Deepwater Discovery Reinforces Brazil's Post-Salt Potential

Petrobras has achieved another significant milestone in Brazil's offshore exploration program with the confirmation of high-quality post-salt crude reserves in the Campos Basin. The Petrobras post-salt oil discovery Brazil Campos basin represents a strategic validation of mature basin revitalization efforts, demonstrating that conventional post-salt formations continue to offer substantial commercial opportunities alongside Brazil's renowned pre-salt mega-projects.

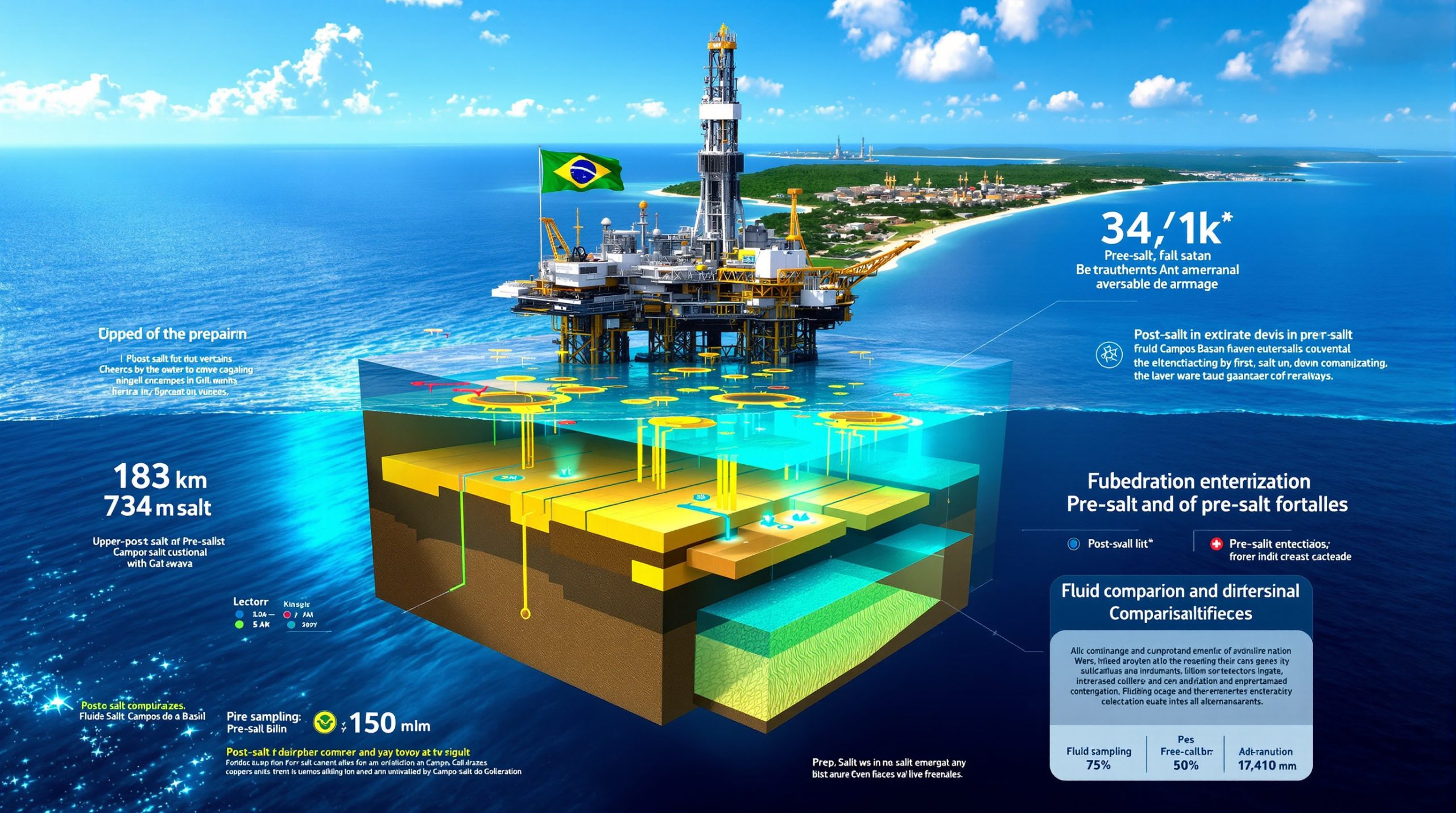

Located 108 kilometers offshore from Campos dos Goitacazes at a water depth of 734 meters, the discovery emerged from well 4-BRSA-1403D-RJS through comprehensive evaluation including electrical logs, gas readings, and fluid sampling analysis. This technical confirmation process underscores the methodical approach required for deepwater exploration in Brazil's complex geological environment.

The discovery's positioning within established infrastructure corridors provides immediate development advantages compared to frontier exploration areas. Unlike ultra-deepwater pre-salt discoveries that require entirely new subsea architectures, this post-salt find benefits from proximity to existing Campos Basin production facilities, potentially accelerating the path to commercial production.

Geological Context and Reservoir Characteristics

Post-salt formations in the Campos Basin present distinct geological advantages over their pre-salt counterparts. These conventional reservoirs typically exhibit predictable pressure regimes and established drilling methodologies, reducing technical uncertainties that often characterize ultra-deepwater developments. Furthermore, advanced 3D geological modelling techniques have enhanced understanding of these complex structural formations.

The post-salt section consists primarily of turbidite sandstones deposited during the Tertiary period, offering generally favorable porosity and permeability characteristics. Moreover, drilling program techniques continue to evolve, providing more precise reservoir evaluation capabilities.

The confirmation methodology employed at Sudoeste de Tartaruga Verde reflects industry-standard practices for post-salt evaluation. Electrical log interpretation provides crucial porosity and saturation data, while gas readings during drilling operations indicate hydrocarbon presence throughout the reservoir interval. Fluid sampling enables detailed composition analysis, determining oil quality parameters essential for development planning.

Laboratory analysis of reservoir samples will characterize critical parameters including:

• API gravity measurements determining oil quality and pricing differentials

• Viscosity profiles affecting production rates and enhanced recovery potential

• Gas-to-oil ratios influencing surface facility requirements

• Water saturation levels impacting recoverable reserve calculations

• Pressure gradient analysis guiding completion design and artificial lift requirements

Strategic Integration Within Brazil's Energy Portfolio

This discovery strengthens Brazil's position as a leading offshore oil producer by diversifying the resource base beyond pre-salt formations. While pre-salt developments like Tupi and Libra capture headlines with their massive reserves, post-salt discoveries provide crucial production bridge opportunities with shorter development cycles and lower capital intensity.

The 2018 5th Production Sharing Round award demonstrates Brazil's continued commitment to exploring mature basins using modern technology. Under this framework, Pré-Sal Petróleo S.A. (PPSA) manages the production-sharing contract while Petrobras maintains 100% operational control, ensuring technical expertise alignment with commercial objectives. Additionally, global oil markets face challenges from oil price stagnation insights and OPEC production impact decisions that influence development strategies.

Brazil's offshore exploration strategy recognizes that post-salt formations offer several competitive advantages:

• Reduced geological risk through analog comparison with producing fields

• Established infrastructure access minimizing greenfield development costs

• Conventional reservoir management techniques reducing operational complexity

• Shorter appraisal programs accelerating commercial decision timelines

• Lower break-even oil prices improving project economics across commodity cycles

Campos Basin Revival and Infrastructure Synergies

The Campos Basin historically served as Brazil's primary offshore production center before pre-salt discoveries shifted focus to the Santos Basin. This latest Petrobras post-salt oil discovery Brazil Campos basin validates the continued prospectivity of mature areas when explored with advanced seismic imaging and drilling technologies.

Modern 3D and 4D seismic surveys have revealed previously undetected stratigraphic traps and structural complexities within post-salt sections. Enhanced data processing algorithms and machine learning applications enable interpreters to identify subtle hydrocarbon indicators that earlier technology generations might have missed.

According to World Oil, this discovery confirms high-quality crude oil characteristics that enhance the commercial potential of post-salt reservoirs.

Existing infrastructure in the Campos Basin includes:

• Production platforms with available processing capacity

• Subsea pipeline networks enabling cost-effective tie-back options

• Export terminals providing direct market access

• Service vessel bases supporting drilling and workover operations

• Helicopter facilities ensuring personnel transportation logistics

Commercial Development Framework and Timeline Considerations

Post-salt discoveries typically follow accelerated development schedules compared to ultra-deepwater pre-salt projects. The Sudoeste de Tartaruga Verde find benefits from established regulatory frameworks and proven development concepts that reduce project execution risks.

Production-sharing agreements in Brazil allocate government participation based on field productivity and development costs. Higher-margin post-salt developments often result in more favorable cost recovery terms, improving project returns for operators while ensuring appropriate government revenue streams.

The development decision process will incorporate multiple economic scenarios considering various factors. For investors evaluating such opportunities, comprehensive investment strategy insights become essential for portfolio optimization.

Critical factors include oil price volatility, infrastructure availability, regulatory approval timelines, and reservoir performance characteristics that collectively determine commercial viability.

Development Timeline Comparison Analysis

| Development Phase | Post-Salt Projects | Pre-Salt Mega-Projects |

|---|---|---|

| Appraisal Period | 12-18 months | 24-36 months |

| Concept Selection | 6-12 months | 18-24 months |

| Detailed Engineering | 18-24 months | 36-48 months |

| Construction/Installation | 24-36 months | 48-72 months |

| First Production | 3-5 years | 7-10+ years |

| Plateau Production | 1-2 years post-startup | 3-5 years post-startup |

Investment Requirements and Economic Modeling

Post-salt developments benefit from moderate capital requirements compared to ultra-deepwater pre-salt projects. Typical development costs range from $15,000 to $25,000 per barrel of daily production capacity, significantly lower than pre-salt developments that often exceed $40,000 per barrel of daily capacity.

Operating expenditures for post-salt fields generally range from $8 to $15 per barrel, reflecting conventional production methods and established infrastructure access. Pre-salt operations typically require $12 to $25 per barrel due to complex reservoir management requirements and specialized equipment needs.

Break-even oil prices for post-salt developments commonly fall between $35 to $50 per barrel, providing economic resilience across commodity price cycles. This contrasts with many pre-salt projects requiring $45 to $65 per barrel break-even prices due to higher capital intensity.

Brazil's Broader Exploration Success Trajectory

The Sudoeste de Tartaruga Verde discovery contributes to Brazil's expanding resource portfolio that extends well beyond pre-salt formations. Recent exploration successes across multiple offshore basins demonstrate the country's geological diversity and continued exploration potential.

Brazilian offshore basins have yielded numerous discoveries since 2020, including:

• Equatorial margin prospects revealing new hydrocarbon systems

• Sergipe-Alagoas Basin finds expanding regional production potential

• Espírito Santo Basin discoveries diversifying resource geography

• Potiguar Basin exploration opening frontier areas

• Recôncavo Basin revitalization demonstrating mature area potential

Technological Innovation Impact

Advanced drilling technologies have enabled successful exploration in previously challenging environments. Managed pressure drilling systems allow precise control of downhole conditions, while rotary steerable systems improve wellbore placement accuracy in complex geological structures.

Real-time formation evaluation capabilities provide immediate reservoir quality assessment during drilling operations. Logging-while-drilling tools deliver continuous petrophysical data, enabling rapid geological model updates and completion design optimization.

Seismic technology advances include:

• Full-waveform inversion improving velocity model accuracy

• Ocean-bottom node surveys enhancing sub-salt imaging quality

• Machine learning interpretation accelerating prospect identification

• 4D seismic monitoring optimising field development strategies

• Multi-component acquisition revealing fracture network characteristics

Market Implications and Investment Dynamics

Brazil's continued exploration success reinforces its position among the world's top offshore oil producers. The country currently produces approximately 2.8 million barrels per day, with offshore operations contributing over 85% of total production.

Post-salt discoveries like Sudoeste de Tartaruga Verde provide crucial production diversity that complements large-scale pre-salt developments. This balanced portfolio approach reduces concentration risk while maintaining competitive production costs across varying market conditions.

Global Supply Context and Energy Security

Brazilian offshore production contributes approximately 3.5% of global oil supply, making continued exploration success strategically significant for international energy markets. Post-salt developments can achieve production startup within 3-5 years, providing relatively rapid supply additions compared to other deepwater regions.

The Petrobras post-salt oil discovery Brazil Campos basin supports Brazil's energy security objectives by:

• Extending domestic production plateau periods through diverse resource development

• Maintaining export capacity supporting favourable trade balance contributions

• Attracting continued investment in domestic energy infrastructure

• Preserving technical expertise within the national oil industry

• Supporting regional employment in specialised maritime sectors

Investment Community Response Framework

Petrobras' exploration success validates the company's technical capabilities and strategic focus on high-return opportunities. The discovery demonstrates effective capital allocation toward lower-risk, shorter-cycle developments that complement the company's pre-salt investment portfolio.

Institutional investors increasingly favour oil companies with diversified project portfolios that balance high-impact discoveries with moderate-risk developments. Post-salt finds provide this balance by offering predictable development timelines and established production techniques.

ESG considerations support post-salt development preferences due to:

• Lower carbon intensity through infrastructure sharing and shorter transportation distances

• Reduced environmental impact from brownfield development approaches

• Established regulatory compliance frameworks minimising approval uncertainties

• Community integration benefits through existing local supply chains

Development Strategy and Future Outlook

Laboratory analysis results will guide Petrobras' appraisal program design, determining optimal well placement for reservoir characterisation and production testing. Extended well testing may provide preliminary production data supporting development concept selection.

Furthermore, industry analysts at Upstream Online emphasise the strategic importance of this discovery within Brazil's broader exploration portfolio.

Potential development concepts include:

• Subsea tie-back to existing Campos Basin facilities

• Shared platform development with adjacent discoveries

• Standalone wellhead platform for localised production

• Phased development approach optimising capital deployment timing

• Enhanced recovery implementation maximising ultimate resource recovery

Regional Development Synergies and Integration

The Campos Basin's mature infrastructure provides multiple tie-back options that can significantly reduce development costs. Shared processing facilities enable smaller discoveries to achieve commercial viability through cost distribution across multiple fields.

Pipeline network access eliminates the need for dedicated export systems, while established supply bases reduce logistics costs and operational complexity. These infrastructure advantages typically improve project internal rates of return by 3-7 percentage points compared to greenfield developments.

Cumulative production from integrated Campos Basin developments could extend regional production plateau periods by 5-10 years, maintaining employment and economic activity in established oil industry communities.

Risk Assessment and Mitigation Strategies

Post-salt developments face conventional exploration and development risks that are generally well-understood and manageable through established industry practices. Reservoir connectivity represents the primary geological uncertainty, requiring comprehensive appraisal to define field boundaries and production characteristics.

Technical risks include:

• Compartmentalisation potentially limiting individual well productivity

• Water influx affecting recovery factors and facility design requirements

• Sand production requiring specialised completion and surface equipment

• Corrosion management in challenging deepwater environments

• Flow assurance ensuring pipeline operability across temperature ranges

Commercial risks encompass:

• Oil price volatility affecting project economics and investment timing

• Regulatory changes impacting taxation and operational requirements

• Infrastructure access constraints limiting development options

• Environmental approval processes extending project timelines

• Currency fluctuations affecting development cost calculations

Mitigation strategies typically include comprehensive insurance programmes, hedging arrangements for commodity price and currency exposure, phased development approaches allowing investment flexibility, and partnership structures sharing risks across multiple operators.

Strategic Implications for Brazilian Energy Independence

The Petrobras post-salt oil discovery Brazil Campos basin contributes to Brazil's long-term energy security by expanding domestic production capacity and reducing import dependence. Post-salt developments provide production stability through conventional reservoir management techniques and established operational practices.

Brazil's energy strategy emphasises production diversification across multiple geological formations and geographical regions. This approach reduces concentration risk while maintaining competitive production costs that support economic growth and fiscal stability.

Government revenue from post-salt developments includes royalty payments, special participation fees, and production-sharing allocations that contribute to public infrastructure investment and social programmes. The National Petroleum Agency (ANP) regulatory framework ensures appropriate benefit distribution between operators and the Brazilian government.

The discovery validates continued investment in Brazilian offshore exploration, supporting the country's position as a leading global oil producer while maintaining technical expertise within the domestic energy sector. This strategic positioning enables Brazil to participate effectively in international energy markets while preserving domestic energy security.

Disclaimer: This analysis is based on publicly available information and industry data. Actual development outcomes may vary based on detailed reservoir characterisation, market conditions, regulatory changes, and technical factors not yet fully determined. Investment decisions should consider comprehensive due diligence and professional financial advice.

Interested in the Next Major Oil Discovery?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries, instantly empowering subscribers to identify actionable opportunities ahead of the broader market. Understand why major mineral discoveries can lead to significant market returns by exploring Discovery Alert's dedicated discoveries page, showcasing historic examples of exceptional outcomes.