Understanding the Dual Uranium Supply Shock: Market Implications and Investment Opportunities

The global uranium market is experiencing an unprecedented dual uranium supply shock that's sending ripples through the industry and creating significant investment implications. This convergence of disruptions in major uranium-producing regions, coupled with structural market factors and growing demand, presents a unique opportunity for investors to understand the complex dynamics shaping this critical resource.

What Is Causing the Current Uranium Supply Shock?

The Convergence of Two Major Supply Disruptions

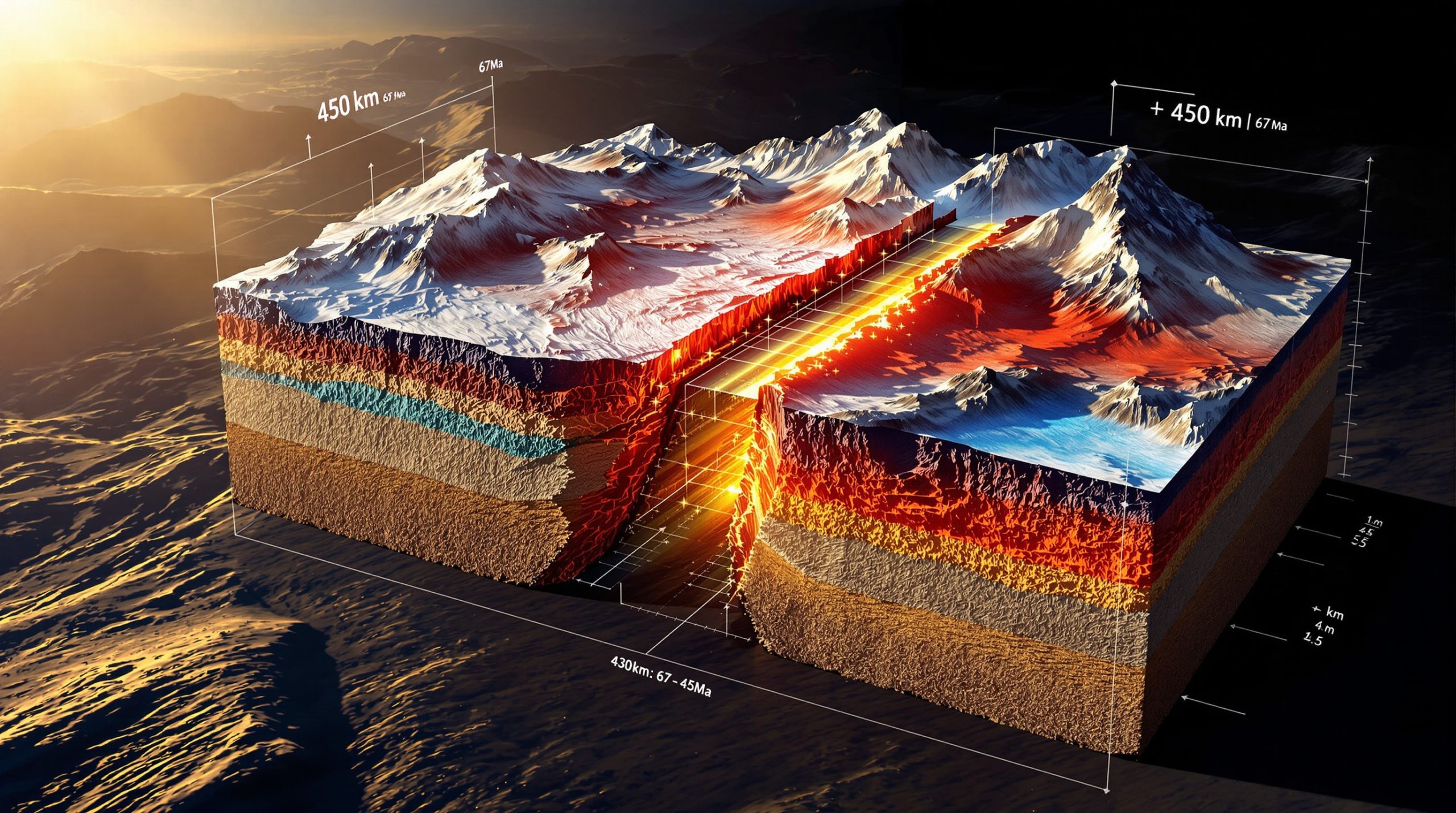

The uranium market faces a rare "dual uranium supply shock" stemming from simultaneous disruptions in two of the world's largest uranium-producing regions. Kazakhstan's Kazatomprom announced a significant 20% production cut, while political instability in Niger threatens operations at Orano's SOMAIR mine. Together, these events affect regions responsible for approximately 50% of global primary uranium production.

This supply shock is particularly impactful given uranium's concentrated production profile, with Kazakhstan accounting for approximately 43% of global uranium production as of 2023, producing over 21,227 tonnes of uranium. Niger, while smaller, contributes approximately 4.7% of global supply with production of 2,020 tonnes in 2022.

Kazatomprom's Strategic Production Reduction

Kazatomprom, the world's largest uranium producer, recently revised its production guidance downward to a mid-point of 14 million pounds of uranium trioxide. This 20% reduction from previous projections represents approximately 11,200-12,800 tonnes U3O8 equivalent, down from previous forecasts.

The reduction reflects both operational constraints in Kazakhstan's in-situ recovery operations and strategic positioning by the company, which historically functions as a swing supplier capable of influencing market stability. Kazatomprom's role extends beyond simple supply provision, as its production decisions directly influence price stability and market sentiment.

Niger's Political Instability and Production Risks

Niger contributes approximately 5% of global uranium supply, with Orano's SOMAIR mine representing a critical component of Western supply chains. Following a 2023 military coup, the country faces export restrictions and operational uncertainties that threaten continued production.

The closure or extended suspension of SOMAIR operations would remove significant supply capacity during a period when alternative sources remain constrained. This situation carries particular significance for European energy security, especially France, which has historically sourced 15-20% of its uranium from Niger through Orano operations.

How Does the Uranium Market Structure Amplify Supply Shocks?

Concentrated Production and Limited Liquidity

The uranium market operates within a uniquely vulnerable framework characterized by several structural factors that amplify supply disruptions:

- Geographic concentration with the top 5 producing countries accounting for approximately 75% of global uranium supply

- Limited trading liquidity averaging only 15-20 million pounds annually compared to 190+ million pounds of annual reactor requirements

- Declining secondary supply from decommissioned weapons and utility stockpiles, down from peak of ~24 million pounds annually to under 7 million pounds

- Few major producers with Cameco Corporation and Kazatomprom together controlling approximately 50% of global production

This market structure creates extraordinary sensitivity to production disruptions, where even modest supply changes can trigger disproportionate price movements.

Recent Price Movements and Market Response

Uranium pricing demonstrated characteristic uranium market volatility during recent months, with prices declining from approximately $79 per pound in late June to $72.30 per pound by mid-July. This correction occurred despite fundamentally tight supply conditions, highlighting the market's sensitivity to short-term sentiment shifts.

The thin trading profile of uranium markets distinguishes it from more liquid commodity markets, creating an environment where relatively modest transaction volumes can generate substantial price movements. Sprott Physical Uranium Trust's accumulation of over 56 million pounds since 2021 demonstrates how relatively modest purchasing can significantly impact prices.

Physical uranium funds now hold approximately 60+ million pounds collectively, removing significant quantities from available supply. Yellow Cake PLC alone holds approximately 17.2 million pounds, further reducing available inventory in an already constrained market.

What Structural Factors Support Long-Term Uranium Demand?

Policy Support for Nuclear Energy Expansion

Recent policy developments signal unprecedented institutional support for nuclear power:

| Policy Development | Impact on Uranium Markets |

|---|---|

| US government initiatives for domestic enrichment | Reduces reliance on foreign uranium sources |

| World Bank's decision to finance nuclear projects | Expands capital access for developing economies |

| Accelerated permitting processes | Supports domestic uranium production growth |

| Trade restrictions on Russian imports | Creates premium for Western-sourced uranium |

These policy shifts address long-standing barriers to nuclear energy development while supporting supply chain resilience objectives across multiple jurisdictions. The US ban on Russian uranium imports begins January 1, 2028, with limited waivers until 2035, creating structural demand for alternative supply sources.

Technological Drivers of Nuclear Energy Growth

Technological developments creating structural demand for uranium include:

- Artificial intelligence applications requiring substantial electricity generation capacity

- Advanced reactor technologies with improved safety and efficiency profiles

- Small modular reactor development accelerating deployment timelines

- Data center electricity requirements supporting baseload generation expansion

Global nuclear capacity is expected to increase from 370 GWe in 2023 to 615 GWe by 2050 in net-zero scenarios according to the International Energy Agency. Currently, 61 reactors are under construction globally, with China leading at 23 units.

Data center electricity consumption is projected to grow 15-20% annually, driving baseload power demand that aligns perfectly with nuclear energy's consistent generation profile. Corporate buyers are increasingly seeking carbon-free electricity for ESG commitments, with Microsoft's partnership with Constellation Energy to restart Three Mile Island Unit 1 demonstrating corporate commitment to nuclear power.

How Are Geopolitical Factors Influencing Uranium Markets?

Nuclear Energy's Strategic Importance

Nuclear energy's intersection with national security priorities has elevated uranium beyond conventional commodity markets into strategic resource considerations. Recent developments demonstrate how geopolitical factors increasingly influence uranium market dynamics:

- Energy security concerns following European gas supply disruptions

- Supply chain resilience initiatives following pandemic-related disruptions

- Military alliance considerations related to nuclear technology access

- Critical mineral designations in multiple jurisdictions

Russia currently supplies approximately 35% of global uranium enrichment services, while the European Union imported 25% of natural uranium from Russia and 32% of enriched uranium in 2022. These dependencies are now viewed through a strategic lens, accelerating efforts to diversify supply chains.

Ukraine's Nuclear Infrastructure Vulnerabilities

Ongoing military activity near Ukraine's Zaporizhzhya nuclear power plant has highlighted vulnerabilities in nuclear infrastructure during geopolitical conflicts. While operational impacts remain limited, the perception of risk surrounding nuclear facilities in conflict zones reinforces the strategic premium associated with secure uranium supply chains.

Nuclear power plants as potential conflict targets underscore energy security considerations that extend beyond traditional commodity market analysis. These developments contribute to policy discussions about supply chain resilience and domestic production capabilities across multiple jurisdictions.

Niger's Changing Political Landscape

France's historical reliance on Niger uranium demonstrates how geopolitical instability in producing regions can disrupt established supply relationships. The potential for extended disruptions highlights the importance of supply diversification for utilities and governments seeking energy security.

Despite regional geopolitical challenges, projects like Global Atomic's Dasa in Niger continue advancing based on their economic fundamentals and strategic importance. The Niger government continues supporting critical mining projects despite broader regional instability, recognizing their importance to the national economy.

How Are Companies Positioned Within This Market Environment?

North American Exploration and Development

Companies with uranium assets in North America benefit from jurisdictional stability and growing policy support for domestic production. Key positioning includes:

- Control of large land positions in premier uranium districts

- Advancement of high-grade deposits with economic viability at various price points

- Existing permits and processing infrastructure providing near-term production optionality

- Technical teams with experience developing uranium projects through previous cycles

ATHA Energy controls the largest uranium land position across Canada's premier uranium districts, including the Athabasca, Thelon, and Central Mineral Belt regions. The company's Lac 50 deposit, with 43.3 million pounds of uranium trioxide at 0.69% grade, represents one of the highest-grade uranium deposits globally outside the Athabasca Basin.

IsoEnergy advances the Hurricane deposit in Saskatchewan's Athabasca Basin, featuring 48.6 million pounds of indicated resources at an exceptional 34.5% grade. The company's United States assets, including the Tony M mine, provide near-term production optionality with existing permits and tolling agreements.

United States Production Capabilities

United States-based uranium production benefits from policy support and growing recognition of domestic supply importance. Strategic advantages include:

- Existing processing infrastructure with conventional uranium capabilities

- Permitted projects with established regulatory frameworks

- Tolling arrangements with operational processing facilities

- Integration with critical mineral supply chains beyond uranium

US uranium market disruption in 2023 highlighted the vulnerability of supply chains, with domestic production totaling only 0.7 million pounds, less than 1% of reactor requirements according to the US Energy Information Administration. This supply gap creates opportunities for domestic producers as policy support increases.

Energy Fuels operates as the largest uranium producer in the United States, with the White Mesa Mill providing the only conventional uranium processing facility in the country. The company's strategic positioning includes rare earth elements production capabilities, creating exposure to multiple critical mineral themes.

US ISR uranium production dominates US uranium mining but faces permitting and operational challenges. Conventional mining methods can achieve competitive costs with proper infrastructure and scale.

African Development Projects

Despite regional challenges, African uranium projects continue advancing based on their economic fundamentals and strategic importance. Key considerations include:

- Government recognition of projects' national economic importance

- High-grade resources supporting competitive production costs

- Infrastructure development supporting future production capabilities

- Strategic importance for diversified uranium supply chains

Global Atomic's Dasa project in Niger features 73 million pounds of uranium reserves with projected lowest quartile operating costs. The project targets production commencement in the second quarter of 2026, providing near-term supply in a constrained market environment.

Despite regional geopolitical challenges, the project maintains support from Niger's government and continues advancing toward production. The strategic importance of the project for Niger's economy provides operational stability despite broader regional concerns.

What Investment Themes Support Uranium Markets?

Supply Constraints and Price Discovery

The uranium market presents distinctive supply characteristics that support investment consideration:

- Concentrated production profile with limited substitution options

- Production lead times extending 5-10 years for new conventional mines

- Declining secondary supply from historical sources

- Limited price elasticity of supply at current price levels

Uranium prices increased from $28/lb in 2020 to over $80/lb in 2024, demonstrating supply-demand fundamentals. Long-term contract prices are averaging $65-75/lb in recent contracting cycles, providing price stability for producers.

Investment fund uranium holdings total over 75 million pounds, representing approximately 40% of annual mine production. This financial market participation has removed significant supply from the market while increasing visibility for uranium as an investment thesis.

Policy Support and Regulatory Evolution

Policy developments supporting nuclear energy development include:

- Streamlined regulatory frameworks for advanced reactor deployment

- Financial support for domestic uranium production and processing

- International financing access for nuclear energy projects

- Critical mineral designations enhancing strategic importance

The World Bank's decision to finance nuclear power projects represents a fundamental shift from historical reluctance to support nuclear energy development. This policy change could significantly impact global capital flows and reduce financing costs for nuclear power projects in developing economies.

International financing support for nuclear power development reinforces the technology's role in global decarbonization strategies while supporting uranium demand growth. The availability of multilateral financing could accelerate nuclear power adoption in regions previously constrained by capital availability.

Technological Demand Acceleration

Technology-driven demand growth supports structural uranium market fundamentals:

- Data center electricity requirements supporting baseload generation needs

- Artificial intelligence applications requiring substantial energy inputs

- Advanced manufacturing processes benefiting from reliable power sources

- Electrification trends increasing overall electricity demand

Westinghouse's collaboration with Google on advanced reactor technologies demonstrates how artificial intelligence applications are driving nuclear power development. The potential for compressed construction timelines could accelerate demand realization compared to traditional nuclear development schedules.

These demand drivers operate independently of short-term price movements, supporting long-term market fundamentals. The alignment of technological innovation with nuclear energy's attributes creates multiple reinforcing trends supporting uranium demand growth.

How Does the Current Market Compare to Historical Uranium Cycles?

Historical Context for Current Market Dynamics

The uranium market has experienced multiple cycles characterized by periods of undersupply and oversupply. The current market environment differs from previous cycles in several important aspects:

- Declining secondary supply from historical sources

- Limited production expansion during extended bear market

- Growing recognition of nuclear energy's role in decarbonization

- Geopolitical premium associated with secure supply chains

Previous uranium bull market (2003-2007) saw prices rise from $10/lb to $136/lb. The current cycle began from $28/lb low in 2020, with more gradual price appreciation reflecting structural market evolution.

These factors create market conditions that differ substantially from previous uranium market cycles, potentially supporting more sustained price appreciation with lower volatility than historical boom-bust patterns.

Supply Development Timeline Constraints

New uranium supply development faces significant timeline constraints:

- Exploration to production timelines extending 7-15 years

- Permitting processes requiring 3-5 years in favorable jurisdictions

- Capital requirements limiting development pipeline

- Technical expertise constraints following industry contraction

Mine development timelines average 10-15 years from discovery to production, longer than previous cycles due to regulatory evolution and technical complexity. These development timeline constraints create potential supply gaps that cannot be quickly addressed through conventional market responses.

Olympic Dam expansion delays and the Paladin uranium mining halt demonstrate increased complexity in major project development and the challenges of replacing lost production capacity.

Institutional Participation Evolution

Financial market participation in uranium markets continues evolving:

- Physical uranium funds providing direct exposure to uranium price movements

- Growing institutional recognition of nuclear energy's role in energy transition

- Expanded investment options across the uranium value chain

- Improved market liquidity supporting institutional participation

Current market structure differs with significant financial market participation through uranium funds. Utility inventory levels are lower than historical averages, creating greater supply security concerns and potential for accelerated contracting.

These developments support broader market participation beyond traditional utility procurement activities, creating multiple demand sources operating on different timeframes and priorities.

What Factors Could Influence Future Uranium Price Movements?

Near-Term Catalysts

Several near-term catalysts could influence uranium market dynamics:

- Utility contracting cycles accelerating in response to supply security concerns

- Production decisions from major producers regarding expansion plans

- Policy implementation details for domestic uranium support programs

- Geopolitical developments affecting major producing regions

Global reactor fleet requires approximately 190 million pounds of uranium annually, while current mine production capacity is approximately 140-150 million pounds annually at full capacity. This structural deficit must be addressed through increased production or inventory drawdowns.

Utility contracting needs are estimated at 1.5-2 billion pounds over the next decade, creating substantial uncovered demand that must be secured through long-term contracts.

Medium-Term Structural Drivers

Medium-term structural drivers supporting uranium markets include:

- Nuclear reactor construction timelines advancing toward completion

- Supply development constraints limiting production growth

- Utility inventory management strategies responding to supply risks

- Financial market participation expanding through various instruments

Uranium price elasticity of supply is limited due to long development timelines and high capital requirements. Seasonal contracting patterns with utilities typically most active in Q4 and Q1 can create cyclical price pressures within broader uptrends.

Kazatomprom's tiered marketing strategy allows price optimization based on market conditions, demonstrating how major producers can influence market dynamics through strategic sales approaches.

Long-Term Thematic Considerations

Long-term thematic considerations for uranium markets include:

- Nuclear energy's role in global decarbonization strategies

- Advanced reactor deployment expanding nuclear applications

- Energy security considerations supporting domestic nuclear capabilities

- Technological developments improving nuclear economics and safety

The International Atomic Energy Agency's confirmation of safety protocols for treated water discharge from Fukushima provides positive signals for maintaining nuclear energy's social license. Successful resolution of post-accident concerns supports broader nuclear energy acceptance and development prospects.

These thematic considerations support structural demand growth beyond current market cycles, creating investment horizons that extend well beyond immediate price catalysts.

What Are the Key Takeaways for Investors?

Risk-Adjusted Return Potential

The uranium market presents distinctive risk-adjusted return potential based on:

- Asymmetric upside potential from constrained supply meeting accelerating demand

- Limited downside risk given production economics at current price levels

- Strategic premium associated with secure uranium supply chains

- Policy support reducing regulatory risks for nuclear energy development

Uranium mining sector market capitalization remains below commodity price-implied valuations based on historical correlations. Development-stage uranium projects require $200-500 million capital investment with 7-10 year timelines, creating significant barriers to supply expansion.

Operating uranium mines generate margins of $30-50/lb at current price levels, providing strong cash flow and reinvestment potential for established producers.

Strategic Positioning Considerations

Strategic positioning within uranium markets includes:

- Exposure to different segments of the uranium value chain

- Geographic diversification across stable mining jurisdictions

- Technical capabilities supporting project advancement

- Financial flexibility to navigate market cycles

Previous uranium cycles demonstrated 10-20x equity returns during supply-demand tightening phases. The current policy environment is more supportive than during previous uranium bull markets, potentially reducing regulatory risks that previously constrained valuation multiples.

Nuclear energy policy support represents a generational shift from historical regulatory constraints, creating a fundamentally different investment environment than previous uranium cycles.

Monitoring Framework for Market Developments

A monitoring framework for uranium market developments includes:

- Production decisions from major producers

- Utility contracting activity and inventory management

- Policy implementation details across key jurisdictions

- Geopolitical developments affecting major producing regions

- Financial market participation through various instruments

This monitoring framework supports informed decision-making as market conditions evolve, allowing investors to identify catalysts and assess their potential impact on market dynamics.

The simultaneous emergence of production constraints from Kazatomprom and operational uncertainty in Niger creates a dual uranium supply shock that exposes fundamental vulnerabilities in global uranium markets. These developments occur within a market structure already characterized by concentrated supply, limited liquidity, and declining secondary sources.

For institutional investors, uranium investment strategies present one of the most compelling asymmetric supply-demand investment opportunities within natural resources. According to Sprott's uranium market analysis, constrained supply, policy support, and structural demand growth suggests sustained repricing potential that extends well beyond current price levels.

Ready to Find the Next Major Mineral Discovery?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries, helping investors identify actionable opportunities before the broader market. Explore why major mineral discoveries can lead to substantial returns by visiting the Discovery Alert discoveries page and begin your 30-day free trial today.