Global supply chains face unprecedented transformation as traditional rare earth dependencies undergo systematic restructuring. While market participants focus on immediate pricing volatility and quarterly production metrics, the underlying architecture supporting critical technology manufacturing experiences fundamental realignment. This shift encompasses not merely commercial relationships but strategic resource allocation patterns that will define technological sovereignty for decades ahead.

The emergence of alternative processing capabilities outside established dominance structures creates new equilibrium possibilities across defense, renewable energy, and consumer electronics sectors. Investment capital increasingly prioritises supply chain resilience over pure cost optimisation, reflecting institutional recognition that rare earth elements constitute strategic infrastructure rather than conventional commodities.

Understanding China's Evolving Rare Earth Export Framework

What Triggered China's 2025 Export Control Overhaul?

Beijing's comprehensive restructuring of rare earth export mechanisms reflects calculated leverage optimisation rather than punitive trade restrictions. The framework encompasses seven critical elements through Ministry of Commerce approval requirements, creating systematic bottlenecks affecting approximately 90% of global processed rare earth supply. This dominance position enables selective control implementation based on end-user applications and geopolitical considerations.

The licensing system operates through differentiated scrutiny mechanisms targeting military-adjacent sectors while maintaining streamlined approval processes for consumer electronics applications. Defence contractors, aerospace manufacturers, and advanced weapons systems face heightened regulatory barriers, whereas commercial technology producers encounter comparatively routine processing timelines.

Key regulatory components include:

- Application-based approval mechanisms with sector-specific requirements

- End-use classification systems distinguishing commercial from strategic applications

- Buyer entity assessment protocols evaluating jurisdiction and strategic sensitivity

- Appeal mechanisms providing structured review processes for rejected applications

Manufacturing sectors including electric vehicles, defence contractors, and renewable energy developers now navigate extended procurement cycles with elevated cost structures. The systematic nature of these controls suggests long-term strategic positioning rather than temporary trade dispute tactics.

How Do Current Export Restrictions Impact Global Supply Chains?

Processing bottlenecks create cascading effects throughout technology manufacturing ecosystems. Electric vehicle production schedules face uncertainty due to permanent magnet supply constraints, while wind turbine manufacturers experience project delays linked to heavy rare earth availability. Defence contractors must develop alternative sourcing strategies or accept extended procurement timelines for critical components.

Supply chain disruption patterns:

- Electric vehicle sector: Permanent magnet motor production constraints affecting manufacturing targets

- Wind energy industry: Turbine generator delays impacting renewable energy deployment schedules

- Defence manufacturing: Extended procurement cycles for radar systems, missile guidance, and satellite components

- Consumer electronics: Price pressure transmission to smartphone, laptop, and appliance manufacturers

The concentration risk becomes particularly acute for heavy rare earth elements like dysprosium and terbium, where alternative sources remain limited through 2027. Technology manufacturers increasingly recognise that single-source dependency creates systemic vulnerability extending beyond commercial considerations into national security implications.

Western Strategic Responses to Chinese Market Dominance

Which Alternative Processing Facilities Are Coming Online?

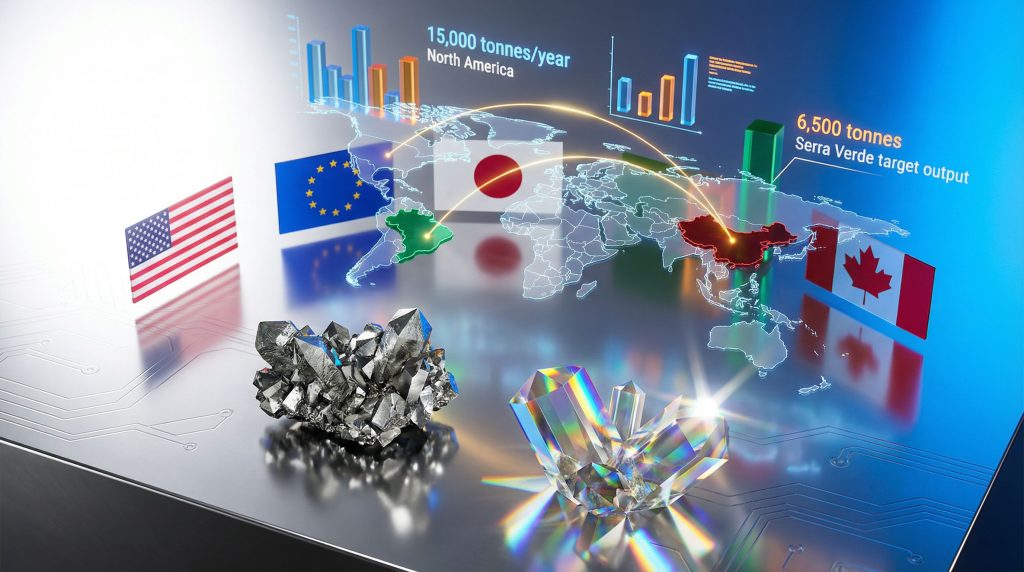

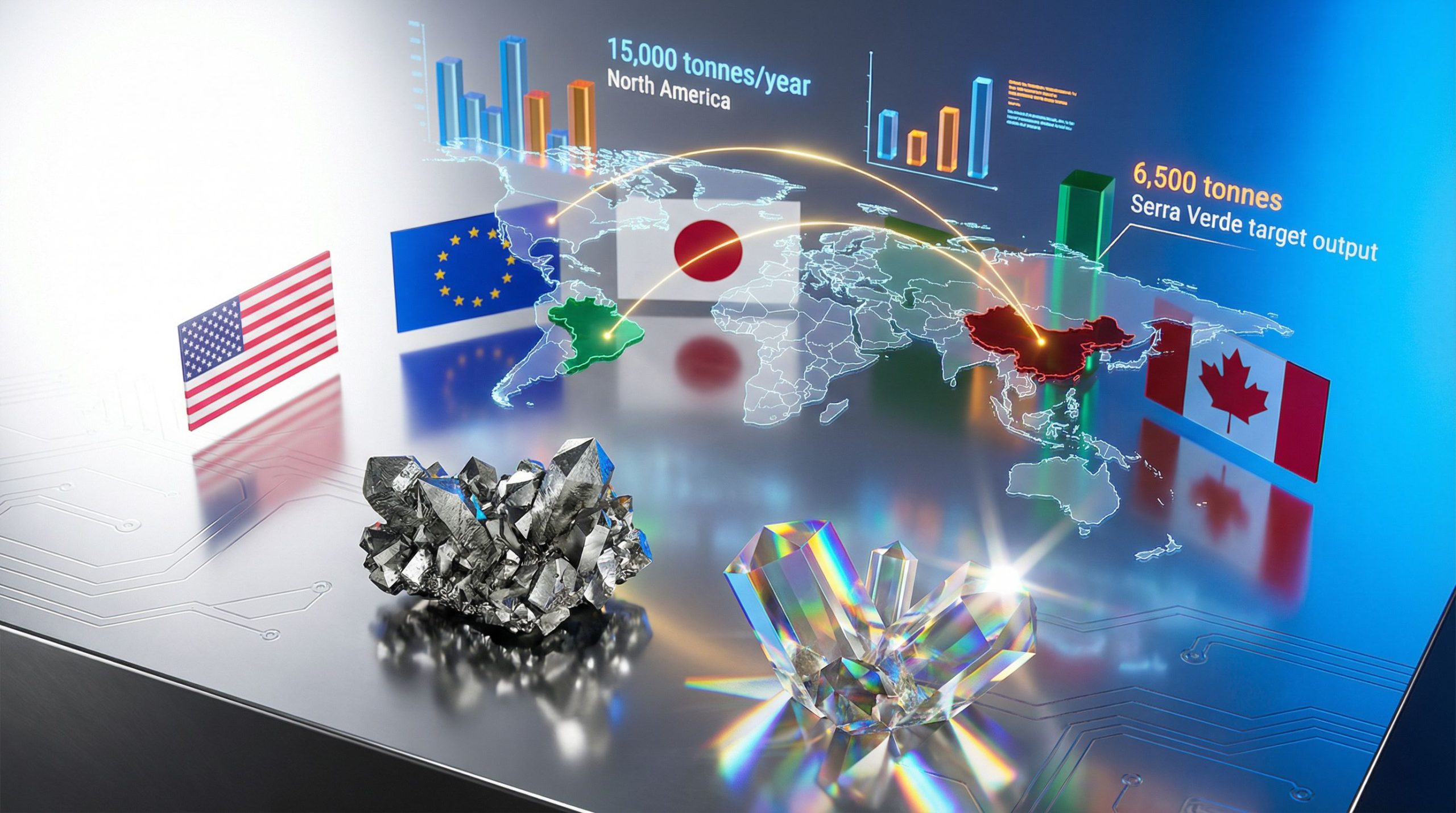

Western nations pursue geographically distributed processing infrastructure targeting combined capacity of approximately 35,500 tonnes annually by 2027. This development strategy prioritises heavy rare earth processing capabilities essential for permanent magnet applications in wind energy and electric vehicle sectors, particularly following recent announcements regarding the European CRM facility.

Regional Processing Development Timeline:

| Region | Development Phase | Target Capacity (tonnes/year) | Heavy REE Focus | Expected Timeline |

|---|---|---|---|---|

| North America | Advanced Development | 15,000 | Yes | 2026-2027 |

| Europe | Planning Stage | 8,500 | Limited | 2027-2028 |

| Australia | Under Construction | 12,000 | Yes | 2026-2027 |

North American facilities emphasise integration with defence supply chains through Pentagon-backed initiatives, whilst Australian projects target Asian market diversification. European development focuses on renewable energy sector requirements, though heavy rare earth processing capabilities remain constrained relative to North American and Australian approaches.

Technology platform differentiation:

- Solvent extraction methods: Capital-intensive systems requiring specialised technical expertise

- Environmental containment: Advanced waste management addressing traditional ionic clay processing concerns

- Separation selectivity: Precision technology enabling efficient heavy rare earth concentration

MP Materials' Mountain Pass facility exemplifies Western processing development, receiving Pentagon guaranteed pricing commitments as part of multi-billion-dollar defence infrastructure initiatives. This model provides institutional precedent for government-backed risk mitigation enabling private capital mobilisation.

What Role Do Government Price Floors Play in Market Development?

Government price guarantee mechanisms represent fundamental departure from traditional commodity market dynamics toward strategic infrastructure protection models. The Pentagon's multi-billion-dollar commitment framework with MP Materials established precedent for risk mitigation enabling rare earth investment under competitive Chinese pricing pressure, complementing recent initiatives outlined in the critical minerals executive order.

Price Floor Implementation Structure:

- Minimum offtake commitments: Government agencies guarantee purchase volumes at specified minimum prices

- Cost-plus formulas: Pricing indexed to documented production costs plus assured margins

- Escalation provisions: Automatic adjustment mechanisms responding to inflation or commodity benchmark changes

- Duration specifications: Multi-year contract terms providing long-term capital planning certainty

The US Development Finance Corporation's $465 million loan approval for Serra Verde demonstrates coordinated government support extending beyond domestic facilities. G7 nations evaluate similar frameworks recognising that rare earth supply chain security constitutes critical national infrastructure rather than conventional commercial arrangements.

European Union policy development parallels American approaches, though implementation timelines lag behind Pentagon initiatives. Japanese and Canadian governments pursue coordinated frameworks reflecting recognition that rare earth dependency represents shared vulnerability requiring multilateral response mechanisms.

Brazilian Heavy Rare Earth Market Entry

How Does Serra Verde's Production Profile Differ From Chinese Deposits?

Serra Verde's ionic clay geology provides strategic advantage for Western supply chain diversification through elevated heavy rare earth concentrations compared to Chinese light rare earth-dominant deposits. The facility targets 6,500 metric tons of total rare earth oxides annually by 2027, with heavy rare earth elements comprising the strategically critical fraction.

Production Development Timeline:

- 2024: Commercial production launch in early period

- 2025: Optimisation phase operating below full capacity

- 2027: Target full production of 6,500 tonnes total rare earth oxides annually

The facility's environmental processing methodology eliminates toxic discharge associated with traditional ionic clay extraction, addressing sustainability concerns that plague conventional Chinese and Myanmar operations. This approach required several hundred million dollars in specialised plant construction but positions the operation as environmentally defensible within Western regulatory frameworks.

Heavy Rare Earth Strategic Importance:

- Dysprosium applications: High-temperature permanent magnets for wind turbine generators, thermal neutron absorption in nuclear applications

- Terbium applications: Green phosphors in efficient lighting systems, high-strength permanent magnets, acousto-optic devices

- Processing differentiation: Ionic clay extraction requiring specialised acid leaching and solvent extraction techniques

Wind turbine manufacturing represents primary demand driver for heavy rare earth elements. Modern wind turbines require neodymium-iron-boron magnets with dysprosium additions maintaining magnetic strength at elevated operating temperatures. Dysprosium supply constraints create direct bottlenecks limiting wind energy capacity expansion critical for Western renewable energy targets.

Why Are Multiple Regions Competing for Serra Verde's Output?

Serra Verde represents the West's only significant heavy rare earth source outside Chinese processing control, creating unprecedented demand concentration among multiple jurisdictions. According to CEO Thras Moraitis, Chinese firms have been cutting their rare earth offtake deals short as Western companies approach the facility given its unique supply position.

Supply Competition Dynamics:

- Defence applications: US and allied nations prioritise allocation for missile guidance systems, satellite components, advanced radar

- Renewable energy: European and Japanese emphasis on wind turbine magnet feedstock for climate targets

- Industrial manufacturing: Japanese and South Korean permanent magnet producers seeking supply diversification

- Strategic stockpiling: Multiple nations building inventory buffers against future supply disruptions

The facility's annual output, though modest relative to global rare earth consumption exceeding 300,000 tonnes annually, represents disproportionate strategic importance. Heavy rare earth supply constraints create bottleneck effects throughout downstream manufacturing chains, amplifying Serra Verde's strategic value beyond pure production volume considerations.

Furthermore, permanent magnet manufacturers in Japan and South Korea face particular vulnerability due to dependence on Chinese heavy rare earth processing. Direct offtake agreements with Serra Verde provide critical diversification reducing exposure to Chinese supply chain concentration risk across defence and commercial applications.

Geopolitical Implications of Offtake Contract Restructuring

What Does the Shift From 10-Year to 2-Year Chinese Contracts Signal?

China rare earth offtake deals have undergone fundamental restructuring as Serra Verde modified contract duration from 10-year commitments to agreements concluding at end of 2026. Original long-term Chinese offtake arrangements were financing prerequisites when Western processing alternatives remained unavailable during initial mine development phases.

Contract Restructuring Implications:

- Optionality preservation: Short-term structures enable switching to alternative processing partners as Western capacity materialises

- Financial leverage improvement: Movement from fixed long-term arrangements to variable structures enhances pricing negotiation power

- Risk reallocation: Shift transfers supply chain uncertainty from producer to processor reflecting changing market conditions

- Strategic signalling: Demonstrates declining Chinese leverage in rare earth procurement negotiations

The restructuring timeline aligns with emerging Western processing facility commissioning schedules. According to Moraitis, in a couple of years there will be options to separate heavy rare earth elements outside Chinese processing infrastructure, creating genuine alternatives to traditional supply arrangements.

This pattern mirrors historical commodity market transitions where suppliers successfully renegotiated long-term contracts as competing processing options emerged. Similar dynamics occurred in liquefied natural gas markets during 2015-2020 when buyers modified rigid take-or-pay structures toward flexible arrangements as alternative supply sources developed.

How Might Trade Negotiations Influence Future Export Policies?

Recent diplomatic engagement between Washington and Beijing resulted in temporary suspension of expanded export controls through November 2026, providing approximately 11-month breathing room for Western supply chain development. This suspension represents negotiated positioning balancing Chinese leverage maintenance with commercial relationship preservation.

Diplomatic Timeline Considerations:

- Suspension duration: November 2026 conclusion aligns with Western processing facility commissioning schedules

- Policy leverage: China maintains export control capabilities while avoiding immediate supply disruption

- Negotiation framework: Temporary measures provide diplomatic space for broader trade relationship discussions

- Strategic timing: Suspension enables Western infrastructure development reducing future Chinese negotiation leverage

The timeline suggests coordinated approach recognising that permanent supply chain restructuring requires multi-year development periods. Chinese policy makers likely calculate that temporary accommodation preserves commercial relationships while Western alternatives remain limited, maintaining strategic influence during transition periods.

Future export policy evolution may target specific end-use applications rather than implementing blanket restrictions. This approach enables revenue maintenance from commercial applications while preserving leverage over strategic and defence-related sectors where alternatives remain constrained.

Investment and Financing Landscape

What Financial Mechanisms Support Western Rare Earth Development?

Government-backed financing mechanisms provide foundation for Western rare earth infrastructure development through risk mitigation unavailable in conventional commodity markets. The coordinated approach encompasses development finance, guaranteed pricing, and strategic investment frameworks addressing private capital concerns about Chinese competitive response, particularly as outlined in Australia's defense materials strategy.

Primary Funding Mechanisms:

- US Development Finance Corporation: $465 million loan approval for Serra Verde demonstrating international project support

- Pentagon guaranteed pricing: Multi-billion-dollar commitment framework providing long-term revenue certainty

- Private equity participation: Denham Capital, Energy and Minerals Group, and Vision Blue ownership demonstrating institutional confidence

- Strategic partnerships: Integration with defence supply chains providing procurement guarantee mechanisms

Vision Blue, led by former Xstrata head Mick Davis, brings significant mining industry expertise to Serra Verde development. The private equity consortium structure provides capital flexibility whilst government backing addresses political and commercial risks associated with rare earth market development.

How Do Institutional Investors View Rare Earth Security Risks?

Investment capital allocation increasingly prioritises supply chain resilience over pure cost optimisation reflecting institutional recognition of rare earth strategic importance. Traditional commodity investment models emphasising lowest-cost producers evolve toward security-focused approaches valuing supply diversification and geopolitical stability.

Investment Priority Evolution:

- Security premium: Institutional willingness to accept higher costs for supply chain diversification

- Long-term value: Recognition that rare earth assets provide strategic hedging against geopolitical disruption

- Technology integration: Investment in complete supply chain solutions rather than isolated mining operations

- Government coordination: Preference for projects with explicit government backing and strategic importance

Pension funds, sovereign wealth funds, and defence-focused investment vehicles demonstrate increased allocation toward rare earth infrastructure recognising that supply chain vulnerability creates systemic risk across technology and defence portfolios. This capital reallocation enables project financing despite higher development costs relative to Chinese alternatives.

Market Dynamics and Pricing Implications

What Factors Drive Heavy Rare Earth Premium Pricing?

Heavy rare earth elements command significant price premiums relative to light rare earth elements due to supply scarcity and specialised applications in high-performance permanent magnets. Dysprosium and terbium shortages create pricing pressure amplified by wind turbine demand growth and electric vehicle motor requirements.

Price Driver Analysis:

- Supply concentration: Limited global production capacity outside Chinese processing infrastructure

- Application specificity: Essential for high-temperature permanent magnet performance in wind turbines and electric vehicles

- Substitution limitations: No effective alternatives for critical applications requiring heavy rare earth magnetic properties

- Stockpiling demand: Strategic inventory building by defence and technology manufacturers

Wind turbine permanent magnet manufacturing represents primary demand driver creating structural supply-demand imbalance. Modern wind turbines require neodymium-iron-boron magnets with dysprosium additions maintaining magnetic strength at elevated operating temperatures exceeding 150 degrees Celsius common in commercial wind applications.

Electric vehicle motor demand compounds supply pressure as automotive manufacturers transition from traditional internal combustion engines toward permanent magnet electric motor architectures requiring heavy rare earth content for optimal performance and efficiency characteristics. This aligns with broader energy transition strategies targeting reduced carbon emissions.

How Might Diversified Supply Sources Affect Long-Term Pricing?

Increased competition among suppliers could moderate Chinese pricing power, though infrastructure development costs may maintain elevated price floors relative to historical levels. Government-backed pricing guarantees provide stability for long-term investment planning whilst creating artificial support mechanisms affecting market dynamics.

Pricing Evolution Scenarios:

- Moderate Chinese leverage: Additional supply sources reduce monopolistic pricing power

- Infrastructure cost floors: High development expenses for Western facilities maintain minimum price levels

- Government support mechanisms: Guaranteed pricing creates artificial market floors supporting investment

- Technology premium: Advanced environmental processing commands price premiums in Western markets

The transition period through 2030 likely maintains elevated pricing reflecting infrastructure development costs and limited alternative supply sources. Long-term pricing depends on successful commissioning of Western processing facilities and their ability to achieve cost competitiveness with Chinese operations.

Market segmentation may emerge with premium pricing for Western-processed materials targeting defence and critical infrastructure applications, whilst Chinese sources continue serving price-sensitive commercial applications where supply security represents lower priority.

Technology and Processing Innovation

What Environmental Advantages Do New Processing Methods Offer?

Advanced extraction techniques eliminate chemical flushing associated with traditional ionic clay processing, addressing environmental concerns whilst maintaining economic viability for Western operations. Serra Verde's several hundred million dollar investment in specialised processing infrastructure demonstrates commitment to sustainable extraction methodologies.

Environmental Processing Innovations:

- Closed-loop systems: Waste containment preventing chemical discharge into water systems

- Chemical recovery: Advanced separation techniques enabling process chemical reuse and recycling

- Water management: Integrated treatment systems eliminating surface water contamination risks

- Land restoration: Minimal surface disruption compared to traditional ionic clay extraction methods

Traditional ionic clay processing in China and Myanmar involves flushing deposits with chemicals causing water supply contamination and deforestation. Western facilities address these environmental concerns through advanced containment and treatment systems, though capital requirements increase significantly relative to conventional approaches.

How Do Processing Technology Transfers Affect Market Competition?

Proprietary separation technologies remain concentrated in Chinese facilities creating dependency even for Western-mined concentrates. Technology development initiatives aim to establish complete domestic processing capabilities, though expertise transfer requires significant time and capital investment.

Technology Development Challenges:

- Intellectual property: Critical separation techniques protected through patent systems and trade secrets

- Expertise transfer: Specialised technical knowledge requiring years of operational experience development

- Equipment manufacturing: Processing facility construction requiring specialised components and systems

- Process optimisation: Efficiency improvements demanding extensive operational refinement periods

Western processing facility development focuses on creating independent technological capabilities rather than relying on Chinese technology transfer. However, new restrictions on rare earth and magnet exports complicate technology acquisition efforts. This approach requires substantial research and development investment but provides long-term strategic independence from Chinese technological dependencies.

Future Supply Chain Scenarios

What Timeline Exists for Western Processing Independence?

Western rare earth processing independence represents multi-year transition requiring coordinated infrastructure development, technology advancement, and market development. The projected timeline spans 2025 through 2030 with gradual capability building rather than immediate Chinese dependency elimination, forming part of broader critical minerals strategy initiatives.

Development Milestone Projections:

- 2025-2026: Limited Western heavy rare earth processing capacity with continued Chinese dependency

- 2027-2028: Moderate supply diversification options enabling partial Chinese dependency reduction

- 2029-2030: Potential for significant Chinese dependency reduction across multiple rare earth categories

The timeline assumes successful commissioning of planned Western processing facilities without major technical or financing setbacks. Delays in facility development, technology acquisition, or government support mechanisms could extend Chinese dependency timelines significantly.

Critical Success Factors:

- Facility commissioning: Successful startup and optimisation of Western processing infrastructure

- Technology transfer: Acquisition or development of proprietary separation techniques

- Market development: Establishment of integrated supply chains from mining through end-user applications

- Government support: Continued policy backing through challenging development phases

How Might Chinese Policy Responses Evolve?

Beijing's strategic approach balances export revenue generation with geopolitical leverage maintenance requiring sophisticated policy calibration as Western alternatives develop. Future policy adjustments may target specific end-use applications whilst preserving commercial relationships in less sensitive sectors.

Potential Chinese Policy Evolution:

- Selective restrictions: Targeting defence and strategic applications whilst maintaining commercial supply relationships

- Pricing strategies: Using competitive pricing to maintain market share as Western capacity develops

- Technology barriers: Restricting processing equipment and expertise transfer to delay Western capability development

- Strategic partnerships: Developing relationships with non-Western markets reducing dependence on Western buyers

Chinese policy makers likely recognise that excessive export restrictions accelerate Western alternative development, potentially reducing long-term Chinese influence. Calibrated approaches maintaining commercial relationships whilst preserving strategic leverage represent optimal positioning during transition periods.

Investment Considerations and Risk Assessment

What Due Diligence Factors Should Investors Prioritise?

Rare earth investment success requires comprehensive evaluation encompassing technical feasibility, government policy support, environmental compliance, and long-term market positioning. Traditional mining investment criteria prove insufficient given unique characteristics of rare earth markets and strategic importance considerations.

Critical Evaluation Criteria:

- Processing technology access: Availability of proprietary separation techniques essential for commercial viability

- Government policy support: Explicit backing through financing, guaranteed pricing, or regulatory support

- Environmental compliance costs: Capital requirements for sustainable processing meeting Western regulatory standards

- Offtake agreement security: Long-term sales contracts providing revenue certainty and project financing capability

Risk Assessment Framework:

- Regulatory risk: Changing export control policies and international trade relationship evolution

- Technology risk: Processing technique effectiveness and intellectual property accessibility

- Market risk: Demand volatility and competitive response from established suppliers

- Execution risk: Facility development and operational optimisation success factors

How Do Currency Fluctuations Impact Rare Earth Investment Returns?

Multi-currency exposure affects operational costs and revenue streams creating additional complexity for rare earth investment returns. Projects spanning multiple jurisdictions with varying monetary policies require sophisticated hedging strategies addressing exchange rate volatility.

Currency Risk Considerations:

- Operational currency: Mining and processing costs denominated in local currencies

- Sales currency: Revenue streams potentially denominated in multiple currencies based on buyer locations

- Financing currency: Debt service requirements potentially mismatched with revenue currencies

- Hedging costs: Financial instruments protecting against currency volatility reducing net returns

Serra Verde's Brazilian operations with US dollar financing and multiple currency buyers exemplify complex currency exposure requiring active management. Investment returns depend significantly on Brazilian real, US dollar, and buyer currency relationships affecting both operational costs and revenue realisation.

Disclaimer: This analysis contains forward-looking statements and projections that involve inherent risks and uncertainties. Actual results may differ materially from those projected. Readers should conduct their own due diligence and consult qualified professionals before making investment decisions. The rare earth market involves significant political, technological, and commercial risks that could impact investment outcomes.

The rare earth sector undergoes fundamental transformation as traditional supply chain architectures face systematic restructuring. Consequently, china rare earth offtake deals represent just one element of broader supply chain reconfiguration affecting global technology manufacturing. China's temporary export control suspension through November 2026 provides strategic development window, yet underlying supply vulnerabilities persist across critical technology and defence applications. Investment opportunities emerge for projects demonstrating genuine supply diversification capabilities, though execution risks remain substantial given technological complexity and evolving regulatory environments.

Success in this evolving landscape requires understanding immediate market dynamics whilst positioning for long-term geopolitical implications. The transition from concentrated dependency toward diversified supply chains represents multi-year process with profound implications for technology manufacturers, defence contractors, and renewable energy developers. Strategic positioning during this transition period may determine competitive advantage for decades ahead as rare earth supply chains achieve new equilibrium configurations.

Ready to Invest in the Next Major Mineral Discovery?

Discovery Alert instantly alerts investors to significant ASX mineral discoveries using its proprietary Discovery IQ model, turning complex mineral data into actionable insights just like the rare earth supply chain transformations outlined above. Understand why major mineral discoveries can generate substantial returns by exploring historic examples, then begin your 30-day free trial today to position yourself ahead of the market with real-time alerts on breakthrough announcements.