How Central Bank Policies Drive Gold Price Rebounds

Understanding what triggers gold price rebound triggers requires a deep examination of the fundamental forces that shape precious metals markets. Central banking policies represent one of the most powerful catalysts for gold price recovery, as monetary decisions ripple through currency markets and reshape investor risk assessments across the global financial system.

The relationship between central bank actions and gold performance operates through multiple interconnected channels. When monetary authorities signal policy shifts, particularly toward accommodation, the resulting changes in real interest rates and currency strength create compelling conditions for precious metals appreciation. This dynamic has played out repeatedly throughout financial history, with policy reversals often marking the beginning of significant gold market performance.

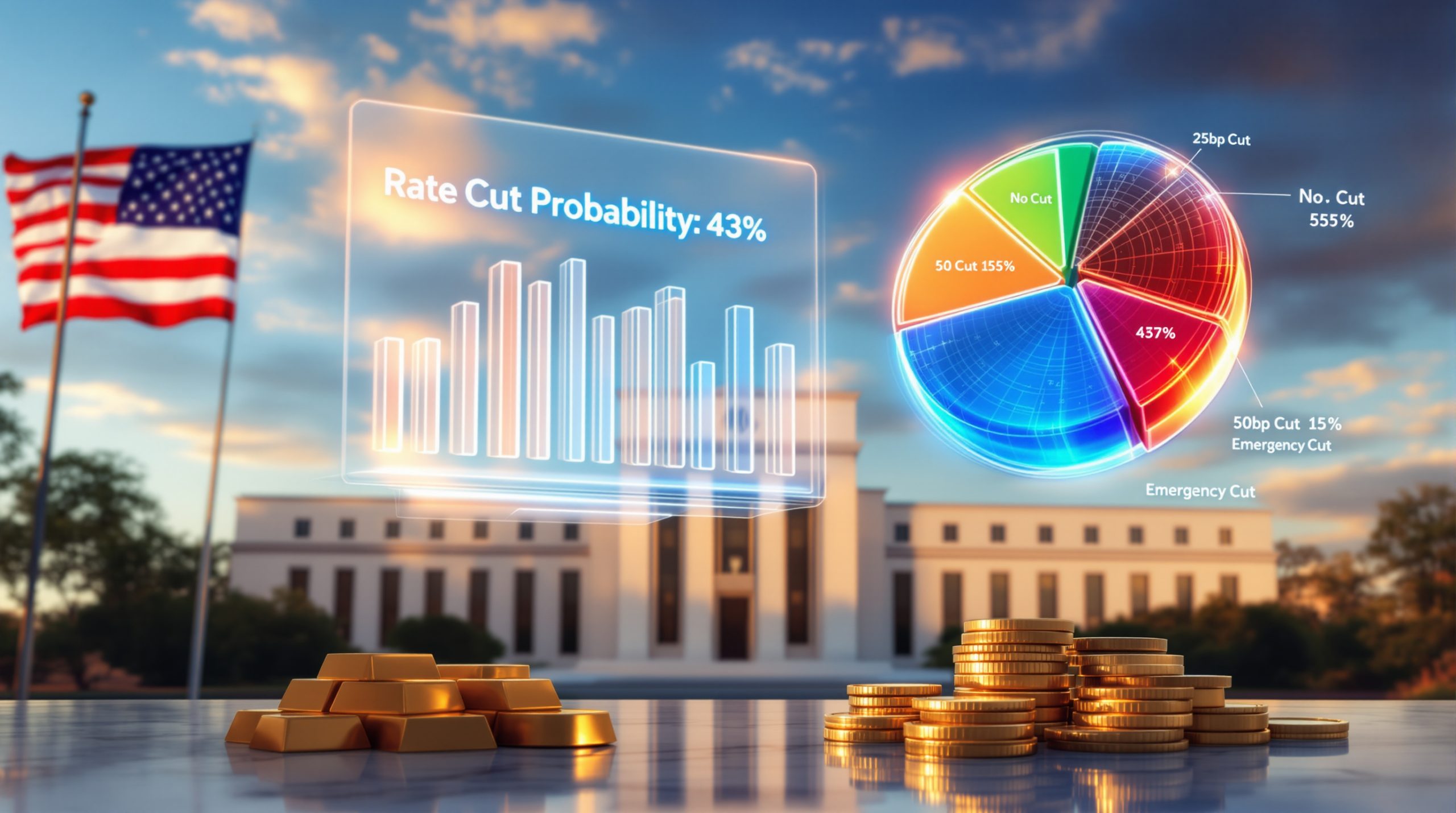

Federal Reserve Rate Cut Expectations and Dollar Weakness

Federal Reserve monetary policy decisions serve as primary drivers of gold price movements, particularly when rate cut expectations begin building in financial markets. The mechanism operates through real interest rate calculations, where the difference between nominal yields and inflation expectations determines the opportunity cost of holding non-yielding assets like gold.

When the Federal Reserve signals potential rate cuts, several factors converge to support gold prices:

• Real yield compression: Lower nominal rates combined with persistent inflation expectations reduce real yields on Treasury securities

• Dollar weakness: Rate cut anticipation typically pressures the US dollar index lower, making gold more attractive to foreign investors

• Portfolio reallocation: Institutional investors shift allocations from fixed-income securities toward alternative stores of value

• Momentum building: Technical buying accelerates as gold breaks through resistance levels on monetary policy news

Historical analysis reveals that rate cut cycles have consistently preceded major gold rallies. The 1975-1976 period exemplifies this pattern, when the Federal Reserve initially tightened monetary policy to combat inflation, causing gold prices to decline by approximately 50%.

However, when policymakers reversed course in late 1975, abandoning their commitment to currency integrity, gold embarked on a multi-year bull market that saw prices increase dramatically. Furthermore, the current monetary environment presents similar dynamics as market participants increasingly question the Federal Reserve's ability to maintain restrictive policy given mounting fiscal pressures.

Government debt servicing costs have reached levels that may constrain the central bank's flexibility, potentially forcing accommodative policies despite inflationary risks. One critical factor supporting US dollar strength relative to other fiat currencies has been the favourable interest rate differential compared to foreign economies.

The nominal interest rate in the United States has remained higher relative to domestic inflation than comparable rates in other developed nations relative to their inflation levels. Any erosion of this advantage through aggressive rate cuts could trigger significant gold price rebound triggers as international investors seek alternative stores of value.

Central Bank Gold Accumulation Strategies

Official sector gold purchases have emerged as a structural support factor for precious metals prices, with central banks worldwide implementing strategic reserve diversification programmes. Recent data indicates central banks purchased 1,037 tonnes of gold in 2024, representing one of the strongest accumulation periods in recent history.

This institutional buying reflects several key motivations:

• Currency diversification: Reducing dependence on any single reserve currency amid geopolitical tensions

• Inflation hedging: Protecting purchasing power as global money supply expansion accelerates

• Monetary sovereignty: Maintaining policy independence through diversified reserve portfolios

• Crisis preparation: Building buffers for potential financial system disruptions

Emerging market central banks have led this accumulation trend, with countries across Asia, Eastern Europe, and Latin America building substantial gold reserves. This buying represents a structural shift away from traditional reserve management focused primarily on US Treasury securities and other developed market government bonds.

The timing and scale of central bank purchases often correlate with periods of currency stress and geopolitical uncertainty. When international tensions escalate or confidence in major currencies wavers, official sector buying tends to accelerate, providing price support during market downturns and amplifying rallies during recovery periods.

What Role Does Geopolitical Uncertainty Play in Gold Rebounds?

Geopolitical events serve as powerful catalysts for gold price rebound triggers by triggering safe-haven demand and reshaping global investment flows. The precious metal's historical role as a store of value during periods of international tension makes it a natural destination for capital seeking stability amid uncertainty.

Safe-Haven Demand During Crisis Periods

Portfolio managers consistently turn to gold during geopolitical crises, creating demand surges that can trigger significant price rebounds. This behaviour reflects institutional risk management protocols that emphasise capital preservation during uncertain periods.

The mechanics of safe-haven flows operate through several channels:

• Risk-off positioning: Equity and corporate bond selling funds precious metals purchases

• Volatility hedging: Gold's negative correlation with stock markets provides portfolio protection

• Currency concerns: Political instability often pressures affected currencies, driving local gold demand

• Liquidity preservation: Physical gold maintains value accessibility across different jurisdictions

Historical analysis reveals consistent patterns in gold performance during major geopolitical events. The precious metal typically experiences initial buying pressure as events unfold, followed by sustained strength if conflicts persist or escalate.

Market psychology during these periods often overrides traditional fundamental analysis, with fear-driven buying creating powerful momentum effects. In addition, the relationship between market volatility measures and gold prices demonstrates this safe-haven dynamic.

When the VIX volatility index spikes above certain thresholds, precious metals inflows accelerate as investors seek portfolio insurance. This pattern has repeated across multiple crisis periods, creating predictable triggers for gold price recovery.

Trade War Implications and Currency Debasement Fears

Trade disputes and protectionist policies create complex dynamics that often benefit gold prices through multiple transmission mechanisms. These conflicts typically involve currency manipulation concerns, supply chain disruptions, and broader questions about global monetary stability.

Trade wars influence gold markets through:

• Competitive devaluation risks: Countries may weaken currencies to maintain export competitiveness

• Reserve currency concerns: Dollar weaponisation fears drive diversification into gold

• Supply chain inflation: Trade barriers increase costs, supporting gold's inflation hedge characteristics

• Regional demand shifts: Local investors increase precious metals allocations during currency stress

Recent trade tensions have demonstrated these dynamics clearly. When tariffs and trade restrictions escalate, affected economies often experience currency pressure and inflation concerns.

Local investors in these regions frequently increase gold allocations as protection against potential currency debasement. The interconnected nature of global trade means that even localised disputes can trigger broader precious metals demand.

Supply chain disruptions affect commodity markets generally, whilst currency concerns spread through international financial networks, creating multiple pathways for record highs as inflation hedge.

How Do Technical Market Factors Amplify Gold Price Movements?

Technical market dynamics play a crucial role in amplifying gold price rebound triggers once fundamental catalysts emerge. These factors include algorithmic trading systems, options market positioning, and institutional flow patterns that can accelerate price movements beyond what fundamental factors alone might justify.

Support Level Testing and Institutional Buying

Professional trading systems often incorporate technical analysis frameworks that trigger buying programmes when gold prices test key support levels. These algorithmic responses can create significant momentum during rebound phases, as programmed buying coincides with fundamental improvements in precious metals demand.

Key technical factors include:

• Support level defence: Large-scale buying emerges at historically significant price levels

• Moving average recaptures: Price movements above key technical indicators trigger momentum strategies

• Volume confirmation: High-volume breakouts attract algorithmic and institutional participation

• Options positioning: Gamma hedging requirements can amplify price movements in either direction

The precious metals market's relatively concentrated nature means that large institutional orders can move prices significantly. When multiple technical signals align with improving fundamentals, the resulting buying pressure often creates rapid price appreciation that attracts additional momentum-driven capital.

Recent gold market behaviour illustrates these dynamics clearly. Price movements that might seem excessive relative to fundamental news often reflect the interaction between technical trading systems and underlying supply-demand imbalances. Understanding these patterns helps explain why gold rebounds can appear sudden and dramatic.

ETF Flows and Retail Investment Patterns

Exchange-traded fund flows represent a critical mechanism through which investor sentiment translates into gold price movements. These vehicles provide accessible exposure to precious metals for both institutional and retail investors, creating direct linkages between investment demand and market prices.

ETF flow patterns during rebounds typically show:

• Western institutional re-entry: Professional managers return after extended periods of outflows

• Asian retail accumulation: Individual investors increase allocations during price corrections

• Momentum acceleration: Initial buying creates positive feedback loops that attract additional capital

• Cross-asset rotation: Money flows from other asset classes into precious metals vehicles

The structure of gold ETFs creates direct physical demand as fund managers purchase bullion to back new shares. This mechanism ensures that investment demand translates into actual market-moving purchases, distinguishing gold ETFs from purely financial derivatives.

Regional variations in ETF flows provide important insights into global investment patterns. Western markets often show more volatility in precious metals allocations, with rapid inflows and outflows based on shorter-term market views. Asian markets typically demonstrate more persistent accumulation patterns, reflecting different investment time horizons and cultural attitudes toward gold ownership.

Which Economic Indicators Signal Gold Price Rebounds?

Specific economic indicators consistently precede gold price rebound triggers by signalling changes in monetary policy expectations, inflation trends, and overall economic stability. Professional investors monitor these metrics closely to identify potential inflection points in precious metals markets.

Inflation Expectations and Real Yield Analysis

Real interest rates represent perhaps the most important single indicator for gold price direction. These rates, calculated as nominal yields minus inflation expectations, determine the opportunity cost of holding non-yielding assets like precious metals.

Critical inflation-related indicators include:

• TIPS breakeven rates: Market-based inflation expectations derived from Treasury Inflation-Protected Securities

• Consumer Price Index trends: Monthly inflation data affecting Federal Reserve policy decisions

• Producer Price Index movements: Upstream inflation pressures that may affect consumer prices

• Market-based versus survey expectations: Comparing different measures of inflation anticipation

When real yields decline toward zero or turn negative, gold becomes increasingly attractive relative to fixed-income alternatives. This relationship has held consistently across different economic cycles, making real yield analysis a reliable framework for precious metals investment decisions.

The current economic environment presents complex inflation dynamics. Supply chain disruptions, energy price volatility, and monetary policy uncertainty create multiple pathways for inflation surprises. Gold markets often anticipate these developments, with prices moving ahead of official inflation data releases.

Employment Data and Economic Growth Concerns

Labour market indicators provide important signals about overall economic health and potential Federal Reserve policy responses. Weakness in employment data often precedes monetary accommodation, creating favourable conditions for gold price rebounds.

Key employment indicators include:

• Unemployment rate trends: Rising joblessness typically leads to easier monetary policy

• Labour force participation: Declining participation may signal economic weakness

• Wage growth patterns: Slow wage increases reduce inflation pressures and rate hike expectations

• Job creation quality: The mix between full-time and part-time employment affects economic strength

Manufacturing indicators also provide early warning signals for economic weakness that may trigger gold rebounds. When Purchasing Managers' Index readings fall below 50, indicating contraction, precious metals often benefit from expectations of policy accommodation.

The relationship between economic growth and gold prices operates through monetary policy expectations. Slower growth typically leads to lower interest rates and currency weakness, both favourable for precious metals. However, severe economic weakness can sometimes create deflationary pressures that temporarily weigh on gold prices.

What Investment Strategies Capitalise on Gold Rebounds?

Successful gold investment requires sophisticated approaches that account for the metal's unique characteristics and market dynamics. Professional strategies focus on optimal allocation, timing considerations, and vehicle selection to maximise returns whilst managing downside risks.

Portfolio Allocation During Market Transitions

Academic research suggests optimal gold allocations between 5% and 15% of total portfolio value, depending on investor risk tolerance and market conditions. During periods of monetary uncertainty or geopolitical stress, higher allocations may be warranted.

Effective allocation strategies consider:

• Risk-adjusted returns: Gold's low correlation with stocks and bonds provides diversification benefits

• Rebalancing triggers: Predetermined allocation ranges that prompt portfolio adjustments

• Market cycle timing: Increasing allocations during late-cycle conditions when risks are elevated

• Tax efficiency: Utilising appropriate investment vehicles to minimise tax consequences

Professional investors often implement dynamic allocation strategies that adjust gold exposure based on changing market conditions. These approaches recognise that optimal allocations vary with economic cycles, monetary policy phases, and geopolitical developments.

The experience of seasoned precious metals investors demonstrates the importance of patience and conviction. Historical analysis shows that significant gains in gold positions typically require holding periods of five to six years, with interim volatility exposing investors to drawdowns of 50% or more even during ultimately successful investments.

Timing Entry Points and Position Sizing

Market entry timing requires balancing fundamental analysis with technical considerations and risk management principles. Professional approaches focus on accumulating positions during periods of pessimism whilst maintaining discipline during speculative peaks.

Successful timing strategies incorporate:

• Dollar-cost averaging: Systematic purchases reduce timing risk and smooth entry points

• Volatility-based sizing: Larger positions during high-volatility, low-price periods

• Fundamental catalysts: Timing entries around monetary policy shifts or geopolitical developments

• Technical confirmations: Using price action and momentum indicators to refine timing

Recent market experience illustrates the importance of rebalancing strategies during volatile periods. Reducing positions during strength allows investors to capture gains whilst maintaining exposure for continued upside participation. This approach recognises that markets rarely provide optimal exit points, making partial profit-taking a prudent risk management tool.

Moreover, the financing environment for precious metals companies also provides timing signals for broader market conditions. When companies can easily access capital without offering significant discounts or warrants, it often indicates overvalued market conditions. Conversely, when financing becomes scarce and expensive, it may signal attractive entry opportunities for patient investors.

How Do Global Supply Dynamics Influence Price Recovery?

Gold supply constraints create fundamental support for price rebounds when demand increases. Unlike many commodities, gold production responds slowly to price signals due to long development timelines and high capital requirements, making supply-side analysis crucial for understanding price dynamics.

Mining Production Constraints and Cost Inflation

Global gold production faces multiple challenges that limit supply growth and support higher prices. All-in sustaining costs have increased significantly across major mining operations due to energy inflation, regulatory requirements, and ore grade decline.

Production constraints include:

• Rising energy costs: Mining operations are highly energy-intensive, making them sensitive to fuel price increases

• Environmental regulations: Stricter standards increase compliance costs and limit operational flexibility

• Ore grade decline: Existing mines process increasingly lower-grade ore, reducing efficiency

• Development pipeline: Few major new discoveries advance to production, limiting future supply growth

The mining industry's capital allocation patterns also affect long-term supply. Major producers increasingly focus on shareholder returns through dividends and buybacks rather than aggressive expansion programmes.

This shift reflects lessons learned from previous cycles where overinvestment during price peaks led to subsequent losses. Furthermore, regulatory challenges pose particular constraints in key mining jurisdictions.

Environmental permitting processes have become increasingly complex and time-consuming, extending development timelines and increasing capital requirements. These factors discourage exploration investment and limit the pipeline of future production, supporting the gold-stock market relationship.

Recycling Flows and Scrap Gold Markets

Recycled gold represents approximately 25% of annual gold supply, with recycling flows showing price elasticity that affects market dynamics during price rebounds. Higher prices typically increase recycling activity, but this response often lags price movements and may be insufficient to offset increased investment demand.

Recycling patterns vary significantly by region:

• Western markets: Price-responsive recycling from jewellery and investment products

• Asian markets: Cultural factors limit recycling despite price incentives

• Technology sector: Industrial recycling provides consistent but limited supply

• Central bank sales: Occasional official sector sales can affect supply, though net purchases have dominated recently

The price elasticity of recycled supply creates interesting market dynamics. During rapid price increases, recycling can temporarily moderate gains by increasing available supply. However, this mechanism typically operates with significant lags and may be overwhelmed by investment demand during strong bull markets.

Competition between investment and industrial demand also affects supply allocation. Technology sector demand for gold continues growing due to electronic applications, creating additional pressure on available supply during periods of strong investment demand.

What Are the Long-Term Implications of Current Gold Trends?

Understanding long-term trends in gold markets requires analysing structural changes in the global monetary system, technology adoption, and generational wealth transfer patterns. These factors will likely shape precious metals demand for decades to come.

Monetary System Evolution and Digital Currencies

Central bank digital currency development represents a significant potential catalyst for gold demand as governments gain unprecedented abilities to monitor and control monetary transactions. This technology may drive increased interest in alternative stores of value that provide privacy and independence from government oversight.

Key monetary system trends include:

• CBDC implementation: Government digital currencies may increase surveillance capabilities

• Cryptocurrency adoption: Digital assets compete with gold for some safe-haven demand

• Blockchain applications: Technology may improve precious metals trading and custody

• Monetary policy tools: New technologies may enable more direct economic intervention

The relationship between gold and cryptocurrencies continues evolving as both asset classes mature. Whilst digital assets may appeal to younger investors seeking alternatives to traditional finance, gold's physical properties and historical precedent provide different advantages that may become more relevant during extreme stress periods.

Blockchain technology applications in precious metals markets could improve transparency and reduce transaction costs whilst maintaining gold's fundamental characteristics. These developments might expand access to gold investment whilst preserving the metal's essential properties as a store of value.

Investment Outlook and Risk Management

Professional forecasting models suggest gold could remain in a structural bull market for an extended period, driven by monetary policy constraints, geopolitical tensions, and supply limitations. However, investors should expect significant volatility during this period, with multiple corrections of 25% or more possible without derailing the broader trend.

Long-term considerations include:

• Generational wealth transfer: Younger investors may have different attitudes toward precious metals

• Climate policies: Environmental regulations may constrain mining whilst increasing recycling

• Technology disruption: New applications for gold could affect industrial demand

• Geopolitical fragmentation: International tensions may drive continued central bank accumulation

Risk management approaches must account for gold's unique volatility patterns. Unlike many assets, precious metals can experience sustained periods of poor performance followed by rapid appreciation. This characteristic requires patient capital and strong conviction to achieve optimal results.

Consequently, portfolio diversification benefits remain compelling despite changing market conditions. Gold's low correlation with financial assets and its performance during crisis periods provide insurance characteristics that become particularly valuable during late-cycle market conditions.

For instance, recent analysis of all-time highs analysis demonstrates how various factors continue supporting precious metals despite evolving market dynamics.

Frequently Asked Questions About Gold Price Rebounds

Common Investor Questions and Expert Responses

When is the optimal time to increase gold allocations?

Professional investors typically increase precious metals exposure during periods of monetary accommodation, geopolitical uncertainty, or when real interest rates decline toward zero. Market timing is challenging, making dollar-cost averaging approaches more suitable for most investors.

What percentage of a portfolio should be allocated to gold?

Academic research suggests allocations between 5-15% depending on individual risk tolerance and market conditions. Higher allocations may be appropriate during periods of elevated systemic risk or monetary instability.

How do gold mining stocks differ from physical gold ownership?

Mining stocks provide leverage to gold prices but carry additional operational and financial risks. Physical gold offers direct exposure without company-specific risks but lacks the potential for operational improvements that can benefit mining shares.

What are the tax implications of different gold investment vehicles?

Tax treatment varies significantly between physical gold, ETFs, mining stocks, and futures contracts. Physical gold held for more than one year typically qualifies for collectibles tax treatment, whilst ETFs and stocks may receive more favourable capital gains treatment. Consultation with tax professionals is recommended.

Should investors focus on dollar-cost averaging or lump-sum investments?

Given gold's volatility, dollar-cost averaging typically provides better risk-adjusted outcomes for most investors. However, lump-sum investments during clear fundamental inflection points may be appropriate for experienced investors with strong conviction.

Looking ahead, the gold price forecast suggests continued structural support from multiple factors. Furthermore, according to Federal Reserve officials, monetary policy decisions will continue influencing precious metals markets. Additionally, recent analysis from the Economic Times highlights how Federal Reserve decisions create ongoing volatility in gold markets.

Disclaimer: This analysis is for informational purposes only and should not be considered personalised investment advice. Past performance does not guarantee future results. Precious metals investments carry significant risks including price volatility and potential losses. Investors should consult qualified financial advisors before making investment decisions.

Looking to Capitalise on Gold Market Rebounds?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries, including gold opportunities that can benefit from the favourable conditions outlined above. Explore Discovery Alert's dedicated discoveries page to see how historic mineral discoveries have generated exceptional returns, then begin your 30-day free trial to position yourself ahead of the market during these promising gold market conditions.