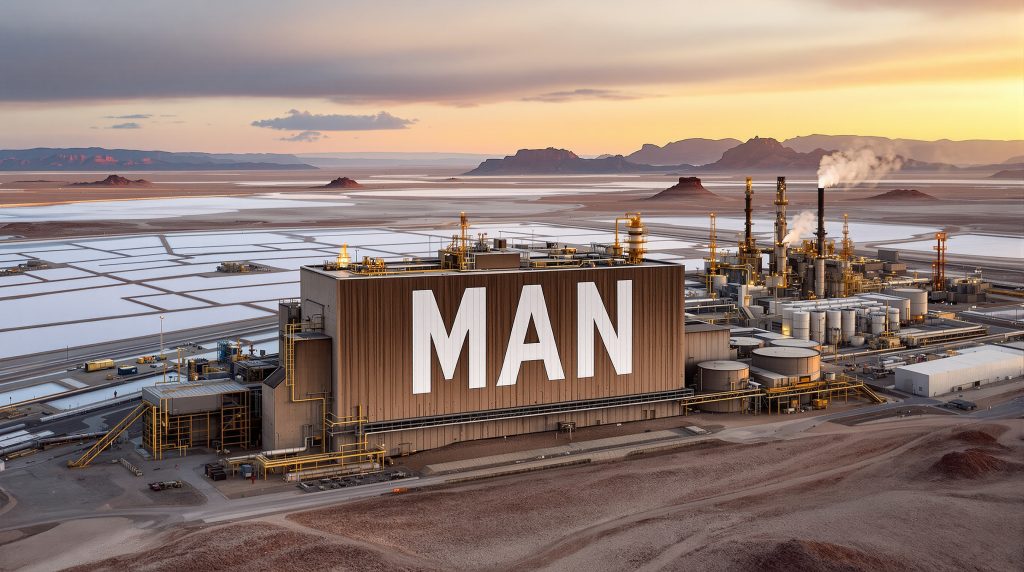

Mandrake Resources Strikes Gold with High-Grade Lithium Sweet Spots in Utah

Mandrake Resources discovers lithium in Utah through a comprehensive breakthrough that positions the company at the forefront of America's domestic supply chain strategy. The ASX-listed explorer (ASX: MAN) has delivered game-changing results from its Lithium Brine Flow Modelling Study, identifying two distinct high-grade lithium concentration "sweet spots" within its 100%-owned Utah Lithium Project.

With the project already hosting an Inferred Resource of 3.3Mt Lithium Carbonate Equivalent (LCE) across 93,755 acres, these findings establish the company as a significant player in America's domestic lithium supply chain. The sweet spots represent a transformational opportunity, overlapping with high-quality reservoirs characterised by enhanced permeability and elevated net pay thicknesses.

Perhaps most importantly for investors, these zones incorporate existing wells that can be re-entered and tested at significantly reduced costs, with access negotiations already underway.

"The comprehensive Lithium Brine Flow Modelling Study was undertaken by a leading team of technical consultants utilising a series of existing advanced datasets including 3D seismic, petrophysical well logs and corresponding drill core, lithium brine chemistry and detailed well files." – Managing Director James Allchurch

Capital Structure Snapshot

| Metric | Value |

|---|---|

| Ordinary Shares | 627,259,920 |

| Current Share Price | 2.4c |

| Market Capitalisation | $15.0M |

| Cash Position | $12.1M (Sept 2025) |

| Debt | Nil |

Revolutionary Brine Flow Modelling Reveals Multiple Opportunities

The sophisticated modelling study has transformed Mandrake's understanding of lithium distribution across the project area. By incorporating core-based porosity and permeability data, 3D seismic interpretations, and regional lithium brine chemistry trends, the company has created a comprehensive exploration model that pinpoints the highest-value targets.

Furthermore, the modelling reveals that areas with complex faulting, including fault intersections and reactivated systems, demonstrate enhanced permeability values. These geological features create ideal conditions for prolonged brine-basement interactions, the key process driving lithium concentration enhancement.

Key technical achievements include:

• Development of flow direction maps detailing brine movement patterns and migration timing

• Identification of fault structures that enhance reservoir permeability through mineral alteration processes

• Correlation between complex faulting systems and elevated lithium concentrations

• Discovery of 59m aggregate clastic net pay thickness within the Paradox Formation

Understanding Brine Flow Modelling: Why It Matters for Lithium Exploration

Brine flow modelling is a sophisticated geological technique that tracks how lithium-rich fluids move through underground rock formations over geological time periods. This approach creates a detailed roadmap showing where lithium-bearing brines naturally accumulate and concentrate.

For investors, this technique offers several compelling advantages that directly impact project economics and risk profiles. Reduces exploration risk by identifying the most prospective zones before expensive drilling, whilst optimising drilling locations to maximise discovery potential and resource grade.

In addition, the modelling accelerates project development by focusing efforts on proven high-concentration areas and minimises capital requirements through strategic targeting rather than broad exploration approaches.

In Mandrake's case, the modelling has revealed that lithium sourced from the underlying crystalline basement becomes increasingly concentrated in southwestern project areas. These zones demonstrate the longest residence time and most extensive basement interactions, creating optimal conditions for high-grade lithium accumulation.

Paradox Formation Delivers World-Class Lithium Potential

Beyond the Leadville Formation sweet spots, Mandrake Resources discovers lithium in Utah through significant potential within the Paradox Formation clastic units. Historical sampling has recorded lithium concentrations up to 340mg/L from the Peterson 88-21 well, with Mandrake's own 2024 sampling confirming 147mg/L at the Big Indian #1 well.

| Formation Zone | Lithium Concentration | Significance |

|---|---|---|

| Paradox Zone A (units 5-10) | Up to 340mg/L | Comparable to world-class Smackover Formation |

| Paradox Zone B (units 11-20) | 147mg/L confirmed | Extensive clastic net pay thickness |

| Leadville Formation | Sweet spot targets | Enhanced by fault-controlled permeability |

However, the Paradox Formation's 29 separate salt cycles interbedded with shales, sandstones, and dolomites create an ideal geological environment for lithium concentration. This configuration mirrors the renowned Smackover Formation and South America's Lithium Triangle, both world-class lithium producing regions.

Strategic Execution Plan: Low-Risk, High-Impact Approach

Mandrake's immediate strategy focuses on cost-effective re-entry of existing wells rather than expensive greenfield drilling. This approach offers several key advantages whilst maintaining high probability of success through targeted, data-driven exploration.

Phase 1: Well Access and Re-entry

The initial phase involves completing negotiations with existing well operators and finalising third-party consultant engineering plans. Target wells within identified sweet spot zones have been prioritised based on the comprehensive modelling study.

Phase 2: Testing and Validation

Subsequently, the company will conduct comprehensive flow and pressure testing alongside detailed chemical analysis of brine samples. This phase aims to validate modelling predictions through empirical data, providing concrete evidence of lithium concentrations and flow characteristics.

Phase 3: Resource Expansion

The final phase extends exploration across additional sweet spot zones whilst integrating new data into refined geological models. This systematic approach optimises future drilling programs based on validated results from earlier phases.

This phased approach significantly reduces capital requirements whilst maintaining high probability of success through strategic, evidence-based exploration targeting.

Investment Thesis: America's Strategic Lithium Play

Mandrake Resources represents a compelling investment opportunity in the rapidly expanding domestic US lithium sector. The company's strategic advantages position it uniquely within the market context where Mandrake Resources discovers lithium in Utah.

Resource Scale and Quality forms the foundation of the investment thesis. The 3.3Mt LCE Inferred Resource establishes top-tier asset status across a substantial 93,755-acre land position in the prolific Paradox Basin. Moreover, newly identified sweet spots offer significant resource expansion potential beyond current estimates.

Strategic Location Benefits provide additional competitive advantages. The project sits within Utah's pro-mining jurisdiction with favourable regulatory environment, whilst accessing Tier 1 infrastructure including power and water resources. This positioning aligns perfectly with US government initiatives for domestic critical mineral production.

Furthermore, Financial Strength and Operational Flexibility distinguish Mandrake from peers. The company maintains a $12.1M cash position with nil debt, providing operational runway without immediate funding pressure. The low-cost re-entry strategy minimises capital requirements whilst multiple exploration targets across different geological formations diversify risk.

Market Context: US Lithium Supply Chain Transformation

The United States is aggressively pursuing domestic lithium production independence, creating significant tailwinds for projects where Mandrake Resources discovers lithium in Utah. Recent government initiatives emphasising strategic and critical materials have elevated the importance of US-domiciled lithium assets within national security frameworks.

Federal support for domestic lithium supply chain development continues expanding, driven by rising demand from North American battery manufacturing facilities. Supply chain security concerns increasingly drive preference for domestic sources over international alternatives, particularly given geopolitical uncertainties.

For instance, Utah's established mining infrastructure and regulatory framework provide additional advantages for project development. The state's pro-mining stance and existing industrial capabilities reduce development timelines and capital requirements compared to greenfield jurisdictions.

Why Investors Should Track Mandrake Resources

The combination of significant resource scale, strategic US location, and innovative exploration approach positions Mandrake as a standout opportunity in the lithium sector. The company's recent brine flow modelling breakthrough demonstrates technical excellence whilst the focus on cost-effective well re-entry showcases prudent capital management.

With immediate catalysts including well access negotiations and upcoming testing programs, investors have clear milestones to track progress. The company's strong balance sheet and nil debt position provide the financial flexibility to execute its strategy without dilutive capital raising pressure.

However, the most compelling aspect remains the transformational potential of the identified sweet spots. These high-grade zones could significantly expand the existing resource base whilst reducing extraction costs through enhanced permeability characteristics.

Key Investment Highlights:

• 3.3Mt LCE resource with newly identified expansion potential through sweet spots

• $12.1M cash position supporting low-risk exploration strategy

• Strategic US location aligned with domestic supply chain initiatives

• Near-term catalysts through well re-entry and testing programs

• Experienced management with proven track record in lithium exploration

The Utah Lithium Project's transformation from a promising exploration play to a strategically targeted development opportunity reflects Mandrake's commitment to value creation. Through technical excellence and strategic positioning in America's emerging lithium landscape, the company has established itself as a significant player in the domestic supply chain evolution.

Consequently, investors seeking exposure to America's lithium future should closely monitor Mandrake's progress as it advances towards becoming a key domestic lithium producer. The confluence of technical innovation, strategic location, and market tailwinds creates a compelling investment proposition in the critical minerals sector.

Want to Discover the Next Major Lithium Breakthrough?

Discovery Alert's proprietary Discovery IQ model delivers instant notifications when companies like Mandrake Resources announce transformational discoveries, helping investors capitalise on market-moving developments before the broader market reacts. Begin your 30-day free trial today and secure your advantage in identifying the next significant mineral discovery in the rapidly expanding critical minerals sector.