Deep Yellow's recent CEO appointment represents a pivotal moment in uranium sector leadership dynamics, as companies navigate complex development phases amid uranium market volatility and growing nuclear energy demand. The appointment of Greg Field, formerly Rio Tinto's Managing Director for Project Development, signals a strategic shift towards prioritising large-scale project execution capabilities over sector-specific experience.

Understanding Leadership Risk in Resource Development Companies

The uranium sector's current renaissance has intensified investor scrutiny of management continuity risks across development-stage companies. When seasoned executives transition from established uranium developers, the strategic implications ripple far beyond individual company performance to encompass broader sector confidence and capital allocation patterns.

Leadership transitions in uranium development present unique challenges that differ markedly from other mining sectors. The complexity stems from the specialised regulatory environment, extended project timelines, and the critical importance of stakeholder relationships across multiple jurisdictions. Furthermore, investors must carefully assess potential management red flags during these crucial transition periods.

Key Leadership Transition Risk Factors:

• Project execution capability gaps during critical development phases

• Institutional knowledge transfer challenges in complex regulatory environments

• Market timing sensitivity during uranium price volatility periods

• Stakeholder relationship continuity across multiple jurisdictions

The uranium market's recovery phase has heightened these risks, as companies approach Final Investment Decision (FID) milestones with significant capital requirements. Greg Field's appointment to lead Deep Yellow exemplifies this dynamic, with the board explicitly prioritising "strong execution capability" and project delivery track records over sector-specific experience.

What Strategic Capabilities Define Effective Uranium Project Leadership?

Modern uranium development demands a convergence of technical, regulatory, and commercial expertise that distinguishes it from other mining sectors. The appointment of executives with major mining conglomerate backgrounds reflects industry recognition that large-scale project delivery capabilities often outweigh sector-specific knowledge.

Essential Executive Competencies for Uranium Development:

• Large-scale capital project execution experience (minimum $500M developments)

• Multi-jurisdictional regulatory navigation capabilities

• Remote operations management in challenging environments

• Integrated supply chain optimisation across mining-to-market value chains

Field's portfolio at Rio Tinto demonstrates this capability framework in practice. His leadership of the $7 billion Oyu Tolgoi underground expansion showcases experience with complex underground mining operations. Additionally, his management of the $400 million Rincon Direct Lithium Extraction facility indicates familiarity with novel processing technologies increasingly important in uranium sector environmental compliance.

The $1.3 billion AP60 aluminium smelter project in Quebec represents another dimension of capability: integrated industrial operations requiring long-term utility partnerships and energy supply arrangements. These capabilities are directly applicable to uranium sector commercial structures.

Commercial Strategy Requirements:

• Long-term contract negotiation with utility counterparties

• Nuclear fuel cycle market dynamics understanding

• Government relations expertise in uranium-producing jurisdictions

• ESG compliance frameworks for nuclear fuel supply chains

How Do Major Mining Conglomerates Develop Project Execution Leaders?

Rio Tinto's project development pathway represents a systematic approach to building executives capable of managing billion-dollar capital programmes across diverse commodity sectors and geographic regions. The company's MD for Project Development role functions as a centralised excellence centre for capital project delivery across the organisation's global portfolio.

Major Project Portfolio Experience:

Field's Rio Tinto tenure provided exposure to fundamentally different technical challenges:

| Project | Commodity | Capital Value | Technical Challenge |

|---|---|---|---|

| Oyu Tolgoi Underground | Copper | $7 billion | Underground hard rock mining in remote location |

| Rincon DLE Plant | Lithium | $400 million | Novel extraction technology implementation |

| AP60 Smelter | Aluminium | $1.3 billion | Integrated industrial operations |

This progression demonstrates deliberate capability building through graduated responsibility increases and technical complexity advancement. However, these developments occur within broader mining industry evolution trends that emphasise technological innovation and operational excellence.

Geographic Expertise Development:

Field's career spans six countries, providing multi-jurisdictional experience essential for modern resource sector leadership:

• South African foundation: Career commencement in established mining jurisdiction

• Namibian familiarity: Regional exposure critical for Deep Yellow's Tumas project

• Western Australian operations: Remote operations management through Argyle Diamonds

• Multi-continental leadership: Project experience across Mongolia, United States, Canada, and Argentina

This geographic diversity provides insight into varying regulatory frameworks, political risk assessment, and stakeholder engagement approaches across different mining jurisdictions.

What Market Positioning Advantages Emerge from Strategic Leadership Appointments?

Executive appointments signal strategic intent to capital markets and significantly influence investor confidence during critical development phases. The Deep Yellow new CEO appointment timing demonstrates sophisticated capital market communication strategy, aligning leadership capability demonstration with project development readiness messaging.

Market Confidence Indicators:

The appointment announcement emphasises immediate value creation potential through strategic timing. Executive Chair Chris Salisbury explicitly noted: "his arrival comes at the perfect time to own the near-term Tumas FID decision and then follow through with execution of this derisked growth project."

This messaging indicates the board views executive credibility as directly influencing capital market confidence during FID phases, when project financing requirements are most substantial. Moreover, such strategic appointments occur amid broader industry consolidation trends affecting sector dynamics.

Strategic Positioning Benefits:

• Enhanced project financing capabilities through executive track records

• Accelerated regulatory approval processes via established relationships

• Improved contractor and supplier negotiation positions

• Strengthened utility customer confidence for long-term contracts

Field's public positioning emphasises alignment with global energy transition narratives: "I believe uranium has a key role to play in the global transition to clean energy, and Deep Yellow is uniquely positioned to contribute to that shift."

This articulation connects executive appointment to broader market opportunity capture, positioning the company within expanding nuclear energy demand scenarios. However, companies must also navigate potential US uranium market disruption that could affect international operations.

Compensation Structures and Performance Alignment

Modern resource sector compensation increasingly emphasises performance-based incentives tied to specific project milestones and operational achievements. Uranium sector executive compensation typically includes significant variable components aligned with development timeline execution and shareholder value creation.

Executive Compensation Optimisation Framework:

• Base salary benchmarking against mid-tier developer standards

• Performance incentives typically 60-100% of base salary

• Long-term equity participation ensuring multi-year commitment

• Milestone-based bonus structures tied to project development achievements

Value Alignment Mechanisms:

• Final Investment Decision (FID) achievement bonuses

• Production ramp-up performance incentives

• Share price appreciation participation through equity grants

• ESG performance metrics integration into compensation frameworks

The appointment announcement highlights the strategic timing of this leadership transition, whilst detailed compensation structures remain confidential pending regulatory disclosures.

Strategic Project Portfolio Advantages Supporting Multi-Asset Development

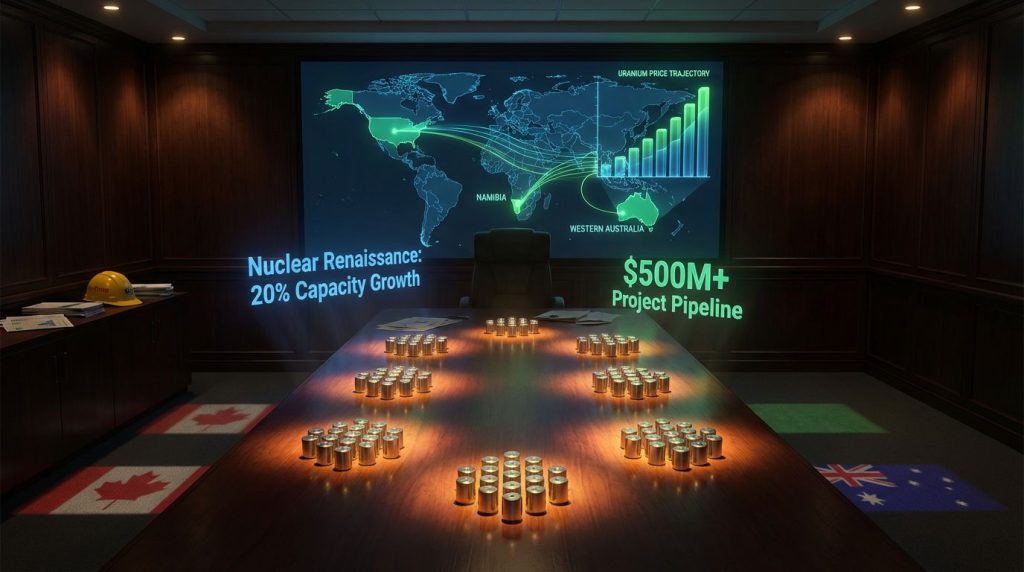

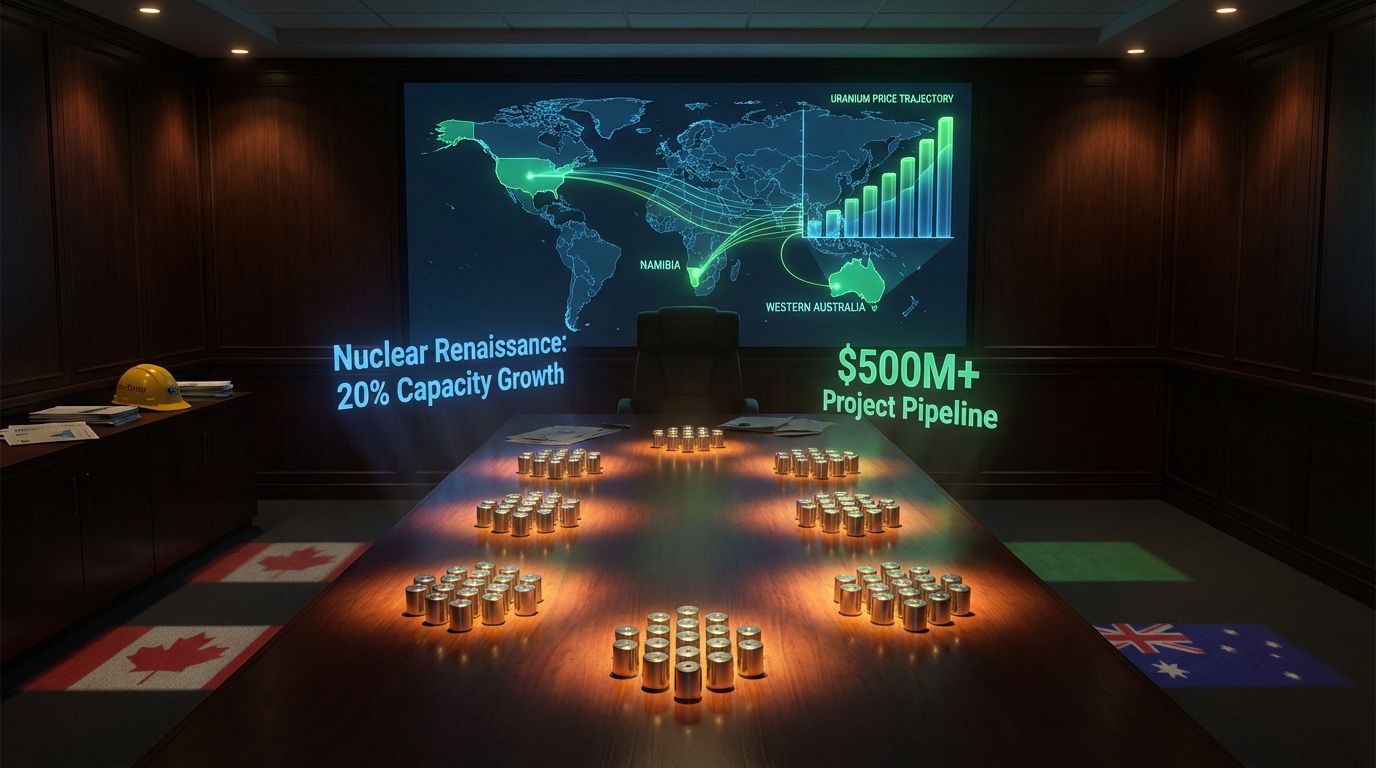

Deep Yellow's geographic diversification across Namibia and Western Australia demonstrates enhanced strategic resilience and capital allocation flexibility. The company's two-project portfolio provides optionality for development sequencing and risk mitigation through sovereign risk distribution.

Tumas Project Strategic Positioning (Namibia):

• Established uranium mining jurisdiction with supportive regulatory framework

• Political stability supporting long-term investment commitments

• Favourable mining taxation regime enhancing project economics

• Proximity to existing uranium infrastructure reducing development costs

Mulga Rock Project Diversification (Western Australia):

• Alternative jurisdiction reducing sovereign risk concentration

• Advanced permitting status enabling rapid development acceleration

• Established mining services infrastructure supporting cost-effective operations

• Domestic market proximity for potential Australian nuclear energy developments

Field's appointment emphasises strategic positioning across both jurisdictions: "With two execution ready projects in Tumas and Mulga Rock, the company is well-positioned to capture the upside potential of the market and deliver long-term value to shareholders."

This geographic diversification provides several strategic advantages during the current uranium market recovery phase. Consequently, it allows flexible capital allocation responses to changing market conditions and regulatory environments.

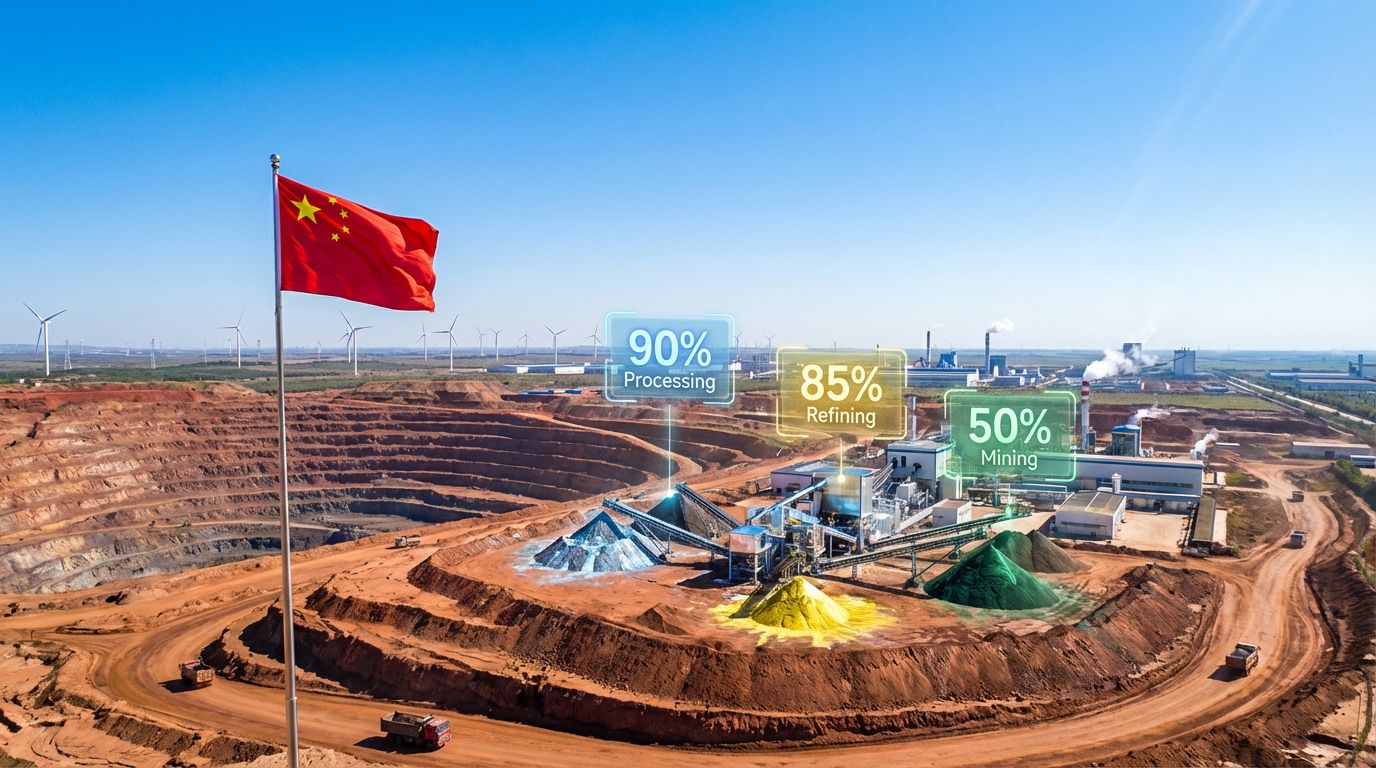

Nuclear Energy Renaissance Impact on Uranium Development Strategies

Global energy transition dynamics are fundamentally reshaping uranium demand forecasts and development timeline priorities across the sector. The convergence of net-zero emission commitments, energy security concerns, and nuclear technology advancement creates unprecedented demand growth potential for uranium producers.

Nuclear Capacity Expansion Drivers:

• Net-zero emission commitments requiring baseload clean energy solutions

• Energy security concerns driving domestic nuclear capacity investments

• Small Modular Reactor (SMR) deployment acceleration creating new demand segments

• Existing reactor life extensions increasing long-term uranium consumption

Supply-Demand Rebalancing Implications:

The uranium sector faces a decade-long underinvestment legacy in new production capacity, creating structural supply deficits as nuclear energy deployment accelerates. This dynamic provides favourable pricing environments for new project development, supporting the economic viability of previously marginal deposits.

Market Demand Transformation Scenarios:

• Geopolitical supply chain diversification requirements

• Long-term contract pricing recovery supporting new project development

• Strategic stockpiling initiatives by nuclear utilities and governments

• Emerging market nuclear programmes creating additional consumption growth

How Does Leadership Transition Timing Impact Project Development?

The Deep Yellow new CEO appointment demonstrates sophisticated transition management, with approximately six months between announcement and commencement. This timeline allows comprehensive knowledge transfer whilst maintaining project momentum during critical development phases.

Transition Management Best Practices:

• Interim management arrangements preserving project continuity

• Key personnel retention programmes during leadership changes

• Stakeholder communication strategies maintaining confidence

• Project timeline protection through enhanced oversight mechanisms

Furthermore, the appointment aligns with broader industry recognition that transferable project management expertise often outweighs sector-specific experience. This represents a significant shift in executive selection criteria across the uranium sector.

Strategic Execution Enhancement:

• Board composition optimisation with relevant industry expertise

• Advisory committee establishment for specialised technical guidance

• External consultant engagement for critical path activities

• Performance monitoring systems ensuring accountability

Deep Yellow's management team demonstrates commitment to maintaining operational excellence whilst integrating new leadership capabilities. This balanced approach addresses both continuity requirements and strategic enhancement objectives.

Risk Management Frameworks Supporting Successful Leadership Transitions

Effective succession planning requires comprehensive risk assessment and mitigation strategies addressing both operational continuity and strategic execution capabilities. Deep Yellow's transition management demonstrates several best practices for uranium sector leadership changes.

Operational Continuity Planning:

The company's appointment timeline provides approximately six months between announcement and commencement, allowing comprehensive transition planning and knowledge transfer protocols. This approach minimises disruption whilst maximising strategic value creation potential.

Key transition management elements include:

• Interim management arrangements preserving project momentum

• Key personnel retention programmes during transition periods

• Stakeholder communication strategies maintaining confidence

• Project timeline protection through enhanced oversight mechanisms

Strategic Execution Enhancement:

• Board composition optimisation with relevant industry expertise

• Advisory committee establishment for specialised technical guidance

• External consultant engagement for critical path activities

• Performance monitoring systems ensuring accountability

Deep Yellow's board prioritisation of "strong execution capability" over sector-specific experience represents a strategic shift toward transferable project management expertise. This reflects broader industry trends in executive selection criteria across the mining sector.

Strategic Leadership Positioning for Uranium Sector Success

Executive leadership transitions in the uranium sector represent critical inflection points that significantly influence project development success and shareholder value creation. The appointment of experienced project delivery executives with major mining conglomerate backgrounds signals strategic intent to execute complex, capital-intensive developments across multiple jurisdictions.

Success factors increasingly emphasise proven large-scale project execution capabilities, multi-jurisdictional regulatory expertise, and comprehensive understanding of nuclear fuel cycle market dynamics. Modern compensation structures emphasise performance-based incentives aligned with specific development milestones and operational achievements.

Companies with diversified project portfolios across stable mining jurisdictions demonstrate enhanced strategic resilience during the current nuclear energy renaissance. Effective risk management frameworks supporting leadership transitions require comprehensive succession planning, operational continuity measures, and strategic execution enhancement initiatives.

Critical Success Elements:

• Multi-billion dollar project delivery experience

• Geographic expertise spanning stable mining jurisdictions

• Regulatory navigation capabilities across complex approval processes

• Commercial acumen in long-term utility contract negotiations

The convergence of global energy transition requirements, supply-demand rebalancing dynamics, and strategic leadership capabilities positions well-managed uranium developers for significant value creation opportunities. However, the evolving clean energy landscape demands continuous adaptation to changing market conditions and regulatory frameworks.

Disclaimer: This analysis is based on publicly available information and industry observations. Investment decisions should consider comprehensive due diligence and professional financial advice. Uranium sector investments involve significant risks including regulatory, technical, and market volatility factors.

Looking for the Next Major Mineral Discovery Before It Hits the Headlines?

Discovery Alert's proprietary Discovery IQ model provides instant notifications on significant ASX mineral discoveries, helping investors identify actionable opportunities ahead of the broader market. Explore why major mineral discoveries can generate substantial returns and begin your 30-day free trial today to position yourself ahead of market movements.