China's rare earth supply chain strategy represents the most sophisticated integration of natural resource advantages with industrial policy in modern economic history. Through decades of coordinated development across mining, processing, manufacturing, and export management, the nation has constructed a comprehensive ecosystem that shapes global technology competition at its most fundamental level. Furthermore, China's export controls have become increasingly important tools for maintaining strategic leverage.

This concentration creates unprecedented leverage opportunities that extend far beyond traditional commodity markets into the realm of technological sovereignty and economic statecraft. In addition, critical minerals energy security has emerged as a cornerstone of national strategic planning across developed nations.

Understanding China's Multi-Layered Resource Dominance Framework

The architecture of China's critical materials strategy operates through multiple interconnected layers that create redundant advantages across the entire value chain. This approach transcends simple resource extraction to encompass technological development, industrial integration, and strategic export management in a coordinated system designed for maximum leverage.

China's geological advantages center on the Bayan Obo mine in Inner Mongolia, which contains approximately 37 million metric tons of rare earth oxide equivalent reserves according to U.S. Geological Survey data. This represents roughly 37% of global reserves in a single location, providing both scale advantages and strategic concentration that no other nation can match.

However, the true strategic advantage lies not in geological endowment but in the systematic industrial development built around these resources. During the 14th Five-Year Plan period (2021-2025), state-owned enterprises like Baogang Group achieved massive expansions of processing capacity while simultaneously developing advanced recycling operations reaching tens of thousands of tons annually.

The integration of primary mining with secondary recovery creates a dual-sourced supply system that reduces dependency on geological extraction while maintaining production flexibility. This approach demonstrates the sophisticated planning horizon that characterizes China's resource strategy, extending beyond immediate market conditions to long-term strategic positioning.

Environmental management represents another layer of strategic advantage. While Western nations face significant regulatory constraints on rare earth processing due to radioactive waste generation and chemical contamination, Chinese operations benefit from more flexible environmental frameworks that enable cost-effective processing at scale.

What Are the Core Pillars of China's Rare Earth Strategic Architecture?

Vertical Integration Across the Value Chain

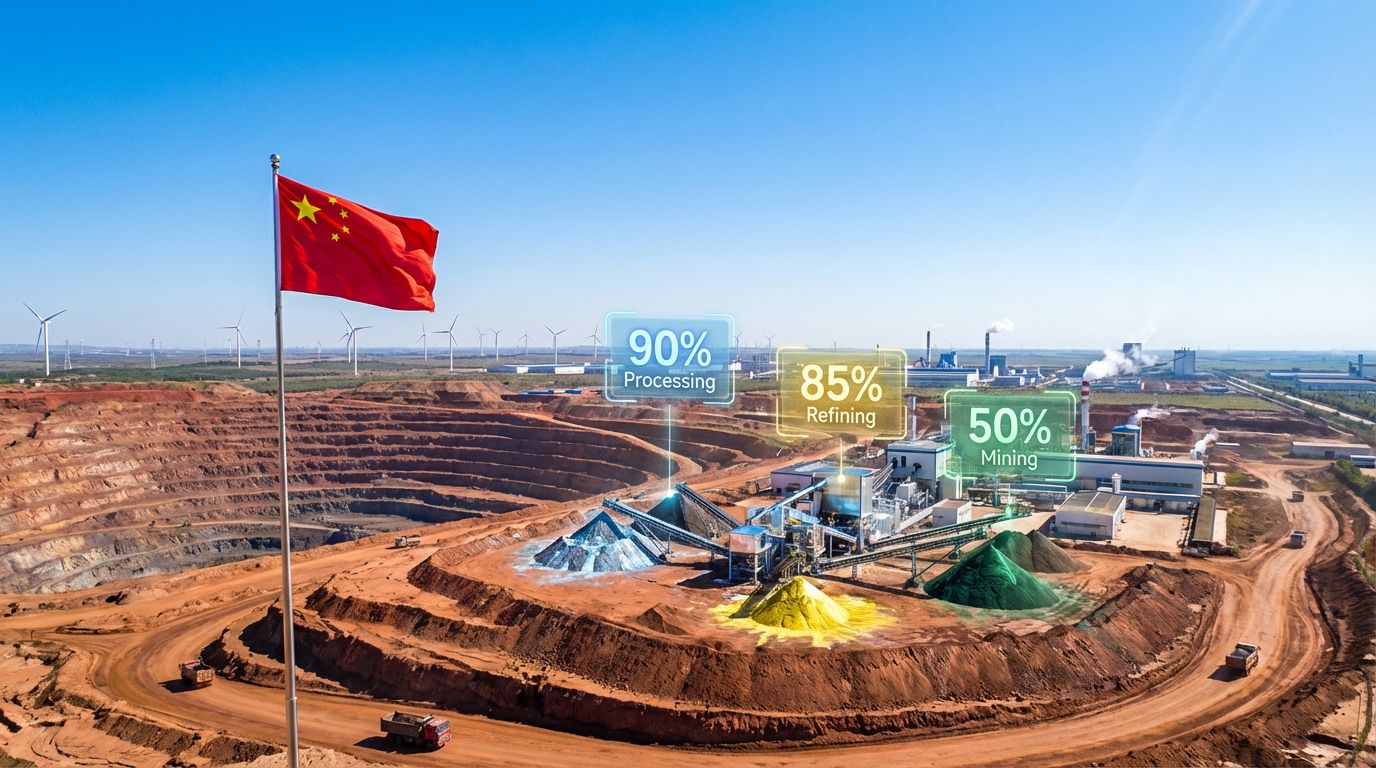

China's dominance extends across every stage of rare earth production, from initial mining through final magnet manufacturing. According to the U.S. Geological Survey, China produced approximately 70% of global rare earth oxide production in 2023, while processing an estimated 85-90% of globally mined rare earth concentrates regardless of origin country.

This vertical integration creates multiple strategic advantages:

• Value capture maximisation – Profit retention across all production stages rather than single-stage participation

• Supply chain control – Ability to prioritise domestic manufacturing over export sales during capacity constraints

• Technical knowledge accumulation – Process expertise developed across the entire value chain rather than specialised segments

• Cost structure optimisation – Internal transfer pricing that enables competitive positioning against fragmented international competitors

Baogang Group exemplifies this integrated approach, operating mining, separation, refining, alloy production, and magnet manufacturing within a coordinated organisational structure. During the 14th Five-Year Plan, the company achieved 100,000 tons annual rare earth magnet production capacity, establishing unprecedented scale in permanent magnet manufacturing.

The integration extends beyond traditional manufacturing to include advanced recycling operations. China has developed sophisticated electronic waste processing capabilities that recover rare earth elements from discarded electronics, creating secondary supply sources that supplement primary mining operations.

Western competitors typically operate individual production stages separately, creating structural disadvantages in competition with integrated Chinese entities. Mining companies like MP Materials Corporation operate extraction facilities without downstream manufacturing capabilities, while magnet manufacturers depend on Chinese processing capacity for raw materials.

Advanced Processing Technology Monopolisation

The technical complexity of rare earth separation represents one of the most significant barriers to international competition. Individual rare earth elements possess nearly identical chemical properties, requiring sophisticated solvent extraction, precipitation, and ion-exchange methodologies that are capital-intensive and generate hazardous waste streams.

China's separation dominance reflects decades of operational experience and proprietary technology development. Recent technological achievements include:

• 99.999% purity rare earth metal targets – Exceeding commercial requirements for specialised applications

• Kilogram-scale high-purity scandium oxide production – Advanced processing of one of the most challenging rare earth elements

• Integrated solid-state hydrogen storage systems – Demonstrating advanced materials applications beyond traditional markets

• World's first 5G unmanned rare earth mining operation – Integration of digital technologies with extraction operations

These technological capabilities create intellectual property barriers that complement geological advantages. While rare earth deposits exist globally, the technical expertise to efficiently separate, purify, and process rare earth elements remains concentrated in Chinese operations.

The environmental integration of processing technology represents another competitive advantage. Chinese facilities have developed separation techniques optimised for local regulatory frameworks and waste management systems, creating cost structures that Western competitors struggle to match under stricter environmental regulations.

Process optimisation has enabled Chinese operations to achieve 90%+ of rare earth permanent magnet production and 95%+ of rare earth metal alloy manufacturing according to industry analysis. This concentration in high-value manufacturing stages ensures maximum economic benefit from geological resources.

How Do Export Controls Function as Economic Statecraft Tools?

Licensing-Based Market Management

China's 2024-2025 expansion of export controls represents a sophisticated approach to supply chain leverage that maintains market functionality while enabling strategic restriction. The April 2024 announcement introduced licensing requirements for seven heavy rare earth elements, followed by October 2024 extensions to five additional elements with extraterritorial reach affecting foreign-made products.

This licensing system creates multiple strategic advantages:

• Selective allocation capability – Licence quantities can prioritise allies while restricting competitors

• Negotiating leverage – Export permissions become tools in trade disputes and diplomatic negotiations

• Market stability maintenance – Licensing avoids complete supply disruption while enabling strategic control

• Information asymmetry – Quota transparency remains limited, creating uncertainty for international manufacturers

The extraterritorial extension represents significant escalation because it applies licensing requirements to finished products containing rare earth elements. This means foreign manufacturers using Chinese rare earth materials cannot export finished goods without Chinese licensing approval, effectively extending control beyond raw materials to manufactured products.

Historical precedent demonstrates the effectiveness of this approach. During 2010 rare earth export restrictions related to territorial disputes with Japan, official quotas reduced from 50,287 tons (2009) to 30,258 tons (2010), creating immediate supply pressures and price increases that influenced diplomatic negotiations.

Strategic Timing and Market Signalling

The timing of export control announcements reveals deliberate coordination with geopolitical events rather than purely economic considerations. April 2024 controls coincided with escalating U.S. semiconductor export restrictions targeting Chinese advanced chip manufacturers, while October 2024 extensions occurred during ongoing US-China trade impacts discussions.

This strategic timing functions as market signalling that communicates several messages:

• Deterrence capability – Demonstrates willingness to deploy supply restrictions in response to technological competition

• Escalation potential – Shows ability to expand controls from raw materials to manufactured goods

• Sustained commitment – Maintaining restrictions over months demonstrates resolve rather than temporary posturing

• Retaliation capacity – Establishes credible threat environment for future trade negotiations

Market responses to export control announcements typically include immediate price increases in rare earth futures markets, equity appreciation for non-Chinese rare earth producers, and supply chain adjustments by downstream manufacturers seeking alternative sources or strategic inventory accumulation.

What Role Does Technological Self-Reliance Play in Long-Term Strategy?

Innovation-Driven Competitive Moats

China's approach to technological self-reliance in rare earth applications extends beyond maintaining current advantages to developing breakthrough technologies that widen competitive gaps. The integration of advanced manufacturing, digital technologies, and materials science creates multiple innovation vectors that reinforce strategic positioning.

Digital transformation represents a key competitive differentiator. Baogang Group's development of the world's first 5G unmanned rare earth mining operation demonstrates integration of telecommunications infrastructure with extraction operations. This approach enables remote monitoring, automated processing, and data analytics that optimise production efficiency while reducing labour costs.

The establishment of a 20,000P industrial computing centre within rare earth operations indicates systematic application of artificial intelligence and machine learning to geological analysis, processing optimisation, and quality control. These technological investments create proprietary advantages that cannot be easily replicated by international competitors.

Materials science advancement focuses on developing applications that require Chinese rare earth processing capabilities. The achievement of 99.999% purity rare earth metal targets enables specialised applications in quantum computing, advanced optics, and precision manufacturing that create new markets dependent on Chinese supply chains.

Digital Transformation of Mining Operations

The integration of Industry 4.0 technologies into rare earth extraction represents a fundamental shift toward automated, data-driven mining operations that enhance both efficiency and strategic control. Advanced sensor networks, satellite monitoring, and predictive analytics enable optimisation of extraction patterns, processing parameters, and inventory management.

5G network integration enables real-time data transmission from remote mining operations to centralised processing facilities, allowing coordinated optimisation across the entire production system. This connectivity creates operational advantages while providing detailed monitoring of resource flows for strategic planning purposes.

Artificial intelligence applications in geological analysis improve resource identification, extraction efficiency, and processing yield optimisation. Machine learning algorithms applied to separation processes enable continuous improvement of technical performance while reducing waste generation and environmental impact.

The digital transformation creates proprietary operational advantages that complement geological and processing technology advantages. International competitors seeking to establish alternative supply chains must invest not only in traditional mining and processing infrastructure but also in sophisticated digital systems that match Chinese operational capabilities.

How Does Geographic Dependency Create Strategic Vulnerabilities?

Myanmar Supply Chain Dependencies

Despite domestic advantages, China relies heavily on Myanmar for specific heavy rare earth elements, particularly dysprosium and terbium essential for high-performance permanent magnets. This dependency creates potential vulnerabilities in China's otherwise integrated supply chain strategy.

Myanmar's contribution to Chinese rare earth supply includes:

• Heavy rare earth concentrates – Elements not available in sufficient quantities from domestic Chinese sources

• Cost-effective extraction – Lower labour and regulatory costs compared to expanding domestic production

• Geographic proximity – Reduced transportation costs and logistics complexity

• Political alignment – Favourable bilateral relationships that ensure supply reliability

However, this dependency creates several risk factors that could disrupt Chinese supply chains:

Political instability in Myanmar affects mining operations and cross-border logistics, particularly in regions where rare earth deposits are located near areas of civil conflict.

Environmental concerns increasingly limit extraction capacity as international pressure mounts regarding environmental and social impacts of mining operations in Myanmar.

Infrastructure constraints in cross-border logistics create bottlenecks that could be exploited by adversaries seeking to disrupt Chinese supply chains.

Diversification Through International Partnerships

China's International Economic and Trade Cooperation Initiative on Green Mining represents a proactive approach to securing alternative supply sources while expanding technological influence globally. This initiative combines resource access with technology transfer and infrastructure development in partner nations.

The strategy involves:

• Technology transfer partnerships – Providing mining and processing technology to partner nations in exchange for preferential access to resources

• Infrastructure investment – Belt and Road Initiative projects that develop mining infrastructure in countries with rare earth deposits

• Joint venture structures – Partnerships that ensure Chinese access to resources while providing local economic benefits

• Capacity building programmes – Technical education and training that create long-term relationships with partner nations

This diversification approach enables China to reduce dependency on Myanmar while extending technological influence to additional countries. Partner nations benefit from Chinese investment and technology while providing supply chain security for Chinese operations.

What Are the Implications for Global Technology Industries?

Electric Vehicle Manufacturing Vulnerabilities

The automotive industry's transition to electric vehicles creates unprecedented demand for rare earth permanent magnets, making manufacturers increasingly dependent on Chinese supply chains. Electric vehicle motors require sophisticated neodymium-iron-boron magnets that depend on Chinese processing capacity for raw materials.

Critical dependencies include:

• Neodymium-iron-boron magnets – Essential for high-efficiency electric motor performance

• Dysprosium additions – Required for high-temperature magnet stability in automotive applications

• Terbium enhancements – Necessary for advanced motor efficiency and performance optimisation

• Specialised magnet geometries – Custom manufacturing capabilities concentrated in Chinese facilities

The scale of electric vehicle production amplifies supply chain vulnerabilities. Major automotive manufacturers require thousands of permanent magnets per vehicle, creating demand volumes that strain global production capacity outside Chinese supply chains.

Quality requirements for automotive applications exceed those for many other magnet applications, requiring consistent chemical composition, magnetic properties, and thermal stability that depend on advanced processing technology concentrated in Chinese operations.

Renewable Energy Infrastructure Risks

Wind turbine manufacturers face particular exposure to rare earth supply disruptions because permanent magnet generators require substantial quantities of neodymium and dysprosium for optimal performance. Direct-drive wind turbines utilise large permanent magnet generators that can contain several hundred kilograms of rare earth materials per turbine.

The renewable energy sector's growth trajectory creates compound supply chain risks:

• Scaling production requirements – Gigawatt-scale wind installations require thousands of turbines with significant rare earth content

• Performance optimisation demands – Efficiency improvements in renewable energy systems drive demand for higher-grade rare earth magnets

• Grid integration technology – Advanced power electronics for renewable energy systems require rare earth materials for transformers and control systems

• Energy storage applications – Battery systems and grid-scale storage increasingly utilise rare earth materials for performance optimisation

Alternative technologies such as copper-wound generators can reduce rare earth dependency but typically involve performance trade-offs including larger size, higher weight, and increased maintenance requirements that affect overall system economics.

How Are Western Nations Responding to Supply Chain Concentration?

Alternative Supply Chain Development Challenges

Efforts to establish non-Chinese rare earth supply chains face significant technical, environmental, and economic obstacles that limit their near-term viability. While rare earth deposits exist in multiple countries, developing competitive processing and manufacturing capabilities requires substantial investment and technical expertise.

Major development barriers include:

• Environmental regulations – Stricter waste management and emissions control requirements increase operational costs compared to Chinese facilities

• Technical expertise gaps – Limited separation and processing knowledge outside Chinese operations

• Capital investment requirements – Significant upfront costs for processing infrastructure with uncertain return timelines

• Market competition – Established Chinese operations can reduce prices to discourage alternative supply development

The Mountain Pass mine in California, operated by MP Materials Corporation, exemplifies these challenges. While the facility produces rare earth concentrates, processing and separation occur in Chinese facilities due to technical and economic constraints. This arrangement reduces geological dependency while maintaining processing dependency.

Australian rare earth projects face similar processing bottlenecks. Lynas Rare Earths operates separation facilities in Malaysia but relies on Chinese technology and faces ongoing regulatory challenges related to radioactive waste management.

Strategic Stockpiling and Reserve Management

Government-led initiatives to build rare earth reserves provide short-term supply security but cannot address long-term dependency issues without substantial industrial development. The U.S. National Defense Stockpile maintains strategic reserves of critical materials, but quantities remain insufficient for extended supply disruptions.

Reserve management strategies include:

• Government stockpiling programmes – Building strategic reserves of critical rare earth elements and finished magnets

• Industrial inventory incentives – Encouraging private sector inventory accumulation through tax incentives or guaranteed purchase programmes

• Allied coordination mechanisms – Cooperative stockpiling arrangements among allied nations to maximise reserve effectiveness

• Recycling capacity development – Investment in electronic waste processing to create secondary supply sources

However, stockpiling approaches face limitations in addressing comprehensive supply chain vulnerabilities. Rare earth applications in advanced technologies continue evolving, requiring updated materials specifications that static reserves cannot address. Additionally, inventory management costs and material degradation over time limit the economic viability of large-scale stockpiling.

What Does the Future Hold for Global Rare Earth Competition?

Technology Race Intensification

The competition for rare earth advantage is evolving beyond traditional mining and processing to encompass advanced materials science, recycling technologies, and alternative magnet chemistries. This technological competition creates multiple pathways for reducing Chinese supply chain dependence while developing new competitive advantages.

Emerging competitive areas include:

• Rare earth recycling advancement – Sophisticated electronic waste processing that recovers rare earth elements from consumer electronics and industrial equipment

• Alternative magnet chemistry development – Research into rare earth-free permanent magnets using iron, cobalt, and other abundant elements

• Advanced separation technology – Novel processing techniques that reduce environmental impact and capital requirements

• Synthetic rare earth production – Laboratory-scale methods for producing rare earth elements through advanced chemistry

Recycling technology represents the most promising near-term alternative to primary mining dependency. Electronic waste contains significant concentrations of rare earth elements that can be recovered through advanced processing techniques, though current recycling efficiency remains limited compared to primary production.

Alternative magnet research focuses on developing permanent magnets with comparable performance to neodymium-iron-boron magnets without rare earth element requirements. While progress has been achieved in specific applications, general-purpose alternatives remain elusive due to fundamental magnetic property limitations.

Geopolitical Realignment of Supply Chains

The rare earth sector is becoming a focal point for broader discussions about economic security, technological sovereignty, and international trade relationships. This geopolitical dimension creates additional complexity beyond traditional market dynamics.

Supply chain realignment involves:

• Allied cooperation frameworks – Multilateral agreements for rare earth supply chain development and strategic coordination

• Investment restriction policies – Limitations on Chinese investment in Western rare earth projects and technology companies

• Technology transfer controls – Export restrictions on rare earth processing equipment and technical knowledge

• Trade agreement restructuring – Bilateral and multilateral trade relationships that prioritise supply chain security over cost optimisation

The CHIPS and Science Act in the United States and similar initiatives in allied nations represent systematic approaches to reducing critical material dependencies through domestic industrial development and international cooperation.

However, geopolitical realignment faces economic constraints as alternative supply chains typically involve higher costs and longer development timelines compared to established Chinese operations. Balancing supply chain security with economic competitiveness remains a central challenge for Western policy makers.

How Is AI Transforming Rare Earth Production Efficiency?

Machine Learning in Geological Analysis

The application of artificial intelligence to geological surveying and mineral identification represents a significant advancement in rare earth exploration efficiency. Machine learning algorithms can analyse geological data patterns, satellite imagery, and geophysical surveys to identify potential rare earth deposits with greater accuracy than traditional methods.

AI in mining operations enables:

• Predictive geological modelling – Advanced algorithms that identify optimal drilling locations

• Real-time ore grade analysis – Immediate quality assessment during extraction operations

• Automated equipment operation – Unmanned vehicles and processing systems that reduce operational costs

• Predictive maintenance – Equipment monitoring that prevents costly production disruptions

Chinese rare earth operations have achieved significant competitive advantages through systematic AI implementation. The integration of machine learning with processing operations enables continuous optimisation of separation efficiency, reducing waste generation while improving product quality.

Western competitors attempting to establish alternative supply chains must invest in similar technological capabilities to achieve competitive cost structures. However, the proprietary nature of Chinese AI applications in rare earth processing creates barriers to technology transfer that complicate international competition.

Strategic Implications for Global Technology Leadership

China's rare earth supply chain strategy represents the most comprehensive integration of natural resource advantages, industrial policy, and technological development in modern economic history. The coordination of mining, processing, manufacturing, and export controls creates multiple layers of strategic advantage that extend far beyond traditional commodity markets.

For global technology industries, understanding these dynamics is essential for risk management and strategic planning. The concentration of rare earth capabilities in China creates both opportunities and vulnerabilities that will shape international technology competition for decades to come.

The development of alternative supply chains, recycling technologies, and substitute materials represents a long-term competitive response that requires sustained investment and international cooperation. However, the technical complexity and capital requirements of rare earth processing create significant barriers to rapid diversification away from Chinese supply chains.

The ongoing competition for critical minerals demonstrates that resource control remains central to technological sovereignty in the digital age.

Disclaimer: This analysis involves forecasts and speculative elements regarding future market developments and geopolitical trends. Rare earth market dynamics are subject to rapid changes in technology, regulation, and international relations that may affect the accuracy of forward-looking assessments. Investment and policy decisions should be based on comprehensive due diligence and professional consultation.

The ongoing evolution of China's rare earth supply chain strategy suggests that critical materials will remain central to global technology leadership, economic security, and international relations as the world transitions toward renewable energy systems and advanced manufacturing capabilities.

Are You Seeking Opportunities in Critical Minerals and Resource-Rich ASX Companies?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant mineral discoveries, including those involving critical materials essential for the technology transition. Subscribers gain immediate access to actionable insights on emerging opportunities across rare earth elements, lithium, and other strategic commodities announced on the ASX, positioning themselves ahead of broader market awareness.