Comprehensive Risk Framework Analysis: Mexico's Unconventional Energy Development Strategy

North American energy markets face unprecedented transformation as traditional supply chains undergo fundamental restructuring. The interplay between domestic resource development, import dependency management, and technological innovation creates complex policy environments where decades-old political positions encounter rapidly evolving technical realities. Within this broader continental energy security framework, Mexico's approach to unconventional hydrocarbon resources represents a critical inflection point that extends far beyond national borders, particularly as Tamaulipas calls for technical debate on fracking.

Furthermore, energy security strategies recognize that modern industrial economies require diversified supply portfolios capable of withstanding geopolitical disruptions, price volatility, and infrastructure constraints. The technical feasibility of unconventional resource development has evolved dramatically over the past decade, with monitoring technologies, environmental safeguards, and operational protocols advancing significantly beyond early-generation hydraulic fracturing practices that generated widespread public concern.

What Regulatory Shifts Are Reshaping Mexico's Unconventional Energy Landscape?

Mexico's regulatory environment for unconventional resource development has undergone significant institutional evolution, particularly following the dissolution of the former Comisión Reguladora de Energía (CRE) and subsequent reorganization of energy sector oversight. The current regulatory framework operates under a centralized authority structure that prioritizes technical assessment over political considerations when evaluating energy development proposals.

National Energy Commission's Centralized Authority Framework

The institutional transformation from the defunct CRE to contemporary energy regulatory bodies reflects Mexico's attempt to create more streamlined decision-making processes for complex energy projects. Walter Ángel, serving as Minister of Energy Development in Tamaulipas and formerly a commissioner with the previous regulatory structure, emphasizes that unconventional development requires strong technical, financial, and operational capabilities alongside explicit public policy support.

Current regulatory authority encompasses comprehensive oversight of exploration permits, environmental impact assessments, and operational compliance monitoring. The centralized framework aims to eliminate jurisdictional conflicts that previously complicated project approval processes while maintaining rigorous technical standards for unconventional operations.

Legal Reforms Enabling Unconventional Resource Development

Mexican energy law does not prohibit hydraulic fracturing or unconventional resource development, contrary to widespread public perception. The legal framework provides mechanisms for unconventional project authorization, though political decisions have historically prevented implementation of these regulatory pathways.

Recent policy discussions indicate potential alignment between federal energy security objectives and state-level economic development priorities. Legal structures exist to support unconventional development under strict regulatory oversight, similar to frameworks employed in proven US shale plays.

Environmental Compliance Standards for Hydraulic Fracturing Operations

Environmental monitoring capabilities have improved substantially since 2015, when baseline seismic data collection was limited and public concerns about induced seismicity peaked. Modern monitoring systems provide real-time assessment of microseismic activity, allowing operators and regulators to evaluate industrial impacts with significantly greater precision.

Water management technologies have advanced to address historical concerns about hydraulic fracturing's environmental footprint. The Mexican Oil Institute has evaluated stimulation techniques utilising carbon dioxide injection rather than large water volumes, potentially reducing environmental impacts while contributing to carbon capture objectives. These technological approaches represent meaningful departures from early unconventional development practices.

Why Has Mexico's Political Stance on Fracking Evolved in 2025?

The Tamaulipas International Energy Congress 2025 marked a significant shift in Mexican political discourse surrounding unconventional resources. State-level officials have begun advocating for technical rather than political evaluation of hydraulic fracturing, reflecting broader concerns about energy security and economic competitiveness.

Energy Security Imperatives Driving Policy Reconsideration

Mexico's persistent reliance on natural gas imports from the United States creates strategic vulnerabilities that complicate long-term energy planning. Current supply arrangements, while operationally functional, concentrate risk in cross-border pipeline infrastructure and expose Mexican industrial consumers to price volatility in US natural gas forecast markets.

The country's growing industrial base requires reliable, cost-effective natural gas supplies to maintain competitiveness in North American manufacturing markets. In addition, energy security analysis indicates that domestic unconventional development could provide supply diversification while reducing import dependency risks.

Natural Gas Import Dependency Challenges

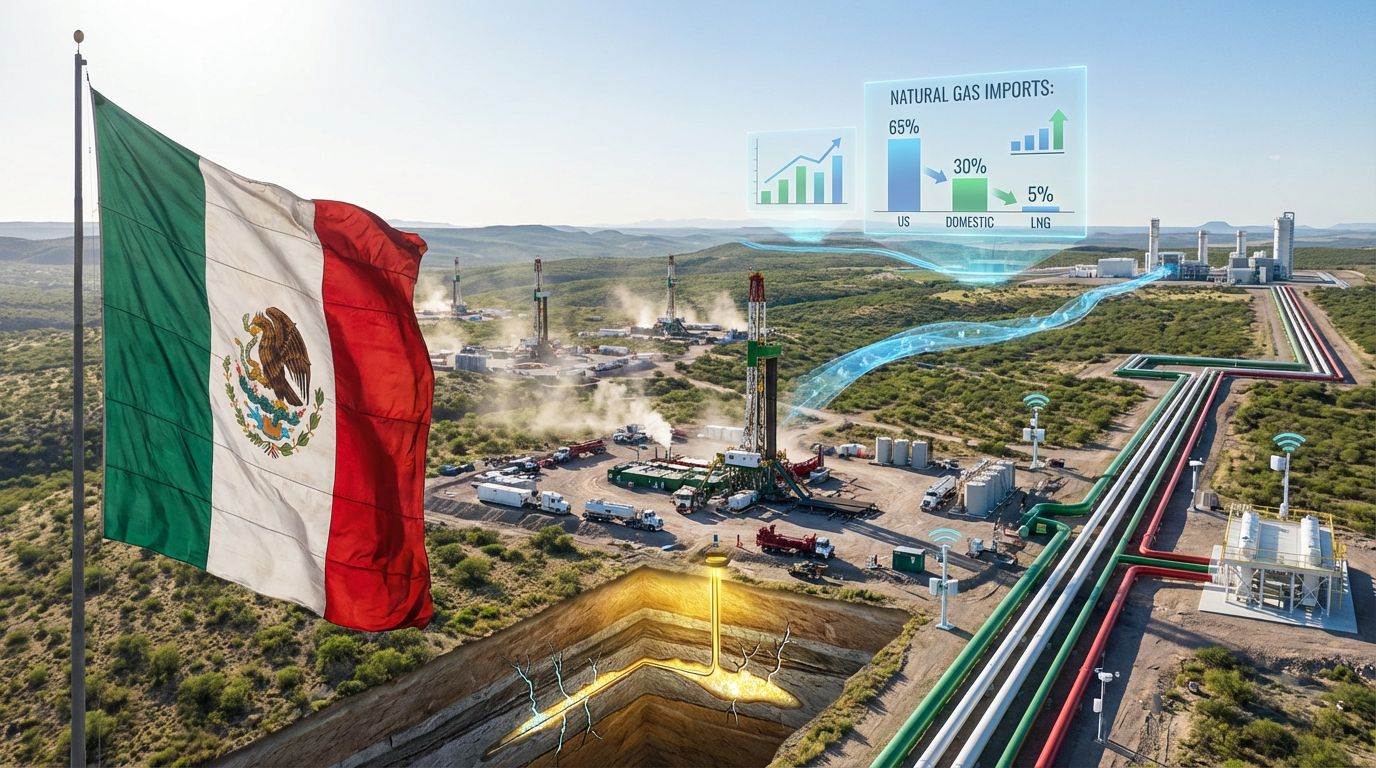

Mexico imports approximately 65% of its natural gas requirements through US pipeline connections, creating significant strategic vulnerability to supply disruptions or price manipulation. Domestic production accounts for roughly 30% of national consumption, though this percentage has declined as demand growth outpaced domestic exploration and development activities.

Liquefied natural gas imports represent only 5% of total supply, limited by insufficient terminal infrastructure and higher transportation costs compared to pipeline imports. This supply concentration creates economic risks for energy-intensive industries and constrains Mexico's ability to negotiate favourable pricing terms.

| Supply Source | Percentage of Total | Strategic Risk Assessment |

|---|---|---|

| US Pipeline Imports | 65% | High dependency vulnerability |

| Domestic Production | 30% | Declining trend concern |

| LNG Imports | 5% | Infrastructure limitations |

Economic Competitiveness and Industrial Growth Requirements

Mexico's industrial competitiveness depends substantially on energy cost structures that enable manufacturing operations to compete with other North American production centres. Natural gas pricing directly affects sectors including petrochemicals, fertiliser manufacturing, steel production, and electricity generation.

State officials argue that Canada energy transition objectives, industrial growth targets, and economic competitiveness initiatives require reliable natural gas supplies at competitive pricing. However, ignoring unconventional resources for political reasons could leave significant domestic reserves undeveloped while regional and global demand continues expanding.

Which Geological Formations Present Mexico's Greatest Unconventional Potential?

Mexico's unconventional resource potential centres on two primary geological formations that demonstrate characteristics similar to successfully developed US shale plays. Technical assessment indicates substantial resource volumes, though commercial development would require significant investment in exploration, infrastructure, and regulatory compliance.

Burgos Basin: Technical Assessment and Development Prospects

The Burgos Basin represents Mexico's most significant unconventional resource opportunity, with estimated reserves of 64 billion barrels of oil equivalent spanning Tamaulipas and adjacent states. This resource estimate approaches the scale of major US shale formations, suggesting substantial commercial potential under appropriate development scenarios.

| Assessment Metric | Burgos Basin | Comparative Analysis |

|---|---|---|

| Estimated Reserves | 64 billion BOE | Eagle Ford equivalent |

| Geographic Coverage | Multi-state formation | Tamaulipas plus adjacent regions |

| Development Status | Early exploration phase | Minimal historical activity |

Current development status remains at minimal exploration levels, reflecting political constraints rather than technical or economic limitations. Industry analysis suggests the formation shares geological characteristics with proven US unconventional plays that have achieved commercial success under strict regulatory oversight.

Tampico-Misantla Region: Strategic Geographic Advantages

The Tampico-Misantla region represents Mexico's second major unconventional resource centre, offering strategic geographic advantages including proximity to existing pipeline infrastructure and industrial demand centres. This formation provides alternative development opportunities that could complement Burgos Basin activities.

Geographic positioning near Gulf Coast industrial facilities and transportation networks could reduce development costs and accelerate project timelines compared to more remote unconventional formations. The region's existing energy infrastructure provides foundational support for potential unconventional operations.

Geological Similarities to Proven US Shale Formations

Industry technical analysis indicates that Mexican unconventional formations share critical characteristics with US shale plays that have achieved commercial production under environmental regulatory oversight. These geological similarities suggest comparable development potential using established operational techniques.

Onshore operators have emphasised that Mexico's formations demonstrate technical parameters consistent with successful US unconventional development, including appropriate formation thickness, organic content, and pressure regimes necessary for commercial hydrocarbon recovery.

How Do Modern Environmental Safeguards Address Historical Fracking Concerns?

Environmental protection technologies and monitoring capabilities have advanced substantially since early hydraulic fracturing operations generated widespread public concern. Modern unconventional development incorporates sophisticated environmental management systems that address historical issues including seismic activity and water consumption.

Seismic Monitoring Technology Advancements

Contemporary seismic monitoring systems provide comprehensive baseline data collection and real-time activity assessment capabilities that were unavailable during earlier unconventional development phases. These technological improvements enable precise evaluation of industrial impacts and rapid response to operational anomalies.

- Baseline data collection protocols establish pre-development seismic activity patterns for accurate impact assessment

- Real-time monitoring networks detect microseismic events with improved sensitivity and geographic precision

- Automated response systems enable immediate operational adjustments when seismic thresholds are approached

- Risk assessment modelling incorporates local geological conditions and operational parameters

Regulatory authorities and operators can now evaluate seismic impacts with significantly greater accuracy than was possible when much of the criticism surrounding induced seismicity emerged.

Water Management Innovation and Conservation Techniques

Water consumption concerns that historically dominated fracking debates have been addressed through technological innovations that dramatically reduce freshwater requirements while improving operational efficiency. For instance, advanced stimulation techniques offer substantial environmental improvements over traditional hydraulic fracturing methods.

Mexican Oil Institute research has developed carbon dioxide injection methodologies that reduce water consumption by up to 70% compared to conventional hydraulic fracturing while simultaneously contributing to carbon capture and storage objectives, representing a significant technological advancement for unconventional resource development.

These technological approaches transform unconventional development from an environmental liability into a potential carbon management solution, addressing climate concerns while accessing domestic energy resources.

Regulatory Oversight and Community Engagement Frameworks

Modern unconventional development incorporates comprehensive community engagement protocols and transparent regulatory oversight that addresses historical concerns about operational secrecy and environmental impacts. Regulatory frameworks now require extensive public consultation and continuous monitoring throughout project lifecycles.

Environmental compliance standards encompass air quality monitoring, groundwater protection, waste management protocols, and emergency response planning. These regulatory requirements exceed standards that governed early unconventional development operations.

What Role Does Pemex Play in Mexico's Unconventional Resource Strategy?

Pemex's involvement in unconventional resource development would require substantial technical capability enhancement and strategic partnership arrangements to achieve commercial success. The national oil company's conventional expertise must be supplemented with specialised unconventional development knowledge and operational experience.

2025-2035 Strategic Plan Integration

Mexico's national energy planning prioritises natural gas supply security as a strategic objective, creating potential alignment between Pemex operations and unconventional resource development. The company's long-term strategic planning must incorporate unconventional resources to achieve domestic supply diversification goals.

Integration of unconventional development into Pemex operations would require substantial capital investment, technology acquisition, and workforce development to build necessary operational capabilities for shale resource development.

Technical Capabilities and Operational Readiness Assessment

Pemex possesses extensive conventional oil and gas operational experience but lacks specialised technical capabilities required for commercial unconventional development. Successful unconventional operations require different drilling techniques, completion methodologies, and production optimisation approaches.

The company would need to develop or acquire expertise in horizontal drilling, multi-stage hydraulic fracturing, production optimisation, and environmental management specific to unconventional formations to achieve commercial success.

Partnership Requirements for Unconventional Development

Commercial unconventional development in Mexico would likely require partnership arrangements between Pemex and international operators with proven shale development expertise. These partnerships could provide technology transfer, operational knowledge, and capital resources necessary for large-scale development.

Partnership structures could include joint ventures, service contracts, or technical assistance agreements that combine Pemex's local knowledge and regulatory relationships with international operators' unconventional development capabilities.

How Do State-Level Energy Policies Influence Federal Decision-Making?

The emergence of state-level advocacy for unconventional resource development, particularly from Tamaulipas, creates new political dynamics that could influence federal energy policy decisions. State governments face direct economic impacts from energy supply constraints and import dependency issues.

Tamaulipas International Energy Congress 2025: Policy Implications

The Tamaulipas International Energy Congress 2025 represented a significant shift in state-level energy policy discourse, with officials explicitly advocating for technical rather than political evaluation of unconventional resources. This position reflects state-level economic development priorities that may differ from federal political considerations, particularly as Tamaulipas calls for technical debate on fracking.

Furthermore, S&P Global notes that experts call for serious debate about fracking Mexico's vast unconventional oil and gas deposits, emphasising the need for technical rather than purely political discussions. Additionally, Mexico Business News reports that Tamaulipas calls for technical debate on fracking, highlighting the state's proactive approach to unconventional resource development.

State officials argue that energy transition goals, industrial competitiveness, and economic development require reliable natural gas supplies that could be provided through domestic unconventional development under appropriate regulatory oversight.

Regional Economic Development and Energy Infrastructure Alignment

Tamaulipas and other border states experience direct economic impacts from energy supply constraints and pricing volatility that affects industrial competitiveness and employment levels. State-level advocacy reflects these immediate economic concerns rather than broader political considerations.

Regional economic development strategies increasingly emphasise energy security and cost competitiveness as fundamental requirements for attracting and retaining industrial investment in manufacturing sectors.

Interstate Coordination for Cross-Border Formation Development

Geological formations extend across state boundaries, requiring interstate coordination for comprehensive resource development. The Burgos Basin spans multiple states, necessitating coordinated regulatory approaches and economic development strategies.

Interstate coordination mechanisms would be essential for managing cross-border environmental impacts, infrastructure development, and economic benefit distribution from unconventional resource development activities.

What Economic Factors Drive Mexico's Reconsideration of Unconventional Resources?

Economic analysis of Mexico's energy supply situation reveals multiple factors that support reconsideration of unconventional resource development, including import dependency costs, industrial competitiveness concerns, and economic development opportunities in resource-rich regions.

Natural Gas Supply Security Analysis

Mexico's natural gas supply structure creates economic vulnerabilities through concentration in US imports and limited supply diversification. Price volatility in North American natural gas markets directly impacts Mexican industrial operations and electricity generation costs.

Supply security analysis indicates that domestic unconventional development could provide price stability and supply reliability that supports long-term industrial planning and investment decision-making. Consequently, reduced import dependency would enhance Mexico's negotiating position in bilateral energy agreements.

Industrial Competitiveness and Manufacturing Sector Requirements

Energy-intensive manufacturing sectors require predictable, cost-effective natural gas supplies to maintain competitiveness with other North American production centres. Chemical manufacturing, steel production, and electricity generation depend on stable natural gas pricing for operational planning.

Industrial competitiveness analysis suggests that domestic unconventional development could provide cost advantages while reducing supply chain risks associated with cross-border pipeline dependencies. Moreover, the impact of oil price dynamics and US-China trade impacts further emphasises the need for energy security through domestic production.

Energy Transition Economics and Natural Gas Bridge Role

Natural gas serves as a critical bridge fuel in energy transition strategies, providing lower-carbon electricity generation while renewable energy infrastructure develops. Mexico's climate commitments require natural gas availability for coal-fired power plant replacement and grid stability support.

Economic modelling indicates that domestic natural gas production from unconventional sources could support climate objectives while reducing energy costs and import dependency risks.

Which Technical Standards Will Govern Future Unconventional Operations?

Technical standards for potential unconventional development in Mexico would likely incorporate international best practices while addressing specific local geological and environmental conditions. Regulatory frameworks would need to balance operational efficiency with environmental protection and community safety requirements.

International Best Practices Adaptation

Mexican regulatory standards would likely incorporate proven practices from successful unconventional development jurisdictions including the United States, Canada, and other countries with extensive shale development experience. These standards address operational safety, environmental protection, and community engagement requirements.

Technical standards would cover drilling practices, completion methodologies, production optimisation, waste management, and environmental monitoring protocols based on demonstrated international best practices.

Environmental Impact Assessment Requirements

Comprehensive environmental impact assessment protocols would be required for unconventional development projects, incorporating air quality monitoring, water resource protection, seismic activity assessment, and ecosystem impact evaluation throughout project lifecycles.

Environmental assessment requirements would likely exceed standards applied to conventional oil and gas development, reflecting public concerns and the need for transparent regulatory oversight of unconventional operations.

Operational Safety and Emergency Response Protocols

Safety protocols for unconventional operations would address well integrity requirements, equipment standards, workforce training, and emergency response planning specific to hydraulic fracturing and horizontal drilling operations.

Emergency response protocols would incorporate coordination between operators, regulatory authorities, and local emergency services to ensure rapid response to operational incidents or environmental concerns.

What Timeline and Implementation Strategy Could Mexico Adopt?

A systematic approach to unconventional resource development would likely involve phased implementation beginning with pilot projects and regulatory framework completion, followed by gradual commercial development under strict oversight and monitoring requirements.

Phased Development Approach for Pilot Projects

Phase 1 (2025-2027): Regulatory Foundation and Pilot Operations

- Complete comprehensive regulatory framework development

- Conduct limited pilot well programmes for technical assessment

- Establish environmental monitoring baselines

- Develop community engagement protocols

Phase 2 (2027-2030): Commercial Development Initiation

- Begin commercial development with strict environmental oversight

- Implement full-scale monitoring and reporting systems

- Establish production optimisation and environmental management protocols

- Evaluate economic viability and environmental impacts

Phase 3 (2030-2035): Integration with National Energy Strategy

- Scale commercial production based on pilot project results

- Integrate unconventional production with national energy planning

- Optimise transportation infrastructure and market development

- Assess long-term sustainability and environmental performance

Regulatory Framework Completion Requirements

Comprehensive regulatory framework development would require coordination between federal energy authorities, environmental agencies, and state governments to ensure consistent oversight and clear operational requirements.

Regulatory completion would address permitting procedures, environmental standards, operational requirements, reporting protocols, and community engagement mandates before commercial development could proceed.

Infrastructure Development and Investment Timelines

Infrastructure requirements for unconventional development include specialised drilling equipment, completion services, pipeline connections, processing facilities, and transportation networks to connect production with demand centres.

Investment timelines would depend on regulatory clarity, economic incentives, and partnership arrangements between domestic and international companies with unconventional development expertise and capital resources.

How Will International Investment and Technology Transfer Support Development?

Successful unconventional resource development in Mexico would require substantial international investment and technology transfer arrangements to access specialised expertise and capital resources necessary for commercial operations at scale.

Foreign Direct Investment Requirements and Opportunities

Commercial unconventional development requires significant capital investment in exploration, drilling, completion, and production infrastructure that exceeds typical conventional oil and gas project requirements. Foreign investment partnerships could provide necessary capital while sharing technical and operational risks.

Investment opportunities would be enhanced by clear regulatory frameworks, stable policy environments, and partnership structures that balance foreign capital access with domestic economic benefits and technology transfer requirements.

Technology Transfer Agreements and Knowledge Sharing

Technology transfer arrangements would be essential for acquiring unconventional development expertise including horizontal drilling techniques, hydraulic fracturing methodologies, production optimisation technologies, and environmental management systems.

Knowledge sharing agreements could provide Mexican operators with access to proven technologies while building domestic technical capabilities through training programmes and operational partnerships.

Service Company Capabilities and Local Content Requirements

Unconventional development requires specialised service companies with expertise in drilling, completion, production optimisation, and environmental management that may not be available in the Mexican market currently.

Local content requirements could be structured to encourage technology transfer and workforce development while ensuring access to specialised technical capabilities necessary for commercial success.

What Are the Long-Term Implications for Mexico's Energy Independence?

Successful unconventional resource development could fundamentally transform Mexico's energy security profile by reducing import dependency, diversifying supply sources, and providing domestic production capacity that enhances negotiating positions in international energy markets.

Supply Diversification and Import Reduction Potential

Domestic unconventional development could reduce US pipeline import dependency from current levels of approximately 65% to more balanced supply portfolios that incorporate domestic production, diversified imports, and strategic storage capabilities.

Supply diversification would enhance Mexico's energy security while providing price stability and supply reliability that supports industrial competitiveness and long-term economic planning initiatives.

Regional Energy Security and Economic Development Benefits

Regional economic development in states with significant unconventional resources could provide employment opportunities, tax revenue generation, and economic diversification benefits while contributing to national energy security objectives.

Energy security improvements would extend beyond Mexico to support North American energy market stability and integration through diversified supply sources and enhanced production capacity.

Integration with North American Energy Market Dynamics

Mexico's unconventional resource development would complement broader North American energy production and could support regional energy security objectives while maintaining competitive market dynamics and supply reliability.

Integration with continental energy markets would provide Mexico with enhanced flexibility in energy supply arrangements while contributing to regional energy security and economic development across North America.

Investment Considerations: This analysis presents policy and technical developments that may affect energy markets and investment opportunities. Investors should conduct independent due diligence and consult qualified advisors before making investment decisions. Energy sector investments carry substantial risks including regulatory changes, commodity price volatility, and operational challenges.

Disclaimer: Future unconventional resource development in Mexico remains subject to regulatory approval, political decisions, and technical feasibility assessments. This analysis is based on publicly available information and industry technical assessments rather than definitive policy commitments or approved development plans.

Ready to Capitalise on North American Energy Market Transformations?

As Mexico evaluates its unconventional energy potential and natural gas supply security, savvy investors are positioning themselves to benefit from the energy transition's impact on commodity markets. Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral and energy discoveries, empowering subscribers to identify actionable opportunities ahead of the broader market and secure their 30-day free trial today.