China's lithium rally has emerged as one of the most significant commodity market developments in late 2025, reflecting fundamental shifts in supply-demand dynamics that extend far beyond traditional electric vehicle applications. The convergence of processing capacity constraints, accelerating grid storage deployment, and strategic resource allocation policies has created conditions for sustained price momentum across global lithium markets.

What's Driving China's Lithium Price Surge in Late 2025?

Supply Chain Disruptions Create Market Tightness

China's lithium carbonate futures reached approximately 95,200 RMB per tonne during mid-to-late November 2025, marking the highest levels since June 2024. This represents a month-over-month rally exceeding 17%, with multiple daily limit-up trading halts demonstrating rapid institutional repricing of lithium exposure.

The price recovery follows an extended period of oversupply conditions that compressed lithium prices by more than 80% from 2022 peaks. Operational disruptions across key processing regions have contributed to near-term supply tightness, with facility shutdowns in Jiangxi province highlighting vulnerability in China's concentrated processing infrastructure.

Key Supply Disruption Factors:

• Processing facility operational challenges affecting monthly production volumes

• Regulatory compliance requirements forcing temporary facility closures

• Equipment maintenance backlogs accumulated during low-price periods

• Qualification bottlenecks for new production capacity additions

New lithium supply facilities require extended qualification periods and battery-grade certification processes before achieving commercial viability. This creates significant lag between announced capacity expansions and actual market supply additions, with technical validation often requiring 12-18 months for battery-grade specifications.

The qualification process involves rigorous testing protocols to ensure lithium compounds meet precise purity standards for cathode material production. Even minor impurities can affect battery performance, making supplier qualification a critical bottleneck that cannot be accelerated through increased capital investment alone.

Demand Acceleration Beyond Electric Vehicles

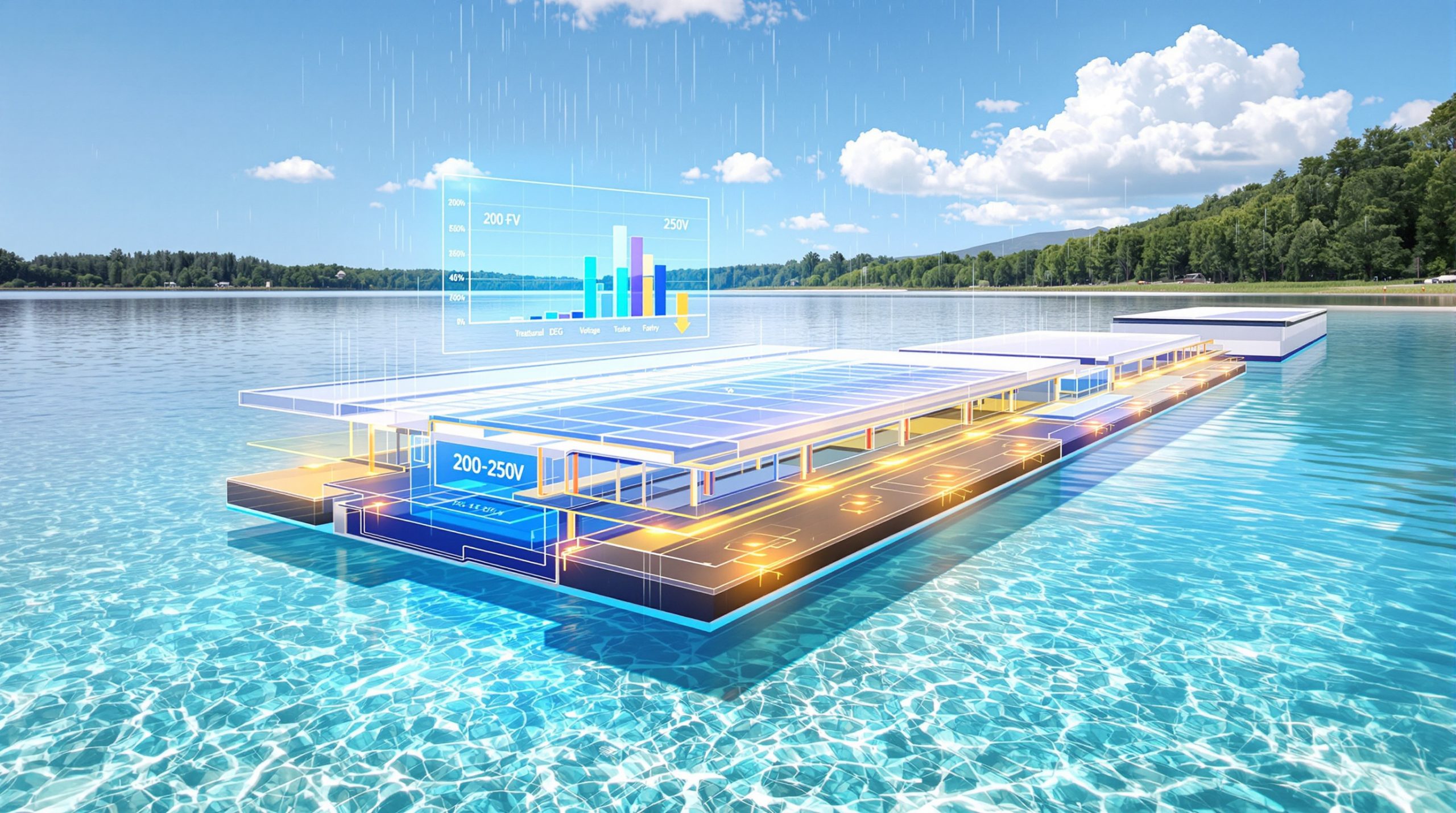

Grid-scale energy storage has emerged as a fundamental demand driver alongside electric vehicle production, creating what industry analysts describe as a second structural demand pillar. This diversification represents a critical shift from purely automotive-dependent lithium consumption patterns toward more balanced industrial applications.

According to the International Energy Agency's Global Energy Storage Database, worldwide battery energy storage deployments reached approximately 60 GWh in 2023, with cumulative installations surpassing 400 GWh by year-end. Annual deployment rates are accelerating, with 2024-2025 expectations reflecting 40-50% year-over-year growth in major markets.

Energy Storage Demand Characteristics:

• Contract duration: Grid storage applications typically involve 3-5 year supply agreements

• Chemistry flexibility: Storage systems accept both carbonate and hydroxide specifications

• Volume predictability: Utility procurement follows planning cycles rather than consumer demand volatility

• Geographic distribution: Demand spans multiple regions rather than concentrating in automotive hubs

China's Five-Year Plan mandated significant grid storage deployment, with the country accounting for approximately 60-65% of global battery energy storage capacity additions by 2025. This represents a structural shift toward contracted, predictable lithium demand that provides pricing stability compared to spot-market automotive procurement patterns.

Furthermore, grid storage applications increasingly accept slightly lower purity specifications compared to automotive cathode materials, creating sourcing flexibility while maintaining technical performance requirements. Long-duration storage systems (4+ hours) utilise different battery chemistries and lithium densities, creating demand stratification by product type and application.

Producer Guidance Signals Market Confidence

Major integrated lithium producers have provided unusually explicit demand and pricing guidance for 2026, signalling confidence in fundamental market rebalancing. Ganfeng Lithium's leadership projected 30-40% lithium demand growth for 2026, accompanied by specific price targets of 150,000-200,000 RMB per tonne for lithium carbonate.

Such precise guidance from tier-one producers typically reflects forward visibility from contracted sales agreements and internal demand forecasting models informed by customer procurement signals. The willingness to defend specific pricing floors suggests producers have conducted comprehensive scenario analysis incorporating both base-case and risk-case demand projections.

Producer Guidance Credibility Factors:

• Track record: Historical accuracy of production targets and capacity development timelines

• Market position: Scale and integration level within the lithium value chain

• Customer relationships: Direct visibility into end-user procurement planning

• Contract coverage: Percentage of production already committed through long-term agreements

The futures market response included limit-up trading sessions, suggesting rapid institutional repricing based on new fundamental information. However, extended limit-up conditions can also reflect trading circuit breakers rather than pure market-driven price discovery, requiring careful interpretation of trading dynamics.

Additionally, Ganfeng Lithium maintained processing capacity exceeding 400,000 tonnes of lithium carbonate equivalent annually by 2024, representing one of the world's largest integrated lithium production platforms. This scale provides credible visibility into global demand patterns and pricing dynamics across multiple end-market applications.

How High Could Lithium Carbonate Prices Climb?

Current Price Trajectory Analysis

The November 2025 price recovery to approximately 95,200 RMB per tonne represents a significant milestone in China's lithium rally, reaching levels not seen since June 2024. This recovery follows an 18-month period of severe demand destruction and supply oversupply that compressed prices to 20,000-30,000 RMB per tonne lows in late 2024.

| Price Recovery Timeline | Price Level (RMB/tonne) | Market Context |

|---|---|---|

| Late 2022 Peak | 600,000+ | EV demand euphoria, severe supply constraints |

| June 2024 Reference | 95,200+ | Previous rally attempt |

| Late 2024 Trough | 20,000-30,000 | Oversupply, demand destruction |

| November 2025 Current | 95,200 | Supply tightness, demand recovery |

Daily limit-up trading halts indicate rapid institutional repricing and suggest potential for continued upward momentum if fundamental conditions persist. Guangzhou lithium carbonate futures operate with daily price limit mechanisms that typically reflect either fundamental supply-demand repricing, technical trading momentum, or regulatory position adjustments.

The current spot levels trading near futures prices suggest tight nearby supply availability, contrasting with typical discount relationships. This convergence indicates immediate supply constraints rather than forward-looking speculation, supporting the legitimacy of current price levels.

Producer Price Target Scenarios

The 150,000-200,000 RMB per tonne price target represents 57-110% upside from November 2025 levels, implying substantial market rebalancing potential. This wide targeting band reflects scenario uncertainty while providing directional guidance for market participants and investors.

Price Target Feasibility Analysis:

Supporting Factors (150,000 RMB/tonne – Lower Band):

• Energy storage procurement acceleration (40%+ annual growth)

• EV production stability maintenance at 2024 levels

• Supply addition delays due to qualification requirements

• Moderate Chinese export allocation policies

Upside Scenario Drivers (200,000 RMB/tonne – Upper Band):

• Grid storage deployment exceeding forecasts

• EV production growth resumption

• Significant supply disruptions or trade restrictions

• Accelerated battery technology adoption

Historical precedent exists for the 150,000+ RMB per tonne range, with lithium carbonate trading at these levels during Q4 2022 through Q1 2023 before demand destruction compressed prices. The key difference in the current cycle is the emergence of grid storage as a persistent demand foundation alongside cyclical automotive consumption.

Moreover, lithium's price elasticity remains relatively inelastic in the near term due to fixed processing capacity constraints, qualification requirements for new supply, and investment lead times for production facilities. This inelasticity supports rapid price adjustment when supply-demand conditions shift, which aligns with insights from Australia lithium innovations in processing technology.

Market Structure Changes Supporting Higher Prices

The transition from spot-dominated to contract-based pricing creates structural support mechanisms for higher price levels. Long-term contracts remove spot supply from markets, reduce volatility, and establish pricing floors through multi-year agreements with negotiated minimum prices.

Contract vs. Spot Market Evolution:

| Pricing Mechanism | Traditional EV Demand | Grid Storage Demand |

|---|---|---|

| Contract Duration | 6-18 months | 3-5+ years |

| Price Discovery | Spot-influenced | Formula-indexed |

| Volume Commitment | Variable | Fixed minimum |

| Quality Tolerance | Strict specifications | Moderate flexibility |

Grid storage's shift toward longer-term procurement fundamentally differs from EV manufacturer purchasing patterns. Utility-scale storage deployments follow infrastructure planning cycles with predictable capacity requirements, creating persistent baseline demand that underpins market pricing.

Contract-based pricing incorporates both base pricing components (fixed elements typically representing 30-50% of total price) and index pricing tied to lithium price benchmarks. This structure provides revenue stability for producers while maintaining market responsiveness for buyers.

Furthermore, the integration of grid storage demand into long-term supply planning enables producers to optimise capacity utilisation and investment decisions. This planning visibility supports higher sustainable price levels compared to spot-market volatility that characterised earlier market cycles.

What Does This Mean for Global Lithium Supply Chains?

China's Domestic Priority Strategy

China's lithium market dynamics increasingly reflect strategic resource allocation policies that prioritise domestic industrial applications over export availability. This domestic-first approach creates structural supply constraints for international markets while supporting China's energy transition and industrial electrification objectives.

Processing capacity allocation between domestic consumption and export markets has shifted significantly, with grid storage and industrial battery applications receiving priority access to battery-grade lithium compounds. This policy stance creates additional friction for international buyers seeking to secure reliable supply sources.

Chinese Lithium Processing and Allocation:

| Application Segment | Allocation Priority | Contract Terms | Price Sensitivity |

|---|---|---|---|

| Domestic Grid Storage | High Priority | Long-term contracts | Moderate |

| Domestic EV Production | High Priority | Integrated supply chains | Low |

| Export Markets | Lower Priority | Spot-influenced | High |

| Industrial Applications | Medium Priority | Medium-term contracts | Moderate |

Export control implications extend beyond immediate pricing to encompass long-term supply security for international lithium consumers. Countries and companies with significant China dependency face increasing pressure to diversify supply sources or develop alternative processing capabilities.

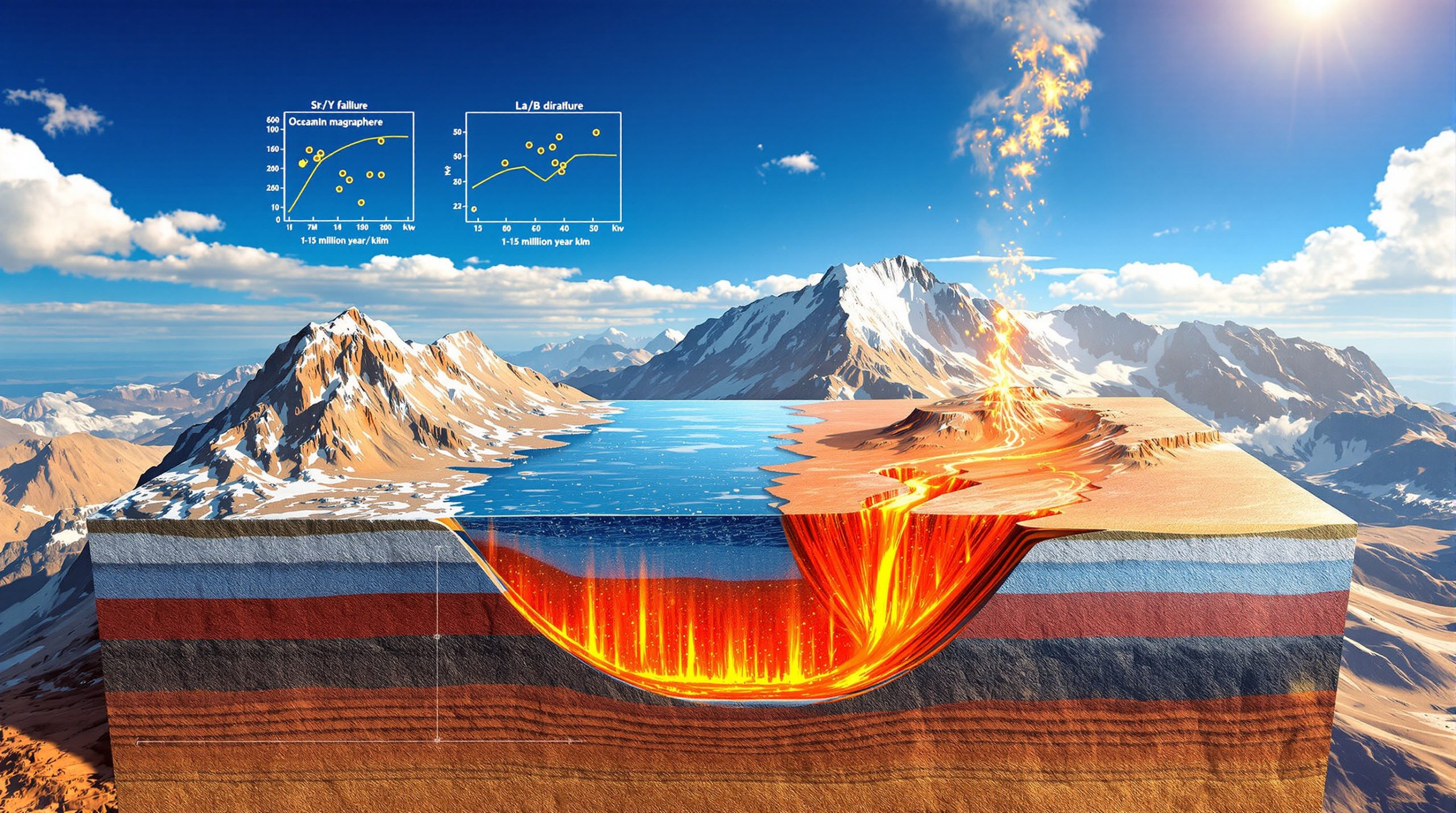

The concentration of lithium processing capacity in China creates systemic risk for global battery supply chains. Approximately 60-70% of worldwide lithium processing capacity operates within China, making international markets vulnerable to policy changes, operational disruptions, or strategic resource allocation decisions.

Qualification Bottlenecks for New Supply

Technical requirements for battery-grade lithium compounds create significant barriers for new supply sources seeking market acceptance. The qualification process involves extensive testing protocols, customer validation procedures, and performance verification that can extend 12-24 months even for established production facilities.

Qualification Process Components:

• Chemical analysis: Purity specifications, trace element content, particle size distribution

• Battery performance testing: Cathode material compatibility, cycling stability, safety validation

• Supply chain verification: Production consistency, quality management systems, logistics capabilities

• Customer approval: End-user testing, procurement approval, contract negotiation

Time-to-market challenges for emerging production facilities reflect the technical complexity of lithium compound production rather than simple capital investment requirements. Even facilities with adequate funding and equipment face extended qualification periods that cannot be accelerated through additional resources.

The qualification bottleneck creates competitive advantages for established suppliers with proven track records and existing customer relationships. New entrants face not only capital requirements but also time-based barriers that limit market supply flexibility.

Consequently, battery manufacturers maintain strict supplier qualification standards to ensure product performance and safety compliance. Any changes to lithium specifications or suppliers require comprehensive re-testing and validation, creating switching costs that support supplier relationships and pricing stability.

Geographic Diversification Pressures

International buyers are implementing comprehensive supply chain risk management strategies to reduce dependency on Chinese lithium processing capacity. These diversification efforts encompass investment flows toward non-Chinese processing facilities, technology transfer initiatives, and strategic partnership development.

Geographic Diversification Strategies:

- Processing capacity investment in Australia, North America, and South America

- Technology licensing agreements for lithium processing expertise

- Strategic equity investments in non-Chinese lithium projects

- Government policy support for domestic processing development

- Long-term supply contracts with diversified supplier networks

Investment flows toward alternative processing locations reflect both commercial considerations and strategic supply security objectives. Government support programs in Australia, Canada, and the United States provide financial incentives for lithium processing capacity development outside China.

The geographic concentration risk extends beyond immediate supply disruptions to encompass pricing power and market manipulation potential. Diversified processing capacity reduces this risk while creating competitive alternatives for international lithium consumers.

Technology transfer and expertise acquisition represent critical components of diversification strategies. Lithium processing requires specialised knowledge and operational experience that cannot be easily replicated without access to proven technologies and experienced personnel.

This trend particularly affects regions like Argentina, where argentina lithium brine insights suggest significant opportunities for international partnerships and technology development initiatives.

Which Investment Themes Emerge from China's Rally?

Hard Rock Spodumene Producer Economics

Spodumene producers face significant margin expansion potential under higher lithium carbonate pricing scenarios. The correlation between spodumene concentrate prices and downstream lithium chemical prices creates operating leverage for established hard rock mining operations.

Spodumene Price Correlation Analysis:

| Lithium Carbonate Price (RMB/tonne) | Implied Spodumene Price (USD/tonne) | Producer Margin Impact |

|---|---|---|

| 95,200 (Current) | 1,200-1,500 | Baseline profitability |

| 150,000 (Target Low) | 2,000-2,500 | Strong margin expansion |

| 200,000 (Target High) | 2,800-3,500 | Exceptional profitability |

Operating leverage analysis for established producers reveals exponential margin improvement above break-even pricing thresholds. Fixed cost structures in hard rock mining operations mean that incremental revenue from higher prices flows directly to operating margins with minimal additional cost.

Hard rock operations maintain several competitive advantages compared to brine-based extraction, including faster production ramp capabilities, predictable grade profiles, and reduced weather dependency. These operational characteristics provide flexibility for production optimisation under favourable pricing conditions.

Geographic diversification benefits extend to spodumene producers located outside China, as international buyers seek supply chain security. Australian, Canadian, and African spodumene operations may command premium pricing for jurisdictional stability and reduced geopolitical risk.

The qualification advantage of established spodumene suppliers creates barriers for new entrants while supporting pricing power for existing operations. Battery manufacturers prefer working with proven suppliers that meet technical specifications consistently.

Downstream Processing Investment Acceleration

Investment in lithium hydroxide and carbonate conversion facilities outside China is accelerating rapidly, driven by supply chain security concerns and favourable economics under higher pricing scenarios. Processing location increasingly matters more than mining location for strategic supply chain considerations.

Processing Investment Opportunities:

• Conversion facility development in Australia, North America, and South America

• Technology licensing and partnerships with established processing companies

• Integrated mining-processing projects that capture value chain margins

• Specialty chemical facilities targeting high-purity applications

Technology transfer and expertise acquisition represent critical success factors for new processing facilities. Lithium conversion requires specialised knowledge of precipitation chemistry, purification processes, and quality control systems that cannot be easily replicated without experienced technical teams.

Government support programs in multiple countries provide financial incentives for lithium processing development, including loan guarantees, tax credits, and infrastructure support. These programs improve project economics and reduce development risks for processing investments.

The margin structure for lithium processing typically provides higher returns than upstream mining operations, particularly for battery-grade products. Processing margins expand significantly during tight market conditions as converters capture price premiums for qualified supply.

For instance, projects like thacker pass lithium production demonstrate the strategic importance of integrated processing capabilities in North American supply chain development.

Energy Storage Infrastructure Beneficiaries

Grid-scale battery deployment acceleration creates investment opportunities across the entire energy storage value chain. The emergence of storage as a persistent demand driver supports multiple technology and infrastructure development themes.

Energy Storage Investment Themes:

• Battery manufacturing capacity expansion for grid-scale applications

• Grid integration technology providers specialising in storage system optimisation

• Long-duration storage technology developers working on 8+ hour applications

• Project development and financing companies focused on utility-scale storage

• Energy management software platforms optimising storage dispatch and revenue

Battery manufacturing capacity specifically designed for grid storage applications differs from automotive production in several important aspects. Grid batteries prioritise cost optimisation, longer service life, and safety over energy density and weight considerations that dominate automotive applications.

Grid integration technology becomes increasingly important as storage penetration reaches levels that affect power system stability. Companies providing inverters, control systems, and grid management software benefit from storage deployment acceleration.

Long-duration storage technology development addresses the gap between 2-4 hour lithium battery systems and longer-term storage requirements. These technologies often require different lithium chemistries or alternative materials, creating specialised demand patterns.

The utility-scale storage project development sector requires specialised expertise in permitting, grid interconnection, financing, and operations. Companies with proven development capabilities benefit from the increasing number of storage procurement programs globally.

How Are Different Lithium Chemistries Positioned?

Lithium Carbonate vs. Hydroxide Demand Dynamics

Different battery applications require specific lithium chemistries, creating segmented demand patterns with distinct pricing dynamics. Understanding these chemistry requirements is essential for evaluating investment opportunities across the lithium value chain.

| Application | Primary Chemistry | Quality Requirements | Growth Rate Projection |

|---|---|---|---|

| EV Batteries (Standard) | Lithium Carbonate | High purity, low impurities | 15-25% annually |

| EV Batteries (High-nickel) | Lithium Hydroxide | Ultra-high purity | 25-35% annually |

| Grid Storage | Both (flexible) | Moderate specifications | 40-50% annually |

| Consumer Electronics | Lithium Carbonate | High consistency | 5-10% annually |

| Industrial Applications | Both (application-dependent) | Variable requirements | 20-30% annually |

Processing route economics vary significantly between carbonate and hydroxide production, with hydroxide typically commanding premium pricing due to higher processing complexity and energy requirements. The conversion from spodumene to hydroxide requires additional processing steps and specialised equipment.

High-nickel cathode materials increasingly require lithium hydroxide rather than carbonate, reflecting the technical requirements of advanced battery chemistries. This trend supports higher pricing for hydroxide relative to carbonate, particularly for battery-grade specifications.

Quality specifications drive significant pricing premiums, with battery-grade lithium commanding substantial premiums over industrial-grade products. Even minor impurities can affect battery performance, making specification compliance critical for market access and pricing power.

Grid storage applications provide flexibility in lithium chemistry selection, accepting both carbonate and hydroxide depending on specific battery system designs. This flexibility creates sourcing optionality while maintaining technical performance requirements.

Emerging Chemistry Trends

Next-generation battery technologies are influencing lithium specification requirements and creating new demand patterns. Solid-state batteries, high-nickel cathodes, and alternative chemistries each require specific lithium characteristics that may differ from current standard specifications.

Advanced Battery Chemistry Requirements:

• Solid-state batteries: Ultra-high purity lithium with specific particle size distributions

• Silicon anodes: Lithium compounds compatible with silicon electrode materials

• High-voltage cathodes: Lithium chemicals meeting enhanced purity standards

• Fast-charging applications: Specialised lithium formulations optimising charging rates

Solid-state battery development represents a potential paradigm shift in lithium requirements, with these advanced systems potentially requiring different lithium processing approaches and quality specifications. The timeline for commercial solid-state deployment affects medium-term lithium demand projections.

High-nickel cathode material trends drive increasing hydroxide demand as battery manufacturers pursue higher energy density. The transition from lithium iron phosphate (LFP) to nickel-rich chemistries creates chemistry-specific demand growth patterns.

Alternative battery chemistries under development may alter lithium consumption patterns or create demand for specialised lithium compounds. Sodium-ion batteries, for example, could potentially reduce lithium demand in certain applications if they achieve commercial viability.

Consequently, the development timeline for emerging battery technologies creates uncertainty in medium-term lithium specification requirements. Companies able to adapt production capabilities to meet evolving chemistry needs maintain competitive advantages in changing markets.

What Are the Key Risk Factors That Could Derail This Rally?

Supply Response Acceleration Risks

The primary threat to sustained higher lithium pricing comes from faster-than-expected supply additions that could recreate oversupply conditions. New production capacity development, direct lithium extraction technology deployment, and operational restarts all represent potential sources of accelerated supply response.

Planned Lithium Production Additions (2025-2027):

| Region | Capacity Additions (LCE tonnes) | Technology Type | Timeline Risk |

|---|---|---|---|

| Australia | 800,000-1,200,000 | Hard rock/Spodumene | Medium |

| South America | 600,000-900,000 | Brine operations | Low-Medium |

| North America | 400,000-600,000 | Mixed technologies | High |

| Africa | 200,000-400,000 | Hard rock/Spodumene | High |

| China (Domestic) | 500,000-800,000 | Processing expansion | Medium |

Direct lithium extraction (DLE) technology represents a potentially disruptive supply source if deployment accelerates beyond current expectations. DLE projects can theoretically achieve faster development timelines compared to conventional brine operations, though technical and operational challenges remain significant.

Operational restart capabilities at previously shuttered facilities could provide rapid supply additions if economic conditions justify reactivation. Many lithium operations maintain infrastructure and permits that could enable relatively quick production resumption under favourable pricing conditions.

The qualification bottleneck that currently constrains new supply could be overcome more rapidly than anticipated if battery manufacturers accelerate supplier validation processes or accept alternative specifications. Changes in qualification requirements or timelines would increase effective supply availability.

However, new extraction technologies and processing improvements could increase yield rates from existing operations, effectively adding supply without new facility construction. Productivity improvements at established operations represent a less visible but potentially significant source of supply growth.

Demand Volatility Scenarios

Electric vehicle market growth rate variations represent the primary demand-side risk to lithium pricing sustainability. EV sales volatility, macroeconomic factors affecting consumer spending, and policy changes could significantly impact lithium consumption patterns.

EV Market Sensitivity Analysis:

| EV Growth Scenario | Impact on Lithium Demand | Price Implications |

|---|---|---|

| Accelerated Growth (+30%) | Demand exceeds supply significantly | Price upside to upper targets |

| Base Case Growth (+15%) | Balanced supply-demand conditions | Pricing within guidance ranges |

| Slower Growth (+5%) | Potential oversupply return | Downward price pressure |

| Decline (-10%) | Severe oversupply conditions | Sharp price corrections |

Consumer affordability concerns related to EV pricing could reduce adoption rates if lithium price increases translate to higher battery costs. The relationship between lithium prices and end-consumer EV prices creates potential demand destruction at elevated commodity price levels.

Macroeconomic factors including interest rates, consumer credit availability, and energy prices all influence EV adoption rates indirectly. Economic recession scenarios could significantly reduce both EV and grid storage deployment rates, creating demand shortfalls.

Government policy changes affecting EV subsidies, mandates, or infrastructure development could alter demand trajectories rapidly. Political shifts in major markets create policy uncertainty that affects medium-term demand visibility.

Grid storage demand faces similar sensitivity to policy support, utility procurement budgets, and renewable energy deployment rates. Changes in energy policy or utility spending priorities could affect storage deployment timelines and volumes.

Furthermore, the potential for lithium market downturn risks remains significant if supply response accelerates faster than demand growth, creating oversupply conditions similar to those experienced in 2023-2024.

Policy and Trade Disruption Potential

Trade policy changes, export restrictions, and strategic stockpiling programs represent significant risk factors that could disrupt lithium market dynamics rapidly. The concentration of processing capacity in China creates vulnerability to policy interventions that affect global supply availability.

Potential Policy Interventions:

- Export quota modifications limiting Chinese lithium chemical exports

- Strategic reserve building programs removing supply from commercial markets

- Processing capacity mandates requiring domestic consumption priorities

- Trade tariff implementations affecting international lithium trade flows

- Foreign investment restrictions limiting international access to Chinese lithium assets

Export restriction escalation possibilities create asymmetric risk for international lithium consumers. China's dominant processing position enables potential market manipulation through export policy changes, creating supply security concerns for global buyers.

Strategic stockpile building by governments or companies could remove significant volumes from commercial markets, creating artificial supply tightness. The scale of potential stockpiling programs could materially affect supply-demand balances independently of fundamental consumption patterns.

Trade dispute escalation between major economies could disrupt established lithium supply chains and force rapid reorganisation of sourcing strategies. Companies with geographically concentrated exposure face particular risks from trade policy changes.

Additionally, currency volatility and exchange rate policies affect the competitiveness of different lithium supply sources. Significant currency movements could alter the relative economics of various production regions and trade flows.

Regional Market Implications Beyond China

Australian Lithium Sector Positioning

Australia's lithium sector maintains unique positioning advantages that become increasingly valuable during periods of supply chain uncertainty and rising prices. The combination of geological resources, political stability, and established infrastructure creates competitive differentiation for Australian operations.

Major Australian Lithium Projects Status:

| Project/Operation | Development Status | Capacity (LCE tonnes/year) | Competitive Advantages |

|---|---|---|---|

| Greenbushes (Operating) | Production expansion | 100,000+ | Established operations, high grade |

| Pilbara Minerals (Operating) | Expansion phases | 80,000+ | Scale, infrastructure |

| Mt Marion (Operating) | Optimisation | 40,000+ | Proven operations |

| Wodgina (Development) | Restart/expansion | 75,000+ | Established infrastructure |

| Earl Grey (Development) | Pre-production | 25,000+ | High-grade resource |

Hard rock mining operations provide competitive advantages through faster production ramp capabilities, predictable resource characteristics, and reduced weather dependency compared to brine operations. These operational benefits become particularly valuable during tight market conditions.

Currency considerations significantly affect Australian producer economics, with AUD weakness against USD and RMB enhancing realised margins for exporters. Exchange rate movements can provide additional margin expansion beyond commodity price increases.

Logistics infrastructure in Western Australia provides established pathways for spodumene concentrate exports to Asian processing facilities. Port facilities, rail connections, and shipping capabilities support efficient product delivery to global markets.

Jurisdictional stability and regulatory predictability create competitive advantages for Australian operations compared to some alternative supply sources. Political risk considerations increasingly influence buyer preferences for supply source diversification.

The established path to OEM-grade supply through qualified processing partnerships provides market access advantages. Australian producers benefit from existing relationships with major lithium processors and end-users globally.

South American Brine Operations Impact

South American lithium brine operations maintain significant production cost advantages that become particularly valuable under higher price environments. The Lithium Triangle region spanning Argentina, Chile, and Bolivia contains world-class brine resources with attractive economics.

South American Brine Operation Characteristics:

• Production cost advantages: Lower operating costs compared to hard rock operations

• Large-scale resources: Multi-decade resource bases supporting long-term production

• Established operations: Proven production and processing capabilities

• Expansion potential: Significant capacity expansion opportunities

• Geographic concentration: Efficient infrastructure and expertise clustering

Expansion timeline considerations for major brine operations typically involve 3-5 year development periods for significant capacity additions. Environmental permitting, community relations, and infrastructure development create longer lead times compared to hard rock expansion projects.

Production cost profiles for established brine operations typically range from $3,000-5,000 per tonne of lithium carbonate equivalent, significantly below hard rock production costs. This cost advantage provides substantial margins under current and projected pricing scenarios.

Technical expertise in brine processing and lithium extraction has developed over decades of commercial operations. Companies with proven brine processing capabilities maintain competitive advantages in development and operational optimisation.

Water resource management and environmental compliance represent critical factors for brine operation sustainability. Operations with established environmental management systems and community relationships maintain operational advantages and expansion potential.

North American Market Development

North American lithium processing capacity development is accelerating through government support programs and private investment initiatives. Supply chain localisation trends and strategic mineral policies drive investment in domestic processing capabilities.

North American Processing Development Initiatives:

• Government loan programs providing favourable financing for strategic mineral projects

• Tax incentive structures supporting domestic processing development

• Infrastructure investment in transportation and utilities for remote projects

• Technical workforce development through university partnerships and training programs

• Regulatory streamlining for strategic mineral project permitting

Supply chain localisation trends reflect both commercial opportunities and strategic supply security objectives. North American automotive manufacturers and battery producers increasingly prioritise regional supply sources to reduce dependency on international suppliers.

Government support programs include the U.S. Inflation Reduction Act provisions, Canadian Critical Minerals Strategy funding, and various state and provincial incentive programs. These initiatives improve project economics and reduce development risks for North American lithium projects.

The development timeline for North American processing facilities typically involves 4-6 years from initial planning to commercial production. Permitting processes, environmental assessments, and community engagement requirements create structured development pathways.

Technical capabilities and workforce development represent critical success factors for North American lithium processing development. Partnerships with established processing companies and university research programs support technical expertise development.

Countries like India are also developing strategic approaches to lithium supply security, as evidenced by India's lithium supply strategy partnerships with Australian producers and processing companies.

Investment Strategy Considerations for 2026

Timing Considerations for Market Entry

Lithium price cycle analysis reveals patterns that inform optimal investment entry timing strategies. Understanding historical cycle duration and characteristics provides context for current market positioning and future price trajectory assessment.

Historical Lithium Price Cycle Analysis:

| Cycle Period | Duration (Months) | Peak-to-Trough Decline | Recovery Timeframe |

|---|---|---|---|

| 2016-2018 | 24 | 65% | 18 months |

| 2018-2020 | 18 | 40% | 12 months |

| 2020-2022 | 24 | N/A (upward cycle) | N/A |

| 2022-2024 | 24 | 85% | 18 months (ongoing) |

Current cycle positioning suggests the market may be transitioning from oversupply conditions toward rebalanced fundamentals. The 18-month recovery period from late 2024 lows aligns with historical patterns, though each cycle reflects unique supply and demand dynamics.

Price volatility management strategies become critical for lithium investment exposure given the commodity's tendency toward rapid price movements. Dollar-cost averaging approaches and staged entry strategies can help manage timing risks in volatile markets.

Entry point optimisation requires balancing current price levels against fundamental improvement prospects. The current recovery to mid-cycle price levels may provide reasonable entry opportunities if supply-demand rebalancing continues as anticipated.

Risk management through position sizing and portfolio diversification becomes essential given lithium's volatility characteristics. Concentrated lithium exposure can generate substantial returns but also creates significant downside risk if market conditions deteriorate.

Value Chain Positioning Analysis

Investment opportunities across lithium value chain segments offer different risk-return profiles and market exposure characteristics. Understanding the relative positioning of upstream, midstream, and downstream opportunities enables portfolio construction optimisation.

Lithium Value Chain Investment Opportunities:

Upstream (Mining and Extraction):

• Operating mines: Immediate cash flow generation, established production

• Development projects: Higher risk/return, leverage to price improvements

• Exploration companies: Highest risk/return, resource discovery potential

• Technology providers: Exposure to industry growth without commodity risk

Midstream (Processing and Refining):

• Integrated producers: Value chain control, margin capture across processing stages

• Specialty chemical processors: Premium pricing for high-purity applications

• Conversion facilities: Strategic positioning between raw materials and end products

• Logistics and storage: Infrastructure supporting lithium supply chains

Downstream (Battery and Applications):

• Battery manufacturers: Direct exposure to lithium demand growth

• Energy storage developers: Grid-scale deployment beneficiaries

• Electric vehicle manufacturers: Automotive electrification exposure

• Grid integration technology: Supporting infrastructure for energy storage

Each value chain segment provides distinct risk-return characteristics and market exposure profiles. Upstream operations offer direct commodity price leverage but face operational and regulatory risks. Midstream processing captures value-added margins while maintaining commodity exposure.

Downstream applications benefit from end-market demand growth but face technology risk and competition. Portfolio construction across multiple value chain segments can provide balanced exposure while managing concentrated risks.

Geographic and Technology Diversification

Geographic diversification across multiple lithium-producing regions reduces political and operational risks while capturing regional growth opportunities. Technology diversification encompasses different extraction methods, processing approaches, and application-specific exposures.

Geographic Investment Considerations:

• Australia: Established hard rock operations, political stability, infrastructure

• South America: Low-cost brine operations, resource scale, expansion potential

• North America: Strategic supply security, government support, market proximity

• Africa: Emerging supply sources, resource potential, development opportunities

Technology diversification includes exposure to various extraction and processing methods, each with distinct characteristics and risk profiles. Direct lithium extraction, conventional brine processing, and hard rock operations offer different operational advantages and market positioning.

Market analysts from Ganfeng's recent statements support the thesis that China's lithium rally reflects fundamental market rebalancing rather than speculative trading, providing additional validation for the investment themes outlined above.

Furthermore, according to recent analysis by lithium market specialists, the $43,000 per tonne price forecast for lithium carbonate equivalent adds credibility to the medium-term price targets discussed throughout this analysis.

China's lithium rally represents more than cyclical price recovery – it signals structural

Ready to Position Yourself in the Next Lithium Discovery?

China's lithium rally demonstrates how rapidly commodity market dynamics can shift, creating exceptional opportunities for investors who identify and act on emerging supply-demand imbalances. Discovery Alert's proprietary Discovery IQ model delivers real-time notifications on significant ASX mineral discoveries, including lithium projects that could benefit from these evolving market conditions – begin your 30-day free trial today to ensure you're positioned ahead of the next major discovery announcement.