Understanding Deepwater Post-Salt Exploration Dynamics

Brazil's offshore petroleum landscape continues evolving through sophisticated deepwater drilling technologies that unlock hydrocarbon reserves beneath complex geological formations. The Petrobras oil discovery Campos Basin represents a significant milestone in post-salt exploration, where operators must navigate through dense salt layers to reach oil-bearing intervals positioned below these challenging formations. Furthermore, these developments demonstrate how advanced oil market movements influence exploration investment decisions across global offshore regions.

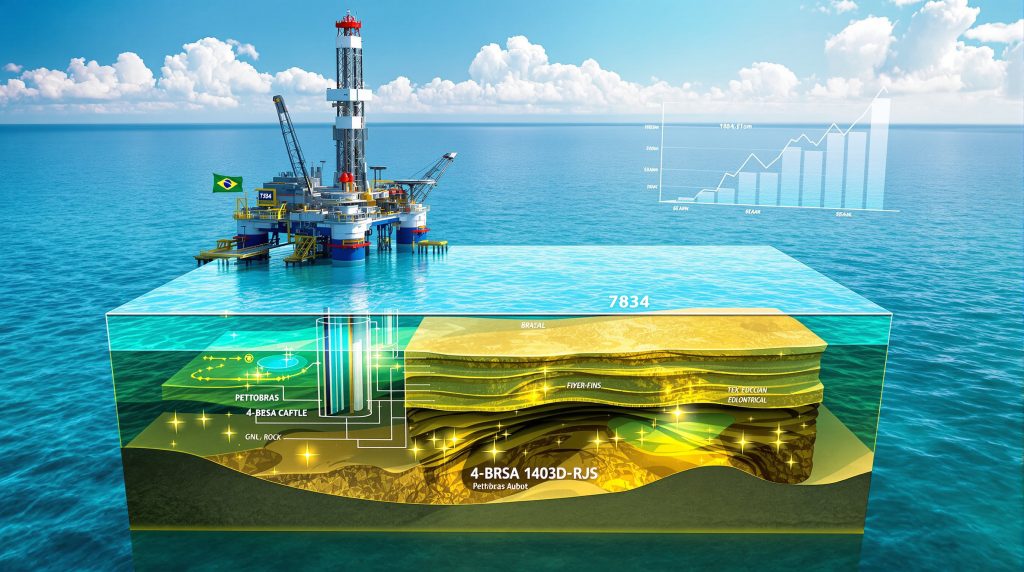

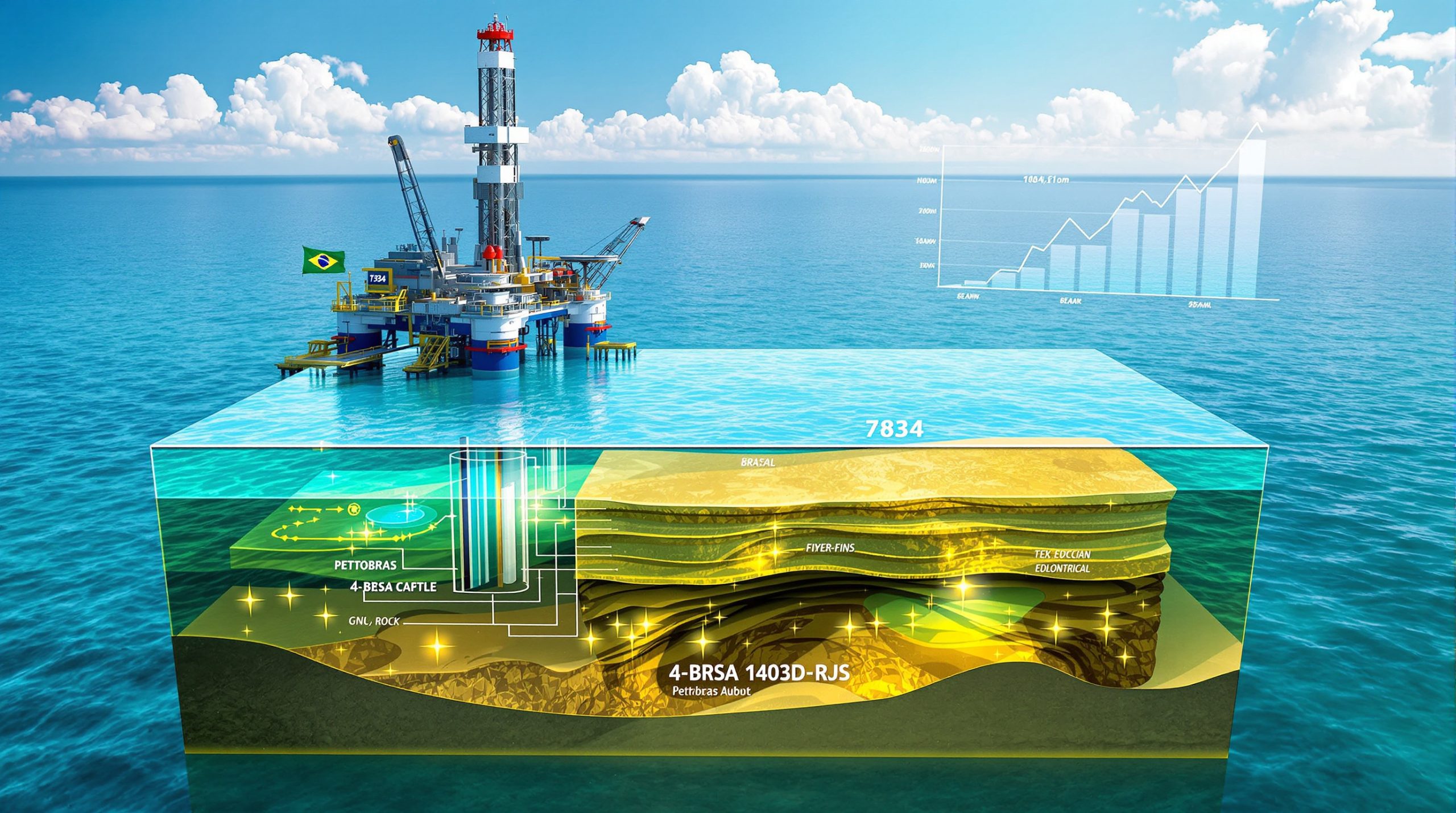

The Southwest Tartaruga Verde block discovery demonstrates the effectiveness of modern electrical profiling techniques combined with direct fluid sampling methodologies. Well 4-BRSA-1403D-RJS, completed at 734 meters water depth and positioned 108 kilometres offshore from Campos dos Goytacazes, utilised electrical resistivity measurements to identify hydrocarbon-bearing zones whilst monitoring gas signatures during drilling operations.

Technical Verification Methods for Offshore Discoveries

Electrical profiling systems measure formation resistivity to distinguish between water-saturated and hydrocarbon-bearing rock intervals. Higher resistivity readings typically indicate the presence of oil or gas, as hydrocarbons exhibit greater electrical resistance compared to formation water. Gas indications observed during drilling operations provide real-time confirmation of hydrocarbon presence through surface monitoring equipment that detects trace gases circulated from downhole formations.

Fluid sampling procedures involve retrieving formation fluids under controlled pressure conditions to maintain sample integrity during transport to surface facilities. These samples undergo detailed laboratory analysis to determine fluid composition, density, viscosity, and other critical reservoir properties that influence development economics and production forecasting. Consequently, the technical success of these operations contrasts sharply with periods of stagnant oil prices that can affect exploration budgets.

Post-Salt Formation Complexity

Post-salt drilling environments present unique operational challenges compared to pre-salt reservoirs. Salt formations create complex pressure regimes and geological structures that require specialised drilling fluids and casing designs. Temperature and pressure conditions beneath salt layers often exceed standard drilling parameters, demanding advanced completion technologies and enhanced safety protocols.

The geological significance of post-salt discoveries lies in their potential to complement existing pre-salt production systems whilst utilising established infrastructure networks. Post-salt reservoirs typically exhibit different fluid characteristics and reservoir properties compared to their pre-salt counterparts, offering diversified production profiles and risk mitigation opportunities for operators.

Brazil's Offshore Production Infrastructure Framework

The Campos Basin maintains its position as a cornerstone of Brazil's offshore petroleum industry through decades of infrastructure development and operational expertise. Established production platforms, subsea manifolds, and pipeline networks create opportunities for efficient tie-back developments that minimise capital expenditure requirements for new discoveries. In addition, industry analysts have noted that such discoveries can provide stability during volatile market conditions, including potential oil price crash insights scenarios.

Regional infrastructure density in the Campos Basin includes multiple production platforms, floating production storage and offloading (FPSO) vessels, and extensive subsea pipeline networks connecting offshore fields to onshore processing terminals. This infrastructure foundation enables rapid development timelines for discoveries that can utilise existing processing capacity and transportation systems.

Integration with National Energy Security Objectives

Brazil's offshore petroleum production supports domestic energy independence goals whilst generating export revenues that strengthen the country's balance of payments. The Campos Basin's mature infrastructure provides strategic flexibility for responding to domestic demand fluctuations and international market opportunities. However, these developments must also navigate the complexities of decline in oil production trends in other global regions.

Operational synergies between Campos Basin and Santos Basin production systems create portfolio diversification benefits through different geological formations, production profiles, and market positioning. These complementary offshore regions enable optimised production scheduling and enhanced operational reliability through redundant infrastructure systems.

What Makes Subsea Infrastructure Utilisation Effective?

Existing subsea infrastructure in the Southwest Tartaruga Verde area includes flowlines, manifolds, and control systems that support multiple field developments through shared transportation and processing facilities. Spare capacity in existing pipeline systems reduces development costs and shortens time-to-production schedules for qualifying discoveries.

The proximity of new discoveries to established infrastructure networks enables tie-back development concepts that leverage existing investments whilst minimising environmental footprint through reduced construction activity. Pipeline connectivity to onshore processing terminals provides direct access to domestic markets and export facilities.

Economic Development Framework and Capital Requirements

Offshore petroleum development follows a structured approach with distinct phases requiring specific capital allocations and technical expertise. The progression from discovery through production involves multiple decision gates where technical data, economic analysis, and market conditions determine project advancement. Furthermore, current oil price rally analysis suggests favourable conditions for accelerating development timelines.

| Development Phase | Estimated Timeline | Capital Requirements | Key Activities |

|---|---|---|---|

| Appraisal drilling | 12-18 months | $50-100 million | Reservoir delineation, fluid sampling |

| Field development | 3-5 years | $2-4 billion | Infrastructure installation, well completion |

| Production startup | 5-7 years | Full ROI cycle | Operations, maintenance, optimisation |

Note: Capital requirement estimates are based on industry benchmarks and may vary significantly based on reservoir characteristics, water depth, and infrastructure requirements.

Revenue Generation and Government Participation

Brazilian offshore petroleum operations operate under a comprehensive fiscal framework that includes royalty payments, special participation fees, and corporate taxation. Government revenues from offshore production support public investment programmes and economic development initiatives across multiple sectors.

Royalty structures for offshore discoveries typically range from 5% to 12% of production value, depending on field characteristics, production volumes, and regional development priorities. Special participation fees apply to high-production fields and provide additional government revenue from exceptionally profitable developments.

Investment Capital Allocation Strategies

Development capital requirements vary significantly based on reservoir size, fluid characteristics, water depth, and infrastructure proximity. Standalone field developments require substantially higher capital investments compared to tie-back projects that utilise existing infrastructure systems.

Risk mitigation strategies for offshore development include:

- Phased development approaches that match investment timing with reservoir performance data

- Infrastructure sharing agreements that reduce individual project capital requirements

- Technology partnerships that provide access to specialised equipment and expertise

- Financial hedging programmes that manage commodity price volatility and currency exposure

Global Deepwater Exploration Competitive Landscape

International deepwater exploration activity provides important context for evaluating the significance of Brazil's offshore discoveries. Global success rates in deepwater drilling continue improving through advanced seismic imaging, drilling technologies, and reservoir characterisation techniques.

Comparative analysis of deepwater discoveries across major offshore basins reveals varying success rates, resource sizes, and development economics based on geological complexity, infrastructure availability, and regulatory frameworks. The North Sea, Gulf of Mexico, and West Africa offshore regions serve as benchmarks for technical performance and commercial viability.

Technological Capabilities and Competitive Positioning

Brazil's deepwater expertise developed through decades of challenging offshore operations in increasingly complex geological environments. This operational experience creates technological advantages in post-salt drilling, subsea completions, and deepwater production systems that position Brazilian operators competitively in international markets.

International oil companies active in Brazilian waters include Shell, ExxonMobil, BP, and other major operators who bring global expertise and capital resources to collaborative development projects. Joint venture structures enable technology transfer, risk sharing, and accelerated development timelines through combined capabilities.

How Do Global Discovery Trends Affect Local Projects?

Recent deepwater exploration results demonstrate improving success rates through enhanced seismic imaging and geological modelling capabilities. Advanced drilling technologies enable operators to reach previously inaccessible reservoirs whilst managing operational risks more effectively. For instance, Petrobras has confirmed multiple discoveries that demonstrate the effectiveness of these technological advances.

Key performance indicators for deepwater exploration include:

- Discovery success rates by geological formation type

- Average discovery size compared to regional benchmarks

- Development cycle times from discovery to first production

- Capital efficiency metrics measuring returns on exploration investment

Environmental Regulatory Framework and Compliance Requirements

Brazil's environmental regulatory system for offshore petroleum operations encompasses federal oversight, state coordination, and international compliance standards. IBAMA (Instituto Brasileiro do Meio Ambiente e dos Recursos Naturais Renováveis) serves as the primary federal environmental agency responsible for licensing offshore development projects.

Environmental impact assessments (EIA/RIMA) provide comprehensive analysis of potential effects on marine ecosystems, fishing communities, and coastal environments. These studies require extensive stakeholder consultation, scientific analysis, and mitigation planning before regulatory approval.

Marine Ecosystem Protection Protocols

Offshore petroleum operations in Brazilian waters must comply with marine protection requirements that address endangered species, sensitive habitats, and fishing area coordination. Seasonal restrictions may apply during marine mammal migration periods or critical breeding seasons for protected species.

Environmental monitoring programmes track water quality, marine life populations, and ecosystem health indicators throughout project development and operations phases. Real-time monitoring systems provide early warning capabilities for environmental incidents and enable rapid response protocols.

Carbon Footprint and Sustainability Integration

Modern offshore developments increasingly incorporate carbon footprint reduction strategies through equipment efficiency improvements, renewable energy integration, and emissions monitoring systems. These sustainability measures address investor expectations and regulatory requirements for environmental performance.

Environmental compliance costs typically represent 5-15% of total development capital, depending on project complexity and environmental sensitivity of the operational area.

ESG (Environmental, Social, and Governance) compliance requirements influence project financing, international partnerships, and market access for petroleum exports. Investors increasingly evaluate environmental performance as a key factor in capital allocation decisions.

Strategic Development Planning and Decision Framework

Laboratory analysis of reservoir fluid samples provides critical data for development planning, including fluid composition, reservoir pressure, temperature characteristics, and production potential. Standard analysis procedures require 4-8 weeks for comprehensive results that support go/no-go development decisions.

Reservoir characterisation involves multiple analytical techniques:

- Pressure-Volume-Temperature (PVT) analysis to determine fluid behaviour under production conditions

- Geochemical analysis to identify fluid origin and migration pathways

- Reservoir pressure testing to assess formation productivity and connectivity

- Fluid contact mapping to define reservoir boundaries and development targets

Resource Assessment and Volumetric Analysis

Geological modelling combines seismic data, well logs, and fluid analysis results to estimate in-place hydrocarbon volumes and recoverable resources. Monte Carlo simulation techniques quantify uncertainty ranges and provide probabilistic resource estimates for development planning.

Decision gate criteria for development advancement typically include:

- Minimum recoverable resource thresholds based on development cost estimates

- Reservoir quality indicators including porosity, permeability, and fluid properties

- Economic returns analysis under various commodity price scenarios

- Technical feasibility assessment for production system design and operations

What Is the Exploration Upside and Regional Potential?

The Southwest Tartaruga Verde block contains additional geological prospects that could support expanded drilling programmes based on seismic interpretation and regional geological trends. Successful appraisal of the current discovery may justify additional exploration investment in adjacent structures.

Seismic reprocessing using advanced imaging techniques can improve resolution of subsurface structures and identify additional drilling targets within the existing block. These technical improvements often reveal previously unidentified prospects that enhance overall block value.

Strategic Significance for Brazil's Energy Independence

The Southwest Tartaruga Verde discovery represents continued expansion of Brazil's offshore petroleum resources through systematic exploration in proven geological basins. This Petrobras oil discovery Campos Basin methodology demonstrates the effectiveness of combining advanced technology with geological expertise in mature offshore regions.

Short-Term Operational Implications

Immediate impacts include validation of post-salt exploration strategies and confirmation of continued hydrocarbon potential in established offshore basins. Success in the Southwest Tartaruga Verde block may influence exploration budget allocation toward similar geological targets in adjacent areas.

Market perception of Brazilian offshore exploration success supports investor confidence in continued resource development and production growth potential. Positive exploration results typically correlate with improved equity valuations and enhanced access to development capital.

Long-Term Energy Security Benefits

Sustained offshore discovery success contributes to Brazil's energy independence objectives whilst providing export revenue opportunities that support economic development. Diversified production from multiple offshore basins enhances supply security and reduces dependence on imported petroleum products.

Technology development through challenging offshore projects creates exportable expertise that positions Brazilian companies competitively in international petroleum services markets. This technological capability represents valuable intellectual property and business development opportunities beyond domestic operations.

The Petrobras oil discovery Campos Basin underscores the continued importance of systematic exploration investment in mature petroleum basins where advanced technology can unlock previously inaccessible resources. This approach provides sustainable growth opportunities whilst maximising utilisation of existing infrastructure investments. Consequently, the Petrobras oil discovery Campos Basin serves as a model for other operators seeking to optimise returns in established offshore regions.

Disclaimer: This analysis is based on publicly available information and industry benchmarks. Actual development costs, timelines, and production results may vary significantly based on detailed technical analysis, market conditions, and regulatory requirements. Investment decisions should be based on comprehensive due diligence and professional consultation.

Want to Capitalise on Energy Sector Discoveries Before the Market?

Discovery Alert's proprietary Discovery IQ model delivers instant notifications on significant ASX mineral discoveries, providing subscribers with actionable insights into energy and resource opportunities ahead of broader market awareness. Start your 30-day free trial today and discover why major mineral discoveries can generate substantial returns by exploring Discovery Alert's dedicated discoveries page.