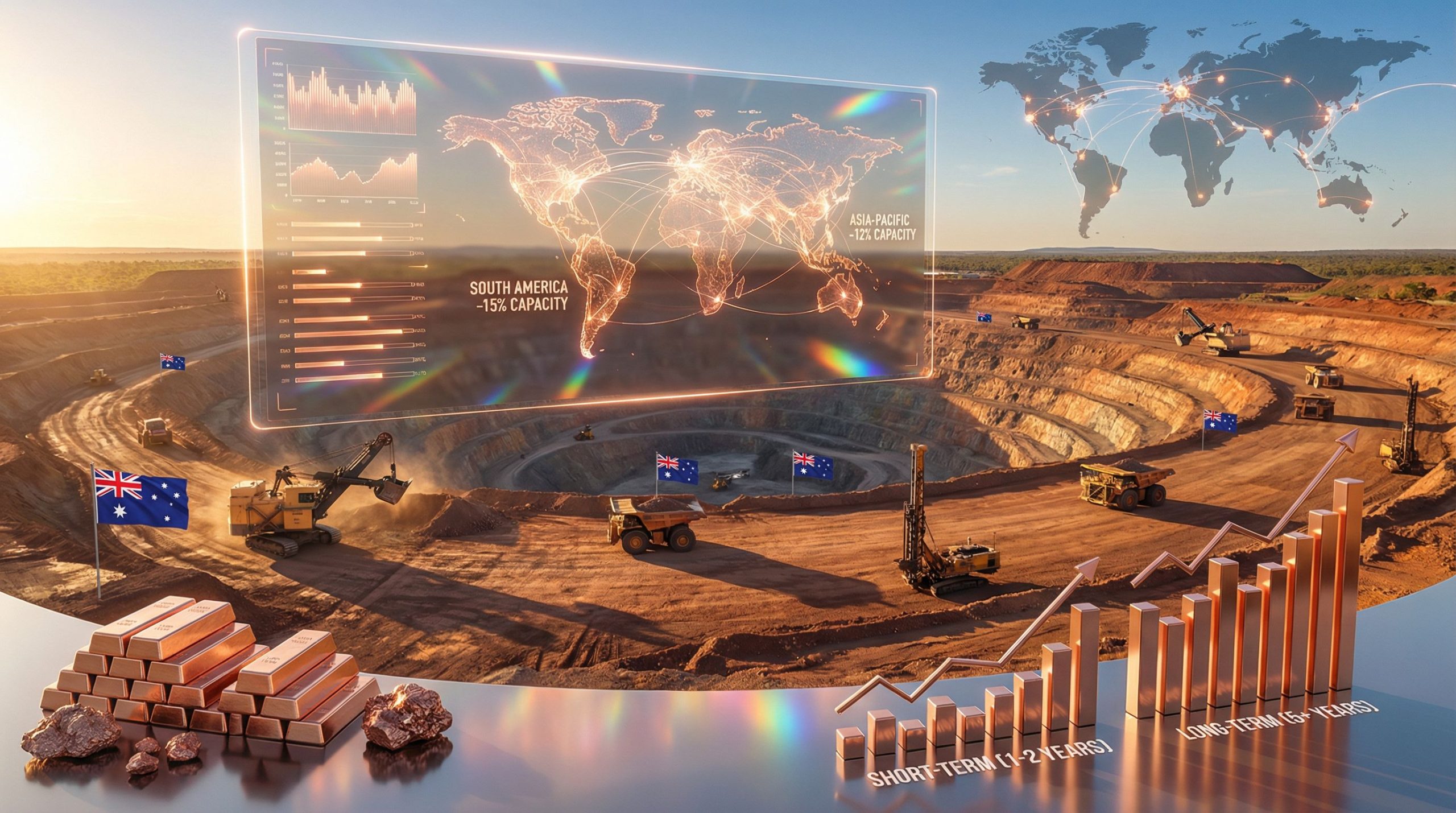

The global earth science technology sector is experiencing accelerated consolidation as mining services companies strategically position themselves for the digital transformation of subsurface exploration. This trend reflects broader industry recognition that data-driven mining operations and sensor technologies will define competitive advantages in resource extraction over the next decade. As mining operations demand increasingly sophisticated geological intelligence, companies are pursuing acquisitions to build comprehensive technology ecosystems rather than relying on fragmented solutions.

What Drives Strategic Acquisitions in Mining Technology Services?

Market Consolidation Patterns in Earth Science Technology

The mining technology services sector demonstrates clear patterns of vertical integration, with established players acquiring specialised companies to expand their technological capabilities. These acquisitions expand IMDEX subsurface tech offerings and represent a broader industry shift toward comprehensive data platforms. Companies seek to control the entire value chain from sensor development through data processing and analysis.

Market dynamics favour organisations that can provide end-to-end solutions across multiple sectors including mining, civil engineering, and energy exploration. This cross-sector approach creates revenue diversification opportunities whilst leveraging common underlying technologies. The integration of optical and acoustic sensing capabilities with advanced software platforms enables companies to address varied customer requirements through unified systems.

Geographic expansion through strategic purchases allows companies to establish regional expertise and manufacturing capabilities. Luxembourg-based operations provide European market access, whilst US facilities offer advantages in technology development and distribution networks across North America.

Value Creation Through Technology Portfolio Expansion

Revenue synergies emerge from complementary product offerings that enhance customer relationships and increase average contract values. Organisations with diverse sensor technologies can provide comprehensive subsurface intelligence solutions that single-point providers cannot match. This positioning creates opportunities for premium pricing and longer-term customer engagement.

Customer retention benefits significantly when companies can offer integrated solution suites rather than requiring clients to manage multiple vendor relationships. Streamlined procurement processes and unified technical support enhance the customer experience whilst reducing operational complexity for mining operations.

The $98.9 million acquisition structure demonstrates how specialised technology companies command premium valuations based on their unique capabilities and market positioning. Performance-linked payment structures align acquisition outcomes with actual integration success and revenue realisation.

How Do Sensor Technology Acquisitions Transform Service Capabilities?

Advanced Downhole Sensing Systems Integration

Optical televiewer technology provides high-resolution borehole imaging capabilities that enhance geological interpretation accuracy. These systems capture detailed visual data about rock formations, fracture patterns, and structural characteristics that traditional sensing methods cannot detect. Integration with existing sensor arrays creates comprehensive data collection capabilities.

Acoustic televiewer systems complement optical technologies by providing information about rock properties through sound wave analysis. This dual-sensor approach enables more accurate geological modelling and reduces uncertainty in resource estimation processes. Real-time data transmission capabilities allow immediate decision-making during drilling operations.

Rock property sensors measure critical parameters including density, porosity, and mineral composition directly within boreholes. These measurements provide ground-truth data that validates surface exploration results and improves orebody delineation accuracy. Enhanced telemetry systems ensure reliable data transmission from challenging underground environments.

Geoscience Data Processing Software Convergence

WellCAD software integration represents a significant advancement in borehole geophysical data interpretation capabilities. This platform processes multiple data streams simultaneously, creating unified geological models that incorporate sensor readings, visual observations, and analytical results. Furthermore, the integration of 3D geological modelling capabilities enhances cross-platform compatibility whilst ensuring seamless data exchange between different systems.

| Technology Integration | Capability Enhancement | Operational Impact |

|---|---|---|

| Optical televiewers | Visual borehole imaging | Improved geological interpretation |

| Acoustic sensors | Rock property analysis | Enhanced resource modelling |

| WellCAD software | Unified data processing | Streamlined workflows |

| Telemetry systems | Real-time data transmission | Faster decision-making |

Field operations benefit from integrated software platforms that eliminate data format compatibility issues and reduce processing time. Standardised workflows across different sensor types improve operational efficiency whilst maintaining data quality standards. These improvements directly translate to reduced project timelines and enhanced accuracy in geological assessments.

What Are the Financial Mechanics of Strategic Technology Acquisitions?

Acquisition Valuation Models in Mining Services

The $98.9 million total consideration includes $55.8 million base payment plus performance-linked deferred payments capped at $20 million. This structure reflects industry practices for specialised technology acquisitions where future performance uncertainty requires risk-sharing mechanisms between buyers and sellers.

Revenue multiple analysis indicates the transaction values the acquired companies at approximately 5.6 times projected annual revenue, demonstrating the premium market assigns to specialised subsurface technology capabilities. This valuation reflects both current revenue streams and anticipated growth from integration synergies.

The 70+ years of combined expertise in geophysical instrumentation development represents significant intangible asset value that traditional financial metrics may not fully capture. Long-established customer relationships and technical reputation contribute substantially to acquisition premiums in specialised technology sectors.

Integration Cost-Benefit Analysis

Financial projections anticipate $10 million incremental revenue for fiscal year 2026, representing significant growth acceleration through combined capabilities. These projections assume successful technology integration and effective cross-selling to existing customer bases. Revenue synergies typically realise over 18-36 month timeframes as integrated solutions gain market acceptance.

$2 million normalised earnings contribution expectations for the acquired companies indicate healthy profitability margins in specialised technology segments. These earnings projections exclude integration costs and one-time expenses associated with combining operations and technology platforms.

Financial Performance Insight: The acquisition structure balances immediate strategic benefits with performance-based payments that align seller incentives with integration success, reflecting sophisticated risk management in technology acquisitions.

Synergy realisation timelines typically follow predictable patterns across operational divisions. Initial cross-selling opportunities emerge within six months, whilst full technology integration and unified platform deployment require 18-36 months for complete implementation.

How Does Geographic Expansion Drive Acquisition Strategy?

Global Market Access Through Strategic Locations

Luxembourg operations provide European technology development hub capabilities with access to skilled engineering talent and proximity to major mining operations across the continent. European regulatory environment supports innovation in mining technology whilst maintaining high safety and environmental standards.

US-based manufacturing and distribution facilities offer strategic advantages including proximity to major mining regions, established supplier networks, and favourable logistics for North American market penetration. American operations also provide access to advanced research institutions and technology development partnerships.

Cross-continental service delivery optimisation becomes critical as mining companies operate globally and require consistent technology support across diverse geographic locations. Integrated operations enable 24-hour technical support capabilities and rapid deployment of specialised equipment to remote mining sites.

Regional Expertise Integration Benefits

Established customer relationships spanning multiple decades provide stable revenue foundations and opportunities for expanded service offerings. Long-term partnerships in specialised technology sectors often include exclusive arrangements and preferred vendor status that create competitive barriers for new entrants.

Local regulatory compliance expertise becomes increasingly valuable as mining operations face evolving environmental and safety requirements across different jurisdictions. Companies with established regional presence can navigate regulatory complexities more effectively than organisations attempting market entry through organic growth.

Technical support capabilities benefit from local expertise that understands regional geological conditions and operational challenges. This knowledge enables customised solutions that address specific regional requirements whilst leveraging global technology platforms.

What Integration Challenges Face Technology Acquisitions?

Technical System Compatibility Requirements

Software platform harmonisation presents significant technical challenges when combining different technology stacks and data formats. Legacy systems often require substantial modification to achieve seamless integration, creating implementation timelines that extend beyond initial projections. Standardising data formats across acquired technologies requires careful planning to preserve existing functionality.

Hardware integration across different sensor technologies involves complex engineering challenges including signal processing, calibration protocols, and field deployment procedures. Ensuring consistent performance standards across diverse equipment types requires substantial testing and validation processes.

Data format standardisation across legacy systems often encounters resistance from users accustomed to existing workflows and interfaces. Change management becomes critical for successful technology integration, requiring comprehensive training programmes and gradual transition strategies.

Organisational Culture Alignment Strategies

Retention of specialised technical expertise represents a critical success factor for technology acquisitions. Key personnel often possess irreplaceable knowledge about proprietary systems and customer relationships. Comprehensive retention programmes including equity participation and leadership roles help preserve essential capabilities during integration periods.

Preservation of innovation capabilities during integration requires maintaining research and development autonomy whilst achieving operational synergies. Balancing standardisation with creative independence challenges acquisition teams to optimise both efficiency and technological advancement.

Customer relationship continuity management involves careful communication during transition periods to maintain confidence in service delivery capabilities. Established customer relationships represent significant acquisition value that requires protection through professional transition management.

Operational Synergy Realisation Timeline

Phase 1 implementation (0-6 months) focuses on immediate cross-selling opportunities leveraging existing customer relationships and complementary product portfolios. This phase typically achieves quickest returns on investment whilst providing momentum for longer-term integration initiatives.

Phase 2 development (6-18 months) emphasises integrated product development that combines acquired technologies with existing capabilities. This phase requires substantial engineering resources and careful project management to deliver enhanced solutions that justify acquisition premiums.

Phase 3 deployment (18-36 months) involves unified platform implementation that fully realises technological synergies. This final phase typically delivers the greatest long-term value but requires sustained commitment and investment throughout the integration process.

How Do Unified Earth Data Platforms Create Competitive Advantages?

Open Platform Architecture Benefits

Third-party integration capabilities enable customers to incorporate additional technologies and services without replacing existing infrastructure investments. Open architecture approaches foster ecosystem development that increases platform value whilst reducing customer switching costs.

Standardised data formats across multiple sensor types facilitate seamless information exchange and analysis workflows. Industry-standard protocols ensure compatibility with existing customer systems whilst enabling future technology upgrades without platform migration requirements.

Scalable infrastructure accommodates expanding customer requirements as mining operations grow and diversify their technology needs. Cloud-based deployment options provide flexibility for remote operations whilst maintaining security standards required for sensitive geological data.

Cross-Sector Application Expansion Opportunities

Mining sector optimisation through enhanced subsurface intelligence creates opportunities for improved resource extraction efficiency and reduced environmental impact. Comprehensive geological modelling enables more precise drilling and extraction strategies that minimise waste and maximise recovery rates.

Civil engineering applications expand market opportunities beyond traditional mining customers to include infrastructure development, foundation analysis, and geotechnical assessment projects. These applications leverage similar underlying technologies whilst addressing different market segments with distinct requirements.

Energy sector applications in geothermal and traditional energy exploration provide additional revenue streams through specialised geological analysis capabilities. Renewable energy projects increasingly require sophisticated subsurface analysis for optimal site selection and resource assessment.

What Future Scenarios Emerge from Strategic Technology Integration?

Digital Transformation Acceleration in Earth Sciences

AI in mining technologies integration with geological data interpretation capabilities promises revolutionary advances in resource exploration accuracy and efficiency. Machine learning algorithms can identify patterns in complex geological data that human analysts might overlook, potentially discovering new resources and optimising extraction strategies.

Automated decision-making systems for drilling operations reduce human error whilst improving operational efficiency. Real-time data analysis combined with automated responses can optimise drilling parameters continuously, reducing costs and improving safety outcomes. These advancements contribute to AI-powered mining efficiency across the industry.

Predictive analytics for resource exploration optimisation enables mining companies to prioritise exploration investments based on geological probability models. Advanced data analysis can identify high-potential areas whilst eliminating low-probability targets, significantly improving exploration success rates.

Market Leadership Positioning Through Innovation

Competitive moat creation through integrated technology stacks becomes increasingly important as mining operations demand comprehensive solutions rather than point products. Companies with unified platforms can provide superior customer experiences whilst maintaining higher profit margins than fragmented competitors.

Barrier-to-entry elevation for new market participants results from the substantial investment required to develop comprehensive technology platforms. Established players with integrated solutions enjoy significant advantages over potential new entrants lacking similar capabilities.

Premium pricing justification through comprehensive solution offerings enables technology providers to capture greater value from customer relationships. Integrated platforms that deliver measurable operational improvements command higher prices than individual components sold separately.

How Should Investors Evaluate Mining Services Technology Acquisitions?

Due Diligence Framework for Technology Integration

Technical compatibility assessment methodologies should evaluate software architecture, hardware integration requirements, and data format standardisation challenges. Comprehensive technical due diligence identifies potential integration costs and timeline risks that impact acquisition returns.

Customer retention risk evaluation during integration periods requires analysis of contract structures, relationship depth, and competitive positioning. Understanding customer switching costs and satisfaction levels helps predict revenue stability during transition phases.

Synergy realisation probability analysis based on historical precedents provides realistic expectations for integration outcomes. Industry benchmarks for similar acquisitions offer valuable insights into typical challenges and success factors for technology integration projects.

Long-term Value Creation Indicators

Market share expansion in specialised niches demonstrates the effectiveness of acquisition strategies in building competitive advantages. Dominant positions in specialised technology segments often generate superior returns due to limited competition and high switching costs.

Recurring revenue stability through software licensing provides predictable cash flows that support higher valuation multiples. Subscription-based revenue models create customer dependency that enhances business stability and growth predictability.

Innovation pipeline strength for future product development ensures continued competitive advantages as technology evolution accelerates. Companies with robust research and development capabilities can maintain market leadership through continuous innovation.

Risk Mitigation Strategies for Acquisition Integration

Key personnel retention programmes protect critical intellectual property and customer relationships during ownership transitions. Equity incentives and career advancement opportunities help maintain continuity in specialised technical roles that drive acquisition value.

Customer communication protocols during transition periods minimise uncertainty that could drive customer defections to competitors. Proactive communication strategies that emphasise enhanced capabilities rather than operational changes help maintain customer confidence.

Technology roadmap alignment with market demands ensures that integrated platforms remain competitive as industry requirements evolve. Regular market research and customer feedback integration help guide development priorities that maximise long-term value creation.

Strategic Technology Acquisition Analysis

Strategic technology acquisitions in the mining services sector reflect fundamental shifts toward integrated data platforms and comprehensive subsurface intelligence capabilities. The acquisitions expand IMDEX subsurface tech offerings and demonstrate how companies are positioning themselves for the digital transformation of resource extraction. According to IMDEX's official announcement, success in these transactions requires careful attention to technical integration challenges, cultural alignment strategies, and long-term market positioning benefits.

Financial structures that balance immediate strategic benefits with performance-based payments help manage integration risks whilst aligning incentives between buyers and sellers. Geographic diversification through acquisitions provides market access and operational advantages that support global customer service requirements. The evolution toward unified earth data platforms creates competitive advantages that justify premium valuations for specialised technology companies.

Furthermore, the broader mining industry evolution emphasises the importance of strategic technology integration. Investors evaluating mining services technology acquisitions should focus on technical compatibility, customer retention prospects, and innovation pipeline strength as key indicators of long-term value creation potential. As reported by Mining Industry magazine, the sector's ongoing consolidation presents both opportunities and risks as companies compete to build comprehensive technology ecosystems that address evolving customer demands in resource exploration and extraction.

Ready to Capitalise on Strategic Mining Technology Consolidation?

Discovery Alert's proprietary Discovery IQ model delivers real-time notifications on significant ASX mineral discoveries across mining services and technology sectors, empowering subscribers to identify actionable opportunities ahead of broader market recognition. Begin your 30-day free trial today and position yourself strategically as the mining technology consolidation accelerates.