Australia's Steep Fall in Global Mining Investment Appeal

Western Australia – once ranked #1 in the world for mining investment attractiveness – has plummeted to 17th position according to the latest Fraser Institute Annual Survey of Mining Companies. This dramatic shift signals a concerning trend across all Australian mining jurisdictions, with none securing a place in the global top 10 for the first time in recent memory.

The decline has sent shockwaves through Australia's resource sector, prompting urgent calls for regulatory reform to restore the nation's competitive edge in global mining landscape.

Understanding the Fraser Institute Survey

The Fraser Institute's Annual Survey of Mining Companies provides a comprehensive global assessment of mining jurisdictions, evaluating 82 regions worldwide based on their attractiveness to mining investors. This influential benchmark analyzes two critical factors: geological attractiveness (mineral and metal potential) and government policies that either encourage or discourage exploration and investment.

The survey serves as a crucial barometer for mining executives and investors, influencing billions in capital allocation decisions across the global mining sector. Regions that consistently rank highly typically enjoy greater mining investment inflows, while those with declining rankings often experience investment hesitancy or outright withdrawal.

Mining companies rely on these rankings when making strategic decisions about where to allocate exploration budgets and development capital, making the survey's findings particularly consequential for resource-dependent economies like Australia's.

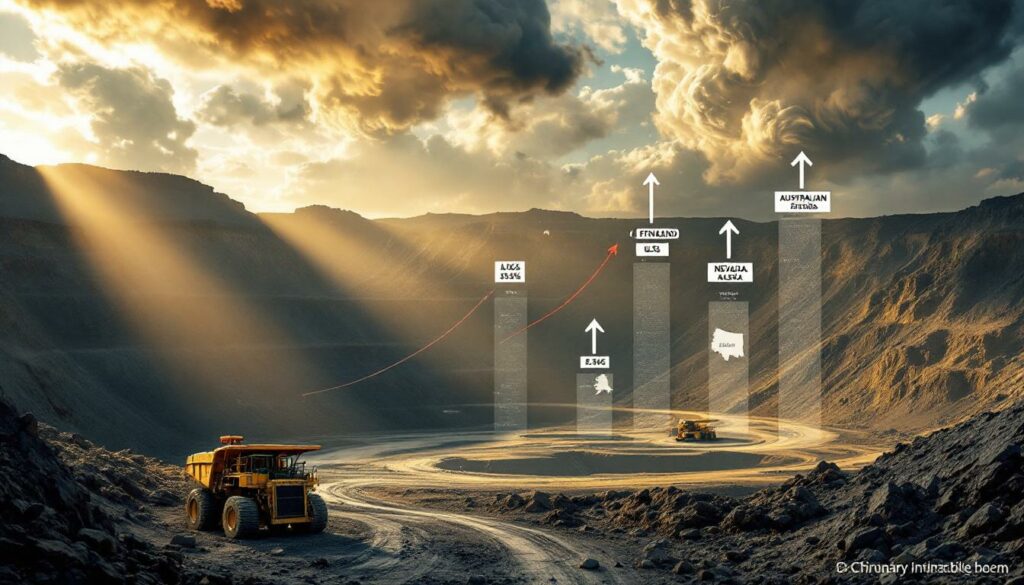

Australia's Dramatic Fall in Rankings

The latest Fraser Institute survey reveals an unprecedented decline in the investment attractiveness of all Australian jurisdictions, marking a stark reversal from the country's historically dominant position in global mining.

Western Australia's Concerning Decline

Western Australia, long considered among the world's premier mining destinations, has experienced a dramatic fall from 4th place globally to 17th position. This decline is particularly alarming considering that not long ago, Western Australia held the coveted #1 ranking worldwide.

Industry observers attribute this decline to mounting regulatory uncertainty and policy issues at both state and federal levels, creating an increasingly challenging environment for mining investment and development.

Other Australian Jurisdictions in Free Fall

The downward trend extends across all Australian mining regions:

- Queensland has plunged from 13th to 39th place

- South Australia has fallen from 19th to 35th

- Northern Territory has declined from 22nd to 38th

- New South Wales has plummeted from 34th to 62nd

- Victoria has dropped from 48th to 63rd

- Tasmania has experienced the most significant fall, from 33rd to 71st, making it Australia's lowest-ranked jurisdiction

This across-the-board decline suggests systematic challenges affecting Australia's entire mining sector rather than isolated state-specific issues.

Historical Context of Australia's Mining Leadership

The absence of any Australian jurisdiction in the global top 10 represents an extraordinary shift from Australia's historical position as a mining investment powerhouse. For decades, Australian mining regions – particularly Western Australia – consistently ranked among the world's most attractive destinations for mining capital.

This dramatic reversal raises fundamental questions about Australia's future competitiveness in an industry that has long been a cornerstone of its economic prosperity.

What Factors Are Driving Australia's Mining Investment Decline?

Industry experts point to several interrelated factors behind Australia's diminishing appeal to mining investors, with regulatory uncertainty emerging as a primary concern.

Regulatory Uncertainty and Policy Volatility

The Association of Mining and Exploration Companies (AMEC) has identified several specific issues undermining Australia's mining investment climate:

- Increasing uncertainty surrounding land access for exploration and development

- Growing complications in approval processes creating delays and unpredictability

- Policy volatility at both state and federal levels disrupting long-term investment planning

- Inconsistent regulatory approaches between different jurisdictions creating compliance challenges

These factors collectively contribute to an environment where mining companies face mounting permitting challenges in mining that make it difficult to predict approval timelines, operational requirements, and investment returns.

Environmental Regulation Complexity

The evolving landscape of environmental regulations has created additional layers of complexity for mining companies operating in Australia. Recent years have seen:

- Expanded environmental assessment requirements

- Shifting biodiversity protection standards

- Increasing uncertainty around offsets and compensatory measures

- Growing administrative burdens for compliance documentation

While environmental protection remains essential, industry stakeholders argue that regulatory efficiency and certainty can coexist with strong environmental safeguards.

Rising Operational Costs

Beyond regulatory challenges, Australia faces mounting cost pressures that affect its global competitiveness:

- Labor costs significantly higher than many competing jurisdictions

- Energy price volatility affecting operational expenses

- Increasing logistics and transportation costs

- Rising compliance expenses associated with regulatory requirements

These cost factors, combined with regulatory uncertainty, create a challenging environment for mining investment decision-makers comparing global opportunities.

Industry Response to the Rankings Decline

The survey results have triggered significant concern across Australia's mining sector, with industry leaders calling for urgent policy reform to reverse the downward trend.

AMEC's Assessment of the Situation

Warren Pearce, Chief Executive of the Association of Mining and Exploration Companies (AMEC), described the results as casting "a dark shadow over the Australian resources industry," highlighting several troubling aspects:

- The unprecedented absence of any Australian jurisdiction in the global top 10

- The stark contrast with the United States, which placed four jurisdictions in the top 10

- The alignment between survey findings and ongoing industry concerns about regulatory uncertainty

"Regrettably, many of the concerns raised reflect what Australian industry has been saying for some time, primarily about increased uncertainty around land access and approvals," Pearce noted, emphasizing that the survey results validate long-standing industry concerns.

Competitive Implications for Australia

Industry stakeholders have emphasized that the rankings decline isn't merely a statistical concern but reflects real challenges in attracting global mining capital:

- International mining companies increasingly view Australian projects as higher risk

- Capital allocation decisions are shifting toward more favorable jurisdictions

- Early-stage exploration activity – crucial for future development pipelines – faces particular challenges

- Australia's traditional competitive advantages are being eroded by regulatory complexity

These competitive pressures threaten to undermine Australia's historical position as a global mining powerhouse if not addressed through meaningful reform.

How Do Other Countries Compare in Mining Investment Appeal?

The global landscape of mining investment attractiveness reveals several jurisdictions outperforming Australia, providing valuable insights into what drives mining investment decisions.

Global Leaders in Mining Investment Attractiveness

The latest Fraser Institute survey identifies several standout performers in mining investment appeal:

Top 5 Most Attractive Jurisdictions

- Finland

- Nevada (USA)

- Alaska (USA)

- Wyoming (USA)

- Arizona (USA)

The United States' strong showing, with four jurisdictions in the top five, highlights the impact of clear regulatory frameworks, established mining traditions, and supportive policy environments.

Finland's top ranking demonstrates that stringent environmental standards can coexist with mining investment attractiveness when implemented within predictable regulatory frameworks.

Policy-Specific Rankings Reveal Key Insights

Beyond overall attractiveness, the survey's policy-specific rankings provide additional perspective:

- Republic of Ireland ranks 1st globally for mining policies, demonstrating the impact of clear regulatory frameworks

- Bolivia ranks last for mining policies, illustrating how policy uncertainty can override geological potential

- Several mid-tier geological jurisdictions achieve high overall rankings through exceptional policy environments

These policy rankings underscore that while geology matters, government approach to regulation often determines whether mineral potential translates to actual investment.

Least Attractive Mining Jurisdictions

The five least attractive jurisdictions globally according to the survey are:

- Ethiopia

- Suriname

- Niger

- Nova Scotia (Canada)

- Mozambique

These jurisdictions typically face challenges related to political instability, regulatory unpredictability, security concerns, or unfavorable fiscal regimes – providing cautionary examples of how policy environments can deter mining investment despite geological potential.

What Remedial Actions Are Being Taken?

Despite the concerning rankings decline, Australian authorities have begun implementing measures aimed at improving the mining investment climate.

Government Response to Industry Concerns

AMEC's Warren Pearce acknowledged some positive developments amid the concerning overall trend:

- The federal government has abandoned contentious "nature positive" reforms that created uncertainty

- A new approach to environmental legislation aims to create simpler, more certain processes

- Active collaboration between federal and state governments with industry stakeholders is underway

"Federally, the Commonwealth has thrown out contentious nature positive reforms and started again, pursuing improvements to our environmental legislation that we hope will support a simpler and more certain process," Pearce noted, highlighting that reform efforts are already in motion.

Reform Initiatives Underway

Several specific reform initiatives are currently being developed or implemented:

- Streamlining of environmental approval processes to reduce duplication

- Efforts to harmonize regulatory approaches across different jurisdictions

- Renewed focus on approval timeframes and predictability

- Review of land access frameworks to provide greater certainty

These initiatives aim to address the core concerns identified in the Fraser Institute survey while maintaining Australia's strong environmental and social standards.

Industry-Government Collaboration

Pearce highlighted that "federal and state governments had been actively working with the industry over the past year on many of the key issues raised," suggesting a collaborative approach to addressing the challenges identified in the survey.

This cooperation between government and industry stakeholders represents a critical pathway to developing solutions that balance investment attractiveness with other policy objectives.

Industry Recommendations for Improvement

To restore Australia's competitive position in global mining investment, industry experts have proposed several targeted reforms:

Streamlining Approval Processes

- Implementing clear timelines for approval decisions

- Reducing duplication between different regulatory frameworks

- Establishing single-touch approval systems where possible

- Creating dedicated case managers for significant projects

Enhancing Regulatory Certainty

- Developing clearer guidelines for environmental and social requirements

- Limiting retrospective regulatory changes that affect existing projects

- Providing greater stability in fiscal and royalty frameworks

- Establishing streamlined dispute resolution mechanisms

Improving Land Access Policies

- Creating more transparent frameworks for determining accessible areas

- Developing clearer protocols for stakeholder engagement

- Establishing more predictable compensation frameworks

- Resolving competing land use conflicts more efficiently

Developing Consistent Cross-Jurisdictional Approaches

- Harmonizing key regulatory requirements across states and territories

- Creating mutual recognition of approvals where appropriate

- Standardizing reporting requirements across jurisdictions

- Establishing consistent environmental assessment methodologies

These recommendations focus on creating greater certainty, efficiency, and predictability without compromising environmental and social standards.

What Are the Implications for Australia's Mining Future?

The rankings decline raises several significant concerns for Australia's resource-dependent economy if not effectively addressed.

Economic Impact Concerns

The survey results point to potential economic consequences for Australia's mining sector and broader economy:

- Potential reduction in foreign direct investment as capital flows to more favorable jurisdictions

- Risk to future project developments, particularly early-stage exploration

- Competitive disadvantage against rising mining jurisdictions in North America and elsewhere

- Possible long-term impacts on WA resource sector impact and economic contribution

Mining has historically served as a foundational pillar of Australia's economy, making these competitive challenges particularly consequential for national prosperity.

Long-Term Structural Challenges

Beyond immediate investment concerns, the rankings decline highlights several structural challenges facing Australia's mining sector:

- Growing complexity in stakeholder expectations and social license requirements

- Balancing climate policy commitments with mining development

- Managing the transition toward Australia's strategic minerals and away from traditional commodities

- Addressing rising production costs in an increasingly competitive global market

Navigating these challenges successfully will require thoughtful policy development that maintains Australia's competitive position while meeting evolving social and environmental expectations.

Opportunities for Reform

Despite the concerning trends, the survey results present a valuable opportunity for policymakers to address:

- Regulatory inefficiencies that create unnecessary costs and delays

- Approval process bottlenecks that impede investment decisions

- Policy uncertainty affecting long-term planning and risk assessment

- Competitive positioning against rising global mining jurisdictions

With focused attention on these areas, Australia has the potential to reverse its rankings decline and restore its historically strong position in global mining investment attractiveness.

FAQ: Australia's Mining Investment Rankings

Why is the Fraser Institute survey important for mining investment?

The survey provides investors with comparative data on 82 global jurisdictions, helping them make informed decisions about where to allocate exploration and development capital. It evaluates both geological potential and policy environments, offering a comprehensive view of investment attractiveness that influences billions in capital allocation decisions annually.

What specific policy issues are affecting Australia's mining investment appeal?

Key concerns include regulatory uncertainty surrounding project approvals, complicated and lengthy approval processes, land access challenges creating exploration barriers, and inconsistent policy approaches between state and federal governments. These issues collectively create an environment where mining companies face difficulty predicting timelines, requirements, and investment returns.

How might Australia's ranking decline affect mining companies?

Companies operating in Australia may face increased difficulty attracting investment capital, potentially leading to project delays, reduced exploration activity, and a shift of resources to more favorable jurisdictions. This is particularly challenging for junior mining companies that rely heavily on investor confidence to fund exploration activities.

What can Australian governments do to improve future rankings?

Streamlining approval processes to create greater efficiency and predictability, enhancing regulatory certainty through clearer guidelines and requirements, improving land access policies to reduce exploration barriers, and developing consistent approaches across jurisdictions would help restore Australia's competitive position in global mining investment.

How does Australia's decline compare historically?

The current rankings represent an unprecedented decline, particularly for Western Australia, which was previously ranked number one globally and has now fallen to 17th position. The absence of any Australian jurisdiction in the global top 10 marks a historic low point in Australia's mining investment attractiveness rankings.

Disclaimer: The mining industry involves inherent risks and uncertainties. Investment decisions should be based on comprehensive research beyond the information presented in this article. While every effort has been made to ensure accuracy, the analysis involves some speculative elements regarding future policy developments and industry evolution trends.

Ready to Spot the Next Major Mineral Discovery?

Stay ahead of the market with Discovery Alert's proprietary Discovery IQ model that instantly notifies you of significant ASX mineral discoveries, turning complex data into actionable investment insights. Explore why major discoveries can generate substantial returns by visiting our dedicated discoveries page and begin your 30-day free trial today.