What Makes China's Supply-Chain Stranglehold on Rare Earth Elements So Complete?

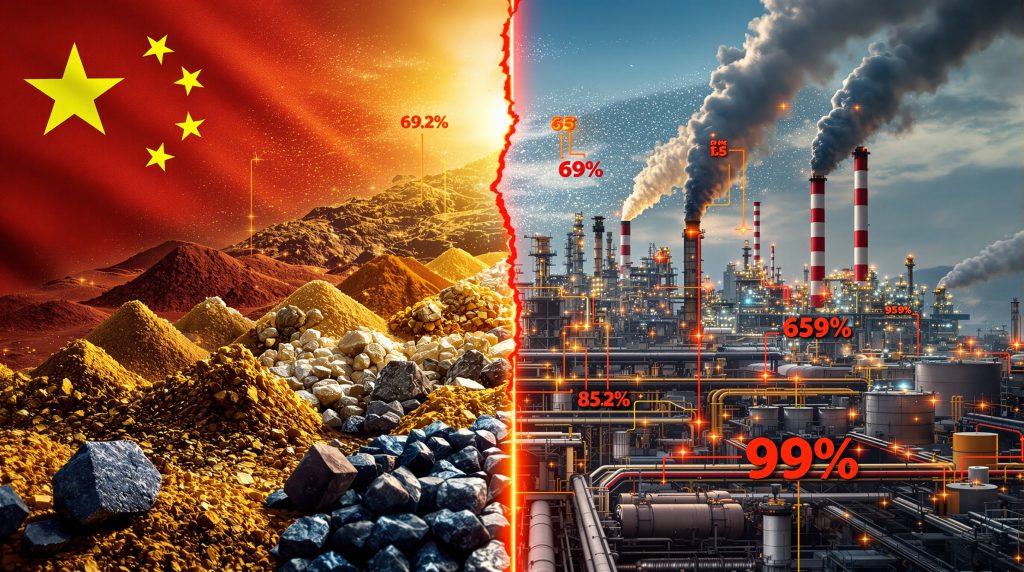

China's dominance in the global rare earth sector represents one of the most comprehensive supply chain monopolies in modern industrial history. The numbers tell a stark story: Chinese producers extracted approximately 270,000 tonnes of rare earth oxide (REO) in 2024, capturing 69.2% of worldwide production according to China-Briefing.com. However, raw extraction statistics only scratch the surface of Beijing's strategic control over these critical materials that form the backbone of modern technology supply chains.

Furthermore, China's supply-chain stranglehold on rare earth elements extends far beyond simple mining operations into sophisticated processing and manufacturing capabilities that competitors struggle to replicate.

Beyond Mining: The Full Value Chain Control

The true power of China's position lies not merely in mining operations, but in its systematic integration across every stage of the rare earth value chain. While other nations focus on ore extraction, China has methodically built capabilities spanning crushing, beneficiation, separation chemistry, refining, and finished product manufacturing. This vertical integration creates multiple leverage points that competitors cannot easily replicate or bypass.

Chinese facilities process approximately 90% of the world's rare earth elements, transforming raw ore into the high-purity oxides and metals demanded by modern technology sectors. This processing monopoly proves far more strategically valuable than mining alone, as even ore extracted in Australia, Africa, or North America typically requires Chinese facilities for refinement into usable materials.

The sophistication extends into downstream manufacturing, where China controls the production of permanent magnets essential for electric vehicles, wind turbines, and defence-critical materials strategy applications. Rare earth permanent magnet manufacturing requires not only processed materials but specialised metallurgical expertise, sintering capabilities, and quality control systems that have taken decades to develop and optimise.

The Numbers Behind the Stranglehold

| Material | China's Global Share | Processing Capacity | Key Applications |

|---|---|---|---|

| Rare Earth Elements | 69.2% production | ~90% processing | Magnets, Electronics |

| Graphite (Spherical) | 85-95% processing | 95% synthetic anode | EV Batteries |

| Heavy REEs | 99% processing | Near-monopoly | Defence, Wind Turbines |

| Permanent Magnets | 80-85% production | Integrated manufacturing | Motors, Generators |

The differentiation between light and heavy rare earth elements reveals the depth of China's control. While Beijing holds approximately 60-70% of light rare earth production (lanthanum, cerium, neodymium), its dominance over heavy rare earth elements approaches 99%. Heavy rare earths including dysprosium, terbium, and europium command premium prices and face the most severe supply constraints globally.

Between 2020 and 2023, roughly 70% of U.S. rare earth compound and metal imports originated from China, according to Visual Capitalist analysis. This dependency has persisted despite explicit policy objectives to diversify supply chains, demonstrating the practical challenges of establishing alternatives to Chinese processing infrastructure.

How Did China Build This Unbreakable Supply Chain Fortress?

China's rare earth dominance did not emerge accidentally or purely through geological advantages. Instead, it represents the culmination of a deliberate, multi-decade industrial strategy that began during the economic reforms of the 1980s and accelerated through systematic technology acquisition, capital deployment, and market positioning.

The 1980s Strategic Foundation

Under Deng Xiaoping's industrial policy framework, China identified rare earths not as commodities subject to market forces, but as strategic materials requiring state-directed development. This perspective fundamentally differed from Western approaches that treated rare earths as fungible mining products competing in global markets.

Chinese rare earth production capacity grew from approximately 15,000 tonnes annually in 1980 to 60,000 tonnes by 2000, supported by preferential state financing and coordinated infrastructure investment. Development banks provided subsidised lending rates that enabled producers to invest in long-term capacity building without facing the profit pressures typical of private Western competitors.

Environmental regulations during this early development period were significantly more lenient than Western equivalents, allowing Chinese operators to externalise pollution costs that would have been prohibitively expensive in jurisdictions with stricter oversight. This regulatory arbitrage provided cost advantages of 20-40% compared to equivalent Western operations, though these advantages have eroded as Chinese environmental standards have tightened since 2015.

Technology Transfer and Expertise Accumulation

China's ascension to processing dominance required more than favourable financing and regulations; it demanded systematic acquisition of proprietary separation and refining chemistry through strategic partnerships with Western technology holders. Consequently, China's approach to rare earth development diverged significantly from traditional commodity extraction models.

During the 1990s and 2000s, Chinese firms engaged in joint ventures, licensing agreements, and academic collaborations specifically designed to absorb Western expertise in rare earth processing. Universities in Baotou, Inner Mongolia, Jiangxi, and other rare earth-adjacent regions developed specialised separation programmes with government research funding directed toward process optimisation and materials science.

The patent accumulation timeline illustrates this systematic approach: Chinese rare earth-related patent filings accelerated from approximately 50-100 annually before 2000 to 200-500 during 2000-2010, then surged to 1,000-2,000 patents annually during 2010-2020. This intellectual property capture complemented physical capacity building and created additional barriers to Western technology catch-up efforts.

Chinese producers simultaneously mastered solvent extraction chemistry, developing specialised extractant compounds with improved selectivity, optimising aqueous phase chemistry to reduce impurities, and integrating downstream precipitation processes to minimise waste streams. This technical expertise, accumulated over decades, cannot be quickly replicated by competitors attempting to rebuild processing capacity.

Why Are Western Supply Chain Alternatives Failing to Materialise?

Despite years of policy rhetoric about supply chain diversification and billions in announced investments, Western alternatives to Chinese rare earth processing have consistently failed to achieve commercial viability. The obstacles prove both more numerous and more intractable than initial assessments suggested.

The Processing Bottleneck Reality

Rare earth separation represents one of the most technically complex processes in modern materials science. The chemistry involves dozens of sequential steps, each requiring precise temperature, pH, and concentration control. Contamination at any stage ruins entire batches, while achieving recovery rates above 90% demands specialised expertise that currently exists primarily within Chinese facilities.

The $2 Billion Processing Plant Problem

Building a single rare earth processing facility requires $1.5-2 billion in capital investment, 5-7 years of construction, and specialised expertise that currently exists primarily in China.

The capital intensity reflects several compounding factors: equipment must be sourced from limited suppliers, demonstration plants are necessary before full-scale operation, customer qualification timelines extend 18-36 months, and initial plants operate at below-optimal efficiency. Western environmental standards for rare earth processing add 20-40% to construction and operating costs compared to equivalent Chinese facilities.

Environmental permitting in Western jurisdictions requires 3-5 year assessment processes, compared to 6-18 months for Chinese equivalents. Regulations governing thorium and uranium co-extraction, acid waste management, and tailings storage are significantly more stringent, creating regulatory moats that benefit existing Chinese producers rather than facilitating Western competition.

Economic Barriers to Competition

Beyond technical and regulatory challenges, Western rare earth processing faces fundamental economic disadvantages that persist regardless of technological capabilities. Chinese producers benefit from minimum viable production thresholds achieved through decades of capacity building, scale economics that new entrants cannot immediately match, and integrated supply chains that reduce transaction costs.

Customer qualification represents a particularly significant barrier. Critical industries including defence, aerospace, and automotive require supplier qualification lasting 18-36 months before accepting new material sources. This qualification encompasses testing, materials analysis, reliability validation, and supply chain auditing.

Furthermore, risk-averse procurement practices in critical industries compound these delays. Defence contractors and automotive manufacturers typically maintain dual-source requirements and prefer suppliers with established track records. New Western processing facilities must demonstrate consistent quality and reliability over multiple production cycles before qualifying for major contracts.

What Are China's New Export Control Weapons?

China's approach to rare earth export regulation has evolved from passive quota management to active supply chain weaponisation. Recent regulatory frameworks provide Beijing with unprecedented leverage over global technology supply chains, extending far beyond traditional trade policy mechanisms.

The November 2025 Regulatory Framework

New Chinese export control regulations implemented in late 2025 require mandatory origin disclosure for all rare earth materials and downstream products. This traceability mandate enables selective supply disruption targeting specific countries, companies, or end-use applications without broad-based export restrictions that might provoke international retaliation.

The non-automatic licensing system replaces previous quota-based restrictions with discretionary approval processes evaluated case-by-case. Chinese authorities can now delay, condition, or deny individual export licenses based on geopolitical considerations while maintaining plausible regulatory justification. Processing times for licence approvals can extend from weeks to months, creating supply uncertainty that forces customers to maintain larger inventories and accept higher costs.

Additionally, these regulatory changes reflect a broader shift in how China leverages its critical raw materials facility control for strategic purposes.

Targeting Downstream Applications

Export controls now extend beyond raw materials to cover finished components and specialised applications. Permanent magnet exports face restrictions based on end-use applications, with defence and aerospace applications subject to enhanced scrutiny. Technology transfer limitations prevent Chinese suppliers from sharing processing expertise with foreign partners attempting to establish competitive facilities.

Intellectual property export controls restrict Chinese companies from licensing separation chemistry and processing technologies to foreign competitors. This regulatory barrier complements existing patent portfolios and technical expertise advantages, making it more difficult for Western companies to acquire the knowledge necessary for independent processing capability.

Chinese export controls now cover the entire rare earth value chain, from raw materials to finished components, giving Beijing unprecedented ability to influence global supply chains through regulatory approval processes.

Which Industries Face the Greatest Supply Chain Vulnerabilities?

The impact of China's supply-chain stranglehold on rare earth elements varies significantly across industrial sectors, with some facing immediate operational risks while others maintain greater resilience through diversification or substitution possibilities.

Electric Vehicle Manufacturing Crisis Points

Electric vehicle production represents perhaps the most vulnerable sector to rare earth supply disruptions. Permanent magnet motors, which account for 80-90% of EV traction motors, require neodymium, dysprosium, and terbium in quantities that cannot be economically sourced outside Chinese processing networks.

Battery production faces parallel vulnerabilities through spherical graphite requirements. China controls 85-95% of spherical graphite processing capacity essential for lithium-ion battery anodes. Synthetic graphite production, increasingly important for high-performance batteries, remains concentrated in Chinese facilities with limited alternative capacity under development elsewhere.

Charging infrastructure components rely on rare earth permanent magnets for efficient power conversion and grid integration systems. Supply disruptions would affect not only vehicle production but the supporting infrastructure necessary for electric vehicle adoption, creating cascading economic impacts across the transportation electrification ecosystem.

Defence and Aerospace Exposure

Military applications face some of the most severe vulnerabilities due to specific performance requirements that preclude material substitution. Guided missile systems require high-performance permanent magnets for precision navigation and control systems. Radar and communication equipment depend on rare earth elements for signal processing and amplification capabilities that cannot be easily replicated with alternative materials.

Fighter jet engines incorporate rare earth elements in specialised alloys that must meet extreme temperature and stress requirements. The qualification timelines for alternative materials in aerospace applications can extend 5-10 years, making short-term supply diversification practically impossible for existing aircraft programmes.

The defence sector's dual challenges include both material availability and security clearance requirements for suppliers. Even if alternative rare earth sources were available, new suppliers must undergo extensive security vetting processes that can take months or years to complete, creating additional barriers to supply chain diversification.

Renewable Energy Infrastructure Threats

Wind turbine manufacturing depends heavily on rare earth permanent magnets for direct-drive generators that eliminate gearboxes and improve reliability. Modern wind turbines contain 200-600 kilograms of rare earth materials per megawatt of capacity, with heavy rare earths like dysprosium essential for high-temperature operation and grid stability.

Solar panel manufacturing requires rare earth elements for specific components including inverters and tracking systems. While silicon photovoltaic cells themselves do not contain rare earths, the supporting infrastructure for utility-scale solar installations relies on Chinese-controlled materials for optimal performance and grid integration.

Grid-scale energy storage systems incorporate rare earth materials in power conversion systems and grid-balancing equipment. As renewable energy deployment accelerates, the cumulative demand for rare earth materials in supporting infrastructure creates compounding supply chain vulnerabilities that extend beyond individual technology sectors.

How Are Global Powers Responding to This Supply Chain Emergency?

Recognition of China's supply chain dominance has prompted coordinated responses from major economies, though the effectiveness of these initiatives remains constrained by technical, economic, and time limitations that cannot be easily overcome through policy declarations alone.

United States Diversification Initiatives

The U.S. government has committed significant resources to rare earth supply chain independence through multiple federal programmes. The Critical Materials Security Program provides funding for domestic processing capacity development, while Defense Production Act authorities enable government investment in strategic facilities deemed essential for national security.

However, practical implementation has proven more challenging than initial announcements suggested. The Mountain Pass mine in California, repeatedly cited as evidence of domestic capability, continues to send the majority of its extracted ore to China for processing due to the absence of cost-competitive separation facilities within the United States.

Strategic partnerships with allied nations represent another component of U.S. diversification efforts. Agreements with Australia, Canada, and selected African nations aim to establish rare earth supply chains that bypass Chinese processing infrastructure. Consequently, these partnerships build upon Australia's strategic mineral reserve initiatives to create more resilient supply networks.

European Union Resource Independence Strategy

The European Union's Critical Raw Materials Act establishes targets for supply chain diversification, including requirements that no more than 65% of strategic material imports originate from a single third country by 2030. However, achieving these targets requires processing capacity that does not currently exist within the EU or its partner nations.

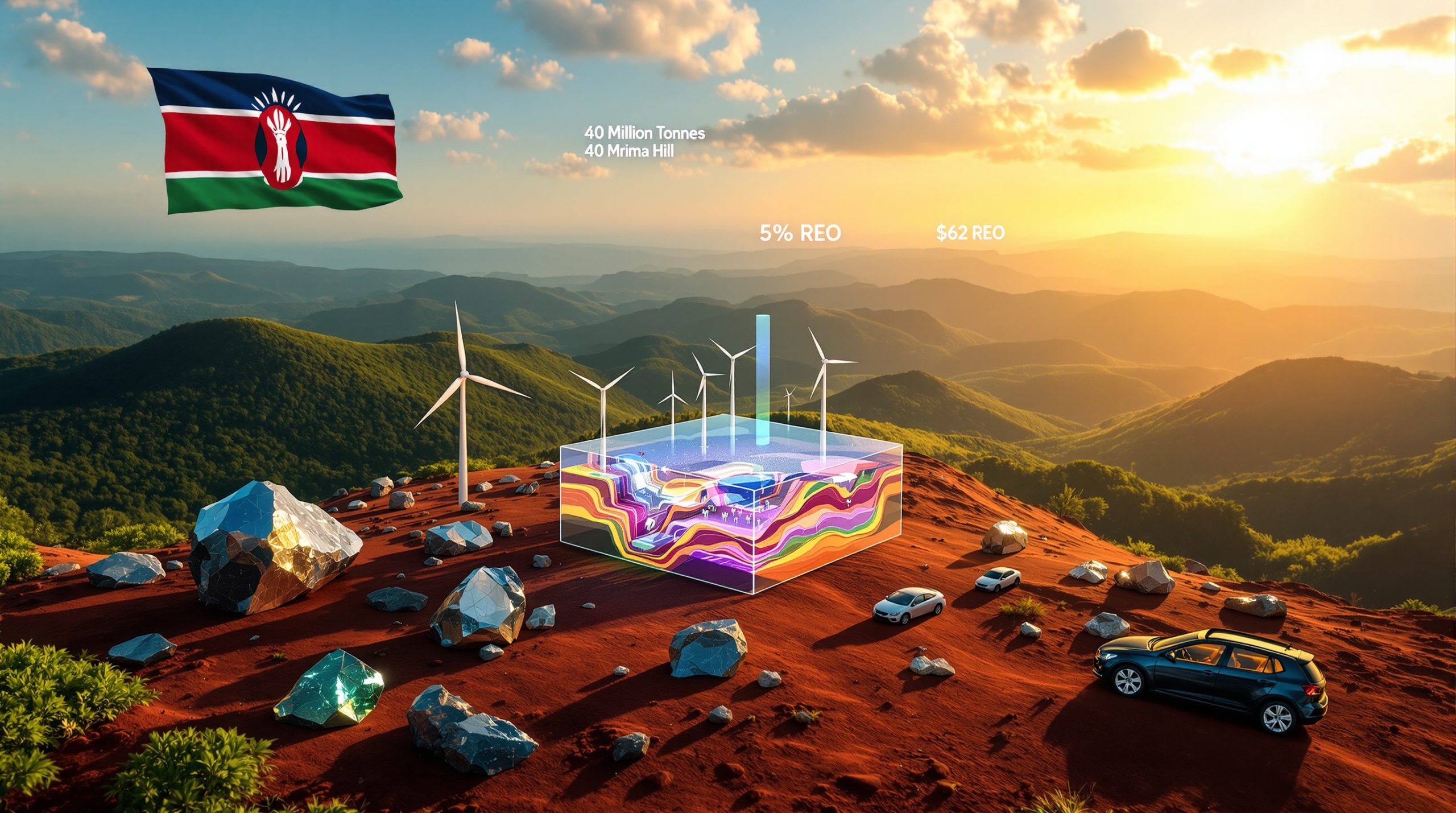

European rare earth initiatives focus heavily on African partnerships, particularly with nations like Malawi and Tanzania that possess significant mineral deposits. These agreements emphasise technical assistance and financing for mining development, though they typically lack the processing infrastructure necessary for complete supply chain independence.

Greenland has emerged as a potential alternative source for European rare earth requirements, with EU-backed exploration projects identifying substantial deposits. However, the harsh Arctic environment, limited infrastructure, and indigenous rights considerations create development timelines extending well beyond immediate supply security needs.

Japan and South Korea Hedging Strategies

Japan and South Korea, as major manufacturers of rare earth-intensive products, have pursued different approaches to supply chain risk management. Both nations maintain strategic reserves intended to buffer short-term supply disruptions, though reserve quantities remain insufficient for extended supply interruptions.

Alternative technology development represents a longer-term hedge against supply chain vulnerabilities. Japanese automotive manufacturers have invested heavily in rare earth-free electric motor designs, while South Korean electronics companies have developed substitution technologies that reduce rare earth content in consumer products.

Southeast Asian partnerships provide geographical diversification for both nations, with investments in Vietnamese and Malaysian processing facilities aimed at reducing dependence on mainland Chinese suppliers. However, these facilities often rely on Chinese technical expertise and equipment, limiting their independence during severe geopolitical tensions.

What Investment Opportunities Exist Outside Chinese Control?

Despite China's overwhelming dominance, specific investment opportunities exist for developing alternative rare earth supply chains, though these require realistic assessment of timelines, capital requirements, and technical challenges that have hindered previous efforts.

Promising Non-Chinese Mining Projects

| Project Location | Estimated Production | Timeline | Key Investors |

|---|---|---|---|

| Greenland (Kvanefjeld) | 15,000 tonnes REO | 2027-2029 | EU-backed consortium |

| Australia (Mount Weld) | 22,000 tonnes REO | Operational expansion | Lynas Corporation |

| Canada (Nechalacho) | 5,000 tonnes REO | 2026-2027 | Vital Metals |

| Malawi (Songwe Hill) | 4,500 tonnes REO | 2025-2026 | Mkango Resources |

Mount Weld in Western Australia, operated by Lynas Corporation, represents the most advanced non-Chinese rare earth operation, though it highlights the processing challenge: extracted ore must be shipped to Malaysia for separation due to the absence of Australian processing facilities. Expansion plans aim to increase production capacity, but processing bottlenecks limit the project's contribution to supply chain independence.

The Nechalacho project in Canada's Northwest Territories possesses advantages including heavy rare earth content and proximity to North American manufacturing centres. However, development faces challenges including remote location, harsh climate, and the need for specialised transportation infrastructure to move processed materials to market.

Moreover, these projects represent broader trends in junior mining investments that are essential for diversifying global supply chains.

Processing Infrastructure Investment Needs

The most critical investment opportunities exist in processing capacity rather than mining operations. Western processing facilities require $1.5-2 billion in capital investment per facility, with construction timelines extending 5-7 years from design to operational capacity.

Government incentive programmes in the United States, European Union, and other allied nations provide significant subsidies for processing facility development, though private investors must still assume substantial technical and market risks. Demonstration plants represent lower-risk entry points, typically requiring $100-300 million in capital while providing opportunities to develop expertise and validate processes.

Technology partnerships with existing operators offer another pathway for processing capacity development. Joint ventures with companies like Lynas Corporation or MP Materials provide access to accumulated expertise while sharing capital requirements and technical risks among multiple partners.

Alternative Technology Development

Investment opportunities in rare earth-free alternatives address supply chain vulnerabilities through substitution rather than diversification. Rare earth-free motor designs for electric vehicles represent a significant market opportunity, though performance trade-offs currently limit commercial adoption.

Recycling and urban mining technologies offer pathways to reduce primary supply requirements through recovery of rare earth materials from end-of-life products. Electronic waste contains substantial concentrations of rare earth elements, though current recycling processes are energy-intensive and economically marginal compared to primary production.

Substitution material research focuses on developing alternative materials with comparable performance characteristics to rare earth applications. These technologies require substantial research and development investment with uncertain commercial timelines, but successful development could dramatically reduce global dependence on Chinese supply chains.

What Does China's Internal Demand Growth Mean for Global Supply?

China's domestic consumption of rare earth materials has grown rapidly alongside the country's expanding clean energy and technology sectors, fundamentally altering the global supply-demand balance and reducing the quantity of Chinese production available for export markets.

Domestic Consumption Surge Analysis

Chinese electric vehicle adoption has accelerated dramatically, with domestic EV sales reaching 8.1 million units in 2024 according to industry estimates. Each electric vehicle requires 1-3 kilograms of rare earth materials for motors, batteries, and electronics, creating domestic demand that absorbs increasing portions of Chinese production capacity.

Renewable energy infrastructure buildout within China represents another significant demand driver. The country's wind power capacity has exceeded 400 gigawatts, with each megawatt of wind capacity requiring 200-600 kilograms of rare earth materials. Solar installations, grid-scale energy storage, and electric grid modernisation create additional domestic consumption that competes with export sales.

Industrial automation expansion across Chinese manufacturing sectors increases demand for rare earth permanent magnets in motors, sensors, and control systems. As Chinese wages rise and manufacturers seek productivity improvements through automation, domestic rare earth consumption continues growing independent of clean energy applications.

This domestic demand surge has significant implications for critical minerals energy security considerations globally, as less Chinese production becomes available for international markets.

Export Availability Calculations

China produced approximately 270,000 tonnes of rare earth oxides in 2024, but domestic consumption has grown to an estimated 150,000-180,000 tonnes annually. This leaves 90,000-120,000 tonnes available for export markets, compared to previous availability of 150,000+ tonnes when domestic consumption was lower.

Strategic reserve accumulation policies further reduce export availability as Chinese authorities stockpile materials for economic security purposes. Government stockpiling typically absorbs 10,000-20,000 tonnes annually, though these quantities can increase during periods of geopolitical tension or trade uncertainty.

Export quota policies provide additional control mechanisms that can restrict availability independent of physical production constraints. Historical export quotas have ranged from 35,000 tonnes to 105,000 tonnes annually, with recent trends toward lower quotas as domestic demand increases and geopolitical tensions escalate.

How Can Investors Navigate This Supply Chain Minefield?

Investing in rare earth-exposed sectors requires sophisticated risk assessment frameworks that account for supply chain vulnerabilities, geopolitical dynamics, and technical challenges that traditional commodity analysis often overlooks.

Risk Assessment Framework

Supply chain dependency auditing must extend beyond first-tier suppliers to encompass the entire value chain from ore extraction through finished product manufacturing. Many companies that believe they source rare earths from non-Chinese suppliers discover that upstream processing still occurs in Chinese facilities, creating hidden dependencies that become apparent only during supply disruptions.

Geopolitical risk modelling should incorporate multiple scenarios ranging from gradual quota tightening to complete export embargos. Each scenario requires different timeline assumptions, with gradual restrictions potentially manageable through inventory building and substitution, while sudden cut-offs could force production shutdowns in vulnerable industries.

Alternative supplier qualification processes must account for the technical barriers and time requirements involved in switching rare earth sources. Customer qualification periods of 18-36 months are typical in critical applications, meaning supply diversification strategies must be implemented well in advance of actual supply needs.

Portfolio Diversification Strategies

Upstream mining exposure through companies operating outside China provides partial hedge against supply chain disruption, though investors must recognise that ore extraction alone does not guarantee supply security. Companies with integrated processing capabilities or partnerships with non-Chinese processors offer superior protection against supply chain vulnerabilities.

Processing capacity investments represent higher-risk, higher-reward opportunities with the potential for substantial returns if supply chain independence efforts succeed. However, these investments require patient capital and tolerance for technical risks that have caused previous processing ventures to fail or experience substantial delays.

Technology substitution positions provide alternative approaches to rare earth exposure through companies developing rare earth-free alternatives or recycling technologies. These investments hedge against supply chain risks while participating in potential technology transitions that could reshape entire industries.

Moreover, according to reporting by The Guardian, Australia's potential to break China's stranglehold remains uncertain despite significant resource endowments.

Timeline for Supply Chain Independence

The 10-Year Reality Check

Industry experts estimate that building truly independent rare earth supply chains outside China will require 8-12 years of sustained investment, assuming no major geopolitical disruptions.

Near-term supply chain diversification (2-3 years) can achieve modest improvements through existing capacity expansion and strategic reserve building, but fundamental independence requires processing infrastructure that does not currently exist outside China. Intermediate timelines (5-7 years) may see demonstration processing facilities and pilot-scale operations, though commercial viability remains uncertain.

Long-term independence (8-12 years) assumes successful development of Western processing capacity, resolution of technical challenges, completion of customer qualification processes, and sustained political support for supply chain diversification investments. Even under optimistic scenarios, China will likely maintain dominant market positions in specific rare earth elements and applications.

What Are the Long-Term Scenarios for Global Supply Chain Restructuring?

The future structure of global rare earth supply chains will depend on complex interactions between technological development, geopolitical tensions, investment decisions, and market dynamics that remain highly uncertain and subject to significant variation across different scenarios.

Best-Case Diversification Timeline

Successful Western processing facility development could reduce Chinese processing market share from current levels near 90% to 60-70% by 2035, though this requires sustained capital deployment, resolution of technical challenges, and stable geopolitical cooperation frameworks. Multiple processing facilities in North America, Europe, and allied nations would need to achieve commercial operation and customer qualification.

Technology breakthrough acceleration in areas like direct extraction, improved separation chemistry, or rare earth-free alternatives could fundamentally alter supply chain dynamics. Advanced separation technologies might reduce processing costs and complexity, enabling smaller-scale facilities to compete economically with Chinese operations.

Stable geopolitical cooperation frameworks between major economies could facilitate technology sharing, joint investment in processing infrastructure, and coordinated responses to supply chain vulnerabilities. Such cooperation would require resolution of current trade tensions and establishment of mechanisms for sharing supply security risks among allied nations.

Worst-Case Supply Disruption Impacts

Complete export embargo scenarios, while unlikely due to economic costs to China, could cause severe disruptions across multiple industries. Electric vehicle production might decline 30-50% within 6-12 months of supply cutoffs, while wind turbine manufacturing could face similar constraints due to permanent magnet requirements.

Critical infrastructure vulnerability exposure would affect defence systems, telecommunications networks, and renewable energy installations that cannot quickly substitute alternative materials. National security implications could force governments to choose between maintaining advanced military capabilities and supporting clean energy transitions that depend on Chinese materials.

Economic security implications extend beyond direct rare earth users to encompass entire technology supply chains. Smartphone manufacturing, data centre equipment, medical devices, and consumer electronics all incorporate rare earth materials at various points, creating vulnerability to supply disruptions that could affect broad economic sectors.

Most Likely Gradual Rebalancing Path

Partial diversification achievements represent the most probable outcome, with Chinese market share declining gradually from current levels while remaining dominant in specific applications and materials. Heavy rare earth processing will likely remain concentrated in China due to geological and technical advantages that are difficult to replicate elsewhere.

Continued Chinese dominance with reduced margins reflects increasing domestic consumption, environmental compliance costs, and competitive pressure from alternative sources. Chinese suppliers may maintain market leadership while accepting lower profit margins and reduced geopolitical leverage as global supply chains become more resilient.

Regional supply chain cluster development could emerge in North America, Europe, and Asia-Pacific, with each region developing processing capabilities optimised for specific applications and customer bases. These clusters would reduce but not eliminate Chinese dependencies while creating redundancy and competition in global markets.

In addition, analysis from ABC News suggests that Australia's emergence as an alternative supplier faces significant technical and economic hurdles despite government support.

Frequently Asked Questions About China's Rare Earth Control

How quickly could China cut off rare earth exports?

China possesses the technical capability to implement export restrictions within days through its existing licensing and quota systems, though complete cutoffs would impose significant economic costs on Chinese producers and downstream industries. Historical precedent from the 2010 Japan tensions suggests that restrictions typically begin with administrative delays and quota reductions rather than immediate embargos.

The practical timeline for restrictions depends on the scope and targeting of export controls. Selective restrictions on specific materials or countries could be implemented quickly, while broad-based embargos would require more extensive coordination among Chinese authorities and industry participants. Export licensing systems provide flexibility for graduated responses that can be escalated or de-escalated based on geopolitical developments.

Are there any rare earth elements China doesn't control?

China's control varies significantly across different rare earth elements, with near-monopoly positions in heavy rare earths but more competitive market structures in some light rare earth applications. Cerium and lanthanum markets have more diverse supply sources, while dysprosium, terbium, and europium remain almost entirely dependent on Chinese processing.

Mining operations outside China exist for most rare earth elements, but processing capabilities remain concentrated in Chinese facilities regardless of ore origin. Even materials extracted in Australia, Canada, or Africa typically require Chinese separation and refining before becoming usable in manufacturing applications.

Future supply chain developments may reduce Chinese dominance in specific elements, particularly light rare earths where alternative processing capacity is more economically viable. However, heavy rare earth dependencies are likely to persist due to geological concentration and technical processing challenges.

What would happen to electric vehicle prices in a supply disruption?

Electric vehicle prices could increase 15-30% during severe rare earth supply disruptions due to motor and battery cost increases, though the magnitude would depend on disruption duration and automaker ability to shift production to alternative technologies. Permanent magnet motor costs might double or triple during extended supply shortages, forcing manufacturers to absorb costs or pass them to consumers.

Automaker responses would likely include accelerating development of rare earth-free motor designs, though these alternatives typically sacrifice performance or efficiency compared to permanent magnet systems. Production shifts toward vehicles using induction motors or other technologies could maintain manufacturing volumes while affecting vehicle performance and market positioning.

Market dynamics during supply disruptions would favour manufacturers with better supply chain diversification or alternative technology capabilities. Companies dependent on Chinese rare earth supply chains might face production constraints that benefit competitors with more resilient material sources.

Can recycling reduce dependence on Chinese rare earths?

Recycling currently provides less than 1% of global rare earth supply due to technical challenges, economic costs, and limited infrastructure for collection and processing of end-of-life products. However, recycling potential could grow significantly as accumulated rare earth-containing products reach end-of-life and recycling technologies improve.

Electronic waste streams contain substantial rare earth concentrations, particularly from hard disk drives, speakers, and permanent magnets. Urban mining operations could potentially recover 10-20% of annual rare earth demand within 10-15 years, though this requires substantial investment in collection infrastructure and recycling technology development.

Economic viability of recycling depends on rare earth prices and recycling process efficiency. Higher prices resulting from supply constraints would improve recycling economics, while technological advances in separation and purification could reduce recycling costs relative to primary production.

Disclaimer: This analysis involves forecasts, speculation, and industry assessments that are subject to significant uncertainty. Rare earth markets are volatile and influenced by geopolitical factors that can change rapidly. Investment decisions should be based on comprehensive due diligence and professional advice rather than relying solely on this analysis. The information presented reflects conditions as of November 2025 and may become outdated as market conditions evolve.

Ready to Capitalise on Critical Minerals Market Disruptions?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant critical mineral discoveries across the ASX, helping investors identify actionable opportunities before supply chain disruptions create market winners and losers. Begin your 30-day free trial today to position yourself ahead of the market as global supply chains reshape around alternative mineral sources.