## Understanding Kenya’s Strategic Minerals

Kenya’s coastal Kwale County is emerging as an exciting area for exploration, particularly within the realm of Kenya Mrima Hill rare earth minerals exploration. This region is noted for its potential to supply elements critical to modern technology. Furthermore, its resource base could reshape global value chains while stimulating local development.

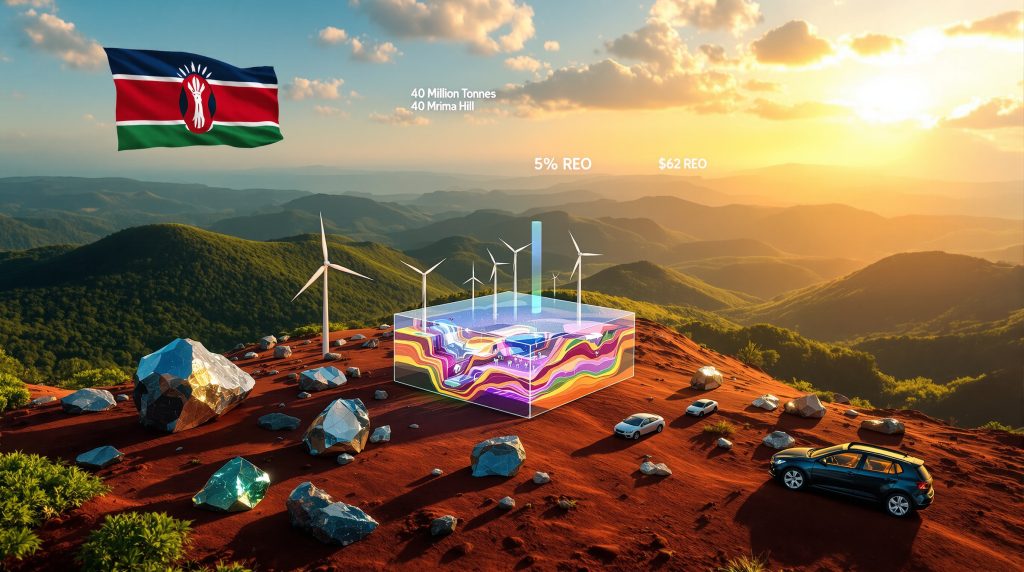

The area’s geological surveys suggest significant deposits of rare earth oxides and niobium. For instance, preliminary estimates indicate approximately 40 million tonnes of ore with around 5% total rare earth oxide content. In addition, the deposit is believed to contain nearly 680 million kilograms of niobium. Notably, such resources are garnering attention from investors and governments alike.

## Geological Importance and Resource Estimates

The deposit’s composition plays a crucial role in various high-tech industries. Light and heavy rare earth elements—such as neodymium, praseodymium, dysprosium, and terbium—support the production of permanent magnets for wind turbines and electric vehicles. Moreover, elements like cerium and lanthanum are indispensable in catalytic converters and battery systems.

Furthermore, the region’s estimated resource profile can be further explored by consulting a mineral deposit tiers guide. In addition, geological assessments have encouraged the implementation of advanced exploration techniques. As investments increase, the potential for innovative extraction methods becomes more appealing.

## International Strategic Interests

Governments and major commercial players are increasingly involved in the competition for Africa’s critical resources. In recent years, international powers have turned their attention to the region, seeking to diversify their critical mineral energy transition strategies. For example, the United States has strengthened its diplomatic presence, while also supporting initiatives that foster critical minerals energy transition.

US and Chinese Engagement

In addition, the United States has shown strategic interest through high-level diplomatic visits. The nation’s focus on securing reliable supplies is part of a broader move to reduce global dependence on traditional suppliers. Meanwhile, Chinese firms continue to assert their influence over market dynamics. For instance, one report on the global rare earth race highlights emerging competition on the African continent.

Furthermore, strategic dialogues and trade partnerships have been initiated with the aim of realising competitive advantages. As a result, investors are more confident that market diversifications will yield stabilised long-term pricing and enhanced supply security.

## Development Challenges and Processing Complexity

Transforming geological potential into commercial production remains a formidable challenge. Multiple factors, including technical refinement, environmental stewardship, and regulatory approvals, must align for a successful project. Addressing these issues requires a focused approach and innovative solutions.

Technical and Regulatory Hurdles

One major technical obstacle is converting resource estimates into proven reserves. This process will rely on extensive geological drilling programs that validate initial findings. Additionally, processing rare earths demands specialised facilities for separation and refining. In parallel, stringent environmental impact assessments must be met to ensure sustainable practices.

Moreover, recent reforms under Kenya’s administration aim to streamline mining procedures. The government has introduced policies to simplify licensing and boost investor confidence. Environmental mitigation, often dealt with through mine reclamation insights, also remains a priority. In this context, regulatory bodies are emphasising transparency, further enhancing the appeal of responsible projects.

It is essential to note that Kenya Mrima Hill rare earth minerals exploration faces not only technological but also administrative challenges that require proactive, collaborative solutions.

## Community and Economic Impact

Balancing economic potential with community welfare is vital for any mining venture. Although the prospect of substantial revenue is promising, local interests and cultural values present unique challenges. The Digo community, for example, maintains a profound spiritual and economic connection to the region, advocating for sustainable practices that protect both nature and tradition.

Local Perspectives

Local residents have expressed mixed views about resource extraction. On one hand, they recognise the benefits of job creation, infrastructural development, and improved social services that accompany mining investments. On the other hand, there is deep concern over environmental degradation and the erosion of cultural heritage.

Community leaders, such as local representatives, call for robust engagement with mining companies. They stress that transparent benefit-sharing practices are essential. Moreover, community members champion initiatives that safeguard traditional land uses, ensuring that economic progress does not come at the expense of cultural integrity.

Economic Transformation Potential

Transforming the mining sector holds considerable promise for the country’s economy. Reliable execution of the project could contribute significantly to Kenya’s GDP. This prospect aligns with national goals to increase the mining sector’s contribution from 0.8% to 10% by 2030. Furthermore, it can catalyse improvements in infrastructure, education, and overall economic resilience.

Key drivers for transformation include:

• Employment Opportunities: Direct jobs in mining and related services.

• Technological Advancements: The introduction of modern mining techniques can spur broader industrial innovation.

• Infrastructure Development: Enhanced transport, energy, and communication systems across the region.

Additionally, evolving mining industry innovation drives greater business opportunities. In parallel, market dynamics are influenced by global trends in resource valuation and demand fluctuations. For instance, a recent analysis on rare earth market trends underscores the impact of geopolitical shifts on pricing and supply.

Successfully harnessing these opportunities could redefine Kenya’s economic landscape. In fact, Kenya Mrima Hill rare earth minerals exploration represents not just an economic opportunity but a transformative catalyst for regional growth.

## Conclusion

The strategic significance of Kenya’s resource potential is undeniable. With the right mix of advanced exploration techniques, proactive regulatory frameworks, and meaningful community engagement, this project could set new benchmarks for sustainable mining. Furthermore, the global competitive landscape is contributing to innovative resource management strategies and robust market realignments.

Looking ahead, investors and policymakers alike are closely monitoring progress along Kenya Mrima Hill rare earth minerals exploration. As technical challenges are addressed and community needs are met, the region is poised to become a cornerstone in the global rare earth ecosystem. Ultimately, the success of this venture will depend on harmonising technological advances with transparent governance and equitable local partnerships.

Ready to Capitalise on the Next Major Mineral Discovery?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries, including rare earth and critical mineral opportunities that mirror the potential highlighted in Kenya's emerging sector. Understand why major mineral discoveries can lead to substantial market returns by exploring Discovery Alert's dedicated discoveries page, showcasing historic examples of exceptional outcomes, and begin your 30-day free trial today to position yourself ahead of the market.