different forms of copper?

The tariffs will cover raw copper (including cathodes and blister copper) as well as semi-finished products like wire, tube, and sheet. Finished products containing copper as a component are not directly affected but may face pass-through price increases.

What options exist for companies seeking tariff exclusions?

The Department of Commerce is expected to establish a product-specific exclusion process similar to those used for previous Section 232 tariffs, allowing companies to request exemptions for products not available from US sources in sufficient quantity or quality.

How will compliance be monitored and enforced?

US Customs and Border Protection will be responsible for enforcing the tariffs at ports of entry, with potential penalties for misclassification or transshipment to evade tariffs.

Economic Impact Questions

How much will consumer prices increase for copper-containing products?

Price increases will vary significantly by product category, depending on copper content and competitive dynamics. Products with high copper content and limited substitution options, like electrical wiring, could see increases of 5-10%, while products where copper is a smaller component may see minimal impact.

What industries will be most affected by the tariffs?

The electrical, construction, automotive, and HVAC industries face the most significant direct impacts due to their high copper usage. Secondary effects will ripple through supply chains to affect a broader range of industries.

How might the tariffs affect US employment in manufacturing?

Employment effects will be mixed – potentially positive for the approximately 12,000 workers in US copper mining but challenging for the much larger workforce in copper-consuming industries.

What are the expected government revenue implications?

Based on current import volumes, the tariffs could generate $2-3 billion annually in government revenue, though this will decline as imports decrease and exemptions are granted.

What's Next for Copper Markets?

Short-Term Market Outlook

The copper market faces a period of significant adjustment and volatility:

Price volatility is expected to remain elevated for at least 3-6 months as supply chains adjust and new trade patterns emerge. Price spreads between US and international markets will likely widen initially before finding a new equilibrium.

Key indicators to monitor include:

- LME and COMEX warehouse inventory levels

- Physical delivery premiums in different regions

- US import volumes by country of origin

- Announcements of production adjustments from major miners

Critical upcoming announcements that could affect market direction include potential country exemptions, details of the product exclusion process, and retaliatory measures from affected trading partners.

Long-Term Industry Transformation Possibilities

The copper tariffs may accelerate several long-term trends in the global copper industry:

Structural changes to global supply chains will likely include more regionalized processing and fabrication to minimize tariff impacts, potentially reversing some aspects of globalization in the metals industry.

Innovation and substitution efforts will accelerate, potentially leading to breakthroughs in aluminum conductivity, polymer performance, or other copper alternatives.

Recycling and circular economy initiatives will receive additional investment as higher prices improve the economics of copper recovery and reuse. The US copper recycling rate could increase from current levels of approximately 40% to 60% or higher over the next decade.

Investment trends will favor US domestic production and processing capacity, potentially reversing the long-term decline in US copper self-sufficiency. Several major miners have already indicated plans to accelerate development of US copper projects that were previously considered marginal, with copper price projections supporting these investments.

The copper tariffs represent a significant shift in US trade policy with far-reaching implications for global markets. While creating opportunities for some stakeholders, they present significant challenges for others and will drive substantial restructuring throughout the copper value chain.

Want Early Insights on Major Mineral Discoveries?

Stay ahead of the market with instant notifications on significant ASX mineral discoveries through Discovery Alert's proprietary Discovery IQ model, which turns complex mineral data into actionable investment insights. Explore Discovery Alert's dedicated discoveries page to understand how major mineral discoveries can lead to substantial returns, then begin your 30-day free trial today.