Project Financing in Mining: Strategic Approaches for Capital-Intensive Ventures

Project financing represents a specialized funding approach where capital is secured against the future cash flows of a specific mining project rather than the mining company's overall balance sheet. This financing structure creates a separate economic entity, typically through a Special Purpose Vehicle (SPV), allowing mining companies to undertake capital-intensive ventures while isolating financial risk.

Key Characteristics of Mining Project Finance

-

Non-recourse or limited recourse structure: Lenders primarily rely on project cash flows for repayment

-

Off-balance sheet treatment: Debt doesn't directly impact the sponsor company's financial statements

-

High leverage ratios: Typically 60-90% debt financing compared to traditional corporate financing

-

Complex contractual frameworks: Involves multiple agreements between sponsors, lenders, and other stakeholders

-

Long-term financing horizon: Structured to match the lifecycle of mining operations

Why is Project Financing Critical for Mining Ventures?

Mining projects require substantial upfront capital expenditure before generating any revenue. The capital-intensive nature of these ventures, combined with their inherent risks and extended development timelines, makes project financing particularly valuable to the mining sector.

Capital Requirements Across Mining Project Stages

-

Exploration phase: $5-20 million for initial resource identification

-

Feasibility studies: $10-50 million for comprehensive technical and economic assessments

-

Mine construction: $100 million to several billion dollars depending on scale and complexity

-

Working capital: Additional 10-15% of total project cost for initial operations

How Does Risk Allocation Work in Mining Project Finance?

The cornerstone of project financing in mining is the strategic allocation of risks among various stakeholders. This risk distribution makes otherwise challenging projects financially viable.

Risk Distribution Framework

-

Geological and resource risks: Typically borne by equity investors and sponsors

-

Construction and completion risks: Often shared between sponsors, contractors, and lenders

-

Operational risks: Managed through experienced operators and technical consultants

-

Market and commodity price risks: Mitigated through hedging, off-take agreements, and financial instruments

-

Political and regulatory risks: Addressed through political risk insurance and multilateral agency involvement

What Financing Structures Are Available for Mining Projects?

Traditional Debt Financing Options

-

Senior secured project loans: Provided by commercial banks with first claim on project assets

-

Subordinated debt: Mezzanine financing with higher returns but lower priority claims

-

Bond issuances: Access to capital markets for larger, more established projects

-

Export credit agency (ECA) financing: Government-backed loans supporting equipment purchases

Alternative Financing Mechanisms

-

Streaming agreements: Upfront capital in exchange for the right to purchase future production at predetermined prices

-

Royalty arrangements: Investors provide capital for a percentage of future revenue

-

Off-take agreements: Advance purchase commitments that secure future revenue streams

-

Equipment financing and leasing: Asset-based financing reducing initial capital requirements

How Do Mining Companies Structure Project Finance Deals?

Essential Components of Mining Project Finance Structures

-

Special Purpose Vehicle (SPV): Legal entity established specifically for the project

-

Equity contribution: Typically 10-40% of project costs from sponsors

-

Debt facilities: Multiple tranches with varying terms and conditions

-

Reserve accounts: Funds set aside for debt service, maintenance, and environmental obligations

-

Security packages: Comprehensive collateral arrangements protecting lenders' interests

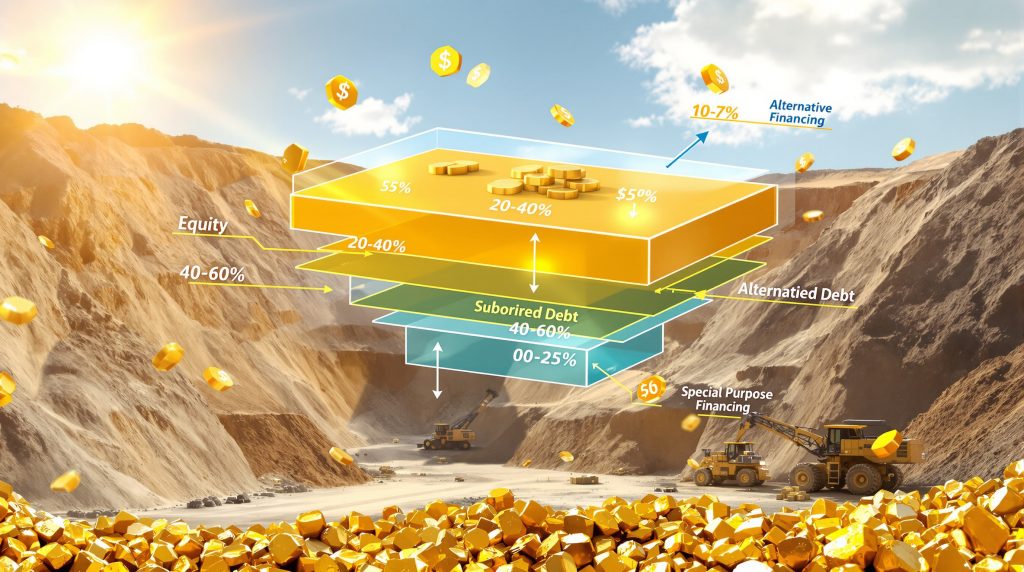

Typical Capital Stack for Major Mining Projects

| Financing Component | Percentage of Total Funding | Key Characteristics |

|---|---|---|

| Sponsor Equity | 20-40% | First-loss position, highest return potential |

| Senior Debt | 40-60% | First priority on cash flows, lowest interest rates |

| Subordinated Debt | 0-20% | Secondary claim, higher interest rates |

| Mezzanine Financing | 0-15% | Hybrid debt/equity features |

| Alternative Financing | 0-25% | Streams, royalties, off-takes |

What Factors Do Lenders Evaluate in Mining Project Finance?

Technical and Economic Feasibility Assessment

-

Resource quality and quantity: Proven and probable reserves verified by independent experts

-

Mining plan viability: Technical assessment of extraction methods and processing technologies

-

Capital and operating cost estimates: Detailed budgets with appropriate contingencies

-

Infrastructure requirements: Power, water, transportation, and logistics considerations

Financial Viability Metrics

-

Net Present Value (NPV): Typically requires positive NPV with appropriate discount rates

-

Internal Rate of Return (IRR): Usually 15-25% minimum threshold for equity investors

-

Debt Service Coverage Ratio (DSCR): Minimum 1.3-1.5x for base case projections

-

Loan Life Coverage Ratio (LLCR): Typically 1.5-2.0x throughout the loan term

-

Break-even analysis: Price levels at which the project remains viable

How Do Environmental and Social Considerations Impact Mining Project Finance?

ESG Integration in Mining Finance

-

Equator Principles compliance: Framework adopted by financial institutions for assessing environmental and social risks

-

Environmental impact assessments: Comprehensive studies required by lenders and regulators

-

Social license to operate: Community relations and stakeholder engagement requirements

-

Closure and reclamation planning: Financial provisions for end-of-life environmental remediation

Financial Implications of ESG Performance

-

Access to capital: Increasing correlation between ESG performance and financing availability

-

Cost of capital: Potential for preferential rates for projects with strong sustainability credentials

-

Risk premiums: Additional costs for projects with significant environmental or social challenges

-

Sustainability-linked financing: Emerging instruments with terms tied to ESG performance metrics

What Are the Advantages of Project Financing for Mining Companies?

Strategic Benefits

-

Risk isolation: Limiting financial exposure to the specific project

-

Balance sheet protection: Preserving corporate debt capacity for other initiatives

-

Higher leverage potential: Accessing greater debt funding than corporate financing would allow

-

Disciplined project governance: Enhanced oversight and reporting structures

Financial Advantages

-

Optimized capital structure: Tailored financing matching project characteristics

-

Tax efficiency: Potential tax benefits through project-specific structures

-

Improved return on equity: Enhanced returns through appropriate leverage

-

Diversified funding sources: Access to specialized capital raising methods

What Challenges Must Be Navigated in Mining Project Finance?

Structural Complexities

-

Documentation intensity: Extensive legal agreements and technical reports

-

Extended negotiation timelines: 12-24 months for complex project finance arrangements

-

Multiple stakeholder coordination: Aligning interests of diverse participants

-

Rigid covenant structures: Detailed compliance requirements and operational restrictions

Cost Considerations

-

Higher transaction costs: 2-5% of total project costs for arranging project finance

-

Increased interest margins: 100-300 basis points above corporate financing rates

-

Substantial advisory fees: Legal, technical, and financial advisory expenses

-

Ongoing compliance costs: Continuous monitoring and reporting requirements

How Does Project Financing Compare to Corporate Financing in Mining?

Comparative Analysis of Financing Approaches

| Aspect | Project Financing | Corporate Financing |

|---|---|---|

| Risk Exposure | Limited to project assets | Extends to entire company |

| Debt Capacity | Based on project cash flows | Based on corporate balance sheet |

| Cost of Capital | Generally higher | Potentially lower for established companies |

| Financial Flexibility | Limited by project agreements | Greater operational discretion |

| Structuring Complexity | High | Moderate to low |

| Transaction Timeline | 12-24 months | 3-6 months |

| Covenant Structure | Project-specific, detailed | Corporate-level, broader |

| Balance Sheet Impact | Off-balance sheet potential | Direct impact on financial statements |

What Are Current Trends in Mining Project Finance?

Evolving Market Dynamics

-

Hybrid financing structures: Combining elements of project and corporate finance

-

Increased private equity participation: Non-traditional sources of capital entering the sector

-

Strategic partner investments: Major consumers securing supply through direct project investment

-

Sustainability-linked financing: Growing integration of ESG metrics into financing terms

Regional Financing Patterns

-

North America: Strong capital markets access with emphasis on public equity

-

Australia: Sophisticated mining finance ecosystem with diverse funding options including share purchase plans

-

Latin America: Increasing reliance on strategic partnerships and development bank participation

-

Africa: Growing importance of multilateral agencies and Chinese state-backed financing

How to Structure a Successful Mining Project Finance Package?

Strategic Planning Steps

-

Develop robust feasibility studies: Comprehensive technical and economic assessments

-

Assemble experienced project team: Technical, financial, and legal expertise

-

Identify optimal financing mix: Tailored combination of debt, equity, and alternative financing

-

Engage potential financiers early: Relationship building with prospective funding sources

-

Implement effective risk mitigation: Comprehensive strategies addressing key project risks

Best Practices in Documentation and Negotiation

-

Clear term sheets: Transparent documentation of key financing conditions

-

Balanced covenant packages: Reasonable operational flexibility while protecting lender interests

-

Appropriate security arrangements: Comprehensive but practical collateral structures

-

Flexible refinancing provisions: Opportunities to optimize financing as project matures

-

Realistic financial projections: Conservative assumptions with appropriate sensitivity analyses

Furthermore, many mining companies are increasingly exploring mining joint ventures to share risks and secure additional funding sources for major projects.

FAQs About Mining Project Finance

What minimum scale is typically required for project financing in mining?

Project financing becomes economically viable for mining projects with capital requirements exceeding $100 million. Smaller projects often rely on corporate finance or investment strategy fundamentals due to the fixed transaction costs associated with project finance structures.

How do commodity price fluctuations affect mining project finance?

Lenders typically require robust price hedging strategies, conservative price assumptions in financial models, and substantial contingency reserves to mitigate commodity price risks. Projects demonstrating viability across various price scenarios have greater financing success. Many investors also consider an ETCs investment guide to understand commodity market dynamics.

What role do multilateral development banks play in mining project finance?

Institutions like the International Finance Corporation (IFC) and regional development banks provide critical financing for projects in emerging markets, offering longer tenors, political risk mitigation, and enhanced credibility that can attract additional commercial financing. According to BDO Australia, these institutions are playing an increasingly important role in financing critical minerals projects.

How are environmental liabilities addressed in mining project finance?

Comprehensive environmental impact assessments, detailed closure plans, and dedicated reclamation bonds or reserve accounts are typically required. Lenders increasingly demand adherence to international standards such as the Equator Principles and IFC Performance Standards. As noted by Norton Rose Fulbright, environmental considerations have become central to project financing decisions.

What financial ratios are most critical for mining project finance?

Debt Service Coverage Ratio (DSCR) of at least 1.5x, Loan Life Coverage Ratio (LLCR) of 1.7-2.0x, and Project Life Coverage Ratio (PLCR) exceeding 2.0x are typically required by lenders, with specific thresholds varying based on project risk profile.

Want to Stay Ahead of Market-Moving Mineral Discoveries?

Discovery Alert's proprietary Discovery IQ model delivers instant notifications on significant ASX mineral discoveries, transforming complex data into actionable investment insights. Explore our dedicated discoveries page to understand how major mineral discoveries have historically generated substantial returns for early investors.