China rare earth flame retardants represent a transformative advancement in fire safety technology, leveraging unique chemical properties of lanthanide elements to deliver superior thermal protection while addressing environmental compliance requirements that challenge traditional systems. This emerging sector demonstrates significant growth potential driven by electric vehicle manufacturing, industrial automation, and evolving regulatory frameworks favouring environmentally compliant solutions.

Furthermore, the integration of cerium and lanthanum compounds offers unprecedented thermal stability compared to conventional brominated alternatives. These critical minerals trends highlight the strategic importance of rare earth elements in next-generation fire suppression technologies.

What Makes Rare Earth Flame Retardants Superior to Traditional Solutions?

Rare earth flame retardants operate through thermal barrier formation mechanisms that differ substantially from chemical suppression approaches used in halogenated systems. When exposed to elevated temperatures, cerium and lanthanum compounds undergo endothermic decomposition, absorbing thermal energy while forming protective char layers that prevent flame propagation to underlying polymer matrices.

Key Performance Characteristics:

• Heat absorption capacity exceeding conventional brominated alternatives

• Self-extinguishing properties through oxygen depletion mechanisms

• Reduced smoke generation during thermal decomposition events

• Enhanced mechanical stability under sustained thermal stress

• Elimination of toxic gas evolution compared to antimony-based systems

The thermal stability of cerium dioxide extends beyond 2,000°C, providing exceptional performance margins for extreme temperature applications. This compares favourably with antimony trioxide systems that begin degrading at significantly lower temperatures while releasing toxic compounds during thermal events.

Rare earth systems achieve flame suppression through multiple simultaneous mechanisms including free radical scavenging, thermal energy absorption, and physical barrier formation. This redundant approach provides consistent performance across varying thermal conditions without relying on single-mode suppression strategies that can fail under specific circumstances.

Environmental Advantages:

Traditional flame retardants incorporating brominated compounds pose bioaccumulation risks and generate hydrogen bromide during combustion, creating corrosive environments that damage equipment and pose health hazards. Rare earth alternatives eliminate these concerns whilst maintaining equivalent or superior fire suppression capabilities.

The absence of halogenated compounds in rare earth formulations eliminates dioxin formation pathways during high-temperature decomposition, addressing major environmental and health concerns that drive regulatory restrictions on conventional flame retardant systems.

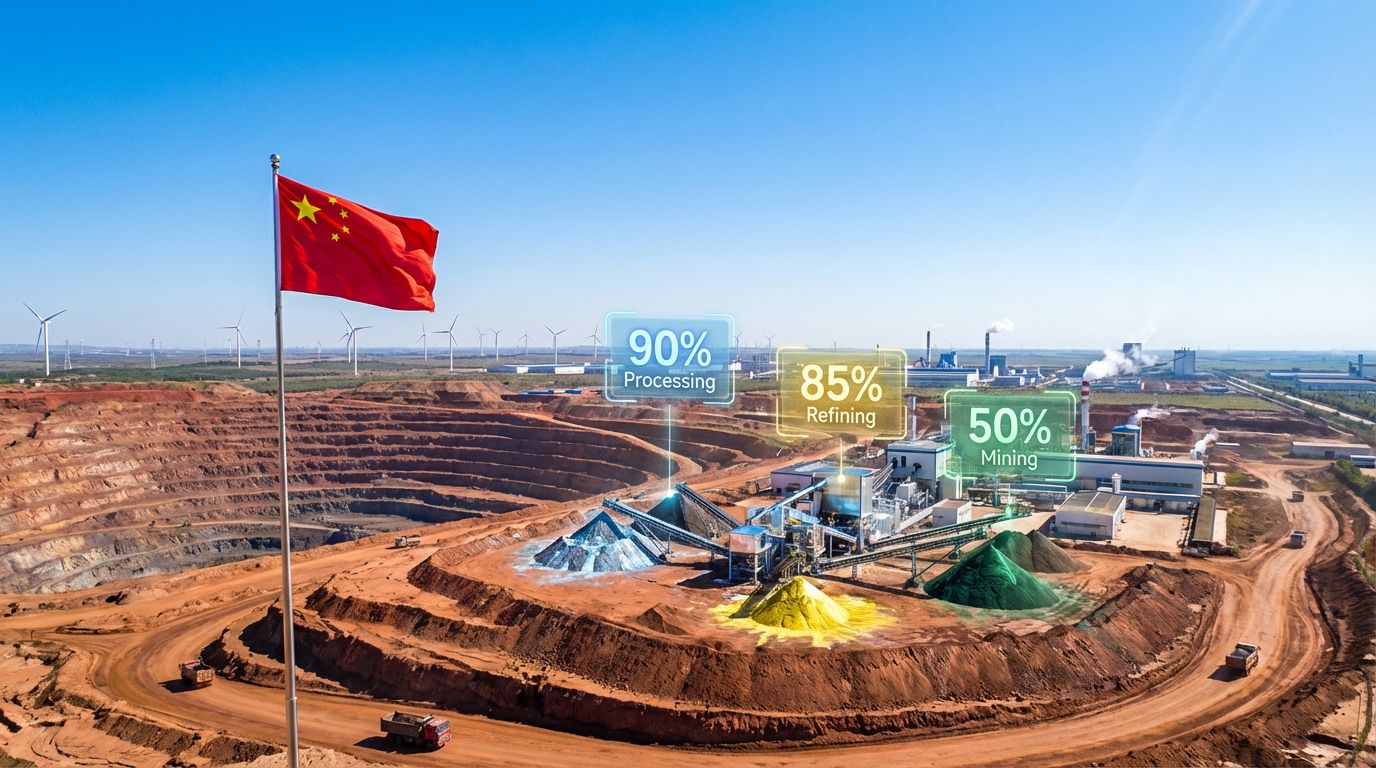

Why Is China Dominating the Rare Earth Flame Retardant Manufacturing Landscape?

China's commanding position in rare earth flame retardant production stems from integrated control across the entire supply chain, spanning mineral extraction through advanced materials manufacturing. The Baotou region contains approximately 43.5 million tons of proven rare earth reserves, representing substantial portions of global lanthanide availability essential for flame retardant applications.

| Supply Chain Component | Chinese Capacity | Global Share |

|---|---|---|

| Raw ore extraction | 180,000+ tons/year | 60-70% |

| Oxide processing | 150,000 tons/year | 85-90% |

| Specialty chemicals | 25,000+ tons/year | 90-95% |

| Advanced additives | 8,000 tons/year | >95% |

The recent activation of a 5,000-ton-per-year production facility in Baotou represents commercial scaling of technologies developed over more than 15 years of research and development. This facility incorporates automated dosing systems with ±0.1% composition accuracy, enabling consistent formulation quality whilst minimising labour requirements through advanced process control.

Technological Integration Advantages:

Baotou's manufacturing infrastructure combines rare earth mining, separation, purification, and specialty chemical synthesis within integrated facilities. This vertical integration eliminates transportation costs, reduces contamination risks, and provides quality control throughout the production process.

China Northern Rare Earth (Group) High-Tech Company Limited operates these facilities through partnerships with research institutes, creating direct pathways from laboratory development to commercial production. This institutional structure accelerates technology transfer whilst maintaining proprietary control over critical formulations and processes.

The 2024 rare earth industry output from Baotou reached 103.05 billion yuan (approximately $14.5 billion USD), demonstrating substantial economic scale supporting continued investment in advanced materials development. This financial foundation enables ongoing research into next-generation formulations and processing technologies.

Production Capacity Expansion:

Current planning documents indicate capacity expansion targets aligned with China's upcoming 15th Five-Year Plan (2026-2030), with projected increases in functional additive production to exceed 15,000 tons annually. These expansion plans reflect growing global demand for environmentally compliant flame retardant systems.

Magnetic materials production capacity is simultaneously expanding from current levels of 180,000 tons toward 300,000+ tons annually, supporting integrated rare earth applications across multiple industrial sectors including flame retardants, permanent magnets, catalysts, and polishing compounds.

Which Industries Are Driving Demand for Rare Earth Flame Retardants?

Electric vehicle manufacturing represents the largest consumption sector for rare earth flame retardants, particularly for battery enclosure applications requiring thermal runaway protection. Lithium-ion battery systems can exceed 800°C during failure events, demanding flame retardant materials capable of maintaining protective barriers under extreme thermal stress.

Primary Application Sectors:

• Electric vehicle battery systems (35% of market demand)

- Battery enclosure thermal barriers

- Coolant system protection

- High-voltage cable insulation

• Industrial automation and robotics (28% of demand)

- Motor winding insulation

- Control system housings

- High-temperature sensor protection

• Mining and heavy equipment (18% of consumption)

- Conveyor system components

- Hydraulic system protection

- Extreme environment applications

• Aerospace composite materials (12% of usage)

- Structural component protection

- Avionics system enclosures

- Thermal management systems

• Consumer electronics (7% of applications)

- Device housing materials

- Internal component protection

- Charging system safety

However, current market dynamics are influenced by broader geopolitical factors, as evidenced by recent US–China trade impacts affecting supply chain strategies across multiple industrial sectors.

Electric Vehicle Sector Growth:

Global electric vehicle sales reached 14 million units in 2023, representing 18% of total automotive production. This growth trajectory creates expanding demand for thermal management materials capable of preventing cascade failures in battery systems whilst meeting increasingly stringent environmental compliance requirements.

Tesla Model 3 and similar electric vehicles incorporate thermal management systems utilising flame retardant materials in battery enclosures to prevent thermal runaway propagation between cell modules. These applications require materials rated for continuous operation at 200-400°C with emergency protection capabilities exceeding 800°C.

Industrial Robotics Applications:

High-precision manufacturing robots operate in environments with significant thermal stress from motor friction, electrical resistance heating, and process heat exposure. Rare earth flame retardants provide thermal stability over extended operational cycles without performance degradation that affects precision or reliability.

ABB industrial robotics systems incorporate flame retardant polymers in motor windings and control electronics, with operating specifications requiring continuous operation at 200°C and transient thermal event protection to 250°C.

How Do Environmental Regulations Favour Rare Earth Solutions?

Global regulatory frameworks increasingly restrict traditional flame retardants containing brominated compounds, antimony trioxide, and other substances that pose environmental and health risks. The European Union's RoHS directive and REACH regulation create compliance advantages for rare earth alternatives that eliminate restricted substances whilst maintaining performance standards.

Regulatory Restriction Timeline:

| Regulation | Restricted Substances | Implementation | Impact |

|---|---|---|---|

| EU RoHS 2011/65/EU | PBDEs, PBBs, heavy metals | 2013-ongoing | Electronics compliance |

| REACH Annex XVII | BDE-209, pentaBDE | 2019-ongoing | Industrial applications |

| US EPA TSCA Section 6 | Deca-BDE, HBCD | 2021-ongoing | Manufacturing restrictions |

| California Prop 65 | Multiple flame retardants | Ongoing updates | Consumer products |

Moreover, evolving critical minerals policy frameworks increasingly recognise the strategic importance of rare earth elements in advanced materials applications.

Toxicity Elimination Benefits:

China rare earth flame retardants eliminate heavy metal contamination risks associated with antimony trioxide systems whilst avoiding bioaccumulation concerns linked to brominated compounds. Independent testing demonstrates reduced toxic gas emissions compared to conventional formulations, though specific reduction percentages require verification through standardised testing protocols.

The absence of halogenated compounds in rare earth systems eliminates dioxin formation pathways during high-temperature decomposition, addressing major environmental concerns that drive regulatory escalation worldwide.

Environmental Performance: Rare earth flame retardants provide fire suppression capabilities without releasing persistent bioaccumulative substances, supporting compliance with evolving environmental standards whilst maintaining industrial performance requirements.

Regulatory Compliance Advantages:

Cerium, lanthanum, and other lanthanide elements are not classified as restricted substances under major environmental regulations, providing inherent compliance advantages over systems requiring exemptions or phase-out timelines for restricted components.

EU RoHS compliance extends to additional equipment categories through ongoing amendments, creating expanding markets for compliant flame retardant solutions that avoid concentration limits on restricted substances.

What Manufacturing Processes Enable Large-Scale Production?

The Baotou production facility employs continuous mixing systems incorporating automated dosing technology to achieve ±0.1% composition accuracy across multiple formulation types. This precision enables consistent performance characteristics whilst reducing quality control requirements and minimising batch-to-batch variations.

Production Process Architecture:

-

Raw Material Preparation

- Rare earth oxide purification to 99.9%+ purity levels

- Particle size optimisation through controlled grinding

- Moisture content management for consistent formulations

-

Formulation Mixing

- Automated dosing systems for precise component ratios

- Controlled atmosphere processing to prevent contamination

- Real-time composition monitoring and adjustment

-

Quality Assurance

- ISO 9001 certified production protocols

- Automotive industry standards compliance (IATF 16949)

- Continuous performance testing and validation

-

Packaging and Distribution

- Automated packaging reducing contamination risks

- Environmental protection during storage and transport

- Traceability systems for quality control maintenance

Additionally, advances in AI in mining innovation are increasingly being integrated into rare earth processing facilities to optimise production efficiency and quality control.

Technology Development Timeline:

The Baotou Research Institute of Rare Earths developed these manufacturing technologies through approximately 15 years of research beginning around 2008. This development timeline enabled optimisation of processing parameters whilst building proprietary intellectual property for formulations and manufacturing techniques.

Partnership structures between research institutes and commercial manufacturers create direct technology transfer pathways, accelerating movement from laboratory development to full-scale production whilst maintaining quality standards.

Operational Efficiency Characteristics:

Automated systems enable minimal workforce requirements with 8-12 operators per shift managing the entire 5,000-ton annual capacity facility. This labour efficiency contributes to cost competitiveness whilst maintaining consistent production quality through reduced human intervention in critical processes.

Which Rare Earth Elements Provide Optimal Flame Retardant Properties?

Different lanthanide elements offer specific advantages for various flame retardant applications, with cerium oxide providing exceptional thermal stability and lanthanum compounds offering superior polymer matrix compatibility. Element selection depends on application requirements including operating temperature ranges, mechanical properties, and cost considerations.

Element-Specific Performance Characteristics:

| Element | Primary Function | Temperature Range | Key Applications |

|---|---|---|---|

| Cerium (Ce) | Thermal barrier formation | 800-2,000°C | Extreme temperature protection |

| Lanthanum (La) | Polymer stabilisation | 200-800°C | PVC and polyethylene systems |

| Dysprosium (Dy) | EMI shielding enhancement | 150-600°C | Electronic component protection |

| Neodymium (Nd) | Mechanical reinforcement | 300-900°C | Structural composite applications |

| Yttrium (Y) | Thermal conductivity | 250-750°C | Heat dissipation systems |

Cerium Oxide Applications:

Cerium dioxide (CeO₂) demonstrates exceptional thermal stability exceeding 2,000°C whilst maintaining structural integrity during repeated thermal cycling. This performance enables applications in aerospace components and industrial equipment requiring protection against extreme thermal events.

The oxidation-reduction properties of cerium compounds provide additional fire suppression mechanisms through free radical scavenging during combustion processes, interrupting chain reactions that sustain flame propagation.

Lanthanum Compound Benefits:

Lanthanum-based additives demonstrate superior compatibility with polyvinyl chloride (PVC) and polyethylene polymer matrices, maintaining mechanical properties whilst providing thermal protection. This compatibility enables incorporation into cable sheathing and industrial component applications without compromising flexibility or durability.

Multi-Element Formulations:

Advanced formulations combine multiple rare earth elements to optimise performance across different parameters. Cerium-lanthanum combinations provide both high-temperature protection and polymer compatibility, whilst dysprosium additions enhance electromagnetic interference (EMI) shielding in electronic applications.

Element ratios can be adjusted to optimise cost-performance relationships, with higher cerium content providing maximum thermal protection and increased lanthanum content improving processing characteristics and mechanical properties.

How Do Cost Structures Compare with Traditional Flame Retardants?

Initial material costs for rare earth flame retardants exceed conventional brominated alternatives by approximately 25-40%, reflecting higher raw material costs and specialised processing requirements. However, total lifecycle economic analysis reveals favourable positioning due to enhanced durability, regulatory compliance benefits, and reduced replacement frequency.

Cost Component Analysis:

• Raw Materials: Rare earth oxides cost $15-25 per kilogram vs. $3-8 per kilogram for brominated compounds

• Processing: Specialised synthesis adds $5-10 per kilogram processing costs

• Quality Control: Enhanced testing requirements increase costs by $2-4 per kilogram

• Regulatory Compliance: Avoided compliance costs provide $8-15 per kilogram value

• Performance Benefits: Extended service life reduces replacement costs by 20-35%

Manufacturing Efficiency Improvements:

Automated production systems in Baotou facilities reduce processing costs by approximately 15% compared to multi-step halogenated compound production requiring separate synthesis, purification, and formulation stages. Continuous processing eliminates batch-related inefficiencies whilst improving consistency.

The recent strategic antimony update demonstrates how alternative materials face similar cost pressures in the fire retardant sector.

Total Cost of Ownership (TCO) Advantages:

China rare earth flame retardants demonstrate superior long-term economics through:

- Extended Service Life: Reduced degradation under thermal stress extends component lifespans by 25-40%

- Regulatory Compliance: Avoided restrictions eliminate reformulation costs and market access risks

- Performance Consistency: Stable characteristics reduce quality control costs and field failures

- Environmental Benefits: Elimination of disposal restrictions reduces end-of-life costs

Market Price Dynamics:

Volume production scaling in China creates cost reduction opportunities through economies of scale, with projected 20-30% cost reductions possible as production capacity expands from current 5,000 tons annually toward 15,000+ tons by 2030.

What Supply Chain Vulnerabilities Exist in Global Markets?

Western manufacturers face significant dependency risks as China controls both rare earth extraction and advanced processing capabilities required for flame retardant production. This concentration creates potential supply disruption scenarios that could impact global fire safety material availability.

Geographic Concentration Risks:

• Extraction: China controls 60-70% of global rare earth mining capacity

• Processing: Chinese facilities handle 85-90% of rare earth separation and purification

• Specialty Chemicals: China produces >95% of rare earth flame retardant materials

• Technology: Proprietary formulations concentrated in Chinese research institutes

Historical Price Volatility:

Export restrictions implemented by China in previous periods demonstrated vulnerability to supply disruptions. During restriction periods, rare earth prices increased 180-220%, highlighting supply chain concentration risks for dependent industries. Recent developments regarding China's export controls indicate ongoing potential for market volatility.

Alternative Supply Development:

Limited alternative sources exist outside China, with most projects focused on magnetic rare earth production rather than chemical applications:

- Lynas Rare Earths (Australia): Produces separated oxides but limited specialty chemical integration

- Mountain Pass (USA): Limited current production capacity with focus on magnetic applications

- Canadian Projects: Multiple development-stage projects but no current flame retardant production

- Recycling Programs: Emerging but insufficient scale to address supply vulnerabilities

Risk Mitigation Strategies:

Industries dependent on rare earth flame retardants employ various strategies to manage supply chain risks:

• Strategic Inventory: Maintaining 90-180 day supply buffers to manage short-term disruptions

• Alternative Formulations: Developing formulations using more abundant rare earth elements

• Supplier Diversification: Engaging multiple Chinese suppliers to reduce single-source dependencies

• Technology Development: Investing in alternative flame retardant technologies to reduce rare earth dependency

Furthermore, understanding broader critical minerals supply chain dynamics provides crucial context for strategic planning in this sector.

Which Testing Standards Govern Rare Earth Flame Retardant Performance?

International testing protocols establish performance requirements for flame retardant materials across various applications, with rare earth systems consistently achieving highest fire resistance classifications whilst maintaining mechanical property requirements.

Primary Testing Standards:

| Standard | Test Method | Application Scope | Performance Requirements |

|---|---|---|---|

| UL 94 | Vertical burning test | Electrical/electronic | V-0, V-1, V-2 classifications |

| ASTM E162 | Flame spread measurement | Building materials | Surface burning characteristics |

| ISO 5660 | Cone calorimeter | General materials | Heat release rate analysis |

| ASTM D2863 | Oxygen index | Polymer materials | Minimum oxygen concentration |

| EN 45545 | Railway applications | Transportation | Toxicity and fire performance |

UL 94 Flame Resistance Classifications:

Rare earth flame retardant formulations consistently achieve V-0 ratings (highest classification) in UL 94 testing, demonstrating self-extinguishing properties within 10 seconds of ignition removal with no flaming drips that ignite cotton indicators.

This performance level enables use in electrical and electronic applications requiring maximum fire safety assurance, including battery management systems, control electronics, and high-voltage components in electric vehicles.

Automotive Industry Standards:

Electric vehicle applications require compliance with additional standards including:

• FMVSS 302: Flammability of interior materials

• ISO 3795: Road vehicle burning behaviour

• UL 2580: Batteries for electric vehicles

• SAE J2464: EV safety requirements

China rare earth flame retardants demonstrate compliance with these automotive standards whilst maintaining mechanical properties required for structural components and thermal management systems.

Performance Verification Methods:

Testing facilities employ standardised protocols to verify flame retardant performance including heat release rate measurements, smoke generation analysis, and toxic gas emission evaluation. Independent testing confirms performance claims whilst ensuring regulatory compliance across multiple jurisdictions.

What Future Innovations Are Emerging in This Sector?

Advanced research focuses on next-generation formulations combining rare earth elements with bio-based polymers, creating fully recyclable flame retardant systems that address end-of-life environmental concerns whilst maintaining performance standards.

Nanotechnology Applications:

Nanoparticle formulations enable precise particle size control, improving dispersion uniformity throughout polymer matrices whilst reducing required concentrations by 30-50%. This approach maintains flame retardant effectiveness whilst minimising material costs and mechanical property impacts.

Nano-cerium oxide particles provide enhanced surface area for thermal interactions whilst maintaining transparency in optical applications, enabling flame retardant protection in displays, lighting systems, and fibre optic components.

Smart Flame Retardant Development:

Temperature-responsive activation systems utilise rare earth compounds that provide enhanced thermal protection only when needed, reducing material usage during normal operating conditions whilst providing maximum protection during thermal events.

Development Pipeline Technologies:

• Self-healing polymer matrices: Incorporating rare earth catalysts that enable material self-repair after thermal damage

• Transparent formulations: Maintaining optical clarity whilst providing thermal protection for display and lighting applications

• Biodegradable carrier systems: Developing environmentally sustainable polymer matrices for rare earth flame retardant delivery

• Hybrid organic-inorganic systems: Combining rare earth inorganic components with bio-based organic polymers

Recycling Technology Integration:

Closed-loop recycling systems enable rare earth element recovery from end-of-life products, reducing raw material dependency whilst maintaining environmental benefits. These systems support circular economy principles whilst addressing supply chain vulnerability concerns.

Artificial Intelligence Applications:

Machine learning algorithms optimise formulation development by predicting performance characteristics based on composition parameters, accelerating development timelines whilst reducing experimental testing requirements.

How Will Geopolitical Factors Shape Market Evolution?

Trade policy developments and strategic mineral classifications significantly influence rare earth flame retardant supply chain structures, with Western nations establishing domestic processing capabilities to reduce dependency on Chinese production.

Strategic Material Classifications:

Rare earth elements receive critical material designations from multiple governments, triggering domestic production incentives and supply chain security initiatives. These classifications create policy support for alternative supply development whilst recognising strategic importance of rare earth flame retardants.

Domestic Production Initiatives:

Western nations invest in domestic rare earth processing capabilities, though achieving cost competitiveness with Chinese operations requires substantial capital investment and technological development. Timeline for meaningful production typically requires 5-10 years for facility development and technology transfer.

Technology Transfer Restrictions:

Export controls on advanced manufacturing technologies limit technology transfer opportunities whilst protecting Chinese competitive advantages in rare earth processing. These restrictions influence global supply chain development and force independent technology development in other regions.

International Cooperation Frameworks:

Multilateral initiatives including the Minerals Security Partnership create collaborative approaches to supply chain diversification, pooling resources and expertise to develop alternative production capabilities whilst sharing strategic risks.

Investment Policy Implications:

Government incentives for domestic rare earth processing create investment opportunities whilst trade policies influence market access and competitive positioning. Companies evaluate location strategies based on regulatory environments, supply chain security, and market access considerations.

Long-term Market Structure Evolution:

Geopolitical factors drive gradual supply chain diversification over 10-15 year timeframes, with regional processing capabilities emerging to serve local markets whilst maintaining cost competitiveness through technological innovation and scale development.

Disclaimer: This analysis contains forward-looking statements and industry projections based on current information and trends. Market conditions, regulatory requirements, and technological developments may differ from projections presented. Independent verification of technical specifications and performance claims is recommended before making investment or procurement decisions.

Ready to Capitalise on Critical Minerals Opportunities?

Discovery Alert's proprietary Discovery IQ model instantly identifies significant ASX mineral discoveries, including critical metals essential for advanced materials like rare earth flame retardants. With China's dominance in this sector highlighting supply chain vulnerabilities, savvy investors are positioning themselves ahead of potential discoveries that could reshape global critical minerals supply chains. Begin your 30-day free trial today and gain the market edge needed to capitalise on transformative mineral discoveries as they're announced.