Critical Mineral Economics and Resource Security Strategy

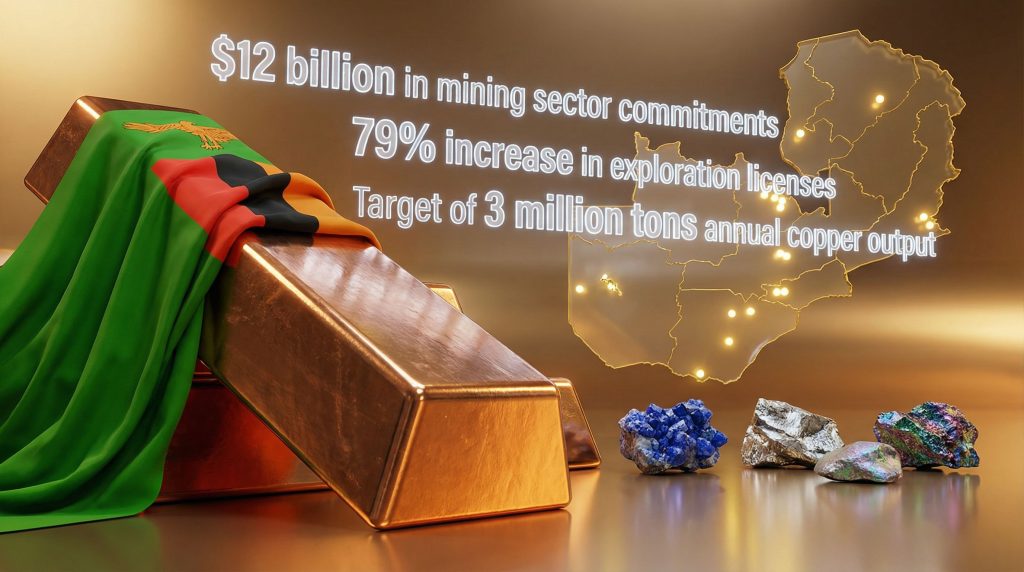

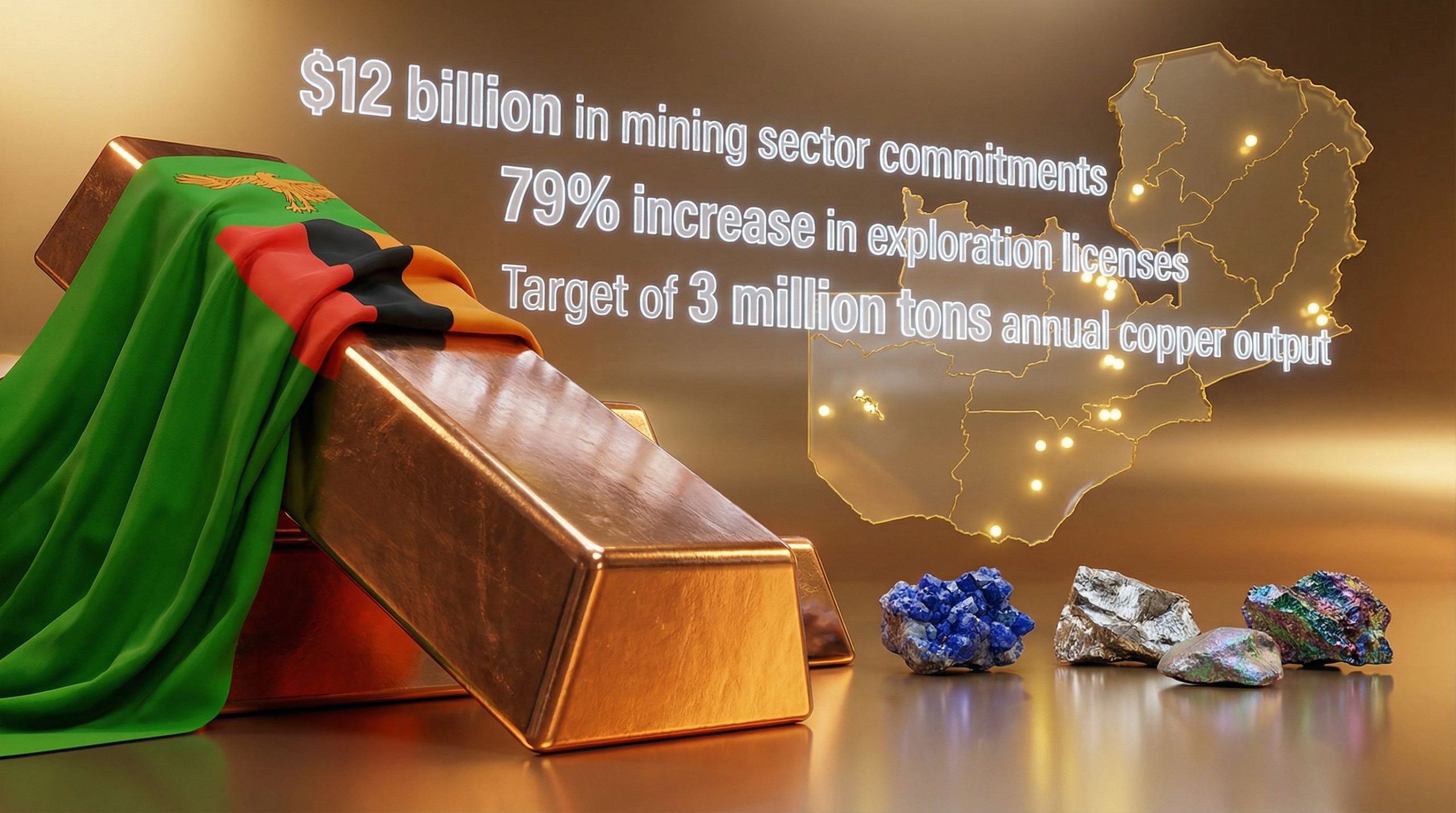

The global energy transition has fundamentally altered how nations approach mineral resource development, transforming traditional mining economies into strategic hubs for critical materials. Countries rich in copper, cobalt, and lithium deposits now find themselves at the centre of supply chain security discussions that extend far beyond conventional commodity markets. This shift represents more than incremental change – it signals a complete restructuring of how mineral-rich economies can leverage geological endowments to drive sustained economic transformation, particularly evident in the Zambia exploration renaissance.

Mining sectors worldwide face unprecedented demand pressures as renewable energy infrastructure requires substantially higher mineral inputs than fossil fuel systems. Electric vehicle batteries, solar panels, and wind turbines depend on reliable access to processed critical minerals, creating investment opportunities that transcend traditional mining cycles. The convergence of technological advancement, geopolitical supply chain concerns, and climate policy implementation has established new frameworks for evaluating the mineral exploration significance and development projects.

Geological Data Infrastructure as Economic Foundation

Modern mineral exploration success depends increasingly on comprehensive geological data systems that integrate historical mining records with advanced geophysical survey techniques. Digital mapping platforms combined with artificial intelligence applications enable systematic identification of previously overlooked mineral deposits, particularly in regions where historical exploration focused on single commodities rather than multi-mineral systems.

The establishment of integrated mining information platforms represents a fundamental shift in how governments support private sector exploration activities. Rather than simply regulating existing operations, public authorities now actively facilitate discovery through data sharing initiatives and transparency frameworks designed to reduce exploration risk for international investors.

Key technological integration elements include:

- High-resolution aerial geophysical surveys providing baseline geological data

- Artificial intelligence algorithms for pattern recognition in geological formations

- Digital repository systems enabling efficient data sharing between public and private sectors

- Advanced remote sensing technologies for identifying surface mineral indicators

- Integrated database platforms supporting multi-company exploration coordination

Ivanhoe Mines has committed US$50 million to copper exploration drilling programs, utilising airborne geophysical data from nationwide surveys to accelerate discovery timelines. This approach demonstrates how government-provided geological infrastructure can directly support private sector investment decisions and exploration efficiency.

Investment Capital Formation and Risk Distribution

The evolution from production-focused mining investment toward exploration-driven capital allocation reflects fundamental changes in how international investors evaluate mineral sector opportunities. Traditional metrics emphasising immediate production capacity have expanded to include discovery potential, technological innovation capabilities, and strategic resource positioning within global supply chains.

Public-private partnership structures now serve as primary mechanisms for distributing exploration risks while ensuring government participation in successful discovery programs. These frameworks enable smaller exploration companies to access capital markets whilst providing established mining corporations with geographic diversification opportunities in regions with proven geological potential.

Investment trend indicators:

| Investment Category | Market Dynamics | Strategic Significance |

|---|---|---|

| Junior Exploration | Technology-enhanced efficiency enables competitive positioning | Critical for early-stage discovery programs |

| Mid-tier Development | Access to advanced data reduces traditional exploration risks | Bridge between discovery and commercial production |

| Major Corporation Partnerships | Geographic diversification and supply chain security focus | Long-term strategic resource positioning |

Giant Mineral Fields has established partnerships with African Holdings Limited and Curprite Geo-Services for Central African Copperbelt exploration across three licence areas, demonstrating how collaborative structures support systematic regional exploration programs rather than isolated project development.

Multi-Commodity Resource Development Strategy

Economic diversification through multi-commodity mineral development requires integrated resource assessment methodologies that identify synergistic opportunities within single geological systems. Copper deposits often contain significant cobalt concentrations, whilst lithium and rare earth element occurrences frequently overlap with established mining districts, creating opportunities for coordinated development approaches.

The transition from single-commodity mining operations toward integrated critical minerals production reflects supply chain requirements for energy transition technologies. Battery manufacturing, renewable energy systems, and electric vehicle production require reliable access to multiple processed minerals, creating demand for coordinated supply chain development rather than fragmented commodity markets.

Critical mineral development progression:

- Cobalt sulfate refining capabilities: First African cobalt sulfate refinery project backed by US$100 million investment demonstrates commercial viability of downstream processing integration

- Graphite exploration programs: High-grade deposits in Lundazi and Kapiri Mposhi regions support diversified mineral portfolio development

- Lithium resource assessment: Early-stage exploration activities focus on energy transition mineral requirements

- Rare earth element development: Kesya Project advancement indicates strategic mineral development beyond base metals

Technology Integration and Exploration Efficiency

Advanced exploration technologies have fundamentally altered risk-return calculations for mineral discovery programs. Artificial intelligence applications in geological data interpretation, combined with high-resolution geophysical survey techniques, enable systematic evaluation of previously unexplored territories whilst reducing traditional exploration costs and timeline requirements.

Furthermore, the integration of digital mapping platforms with historical geological databases creates comprehensive resource potential assessments that support informed investment decisions. These technological capabilities enable smaller exploration companies to compete effectively with major mining corporations by leveraging data-driven discovery methodologies rather than relying solely on extensive capital resources.

Technology implementation examples:

- Induced Polarisation (I.P.) surveys: Cameo Resources completion of advanced geophysical surveys demonstrates systematic application of modern exploration techniques

- Airborne geophysical data integration: Nationwide survey programs provide baseline geological information supporting private sector exploration acceleration

- AI-powered geological analysis: Machine learning algorithms identify mineral potential patterns within complex geological datasets

- Digital mapping coordination: Integrated platforms support multi-company exploration coordination and data sharing initiatives

Koryx Copper actively explores two large-scale licences covering Luanshya West and Mpongwe areas totalling over 700 km², utilising historical geological data combined with modern geophysics and planned drilling programs to test high-potential targets systematically.

Infrastructure Development as Economic Multiplier

Transportation infrastructure development supporting mineral exploration and production creates economic spillover effects that extend far beyond the mining sector itself. Railway improvements, port facility expansion, and logistics corridor development establish capabilities supporting broader economic diversification whilst reducing operational costs for mining companies.

The establishment of processing infrastructure for critical minerals creates vertical integration opportunities that capture additional value within domestic economies rather than exporting raw materials for processing elsewhere. Cobalt sulfate refining, copper cathode production, and rare earth element separation facilities represent strategic infrastructure investments supporting long-term economic transformation.

Infrastructure development priorities:

- Transportation logistics: Railway and port improvements supporting mineral export efficiency

- Processing capabilities: Downstream mineral processing infrastructure development

- Power supply systems: Reliable energy infrastructure supporting mining operations

- Digital connectivity: Communications infrastructure enabling modern mining operations

- Skills development: Technical training capabilities supporting advanced mining operations

Strategic Partnership Frameworks and Technology Transfer

International cooperation agreements focusing on knowledge transfer and technology sharing represent strategic alternatives to purely capital-based investment relationships. These partnerships provide access to advanced exploration technologies, human capital development programs, and processing capabilities that support long-term economic transformation rather than simple resource extraction.

Joint venture structures enable risk distribution whilst ensuring technology transfer and skills development within domestic economies. Rather than traditional foreign direct investment models, these collaborative frameworks support institutional capacity building and technical expertise development essential for sustained mineral sector growth, particularly relevant to junior mining investments strategies.

Partnership structure benefits:

- Access to advanced exploration and processing technologies

- Human capital development through technical training programs

- Institutional capacity building for regulatory and oversight functions

- Market access facilitation for processed mineral products

- Research and development collaboration supporting innovation

How Are International Partners Facilitating Technology Transfer?

Established mining corporations increasingly partner with local companies to facilitate knowledge transfer whilst accessing regional expertise and regulatory familiarity. These partnerships often include comprehensive training programs, equipment sharing agreements, and joint research initiatives that benefit both parties.

For instance, international mining safety standards and practices are being adapted to local conditions through partnerships with organisations such as Zambia Mine Safety, ensuring that technological advancement coincides with enhanced safety protocols.

Global Supply Chain Security and Market Positioning

Supply chain security considerations have elevated certain mineral-producing regions to strategic importance within global energy transition planning. Countries controlling significant copper, cobalt, and lithium resources now occupy positions analogous to traditional oil and gas producers, with the added advantage of supporting rather than competing with climate policy objectives.

The concentration of critical mineral production in limited geographic regions creates supply chain vulnerabilities that consuming nations seek to address through diversified sourcing strategies. This dynamic creates opportunities for countries with underdeveloped but significant mineral resources to establish themselves as strategic suppliers supporting energy transition requirements.

Consequently, the critical minerals strategy has become central to economic planning, with recent developments highlighting significant potential for the Zambia exploration renaissance to contribute substantially to global supply chain diversification.

Market positioning factors:

- Geological resource base: Proven mineral reserves and exploration potential

- Political stability: Regulatory consistency and investment protection frameworks

- Infrastructure capability: Transportation and processing infrastructure development

- Technical capacity: Skills and institutional capabilities supporting modern mining operations

- Environmental standards: Sustainable development practices supporting long-term market access

Economic Transformation Through Discovery-Driven Growth

The success of exploration-led economic development strategies depends on systematic coordination between geological discovery programs, infrastructure development, and institutional capacity building. Rather than relying on individual project success, sustainable transformation requires integrated approaches that leverage geological endowments through comprehensive economic development planning.

However, this transformation extends beyond simple resource extraction to encompass comprehensive economic restructuring that positions countries as essential participants in global energy transition supply chains. The current Zambia exploration renaissance exemplifies this approach, with multiple international partnerships and significant capital commitments supporting systematic exploration and development programs.

Investment and development metrics indicate significant momentum:

- US$50 million committed by Ivanhoe Mines for copper exploration drilling programs

- US$100 million backing for cobalt refinery development targeting late 2025 completion

- Multiple exploration partnerships established across Central African Copperbelt regions

- Systematic geophysical survey programs providing foundational geological data

- Advanced exploration techniques implementation across multiple licence areas

Investment Risk Considerations: While exploration renaissance activities demonstrate significant potential, investors should note that mineral exploration inherently involves substantial risks including geological uncertainty, regulatory changes, commodity price volatility, and infrastructure development requirements. Past exploration success does not guarantee future discovery or commercial viability.

Future Market Dynamics and Strategic Implications

The emergence of critical minerals as strategic resources comparable to traditional energy commodities establishes new frameworks for international economic relationships. Countries with significant undeveloped mineral resources face opportunities to establish themselves as essential suppliers within energy transition supply chains, provided they can develop appropriate technological capabilities and infrastructure systems.

Furthermore, industry observers note that Zambia's mining renaissance demonstrates how systematic exploration combined with strategic infrastructure investment can position countries advantageously within evolving global mineral markets.

Long-term success requires balancing immediate exploration and development opportunities with sustainable economic transformation strategies that create lasting institutional capabilities and human capital development. The current period of intensive exploration activity and infrastructure investment represents a critical window for establishing competitive advantages within evolving global mineral markets.

What Factors Will Determine Long-Term Success?

The transformation from traditional mining economies toward integrated critical minerals production systems requires coordinated public and private sector investment in geological data infrastructure, processing capabilities, and technical skills development. Success in this transition will determine whether resource-rich countries can capture sustainable economic benefits from global energy transition requirements or remain dependent on raw material export models with limited value capture potential.

The ongoing Zambia exploration renaissance serves as a compelling case study for how strategic coordination between government policy, private investment, and technological innovation can create sustainable competitive advantages in global critical minerals markets.

Ready to Capitalise on the Next Major Mineral Discovery?

Discovery Alert's proprietary Discovery IQ model delivers instant notifications on significant ASX mineral discoveries, transforming complex geological data into actionable trading insights that keep you ahead of market movements. Explore how major mineral discoveries have delivered exceptional returns to early investors, then begin your 30-day free trial today to position yourself at the forefront of Australia's dynamic exploration sector.