What Makes China's September Coal Import Record Significant?

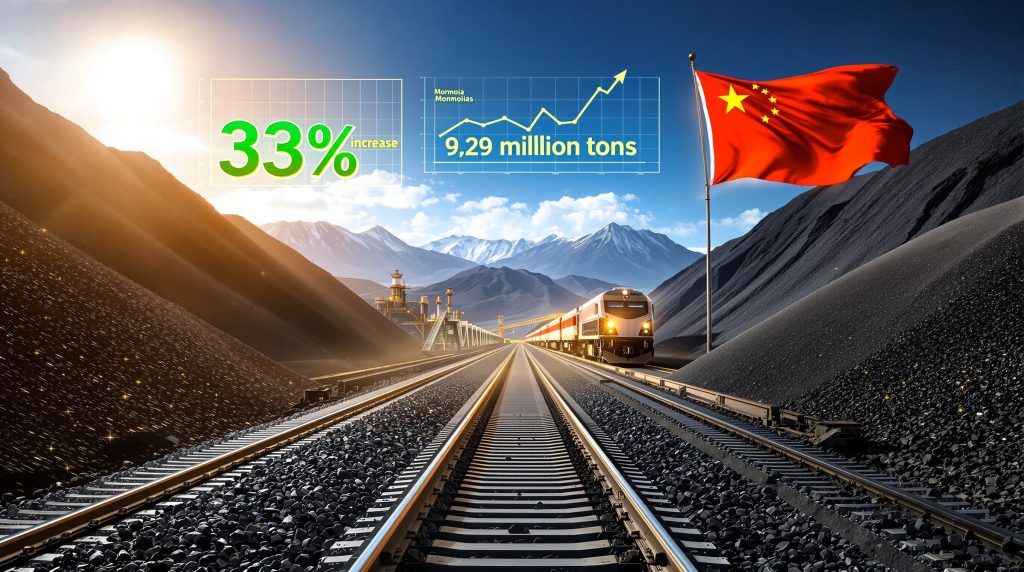

September 2025 marked a pivotal moment in China-Mongolia energy relations when China imports record amount of Mongolian coal in September reached an unprecedented 9.29 million metric tons, establishing a new monthly record since data collection commenced in 2015. This surge represents far more than statistical achievement, signaling a fundamental realignment in regional energy trade patterns that could reshape Asia's coal supply chains for years to come.

Breaking Down the Record Numbers

The September figures demonstrate a remarkable 33% year-over-year increase compared to 2024 levels, highlighting Mongolia's emerging role as China's most strategically important overland coal supplier. This dramatic expansion occurred against the backdrop of China's overall coal import decline of 11% during the first nine months of 2025, underscoring the targeted nature of Beijing's sourcing decisions.

Key Performance Indicators:

• Volume achievement: 9.29 million metric tons in a single month

• Growth trajectory: 33% year-over-year expansion

• Historical context: Highest monthly level since systematic tracking began

• Market positioning: Counter-trend growth amid declining total imports

The contrast between Mongolia's explosive growth and China's reduced total imports reveals a deliberate shift toward specific supplier relationships rather than increased overall demand.

Context Within China's Broader Import Strategy

China's total coal imports through September 2025 reached approximately 346 million tons, representing an 11% decline from the previous year's corresponding period. Within this shrinking market, Mongolia's record performance indicates strategic prioritisation of reliable, geographically proximate suppliers over traditional maritime sources.

Furthermore, this selective approach reflects Beijing's evolving energy security framework, where supply chain resilience takes precedence over purely cost-driven procurement decisions. However, the broader energy export challenges facing traditional suppliers have created opportunities for alternative providers.

Why Did China Turn to Mongolian Coal Suppliers?

The surge in Mongolian coal imports stems from calculated domestic policy interventions designed to address structural market imbalances and price volatility within China's coal sector.

Domestic Production Restrictions Drive Import Demand

Chinese regulatory authorities suspended operations at 15 mines in Inner Mongolia following capacity violations, creating immediate supply shortfalls that required external sourcing solutions. This enforcement action represents a cornerstone of China's broader anti-involution campaign targeting overcapacity and unsustainably low pricing across multiple industrial sectors.

Moreover, these coal supply challenges in China's domestic market have highlighted the vulnerability of relying solely on internal production. The regulatory crackdown addressed fundamental market distortions that emerged during the first half of 2025, when unexpected supply increases depressed domestic coal prices to levels deemed economically destructive by policymakers.

Price Pressures Create Import Opportunities

Domestic thermal coal prices reached eight-month highs following production restrictions, whilst metallurgical coal futures experienced a dramatic 30% increase since July 2025. These price escalations transformed imported Mongolian coal from a supplementary source into an economically attractive alternative for Chinese buyers seeking cost mitigation strategies.

Coal Market Impact Analysis

| Coal Type | Price Movement | Market Response | Strategic Implication |

|---|---|---|---|

| Thermal Coal | Eight-month high | Domestic shortages | Import demand surge |

| Metallurgical Coal | 30% increase since July | Steelmaker pressure | Alternative sourcing |

| Mongolian Imports | 33% volume growth | Competitive positioning | Supply diversification |

Consequently, the convergence of regulatory restrictions and price pressures created optimal conditions for Mongolia's market share expansion.

How Does Mongolia Benefit from China's Coal Demand?

Mongolia's strategic positioning adjacent to China's northern border provides unique competitive advantages that traditional seaborne suppliers cannot replicate, particularly during periods of domestic supply constraints.

Geographic Proximity Reduces Transportation Costs

Mongolia's shared land border with China eliminates maritime shipping expenses including vessel charter rates, bunker fuel costs, port handling fees, and marine insurance premiums. This proximity advantage becomes increasingly valuable when domestic supply gaps require rapid response capabilities.

Transportation Cost Advantages:

• Elimination of ocean freight charges

• Reduced delivery timeframes

• Lower insurance requirements

• Simplified logistics coordination

• Weather-independent supply chains

Infrastructure Investments Support Export Growth

Recent railway infrastructure expansions and strategic investments have enhanced Mongolia's export capacity significantly. Coal exports to China expanded from 69.9 million tons in 2023 to an estimated 82.9 million tons in 2024, representing 18.6% year-over-year growth with ambitious projections targeting 100 million tons for 2025.

Furthermore, according to Mysteel's analysis, these infrastructure improvements are supporting China's record-breaking coal import levels.

Mongolia's export capacity expansion demonstrates sustained commitment to becoming China's primary overland coal supplier, with infrastructure investments supporting long-term trade relationship development.

These infrastructure improvements create lasting competitive advantages that position Mongolia for continued market share growth beyond current record levels.

What Role Does Trade Diversification Play?

China's increased reliance on Mongolian coal reflects comprehensive strategic considerations extending beyond immediate supply requirements to encompass geopolitical risk management and supply chain resilience building.

Reducing Dependence on Volatile Trade Relationships

Historical trade tensions with suppliers including Australia and the United States have created recurring supply chain uncertainties for Chinese coal imports. Moreover, the ongoing US‑China trade war impact continues to influence sourcing decisions. Mongolia offers a geopolitically stable alternative that reduces exposure to international trade disputes and diplomatic complications.

The stability of China-Mongolia relations provides predictable trading conditions that major buyers value when developing long-term procurement strategies.

Building Long-Term Supply Chain Resilience

The steady growth trajectory in Mongolian coal imports represents a deliberate diversification strategy designed to create multiple reliable supply sources capable of ensuring energy security during various market conditions and geopolitical scenarios.

Diversification Benefits:

• Reduced single-supplier dependence

• Enhanced negotiating leverage

• Improved supply security

• Geographic risk distribution

• Political stability advantages

How Do Other Suppliers Compare in September's Import Data?

Whilst Mongolia achieved unprecedented volume records, other major suppliers experienced varied performance reflecting different market dynamics and policy influences.

Indonesian Coal Imports Show Recovery

Indonesia, maintaining its position as China's largest coal supplier, shipped 21.48 million tons in September 2025, marking a modest 1% year-over-year increase and reaching the highest level recorded in nine months. This recovery followed Indonesia's cancellation of an unpopular government benchmark requirement that had complicated trading relationships.

The benchmark policy reversal demonstrates how regulatory decisions can significantly impact bilateral trade volumes and market positioning.

Market Share Dynamics Among Suppliers

China's Coal Import Performance – September 2025

| Supplier Country | Volume (Million Tons) | YoY Change | Notable Factors |

|---|---|---|---|

| Indonesia | 21.48 | +1% | Benchmark policy reversal |

| Mongolia | 9.29 | +33% | Infrastructure advantages |

| Other Suppliers | Variable | Mixed | Trade policy dependent |

The performance differential between suppliers illustrates how policy changes, infrastructure capacity, and geopolitical relationships influence market outcomes. Additionally, industry reports from Reuters confirm these trends are part of broader market transformations.

What Are the Implications for Global Coal Markets?

China's record Mongolian coal imports signal broader transformations in international energy trade patterns, potentially establishing new precedents for regional supply chain integration and overland trade relationship development.

Regional Trade Integration Strengthens

The expansion of China-Mongolia coal trade demonstrates deepening regional economic integration that could serve as a model for other bilateral energy partnerships across Asia. In addition, this trend suggests movement toward continental supply networks that complement rather than replace maritime trade routes.

Maritime vs. Overland Trade Balance Shifts

Mongolia's success challenges traditional assumptions about seaborne coal trade dominance, suggesting that land-based supply chains may gain increasing importance for major consuming nations prioritising supply security over purely economic considerations. This shift aligns with broader mining industry evolution trends emphasising supply chain resilience.

Strategic Implications:

• Continental trade network development

• Supply chain risk redistribution

• Transportation method diversification

• Regional economic integration acceleration

• Geopolitical influence pattern changes

How Might This Trend Continue Into 2026 and Beyond?

Multiple converging factors suggest China's preference for Mongolian coal represents a sustained strategic shift rather than temporary market adjustment, with implications extending well beyond current trading patterns.

Infrastructure Development Supports Long-Term Growth

Ongoing railway capacity expansions and border infrastructure improvements will likely enhance Mongolia's export capabilities significantly, supporting continued volume growth beyond current record levels. These investments create lasting competitive advantages that traditional suppliers cannot easily replicate.

Policy Alignment Favours Continued Partnership

Both nations demonstrate commitment to strengthening energy trade relationships, with Mongolia's ambitious 100 million ton export target for 2025 indicating growth plans that align closely with China's diversification objectives and supply security priorities.

Market Conditions Support Sustained Demand

As long as China maintains domestic production restrictions through its anti-involution campaign and faces periodic supply constraints, Mongolian coal will remain an economically attractive alternative for price-conscious buyers seeking reliable supply sources. However, the broader energy security transition may influence long-term demand patterns.

Growth Sustainability Factors:

• Infrastructure capacity expansion

• Policy coordination improvements

• Market condition advantages

• Geographic proximity benefits

• Long-term contract potential

Economic and Strategic Considerations for the Future

The transformation of China-Mongolia coal trade relationships extends beyond immediate commercial considerations to encompass broader economic development strategies and regional influence patterns that could reshape Asian energy markets fundamentally.

Investment Flow Implications

Chinese strategic investments in Mongolian coal infrastructure create mutual dependencies that strengthen bilateral relationships whilst providing China with enhanced supply chain control. These investments generate multiplier effects throughout Mongolia's economy, creating stakeholder alignment that supports sustained trade growth.

Technology Transfer Opportunities

The expanding trade relationship facilitates technology transfer in mining operations, transportation systems, and processing capabilities that enhance Mongolia's long-term competitiveness. Furthermore, these improvements benefit both nations through increased efficiency and reduced operational costs.

Conclusion: A New Chapter in Regional Energy Trade

China imports record amount of Mongolian coal in September represents more than statistical achievement, signalling the emergence of a transformed bilateral energy partnership positioned to influence regional trade dynamics significantly. The combination of geographic advantages, infrastructure investments, policy alignment, and strategic necessity creates conditions for sustained growth that extend far beyond traditional commodity trading relationships.

This development demonstrates how continental suppliers can successfully compete with maritime alternatives when supported by appropriate infrastructure, policy coordination, and strategic investment. The success of this overland trade relationship offers valuable lessons for other nations seeking to build resilient, diversified energy supply chains in an increasingly complex global environment.

As both countries continue investing in infrastructure development and policy alignment, this trend appears well-positioned for continued expansion, potentially establishing new standards for regional energy cooperation and supply chain integration across Asia and beyond.

Disclaimer: This analysis is based on publicly available information and market observations. Future trade patterns may be influenced by policy changes, economic conditions, and geopolitical developments that cannot be predicted with certainty. Readers should conduct independent research and consult professional advisors before making investment or business decisions based on this information.

Interested in Energy Commodity Investment Opportunities?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries across energy commodities, instantly empowering subscribers to identify actionable opportunities ahead of the broader market. Begin your 30-day free trial today and secure your market-leading advantage.