China's Strategic Oil Reserves: National Security Through Stockpiling

China's oil stockpiling strategy represents one of the world's most ambitious energy security programs, designed to shield the nation from supply disruptions and price volatility in global oil markets. As the world's largest crude oil importer, China has systematically built massive storage capacity while opportunistically filling these reserves during periods of lower prices.

The strategy combines government-controlled Strategic Petroleum Reserves (SPR) with commercial storage requirements for state-owned enterprises, creating a multi-layered buffer against potential energy crises. This approach reflects China's recognition of oil as a critical national security asset rather than merely an economic commodity.

Why is China Aggressively Stockpiling Oil?

Reducing Vulnerability to Supply Disruptions

China's dependence on imported oil has grown dramatically over the past two decades, with foreign supplies now accounting for approximately 70% of its total consumption. This reliance creates significant vulnerability to geopolitical tensions, shipping disruptions, and price volatility.

The 2022 Russia-Ukraine conflict highlighted these risks, demonstrating how quickly global energy markets can destabilize. For Chinese policymakers, extensive oil reserves represent a crucial insurance policy against similar future disruptions that could threaten economic stability.

Strategic Leverage in Global Markets

Oil stockpiling provides China with increased flexibility and negotiating power in international energy markets. By maintaining substantial reserves, China can:

- Continue normal economic operations during supply disruptions

- Reduce purchasing during price spikes

- Increase buying during market downturns

- Exercise greater influence in negotiations with producer nations

This strategic positioning allows China to partially insulate its economy from external price shocks while optimizing its long-term procurement costs.

Responding to Geopolitical Uncertainties

The acceleration of China's stockpiling efforts coincides with increasing geopolitical tensions and uncertainties, particularly regarding:

- Maritime security in key shipping lanes

- Sanctions risks affecting major suppliers

- Competition with other major consumers

- Regional conflicts in oil-producing regions

These factors have intensified China's determination to build reserves that significantly exceed international norms for energy security.

How Extensive is China's Oil Storage Capacity?

Current Storage Infrastructure

China's oil storage network has expanded dramatically in recent years, comprising both government-controlled strategic facilities and commercially operated tanks. Current estimates suggest:

| Storage Category | Estimated Capacity (Million Barrels) | Notes |

|---|---|---|

| Strategic Petroleum Reserve | 400+ | Government-controlled facilities |

| Commercial Above-Ground Storage | 668 | Operated by state and private companies |

| Underground Facilities | 130 | Includes caverns and specialized facilities |

| Total Current Capacity | ~1,200 | Combined strategic and commercial |

This extensive network places China second only to the United States in terms of total petroleum storage capacity, representing a remarkable achievement for a country that began serious strategic stockpiling only in the early 2000s.

Planned Expansion Through 2026

China's storage expansion continues at an accelerated pace, with plans to add at least 169 million barrels of new crude storage capacity across 11 major sites by the end of 2026. Of this planned expansion:

- 37 million barrels of capacity has already been completed

- The remaining facilities are in various stages of construction

- Most new sites are being developed by state-owned energy companies

This expansion represents approximately 40-45% growth over the storage capacity added during the entire 2020-2024 period, indicating a significant acceleration in China's stockpiling efforts.

How Does China Manage Its Strategic Oil Reserves?

Governance Structure

China's strategic petroleum reserve system operates under a sophisticated governance structure:

- Policy Direction: The National Development and Reform Commission (NDRC), operating under the State Council, establishes strategic guidelines and oversees implementation

- Operational Management: State-owned energy companies, primarily Sinopec, CNPC, and CNOOC, handle day-to-day operations of storage facilities

- Commercial Requirements: Regulatory mandates require commercial operators to maintain minimum inventory levels as part of the national strategy

This integrated approach allows China to coordinate strategic reserves with commercial operations while maintaining government control over critical energy security assets.

Strategic Fill Patterns

China's approach to filling its reserves demonstrates sophisticated market awareness:

- Price-Sensitive Purchasing: Accelerated buying during periods when oil trades below $70 per barrel

- Opportunistic Acquisition: Taking advantage of market oversupply conditions

- Counter-Cyclical Behavior: Reducing purchases during price spikes to avoid exacerbating market tightness

- Diversified Sourcing: Balancing purchases across multiple suppliers and grades

These patterns reveal a disciplined, long-term approach designed to optimize cost while steadily building strategic inventories.

What Are China's Strategic Reserve Targets?

Coverage Goals vs. International Standards

China's reserve targets significantly exceed international norms:

| Reserve Standard | Days of Import Coverage | Equivalent Volume (Est.) |

|---|---|---|

| IEA Minimum Requirement | 90 days | ~900 million barrels |

| Current Chinese Coverage | ~120 days | ~1.2 billion barrels |

| Reported Chinese Target | Up to 180 days | ~1.8 billion barrels |

| Ambitious Long-Term Goal | Up to 6 months | ~2 billion barrels |

These targets reflect China's unique energy security concerns and its determination to establish reserves that can withstand prolonged supply disruptions.

Strategic vs. Commercial Reserves Balance

China's approach balances government-controlled strategic reserves with commercially held inventories:

- Strategic Reserves: Directly controlled by the government for emergency use

- Commercial Mandates: Requirements for state-owned companies to maintain minimum inventory levels

- Operational Stocks: Working inventories needed for normal refinery operations

This multi-layered system creates redundancy and flexibility, allowing different reserve components to serve distinct but complementary purposes within the overall strategy.

How Does China's Stockpiling Affect Global Oil Markets?

Price Support During Market Weakness

China's consistent buying during periods of lower prices has provided significant support to global oil markets:

- During 2023-2025, China absorbed approximately 1 million barrels per day into storage

- This demand cushioned price declines during periods of market oversupply

- The pattern created a "price floor" effect that benefited oil producers worldwide

This behavior has made China an important stabilizing force in global oil markets during periods of weakness.

Influence on OPEC+ Decision-Making

China's stockpiling activities have become an important factor in OPEC+ production decisions:

- Producer nations closely monitor Chinese storage builds as an indicator of underlying demand

- OPEC+ has adjusted production targets in response to Chinese buying patterns

- Strategic communications between Chinese officials and producer nations have increased

This dynamic has elevated China's influence within global oil governance structures, reflecting its status as the world's largest importer.

Market Intelligence Challenges

China's limited transparency regarding its strategic reserves creates significant challenges for market analysts:

- Official data on storage levels is rarely published

- Satellite monitoring provides incomplete information

- Commercial inventory reporting lacks consistency

- Import versus consumption differentials offer only approximate insights

This information asymmetry gives China strategic advantages in market negotiations while complicating global price discovery mechanisms.

How Does Oil Stockpiling Fit into China's Broader Energy Security Strategy?

Diversification of Import Sources

China has systematically diversified its oil suppliers to reduce dependency on any single source:

- Increased imports from Russia via pipelines (reducing maritime vulnerability)

- Expanded purchases from Brazil, Guyana, and other emerging producers

- Maintained strategic relationships with Middle Eastern suppliers

- Invested in production assets across Africa, Latin America, and Central Asia

This geographic diversification complements stockpiling efforts by reducing concentration risk in China's oil supply chain.

Integration with Domestic Production Strategy

Strategic reserves operate in coordination with efforts to maximize domestic production:

- Maintaining production from mature fields despite declining yields

- Developing challenging resources in western China

- Exploring offshore potential in the South China Sea

- Investing in enhanced oil recovery technologies

While domestic production cannot meet China's needs, it provides a baseline supply that reduces import requirements and strengthens overall energy security.

Complementary Energy Transition Initiatives

China's oil stockpiling strategy operates alongside ambitious energy transition goals:

- Accelerated electrification of transportation

- Expansion of renewable energy capacity

- Development of hydrogen as an alternative fuel

- Improvements in energy efficiency across the economy

These parallel efforts aim to eventually reduce China's oil dependency, with forecasts suggesting peak oil demand around 2027-2030, after which strategic reserves may serve a declining but still critical security function.

What Challenges Does China Face in Its Oil Stockpiling Strategy?

Storage Construction Constraints

Despite ambitious expansion plans, China faces several challenges in building storage capacity:

- Limited suitable locations for large-scale facilities

- Environmental concerns in densely populated regions

- Construction material and labor constraints

- Coordination challenges between multiple state entities

These factors have occasionally delayed storage expansion projects, though the overall trajectory remains strongly upward.

Financial Considerations

The massive scale of China's stockpiling program creates significant financial considerations:

- Capital costs for new storage facilities (estimated $15-25 per barrel of capacity)

- Opportunity costs of capital tied up in stored oil

- Maintenance expenses for existing facilities

- Potential for "stranded assets" if energy transition accelerates

These costs are substantial but are viewed by Chinese policymakers as justified by the strategic benefits.

Quality Management Challenges

Maintaining crude quality during long-term storage presents technical challenges:

- Prevention of sedimentation and stratification

- Management of sulfur content in stored crudes

- Monitoring for water contamination

- Periodic circulation requirements

These issues necessitate sophisticated monitoring systems and occasional rotation of stored volumes to maintain quality standards.

What Does the Future Hold for China's Oil Stockpiling Strategy?

Integration with Global Energy Governance

China's massive reserves will increasingly influence global oil influence:

- Potential coordination with other major consumers during supply emergencies

- Possible formal participation in IEA emergency response mechanisms

- Increased transparency in reserve management

- Bilateral coordination agreements with key suppliers

These developments could transform China from a unilateral actor to a more integrated participant in global energy security frameworks.

Adaptation to Energy Transition Realities

As energy transition progresses, China's stockpiling strategy will likely evolve:

- Potential shift toward strategic reserves of refined products

- Integration with emerging battery storage networks

- Recalibration of reserve targets as import dependency changes

- Repurposing of some storage assets for alternative fuels

This evolution will reflect changing energy security priorities in a transitioning global system.

Potential Market Stabilization Role

China's reserves could increasingly serve as a market stabilization mechanism:

- Strategic releases during supply disruptions

- Coordinated action with other major consumers

- Use of reserves to moderate extreme price volatility

- Leveraging storage capacity as a form of "energy diplomacy"

This expanded role would represent a maturation of China's approach from purely defensive stockpiling to more sophisticated market engagement.

FAQ: China's Oil Stockpiling Strategy

How much oil does China currently have in strategic storage?

While official figures are rarely published, analysts estimate China currently holds approximately 400 million barrels in government-controlled strategic petroleum reserves, plus an additional 668 million barrels in commercial above-ground storage. Combined with underground facilities, total strategic and commercial reserves are believed to exceed 1.2 billion barrels.

How does China's stockpiling compare to other major economies?

China's strategic reserves are second only to the United States in volume, though China aims to achieve significantly higher import coverage (potentially up to 180 days compared to the standard 90 days maintained by most IEA members). Japan and South Korea also maintain substantial reserves, but China's stockpiling program is expanding more rapidly than any other major economy.

Does China coordinate its reserve policy with international organizations?

China maintains observer status with the International Energy Agency but does not participate in coordinated release mechanisms. Its reserve management remains largely independent, though informal coordination does occur during major market disruptions. China has shown increasing willingness to engage in dialogue about reserve policies but maintains full sovereignty over its strategic stockpiles.

How does China decide when to add to its strategic reserves?

China typically accelerates purchases when oil prices fall below certain thresholds (particularly under $70 per barrel) and reduces buying during price spikes. This counter-cyclical approach allows cost optimization while steadily building reserves. Decisions are coordinated through the National Development and Reform Commission with input from state energy companies and economic planning authorities.

Could China's reserves affect global oil prices if released?

A significant release from China's strategic reserves could substantially impact global oil prices, potentially reducing prices by $5-10 per barrel depending on market conditions and release volumes. However, China has historically been reluctant to use its reserves for price management, preserving them primarily for genuine supply emergencies rather than market intervention. Recent oil price crash analysis suggests such releases could combine with other factors to create significant market volatility, particularly affecting WTI and Brent trends.

In addition, ongoing trade war market impact analyses suggest that geopolitical tensions could further complicate China's strategic calculations around reserve management in coming years.

Disclaimer: This article contains analysis and forecasts about oil markets and geopolitical factors that may affect energy prices. These views represent the author's understanding of current market conditions but should not be considered investment advice. Energy markets are inherently volatile and subject to rapid changes based on geopolitical events, policy decisions, and market dynamics.

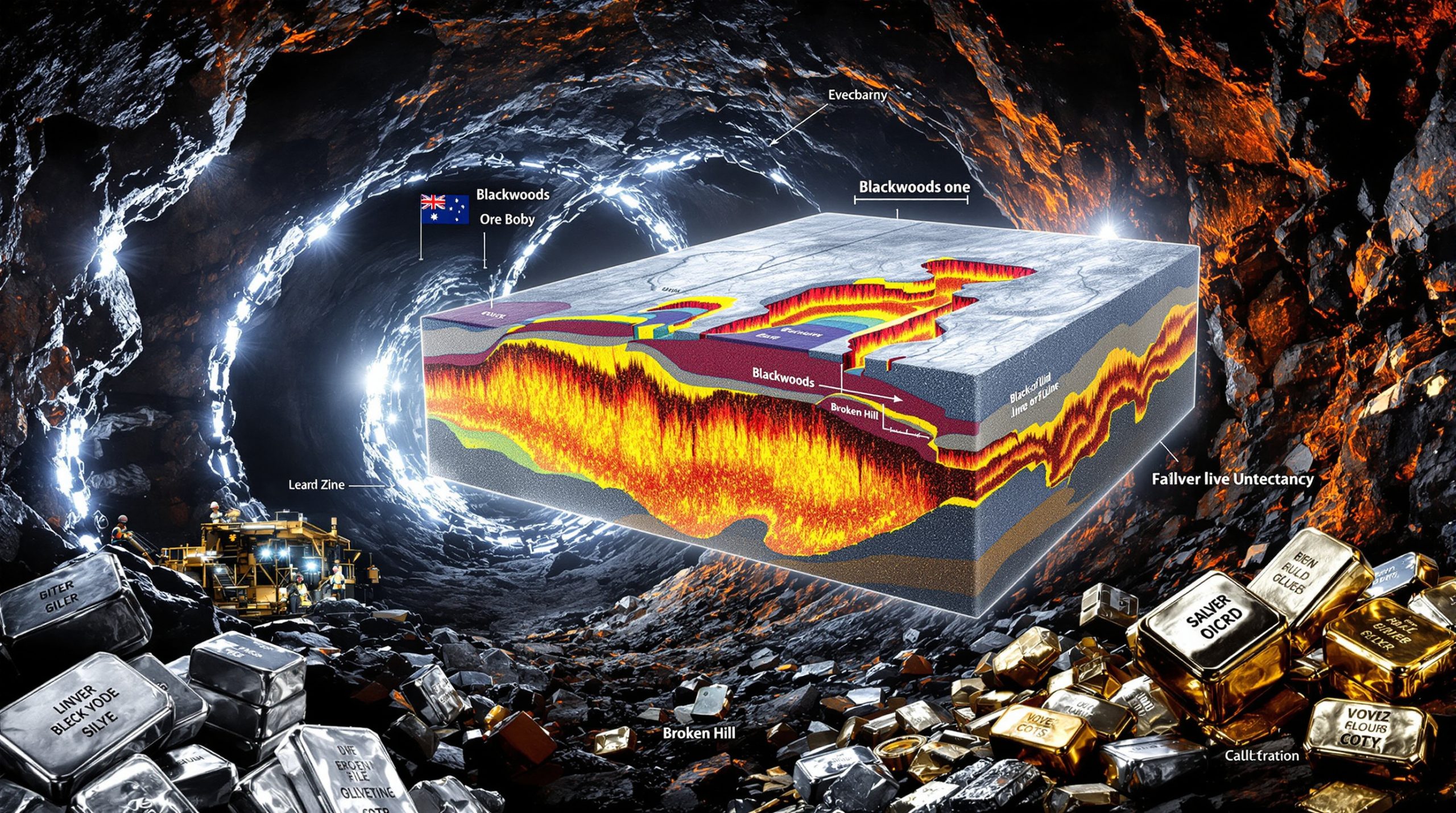

Interested in Discovering the Next Major Mineral Opportunity Before the Market?

Stay ahead of the curve with Discovery Alert's proprietary Discovery IQ model, which instantly notifies investors of significant ASX mineral discoveries, transforming complex data into actionable insights. Visit our dedicated discoveries page to understand how major mineral discoveries can lead to substantial returns and begin your 30-day free trial today.