China's dominance in global rare earth supply chains has created complex strategic interdependencies that extend far beyond basic commodity trading relationships. These elements underpin virtually every modern technology, from smartphone displays to electric vehicle motors, creating vulnerabilities that governments and corporations are only beginning to fully understand. The intricate web of dependencies has evolved over decades of manufacturing consolidation, leaving global industries exposed to policy shifts from a single source nation.

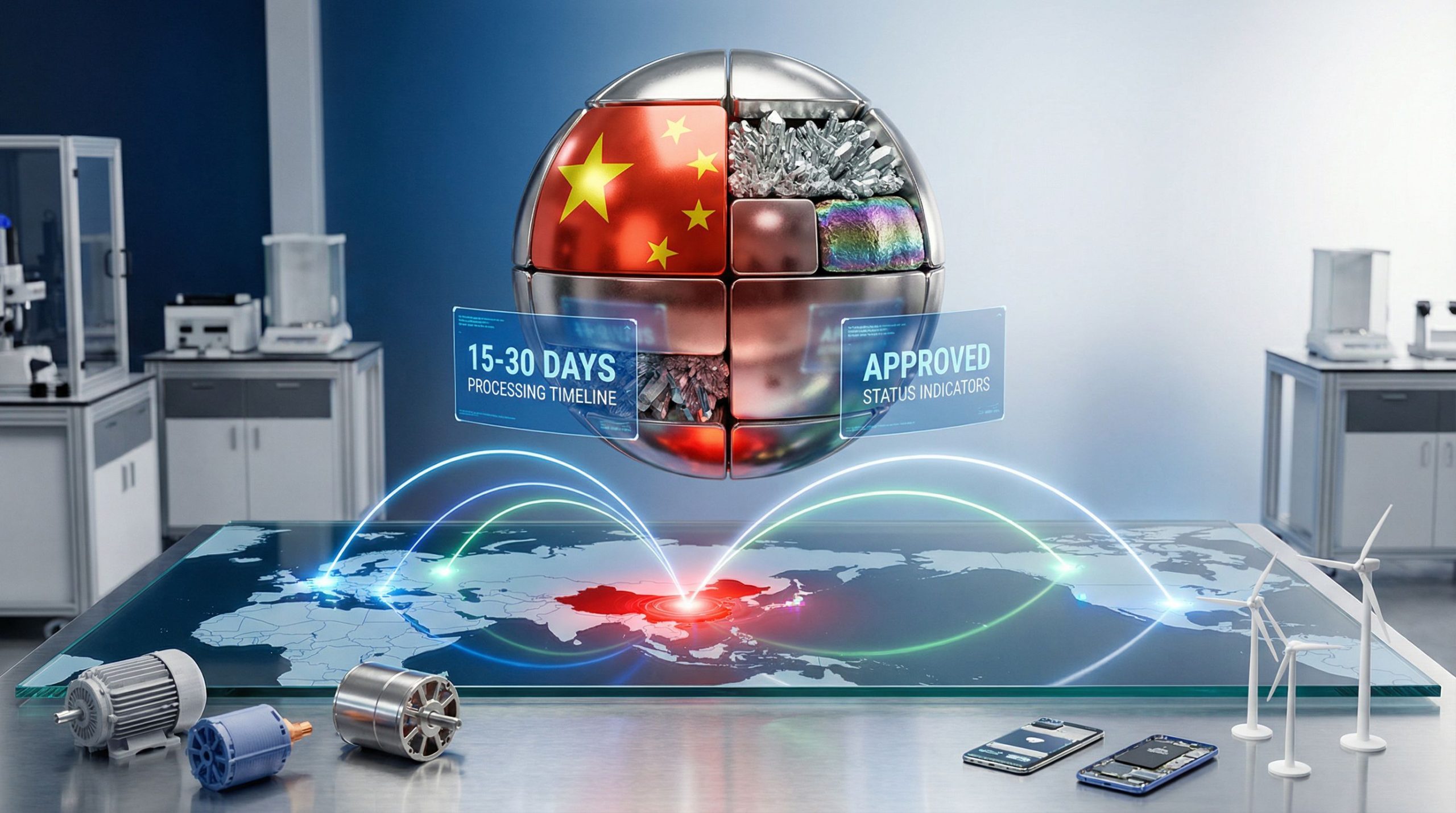

The recent announcement from Beijing regarding China civilian rare earth exports represents a calculated diplomatic manoeuvre designed to maintain economic relationships while preserving strategic leverage. This development occurs against a backdrop of increasing geopolitical tensions and growing international awareness of critical mineral vulnerabilities. Furthermore, international agreements such as the us rare earth deal demonstrate the urgency with which nations are seeking alternative supply arrangements.

Understanding China's Dual-Track Export Control Framework

China's approach to rare earth export controls operates through a sophisticated regulatory mechanism that distinguishes between end-use applications with remarkable precision. The Ministry of Commerce has developed classification systems that evaluate not just the chemical composition of exports, but their intended destination within complex global supply chains.

Civilian vs. Military Application Classifications

The regulatory framework establishes clear boundaries between materials destined for consumer markets and those with potential military applications. Civilian applications encompass a broad spectrum of manufacturing sectors, including automotive electrification, renewable energy infrastructure, consumer electronics, and medical device production. These categories receive streamlined processing under China's current policy framework.

Military-sensitive classifications apply to rare earth elements intended for guidance systems, advanced sensors, missile components, and other defence technologies. These applications face significantly more restrictive approval processes and often encounter extended review periods or outright denials.

The distinction relies heavily on end-user documentation and intended application verification. Manufacturers must provide detailed specifications regarding their intended use of rare earth materials, including technical drawings, production schedules, and final product destinations.

Ministry of Commerce Approval Process Mechanics

The Chinese regulatory system operates through multiple layers of bureaucratic review, each designed to assess different aspects of export applications. Initial screening focuses on basic compliance with existing regulations and proper documentation submission.

Secondary review examines the strategic implications of specific exports, considering factors such as:

• Technology transfer potential

• Dual-use application risks

• Geopolitical relationships with destination countries

• Domestic supply availability

• Strategic reserve maintenance requirements

The approval process incorporates feedback from multiple government agencies, including the Ministry of Industry and Information Technology, the National Development and Reform Commission, and relevant military oversight bodies. This multi-agency approach ensures comprehensive evaluation but can create extended processing timelines.

What Industries Benefit from China's Streamlined Civilian Export Policy?

The recent policy clarification specifically benefits sectors that demonstrate clear civilian end-use applications and maintain transparent supply chain documentation. These industries have experienced the most significant relief from the regulatory uncertainties that characterised the 2024-2025 period.

Electric Vehicle and Clean Energy Sectors

Electric vehicle manufacturers rely heavily on neodymium-iron-boron (NdFeB) permanent magnets for motor applications. These magnets require precise ratios of neodymium, dysprosium, and praseodymium to achieve the performance characteristics necessary for automotive applications. The streamlined approval process ensures consistent supply for this rapidly expanding market segment.

Wind turbine manufacturers similarly depend on large quantities of rare earth elements for generator systems. Modern wind turbines can contain up to 600 kilograms of rare earth materials, primarily in permanent magnet generators that convert mechanical rotation into electrical energy.

The renewable energy sector's growth trajectory makes it particularly sensitive to supply chain disruptions. Solar panel manufacturers utilise rare earth elements in inverter systems and energy storage components, creating additional demand streams that benefit from regulatory clarity. In addition, the development of a comprehensive critical minerals strategy becomes increasingly vital for long-term supply security.

Consumer Electronics and Medical Device Manufacturing

Consumer electronics manufacturers utilise rare earth elements across numerous applications, from display technologies requiring europium and terbium phosphors to speaker systems incorporating neodymium magnets. The smartphone industry alone represents a significant consumption category, with each device containing small quantities of multiple rare earth elements.

Medical device manufacturing presents unique supply chain requirements due to strict quality standards and regulatory oversight. Magnetic resonance imaging (MRI) systems require specialised rare earth compounds for contrast enhancement, whilst advanced surgical equipment often incorporates precision magnets for guidance and positioning systems.

The medical sector's critical nature provides additional justification for streamlined export processes, as supply disruptions could directly impact healthcare delivery capabilities in importing nations.

How Do China's Export Controls Impact Global Manufacturing Supply Chains?

The interconnected nature of modern manufacturing creates cascading effects when rare earth supply chains experience disruptions. Even temporary regulatory delays can trigger inventory shortages that propagate through multiple production tiers.

Regional Manufacturing Hub Dependencies

European automotive manufacturers face particularly acute vulnerabilities due to their aggressive electrification timelines. Major automakers have committed to substantial electric vehicle production targets that require consistent rare earth element supplies. However, initiatives such as the european supply facility development aim to address these dependencies through strategic infrastructure investment.

Japanese electronics manufacturers operate highly efficient just-in-time production systems that minimise inventory holding costs but increase sensitivity to supply disruptions. The precision required for consumer electronics applications means that alternative suppliers often cannot provide immediate substitutes without significant retooling and qualification processes.

North American clean energy projects depend on Chinese rare earth supplies for wind turbine installations and grid-scale energy storage systems. The Infrastructure Investment and Jobs Act and Inflation Reduction Act have created substantial domestic demand for these technologies, making supply chain reliability a national security consideration. Consequently, the recent us critical minerals order represents a strategic response to these vulnerabilities.

Price Volatility and Market Response Patterns

Historical analysis reveals that rare earth element prices respond rapidly to regulatory uncertainty. The 2024-2025 licensing slowdown created price volatility that extended beyond directly affected materials to impact substitute elements and downstream products.

Manufacturing companies have developed various strategies to mitigate price volatility:

• Forward contracting arrangements with suppliers

• Strategic inventory building during stable periods

• Alternative material qualification programmes

• Supply base diversification initiatives

• Vertical integration into processing capabilities

Financial markets demonstrate heightened sensitivity to rare earth policy announcements, with affected company valuations experiencing significant volatility during periods of regulatory uncertainty. This market behaviour reflects the concentrated nature of supply chains and limited near-term substitution possibilities.

Why China's "Compliant" Definition Creates Strategic Ambiguity

The subjective nature of compliance determination provides China with significant discretionary authority over global supply chains. This ambiguity serves multiple strategic purposes whilst creating ongoing uncertainty for international manufacturers.

Subjective Interpretation Risks for Manufacturers

The definition of "compliant" civilian applications remains largely at the discretion of Chinese regulatory authorities. This subjectivity creates several challenges for international manufacturers attempting to navigate the approval process:

Documentation requirements can vary significantly between similar applications, making it difficult to establish standardised procedures. Companies often must engage specialised trade consultants to interpret regulatory guidance and prepare appropriate submission materials.

End-use monitoring extends beyond initial export approval to include ongoing verification of material utilisation. Chinese authorities may request detailed accounting of rare earth element usage, creating additional compliance burdens for purchasing companies.

The potential for retroactive compliance determination changes creates ongoing uncertainty even for approved applications. Materials that receive export approval under current interpretations could face restrictions if regulatory guidance evolves.

Geopolitical Leverage Through Regulatory Discretion

China's export control framework serves as a sophisticated tool for economic diplomacy, allowing selective pressure application without broad trade war escalation. The ability to adjust compliance interpretations provides flexibility to respond to changing geopolitical circumstances.

Strategic resource nationalism has become increasingly prominent in Chinese policy formulation. Rare earth elements represent a unique leverage point due to the combination of Chinese supply dominance and the critical nature of these materials for advanced technology applications.

The regulatory framework allows for graduated responses to international tensions, from increased documentation requirements to extended review periods to selective application denials. This graduated approach provides policy flexibility whilst maintaining plausible regulatory justification.

What Alternative Supply Sources Are Manufacturers Developing?

Recognition of supply chain vulnerabilities has accelerated development of alternative rare earth sources outside China. These initiatives span multiple approaches, from traditional mining projects to innovative recycling technologies.

Non-Chinese Mining Project Development Status

Australia has emerged as a leading alternative source through companies like Lynas Rare Earths, which operates processing facilities in Malaysia and Australia. The company has announced expansion plans to increase production capacity and reduce dependence on Chinese processing capabilities.

North American projects are advancing through various development stages. MP Materials operates the Mountain Pass mine in California and has invested in downstream processing capabilities to reduce reliance on Chinese refinement services. The facility represents the largest rare earth mining operation outside China.

Canadian development projects are progressing through feasibility studies and permitting processes. Ucore Rare Metals is developing the Bokan Mountain project in Alaska, focusing on heavy rare earth elements that command premium pricing due to supply scarcity.

African mining initiatives are attracting international investment, particularly in countries with established mining industries. These projects often benefit from lower labour costs but face infrastructure and political stability challenges that can impact development timelines.

Recycling and Circular Economy Initiatives

Rare earth element recycling represents a rapidly developing alternative supply source that offers both environmental benefits and supply security advantages. Electronic waste streams contain significant quantities of rare earth elements that can be recovered through specialised processing techniques. Furthermore, innovative approaches to the battery recycling process demonstrate the potential for closed-loop supply chains in critical applications.

Urban mining initiatives focus on extracting valuable materials from discarded consumer electronics. Smartphones, computers, and other devices contain small but economically recoverable quantities of rare earth elements that accumulate in sufficient volumes for commercial processing.

Magnet recycling technologies are advancing rapidly, driven by the high value of neodymium-iron-boron permanent magnets used in electric vehicles and wind turbines. These applications contain relatively large quantities of rare earth elements in concentrated forms that facilitate economic recovery.

Industrial process optimisation can reduce primary rare earth consumption through improved efficiency and material substitution. Research into alternative materials and production processes may reduce dependence on specific rare earth elements.

How Should Investors Position for China's REE Export Policy Evolution?

Investment strategies must account for both immediate policy implications and longer-term structural changes in global rare earth markets. The complex interplay between geopolitical factors and supply chain dynamics creates multiple potential scenarios that investors should consider.

Sector-Specific Investment Implications

Clean energy sector investments benefit from stable rare earth supply expectations for civilian applications. Solar, wind, and battery storage companies should experience reduced supply chain uncertainty, potentially supporting higher valuation multiples and improved project economics.

Electric vehicle manufacturers face mixed implications from current policy developments. Whilst civilian applications receive streamlined approval, the automotive sector's increasing integration with autonomous driving and advanced sensor technologies could create future classification uncertainties.

Defence contractors must prepare for continued supply chain constraints on military-sensitive rare earth applications. These companies should prioritise alternative sourcing strategies and consider vertical integration into processing capabilities.

Technology companies with dual-use applications face ongoing uncertainty regarding compliance determination. Investment in supply chain diversification and alternative material development becomes increasingly critical for maintaining competitive positioning.

Portfolio Risk Management Strategies

Geographic diversification across rare earth supply sources provides protection against regulatory changes or operational disruptions. Investors should consider exposure to Australian, North American, and emerging African mining projects alongside Chinese producers.

Processing capability investments offer potential value creation opportunities as countries seek to reduce dependence on Chinese refinement services. Downstream processing operations command higher margins and provide greater supply chain control.

Recycling technology investments align with both environmental objectives and supply security goals. Companies developing efficient rare earth recovery processes may benefit from regulatory support and growing demand for sustainable sourcing.

Strategic Considerations for Investment Positioning:

| Investment Category | Risk Level | Opportunity Type | Time Horizon |

|---|---|---|---|

| Chinese REE Producers | Medium-High | Market leadership | 3-5 years |

| Alternative Mining Projects | High | Supply diversification | 5-10 years |

| Recycling Technologies | Medium | Sustainable sourcing | 3-7 years |

| Processing Capabilities | Medium | Value-added operations | 2-5 years |

| End-User Applications | Low-Medium | Demand growth | 1-3 years |

What Long-Term Trends Will Shape China's Civilian Export Strategy?

Understanding the structural forces influencing Chinese rare earth policy provides insight into potential future developments and their implications for global supply chains.

Domestic Consumption Growth Projections

China's internal rare earth consumption continues expanding rapidly, driven by domestic manufacturing growth and technological advancement. The country's transition toward higher-value manufacturing creates substantial internal demand for the same materials previously exported to international markets.

Electric vehicle production within China represents one of the largest growth drivers for domestic rare earth consumption. Chinese automakers are rapidly scaling production to serve both domestic and international markets, creating competition for materials traditionally available for export.

Renewable energy infrastructure development within China requires substantial rare earth inputs for wind turbine and solar panel production. Government commitments to carbon neutrality by 2060 necessitate massive clean energy installations that will consume increasing quantities of domestic rare earth production.

Advanced technology development in areas such as artificial intelligence, quantum computing, and aerospace applications creates additional domestic demand streams that prioritise national strategic objectives over export revenue.

International Regulatory Response Development

Western governments are implementing comprehensive critical mineral security strategies designed to reduce dependence on Chinese supply chains. These initiatives encompass mining development, processing capability establishment, and strategic reserve accumulation.

The United States has designated rare earth elements as critical materials under various legislative frameworks, including the Defense Production Act and Infrastructure Investment and Jobs Act. These designations provide regulatory authority and funding mechanisms for supply chain development.

European Union critical raw materials legislation establishes targets for supply diversification and domestic processing capability development. The regulations create preferential treatment for projects that reduce strategic dependencies on non-EU sources.

International cooperation frameworks are emerging to coordinate critical mineral supply chain development among allied nations. These arrangements facilitate technology sharing, joint investment, and coordinated diplomatic approaches to supply security challenges.

Navigating Compliance Requirements and Documentation Standards

Understanding the practical aspects of China's export control system helps manufacturers develop effective compliance strategies and minimise regulatory risks.

Essential Documentation and Verification Processes

Export licence applications require comprehensive documentation that extends beyond basic material specifications. Companies must provide detailed end-use certifications that demonstrate civilian application intent and include technical specifications for final products.

Supply chain transparency requirements mandate disclosure of all intermediate processors and final assembly locations. This documentation helps Chinese authorities track material flows and verify compliance with approved applications.

Third-party verification services have emerged to assist companies in meeting documentation standards and navigating regulatory requirements. These specialised consultants provide expertise in Chinese regulatory interpretation and application preparation.

Ongoing compliance monitoring extends beyond initial export approval to include periodic reporting on material utilisation and final product distribution. Companies must maintain detailed records that can be audited by Chinese authorities.

Best Practices for Regulatory Engagement

Proactive communication with Chinese regulatory authorities helps establish positive relationships and facilitates smoother approval processes. Companies that engage early and transparently often experience fewer delays and complications.

Legal counsel specialising in Chinese export control regulations provides essential guidance for complex applications and dispute resolution. The regulatory framework's complexity necessitates specialised expertise for optimal navigation.

Industry association participation offers opportunities to influence regulatory development and access collective expertise. Trade organisations often maintain relationships with Chinese authorities that benefit member companies.

Market Psychology and Investment Sentiment Dynamics

Rare earth markets exhibit unique psychological characteristics that influence pricing, investment flows, and strategic decision-making across the supply chain.

Sentiment Drivers and Market Reactions

Geopolitical tensions create immediate market volatility that often exceeds the actual impact of specific policy changes. Investor psychology tends to amplify uncertainty, leading to overreactions in both directions. For instance, Chinese authorities have confirmed their commitment to processing compliant export applications, providing some market reassurance.

Supply security concerns drive premium valuations for alternative source projects, even those in early development stages. Market participants place significant value on supply chain diversification potential, creating investment opportunities for non-Chinese projects.

Technology advancement announcements can trigger rapid sentiment shifts as markets evaluate potential demand changes or substitution possibilities. Battery technology developments, for example, significantly influence lithium and rare earth element pricing expectations.

Policy announcement timing often correlates with broader geopolitical developments, creating complex interactions between multiple risk factors. As China has indicated, their approach to China civilian rare earth exports balances economic interests with strategic considerations.

Long-Term Strategic Positioning Considerations

The evolution of China's civilian rare earth export policies reflects broader strategic competition dynamics that extend beyond simple trade relationships. Understanding these underlying forces provides insight into potential future developments and their investment implications.

China's approach to rare earth export controls represents a sophisticated balance between economic interests and strategic objectives. The country benefits economically from export revenue whilst maintaining leverage through selective availability controls. This dual-purpose approach is likely to continue as China navigates complex international relationships.

The global transition toward sustainable technologies ensures continued growth in rare earth demand across civilian applications. Electric vehicles, renewable energy systems, and energy storage technologies will drive sustained consumption growth regardless of short-term policy fluctuations.

International efforts to develop alternative supply chains will gradually reduce global dependence on Chinese exports, but this transition will require significant time and capital investment. The complex nature of rare earth processing and the specialised knowledge required for efficient operations create substantial barriers to rapid supply source diversification.

The analysis presented here is for informational purposes only and should not be considered as investment advice. Rare earth markets are subject to significant volatility, regulatory changes, and geopolitical risks that can substantially impact investment outcomes. Investors should conduct thorough due diligence and consult with qualified financial advisors before making investment decisions in rare earth-related securities or projects.

Understanding China civilian rare earth exports requires appreciation for their role within broader strategic frameworks. Whilst current announcements provide reassurance for civilian applications, the underlying dynamics of resource nationalism, technological competition, and geopolitical tension continue to shape long-term market evolution.

Ready to Capitalise on Critical Mineral Market Opportunities?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries, instantly empowering subscribers to identify actionable opportunities ahead of the broader market. Understanding why major mineral discoveries can generate substantial returns by exploring Discovery Alert's dedicated discoveries page, showcasing historic examples of exceptional outcomes, and begin your 30-day free trial today to position yourself ahead of the market.