What's Driving China's Lithium Futures Rally?

The market experienced a dramatic shift when china lithium futures rise 8% to hit six-month high. This development underscores evolving trends in the lithium industry and sets the stage for broader discussions on global supply, demand, and technological innovation. It is the first clear indicator that change is afoot.

Recent Market Performance

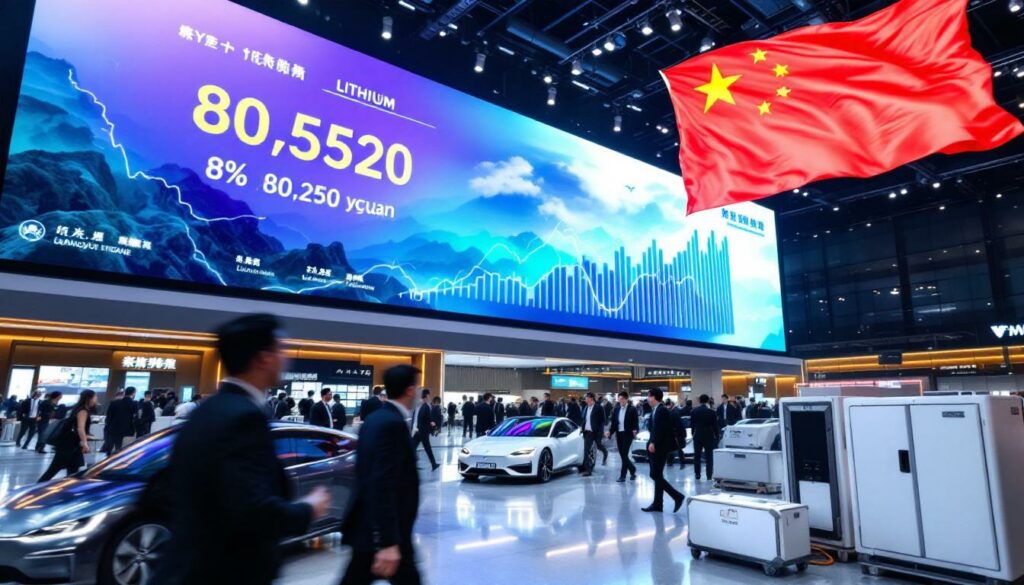

On July 25, 2025, lithium carbonate futures surged by 8%, reaching 80,520 yuan per metric ton. This spike represents the highest level since January 21, 2025 and has drawn attention worldwide.

Market volatility has been atypically high, hinting that a real change may be underway. Analysts now view this rally as more than short-term speculation.

Wei Zhang, a senior commodities analyst at Shanghai Metals Market, commented, "The velocity of this price change really signifies a fundamental shift in market sentiment."

Furthermore, updated exchange rates now intensify the global ripple effects.

Global Supply-Demand Factors

A series of factors have contributed to this market reversal:

- Production constraints: Australian and Chilean producers have reduced output.

- Rebounding demand: Chinese electric vehicle production increased noticeably.

- Strategic stockpiling: Battery manufacturers secure lithium supplies ahead of shortages.

Recent data shows that global lithium demand, expected to reach 2.5 million tonnes of LCE by 2030, highlights the market’s accelerating momentum. In addition, pressures from supply-demand imbalances remain a key theme in industry analyses.

Electric Vehicle Manufacturing Implications

An 8% surge in lithium prices directly affects EV manufacturers. Lithium forms between 15% and 20% of battery cell costs, making these price changes impactful.

Vertically integrated manufacturers face minimal short-term effects, while non-integrated companies face significant margin pressures.

Moreover, Chinese domestic brands that benefit from government-backed supply agreements see moderate exposure compared to their competitors.

Large companies like BYD and CATL are better shielded, having secured long-term contracts. Nonetheless, newer EV startups face cost challenges that may force them to adjust production strategies.

Energy Storage Sector Effects

The broader energy storage market is also impacted by rising lithium prices. Grid-scale battery installations—growing by 160% in 2024—now confront higher material costs.

This surge spurs key trends:

• Diversification into alternative chemistries such as sodium-ion and iron-flow

• Increased recycling investments to recover lithium from spent batteries

• Enhanced vertical integration by storage developers securing supply chains

For instance, projects utilising geothermal lithium extraction are looking to benefit from these market conditions. Additionally, innovations continue to reshape cost structures in the sector.

Broader Economic Implications

China’s strategic industrial policies play a significant role in shaping global markets. Under policies from its 14th Five-Year Plan, lithium is deemed a strategic emerging industry.

China dominates approximately 60% of global lithium processing capacity and 75% of battery cell manufacturing. This concentration empowers Chinese exchanges to set global price benchmarks.

Moreover, these policies have encouraged domestic resource development. For example, recent projects in Tibet and Qinghai are being designed to leverage higher lithium prices.

As these projects become operational, the market could see further price adjustments down the line.

International Trade Considerations

International market participants have their eyes on this development. Countries that designate lithium as a critical mineral face higher costs building independent supply chains.

In response, Australia is exploring new opportunities with its resource sector, evident from ongoing Australia lithium innovations.

Additionally, Argentina is also repositioning itself, as seen through recent reports on Argentina lithium insights.

Trade flows will likely change:

• Australia may focus exports on non-Chinese markets.

• Chile and Argentina might fast-track new project developments.

• African resources could attract greater Western investment for diversification.

External data from global lithium market sources further supports these shifts, while commodity trends indicate a broader realignment in the supply chain.

Historical Price Patterns and Analysis

Analysing the past six months reveals a steady yet volatile price evolution.

January saw an average price of 79,800 yuan/ton. February fell to 75,200 yuan/ton, largely due to seasonal slowdowns.

March and April experienced fluctuations as significant announcements, such as major Australian mine expansions, influenced prices.

Inventory drawdowns became visible in May and June, setting the groundwork for the current rally.

This price trajectory is gaining momentum, with technical analysts noting key resistance and support levels that validate the current trend.

Notably, industry experts refer to this as a phase aligning closely with the headline sentiment: china lithium futures rise 8% to hit six-month high.

Investment Implications for Mining Projects

The recent price jump improves the economics of lithium mining globally. Projects that were once marginal now appear viable.

Hard-rock operations require prices above 70,000 yuan/ton, while new brine projects need above 65,000 yuan/ton.

With prices now at 80,520 yuan/ton, even previously discouraged projects gain investment appeal.

Developers in regions like the Salton Sea in the USA are eyeing direct lithium extraction to make processes more efficient.

Moreover, emerging operations in Africa and Australia, including advancements in battery-grade lithium refinery, are under review. This dynamic environment is clearly influencing capital allocation decisions by investors.

Technology and Processing Innovations

Technological breakthroughs are reshaping industry economics.

Direct lithium extraction now offers rapid processing techniques compared to the traditional, lengthy evaporation methods.

These improvements also benefit hard-rock processing, which continually seeks to reduce energy requirements and environmental impacts.

Additionally, recycling innovations allow recovery of up to 95% of lithium from spent batteries. Such processes are critical given that environmental concerns and water scarcity affect many regions within the Lithium Triangle.

As investments in technology grow, market analysts are optimistic about long-term cost savings and sustainability improvements.

It is worth noting that the current market conditions further reinforce the earlier observation: china lithium futures rise 8% to hit six-month high. This milestone bolsters confidence in technology-driven solutions.

Analyst Perspectives and Future Trends

Several market experts have shared their forward-looking opinions.

A bullish case suggests that supply constraints will push prices toward 100,000 yuan/ton by year-end 2025.

Conversely, bearish voices warn that the rally may be short-lived, with provisional stabilisation near 75,000 yuan/ton.

A balanced view sees structural rebalancing, with prices sustained between 80,000 and 90,000 yuan/ton through 2026.

Technical analysis indicates that resistance may emerge around psychological price levels.

Industry participant Li Wei from CITIC Securities emphasized, "Futures signals provide a preview of physical market trends, and inventory levels remain a key factor."

This sentiment echoes the headline intuition: china lithium futures rise 8% to hit six-month high.

FAQ: China's Lithium Market Movement

Why is the 8% increase significant?

The 8% jump signals atypical volatility, demonstrating that market sentiments are shifting. This single-day movement indicates that investors expect supply-demand rebalancing soon.

How does the Chinese market influence global prices?

China’s dominant processing capacity and battery production set benchmarks globally. Such influence affects spot transactions, contract pricing, and even major mining investments across continents.

What factors drive lithium price volatility?

Lithium prices are affected by production constraints, changing EV forecasts, battery technology improvements, policy changes, and speculative investment.

Will consumers feel the impact?

Direct effects on consumer products are marginal initially, but persistent high prices could eventually lead to increased costs for electric vehicles and electronics.

Conclusion

In summary, the recent market movement, underscored by china lithium futures rise 8% to hit six-month high, reflects a broader transition in the lithium and battery metals sectors.

Investors, manufacturers, and policymakers are now closely monitoring these dynamics as supply shifts, technological innovations, and geopolitical factors interact.

Continued industry vigilance and adaptive strategies will be critical in navigating this evolving landscape.

Looking to Invest in the Next Major Mineral Discovery?

Discovery Alert's proprietary Discovery IQ model instantly notifies investors of significant ASX mineral discoveries, turning complex data into actionable insights for both short-term trading and transformative long-term opportunities. Explore why historic discoveries generate substantial returns by visiting Discovery Alert's dedicated discoveries page and begin your 30-day free trial today.