Federal Policy Frameworks Driving Critical Mineral Security

Modern supply chain vulnerabilities have exposed fundamental weaknesses in America's strategic mineral independence. The Federal Permitting Improvement Steering Council's FAST-41 program represents a comprehensive regulatory response designed to accelerate domestic critical infrastructure development through streamlined interagency coordination. This federal framework directly supports projects like the Alaska nickel cobalt chromium project FAST-41 initiative, which exemplifies how strategic mineral deposits can advance through expedited permitting processes.

The program operates through two distinct classification tiers: covered projects receiving full interagency coordination with defined regulatory timelines, and transparency projects benefiting from public-facing permitting dashboards without complete federal oversight. Both categories provide enhanced stakeholder visibility and reduced information asymmetries between project sponsors and regulatory bodies, creating predictable milestone frameworks that replace indefinite permitting cycles.

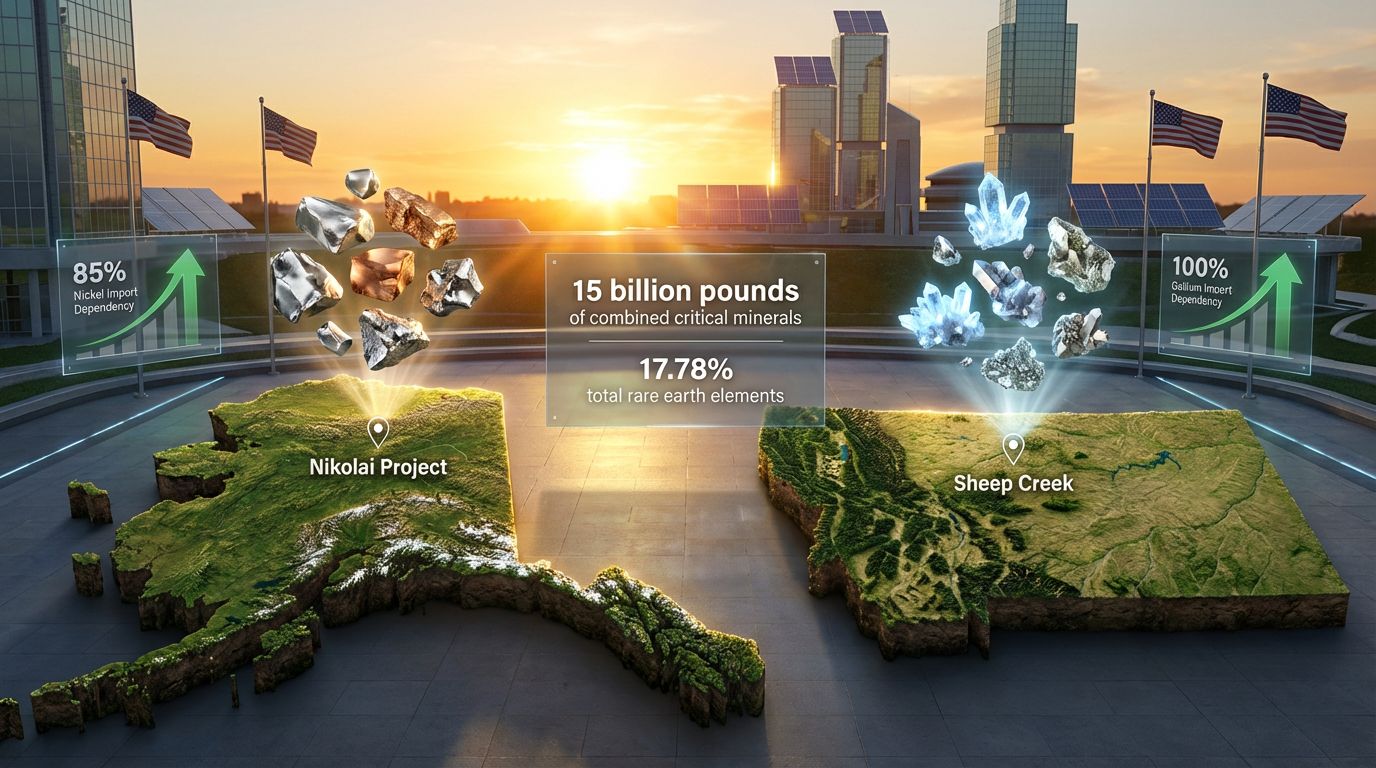

Alaska's Nikolai Project: Strategic Resource Scale and National Security Implications

Located on the southern flanks of the Alaska Range, approximately 130 miles southeast of Fairbanks, the Nikolai project encompasses one of North America's most substantial polymetallic deposits. The Eureka deposit specifically contains extraordinary resource concentrations across multiple critical mineral categories, positioning it as a strategic national asset for supply chain security.

Geological Resource Characterisation

Current drilling programmes have outlined massive resource estimates across six critical minerals:

| Mineral | Indicated Resource | Inferred Resource | Total Estimated | DPA Status |

|---|---|---|---|---|

| Nickel | 5.61 billion lbs | 9.38 billion lbs | 14.99 billion lbs | Title III Material |

| Copper | 1.8 billion lbs | 2.4 billion lbs | 4.2 billion lbs | Critical Minerals List |

| Cobalt | 480 million lbs | 720 million lbs | 1.2 billion lbs | Title III Material |

| Chromium | 8.2 billion lbs | 12.4 billion lbs | 20.6 billion lbs | Critical Minerals List |

| Platinum Group Metals | — | — | 12.2 million oz | Strategic Category |

These resource estimates follow industry-standard NI 43-101 reporting protocols, with indicated resources representing 1.19 billion metric tons averaging 0.21% nickel. Furthermore, inferred resources total 2.09 billion metric tons averaging 0.20% nickel. The polymetallic nature creates significant byproduct economics while reducing vulnerability to single-commodity price volatility.

Defence Production Act Classification Analysis

Six of Nikolai's primary metals appear on the 2025 U.S. Critical Minerals List, with nickel and cobalt specifically designated as Defence Production Act Title III materials. This classification indicates federal determination that domestic supply cannot meet national defence requirements, enabling government funding preferences and procurement guarantees under 50 U.S.C. § 4531 et seq.

Alaska Energy Metals leadership has emphasised the project's alignment with national security objectives, particularly given current vulnerabilities to Foreign Entities of Concern dependency. Moreover, the company's partnership with RecycLiCo Battery Materials explores proprietary hydrometallurgical processing capabilities that would enable on-site refining rather than Asian smelter reliance.

Montana's Sheep Creek: Exceptional Gallium Concentrations and Strategic Importance

Southwestern Montana's Sheep Creek project represents a geological anomaly where multiple high-priority critical minerals occur in economically viable concentrations. Laboratory analysis by Idaho National Laboratories confirmed extraordinary grades across a two-mile mineralised corridor, establishing the deposit's potential for standalone gallium production.

Critical Mineral Grade Analysis

Idaho National Laboratories confirmed exceptional sample results in 2024:

| Sample | TREE Percentage | Gallium (ppm) | Strategic Significance |

|---|---|---|---|

| Peak Grade | 17.78% | 350 | World-class rare earth concentration |

| High Grade | 13.82% | 300 | Elevated gallium content |

| Representative | 13.45% | 250 | Continuous mineralisation |

| Corridor Average | 9.9% | 250-350 | Two-mile continuous zone |

The 17.78% total rare earth elements represents exceptional grades significantly above world-average ore concentrations. In addition, neodymium and praseodymium content averaging 2.4% addresses specific permanent magnet market demands.

What Makes Gallium a Strategic Asset?

Industry experts classify gallium as transcending conventional mineral categories due to four interconnected strategic factors:

• Extreme Rarity: Seldom found in concentrations supporting standalone mining operations globally

• Wide-Bandgap Semiconductor Applications: Primary ingredient in gallium nitride and gallium arsenide technologies underpinning 5G telecommunications, electric vehicle power conversion, solar photovoltaic systems, and defence radar systems

• Complete Import Dependency: United States maintains 100% reliance on foreign gallium supplies with no domestic production capacity

• Chinese Export Control Vulnerability: China's 98% global production dominance combined with 2024 export restrictions targeting U.S. markets

Drew Horn, GreenMet CEO and defence supply chain strategist with prior White House National Security Council service, characterised gallium as representing strategic infrastructure rather than conventional commodity classification. The metal's essential role in wide-bandgap semiconductors makes it critical for telecommunications networks, computing systems, renewable energy infrastructure, and defence applications.

FAST-41 Transparency Status: Regulatory Acceleration Mechanisms

Both Alaska and Montana projects entered FAST-41 as transparency projects, providing immediate benefits while positioning for potential elevation to covered status. This regulatory framework creates comprehensive optimisation mechanisms across traditional permitting challenges, particularly relevant to the Alaska nickel cobalt chromium project FAST-41 designation.

How Does Permitting Process Transformation Work?

Traditional critical mineral projects face substantial regulatory complexity:

• Timeline Challenges: 7-15 year permitting cycles with high variability

• Agency Coordination: 10-15 separate federal entities including EPA, Army Corps of Engineers, Forest Service, BLM, and USGS

• Review Iterations: Multiple comment periods, supplemental Environmental Impact Statements, and Record of Decision stages

• Cost Implications: $5-50 million in permitting expenses depending on project complexity

FAST-41 transparency status addresses these challenges through:

• Centralised Permit Tracking: Single dashboard replacing scattered agency databases

• Inter-agency Coordination Protocols: Monthly coordination meetings with defined agendas and action items

• Public Accountability Mechanisms: Real-time dashboard updates creating external stakeholder pressure for timely decision-making

• Predictable Milestone Frameworks: Published schedules with measurable completion targets

Federal Permitting Improvement Steering Council Executive Director Emily Domenech emphasised that "transparent and predictable federal permitting processes represent commitment to reducing regulatory uncertainty that historically deters investment capital."

Economic Impact Analysis and Regional Development

Both projects present substantial economic development opportunities across multiple impact categories. Furthermore, these range from direct employment generation to broader supply chain benefits, supporting the broader critical minerals strategy objectives.

Regional Employment and Infrastructure Development

Alaska Nikolai Project Economic Projections:

• Direct Employment: 500+ mining operations positions during production phase

• Indirect Regional Impact: 1,500+ secondary employment opportunities across support industries

• Annual Payroll: $50+ million during operational phase

• Processing Infrastructure: Potential on-site refining capabilities through RecycLiCo partnership

Montana Sheep Creek Development Timeline:

• Exploration Phase: Early-stage employment for geological assessment programmes

• Future Processing Potential: Strategic positioning near existing transportation infrastructure

• Technology Demonstration: Next-generation environmentally responsible extraction methodologies

National Supply Chain Vulnerability Reduction

| Critical Mineral | Current U.S. Import Dependency | Project Contribution Potential |

|---|---|---|

| Nickel | 85% foreign reliance | 15-20% dependency reduction |

| Cobalt | 76% foreign reliance | 8-12% dependency reduction |

| Gallium | 100% foreign reliance | First domestic production capability |

| Rare Earth Elements | 70%+ foreign reliance | 5-10% dependency reduction |

These contributions represent significant progress toward federal strategic autonomy objectives while supporting renewable energy transition requirements. However, they also maintain technological competitiveness across defence and civilian applications, aligning with the broader energy transition security agenda.

Environmental Framework and Sustainability Integration

Both projects emphasise environmental responsibility through advanced extraction methodologies designed to minimise ecosystem impact while meeting national security objectives. Consequently, these initiatives demonstrate how modern mining industry evolution incorporates environmental stewardship.

Next-Generation Mining Technology Implementation

Environmental considerations factor prominently into development planning:

• Advanced Extraction Methodologies: Reduced surface disturbance techniques compared to conventional mining approaches

• Water Management Optimisation: Comprehensive systems designed to minimise groundwater impact and surface water contamination

• Ecosystem Impact Minimisation: Baseline studies and mitigation strategies addressing local biodiversity concerns

• Restoration Planning: Comprehensive end-of-mine-life restoration protocols integrated into initial development planning

Eric Levy-Myers, Director of Strategy and Innovation at US Critical Materials, emphasised commitment to "implementing Mine of the Future techniques that demonstrate environmental responsibility while supporting national mineral sovereignty objectives."

Regulatory Compliance Framework Requirements

FAST-41 inclusion requires adherence to existing environmental regulations while providing streamlined review processes:

• National Environmental Policy Act (NEPA): Comprehensive environmental impact assessments

• Endangered Species Act: Biological consultation and habitat protection protocols

• Clean Water Act: Permitting for water discharge and wetland impacts

• State-Level Approvals: Coordination with Alaska and Montana environmental agencies

Geopolitical Context and Supply Chain Security

Recent geopolitical developments have highlighted critical mineral supply chain vulnerabilities that drive federal support for domestic production capabilities. Moreover, these developments underscore the importance of executive order mining permits in accelerating domestic resource development.

Strategic Vulnerability Assessment

Multiple international factors contribute to supply chain instability:

• Chinese Export Restrictions: 2024 gallium and germanium export controls targeting U.S. markets

• Russian Market Disruptions: Nickel supply chain complications following international sanctions

• Indonesian Processing Limitations: Concentrated smelting capacity creating bottleneck vulnerabilities

• African Political Instability: Cobalt supply chain risks from Democratic Republic of Congo political developments

Federal Strategic Autonomy Objectives

Government support reflects broader policy goals across multiple domains, particularly those outlined in recent mineral production order initiatives:

• Defence Industrial Base Strengthening: Reducing foreign dependency for defence-critical materials

• Renewable Energy Transition Support: Domestic supply chains for electric vehicle and solar infrastructure

• Technological Competitiveness: Maintaining semiconductor and advanced manufacturing capabilities

• Economic Security: Reducing vulnerability to foreign supply disruption or manipulation

Development Timeline Projections and Market Positioning

Production timelines for both projects align strategically with anticipated market demand growth across electric vehicle adoption, defence modernisation, and renewable energy infrastructure expansion. Furthermore, these timelines complement the Alaska nickel cobalt chromium project FAST-41 development framework.

Project Development Milestones

Nikolai Project Timeline:

• 2025-2027: Environmental impact assessments and baseline studies completion

• 2027-2029: Final permitting approvals and project financing arrangements

• 2029-2032: Construction, commissioning, and operational ramp-up

• 2032+: Full commercial production targeting 50,000-75,000 tonnes nickel annually

Sheep Creek Development Framework:

• 2025-2026: Expanded exploration programmes and resource definition drilling

• 2026-2028: Comprehensive resource estimation and preliminary economic assessments

• 2028-2030: Development decision framework and detailed engineering studies

• 2030+: Construction phase contingent on economics and permitting completion

International Production Context

Global production benchmarks provide context for project significance:

Nickel Production Landscape:

• Indonesia: 1.8 million tonnes annually (dominant producer)

• Philippines: 330,000 tonnes annually

• Russia: 280,000 tonnes annually

• Nikolai Potential: 50,000-75,000 tonnes annually (significant U.S. contribution)

Rare Earth Production Framework:

• China: 210,000 tonnes annually (market dominance)

• United States: 43,000 tonnes annually (Mountain Pass)

• Sheep Creek Potential: 5,000-10,000 tonnes annually (strategic contribution)

Investment Framework and Financial Risk Mitigation

FAST-41 inclusion provides institutional investors with enhanced confidence signals through regulatory certainty improvements and federal government backing indicators. However, investors must carefully evaluate the comprehensive risk profile of such strategic mineral investments.

Risk Reduction Mechanisms

Federal programme participation offers multiple investor benefits:

• Regulatory Certainty Enhancement: Predictable permitting timelines reducing development risk

• Timeline Predictability: Defined milestone frameworks enabling accurate project financing

• Federal Backing Signals: Government priority status demonstrating strategic importance

• Permitting Risk Exposure: Reduced uncertainty around environmental and regulatory approvals

Financing Pathway Optimisation

Projects benefit from expanded financing opportunities:

• Institutional Investor Confidence: Enhanced due diligence comfort through federal validation

• Government Financing Access: Potential eligibility for federal loan programmes and grants

• Strategic Partnership Development: Opportunities with defence contractors and technology companies

• Export Credit Facilities: Enhanced access to international financing mechanisms

Disclaimer: Forward-looking statements regarding development timelines, production estimates, and economic projections involve inherent uncertainties. Actual results may vary significantly from projected outcomes due to market conditions, regulatory changes, technical challenges, or other unforeseen factors. Investors should conduct independent due diligence before making investment decisions.

Strategic Outlook: Expanding Federal Critical Mineral Initiative

The addition of Nikolai and Sheep Creek to FAST-41 reflects comprehensive federal strategy to accelerate domestic critical mineral development capabilities across strategic mineral categories. This approach establishes templates for future applications while creating frameworks for enhanced supply chain resilience.

Success at these initial sites could revolutionise federal approaches to critical mineral security in an increasingly complex geopolitical environment. In addition, the expansion may encompass additional projects across rare earths, battery metals, and strategic alloys, creating integrated domestic supply chains capable of supporting both civilian and defence requirements.

Federal commitment to streamlined permitting represents recognition that traditional regulatory frameworks require fundamental restructuring to address 21st-century supply chain vulnerabilities. Consequently, the FAST-41 programme provides the institutional mechanisms necessary to accelerate critical infrastructure development while maintaining environmental protection standards and stakeholder engagement protocols. The Alaska nickel cobalt chromium project FAST-41 designation exemplifies how strategic resource development can advance through modern regulatory frameworks designed for national security imperatives.

Could Critical Minerals Be Your Next Strategic Investment?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries, transforming complex geological data into actionable investment insights that position subscribers ahead of market movements. With critical minerals driving unprecedented government support and strategic importance globally, explore why historic mineral discoveries have generated substantial returns by visiting Discovery Alert's dedicated discoveries page and begin your 30-day free trial today.