The modern industrial landscape depends on materials that often operate behind the scenes, invisible to consumers yet critical to countless manufacturing processes. Boron represents one such element, quietly enabling over 300 distinct industrial applications while maintaining a surprisingly concentrated global supply chain. This versatility stems from boron's unique atomic properties, particularly its exceptional neutron absorption capabilities and thermal resistance characteristics that make it irreplaceable across sectors ranging from nuclear energy to consumer electronics.

Recent developments in supply chain analysis have elevated the boron critical mineral from a relatively obscure industrial material to a strategically significant resource warranting critical mineral designation by the United States Geological Survey in 2025.

The Element Behind 300+ Industrial Applications

Boron's atomic structure, featuring just five protons and a neutron absorption cross-section of approximately 760 barns, creates exceptional versatility in industrial applications. This fundamental property enables boron to function as both a structural enhancer and a functional additive across diverse manufacturing processes.

The element's chemical characteristics include:

- Neutron absorption capacity: Essential for nuclear reactor control systems without creating highly radioactive byproducts

- Thermal resistance: Maintaining structural integrity at temperatures exceeding 4,000°C

- Hardness enhancement: Improving material strength through crystalline structure modification

- Corrosion resistance: Providing protective barriers in harsh environmental conditions

These properties enable boron compounds to serve critical functions in sectors as diverse as agriculture, where boric acid serves as an essential plant micronutrient, and aerospace, where boron fiber composites provide lightweight strength for aircraft components.

From Consumer Products to Defense Systems

The breadth of boron applications spans from everyday household items to classified defense systems. Consumer-facing applications include borosilicate glass products like laboratory equipment and thermal-resistant cookware, leveraging boron's ability to withstand rapid temperature changes without cracking.

In high-technology sectors, boron enables the production of neodymium-iron-boron permanent magnets, which power electric vehicle motors and wind turbine generators. These magnets represent one of the strongest permanent magnet technologies available, directly supporting clean energy infrastructure development.

Defense and nuclear applications represent perhaps the most critical uses, where boron compounds serve as:

- Nuclear reactor control rods for power regulation and emergency shutdown systems

- Armor plating components in military vehicles and personnel protection systems

- Weapon system components requiring specialized thermal and structural properties

- Aerospace ceramics for hypersonic vehicle applications

Critical Mineral Designation: Supply Vulnerability Meets Economic Importance

The 2025 decision by the U.S. Geological Survey to designate boron critical mineral reflects a fundamental shift in how policymakers assess supply chain vulnerabilities. This designation followed extensive analysis of boron's role across multiple American manufacturing sectors and the concentrated nature of global production capacity.

Furthermore, the designation aligns with a broader critical minerals strategy being implemented across multiple nations to secure strategic material supplies.

USGS Criteria Analysis: Supply Vulnerability vs. Economic Importance

The USGS employs a dual-factor methodology for critical mineral assessment, evaluating both economic significance and supply chain risk factors. For boron critical mineral applications, economic importance was demonstrated through integration across clean energy technologies, defense systems, agriculture, and electronics manufacturing.

Supply vulnerability emerged as the primary concern, with nearly all U.S. boron supply originating from a single mining and refining complex operated by Rio Tinto in California's Mojave Desert. This facility produces approximately 30% of global refined boron products, creating what analysts describe as an extraordinary single point of failure for American supply chains.

The vulnerability assessment considered:

- Concentration risk: Geographic clustering of production capacity

- Infrastructure dependencies: Specialised refining capabilities

- Market dynamics: Limited alternative suppliers with equivalent capacity

- Geopolitical factors: Potential foreign dependency scenarios

The Single Point of Failure Problem

Congressional representatives Jay Obernolte and Jimmy Panetta formally documented their concerns regarding boron supply concentration in correspondence with USGS officials. Representative Obernolte emphasised the geopolitical dimension, noting that critical mineral designation would help ensure the United States avoids dependency on foreign suppliers, particularly China, for boron-based materials.

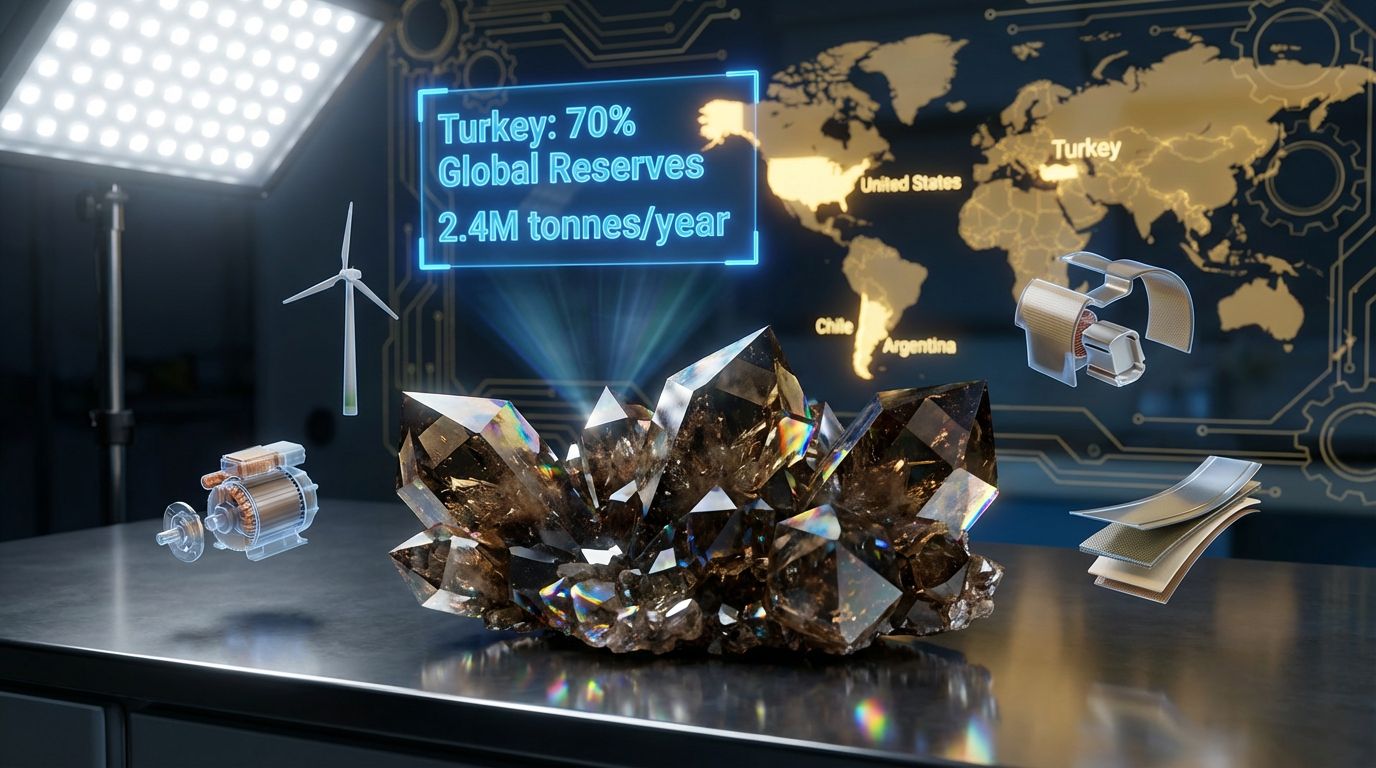

The concentration risk extends beyond raw material extraction to refined product manufacturing. China's dominance in downstream processing, controlling approximately 80% of global boron carbide production, creates additional chokepoints in supply chains serving defence and aerospace applications.

This market structure demonstrates how mineral criticality encompasses not just geological availability but also processing infrastructure and technological capabilities distributed across different nations.

Global Boron Supply Chain Architecture

Understanding boron's strategic importance requires examining the geographic distribution of reserves, production capacity, and refining capabilities across major producing regions. The global boron supply chain exhibits significant concentration risks that extend from mining operations through final product manufacturing.

Who Controls the World's Boron Resources?

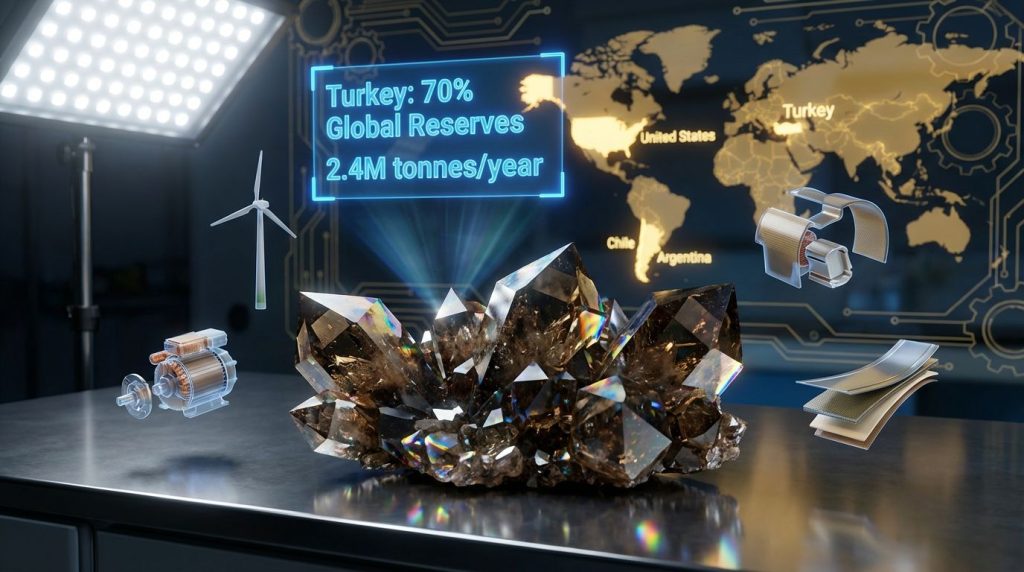

Global boron reserves demonstrate extreme geographic concentration, with Turkey controlling approximately 70% of identified reserves through major deposits at Kırka and Emet. The United States holds roughly 15% of reserves, primarily in the Mojave Desert region, while Argentina and Chile control smaller percentages through salar deposit operations.

| Country | Reserve Share | Key Deposits | Annual Production Capacity |

|---|---|---|---|

| Turkey | 70% | Kırka, Emet | 2.4 million tonnes |

| United States | 15% | Mojave Desert | 1.1 million tonnes |

| Argentina | 8% | Salar deposits | 0.6 million tonnes |

| Chile | 4% | Atacama region | 0.4 million tonnes |

The distinction between reserves and refined product capacity proves critical for understanding supply chain dynamics. While Turkey dominates raw mineral reserves, Rio Tinto's Mojave facility represents disproportionate influence in refined product markets serving high-specification industrial applications.

Market Concentration and Pricing Dynamics

The oligopolistic structure of global boron production creates pricing dynamics distinct from commoditised mineral markets. Long-term supply agreements between major producers and industrial consumers provide price stability but limit market flexibility during supply disruptions.

Rio Tinto's Boron operation, valued at approximately $2 billion according to recent financial analyses, represents both significant industrial infrastructure and potential market vulnerability. The facility's proposed divestment by Rio Tinto introduces uncertainty regarding operational continuity and strategic priorities under new ownership.

Historical context reveals that boron mining in the Mojave region began in 1891, when ore transport required 18 mules and two horses for a gruelling 10-day journey to market. This legacy persists in the "20 Mule Team Borax" brand, still visible on consumer product packaging more than a century later.

Regional Critical Mineral Designations: A Comparative Analysis

The 2025 U.S. designation of boron as a critical mineral occurs within a broader international context of supply chain security initiatives. Major economic regions have developed distinct frameworks for assessing and managing critical material dependencies, reflecting different industrial priorities and geopolitical positions.

In addition, initiatives such as the European CRM facility demonstrate coordinated approaches to reducing import dependencies across strategic materials.

How Different Nations Classify Boron's Strategic Importance

The European Union's Critical Raw Materials Act incorporates boron within a comprehensive framework addressing supply chain resilience across member states. This designation reflects EU dependency on imported boron for glass manufacturing, ceramics production, and clean energy technology applications.

The United Kingdom's 2024 Criticality Assessment evaluated boron through the lens of advanced manufacturing requirements and defence technology needs. Japan and South Korea have similarly classified boron as strategically significant due to electronics manufacturing and permanent magnet production dependencies.

Australia's approach differs substantially, given its position as a potential future producer rather than primarily an importer. The Australian strategic reserve initiatives emphasise resource development and export opportunities rather than import dependency mitigation.

Geopolitical Implications of Boron Dependencies

Import reliance patterns across major economies reveal varying degrees of supply chain vulnerability. European nations depend heavily on Turkish production, while Asian markets split between multiple suppliers including Turkey, the United States, and South American salar operations.

Trade route analysis identifies several potential chokepoints:

- Mediterranean shipping lanes for Turkish exports to European markets

- Suez Canal routing representing critical infrastructure for European supply chains

- Pacific shipping routes connecting South American producers to Asian markets

- North American rail networks serving domestic distribution from Mojave production

Strategic stockpiling policies vary significantly across nations, with some maintaining substantial reserves while others rely on just-in-time supply chain management. These different approaches create varying degrees of resilience during supply disruptions.

Industrial Applications Driving Critical Status

The breadth of industries dependent on boron compounds creates multiple pathways for economic impact during supply disruptions. Clean energy technologies represent perhaps the fastest-growing demand sector, driven by electric vehicle adoption and renewable energy infrastructure deployment.

The interconnection between boron critical mineral applications and broader minerals and energy security concerns highlights the strategic nature of these supply chains.

Clean Energy Technology Dependencies

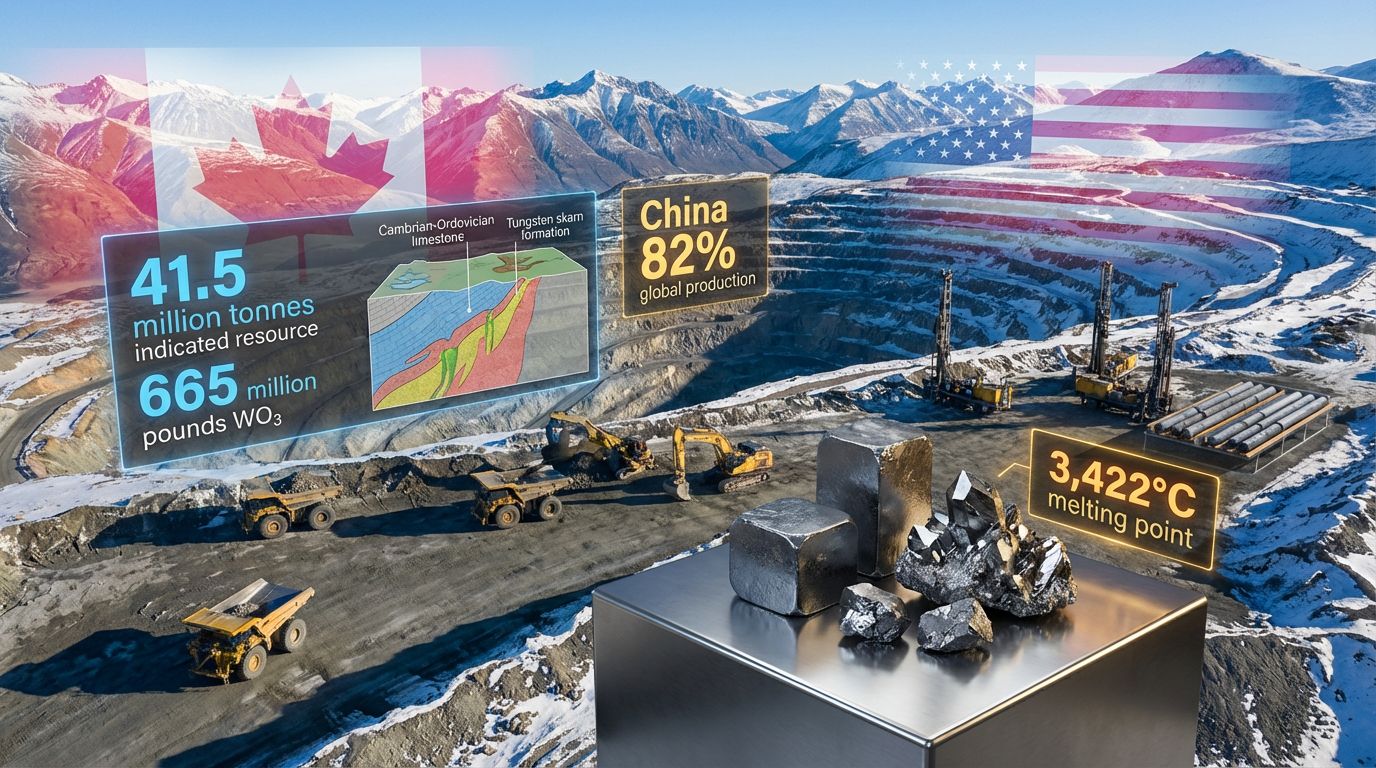

Electric vehicle motors rely on neodymium-iron-boron permanent magnets for efficient power conversion and compact design. These magnets enable the high power-to-weight ratios essential for vehicle performance while maintaining efficiency standards required for extended driving ranges.

| Application | Boron Compound | Annual Growth Rate | Strategic Importance |

|---|---|---|---|

| EV Motors | Nd-Fe-B magnets | 25% | High |

| Wind Turbines | Permanent magnets | 15% | High |

| Solar Glass | Borosilicate | 12% | Medium |

| Grid Storage | Thermal ceramics | 30% | High |

Wind turbine generators similarly depend on high-strength permanent magnets for direct-drive systems that eliminate mechanical gearboxes. This application has driven substantial demand growth as wind energy capacity expands globally.

Solar panel manufacturing utilises borosilicate glass for enhanced durability and thermal resistance. While representing lower strategic importance than magnetic applications, solar glass production supports renewable energy infrastructure development at scale.

Defence and Aerospace Requirements

Nuclear reactor control systems represent perhaps the most critical boron application from a national security perspective. Boron's neutron absorption properties enable precise reactor power control and emergency shutdown capabilities without creating long-lived radioactive waste products.

Advanced ceramics containing boron compounds serve specialised defence applications:

- Hypersonic vehicle components requiring extreme thermal resistance

- Armour systems utilising boron carbide's exceptional hardness

- Aerospace composites providing strength-to-weight advantages

- Thermal protection systems for spacecraft and military aircraft

These applications often require highly refined boron compounds meeting stringent quality specifications, creating dependencies on specialised processing capabilities concentrated in limited facilities.

Supply Chain Vulnerabilities and Risk Assessment

Analysing potential disruption scenarios reveals cascading effects across multiple industrial sectors dependent on boron-based materials. The concentrated nature of global production creates systemic vulnerabilities extending beyond direct consumers to downstream manufacturers and end users.

Recent policy developments, including the Trump critical minerals order, underscore the growing recognition of these supply chain risks.

What Happens When Boron Supply Is Disrupted?

Supply interruption modelling demonstrates varying impact levels across different industrial applications. High-specification defence and aerospace applications face the most severe consequences due to limited substitution possibilities and stringent quality requirements.

Historical precedent suggests that supply disruptions create price volatility and allocation priorities favouring long-term contract holders over spot market participants. This dynamic particularly affects smaller manufacturers and emerging technology companies lacking established supplier relationships.

Economic impact assessment reveals multiplier effects as boron-dependent industries reduce production or delay new product development. Electric vehicle manufacturing represents a particularly significant risk given rapid market expansion and limited alternative magnet technologies.

Downstream Processing Chokepoints

China's 80% market share in boron carbide manufacturing creates additional supply chain vulnerabilities beyond primary extraction and refining. This concentration affects defence applications requiring specialised ceramic components and industrial applications needing ultra-hard materials.

Refining capacity constraints limit the ability to rapidly increase supply during demand surges or primary production disruptions. The specialised nature of boron compound processing requires significant technical expertise and dedicated equipment investments.

Quality specification requirements for different applications create market segmentation that limits supply flexibility. Military and aerospace applications demand higher purity levels than consumer products, restricting potential substitution during shortages.

Investment and Development Landscape

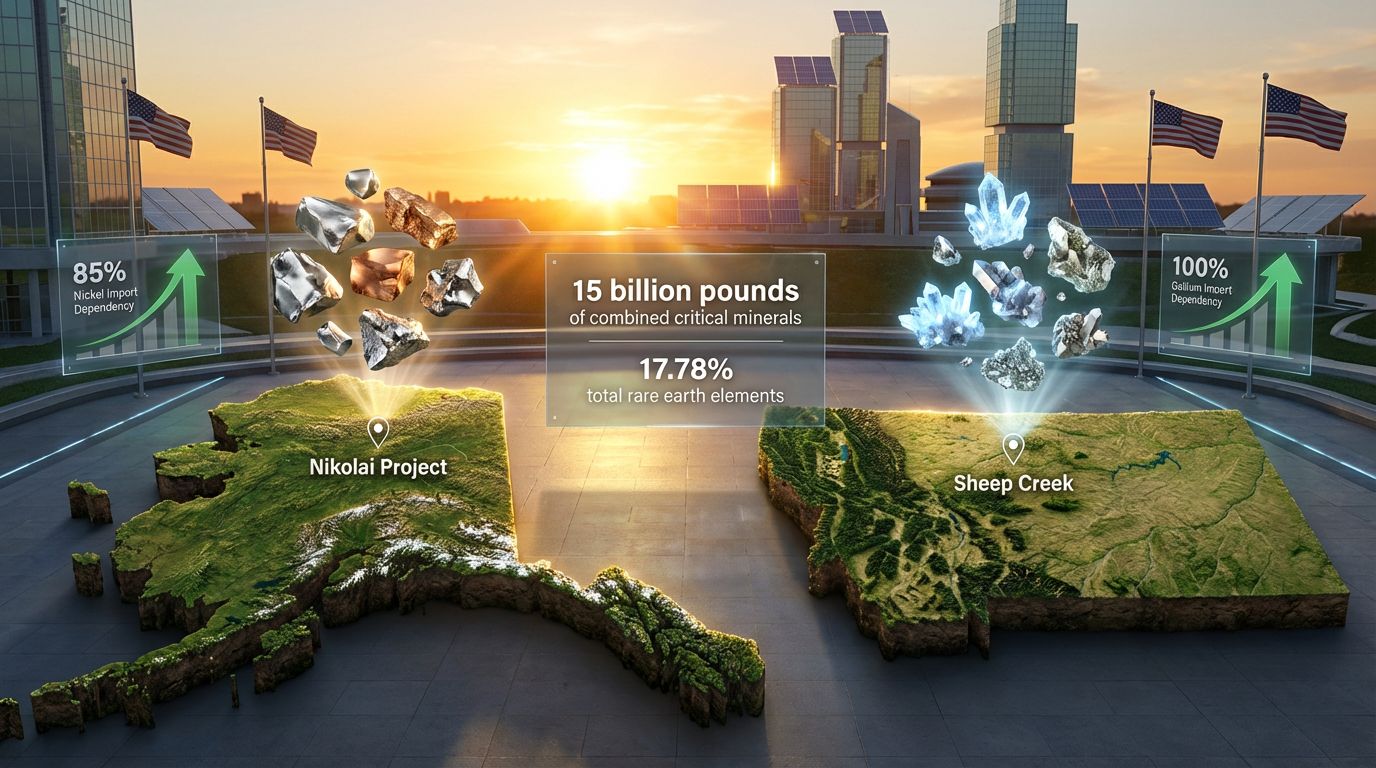

The boron market's concentrated structure has historically discouraged new entrant investment due to established producer advantages and significant capital requirements. However, critical mineral designations and supply chain security concerns are beginning to attract development interest.

Emerging Boron Projects and Production Expansion

Project development pipeline analysis reveals limited near-term capacity additions relative to projected demand growth. The Fort Cady project in California represents one potential domestic supply source, though development timelines remain uncertain.

South American salar deposits in Argentina and Chile offer expansion opportunities, particularly given existing lithium extraction infrastructure that could potentially support boron recovery operations. However, environmental considerations and water usage concerns may limit development scope.

Technology innovations in extraction and processing could improve economics for lower-grade deposits currently considered sub-economic. Advances in selective extraction methods and energy-efficient refining processes may expand the viable resource base.

Market Valuation and Growth Projections

Current global boron market valuation approaches $2.8 billion annually, with projected growth to $3.2 billion by 2028 driven primarily by clean energy technology adoption. This growth rate reflects accelerating demand from electric vehicle and renewable energy sectors.

Investment requirements for meaningful supply chain diversification likely exceed $1 billion given the capital-intensive nature of mining and refining operations. This scale necessitates either government support or major corporate commitments to justify development risks.

Financial analysis suggests that the boron critical mineral designation may improve project financing prospects by providing policy support and reducing regulatory uncertainties for development initiatives.

Strategic Response Options for Supply Security

Nations dependent on boron imports face several strategic options for reducing supply chain vulnerabilities. These range from domestic resource development to international partnership frameworks and technology substitution research.

How Can Nations Reduce Boron Import Dependencies?

Domestic resource development represents the most direct approach to supply security, though geological limitations constrain options for many countries. Comprehensive geological surveys may identify previously unrecognised deposits suitable for development under current market conditions.

Strategic partnership frameworks offer alternative approaches through long-term supply agreements, joint venture arrangements, and diplomatic initiatives. These partnerships can provide supply security while sharing development costs and technical risks among multiple parties.

Technology substitution research focuses on developing alternative materials or processes that reduce boron dependency. While complete substitution remains unlikely for many applications, efficiency improvements and recycling enhancements can reduce primary material requirements.

Industry Adaptation Strategies

Material efficiency improvements represent immediate opportunities for reducing boron dependency without compromising product performance. Advanced manufacturing techniques and precision application methods can minimise waste and optimise material utilisation.

Recycling initiatives face technical challenges due to boron's dispersion in end-use products and the energy-intensive nature of recovery processes. However, specialised recycling from industrial sources may prove economically viable for high-value applications.

Supply chain diversification strategies include qualifying multiple suppliers, maintaining strategic inventory levels, and developing flexible sourcing capabilities. These approaches require coordination between government policy and private sector investment decisions.

Future Outlook: Boron in the Critical Minerals Ecosystem

Long-term demand projections for boron reflect accelerating adoption of clean energy technologies and advanced materials applications. Electric vehicle market expansion represents the most significant demand driver, with growth rates potentially exceeding current supply expansion capabilities.

Demand Projections Across Key Sectors

Electric vehicle market expansion could increase boron demand by 300-400% over the next decade as permanent magnet motor adoption accelerates. This growth rate substantially exceeds current production expansion plans, suggesting potential supply constraints.

Renewable energy infrastructure buildout requirements include both direct boron applications in wind turbine magnets and indirect uses in supporting materials like thermal ceramics for energy storage systems. Grid-scale storage deployment may create additional demand growth.

Defence spending trends suggest continued demand growth for specialised boron applications in aerospace and weapons systems. Hypersonic vehicle development and advanced armour systems represent emerging applications with potentially significant material requirements.

Policy Implications and Regulatory Developments

Critical minerals legislation provides policy frameworks for supporting domestic production and supply chain resilience initiatives. Funding mechanisms may include development incentives, research grants, and strategic stockpile establishment.

International cooperation frameworks offer opportunities for burden-sharing among allied nations facing similar supply chain vulnerabilities. Coordinated policies and joint development initiatives could improve collective supply security whilst reducing individual nation costs.

Trade policy considerations include tariff structures, export restrictions, and investment screening mechanisms that affect global boron markets. These policies must balance supply security objectives with international trade commitments and economic efficiency concerns.

Integration with Broader Critical Minerals Strategy

Cross-mineral dependencies create portfolio effects that complicate individual material security strategies. Furthermore, the boron critical mineral designation demonstrates how multiple critical material vulnerabilities can compound systemic risks.

Infrastructure investment priorities must consider processing capabilities alongside primary extraction capacity. The concentration of specialised refining facilities creates chokepoints that may require targeted policy interventions and investment support.

Long-term supply security planning frameworks should incorporate scenario analysis and adaptive management approaches that can respond to changing market conditions and technological developments. These frameworks must balance security objectives with economic efficiency and international cooperation opportunities.

The strategic significance of boron extends beyond its immediate industrial applications to encompass broader questions of supply chain resilience and national security in an increasingly complex global economy. As clean energy transitions accelerate and advanced technologies proliferate, the boron critical mineral classification reflects growing recognition that seemingly specialised materials can have outsized importance for economic and security interests.

Looking to Capitalise on Critical Mineral Opportunities?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant critical minerals discoveries across the ASX, instantly empowering subscribers to identify actionable opportunities ahead of the broader market. Understand why historic discoveries can generate substantial returns by exploring Discovery Alert's dedicated discoveries page, and begin your 30-day free trial today to position yourself ahead of the market.