US Strategic Investment in Australian Rare Earths: Security, Supply Chains, and Economic Implications

The Strategic Importance of Rare Earths

Rare earth elements are increasingly pivotal in the global technology landscape. These critical minerals energy transition are essential components in advanced technologies, defense systems, and renewable energy infrastructure. Despite their name, rare earths are relatively abundant in Earth's crust, but concentrated, economically viable deposits are scarce.

China currently dominates the global rare earth supply chain, controlling over 80% of processing capacity worldwide. This concentration has raised significant concerns among Western nations about supply vulnerabilities and the national security implications of depending on a single source for these strategic materials.

Australian rare earth projects have emerged as key alternative sources for Western economies seeking to diversify their supply chains. With significant deposits and a stable political environment, Australia offers a reliable partner for countries looking to reduce dependence on Chinese sources.

Geopolitical Context Shaping Investment Decisions

The intensifying strategic competition between the United States and China is significantly influencing investment decisions in the critical minerals sector. As tensions between these major powers increase, securing stable supplies of rare earths has become a national security priority.

Western nations are increasingly embracing "friend-shoring" – redirecting supply chains through politically aligned countries to reduce vulnerabilities. This approach represents a fundamental shift in how critical resources are sourced and processed globally.

Australia's position as a trusted US ally with substantial rare earth deposits makes it an ideal partner in this new paradigm. The country offers both resource security and political reliability, critical factors in strategic resource planning.

Recent investments align with broader Indo-Pacific economic security initiatives that seek to counter Chinese dominance in defence critical minerals crisis. These initiatives reflect a recognition that economic security and national security have become increasingly intertwined in the modern geopolitical landscape.

How Significant is the VHM Goschen Project Investment?

Project Overview and Strategic Value

The Goschen project, located in Victoria, Australia, is classified as a Tier 1 integrated rare earth and mineral sands project. This designation indicates its substantial scale and strategic importance in global rare earth markets.

Industry analysts consider Goschen to be a globally significant resource with long-term production potential that could operate for decades. The project's extensive reserves provide assurance of sustained supply – a critical factor for industries requiring long-term resource security.

The project is positioned to become a major non-Chinese supplier of critical rare earth elements, potentially capturing a significant share of the market outside Chinese control. This positioning is particularly valuable as technology manufacturers seek to diversify their supply chains.

One of Goschen's key advantages is its integrated mining and processing capabilities. By combining extraction and processing operations, the project reduces supply chain vulnerabilities and decreases dependence on external processing facilities – historically a major bottleneck in rare earth supply chains.

Financial Commitment Details

The US Export-Import Bank (EXIM) has expressed interest in providing up to $200 million in funding to support the development of VHM's Goschen project. This substantial financial commitment reflects the strategic importance Washington places on securing reliable rare earth supplies.

The proposed funding includes a maximum repayment term of 12 years, indicating the long-term strategic partnership envisioned between the US government and VHM. This extended timeframe provides the project with financial stability during its critical development phase.

The funding is part of EXIM's Supply Chain Resiliency Initiative (SCRI), specifically targeting critical minerals essential for US mineral production order and defense needs. This initiative represents a coordinated government effort to address vulnerabilities in strategic supply chains.

Financial markets responded positively to the announcement, with VHM shares rising 6.1% to A$0.26 following the news – reaching their highest level since September 25, 2025. This market reaction indicates investor confidence in both the project's viability and its strategic importance.

Economic Implications for Both Countries

The development of the Goschen project is expected to create significant job opportunities in Victoria's mining sector, boosting local employment and economic activity. These jobs will range from direct mining positions to roles in processing, logistics, and administration.

Beyond direct employment, the project facilitates valuable technology transfer and processing expertise development between the United States and Australia. This knowledge sharing strengthens Australia's position in the global rare earths sector while providing the US with greater supply chain security.

The investment further strengthens bilateral trade and investment relations between the two countries, building on their already robust economic partnership. This cooperation creates a template for future resource collaboration between allied nations.

Looking forward, the project creates potential for downstream manufacturing opportunities in both countries. As processing capabilities develop, there may be opportunities to expand into higher-value activities, creating additional economic benefits beyond raw material extraction.

What Makes Australian Rare Earths Strategically Valuable to the US?

Resource Quality and Composition

Australian rare earth deposits often contain high concentrations of heavy rare earth elements, which are particularly critical for advanced technologies. These elements, including dysprosium and terbium, are essential for permanent magnets used in electric vehicles, wind turbines, and defense applications.

The favorable mineralogy of many Australian deposits allows for more efficient extraction and processing compared to alternatives. This efficiency translates to lower production costs and reduced environmental impacts throughout the supply chain.

Environmental considerations also favor Australian resources, as they typically require less intensive processing methods than some alternative sources. This advantage is increasingly important as manufacturers face pressure to reduce the environmental footprint of their supply chains.

Beyond current production, Australia possesses substantial reserves that ensure long-term supply security. This resource longevity provides confidence for industries making strategic investments in technologies dependent on rare earth elements.

Australia's Mining Infrastructure Advantages

Australia offers a well-established mining regulatory framework with clear environmental standards and processes. This regulatory clarity reduces project risks and provides certainty for investors and operators.

The country's existing skilled workforce and technical expertise in mining and minerals processing are significant advantages for rare earth development. These capabilities reduce training requirements and accelerate project timelines.

Australia's reliable transportation and export infrastructure facilitates efficient movement of materials from mines to processing facilities and international markets. This logistical network reduces supply chain vulnerabilities and transportation costs.

Political stability and a transparent business environment further enhance Australia's attractiveness as a strategic resource partner. These factors minimize the political and regulatory risks that often complicate resource developments in other regions.

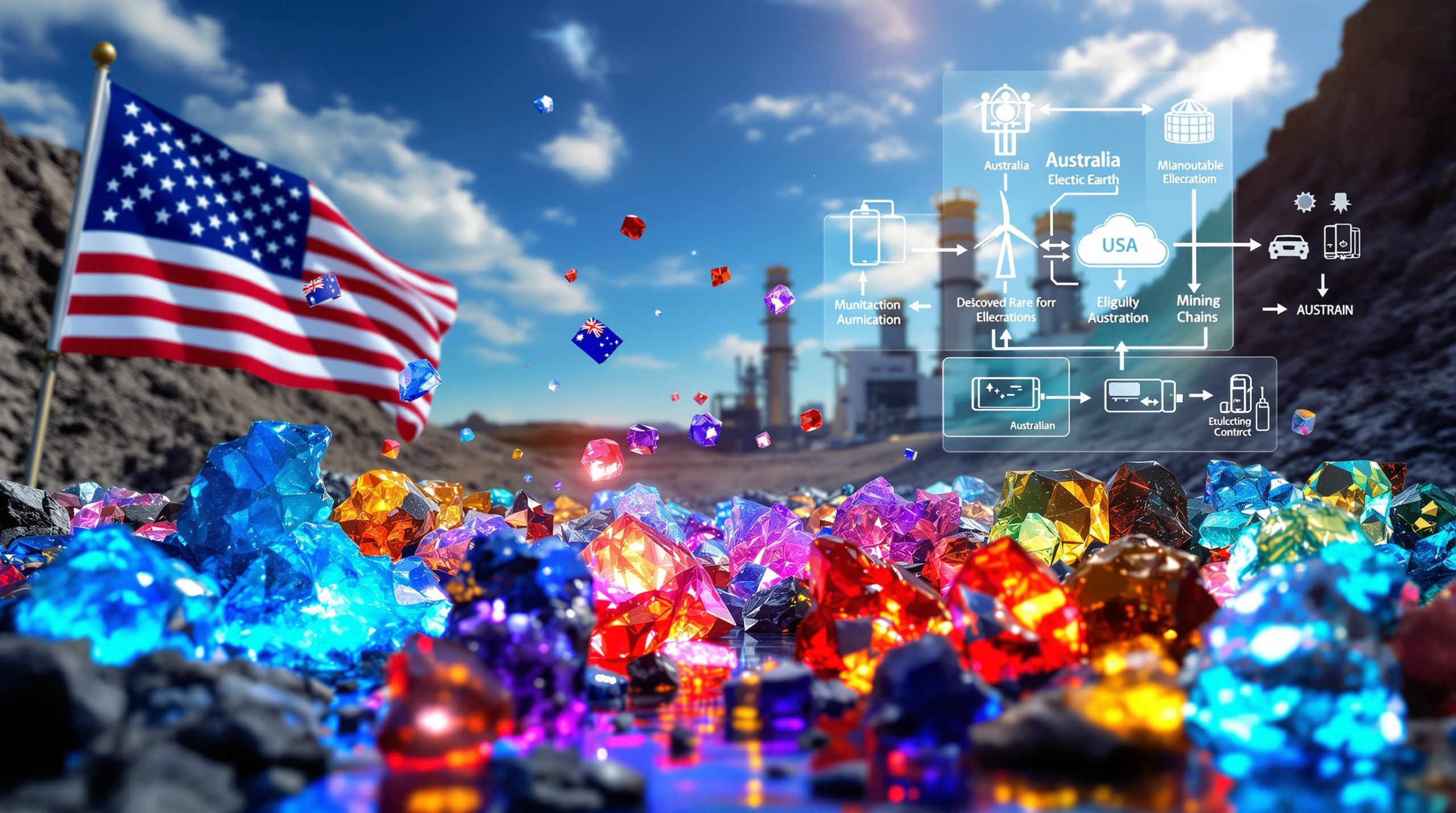

Supply Chain Integration Potential

The Goschen project creates opportunities for developing processing capabilities outside China, reducing dependence on a single country for critical technologies. This diversification is essential for industries sensitive to supply disruptions.

The investment supports the potential for creating allied rare earth value chains from mine to manufacturing, ensuring security throughout the production process. This integrated approach addresses vulnerabilities at multiple points in the supply chain.

By building alternative supply routes, the project reduces vulnerability to supply disruptions or economic coercion that could affect national security or economic stability. This resilience is particularly valuable given the strategic importance of rare earth materials.

The development enhances industrial security for both defense and clean energy technologies, supporting national security and climate objectives simultaneously. This dual benefit makes rare earth projects particularly attractive for strategic investment.

How Does This Fit Into Broader US Critical Minerals Strategy?

The Supply Chain Resiliency Initiative Explained

EXIM's Supply Chain Resiliency Initiative (SCRI) specifically targets critical supply chain vulnerabilities identified by the US government. The program aims to reduce dependence on potentially unreliable sources for materials essential to national security and economic prosperity.

The initiative focuses on strategic minerals that are essential for economic and national security, including rare earth elements, lithium, and other critical materials. These resources form the foundation of modern defense systems, renewable energy technologies, and communications infrastructure.

Companies developing projects under SCRI can access preferential financing terms designed to accelerate development and reduce financial risks. These terms reflect the national security premium placed on establishing secure supply chains.

The SCRI represents part of a whole-of-government approach to resource security that coordinates policy, financing, and diplomatic efforts across multiple agencies. This coordinated approach increases effectiveness compared to isolated initiatives.

Parallel Investments in Rare Earth Projects Globally

Beyond Australia, the US government has expressed interest in Greenland's rare earth deposits, with officials discussing taking a stake in Critical Metals Corp's project there. This geographic diversification reduces vulnerability to regional disruptions or political changes.

Domestically, the US has supported rare earth development initiatives in Wyoming and other states to rebuild domestic capacity in this critical sector. These projects aim to revitalize America's rare earth capabilities, which have atrophied over decades.

Together, these investments create a diversified portfolio of secure supply options spanning multiple continents and geological formations. This diversity provides resilience against both geological and geopolitical risks.

The strategy recognizes that no single source can meet all requirements, necessitating a network of reliable suppliers across allied and partner nations. This networked approach represents a fundamental shift from the concentrated supply chains of previous decades.

Legislative and Policy Frameworks Supporting Investment

Critical minerals provisions have been incorporated into defense authorization bills, reflecting the security implications of rare earth supply chains. These provisions provide legal and budgetary foundations for strategic investments.

Executive orders focused on securing critical supply chains have established policy frameworks guiding government actions across agencies. Trump's executive order on minerals elevated supply chain security as a national priority requiring coordinated response.

International partnerships and agreements on critical minerals, including those between the US and Australia, create diplomatic foundations for investment and cooperation. These agreements facilitate information sharing and coordinate policy approaches.

Tax incentives and research funding for rare earth processing technologies complement direct investments, addressing technological barriers to supply chain development. These programs recognize that financial support alone is insufficient without technological innovation.

What Challenges Remain for Australian Rare Earth Development?

Technical and Processing Hurdles

Rare earth separation and refining processes are technically complex and require specialized expertise that has been concentrated in China for decades. Rebuilding this knowledge base outside China requires significant investment in human capital and research.

The high capital costs for developing processing facilities represent a major barrier to entry, especially for smaller companies. These costs can reach billions of dollars for integrated facilities capable of producing separated rare earth oxides.

Environmental management considerations for waste streams pose significant technical and regulatory challenges. Rare earth processing generates radioactive waste and chemical byproducts that require careful management to prevent environmental damage.

Developing the specialized technical expertise and equipment needed for rare earth processing outside established centers will take time and substantial investment. Universities, research institutions, and private companies must collaborate to rebuild this capability.

Market Competition Factors

Chinese dominance in processing technology and capacity creates formidable competitive pressures for new entrants. Established Chinese companies benefit from economies of scale, government support, and decades of operational experience.

Price volatility and market uncertainty complicate investment decisions and financing arrangements. Rare earth prices have historically experienced significant fluctuations, challenging project economics.

Long development timelines for rare earth projects conflict with urgent security needs, creating tension between commercial and strategic imperatives. Projects typically require 5-10 years from discovery to production, while security concerns demand immediate solutions.

Balancing commercial viability with strategic imperatives remains a key challenge for government-supported projects. Market-competitive operations are necessary for long-term sustainability, even with strategic importance.

Environmental and Regulatory Considerations

Australia maintains stringent environmental approval processes that can extend project timelines and increase development costs. These processes ensure environmental protection but can delay strategic projects.

Community engagement and indigenous land rights are important considerations in Australian mining development. Project developers must navigate complex social and cultural landscapes to secure community support and necessary approvals.

Water usage and waste management requirements are particularly important for rare earth projects, which can generate significant quantities of processing waste. These environmental factors influence project design, costs, and social acceptance.

The carbon footprint of mining and processing operations faces increasing scrutiny as companies and governments pursue decarbonization goals. Rare earth projects must incorporate sustainability considerations into their development plans to remain viable in a carbon-constrained future.

How Might This Investment Impact the Global Rare Earths Market?

Potential Market Rebalancing Effects

The diversification of global supply sources beyond China could gradually reduce China's market dominance and price-setting power. This rebalancing would create a more competitive market environment with multiple centers of production.

Changes in supply dynamics may impact pricing and market structures as new producers enter the market. While increased supply could potentially lower prices, the strategic premium placed on non-Chinese sources may support price levels for those producers.

The creation of parallel supply chains for allied nations establishes a two-tier market divided along geopolitical lines. This segmentation could result in different pricing, quality standards, and supply arrangements for different customer groups.

The VHM investment could stimulate further investment in non-Chinese rare earth projects as other companies and countries seek to participate in this strategic market shift. This multiplier effect could accelerate the transformation of global rare earth markets.

Implications for Technology Manufacturing

Enhanced security for defense technology supply chains reduces vulnerabilities for military systems dependent on rare earth materials. This security allows defense planners to develop advanced systems without supply constraints.

The development of secure rare earth supplies supports renewable energy manufacturing capacity, particularly for wind turbines and electric vehicles that require significant quantities of rare earth magnets. This alignment supports both security and climate objectives.

Secure material supplies may encourage reshoring of certain high-tech manufacturing operations that depend on reliable rare earth access. This manufacturing renaissance could generate significant economic benefits beyond the mining sector.

The investment contributes to the development of more resilient technology ecosystems spanning multiple countries and companies. This resilience reduces systemic risks and supports continued innovation in critical sectors.

Long-term Strategic Outcomes

Reduced vulnerability to economic coercion in critical sectors strengthens both national security and economic sovereignty. Countries with secure supply chains can make policy decisions without fear of resource leverage.

The development of allied critical minerals capabilities creates a foundation for broader technological cooperation and innovation. These collaborative networks can address multiple resource challenges beyond rare earths.

New industrial partnerships and innovation may emerge from the focus on secure supply chains, creating opportunities for technological advancement and economic growth. These partnerships can establish new models for international resource cooperation.

Strengthening Australia's critical minerals reserve contributes to regional stability and prosperity in the Indo-Pacific. As one of the world's most dynamic economic regions, Indo-Pacific resource security has global implications.

What Does VHM's CEO Say About the Project's Significance?

Leadership Perspective on Market Positioning

VHM CEO Andrew King has emphasized the company's position to "advance the Goschen Project and become a globally significant solution to the current critical minerals supply chain issues." This statement positions the project as addressing a strategic need rather than merely a commercial opportunity.

Company leadership has consistently emphasized the project's role in addressing supply chain vulnerabilities that affect multiple industries and national security concerns. This framing aligns commercial objectives with broader policy goals.

Beyond immediate financial returns, VHM focuses on the long-term strategic value of establishing a major non-Chinese rare earth source. This perspective acknowledges the project's importance extends beyond traditional metrics of mining project success.

King has expressed confidence in meeting growing demand for secure rare earth supplies as technology manufacturers seek to diversify their sourcing strategies. This market assessment aligns with broader industry trends toward supply chain resilience.

Project Development Timeline and Milestones

The company has been progressing through key regulatory approvals and environmental permitting processes necessary for project development. These processes establish the legal and environmental foundations for the project.

With EXIM's interest secured, VHM is advancing its capital raising and financing structure planning to bring the project to fruition. This financial engineering will determine the project's ownership structure and governance arrangements.

The company has established production targets and capacity projections based on resource assessments and market demand forecasts. These projections inform investment decisions and development planning.

VHM continues to pursue strategic partnerships and offtake agreements to secure long-term market access and revenue stability. These commercial arrangements complement government support and enhance project viability.

How Are Other Countries Responding to Rare Earth Supply Challenges?

European Union Initiatives

The European Raw Materials Alliance (ERMA) has made rare earth value chains a priority focus, aiming to reduce Europe's complete dependence on imports. This initiative coordinates policy, investment, and research across EU member states.

The EU has substantially increased investment in recycling and urban mining technologies to recover rare earths from electronic waste and industrial byproducts. These circular economy approaches complement primary production from mines.

Significant research funding has been directed toward alternative materials and substitution that could reduce dependence on critical rare earths. These technological solutions seek to redesign products to use more abundant materials.

The EU has established strategic partnerships with Australia and other resource-rich nations to secure access to primary supplies while developing domestic capabilities. These partnerships reflect Europe's multi-faceted approach to resource security.

Japan's Strategic Approach

Japan has made long-term investments in rare earth recycling technologies following supply disruptions during previous diplomatic tensions with China. These investments have established Japan as a leader in rare earth recovery from electronic waste.

The country maintains stockpiling programs for critical materials to buffer against short-term supply disruptions. These strategic reserves provide time for market adjustment during supply shocks.

Japanese companies and government agencies provide financing support for overseas mining projects to secure offtake agreements and supply security. This approach leverages Japan's financial strength to secure physical resources.

Japanese researchers have pioneered research into deep-sea mining of rare earth resources found in significant concentrations on the Pacific Ocean floor. While still developing, this approach could open entirely new resource frontiers.

Emerging Producer Countries

Canada has developed a comprehensive critical minerals strategy that identifies rare earth elements as priority resources. Several Canadian projects are advancing toward production with government support.

Brazil is increasing its focus on rare earth extraction from existing mining operations, particularly from the byproducts of niobium mining. This approach leverages existing infrastructure to reduce development costs.

Several African nations possess significant but underdeveloped rare earth potential that could contribute to global supply diversification. Countries like Burundi, Malawi, and South Africa are working to develop these resources.

India has launched efforts to revitalize domestic rare earth production, leveraging its substantial reserves and technical capabilities. As the world's most populous country, India's resource security has global implications.

What's the Outlook for US-Australia Rare Earth Collaboration?

Near-term Development Prospects

Securing financing through mechanisms like EXIM funding allows for acceleration of project timelines, potentially bringing new supplies online years earlier than would otherwise be possible. This acceleration addresses urgent supply security needs.

The successful VHM funding model could attract additional US interest in Australian rare earth projects, creating a pipeline of developments. This investment cascade would substantially reshape global rare earth markets.

Joint technology development for processing innovations could reduce costs and environmental impacts while increasing recovery rates. These technological advances would improve project economics and sustainability.

The creation of integrated supply chains spanning both countries connects Australian resources with American manufacturing capabilities. This integration maximizes value creation and security benefits.

Long-term Strategic Partnership Potential

The VHM investment establishes a framework for ongoing collaboration in critical minerals that could extend to other resources beyond rare earths. This framework provides a template for addressing other resource security challenges.

Public-private partnerships could evolve into joint ventures in processing and manufacturing, capturing more value from raw materials. These ventures would distribute benefits throughout the value chain.

Research and development cooperation on next-generation technologies could address processing challenges and develop new applications for rare earth materials. This innovation would enhance the strategic value of rare earth resources.

Coordinated policy approaches to critical mineral security between the US and Australia could influence global standards and market structures. This policy alignment would enhance the effectiveness of both countries' resource strategies.

Investment and Market Growth Projections

Industry analysts project a significant increase in Australian rare earth production capacity by 2027, with multiple projects moving toward commercial production. This capacity expansion will substantially alter global supply patterns.

With continued investment and development, Australia could potentially supply 20-30% of global rare earth demand by 2030, establishing itself as the primary alternative to Chinese sources. This market share would provide meaningful supply diversification.

The focus on rare earth security is driving growth in downstream value-added processing capabilities that capture more economic value within Australia and allied countries. This vertical integration creates additional investment opportunities.

The rare earth sector transformation is generating new investment opportunities throughout the supply chain, from mining to advanced materials production. These opportunities attract capital that further accelerates market development.

FAQ: US Investment in Australian Rare Earths

What are rare earth elements and why are they important?

Rare earth elements comprise 17 metallic elements essential for many high-tech applications. Despite their name, these elements are relatively abundant in Earth's crust but rarely found in concentrated, economically viable deposits.

They're crucial components in permanent magnets used in wind turbines and electric vehicles, with neodymium, praseodymium, dysprosium, and terbium being particularly valuable. These magnets enable the production of smaller, lighter, and more efficient motors and generators.

Defense applications include precision-guided munitions, radar systems, avionics, and communications equipment that depend on rare earth components. This military importance elevates their strategic significance beyond commercial considerations.

Consumer electronics like smartphones, hard drives, and speakers also require rare earth elements for components including speakers, vibration motors, and displays. These everyday applications create massive demand for these specialized materials.

Why is the US seeking rare earth supplies outside China?

China's dominance of global rare earth processing, controlling over 80% of capacity, creates significant supply vulnerabilities for industries dependent on these materials. This concentration represents a single point of failure in critical supply chains.

Previous export restrictions imposed by China during diplomatic tensions demonstrated the potential for rare earths to be used as economic leverage. These historical actions heightened awareness of supply vulnerabilities.

The US is working to reduce this dependency by diversifying supply sources to ensure national security, support clean energy transitions, and maintain technological competitiveness. This diversification represents a fundamental shift in resource strategy.

Building secure supply chains requires both raw material access and processing capacity development, necessitating substantial investment and long-term planning. The VHM investment addresses both these requirements.

How does the VHM Goschen project compare to other global rare earth developments?

The Goschen project is classified as a Tier 1 integrated rare earth and mineral sands project, placing it among the more significant developments outside China. This classification reflects both resource size and development potential.

Its combination of scale, resource quality, and integrated mining-processing approach positions it as a potentially major contributor to non-Chinese supply chains. Few projects globally offer this combination of attributes.

Compared to other major projects in Greenland, Canada, and the US, Goschen benefits from Australia's established mining infrastructure and regulatory environment. These advantages can substantially reduce development risks and timelines.

While each major rare earth project has unique geological and economic characteristics, Goschen represents one of the more advanced developments with strong government backing. This backing enhances its development prospects.

What specific technologies depend on rare earths from projects like Goschen?

Electric vehicles rely heavily on neodymium-iron-boron (NdFeB) permanent magnets for their motors, with each vehicle requiring approximately 1-2 kg of rare earth elements. As EV adoption accelerates, demand for these materials is growing rapidly.

Wind turbines, particularly direct-drive models preferred for offshore installations, use up to 600 kg of rare earth magnets per megawatt of capacity. This application creates substantial demand as renewable energy capacity expands.

Precision-guided munitions and military radar systems depend on rare earth components for accuracy and performance. These defense applications require secure, domestic supply chains invulnerable to foreign interference.

Consumer electronics including smartphones, hard disk drives, and speakers incorporate small but essential quantities of rare earth elements. While individual devices use minimal amounts, the billions of devices produced annually create massive aggregate demand.

Catalytic converters and petroleum refining catalysts use rare earth elements like cerium and lanthanum as catalysts. These applications consume significant quantities of the lighter rare earth elements.

Advanced medical imaging equipment, including MRI machines, depends on rare earth magnets and phosphors for functionality and performance. Healthcare technology represents a growing application for these materials.

What is the expected timeline for the Goschen project to begin production?

While specific production timelines depend on financing completion, regulatory approvals, and construction progress, major rare earth projects typically require 3-5 years from financing to production. This timeline reflects the complexity of rare earth development.

With EXIM's funding interest announced in October 2025, initial production could potentially begin between 2028-2030, assuming no significant delays. This timeline aligns with typical development schedules for projects of similar scale.

The development schedule will likely include phased commissioning, with mining operations beginning before full processing capabilities are online. This approach allows for earlier cash flow while complex processing facilities are completed.

Factors that could accelerate or delay this timeline include permitting processes, equipment procurement, skilled labor availability, and market conditions. These variables introduce uncertainty into specific production start dates.

Ready to Stay Ahead of Major Mineral Discoveries?

Don't miss your chance to receive instant alerts on significant ASX mineral discoveries with Discovery Alert's proprietary Discovery IQ model, transforming complex data into actionable investment opportunities. Visit our discoveries page to see how major mineral discoveries have historically generated substantial returns, and begin your 30-day free trial today.