European battery manufacturing faces a critical dependency paradox. While the continent races to establish gigafactory capacity exceeding 3,000 GWh annually by 2030, domestic lithium supply represents less than 1% of global production. This supply chain vulnerability exposes European automotive and energy storage sectors to geopolitical risks and price volatility from concentrated South American suppliers. Furthermore, the development of a lithium project in Germany represents a strategic shift towards domestic resource security.

Strategic mineral independence has become a cornerstone of European industrial policy, with Germany emerging as the continental leader in innovative extraction methodologies. The convergence of abundant geothermal resources and subsurface lithium deposits creates unprecedented opportunities for integrated resource development that simultaneously addresses energy transition and critical mineral security objectives.

Advanced Direct Lithium Extraction technologies are transforming traditional mining paradigms by enabling rapid, sustainable resource development with minimal environmental disruption. These technological breakthroughs position European nations to achieve strategic autonomy in battery supply chains while maintaining strict environmental standards that differentiate them from conventional extraction methods employed globally.

Germany's Strategic Lithium Development Framework

Germany's approach to lithium security operates through a comprehensive three-tier strategic model designed to reduce import dependency and establish technological leadership in sustainable extraction methodologies. This framework addresses both immediate supply needs and long-term industrial competitiveness in the global battery materials market.

Three-Tier Lithium Security Architecture

The domestic extraction tier leverages Germany's unique geological advantages in the Upper Rhine Valley, where Europe's largest identified lithium brine resource contains an estimated 240,000 tonnes of lithium carbonate equivalent across multiple deposits. These subsurface brines benefit from natural geothermal heating, reducing processing energy requirements compared to traditional evaporation-based operations.

International partnership frameworks complement domestic production through strategic alliances and technology sharing agreements. The recent European Union-Australia strategic partnership on minerals and critical raw materials exemplifies this approach, providing access to proven extraction technologies and diversified supply sources while maintaining focus on domestic capability development.

Advanced processing infrastructure forms the third pillar, with specialised refining capabilities targeting battery-grade lithium hydroxide production. This integrated approach ensures complete value chain control from extraction through final product delivery to European battery manufacturers, reducing reliance on Chinese processing facilities that currently dominate global lithium refining capacity. Additionally, this supports broader critical minerals & energy security objectives.

Critical Success Factors for German Independence

Technology integration between renewable energy generation and lithium extraction creates unique competitive advantages. The co-location of geothermal energy production with Direct Lithium Extraction operations enables carbon-neutral processing while generating additional revenue streams from renewable power sales to local communities and industrial consumers.

Regulatory framework optimisation supports accelerated project development through EU Critical Raw Materials Act designation, providing streamlined permitting procedures and enhanced government funding mechanisms. German federal and state governments have committed over €200 million in grants specifically for lithium project development, demonstrating policy-level commitment to strategic mineral independence.

Supply chain resilience metrics focus on reducing average transport distances and diversifying supplier bases across multiple extraction methodologies. This approach contrasts sharply with current European lithium imports, which travel approximately 12,000 kilometres from South American salt flats and require 12-18 month evaporation cycles before reaching European refineries.

Revolutionary Geothermal Lithium Extraction Technology

The Upper Rhine Valley's exceptional geological characteristics enable a paradigm shift in lithium extraction methodology that eliminates many environmental concerns associated with traditional mining operations. This revolutionary approach integrates renewable energy production with critical mineral extraction, creating a circular economic model unprecedented in global lithium supply chains.

Upper Rhine Valley's Geological Advantages

Europe's largest subsurface lithium brine resource benefits from geothermal gradients exceeding 80°C per kilometre depth, significantly higher than the European average of 25-30°C per kilometre. This natural heating reduces processing energy requirements and enables economical heat extraction for industrial applications and district heating systems.

The Upper Rhine Valley Brine Field contains naturally occurring lithium concentrations suitable for direct extraction without extensive pre-processing. These geological advantages eliminate the water consumption issues plaguing South American operations, where traditional evaporation methods require over 500,000 gallons per tonne of lithium carbonate equivalent production.

Co-located geothermal energy potential exceeds 1,000 MW of exploitable capacity across the region, providing sustainable power for extraction operations while contributing to Germany's renewable energy transition goals. This dual-purpose infrastructure approach maximises resource utilisation efficiency and economic returns per project investment.

Zero-Emission Extraction Methodology

Direct Lithium Extraction from geothermal brines represents a fundamental departure from conventional lithium production methods. The process utilises selective absorption systems that preferentially capture lithium ions from naturally heated subsurface brine, eliminating fossil fuel consumption throughout the extraction and initial processing phases.

Advanced filtration and concentration technologies enable rapid lithium recovery without the 12-18 month evaporation cycles required in South American salt flat operations. This technological advantage reduces time-to-market for lithium projects from 5-7 years to 2-3 years while maintaining higher environmental standards than traditional mining approaches.

The circular extraction model generates multiple revenue streams from a single resource base. Beyond lithium production, operations co-produce renewable electricity for grid distribution and process heat for industrial applications, creating economic sustainability that supports long-term project viability independent of lithium price volatility. This approach aligns with mining industry innovation trends worldwide.

Direct Lithium Extraction Technology Comparison

| Technology Approach | Environmental Impact | Production Timeline | Capital Requirements | Water Usage |

|---|---|---|---|---|

| Geothermal Brine DLE | Minimal surface disruption | 2-3 years to production | €2-4 billion | Minimal (closed loop) |

| Traditional Evaporation | High water usage, salt contamination | 12-18 months plus ramp-up | €500M-1B | 500,000+ gal/tonne |

| Hard Rock Mining | Significant land use, tailings | 5-7 years | €1-2 billion | Moderate to high |

The technological differentiation becomes particularly evident when comparing carbon footprints. Geothermal-based operations achieve carbon neutrality through renewable energy integration, while traditional methods rely on diesel-powered equipment and grid electricity often sourced from fossil fuels in remote locations.

Strategic Comparison of Germany's Major Lithium Projects

Germany's lithium development landscape features distinct project profiles that collectively address different aspects of domestic supply security and technological innovation. Each project contributes unique capabilities to the overall strategic framework while pursuing different extraction methodologies and market positioning strategies.

Vulcan Energy's Lionheart Project Leadership

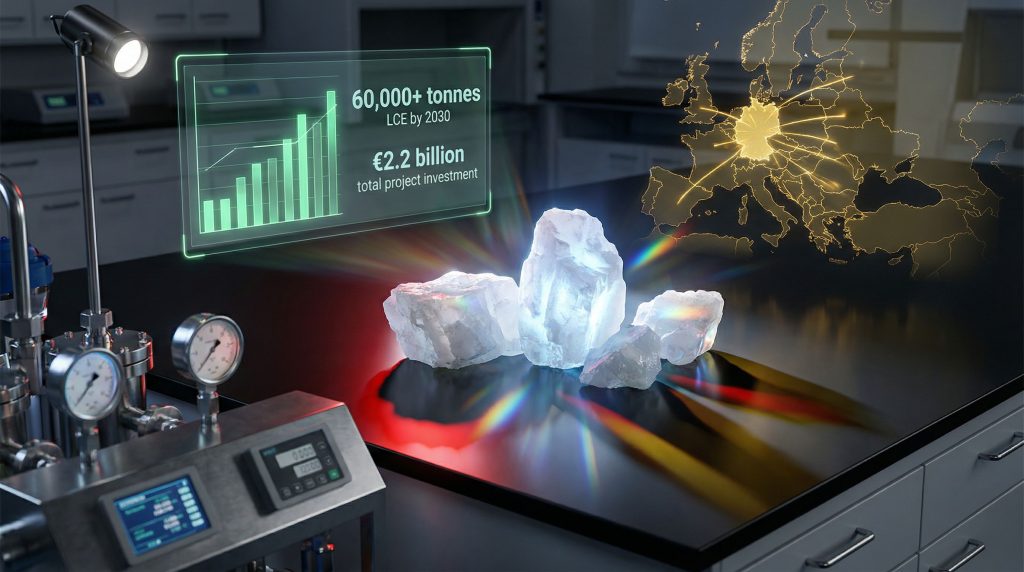

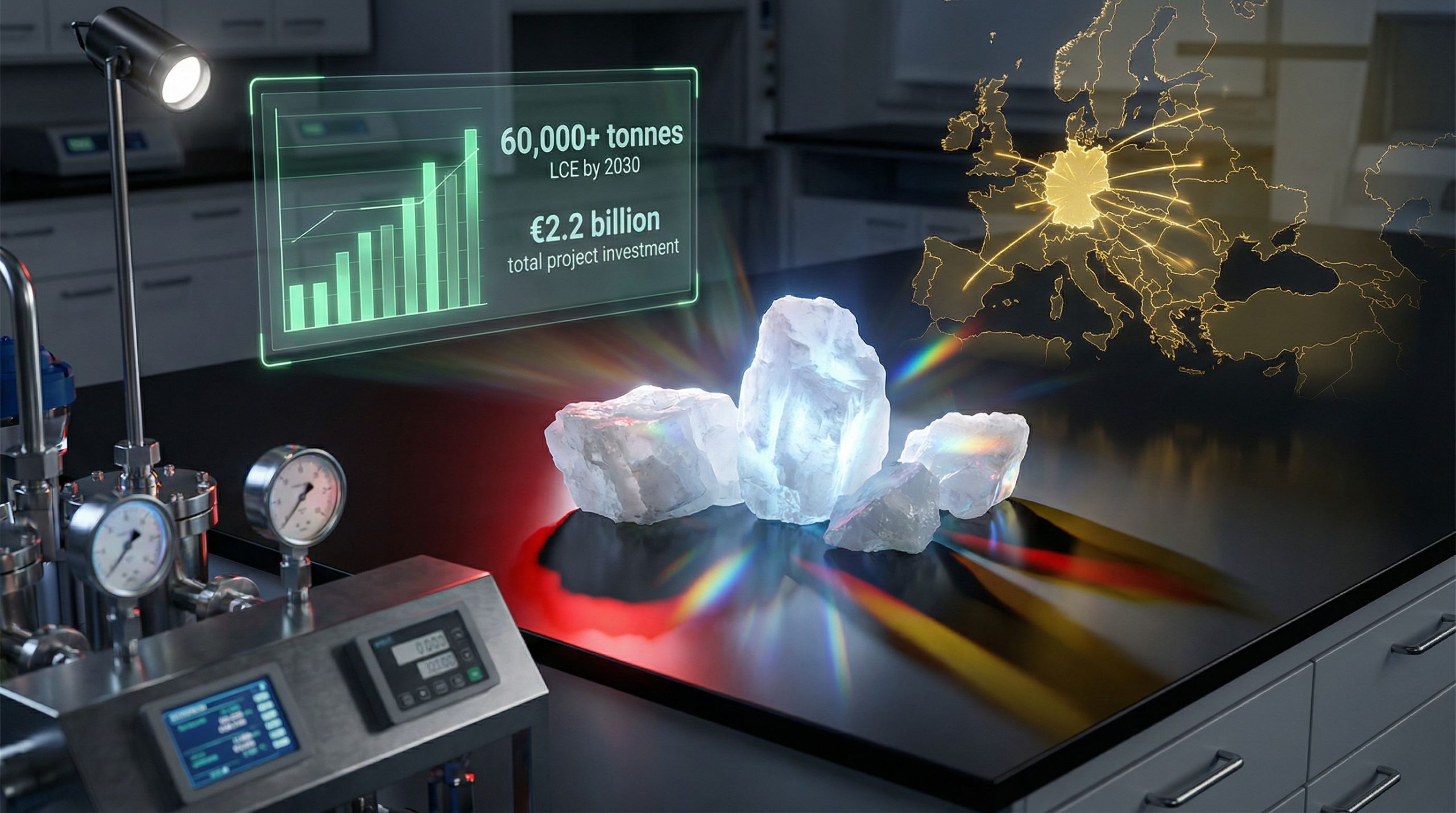

The Lionheart project represents Europe's most advanced integrated lithium-renewable energy development, achieving Final Investment Decision in December 2025 with €2.2 billion in committed financing. This milestone positions the project as the continental leader in sustainable lithium production technology and commercial viability demonstration.

Production specifications target 24,000 tonnes per annum of lithium hydroxide monohydrate, sufficient for 500,000 electric vehicle batteries annually. The integrated design co-produces 275 GWh of renewable energy and 560 GWh of heat for local industrial consumers, creating multiple revenue streams that enhance project economics and community benefits.

Strategic investor participation includes Gina Rinehart holding a 7.5% stake and HOCHTIEF committing €39 million in construction services plus up to €130 million in share subscriptions. This contractor-investor alignment incentivises construction efficiency while demonstrating confidence in the integrated extraction model from established engineering firms.

The 30-year operational lifespan projection provides long-term supply security for European battery manufacturers seeking "green lithium" certification. However, this approach contrasts with developments in other regions, such as those exploring lithium brine insights from South American operations. Government support includes €204 million in German federal and state grants, reflecting policy-level commitment to strategic mineral independence and sustainable extraction leadership.

Integrated Energy-Extraction Model Advantages

The Lionheart project's utilisation of existing geothermal infrastructure, including the NatürLich Insheim facility, demonstrates proven operational capability in the specific geological environment. This facility's 13-year operational history (2012-2025) validates long-term reliability of subsurface access and brine circulation systems essential for lithium extraction operations.

Zero fossil fuel consumption throughout the extraction and processing phases differentiates the project from conventional lithium operations worldwide. This environmental positioning aligns with European battery manufacturers' sustainability requirements and enables premium pricing for certified green lithium products in increasingly ESG-focused markets.

Revenue diversification through renewable energy sales creates financial resilience against lithium price volatility. The 275 GWh annual power production capability provides additional income streams while supporting Germany's renewable energy transition goals and reducing regional dependence on imported energy sources.

Capital Structure Innovation in German Lithium Development

Vulcan Energy's funding achievement of €2.2 billion financing demonstrates institutional confidence in German lithium extraction technology and regulatory frameworks. The funding structure combines institutional placements (€603 million), shareholder rights offerings (€465 million), strategic partner investments (€39 million), and debt financing (€1.1+ billion) to minimise dilution while ensuring adequate capital for construction completion.

EU Strategic Project designation under the Critical Raw Materials Act provides regulatory advantages including streamlined permitting procedures and access to additional government funding mechanisms. This status recognition validates the project's strategic importance for European supply chain independence and technological leadership in sustainable extraction methodologies.

The integrated EPCM services agreement with Sedgman and HOCHTIEF Joint Venture provides end-to-end construction management for both the €397 million lithium extraction plant and €337 million central lithium processing facility. This comprehensive service approach reduces execution risk while leveraging proven engineering expertise in mineral processing and infrastructure development.

Economic Development Scenarios for German Lithium Industry

Germany's lithium sector development faces multiple pathways depending on regulatory efficiency, technology scaling success, and market demand evolution. Each scenario presents distinct implications for European supply chain independence and global competitive positioning in sustainable extraction methodologies.

Base Case Scenario Analysis

Moderate development projections anticipate combined German lithium production reaching 60,000+ tonnes LCE annually by 2030, representing 15-20% satisfaction of projected European battery demand. This baseline assumes successful completion of currently planned projects including Lionheart's 24,000 tpa capacity contribution, equivalent to approximately 13,200 tonnes LCE annually.

Total sector investment requirements approach €8-12 billion across extraction, processing, and supporting infrastructure development. Capital intensity averaging €91.7 million per 1,000 tpa capacity (based on Lionheart project economics) suggests substantial financial commitments necessary for achieving domestic supply security objectives.

European battery market demand projections indicate 3,000+ GWh annual production capacity by 2030, requiring approximately 24,000 tonnes LCE at standard 8 kg lithium per kWh battery composition. German production capacity targeting 60,000 tonnes significantly exceeds domestic European needs, positioning the country for potential export markets and strategic stockpiling capabilities.

Regional economic impact modelling suggests 2,000+ direct employment opportunities across extraction, processing, and support services. Indirect employment multipliers in specialised engineering, environmental services, and logistics could generate additional job creation throughout German industrial regions, particularly in traditionally mining-dependent areas seeking economic diversification.

Accelerated Development Scenario

Rapid scale-up projections envision 100,000+ tonnes annual capacity by 2028 through expedited permitting, enhanced government support, and successful technology transfer from pilot operations. This scenario requires €15-20 billion investment acceleration and assumes resolution of current regulatory bottlenecks affecting project timelines.

Supply chain implications include 30-35% coverage of European lithium demand, substantially reducing import dependency from South American suppliers. This level of domestic production capability would position Germany as a net lithium exporter within the European market and potentially to other regions pursuing supply chain diversification strategies.

Technology leadership benefits emerge through advanced Direct Lithium Extraction licensing opportunities and consulting services for similar geological formations globally. Furthermore, the German expertise could support developments such as battery-grade refinery overview projects in emerging markets. German engineering expertise in sustainable extraction could become a significant export industry, generating additional revenue streams beyond direct lithium production.

Strategic autonomy achievements under this scenario enable independent decision-making regarding lithium allocation, pricing, and export policies. Enhanced negotiating positions with Chinese processing facilities and South American suppliers create additional leverage for European battery manufacturers and automotive OEMs.

Conservative Development Timeline

Delayed implementation scenarios project 35,000 tonnes capacity by 2032, representing 8-12% of European demand satisfaction. This conservative outlook accounts for potential permitting delays, technology scaling challenges, and extended financing timelines that could affect project development schedules.

Regulatory uncertainties remain significant factors in project timelines, particularly regarding environmental impact assessments and community consultation processes. German Mining Law amendments specifically addressing DLE operations may require additional legislative review periods that extend approval processes beyond current projections.

Market risk considerations include potential lithium price volatility affecting project economics and investor confidence. Global oversupply scenarios emerging from expanded production in Australia, Chile, and emerging African deposits could pressure pricing assumptions underlying current feasibility studies.

Extended timeline implications maintain European dependence on imported lithium through the late 2020s, potentially constraining domestic battery manufacturing expansion and automotive industry electrification goals. This scenario emphasises the importance of policy support and regulatory efficiency in achieving strategic mineral independence objectives.

Global Supply Chain Transformation Impact

German lithium projects represent a paradigm shift in global supply chain architecture, challenging traditional dependencies on geographically concentrated production regions. The integration of sustainable extraction with renewable energy production creates new competitive dynamics that influence international pricing, quality standards, and environmental compliance expectations.

European Battery Value Chain Revolution

The emergence of domestic European lithium production fundamentally alters battery manufacturing economics by reducing transportation costs, supply chain complexity, and geopolitical risks. German projects' proximity to major automotive manufacturing centres in Bavaria, Baden-Württemberg, and neighbouring countries creates significant logistics advantages over South American imports.

Quality standardisation benefits emerge through direct coordination between extraction operations and battery manufacturers, enabling customised lithium hydroxide specifications optimised for specific battery chemistries. This technical integration capability contrasts with current arrangements requiring adaptation to standardised products from distant suppliers with limited customisation flexibility.

Strategic Supply Chain Insight: Germany's integrated approach combining lithium extraction with renewable energy production creates unprecedented competitive advantages in global battery materials markets through carbon-neutral certification and supply chain transparency that addresses increasingly stringent ESG requirements from automotive OEMs and battery manufacturers.

Technological spillover effects extend beyond lithium production to advanced materials processing, recycling technologies, and circular economy applications. German engineering expertise in precision manufacturing and environmental compliance creates opportunities for technology export to other regions developing similar integrated extraction capabilities.

Geopolitical Supply Dependencies Restructuring

Traditional lithium supply chains concentrate approximately 58% of global production within the South American Lithium Triangle (Argentina, Bolivia, Chile), creating vulnerability to regional political instability, water rights disputes, and export policy changes. German domestic production reduces this dependency while providing alternative supply sources for European strategic stockpiling initiatives.

Negotiating leverage improvements enable European battery manufacturers to secure more favourable long-term contracts and pricing arrangements with international suppliers. Domestic production capability provides backup supply options that strengthen bargaining positions during contract negotiations and reduce susceptibility to market manipulation.

Strategic autonomy implications extend to defence and aerospace applications requiring high-purity lithium for specialised battery systems. Domestic supply chains eliminate potential export restrictions and ensure continuous availability for critical national security applications independent of international political considerations.

Regional cooperation opportunities emerge through technology sharing with other European nations possessing similar geological formations, including France's Alsace region and Czech Republic's geological extensions of German deposits. Coordinated development could further enhance European supply security and technology advancement. Additionally, these developments support broader lithium industry innovations across the region.

Investment Framework Analysis for German Lithium Development

German lithium project investment structures demonstrate innovative financing approaches that balance public policy objectives with private sector capital requirements. The integration of government grants, strategic equity investments, and debt financing creates models applicable to similar strategic mineral developments across Europe.

Public-Private Partnership Excellence

Government support mechanisms totaling €204 million in federal and state grants for the Lionheart project alone demonstrate substantial public sector commitment to strategic mineral independence. This funding approach reduces private sector risk while ensuring public benefit through domestic job creation and supply chain security achievements.

EU Critical Raw Materials Act designation provides additional benefits including accelerated permitting procedures, reduced regulatory compliance costs, and access to European Investment Bank financing programmes specifically targeting critical mineral projects. These policy advantages significantly improve project economics and development timelines compared to conventional mining investments.

Strategic investor participation through entities like Gina Rinehart's 7.5% stake in Vulcan Energy demonstrates confidence from experienced natural resources investors in German lithium extraction technology and market fundamentals. This high-profile endorsement attracts additional institutional investment and validates commercial viability assumptions.

Technology development partnerships with established engineering firms like HOCHTIEF create risk-sharing arrangements that align contractor incentives with project success. The €39 million construction services investment plus up to €130 million share subscription commitment ensures construction quality while providing additional equity financing sources.

Risk-Return Investment Analysis

| Risk Category | Probability Assessment | Mitigation Strategy | Impact Level | Time Horizon |

|---|---|---|---|---|

| Regulatory delays | Medium | Early stakeholder engagement, EU Strategic Project status | Moderate | 1-2 years |

| Technology scaling | Low | Proven DLE methods, existing geothermal infrastructure | Low | 6-12 months |

| Market price volatility | High | Long-term offtake agreements, renewable energy co-products | High | Ongoing |

| Environmental opposition | Medium | Sustainable extraction focus, community benefits | Moderate | 6-18 months |

| Financing completion | Low | Diversified funding sources, government backing | Low | 3-6 months |

Market risk mitigation through secured offtake agreements with leading European battery manufacturers provides revenue certainty that supports debt financing arrangements. These long-term contracts typically include pricing mechanisms that protect against downside volatility while enabling participation in potential lithium price appreciation.

Operational risk reduction benefits from Germany's established regulatory framework, skilled workforce availability, and advanced infrastructure supporting industrial operations. These factors reduce execution risk compared to greenfield developments in less developed regions with limited supporting infrastructure.

Alternative Financing Pathway Development

Green bond financing opportunities emerge through projects' carbon-neutral credentials and renewable energy integration. European institutional investors increasingly seek ESG-compliant investment opportunities that support climate transition objectives while providing stable returns from infrastructure-style investments.

European Investment Bank critical materials funding programmes specifically target strategic mineral projects supporting European supply chain independence. These lending facilities offer favourable terms and longer repayment periods compared to commercial financing while supporting EU policy objectives through private sector development.

Strategic automotive OEM partnership potential exists through equity investments or prepaid offtake arrangements that secure lithium supplies while providing project financing. Major European automotive manufacturers facing electrification mandates may view upstream integration as strategic necessity for ensuring battery material availability.

Multilateral development bank participation through institutions like the European Bank for Reconstruction and Development could provide additional financing sources while ensuring compliance with international environmental and social standards that enhance project credibility and stakeholder acceptance.

Advanced Technology Integration Opportunities

The convergence of geothermal energy systems with lithium extraction technologies creates unique opportunities for technological advancement and efficiency optimisation. German projects serve as testing grounds for innovations applicable to similar geological formations worldwide while establishing technological leadership in sustainable critical mineral production.

Renewable Energy-Lithium Synergies

Geothermal power generation during lithium extraction operations creates exceptional energy efficiency through waste heat utilisation and integrated system design. The Lionheart project's 275 GWh annual renewable energy production capability demonstrates commercial viability of dual-purpose infrastructure that maximises resource utilisation from single capital investments.

Grid stabilisation services through coordinated geothermal-lithium operations provide additional revenue streams while supporting Germany's renewable energy transition. Advanced battery storage systems using locally produced lithium create closed-loop energy storage capabilities that enhance regional grid reliability and reduce transmission losses.

Circular economy applications extend beyond energy production to include waste heat recovery for industrial processes, district heating systems, and agricultural applications. These integrated approaches maximise economic returns per unit of subsurface resource accessed while creating community benefits that support project acceptance and long-term sustainability.

Industrial symbiosis opportunities emerge through co-location of lithium processing with other industrial operations requiring process heat, such as chemical manufacturing or materials processing facilities. This clustering approach reduces overall energy consumption and creates regional industrial competitiveness advantages.

Processing Technology Innovation

Battery-grade lithium hydroxide production requires specialised refining technologies that ensure consistent quality standards meeting automotive and electronics industry specifications. German projects' focus on lithium hydroxide monohydrate production targets the highest-value market segments while reducing processing complexity compared to lithium carbonate conversion processes.

Integrated refining capabilities eliminate transportation and handling costs associated with shipping intermediate products to external processing facilities. This vertical integration approach provides quality control advantages while reducing supply chain complexity and associated risks of product contamination or specification deviations.

Quality control automation systems ensure consistent product specifications while reducing labour costs and human error risks. Advanced analytical technologies enable real-time process optimisation and predictive maintenance strategies that maximise operational efficiency and minimise unplanned downtime costs.

Process optimisation through artificial intelligence and machine learning applications enables continuous improvement in extraction efficiency, energy utilisation, and product quality. These technological advancements create competitive advantages that can be licensed to similar operations globally, generating additional revenue streams beyond direct lithium production.

European Policy Influence and Strategic Implementation

German lithium projects operate within expanding European Union frameworks designed to enhance strategic mineral independence and reduce critical supply chain vulnerabilities. These policy developments create supportive regulatory environments while establishing precedents applicable to similar projects across member states.

Critical Raw Materials Act Implementation

Strategic project designation provides significant regulatory advantages including streamlined environmental impact assessments, accelerated permitting procedures, and priority access to government funding programmes. These benefits reduce project development timelines and associated costs while ensuring compliance with European environmental standards.

Enhanced government support mechanisms include direct grants, loan guarantees, and tax incentives specifically targeting critical mineral projects supporting European supply chain independence. The €204 million committed to German lithium projects demonstrates substantial public sector investment in strategic mineral security initiatives.

Regulatory harmonisation across EU member states creates standardised frameworks for critical mineral project development that reduce compliance complexity and enable technology transfer between similar geological formations in different countries. This coordination enhances overall European competitive positioning in global markets.

Priority infrastructure development includes transportation, energy, and communications systems supporting critical mineral operations. Government commitment to these supporting investments reduces private sector infrastructure costs while ensuring long-term operational sustainability for strategic projects.

EU-Australia Strategic Partnership Integration

Technology transfer opportunities through bilateral cooperation agreements enable German companies to access proven Australian lithium extraction and processing technologies while providing European market access for Australian equipment and services suppliers. This collaboration accelerates technology development and reduces innovation risks.

Joint research and development initiatives focus on advanced extraction technologies, environmental impact mitigation, and processing efficiency improvements. Shared funding for these programmes reduces individual company research costs while accelerating technological advancement benefiting both regions' lithium industries.

Supply chain diversification strategies include coordinated stockpiling arrangements, emergency supply protocols, and shared quality standards that enhance overall supply security for European battery manufacturers. These arrangements provide backup supply sources while maintaining competitive market dynamics.

Investment framework coordination enables European companies to participate in Australian lithium projects while Australian investors gain access to European operations. This cross-investment approach strengthens bilateral relationships while diversifying supply sources and technological capabilities for both regions.

Long-Term Strategic Outcomes and Industry Transformation

The successful development of German lithium projects establishes precedents for sustainable critical mineral extraction that influence global industry standards and competitive dynamics. These outcomes extend beyond immediate supply security to encompass technological leadership, environmental stewardship, and economic development models applicable worldwide.

2030 German Lithium Industry Projections

Operational project forecasts indicate 3-5 commercial lithium facilities achieving combined annual capacity of 80,000-120,000 tonnes by 2030, substantially exceeding European battery industry lithium requirements. This production capability positions Germany as a potential net lithium exporter within global markets while maintaining strategic stockpiling capabilities for domestic security.

Direct employment creation approaches 2,000+ positions across extraction, processing, and support services, with indirect employment multipliers generating additional opportunities throughout German industrial regions. Specialised skills development in geothermal engineering, chemical processing, and advanced materials creates high-value employment opportunities supporting economic diversification goals.

Cumulative investment reaching €20+ billion across the lithium sector demonstrates substantial capital commitment to strategic mineral independence while creating significant economic impact through construction, equipment procurement, and ongoing operations. This investment scale establishes Germany as a major player in global lithium markets.

Technology export potential emerges through licensing of German-developed extraction and processing technologies to similar geological formations worldwide. This intellectual property development creates ongoing revenue streams while establishing German technological leadership in sustainable critical mineral production methodologies.

European Battery Independence Achievement

By 2035, German lithium projects combined with similar developments in neighbouring countries could supply 40-50% of European battery-grade lithium demand, fundamentally reshaping global supply chain dependencies and reducing European vulnerability to geopolitical supply disruptions from traditional producing regions.

Strategic Industry Forecast: European lithium independence through German technological leadership will transform global supply chain dynamics, establishing new benchmarks for sustainable extraction while reducing battery manufacturing costs through shortened logistics chains and enhanced supply security.

Strategic autonomy implications enable European decision-making independence regarding lithium allocation, export policies, and industrial development priorities. This autonomy supports European automotive industry competitiveness while maintaining leverage in international trade negotiations affecting critical mineral access.

Quality leadership through environmental compliance and sustainable extraction practices establishes European lithium as premium products commanding price premiums in global markets increasingly focused on ESG compliance and carbon footprint reduction throughout supply chains.

Global Technology Leadership Export Opportunities

German engineering expertise in sustainable lithium extraction creates significant export opportunities for equipment, consulting services, and technology licensing to regions developing similar geological resources. Countries including France, Czech Republic, and emerging geothermal regions worldwide represent substantial market opportunities for German technology transfer.

Consulting services leveraging German operational experience in integrated geothermal-lithium extraction could generate substantial revenue streams while establishing technological leadership in rapidly growing global markets for sustainable critical mineral production. This expertise export complements direct lithium production revenue while diversifying industry economic contributions.

Equipment manufacturing opportunities emerge through development of specialised Direct Lithium Extraction technologies, geothermal integration systems, and processing equipment optimised for sustainable operations. German industrial capabilities in precision manufacturing and environmental compliance create competitive advantages in these emerging market segments.

European Integration and Replicability Framework

Similar geological formations across European regions including the Alsace Valley in France, Czech Republic's geological extensions, and potential developments in other countries create opportunities for coordinated lithium sector development utilising German technological achievements and regulatory frameworks as templates for broader European critical mineral independence.

Standardised regulatory frameworks developed through German project experience can be adapted across EU member states to accelerate similar developments while ensuring environmental compliance and community acceptance. This regulatory harmonisation reduces development costs and timelines for subsequent projects throughout Europe.

Shared technology development initiatives enable cost reduction through collaborative research and development programmes focusing on extraction efficiency improvements, environmental impact mitigation, and processing technology advancement. These collaborative approaches accelerate innovation while distributing development costs across multiple projects and countries.

Technology transfer mechanisms including equipment standardisation, operational protocols, and training programmes enable rapid scaling of successful German approaches to other European lithium projects. This knowledge transfer accelerates European-wide lithium sector development while maintaining quality and environmental standards established through German pioneering projects.

The emergence of Germany as a lithium project in Germany leader demonstrates the viability of sustainable critical mineral extraction within developed economies, creating models applicable globally for countries seeking strategic mineral independence while maintaining environmental leadership and technological advancement in rapidly evolving battery supply chains.

Ready to Invest in Europe's Lithium Independence Revolution?

Germany's breakthrough lithium projects powered by innovative geothermal extraction are reshaping European battery supply chains and creating unprecedented investment opportunities in strategic mineral independence. Discovery Alert's proprietary Discovery IQ model identifies emerging opportunities in critical minerals and energy transition sectors across ASX-listed companies, delivering real-time alerts when significant discoveries are announced that could transform market positioning in this rapidly evolving sector. Begin your 30-day free trial today to position yourself ahead of the market in the next phase of critical minerals development.