US-China Critical Minerals Battle: Australia's Strategic Position

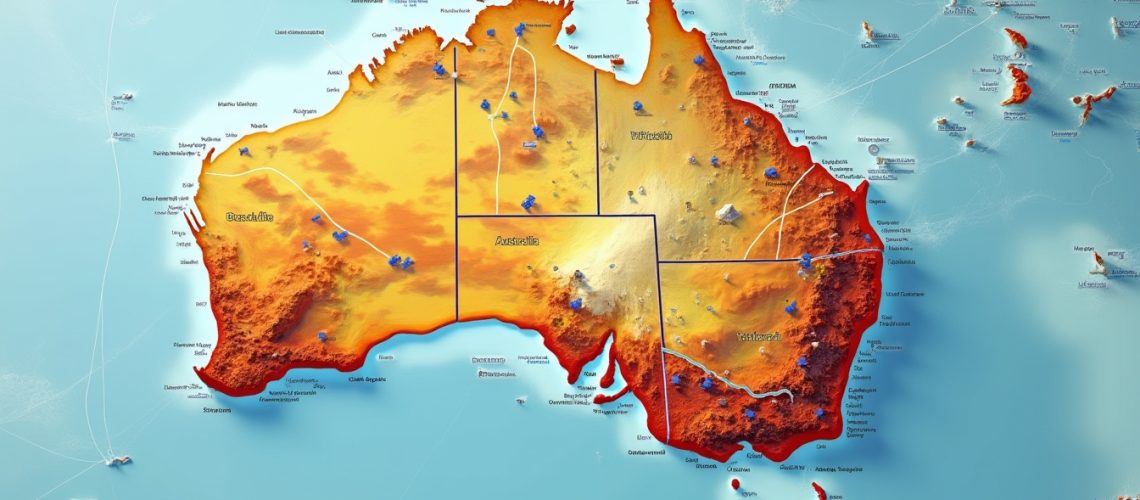

Australia finds itself at the epicentre of a high-stakes geopolitical chess match, where critical minerals have become the new currency of global power. As the United States and China vie for technological supremacy, Australia's mineral-rich landscape has transformed into a strategic battleground of unprecedented importance. With a reputation for vast natural resources and a robust mining legacy, the nation now plays a pivotal role in determining the future of global supply chains.

What Are Critical Minerals and Why Do They Matter?

Critical minerals represent the lifeblood of modern technological innovation, encompassing rare earth elements, lithium, cobalt, and other strategic resources essential for advanced technologies. These minerals underpin everything from renewable energy infrastructure to sophisticated defence systems. Their supply chain vulnerability means that any disruption can have significant repercussions on economic strategy and national security.

Australia's geological treasure trove, for instance, is a major contributor to global supply. As the country holds significant deposits of lithium, it is no surprise that discussions around australia's lithium ambitions frequently highlight both the opportunities and challenges ahead. With the world’s largest known lithium reserves and extensive deposits of rare earth elements, the nation has a strategic edge in this global resource race.

Key facts include:

- Lithium demand is predicted to increase 40-fold by 2040.

- Australia controls 55% of global lithium reserves.

- Critical projects have attracted nearly A$46 billion in foreign investments since 2020.

These figures underline the nation's critical role in the emerging global mineral ecosystem and its influence over future technological and economic advances.

How Did Australia Become a Mineral Geopolitical Hotspot?

Western Australia, in particular, has emerged as a powerhouse in the global minerals market. The Pilbara region and other key mineral provinces have rapidly evolved into hubs for international investment. Some of the factors contributing to Australia’s rise as a mineral geopolitical hotspot include:

- A stable political and regulatory environment that encourages long-term investments.

- World-class mining infrastructure and technological innovation in extraction and processing.

- Extensive exploration and proven reserves that position the country as a major supplier of critical minerals.

Major global players have taken notice. The aggressive pursuit of strategic investments and long-term supply agreements has led to partnerships involving state-owned enterprises from both the United States and China. While the US bolsters its focus on secure mineral supply chains, China remains determined to maintain economic ties and ensure a steady flow of materials essential for its industrial growth.

Recent projects have underscored the importance of staying competitive. Analysts frequently point to mining sector trends that highlight both the opportunities and economic challenges faced by the industry.

Can Australia Boost Global Rare Earth Supply?

Australia’s efforts to bolster the global rare earth supply are a crucial step in securing national interests and fulfilling international obligations. The country is actively investing in advanced processing facilities that strengthen its position in the rare earth value chain. Iluka Resources’ Eneabba Refinery stands as a testament to these ambitions, paving the way for innovations that extend Australia’s influence on the global stage.

Such initiatives help diversify supply chains, ensuring that critical materials are not overly reliant on any single source. By developing downstream processing capabilities, Australia mitigates risks associated with external pressures and geopolitical uncertainties. For instance, global rare earth supply improvements are a key focus for both government and private stakeholders, aiming to balance economic growth with national security imperatives.

What Role Do Strategic Investments Play in Securing Mineral Supply?

The geopolitical landscape surrounding critical minerals is further complicated by significant foreign direct investments and government policies directed at safeguarding these essential resources. The United States, for example, has steadily increased its strategic investments into Australian mineral resources. In 2024 alone, the US Department of Defence allocated $650 million for projects aimed at reinforcing the integrity of supply chains. These funds, coupled with defence production act allocations that have increased by 300% since 2022, are indicative of the gravity of the situation.

Strategic acquisitions, such as Lockheed Martin's A$220 million rare earth deal with Iluka Resources, are explicitly framed as “mineral insurance” against potential geopolitical contingencies. Such investments demonstrate a commitment to fostering a resilient supply chain that can withstand international tensions. The emphasis on securing processing capabilities is further illustrated by the development of state-of-the-art facilities like the rare earths refinery, which not only refines raw materials but also drives the innovation necessary for future competitiveness.

Some key points regarding strategic investment include:

- US investments serve as a hedge against geopolitical risks.

- Cutting-edge processing facilities reduce reliance on crude exports.

- Ongoing collaborations between Australian companies and international investors are essential for long-term success.

How Are Diplomatic Balancing Acts Shaping Australia’s Strategy?

Australia's role in the global mineral supply chain requires an extraordinarily delicate diplomatic balancing act. The nation must navigate relationships with two superpowers with opposing interests, ensuring that it does not alienate either while pursuing its own national priorities. The AUKUS security partnership mandates that 15% of critical mineral inputs must come from US-aligned sources by 2027, an arrangement designed to safeguard supply chains from potential geopolitical shocks. At the same time, Australia recognises the economic significance of maintaining strong ties with China, a key importer and investor in its mining sector.

This classic tightrope walk has led to the following outcomes:

- Enhanced scrutiny of foreign investments in critical sectors.

- A pragmatic approach to bilateral negotiations.

- Increased emphasis on developing domestic processing capabilities to reduce foreign dependencies.

Recent polling indicates that 73% of Australian voters oppose forced alignment with either superpower, reflecting widespread public sentiment favouring an independent national approach. A former Australian ambassador succinctly remarked, "We're trying to be Switzerland with kangaroos," capturing the essence of Australia’s diplomatic tightrope.

What Does the Future Hold for Australia’s Critical Minerals Industry?

Looking forward, Australia's strategy to leverage its rich mineral resources is set to evolve along several key dimensions:

- Diversifying mineral export destinations to reduce overreliance on specific markets.

- Developing integrated downstream processing capabilities to capture greater value from raw materials.

- Strengthening research and development to drive innovation within the mining sector.

- Enhancing collaborations between government, industry, and academia to create a sustainable, future-proof regulatory framework.

Government initiatives such as federal grants support are crucial in propelling the industry towards global leadership. These grants not only support research in sustainable mining practices but also foster a collaborative environment where emerging technologies can be seamlessly integrated into existing operations.

Moreover, Australia is set to benefit from strategic partnerships that span across continents. By capitalising on its natural advantages and utilising strategic investments, the nation can transform its mineral wealth, turning potential liabilities into dynamic diplomatic assets. The interplay of domestic policy, international investment, and cutting-edge technology will define the trajectory of Australia’s stay in the global critical minerals arena.

Summarised Key Points

- Australia’s critical minerals, notably lithium and rare earth elements, bolster its global strategic position.

- The mining sector attracts substantial foreign investments driven by the need for secure and diverse supply chains.

- Strategic investments by the US and China have significantly influenced Australia’s mining dynamics.

- Robust initiatives aimed at expanded processing capacities and government-backed grants are steering Australia towards global leadership.

- Diplomatic balancing is crucial as the nation navigates competing interests from economic giants.

Through these multifaceted strategies, Australia is not just responding to the current global scenario but actively shaping a future where its rich mineral resources continue to drive both economic prosperity and geopolitical stability. The nation’s approach is a blend of resource management, technological advancement, and robust international diplomacy, making it a linchpin in the evolving narrative of global critical minerals.

Ready to Unlock Insider Insights on Critical Minerals?

Discover strategic investment opportunities with Discovery Alert's AI-powered real-time notifications, designed to simplify the complex world of mineral exploration and help investors navigate the critical minerals landscape with confidence. Start your 30-day free trial today and gain an edge in understanding the dynamic intersection of technology, investment, and global resource strategies.