What Are ASX Resources Shares and Why Do They Matter Now?

The Australian Securities Exchange resources sector represents one of the most critical components of the nation's equity markets, encompassing mining companies, energy producers, and metals specialists that form the backbone of Australia's export-driven economy. ASX resources shares span everything from iron ore giants operating in the Pilbara to gold miners scattered across Western Australia's goldfields, creating a diverse investment universe that attracts both domestic and international capital.

Recent analysis suggests the sector composition includes iron ore operations accounting for approximately 52.6% of the index, gold mining representing 19.6%, and oil and gas contributing 11.7% of total sector weighting. These percentages reflect Australia's position as a global commodity powerhouse, with companies like BHP Group and Rio Tinto dominating iron ore production, while Evolution Mining and Northern Star Resources lead gold extraction activities.

The economic significance extends far beyond market capitalisation figures. Australia's resources sector contributes substantially to national GDP through direct extraction activities, supporting infrastructure, and export revenues that strengthen the Australian dollar during commodity booms. This sector's performance often correlates with broader economic cycles, making it a barometer for both domestic prosperity and global industrial demand.

Current Market Positioning Within Global Commodity Cycles

After enduring a three-year sector downturn, momentum in ASX resources shares appears to be shifting toward recovery. According to recent analysis from Wilsons Advisory and Canaccord Genuity, broad-based strength across major commodities now underpins what could be the early stage of a significant resources upgrade cycle. This represents a fundamental shift from the prolonged weakness that characterised the sector from 2021 through 2024.

Greg Burke, Equity Strategist at Wilsons Advisory, noted that this momentum change reflects improving supply and demand fundamentals rather than temporary price spikes. The transformation suggests structural factors are aligning to support sustained commodity price strength, potentially creating multi-year investment opportunities for strategic investors.

When compared to international mining indices, ASX resources shares have historically demonstrated higher volatility but superior long-term returns during commodity supercycles. Furthermore, investors can access comprehensive sector analysis through platforms like the ASX 200 Resources Index, which tracks the performance of Australia's leading resource companies.

The sector's concentration in high-quality, low-cost operations provides defensive characteristics during downturns while offering leveraged exposure to commodity price recovery phases. However, understanding current iron ore price trends remains crucial for evaluating sector prospects.

How Are Macroeconomic Forces Reshaping Resources Investment Opportunities?

Federal Reserve Policy Impact on Commodity Demand

The global monetary policy landscape has shifted dramatically in favour of commodity-producing nations and their equity markets. Rate cuts in the US should help stimulate global commodity demand, creating a supportive environment for Australian resources companies. This monetary accommodation operates through multiple transmission mechanisms that benefit the sector.

Lower US interest rates reduce the opportunity cost of holding non-yielding commodities like gold, while simultaneously reducing discount rates applied to future cash flows from mining operations. The result is improved present value calculations for resource projects and enhanced attractiveness of commodity investments relative to fixed-income alternatives.

Additionally, a weaker USD offers a tailwind for dollar-priced commodities. Since most commodities trade in US dollars, currency weakness makes these materials more affordable for international buyers using other currencies. This pricing advantage typically translates into increased demand volumes and improved profit margins for Australian producers who benefit from both higher commodity prices and favourable AUD/USD exchange rate dynamics.

Historical analysis reveals strong correlations between Federal Reserve easing cycles and commodity bull markets. The 2001-2003 and 2007-2009 rate cutting cycles preceded significant commodity price appreciation, though investors should note that correlation doesn't guarantee causation and multiple factors influence resource sector performance.

China's Economic Transition and Demand Dynamics

China's economic evolution presents both challenges and opportunities for Australian resources companies. A negative view on China's growth has contributed to the multi-year downtrend in resources, particularly affecting iron ore demand as the property sector weakness continues. The property sector remains central to iron ore consumption, given steel-intensive construction activities.

However, the narrative is becoming more nuanced. While China's economy may slow further, investor sentiment seems to be improving, supported by easier monetary policy and rising credit availability. This represents a shift from contractionary to accommodative policy settings that could support commodity-intensive infrastructure and manufacturing activities.

Looking ahead, potential for large-scale stimulus in China in 2026 exists, as greater clarity emerges around the US tariff situation. This stimulus potential creates an asymmetric risk profile for commodity investors: downside appears limited by current pessimistic expectations, while upside could be substantial if stimulus materialises at scale.

The transition from property-led to infrastructure and manufacturing-led growth doesn't necessarily reduce total commodity intensity. High-speed rail networks, renewable energy installations, and electric vehicle manufacturing require substantial copper, steel, and rare earth inputs. The composition of demand may evolve, but aggregate volumes could remain supportive of Australian resource exports.

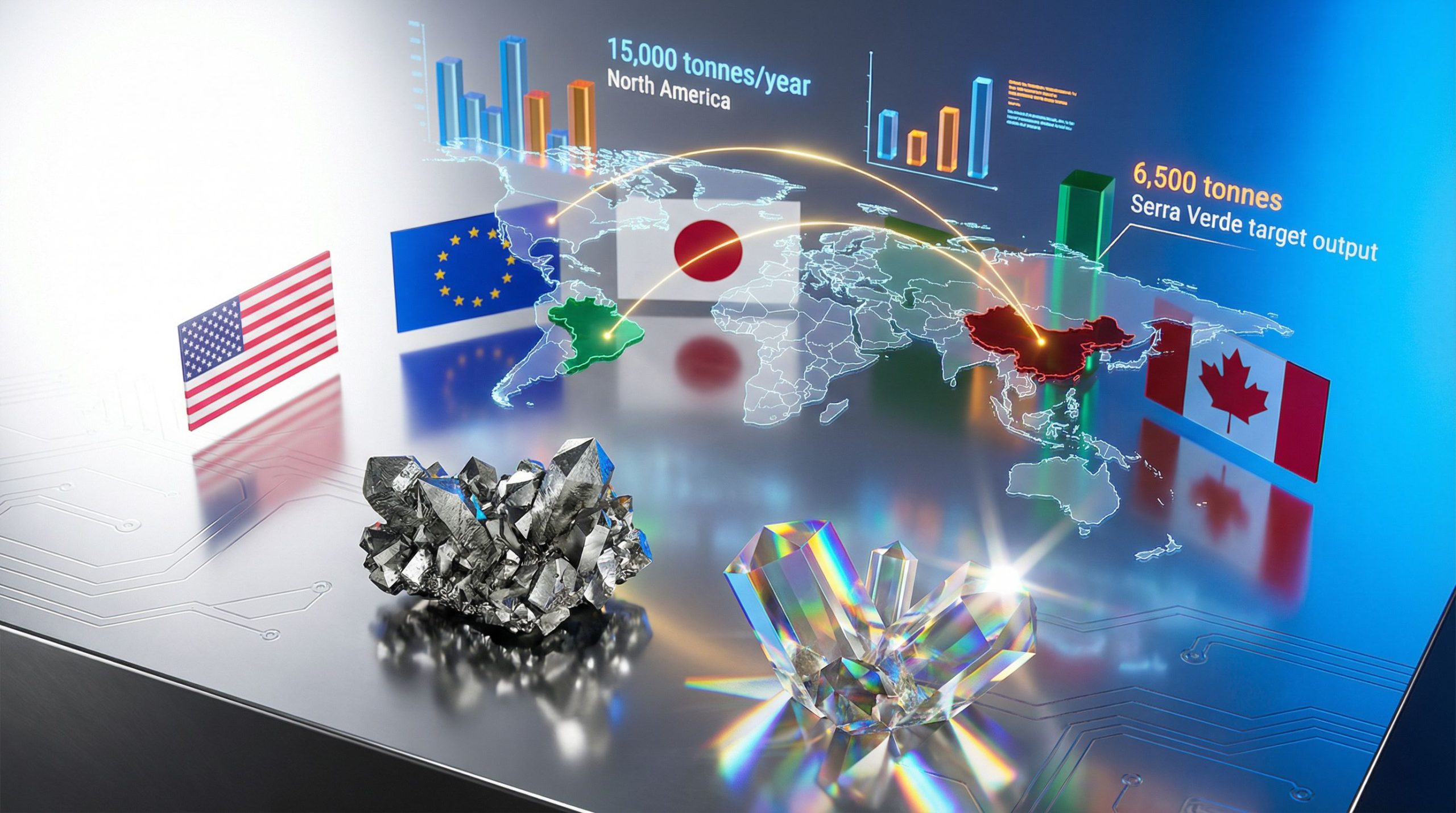

Geopolitical Trade Environment and Supply Chain Security

The geopolitical landscape is evolving in ways that could benefit ASX resources shares through multiple channels. Trump's 'Big Beautiful Bill' will take effect early next year and is expected to stimulate US manufacturing, creating additional demand for industrial commodities including copper, steel, and aluminium.

This manufacturing stimulus occurs alongside broader supply chain security considerations. Western economies are increasingly focused on diversifying supply sources away from geopolitically sensitive regions, creating opportunities for Australian suppliers of critical minerals and energy resources. Australia's stable political environment and strong rule of law provide competitive advantages in this context.

Further easing of trade frictions between the US and the rest of the world could help improve global growth. Reduced trade policy uncertainty typically supports business investment decisions, including commodity-intensive manufacturing and infrastructure projects. The resolution of trade tensions could unlock pent-up demand for industrial materials.

Supply chain security concerns extend beyond immediate trade policies to encompass strategic mineral reserves and processing capabilities. Nevertheless, careful analysis of US economic tariffs analysis remains essential for understanding potential impacts on global commodity flows.

Which Commodity Subsectors Offer the Strongest Investment Case?

Gold Mining: Defensive Growth in Uncertain Times

Gold mining companies present compelling investment opportunities within the ASX resources universe, combining defensive characteristics with growth potential. The subsector has demonstrated resilience during the broader resources downturn, maintaining investor interest amid macroeconomic uncertainty.

Evolution Mining Ltd (ASX: EVN) represents what analysts consider the cleanest gold leverage for near-term investors. The company has demonstrated best-in-class operational delivery and offers an attractive FCF yield over the next couple years. Wilsons Advisory and Canaccord Genuity maintain a $12.25 price target on Evolution Mining shares, reflecting confidence in operational execution and cash generation capabilities.

Evolution Mining's competitive advantages include:

- Consistent operational delivery across multiple mining sites

- Strong free cash flow generation supporting dividend sustainability

- Disciplined capital allocation maintaining cost competitiveness

- Diversified asset portfolio reducing single-mine risk exposure

Northern Star Resources Ltd (ASX: NST) offers a different value proposition focused on medium-term growth potential. NST offers the greatest medium-term upside, driven by its strong production growth outlook, relatively attractive valuation, and the rolling off of its hedging profile. The company carries a $34.50 price target from Wilsons Advisory, implying substantial upside from current levels.

Northern Star's investment thesis rests on several pillars:

- Production growth pipeline from brownfield expansions

- Hedging profile normalisation allowing full gold price exposure

- Operational scale advantages improving cost per ounce metrics

- Exploration upside potential in proven geological provinces

The gold mining subsector benefits from multiple tailwinds including central bank purchases, geopolitical uncertainty, and currency debasement concerns. Current gold market performance reflects these supportive factors, while Australian producers additionally benefit from operational expertise, favourable geology, and established infrastructure that reduces development risks compared to frontier mining jurisdictions.

Iron Ore: Navigating Structural Headwinds

Iron ore presents a more complex investment proposition, with structural headwinds from Chinese demand evolution balanced against operational excellence of leading Australian producers. The subsector faces medium-term challenges as China's property sector weakness continues impacting steel consumption patterns.

BHP Group Ltd (ASX: BHP) emerges as the preferred iron ore exposure despite sector headwinds. As the lowest-cost producer globally with a strong track record of operational delivery and disciplined management, BHP offers defensive characteristics during challenging periods while maintaining upside participation during recovery phases.

BHP's strategic positioning includes several advantages:

- Industry-leading cost structure providing margins during price downturns

- Operational excellence maintaining production guidance achievement

- Commodity diversification reducing iron ore dependency

- Capital discipline supporting shareholder returns through cycles

Particularly significant is BHP's evolving commodity mix, with approximately 45% of FY26 EBITDA expected to come from copper operations. This diversification provides valuable exposure to energy transition metals while reducing reliance on iron ore price performance. The company's BHP strategic pivot demonstrates management's focus on future-oriented commodity positioning.

The iron ore outlook requires careful consideration of Chinese steel demand evolution, potential stimulus impacts, and supply discipline from major producers. While structural headwinds exist, the highest-quality operators like BHP maintain competitive advantages that should preserve profitability and cash generation capabilities.

Copper Exposure: Critical Minerals for Energy Transition

Copper represents perhaps the most compelling long-term commodity theme within the ASX resources sector, driven by global electrification and renewable energy infrastructure requirements. The energy transition demands substantial copper inputs for power generation, transmission, and storage systems.

Demand drivers for copper include:

- Electric vehicle adoption requiring 4x more copper than conventional vehicles

- Renewable energy installations with high copper intensity per megawatt

- Grid infrastructure upgrades supporting distributed energy systems

- Energy storage deployment requiring copper-intensive battery systems

Supply constraints compound the demand growth story. Major copper deposits require decade-long development timelines, while existing mines face grade decline and increased extraction costs. This supply-demand imbalance supports higher long-term price expectations for copper compared to other industrial commodities.

ASX-listed companies with significant copper exposure benefit from these structural trends while maintaining exposure to shorter-term economic cycles. The combination of secular demand growth and cyclical recovery potential creates attractive risk-adjusted return profiles for copper investment insights.

Companies like BHP, with substantial copper operations, provide diversified exposure to both iron ore and energy transition metals. This positioning allows investors to benefit from traditional commodity cycles while gaining exposure to longer-term structural demand themes.

What Investment Strategies Work Best for Resources Exposure?

Direct Stock Selection Versus ETF Diversification

Investors face a fundamental choice between targeted individual stock exposure and diversified ETF approaches when accessing ASX resources shares. Each strategy offers distinct advantages depending on investor expertise, risk tolerance, and return objectives.

Individual Stock Selection Benefits:

- Targeted commodity exposure allowing specific thematic positioning

- Management quality differentiation capturing operational excellence premiums

- Dividend yield optimisation focusing on income-generating assets

- Valuation timing opportunities exploiting market inefficiencies

- Corporate action participation benefiting from takeovers and restructuring

Direct stock selection requires significant research capabilities and ongoing monitoring but offers superior returns when executed successfully. Investors can concentrate on highest-conviction positions while avoiding dilution from weaker sector participants.

ETF Diversification Options:

The Betashares Australian Resources Sector ETF (QRE) provides broad sector exposure across multiple commodities and company sizes. This approach reduces single-stock risk while maintaining sector-specific positioning.

The SPDR S&P/ASX 200 Resources ETF (OZR) offers benchmark tracking with lower fees, suitable for passive exposure strategies. These ETFs eliminate stock selection risk while providing liquid access to sector performance.

ETF benefits include:

- Risk mitigation through sector-wide diversification

- Lower transaction costs for smaller investment amounts

- Professional management eliminating research requirements

- Liquidity advantages enabling easy position sizing adjustments

Furthermore, comprehensive sector research is available through resources like small cap mining analysis, which provides additional insights into emerging opportunities within the sector.

Timing Considerations and Market Entry Strategies

Resource sector investing requires careful attention to commodity cycles and valuation metrics. The cyclical nature of commodity prices creates both opportunities and risks that impact optimal entry and exit timing.

Dollar-Cost Averaging During Volatility:

Systematic investment approaches help navigate resource sector volatility by spreading entry points across market cycles. This strategy reduces timing risk while building positions during both advancing and declining markets.

Commodity Price Cycle Positioning:

Understanding commodity price cycles enables more informed investment decisions. Early-cycle positioning often provides superior returns, though identifying cycle inflection points requires analysis of supply-demand fundamentals, inventory levels, and macroeconomic conditions.

Portfolio Allocation Recommendations:

- Conservative portfolios: 5-10% allocation to resources shares

- Moderate portfolios: 10-15% allocation across multiple commodities

- Aggressive portfolios: 15-20% with individual stock concentration

These allocations should be adjusted based on commodity cycle positioning and individual risk tolerance. Higher allocations during cycle troughs may generate superior long-term returns, though require greater volatility tolerance.

How Do Current Valuations Compare to Historical Norms?

Price-to-Earnings Analysis Across Subsectors

Resource sector valuations exhibit significant variation across commodities and individual companies, reflecting different supply-demand dynamics and earnings volatility patterns. Current price-to-earnings ratios provide insight into market expectations and potential value opportunities.

Gold mining companies typically trade at premium valuations due to defensive characteristics and consistent cash generation. Evolution Mining's premium positioning reflects operational excellence and free cash flow sustainability, though investors pay higher multiples for quality and predictability.

Iron ore producers face valuation compression due to China demand concerns and structural headwinds. BHP's valuation reflects both commodity headwinds and operational advantages, creating potential value opportunities for patient investors with conviction in long-term demand recovery.

Key Valuation Metrics to Monitor:

- Price-to-earnings ratios relative to historical averages

- Free cash flow yields indicating cash generation capacity

- Enterprise value to EBITDA comparisons with global peers

- Price-to-book ratios reflecting asset replacement costs

Book Value and Asset Replacement Cost Considerations

Resource companies' book values often understate true asset worth due to historical cost accounting and reserve appreciation. Modern mining operations require substantial capital investments that would cost significantly more to replicate at current construction and equipment prices.

Asset Quality Considerations:

- Resource reserve valuations based on current commodity prices

- Infrastructure asset quality including processing facilities and transportation

- Operational leverage from fixed cost structures during price cycles

- Exploration potential in proven geological provinces

Replacement cost analysis becomes particularly relevant during commodity downturns when market capitalisations may trade below the cost of developing equivalent assets. This creates potential value opportunities for investors with long-term perspectives.

Mining companies with established operations, proven reserves, and quality infrastructure often trade at discounts to replacement cost during cycle troughs. These discounts can provide attractive entry points for patient investors willing to navigate commodity volatility.

What Risks Should Investors Consider?

Commodity Price Volatility and Demand Uncertainty

Resource sector investments face inherent volatility from commodity price fluctuations that can dramatically impact company profitability and share price performance. This volatility stems from supply-demand imbalances, macroeconomic changes, and speculative trading activities.

Chinese Economic Slowdown Scenarios:

China's economic evolution presents the primary demand risk for Australian resource companies, particularly iron ore producers. Property sector weakness could persist longer than expected, while infrastructure stimulus may prove insufficient to offset demand destruction.

Potential downside scenarios include:

- Accelerated property sector contraction reducing steel consumption

- Debt deleveraging limiting credit availability for commodity-intensive activities

- Trade tension escalation disrupting supply chain relationships

- Currency volatility affecting purchasing power and trade competitiveness

Global Recession Risks:

Synchronous global economic contractions typically devastate commodity demand as industrial production declines and inventory destocking occurs. The combination of reduced consumption and inventory liquidation can create severe price dislocations.

Historical examples include the 2008-2009 financial crisis when commodity prices declined 50-70% from peak levels, eliminating company profitability and forcing widespread production curtailments.

Operational and Environmental Regulatory Challenges

Modern mining operations face increasingly complex regulatory environments that impact operational costs, project approval timelines, and social licence to operate. These factors can significantly affect company profitability and growth prospects.

ESG Compliance Costs:

Environmental, social, and governance requirements continue expanding, requiring substantial investments in:

- Emissions reduction technologies to meet carbon neutrality commitments

- Water treatment systems addressing environmental protection requirements

- Community engagement programmes maintaining social licence to operate

- Workplace safety improvements reducing operational and reputational risks

Carbon Pricing Implications:

Expanding carbon pricing mechanisms affect energy-intensive mining operations through increased electricity costs and potential carbon tax exposures. Companies with high emissions profiles face greater regulatory risks and transition costs.

Water Usage and Environmental Rehabilitation:

Mining operations require substantial water inputs while generating long-term environmental rehabilitation obligations. Drought conditions, competing water usage claims, and stricter environmental standards can limit operational flexibility and increase costs.

Geopolitical and Supply Chain Disruption Risks

Resource companies face geopolitical risks from trade policy changes, export restrictions, and supply chain disruptions that can affect both demand and operational continuity.

Trade War Escalation:

Renewed trade tensions between major economies could disrupt commodity flows and reduce demand through economic uncertainty. Tariff imposition, export restrictions, and supply chain decoupling create multiple risk vectors for resource companies.

Critical Mineral Export Controls:

Growing focus on supply chain security may lead to export restrictions on critical minerals, affecting both pricing dynamics and market access for Australian producers. National security considerations increasingly influence commodity trade policies.

Infrastructure and Logistics Costs:

Resource companies depend on complex logistics networks for transporting products to global markets. Infrastructure bottlenecks, shipping cost inflation, and port congestion can significantly impact profitability margins.

How Can Investors Position for Long-Term Success?

Thematic Investment Approaches

Long-term resource sector success requires identifying and positioning for structural demand themes that transcend short-term commodity cycles. These thematic approaches can provide sustained returns while reducing dependence on timing cyclical movements.

Energy Transition Metals Exposure:

The global shift toward renewable energy and electrification creates multi-decade demand growth for specific commodities:

- Lithium demand from battery manufacturing and energy storage deployment

- Copper requirements for electrical infrastructure and electric vehicle production

- Rare earth elements essential for wind turbines and electric motors

- Nickel consumption in battery cathodes and stainless steel applications

Defensive Commodity Positioning:

Gold allocation provides portfolio insurance against currency debasement, geopolitical instability, and economic uncertainty. Gold mining companies offer leveraged exposure to gold prices while generating dividend income during stable periods.

Infrastructure-Linked Materials:

Global infrastructure investment requirements support long-term demand for construction materials, steel, and industrial commodities. Aging infrastructure in developed markets and infrastructure gaps in emerging economies create sustained demand patterns.

Portfolio Construction and Risk Management

Successful resource sector investing requires careful portfolio construction that balances return potential with volatility management. Proper allocation and diversification strategies can improve risk-adjusted returns while reducing emotional decision-making during market turbulence.

Sector Allocation Guidelines:

- Conservative investors: 5-10% allocation during cycle peaks, 10-15% during troughs

- Moderate risk tolerance: 10-15% baseline allocation with tactical adjustments

- Aggressive growth focus: 15-25% allocation with individual stock concentration

Correlation Analysis:

Resource shares often exhibit low correlation with other equity sectors during specific market conditions, providing diversification benefits. However, correlations can increase during market stress periods, reducing diversification effectiveness when most needed.

Rebalancing Strategies:

Systematic rebalancing during commodity cycle extremes can enhance long-term returns:

- Reduce allocations during euphoric bull market peaks

- Increase exposure during pessimistic bear market troughs

- Maintain discipline avoiding emotional decision-making during volatility

Monitoring Key Performance Indicators

Successful resource investing requires ongoing monitoring of operational and financial metrics that indicate company performance and sector health.

Production and Cost Metrics:

- Production guidance achievement indicating operational competence

- All-in sustaining costs trends showing cost management effectiveness

- Reserve replacement ratios demonstrating resource sustainability

- Capital expenditure discipline maintaining financial flexibility

Management Quality Indicators:

- Capital allocation decisions including acquisition and divestment success

- Dividend sustainability through commodity price cycles

- Project delivery track record on time and budget performance

- ESG leadership addressing regulatory and social requirements

Market Environment Signals:

- Commodity inventory levels indicating supply-demand balance

- Forward curve structures reflecting market expectations

- Exploration expenditure trends suggesting future supply growth

- Merger and acquisition activity indicating sector consolidation

Strategic Positioning for December 2025 and Beyond

Summary of Investment Thesis

The ASX resources sector stands at a potential inflection point following a challenging three-year period. More supportive supply/demand fundamentals for most metals are now driving upgrades to consensus commodity price forecasts and, importantly, translating into stronger earnings expectations for the ASX Mining sector.

Key supporting factors include accommodative US monetary policy, potential Chinese stimulus in 2026, easing trade tensions, and structural demand growth from energy transition themes. These macroeconomic tailwinds create favourable conditions for resource sector recovery and sustained performance improvement.

The investment thesis centres on selective exposure to high-quality operators with strong balance sheets, operational excellence, and exposure to favourable commodity themes. Companies like Evolution Mining, Northern Star Resources, and BHP Group exemplify the characteristics that should outperform during recovery phases.

Action Steps for Investors

Investors considering ASX resources exposure should evaluate their risk tolerance, investment timeline, and portfolio allocation objectives before implementation. The following framework provides structure for investment decision-making:

Due Diligence Checklist:

- Assess management track record for operational delivery and capital discipline

- Analyse cost structure positioning relative to industry benchmarks

- Evaluate reserve quality and mine life for sustainability assessment

- Review balance sheet strength and financial flexibility during downturns

- Understand commodity exposure and diversification benefits or risks

Portfolio Implementation Timing:

- Gradual accumulation through dollar-cost averaging reduces timing risk

- Opportunistic additions during market volatility and price weakness

- Systematic rebalancing maintaining target allocations through cycles

- Tax loss harvesting optimising after-tax returns where applicable

Ongoing Position Management:

Resource investments require active monitoring due to operational complexity and commodity price volatility. Investors should establish review schedules for quarterly results, production updates, and commodity price developments.

Regular assessment of investment thesis validity helps maintain conviction during inevitable volatility periods while identifying opportunities for position adjustments based on changing fundamentals.

Disclaimer: This analysis contains forward-looking statements and market projections that involve inherent risks and uncertainties. Commodity prices, company performance, and macroeconomic conditions can vary significantly from expectations, affecting investment returns. Past performance does not guarantee future results. Investors should conduct independent research and consider consulting with qualified financial advisors before making investment decisions. The information presented is for educational purposes and should not be considered personalised investment advice.

Ready to Capitalise on the Next Major Mineral Discovery?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries, instantly empowering subscribers to identify actionable opportunities ahead of the broader market. Begin your 30-day free trial today and secure your market-leading advantage in the evolving resources sector.