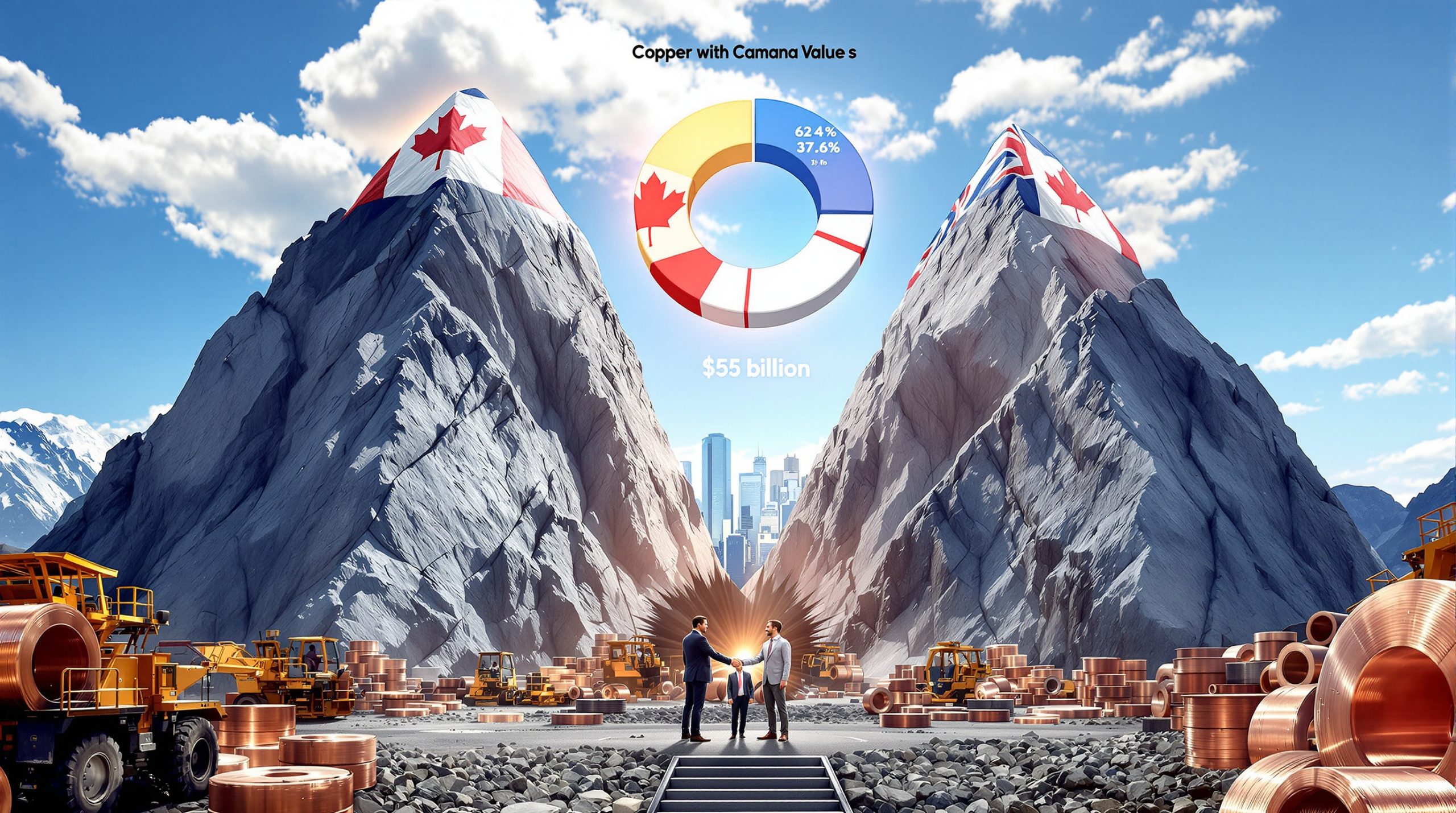

Anglo American-Teck Merger: Creating a Global Mining Powerhouse

The Anglo American-Teck merger represents one of the most significant consolidations in the mining industry in recent years. This strategic combination brings together two mining giants to create a new entity called "Anglo Teck," positioning it as a global leader in copper and critical minerals energy transition. The transaction marks a pivotal moment in mining industry consolidation, with far-reaching implications for global mineral supply chains and market dynamics.

Key Transaction Details

The merger will bring together complementary portfolios under a unified management structure, combining Anglo American's global operational expertise with Teck's strong North American presence and copper assets. While exact financial details require verification from official sources, the transaction follows an all-share structure that preserves capital for future growth initiatives.

Leadership continuity appears to be a priority in the merger structure, with executives from both companies taking key roles in the combined entity. This approach aims to maintain operational stability while navigating the complex integration process ahead.

Why is the Vancouver Headquarters Significant?

The decision to establish Anglo Teck's global headquarters in Vancouver represents a strategic commitment to maintaining a strong Canadian presence. According to Teck CEO Jonathan Price, this location choice constitutes "a perpetual commitment" to Canada, emphasizing the long-term nature of the company's investment in the region.

"The commitment that we are making to Canada and the presence of the global headquarters of Anglo Tech in Canada is an enduring commitment," Price told Bloomberg Television. He further noted that establishing the global headquarters in Vancouver, with most senior executives based there, "is a great thing for the country."

Canadian Regulatory Considerations

This headquarters decision addresses critical regulatory concerns in Canada's mining sector. In 2024, Canadian authorities stated they would only approve foreign takeovers of large mining companies involved in critical minerals production "in the most exceptional of circumstances." By establishing the global headquarters in Vancouver, Anglo Teck demonstrates its commitment to maintaining a significant corporate presence in Canada.

The headquarters location serves as both a strategic business decision and a regulatory consideration, potentially facilitating approval from Canadian authorities concerned about foreign control of critical mineral assets. This approach acknowledges Canada's growing focus on maintaining domestic influence over strategically important resources.

Economic Impact on British Columbia

Establishing the global headquarters in Vancouver will bring substantial economic benefits to British Columbia's mining sector. The region has a long history as a mining finance hub, and this decision reinforces Vancouver's position as a global mining center. Beyond the direct employment at headquarters, the commitment signals ongoing investment in Canadian mining operations and exploration activities.

The presence of senior leadership in Vancouver will likely enhance connections between Anglo Teck and Canadian financial institutions, service providers, and government stakeholders. This proximity can facilitate more responsive decision-making for Canadian operations while ensuring Canadian perspectives influence corporate strategy.

How Will the Merger Transform the Global Mining Landscape?

The Anglo-Teck merger represents a significant shift in the global mining industry landscape, creating a more consolidated sector with fewer but larger players. By combining their operational expertise and asset portfolios, the merged entity will emerge as a major force in the production of metals essential for the global energy transition.

Creating a Copper Production Powerhouse

The combined entity will emerge as one of the world's top five copper producers, according to industry sources. This positioning comes at a critical time when surging copper demand is projected to rise significantly due to global electrification initiatives, renewable energy expansion, and electric vehicle manufacturing growth.

Anglo Teck's enhanced copper portfolio will include operations across multiple continents, creating geographical diversification that can help mitigate regional operational risks. The combined development pipeline will enable more strategic capital allocation to high-potential copper projects, potentially accelerating production timelines to meet growing global copper supply forecast.

Strategic Portfolio Realignment

The merger signals a strategic portfolio shift for both companies, moving toward metals critical for the global energy transition while potentially reducing exposure to traditional fossil fuel-related mining. This realignment reflects changing market demands and evolving investor expectations regarding environmental sustainability.

Key strategic priorities for the combined entity appear to include:

- Accelerating copper project development and production

- Expanding critical minerals exploration and extraction

- Optimizing premium iron ore operations

- Evaluating potential reductions in coal and diamond activities

- Reviewing nickel operations for strategic alignment

Operational Synergies and Cost Efficiencies

Beyond portfolio optimization, the merger creates significant opportunities for operational efficiencies across the combined entity. These include:

- Consolidated procurement leveraging greater scale

- Shared technical expertise across similar operations

- Optimized logistics and transportation networks

- Standardized operational best practices

- Integrated sustainability initiatives

The combined company will likely implement phased integration of systems and processes, balancing immediate efficiency gains against the need to maintain operational continuity during the transition period.

What Challenges Does the Merger Face?

Despite its strategic logic, the Anglo-Teck merger faces several significant challenges that will require careful navigation to ensure successful implementation and value creation for shareholders.

Regulatory Hurdles

The transaction faces a complex regulatory approval process across multiple jurisdictions:

- Canada: Foreign investment review focusing on critical minerals security and national economic interests

- United States: Antitrust considerations related to market concentration in specific mineral segments

- China: Regulatory review of implications for global supply chains and mineral accessibility

- Other jurisdictions: Local approvals in countries where the companies maintain significant operations

The expected 12-18 month timeline for transaction completion reflects the complexity of these regulatory processes. Each jurisdiction will evaluate the merger against its own strategic interests related to mineral security and market competition.

Integration Complexities

Merging two major mining companies presents significant operational challenges that extend beyond regulatory approvals:

- Harmonizing different corporate cultures and management philosophies

- Integrating disparate technology platforms and operational systems

- Standardizing safety protocols and environmental practices

- Managing potential workforce redundancies and organizational restructuring

- Maintaining operational continuity during the transition period

Successful integration will require detailed planning, clear communication with stakeholders, and phased implementation to minimize disruption to ongoing operations.

Operational Challenges

The merger comes amid operational challenges at Teck's Chilean copper operations. When asked if these issues influenced the transaction timing, CEO Price emphasized the company's confidence in resolving these challenges, stating "we're fully confident that we'll overcome those challenges."

Price further explained the transaction timing by noting that "these opportunities don't come along very often" and "when you see them, you have to seize them." This suggests the strategic rationale outweighed near-term operational considerations in the decision to proceed with the merger.

What Are the Strategic Benefits of the Merger?

The Anglo-Teck merger offers several strategic advantages that potentially create significant long-term value for shareholders, employees, and other stakeholders across the combined entity's operations.

Enhanced Critical Minerals Portfolio

The combined company will have strengthened positions across several minerals essential for global electrification and clean energy transition:

- Copper: Critical for electrical transmission, renewable energy systems, and electric vehicles

- Zinc: Essential for infrastructure, manufacturing, and corrosion protection

- Premium Iron Ore: Required for high-quality steel production with lower emissions intensity

- Crop Nutrients: Vital for global food security and agricultural productivity

This diversified portfolio positions Anglo Teck to benefit from multiple demand drivers related to infrastructure development, electrification, and food production.

Improved Financial Resilience

The merger creates a more financially robust entity with enhanced ability to withstand commodity price volatility:

- Diversified revenue streams across multiple commodities reduce exposure to single-commodity price fluctuations

- Combined balance sheet strength provides greater capital allocation flexibility

- Enhanced project development capacity enables more strategic growth investments

- Potential for improved cost of capital through scale and diversification benefits

These financial advantages could translate into more consistent returns for shareholders across commodity price cycles while enabling continued investment in growth projects.

Sustainability Leadership Potential

The combined entity has an opportunity to establish leadership in sustainable mining practices by:

- Implementing advanced water conservation technologies across operations

- Deploying renewable energy at mine sites to reduce carbon footprint

- Standardizing best practices in community engagement and social responsibility

- Developing innovative approaches to mine rehabilitation and closure

- Establishing industry-leading transparency in environmental performance reporting

This sustainability focus aligns with growing investor expectations regarding environmental, social, and governance (ESG) performance in the mining sector.

How Will the Merger Impact Global Copper Markets?

The creation of Anglo Teck will significantly influence global copper markets at a time when the metal is experiencing growing demand from electrification, renewable energy development, and infrastructure modernization.

Supply Implications

The merger consolidates significant copper production capacity under unified management, potentially influencing global supply dynamics:

- Combined production from operations in Chile, Peru, Canada, and other regions creates substantial market presence

- Enhanced capital allocation capabilities may accelerate development of new copper projects

- Technical expertise sharing could improve recovery rates and operational efficiency

- Streamlined decision-making may enable more responsive production adjustments to market conditions

These supply impacts come amid growing concerns about potential copper supply gaps as demand accelerates from clean energy technologies, electric vehicles, and grid modernization.

Market Concentration Effects

The merger contributes to ongoing consolidation in copper mining, creating another major player alongside existing industry leaders:

- Reduced number of independent large-scale copper producers may influence pricing dynamics

- Consolidated production decisions could impact market supply/demand balance

- Potential for more disciplined capital investment across the sector

- Possible follow-on consolidation among mid-tier producers seeking scale advantages

This market concentration will likely attract regulatory scrutiny regarding competitive impacts while potentially influencing long-term copper price formation.

Strategic Positioning for Copper Demand Growth

Anglo Teck will be strategically positioned to capitalize on copper demand growth drivers:

- Global electrification initiatives requiring substantial copper for transmission infrastructure

- Renewable energy development utilizing significant copper in generation equipment

- Electric vehicle manufacturing with each vehicle requiring substantially more copper than conventional vehicles

- Data center and digital infrastructure expansion demanding reliable copper supply

- Grid modernization projects worldwide enhancing electricity transmission capabilities

By consolidating copper assets under unified management, Anglo Teck can potentially optimize production and development decisions to align with these demand growth trajectories.

What Does the Merger Mean for Investors?

The Anglo-Teck merger represents a significant opportunity for investors to reassess their exposure to the mining sector, particularly regarding critical minerals essential for the global energy transition.

Shareholder Value Proposition

The merger offers potential benefits for shareholders of both companies:

- Exposure to a more diversified mining portfolio reducing single-commodity risk

- Enhanced growth prospects in high-demand commodities like copper

- Potential operational synergies improving cost structures and margins

- More disciplined capital allocation across a larger project pipeline

- Possible market re-rating reflecting the strategic positioning in growth minerals

According to Price, preliminary investor conversations have shown "real recognition here for the industrial logic of this and the quality of the business we are creating." This suggests initial market reception has focused on the strategic rationale rather than near-term integration challenges.

Investment Timeline Considerations

Investors should consider several key milestones when evaluating the merger:

- Regulatory approval process extending 12-18 months

- Integration planning and implementation phases

- Portfolio optimization decisions regarding non-core assets

- Capital allocation strategy updates post-closing

- Potential synergy realization timelines and magnitude

The extended closing timeline provides investors with an opportunity to evaluate the transaction's strategic logic and regulatory prospects before making final investment decisions.

Long-Term Market Positioning

Beyond near-term integration considerations, the merger positions Anglo Teck for potential long-term advantages:

- Scale benefits in procurement, operations, and market presence

- Enhanced ability to develop larger, more capital-intensive projects

- Improved access to financing for growth initiatives

- Greater resilience against industry consolidation pressures

- Strategic positioning in minerals essential for energy transition

These long-term considerations may ultimately prove more significant for investor returns than near-term integration challenges or regulatory hurdles.

How Will Anglo Teck Address Operational Challenges?

The combined entity will face various operational challenges requiring coordinated responses across its global footprint, starting with existing issues at certain operations.

Chilean Copper Operations

The merger comes amid operational challenges at Teck's Chilean copper operations, which CEO Price addressed directly:

"We're fully confident that we'll overcome those challenges," Price stated, emphasizing that operational issues did not drive the transaction timing. Instead, he noted that strategic opportunities of this magnitude "don't come along very often" and "when you see them, you have to seize them."

This perspective suggests the company views current operational challenges as manageable within the context of the broader strategic benefits of the merger. The combined technical expertise of both organizations may accelerate problem resolution at challenging operations.

Technical and Operational Integration

Successfully integrating the technical and operational aspects of two major mining companies will require:

- Standardization of mining methodologies where appropriate

- Harmonization of equipment specifications and maintenance practices

- Alignment of health and safety protocols across all operations

- Integration of digital systems and operational technologies

- Knowledge transfer between technical teams from both organizations

This integration process will likely follow a phased approach, prioritizing critical operational systems while maintaining production continuity during the transition period.

Supply Chain Optimization

The merged entity will have opportunities to optimize its global supply chain:

- Consolidated procurement leveraging greater scale and buying power

- Streamlined logistics networks reducing transportation costs

- Standardized inventory management practices improving working capital efficiency

- Enhanced supplier relationships through larger contract volumes

- Technology-enabled supply chain visibility improving planning capabilities

These supply chain improvements could deliver significant cost savings while improving operational resilience against disruptions.

What Are the Future Growth Prospects for Anglo Teck?

The combined Anglo Teck entity will have multiple pathways for future growth across its diverse portfolio, with particular emphasis on minerals essential for global electrification and clean energy transition.

Project Pipeline Development

The merged company will have an extensive growth pipeline including:

- Expansion opportunities at existing copper operations

- Development projects for critical minerals production

- Brownfield growth at premium iron ore assets

- Exploration programs targeting high-potential mineral districts

- Technology implementation initiatives to improve recovery and reduce costs

This diverse project pipeline provides flexibility in capital allocation, allowing the company to prioritize investments based on market conditions, regulatory environments, and expected returns.

Strategic Acquisition Opportunities

Beyond internal growth projects, Anglo Teck may consider targeted acquisitions to:

- Strengthen positions in core commodities like copper

- Access new resources in strategically important regions

- Acquire technologies that enhance operational performance

- Establish joint ventures to share development risks

- Consolidate fragmented mining districts to improve operational efficiency

The company's enhanced scale following the merger provides greater capacity to pursue such opportunities while maintaining financial discipline.

Innovation and Technology Focus

Future growth will likely be supported by mining industry innovation initiatives focused on:

- Autonomous mining equipment deployment to improve safety and productivity

- Advanced processing technologies to enhance recovery rates

- Digital twins and predictive analytics for maintenance optimization

- Water recycling and conservation technologies

- Energy efficiency and renewable power integration

These technology investments can potentially deliver both cost reductions and environmental performance improvements, supporting sustainable growth across the portfolio.

FAQs About the Anglo American-Teck Merger

What is the timeline for completing the merger?

The merger is expected to close within 12-18 months, pending regulatory approvals from multiple jurisdictions including Canada, the United States, and China. This extended timeline reflects the complexity of the regulatory review process and the strategic importance of the minerals involved.

How will the merged company be structured?

Anglo Teck will maintain its global headquarters in Vancouver, Canada, demonstrating a "perpetual commitment" to maintaining a strong Canadian presence. While leadership details require confirmation from official sources, the headquarters location decision addresses Canadian regulatory concerns regarding foreign control of critical minerals assets.

What regulatory challenges might the merger face?

Key regulatory hurdles include Canada's foreign investment review process, which has previously indicated strict scrutiny for critical minerals takeovers. The transaction will also require antitrust reviews in multiple jurisdictions examining market concentration effects, particularly in copper and other critical minerals markets.

How will the merger affect global copper supply?

Anglo Teck will emerge as one of the world's top five copper producers, potentially accelerating development of new projects and influencing global supply dynamics. This consolidated production capacity comes amid growing demand for copper driven by electrification, renewable energy, and infrastructure modernization.

What commitments has Anglo Teck made to Canada?

The decision to establish the global headquarters in Vancouver represents a "perpetual commitment" to Canada, according to Teck CEO Jonathan Price. This headquarters location will maintain a significant corporate presence in Canada with most senior executives based there, addressing Canadian concerns about foreign control of critical minerals assets.

What drove the timing of this transaction?

When asked about transaction timing amid operational challenges at Chilean copper operations, Teck CEO Price emphasized that "these opportunities don't come along very often" and "when you see them, you have to seize them." This suggests the strategic rationale for the merger outweighed near-term operational considerations.

Ready to Invest in the Next Mining Giant?

Discover how mergers like Anglo-Teck reshape the mining landscape and create investment opportunities through Discovery Alert's proprietary Discovery IQ model, which delivers real-time alerts on significant ASX mineral discoveries. Visit our discoveries page to understand how major mineral discoveries can lead to substantial market returns and begin your 30-day free trial today.