What's Driving the Federal Reserve's December Rate Cut Hesitation?

Economic uncertainty permeates global markets in ways that extend far beyond traditional policy frameworks. December rate cut uncertainty has become a defining characteristic of current monetary conditions, reflecting a convergence of structural disruptions that challenge conventional wisdom. The interaction between government fiscal operations, international trade dynamics, and supply chain vulnerabilities creates feedback loops that amplify market volatility across asset classes.

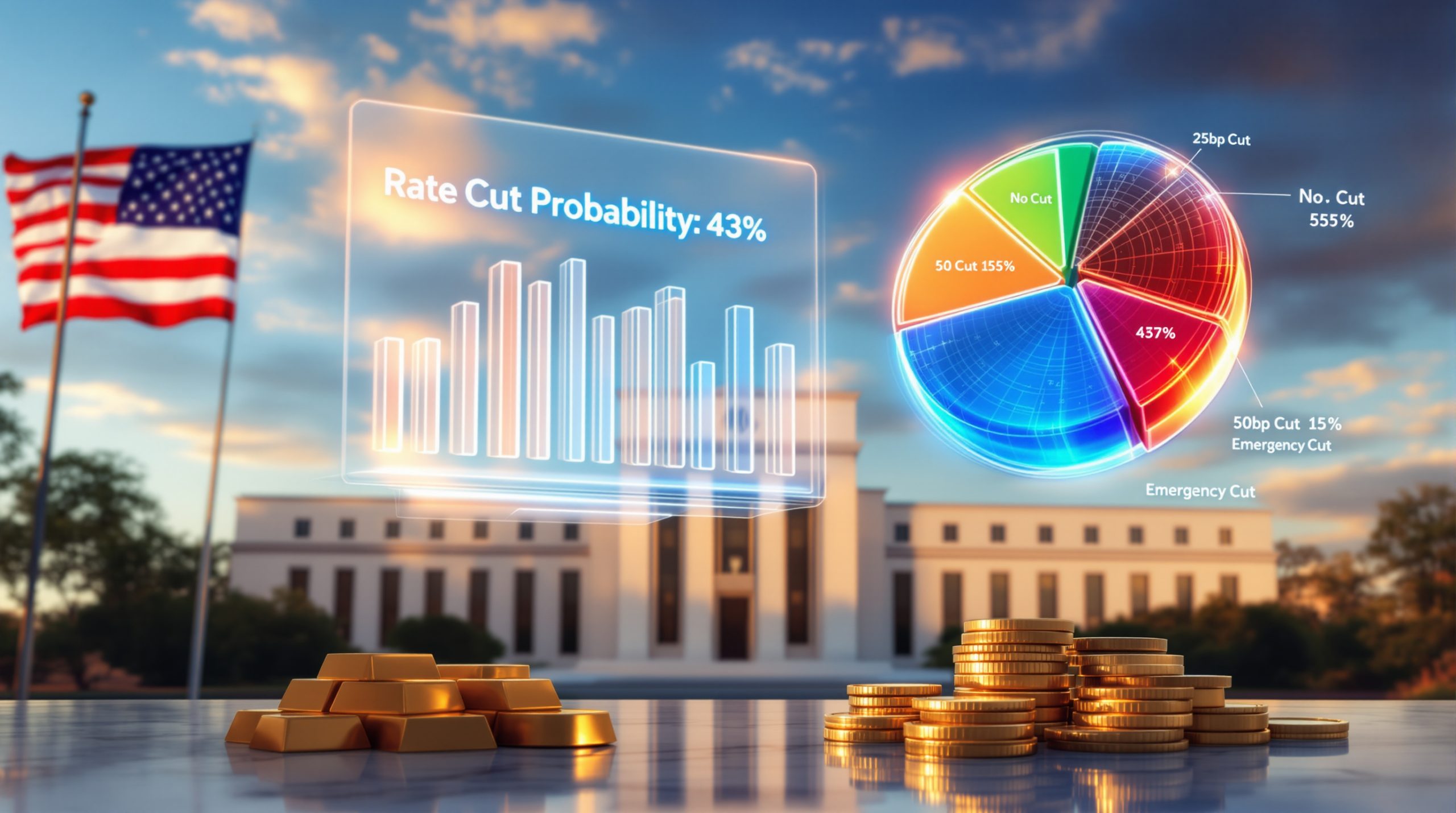

Market expectations for Federal Reserve policy decisions have undergone dramatic shifts throughout late 2024. The probability of a quarter-point reduction in December declined from near-certainty to approximately 43% by mid-November, representing one of the most significant expectation repricing events in recent policy cycles. Furthermore, this shift highlights how traditional economic relationships no longer provide reliable guidance for investment decisions.

Economic Data Disruption and Policy Uncertainty

The October 2024 government shutdown created unprecedented disruptions to the Federal Reserve's primary data sources, fundamentally altering the information landscape for monetary policy decisions. When government operations ceased, critical economic reporting from agencies including the Bureau of Labor Statistics and Department of Commerce suspended regular publication schedules, forcing policymakers to rely on alternative data sources.

Employment statistics became particularly distorted during this period, with government employee furloughs and contractor terminations creating artificial deterioration in headline job numbers. Government employees eventually received back pay upon shutdown resolution, while contractor positions were permanently eliminated when funding authorization expired.

This distinction meant that employment data reflected both temporary and permanent job losses without clear differentiation in headline reporting. Federal Reserve officials demonstrated sophisticated understanding of these data quality issues, recognising that employment deterioration during shutdown periods often overstates actual labour market weakness.

Inflation Persistence vs. Employment Concerns

Core Personal Consumption Expenditures inflation registered 2.1% in the most recent reporting period, marginally above the Federal Reserve's 2.0% target. This modest overshoot occurs alongside unemployment rates of 3.9%, suggesting continued labour market tightness that could support wage pressures.

The Fed faces a complex balancing act between preventing inflation acceleration and maintaining employment gains. With GDP growth running at 2.8% annualised and labour force participation at 63.4%, economic conditions appear sufficiently robust to withstand delayed accommodation.

This backdrop provides justification for policy patience rather than aggressive easing. Additionally, the gold price analysis suggests that monetary policy uncertainty creates significant ripple effects across commodity markets.

Political Transition and Fiscal Policy Variables

Congressional discussions regarding potential stimulus measures add another layer of uncertainty to monetary policy calculations. Speculation about consumer stimulus payments creates inflationary expectations that could complicate Fed decision-making, particularly if fiscal expansion coincides with continued economic growth.

Chair Powell and the Federal Open Market Committee now operate with enhanced justification for policy pauses. They can use data quality disruptions as cover for a more restrictive stance, allowing the Fed to maintain credibility while responding to evolving economic conditions.

How Do Interest Rate Expectations Impact Precious Metals Markets?

Interest rate expectations drive precious metals pricing through multiple transmission mechanisms that extend beyond simple inverse correlations. Lower rates reduce opportunity costs for holding non-yielding assets like gold and silver, while higher rates increase competition from income-producing investments.

However, current market behaviour suggests these traditional relationships have become more complex. The interaction with global recession analysis indicates that multiple factors now influence precious metals beyond simple monetary policy considerations.

The Traditional Inverse Relationship Framework

Precious metals historically benefit from accommodative monetary policy through several channels:

- Reduced opportunity cost of holding non-interest-bearing assets

- Currency debasement concerns during periods of monetary expansion

- Real interest rate dynamics that favour hard assets during negative real rate environments

- Portfolio rebalancing toward alternative stores of value

When the Federal Reserve signals rate cuts, markets typically begin pricing these benefits before policy implementation occurs. This forward-looking mechanism explains why precious metals can rally on expectations alone, independent of actual policy changes.

Forward-Looking Market Pricing Mechanisms

Market participants continuously adjust precious metals positions based on evolving rate cut probabilities rather than waiting for official policy announcements. The shift from near-certain December rate cuts to 43% probability represents significant repricing of expected future monetary conditions.

This dynamic creates volatility around Federal Reserve communications and economic data releases. Even minor shifts in policymaker rhetoric can trigger substantial position adjustments as traders recalibrate probability assessments for future rate paths.

Volatility Amplification in Thin Trading Conditions

Current precious metals markets exhibit reduced liquidity that amplifies price responses to expectation changes. When trading volume declines, smaller order flows can generate disproportionate price movements as market makers adjust bid-offer spreads and reduce position sizes.

The cascading effect of stop-loss orders and algorithmic trading strategies intensifies these movements. During periods of thin liquidity, automated selling can accelerate price declines beyond levels justified by fundamental information, creating feedback loops that extend volatility episodes.

Why Are Current Market Conditions Different from Historical Patterns?

Multiple structural changes have converged to disrupt traditional precious metals market behaviour, creating an environment where historical patterns provide limited predictive value. These disruptions span supply chains, geopolitical frameworks, and monetary policy transmission mechanisms.

Supply Chain Disruptions in Physical Metal Markets

Physical silver markets currently experience significant supply constraints at major exchanges, with metal flowing from Western markets toward Asian demand centres. Shanghai trading conditions have tightened considerably, reducing liquidity at key pricing nodes and creating potential disconnects between paper and physical markets.

This supply tightness manifests in several ways:

- Exchange inventory depletion reducing available deliverable metal

- Geographic arbitrage opportunities as regional markets diverge

- Delivery timing delays affecting physical settlement mechanisms

- Premium expansion between spot prices and physical delivery costs

These conditions create price volatility independent of monetary policy expectations. The silver market squeeze demonstrates how supply-demand imbalances generate their own trading dynamics.

Geopolitical Risk Premium Integration

Current market pricing increasingly reflects geopolitical uncertainty across multiple dimensions. Government operational continuity, international trade framework stability, and currency regime reliability all contribute to elevated risk premiums that weren't present in previous market cycles.

Unlike historical periods when precious metals responded primarily to monetary policy and growth dynamics, today's markets must price multiple sources of systemic uncertainty simultaneously. This complexity makes traditional catalyst analysis less reliable as an interpretive framework.

Technology Sector Demand vs. Traditional Safe Haven Flows

Silver demand patterns now reflect significant industrial consumption from technology sectors including semiconductor manufacturing, battery production, and solar panel assembly. This industrial demand operates independently of traditional safe-haven investment flows, creating dual demand streams that can work at cross-purposes.

When monetary policy expectations would traditionally drive investment demand lower, persistent industrial demand can provide price support. Conversely, during periods of strong investment demand, industrial supply constraints can amplify price movements beyond levels suggested by financial factors alone.

What Economic Indicators Will Shape the December FOMC Decision?

The December 9-10 Federal Open Market Committee meeting will synthesise multiple economic indicators to determine appropriate policy stance. Recent data quality disruptions complicate this analysis, requiring policymakers to weight alternative information sources alongside traditional metrics.

Key Economic Metrics Influencing Rate Cut Probability

| Indicator | Current Reading | Fed Priority | Impact Assessment |

|---|---|---|---|

| Core PCE Inflation | 2.1% | High | Slight hawkish bias |

| Unemployment Rate | 3.9% | High | Neutral to dovish |

| GDP Growth | 2.8% annualised | Medium | Hawkish (above trend) |

| Labour Force Participation | 63.4% | Medium | Neutral |

| Government Data Quality | Impaired | High | Justifies caution |

Employment Data Quality and Interpretation Challenges

October employment statistics require careful interpretation due to government shutdown effects. The Federal Reserve must distinguish between temporary furlough impacts and permanent contractor job losses to assess underlying labour market conditions accurately.

Alternative employment indicators from private sector sources provide supplementary information, though these datasets may not capture government sector dynamics comprehensively. ADP payroll processing data, initial jobless claims, and high-frequency economic indicators offer real-time insights that complement official statistics.

Inflation Trajectory Analysis and Core Metrics

Core PCE inflation at 2.1% suggests modest price pressures that remain manageable but warrant monitoring. The Federal Reserve's symmetric 2.0% target allows for temporary overshoots, though sustained elevation above target could justify policy restraint.

Services inflation components deserve particular attention given their persistence and connection to wage dynamics. Housing costs, healthcare expenses, and professional services pricing reflect underlying economic momentum that monetary policy affects with significant lags.

Global Economic Spillover Effects

International economic developments increasingly influence Federal Reserve decision-making through trade channels, capital flows, and currency mechanisms. European Central Bank policy divergence, emerging market stability, and Chinese economic performance all factor into domestic policy considerations.

Dollar strength dynamics affect import price inflation and export competitiveness, creating transmission mechanisms between domestic monetary policy and international economic conditions. The us-china trade impact analysis reveals how these international factors complicate Fed decision-making.

How Might December Rate Cut Uncertainty Affect Investment Strategies?

Investment positioning becomes increasingly complex when monetary policy expectations fluctuate significantly within short timeframes. The shift from high confidence in December rate cuts to substantial uncertainty requires strategic adjustments across multiple asset classes and time horizons.

Portfolio Rebalancing Considerations

Traditional 60/40 equity-bond portfolio allocations may require modification during periods of monetary policy uncertainty. When rate cut timing becomes unpredictable, fixed-income duration risk and equity sector rotation patterns both become more volatile.

Precious metals allocation decisions must account for both monetary policy sensitivity and supply-demand fundamentals. Current conditions suggest that metals may respond less predictably to Fed communications than in previous cycles, requiring more nuanced position sizing.

Currency Hedging Implications for International Investors

Dollar strength expectations tied to Federal Reserve policy affect international investment returns through currency translation effects. When rate cut probabilities decline, dollar appreciation potential increases, benefiting U.S.-based investors but creating headwinds for international equity and commodity exposure.

Currency hedging costs fluctuate with interest rate differentials, making hedging decisions more complex during periods of policy uncertainty. Forward contract pricing reflects evolving rate expectations, requiring regular hedge ratio adjustments.

Sector Rotation Patterns in Rate-Sensitive Industries

Interest rate sensitive sectors including real estate investment trusts, utilities, and high-dividend equities experience increased volatility during periods of monetary policy uncertainty. These sectors may underperform during hawkish policy shifts but could rebound quickly if accommodation resumes.

Financial sector positioning becomes particularly relevant as banks benefit from steeper yield curves and higher interest margins. When rate cut expectations decline, financial stocks often outperform while interest-sensitive sectors lag.

What Are the Broader Economic Implications of Fed Policy Uncertainty?

Monetary policy uncertainty creates spillover effects throughout the economy that extend far beyond immediate market pricing. Credit allocation decisions, business investment planning, and consumer spending patterns all respond to changes in December rate cut uncertainty expectations.

Credit Market Transmission Mechanisms

Corporate borrowing costs reflect both current interest rates and expectations for future policy paths. When December rate cut uncertainty increases, credit spreads may widen as lenders demand higher risk premiums for longer-term exposures.

Small and medium enterprises face particular challenges during periods of policy uncertainty, as their financing costs remain more sensitive to rate changes than large corporations with diversified funding sources. This creates potential for uneven economic impacts across business sizes.

Housing Market Sensitivity to Rate Expectations

Mortgage markets immediately reflect changes in interest rate expectations through daily pricing adjustments. The shift from expected rate cuts to policy uncertainty translates directly into higher borrowing costs for homebuyers, potentially reducing purchase activity.

Real estate investment decisions incorporate long-term financing cost projections, making property valuations sensitive to evolving Fed policy expectations. Commercial real estate markets may experience particular volatility as investors reassess cap rate assumptions.

Corporate Investment Decision Delays

Capital investment planning becomes more challenging when interest rate trajectories remain uncertain. Companies may delay major projects until policy clarity emerges, potentially reducing economic growth momentum in subsequent quarters.

This investment delay effect can become self-reinforcing, as reduced capital spending weakens economic growth and paradoxically increases the likelihood of future rate cuts. The Federal Reserve must balance immediate policy objectives against these dynamic feedback effects.

How Should Investors Position for Multiple Rate Cut Scenarios?

Effective investment strategy during periods of monetary policy uncertainty requires preparation for multiple potential outcomes rather than betting on single scenarios. Probability-weighted positioning helps manage risks while maintaining upside participation across different policy paths.

Federal Reserve Policy Scenario Analysis

| Scenario | Market Probability | Primary Drivers | Strategic Response |

|---|---|---|---|

| 25bp December Cut | 43% | Data improvement, dovish pivot | Increase duration, reduce cash |

| Policy Hold | 35% | Current economic strength | Maintain diversification |

| Surprise 50bp Cut | 15% | Economic deterioration | Full risk asset allocation |

| Hawkish Hold | 7% | Inflation persistence | Defensive positioning |

Risk Management Through Uncertainty

Diversification across multiple asset classes becomes essential when policy outcomes remain unclear. Rather than concentrating positions based on single scenario expectations, investors should maintain exposure to assets that perform well under different monetary policy regimes.

Options strategies can provide downside protection while maintaining upside participation during volatile periods. Put spreads, covered calls, and collar structures allow for position customisation based on specific risk tolerance and return objectives.

Diversification Strategies Across Asset Classes

Asset class correlation patterns may shift during periods of monetary policy uncertainty, reducing the effectiveness of traditional diversification approaches. Real assets, international exposure, and alternative investments can provide portfolio stability when conventional equity-bond correlations become unreliable.

Precious metals allocation requires careful consideration of both monetary policy sensitivity and supply-demand fundamentals. The current gold market trends analysis suggests that gold and silver may respond less predictably to Fed communications than historically.

Timing Considerations for Long-term Positioning

Dollar-cost averaging strategies may prove particularly valuable during periods of heightened uncertainty, allowing investors to build positions gradually rather than attempting to time specific policy announcements.

Rebalancing frequency may require adjustment during volatile periods, with more frequent portfolio reviews ensuring that asset allocation remains aligned with changing market conditions and policy expectations.

What Historical Precedents Inform Current Fed Decision-Making?

Federal Reserve policy decisions occur within the context of institutional memory and historical precedent, though current conditions present unique challenges that limit the applicability of past experience.

2019 Insurance Cuts vs. 2024-2025 Normalisation Cycle

The Federal Reserve's 2019 rate cuts were characterised as "insurance" against global growth risks and trade policy uncertainty. Current policy considerations reflect different dynamics, with domestic economic strength and inflation concerns taking precedence over global risk factors.

Unlike 2019, when policy accommodation addressed external threats to economic expansion, today's decisions must balance continued growth against inflation risks and financial stability concerns. This fundamental difference limits the predictive value of 2019 precedents for current policy paths.

Communication Strategy Evolution Under Powell

Chair Powell has emphasised forward guidance and clear policy communication throughout his tenure, though recent messaging suggests greater policy optionality than markets initially anticipated. The evolution from dovish forward guidance to conditional policy stance reflects changing economic conditions.

Federal Reserve communications now incorporate greater emphasis on data dependency and policy flexibility, reducing market ability to predict future decisions based on current statements. According to recent analysis, this communication strategy may continue as economic uncertainty persists.

Market Reaction Patterns to Policy Pivot Points

Historical policy pivot points demonstrate that markets often overshoot in both directions when Fed stance changes, creating volatility around transition periods. Current December rate cut uncertainty may represent such a pivot point, with implications extending beyond immediate policy decisions.

Asset price reactions during previous policy transitions suggest that uncertainty periods often resolve with swift moves once policy direction clarifies. Investors should prepare for potential volatility acceleration following the December FOMC meeting.

How Do Global Central Bank Policies Influence Fed Decisions?

Federal Reserve policy operates within a global context where central bank coordination and currency dynamics influence domestic decision-making. International policy divergence creates spillover effects that factor into U.S. monetary policy considerations.

European Central Bank Divergence Implications

Divergent monetary policies between the Federal Reserve and European Central Bank create currency pressures and trade implications that affect U.S. economic conditions. When the ECB maintains more accommodative policy than the Fed, dollar strength can reduce import price inflation while harming export competitiveness.

This policy divergence affects Federal Reserve calculations through multiple channels, requiring coordination considerations that extend beyond domestic economic objectives. International policy meetings and communication coordination become increasingly important during divergent policy periods.

Emerging Market Capital Flow Considerations

U.S. monetary policy changes trigger capital flow adjustments in emerging markets that can create financial stability risks. When Federal Reserve policy becomes more restrictive relative to global norms, capital flows toward dollar-denominated assets, potentially destabilising emerging market currencies and debt markets.

These international spillover effects factor into Federal Reserve decision-making through financial stability mandates and global economic growth implications. Emerging market stress can eventually affect U.S. economic conditions through trade and financial market channels.

Currency War Prevention and Coordination Mechanisms

International policy coordination mechanisms help prevent competitive devaluation cycles that could destabilise global trade and financial systems. Federal Reserve decisions increasingly incorporate these coordination considerations, particularly during periods of global economic uncertainty.

G7 and G20 policy coordination frameworks provide venues for central bank communication and coordination, though the effectiveness of these mechanisms depends on shared economic objectives and political cooperation.

What Are the Long-term Structural Changes in Monetary Policy?

Current monetary policy uncertainty occurs within the context of longer-term structural changes in central bank frameworks and operational procedures. Understanding these evolutionary trends provides context for immediate policy decisions.

New Framework Implementation and Flexibility

The Federal Reserve's adoption of average inflation targeting provides greater policy flexibility during periods of economic uncertainty. This framework allows for temporary inflation overshoots without triggering automatic policy tightening, creating optionality that didn't exist under previous regimes.

Policy communication strategies continue evolving to incorporate this flexibility while maintaining market confidence and inflation expectations anchoring. The balance between flexibility and credibility requires ongoing calibration as economic conditions change.

Financial Stability Mandate Integration

Financial stability considerations play increasingly prominent roles in Federal Reserve decision-making, complementing traditional employment and inflation objectives. When asset price valuations become extended, policy decisions must account for financial stability risks alongside macroeconomic conditions.

This expanded mandate creates additional complexity in policy decisions, as financial stability objectives may conflict with traditional monetary policy goals during certain economic conditions. December rate cut uncertainty reflects these competing considerations.

Climate Risk and Policy Tool Evolution

Climate-related financial risks are becoming integrated into central bank policy frameworks, though implementation remains in early stages. These considerations may influence long-term policy tool development and regulatory approaches.

The intersection of climate policy and monetary policy creates new channels for policy transmission that may affect precious metals markets through renewable energy demand and carbon pricing mechanisms.

Investment Disclaimer: The analysis presented reflects current market conditions and policy expectations as of late 2024. Federal Reserve policy decisions involve multiple complex factors and actual outcomes may differ significantly from current market expectations. Economic forecasts and scenario analysis should not be considered investment advice, and individual investment decisions should account for personal financial circumstances and risk tolerance.

Key Takeaways:

- December rate cut probability declined to approximately 43% from near-certainty, representing significant expectation repricing

- Government shutdown data disruptions provided Federal Reserve justification for policy caution beyond pure economic factors

- Precious metals markets exhibit reduced liquidity that amplifies volatility around policy expectation changes

- Supply chain disruptions in physical silver markets create price dynamics independent of monetary policy expectations

- Multiple structural changes have disrupted traditional market relationships, reducing historical precedent reliability

- Investment strategy requires preparation for multiple policy scenarios rather than single outcome positioning

The December 9-10 FOMC meeting represents a critical juncture for monetary policy direction and market expectations. While traditional relationships between interest rates and precious metals remain relevant, current conditions require more nuanced analysis that accounts for supply disruptions, geopolitical risks, and evolving Fed communication strategies. Investors should prepare for continued volatility as policy uncertainty resolves and new market dynamics establish themselves.

Looking to capitalise on Federal Reserve policy shifts?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries, helping investors position ahead of market movements driven by monetary policy changes and economic uncertainty. Whether you're navigating rate cut volatility or seeking opportunities in precious metals markets, our instant notifications transform complex market conditions into actionable trading insights. Begin your 30-day free trial today to gain a market-leading edge during these dynamic economic times.