Understanding Arctic Hydrocarbon Exploration Dynamics

Arctic hydrocarbon exploration represents one of the most technically challenging frontiers in the global energy sector, where extreme operating conditions intersect with sophisticated geological formations to create unique development opportunities. The convergence of advanced drilling technologies, mature petroleum systems, and strategic infrastructure positioning has transformed previously inaccessible reserves into commercially viable prospects. Furthermore, recent developments in the region have shown how oil price rally analysis influences exploration investments in these remote areas.

Modern Arctic exploration campaigns demonstrate how technological innovation enables operators to overcome environmental constraints while maintaining operational safety standards. These projects showcase the evolution from speculative frontier exploration to systematic resource development, where proximity to existing infrastructure often determines commercial viability.

What Makes the Barents Sea a Strategic Exploration Target?

Geological Framework and Basin Architecture

The Barents Sea contains one of Europe's most significant underdeveloped hydrocarbon provinces, characterized by complex structural geology and multiple productive horizons. The region's geological framework spans several key formations that have proven their hydrocarbon potential through recent exploration successes.

Triassic-Jurassic Reservoir Systems:

• Lower Jurassic Realgrunnen Subgroup formations (Tubåen and Fruholmen) containing gas-oil accumulations

• Middle Triassic Kobbe Formation hosting oil-bearing intervals with significant column thickness

• Fault-block structural architecture creating isolated hydrocarbon traps across the basin

• Multiple formation penetration demonstrating vertical hydrocarbon distribution patterns

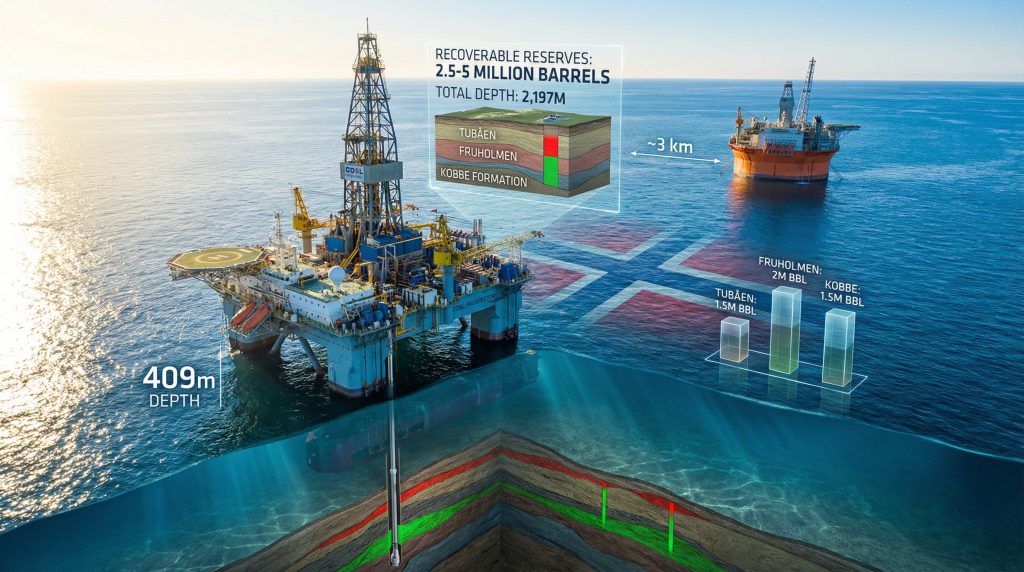

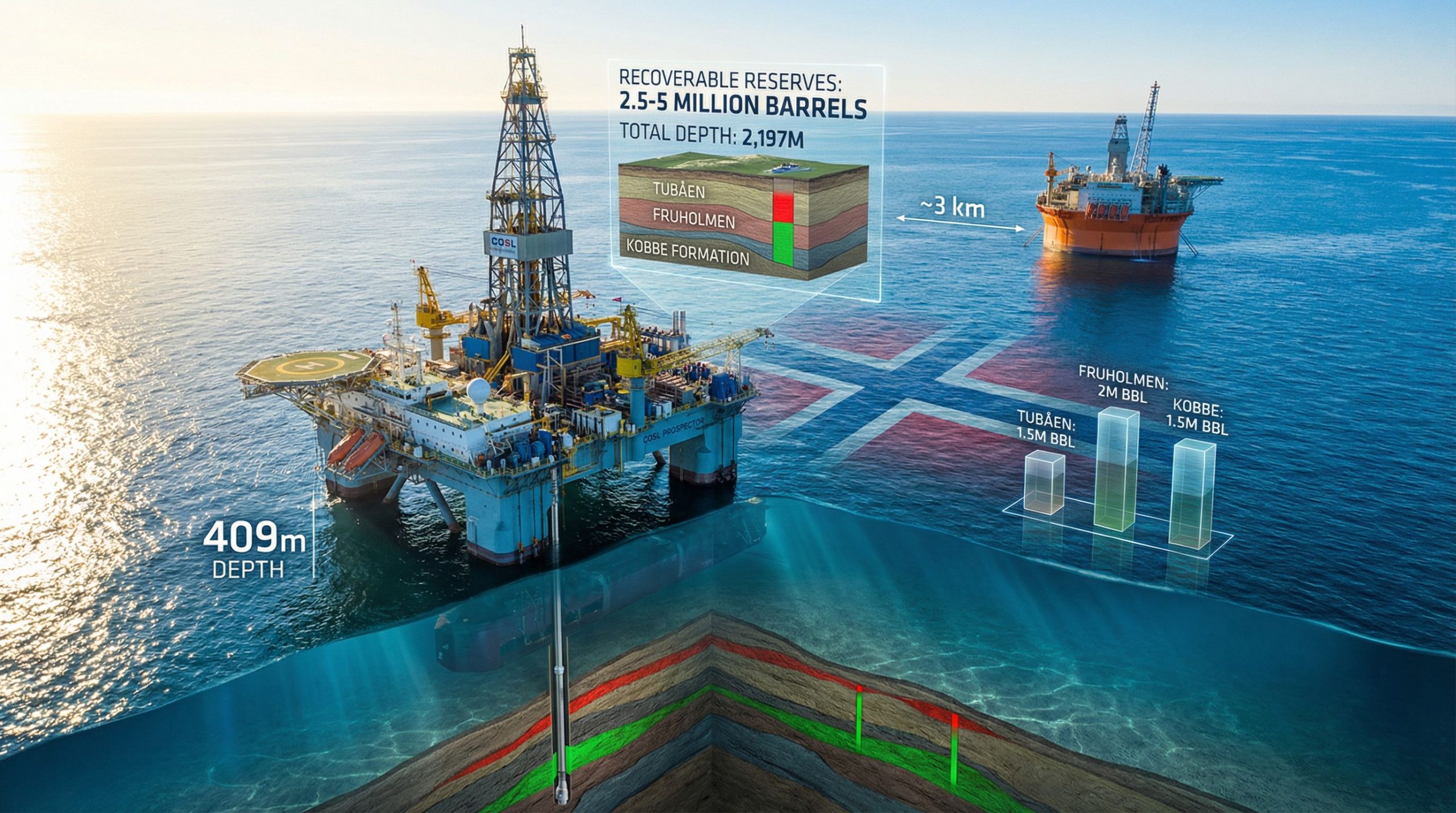

The recent oil and gas discovery in the Barents Sea at well 7122/7-8 exemplifies this geological complexity, where a single wellbore encountered three separate hydrocarbon-bearing zones across different stratigraphic levels. The Tubåen formation revealed an 8-meter gas-oil column, while the Fruholmen formation contained a 6-meter gas-oil interval, and the Kobbe formation displayed a substantial 17-meter oil column.

Regional Petroleum System Maturity

The Barents Sea's petroleum system demonstrates advanced maturity through effective source rock generation, migration pathways, and structural trapping mechanisms. Evidence from recent drilling campaigns indicates that the Norwegian Offshore Directorate has documented significant exploration successes in this region over the past decade. The Barents Sea exploration activities have revealed multiple productive formations across various structural settings.

Hydrocarbon Charge Efficiency:

• Multi-zone accumulations at precise contact depths (1,255m, 1,285m, and 2,048m subsea)

• Distinct pressure regimes controlling gas-oil and oil-water contact relationships

• Effective migration pathways enabling vertical hydrocarbon distribution across formations

• Structural trap integrity maintaining discrete accumulations without cross-flow

Comparative Basin Analysis

When evaluated against other Arctic exploration provinces, the Norwegian Barents Sea offers several strategic advantages that distinguish it from comparable regions. The area benefits from established regulatory frameworks, existing infrastructure networks, and proven geological models that reduce exploration risk. Additionally, recent regulatory developments affecting exploration licenses impact demonstrate how government policies influence exploration investment decisions globally.

| Basin Characteristic | Norwegian Barents Sea | Regional Arctic Average |

|---|---|---|

| Water Depth Range | 200-500m | 50-2000m+ |

| Infrastructure Density | Moderate-High | Low-Moderate |

| Regulatory Stability | High | Variable |

| Discovery Success Rate | 35-40% | 15-25% |

The proximity of recent discoveries to existing production facilities creates development synergies unavailable in more remote Arctic basins, fundamentally altering project economics through shared infrastructure utilization.

How Do Modern Arctic Drilling Operations Overcome Technical Challenges?

Advanced Drilling Technologies in Extreme Environments

Contemporary Arctic drilling operations employ sophisticated technologies specifically designed for harsh marine environments, where operational windows are constrained by weather, ice conditions, and logistical complexities. The successful execution of exploration programs in these conditions requires specialized equipment and operational protocols. Moreover, the integration of AI drilling innovations has revolutionised traditional drilling methodologies in challenging environments.

Semisubmersible Rig Capabilities:

The COSL Prospector semisubmersible demonstrated advanced Arctic capability by operating in 409 meters of water depth while drilling to 2,197 meters total vertical depth subsea. This operational envelope showcases modern rig specifications:

• Environmental tolerance for harsh weather and sea state conditions

• Dynamic positioning systems maintaining precise location during drilling operations

• Ice management capabilities for seasonal Arctic conditions

• Extended operational autonomy reducing weather-related downtime

Wellbore Stability Management

Arctic drilling operations encounter unique geological challenges related to formation pressure regimes, temperature variations, and complex lithology sequences. Successful wellbore construction requires comprehensive planning and real-time adaptation to changing downhole conditions.

The oil and gas discovery in the Barents Sea drilling program successfully penetrated multiple formations with varying characteristics:

Formation-Specific Challenges:

• Lower Jurassic sequences requiring specialised drilling fluids for shale stability

• Middle Triassic formations with varying porosity and pressure characteristics

• Multi-zone pressure management across three distinct hydrocarbon-bearing intervals

• Completion zone isolation ensuring accurate contact depth determination

Data Acquisition Methodologies

Comprehensive reservoir characterisation in Arctic exploration requires advanced logging technologies and sampling protocols that maximise information recovery from limited drilling opportunities. The high cost of Arctic operations necessitates extensive data acquisition programs to reduce future appraisal requirements. Furthermore, recent advances in offshore exploration technologies have been documented in industry publications highlighting similar Arctic drilling discoveries.

Advanced Logging Technologies:

Modern Arctic drilling campaigns deploy comprehensive logging suites across all target formations, providing detailed reservoir characterisation without requiring formation testing in extreme environments.

The recent Barents Sea exploration well employed extensive data acquisition protocols, including:

• Multi-zone logging programs characterising reservoir quality across three formations

• Precise contact identification through resistivity and saturation analysis

• Core sampling protocols for detailed petrographic analysis

• Wellbore imaging techniques defining structural and stratigraphic relationships

What Are the Key Reservoir Characteristics of This Discovery?

Hydrocarbon Distribution Analysis

The recent oil and gas discovery in the Barents Sea reveals a complex multi-zone accumulation system with distinct hydrocarbon distributions across three productive formations. This vertical stacking pattern demonstrates the basin's petroleum system efficiency and provides insights into regional exploration potential.

| Formation | Hydrocarbon Type | Column Thickness | Net Reservoir | Contact Depth (m subsea) |

|---|---|---|---|---|

| Tubåen | Gas-Oil | 8m | 6.5m | GOC: 1,255m |

| Fruholmen | Gas-Oil | 6m | Not specified | GOC: 1,285m, OWC: 1,290m |

| Kobbe | Oil | 17m | 12m | OWC: 2,048m |

Resource Volume Estimation

Preliminary resource assessments indicate the discovery contains 0.4-0.8 million standard cubic metres of recoverable oil equivalent, translating to approximately 2.5-5 million barrels of oil equivalent (MMboe). This resource range places the accumulation within the category of discoveries requiring infrastructure synergies for commercial development.

Resource Distribution by Formation:

• Tubåen Formation: Primary gas-bearing interval with oil rim potential

• Fruholmen Formation: Thin oil layer between gas cap and aquifer contact

• Kobbe Formation: Largest individual oil accumulation with significant net-to-gross ratio

• Total System: Multi-phase hydrocarbon distribution across 793-meter vertical interval

Reservoir Quality Assessment

All three productive formations demonstrate good reservoir quality characteristics, indicating favourable porosity, permeability, and completion potential. The reservoir assessment suggests conventional production methods will be applicable across the discovery.

Formation Evaluation Results:

• Porosity characteristics supporting commercial flow rates

• Permeability distributions enabling effective drainage patterns

• Rock quality indicators confirming completion feasibility

• Pressure regime analysis supporting multi-zone development concepts

The vertical separation between productive zones enables selective completion strategies, potentially maximising recovery efficiency through targeted production optimisation techniques.

How Does Proximity to Existing Infrastructure Impact Development Economics?

Tieback Development Scenarios

The discovery's strategic location 3 kilometres from the Goliat FPSO creates significant development advantages through potential subsea tieback integration. This proximity transforms what might otherwise be a marginal accumulation into a commercially viable development opportunity.

Infrastructure Integration Benefits:

• Goliat Sevan 1000 FPSO providing established processing capabilities

• Hammerfest terminal connection via existing pipeline infrastructure (90km distance)

• Shared operational systems reducing ongoing operational expenditure

• Proven production technology minimising development risk

Infrastructure Utilisation Metrics

The existing Goliat field infrastructure provides a proven development pathway for the oil and gas discovery in the Barents Sea, enabling accelerated development timelines and reduced capital requirements compared to standalone development concepts. Additionally, current market conditions affecting OPEC production impact influence the commercial viability of such infrastructure-dependent projects.

| Development Metric | Tieback Scenario | Standalone Scenario |

|---|---|---|

| Distance to Processing | 3km | N/A |

| Pipeline Infrastructure | Existing | New Required |

| Processing Facilities | Shared | New Required |

| Development Timeline | 3-4 years | 6-8 years |

Capital Expenditure Reduction

Brownfield development through subsea tieback offers substantial capital cost advantages over standalone platform construction, particularly for discoveries in the 2.5-5 MMboe size range where project economics are sensitive to infrastructure investments.

Cost Optimisation Elements:

• Subsea production system connecting to existing processing facilities

• Shared utilities and logistics leveraging Goliat operational infrastructure

• Proven reservoir development reducing technical and execution risk

• Accelerated cash flow through shortened development timelines

What Are the Technical Specifications of the Drilling Campaign?

Well Design and Execution Parameters

The exploration campaign employed sophisticated drilling technologies specifically configured for Arctic marine operations. Well 7122/7-8 represents a successful example of complex multi-zone exploration executed under challenging environmental conditions.

Technical Drilling Specifications:

• Production Licence: PL 229 (Norwegian Continental Shelf designation)

• Water Depth: 409 metres (within advanced semisubmersible capability range)

• Total Vertical Depth: 2,197 metres subsea (reaching Middle Triassic termination)

• Target Formation: Kobbe Formation (Middle Triassic stratigraphic level)

• Drilling Rig: COSL Prospector semisubmersible platform

Data Acquisition and Sampling Program

The comprehensive data acquisition program maximised information recovery from this high-cost Arctic exploration well, employing advanced logging technologies and sampling protocols across all productive formations.

Logging and Evaluation Program:

Extensive data acquisition and sampling were conducted across all three hydrocarbon-bearing formations, providing comprehensive reservoir characterisation without formation testing requirements.

The program included:

• Multi-zone logging suites characterising reservoir properties across Tubåen, Fruholmen, and Kobbe formations

• Precise contact determination through advanced resistivity and saturation analysis

• Core sampling protocols enabling detailed petrographic and petrophysical analysis

• Wellbore imaging programs defining structural and stratigraphic relationships

Operational Excellence in Extreme Conditions

The successful execution of this oil and gas discovery in the Barents Sea drilling program demonstrates advanced operational capabilities in Arctic marine environments, where weather windows, logistics constraints, and environmental considerations create complex operational challenges. However, broader market factors including global tariff market impact influence overall project economics and investment decisions in such frontier regions.

Operational Achievement Metrics:

• Zero formation testing while achieving comprehensive reservoir characterisation

• Multi-zone penetration across three distinct productive intervals

• Permanent abandonment completing all environmental compliance requirements

• Data quality achievement supporting commercial decision-making processes

How Does This Discovery Compare to Regional Exploration Results?

Barents Sea Discovery Benchmarking

Recent exploration results in the Norwegian Barents Sea demonstrate a range of outcomes, from significant commercial discoveries to sub-economic accumulations. The latest oil and gas discovery in the Barents Sea falls within the middle tier of regional discoveries, offering development potential through infrastructure synergies.

| Discovery Category | Size Range (MMboe) | Development Status | Infrastructure Requirements |

|---|---|---|---|

| Major Standalone | 50+ | Producing/Development | New Infrastructure |

| Mid-Tier Tieback | 5-25 | Evaluation | Shared Infrastructure |

| Marginal Discoveries | 1-5 | Risk Evaluation | Infrastructure Dependent |

| Sub-Economic | <1 | Typically Abandoned | Not Viable |

Success Rate Analysis

The Norwegian Barents Sea demonstrates higher exploration success rates compared to other Arctic basins, reflecting improved geological understanding, advanced seismic technologies, and systematic exploration programs targeting proven petroleum systems.

Regional Exploration Metrics:

• Discovery frequency averaging 1-2 significant findings per exploration season

• Commercial success rate approximately 35-40% for wells targeting proven formations

• Infrastructure utilisation enabling development of smaller discoveries through tieback concepts

• Technology advancement improving reservoir characterisation and development efficiency

Economic Viability Thresholds

Barents Sea development economics are heavily influenced by infrastructure proximity, resource size, and commodity price environments. The current discovery benefits from favourable positioning relative to existing facilities.

Development Threshold Analysis:

• Standalone development typically requiring 25+ MMboe resources for commercial viability

• Tieback development potentially viable with 5+ MMboe resources in favourable locations

• Infrastructure leverage reducing capital intensity and improving project returns

• Operational synergies enabling shared services and cost optimisation

What Are the Operational Implications for Arctic Development?

Production Integration Scenarios

The oil and gas discovery in the Barents Sea presents multiple development pathway options, each with distinct operational implications and capital requirements. The preferred development concept will balance resource optimisation with capital efficiency through existing infrastructure utilisation.

Multi-Zone Development Strategy:

• Selective completion design enabling independent production from three formations

• Pressure management systems optimising production across different reservoir characteristics

• Enhanced recovery potential through advanced completion technologies

• Production optimisation maximising recovery efficiency from each productive zone

Environmental and Regulatory Framework

Norwegian offshore operations operate under comprehensive regulatory oversight designed to ensure environmental protection while enabling responsible resource development. Arctic operations require additional environmental considerations and stakeholder engagement protocols.

Regulatory Compliance Requirements:

• Norwegian Offshore Directorate oversight for all exploration and development activities

• Environmental impact assessment protocols for Arctic marine ecosystems

• Stakeholder engagement with local communities and environmental organisations

• Sustainability metrics incorporating carbon footprint and environmental stewardship

Flow Assurance Considerations

Arctic marine environments present unique challenges for hydrocarbon production, transportation, and processing. Flow assurance engineering must address temperature variations, potential hydrate formation, and corrosion management in harsh conditions.

Technical Considerations:

Arctic production systems require specialised engineering solutions for flow assurance, corrosion management, and environmental compliance to ensure reliable operations throughout the field life.

Key engineering challenges include:

• Subsea system design for harsh marine environment operations

• Pipeline insulation preventing hydrate formation during transportation

• Corrosion inhibition protecting equipment from accelerated marine corrosion

• Emergency response systems ensuring operational safety in remote locations

How Does This Discovery Fit Into Norway's Energy Strategy?

National Resource Portfolio

The oil and gas discovery in the Barents Sea contributes to Norway's strategic objective of maintaining hydrocarbon production levels while developing frontier resources on the Norwegian Continental Shelf. Arctic discoveries play an increasingly important role in offsetting natural production decline from mature fields.

Continental Shelf Development Priorities:

• Frontier region exploration targeting underdeveloped Arctic resources

• Infrastructure optimisation maximising utilisation of existing production facilities

• Technology advancement developing Arctic-specific operational capabilities

• Resource base expansion maintaining long-term production capacity

Energy Security Contributions

Norwegian Arctic hydrocarbon development enhances European energy security through diversified supply sources and reduced dependence on alternative supply regions. Barents Sea resources provide strategic energy reserves accessible through established transportation infrastructure.

Strategic Energy Value:

• Domestic production supporting Norwegian economic objectives

• European energy supply contributing to regional energy security

• Transportation infrastructure leveraging existing pipeline networks to European markets

• Technology export potential developing Arctic expertise for global application

International Competitiveness

Norway's Arctic exploration and development capabilities position the country as a global leader in harsh environment operations, creating technology export opportunities and operational expertise applicable to other Arctic basins worldwide.

Technology Leadership Areas:

• Harsh environment drilling technologies and operational protocols

• Subsea production systems designed for extreme marine conditions

• Environmental management balancing resource development with ecosystem protection

• Regulatory frameworks providing models for responsible Arctic development

What Are the Next Steps in the Development Process?

Technical Evaluation Phase

Following the successful oil and gas discovery in the Barents Sea, the operator will initiate comprehensive technical and commercial evaluation processes to determine optimal development strategies. This phase typically spans 12-18 months and establishes the foundation for investment decision-making.

Evaluation Program Components:

• Reservoir simulation modelling incorporating multi-zone production optimisation

• Development concept studies comparing tieback versus standalone options

• Economic sensitivity analysis across various commodity price scenarios

• Risk assessment frameworks addressing Arctic operational challenges

Commercial Decision Timeline

The partnership between Vår Energi (65% operator) and Equinor (35%) will evaluate development options based on technical feasibility, commercial returns, and strategic fit within their respective portfolio objectives.

Decision Framework Elements:

• Resource certification confirming recoverable reserve estimates

• Infrastructure integration assessment with Goliat field operations

• Market timing considerations for Arctic project execution

• Capital allocation priorities within operator development portfolios

Partnership Evaluation

The existing partnership structure provides complementary capabilities for Arctic development, combining operational expertise with financial resources necessary for successful project execution.

Partnership Synergies:

• Vår Energi operational leadership in Arctic marine environments

• Equinor technical expertise in complex reservoir development

• Shared risk profile appropriate for frontier development projects

• Combined financial capacity supporting integrated development concepts

The development timeline for Arctic projects typically extends 3-5 years from investment decision to first production, depending on concept selection and regulatory approval processes. Infrastructure integration through subsea tieback could potentially accelerate this timeline while reducing capital requirements.

Market Psychology Considerations:

Arctic hydrocarbon development decisions are increasingly influenced by long-term energy market dynamics, environmental considerations, and technological advancement rates rather than short-term commodity price fluctuations.

This discovery represents a significant step forward in Norwegian Arctic resource development, demonstrating the continued viability of systematic exploration programs in challenging frontier environments where infrastructure proximity and technological capabilities combine to unlock previously uneconomic resources.

Ready to Capitalise on the Next Breakthrough Discovery?

Discovery Alert's proprietary Discovery IQ model instantly alerts investors to significant ASX mineral discoveries, transforming complex geological data into actionable market insights within moments of announcement. Explore how major discoveries have historically delivered exceptional returns and begin your 30-day free trial today to position yourself ahead of the market.