Global commodity markets continue their complex dance between oversupply concerns and infrastructure demand, creating challenging investment landscapes for resource-dependent companies. Iron ore price trends reflect broader economic uncertainties, with Chinese steel demand patterns shifting amid evolving industrial policies and green transition initiatives. Mining companies face mounting pressure to balance traditional dividend expectations with capital allocation toward sustainability projects, creating tension between immediate shareholder returns and long-term strategic positioning.

Fortescue Dividend Timeline: Essential 2026 Calendar Dates

The Australian iron ore giant has established a structured corporate calendar for 2026, providing shareholders with predictable dividend announcement windows and operational transparency through quarterly reporting cycles. Furthermore, understanding the Fortescue dividend dates becomes crucial for income-focused investors planning their portfolio strategies.

Critical Dividend Declaration Dates

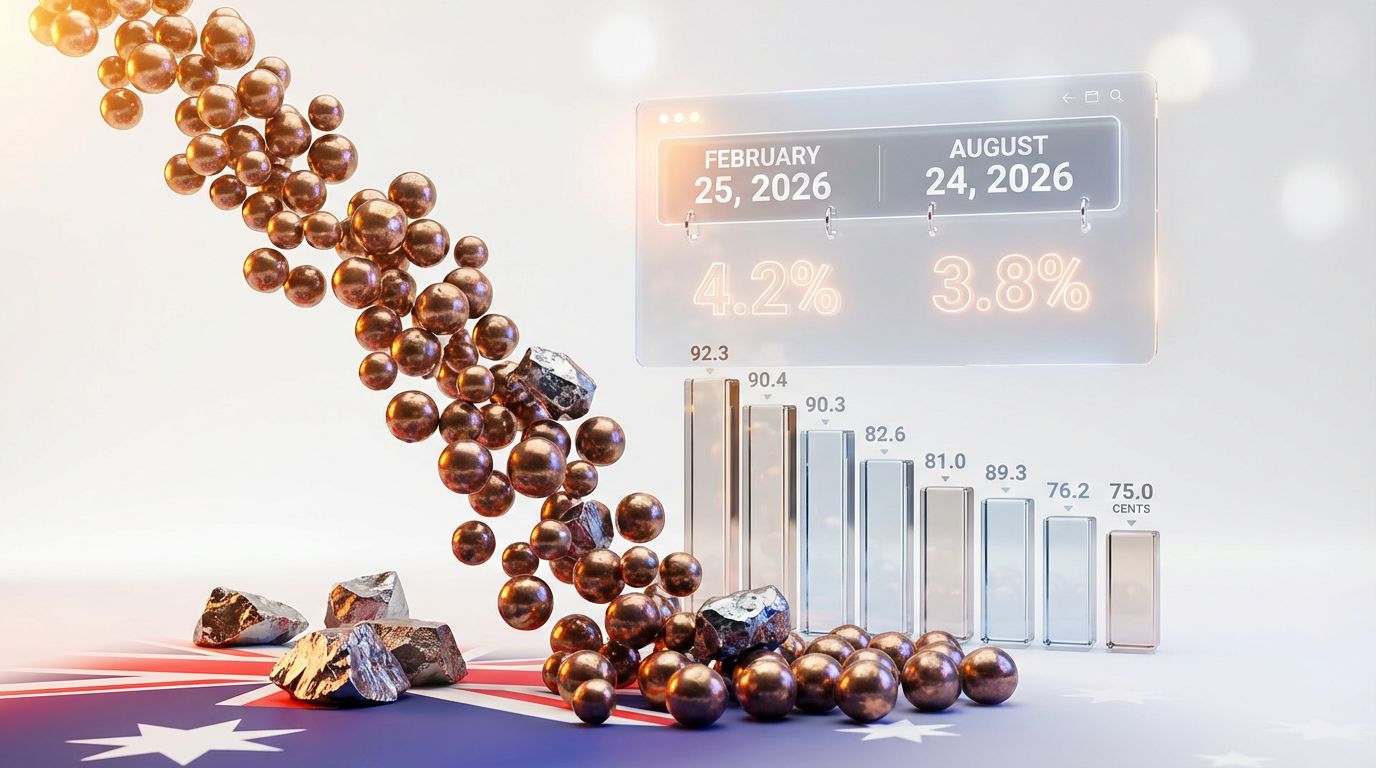

Fortescue's interim dividend announcement is scheduled for February 25, 2026, coinciding with the release of half-year financial results. This timing follows the company's established pattern of mid-to-late February reporting, allowing adequate time for financial consolidation and board review processes.

The final dividend declaration will occur on August 24, 2026, alongside full-year results presentation. This August timing maintains consistency with historical reporting schedules and provides sufficient analysis period for annual performance assessment.

Key Timeline Elements:

- Ex-dividend dates typically occur 5-7 business days post-announcement

- Payment processing requires 4-6 weeks following ex-dividend dates

- Dividend eligibility determined by shareholding on record date

- Full franking credits attached to all dividend payments

Quarterly Production Reporting Schedule

Operational transparency continues through quarterly production updates:

- January 22, 2026: Q1 FY26 production metrics

- April 23, 2026: Q2 FY26 operational results

- July 23, 2026: Q3 FY26 performance data

- October 22, 2026: Q4 FY26 production summary

These reports provide crucial insights into shipment volumes, operational efficiency, and guidance achievement, directly impacting investor sentiment and dividend sustainability assessments.

Annual General Meeting

The October 29, 2026 AGM will address strategic direction, board composition, and shareholder resolutions. This timing allows comprehensive discussion of full-year results and forward-looking strategic initiatives.

Dividend Decline Projections Through 2028

Analyst consensus points toward substantial dividend compression over the coming three-year period, reflecting profit margin challenges and shifting capital allocation priorities. Moreover, these projections highlight investment risk indicators that income investors should carefully consider.

Current Dividend Context

Fortescue maintained a $1.10 per share annual dividend for FY25, representing a 65% payout ratio of net profit after tax. This payout level sits within the company's stated policy range of 50-80% NPAT distribution, demonstrating commitment to shareholder returns despite challenging operating conditions.

The FY25 financial performance showed significant headwinds, with NPAT declining 41% to US$3.4 billion compared to FY24. Despite this profit compression, operational metrics remained robust with iron ore shipments reaching 198.4 million wet metric tonnes, up 4% year-on-year.

Forward Dividend Forecasts

Three-Year Dividend Trajectory:

| Financial Year | Dividend Per Share | Yield at $21.80 | Change from FY25 |

|---|---|---|---|

| FY26 | 92.3 cents | 4.2% | -16.1% |

| FY27 | 82.0 cents | 3.75% | -25.5% |

| FY28 | 75.0 cents | 3.4% | -31.8% |

This declining trajectory reflects analyst expectations of continued margin pressure despite iron ore prices maintaining above the US$100 per tonne psychological threshold. Iron ore pricing has shown resilience with a 3% increase during 2025, yet profitability recovery remains elusive.

Production Guidance and Operational Outlook

Management guidance for FY26 targets 195-205 million wet metric tonnes of iron ore shipments, suggesting potential production stabilisation within a 2-5% range of FY25 levels. The Q1 FY26 performance delivered 49.7 million wet metric tonnes, marking a quarterly shipment record despite representing a 10% sequential decline from Q4 FY25.

This production consistency provides a foundation for earnings stability, though margin compression indicates cost pressures or capital intensity impacts are offsetting volume benefits. In addition, iron ore demand insights suggest that global demand patterns continue evolving.

Investment Merit Assessment: Income Reliability Analysis

Fortescue's position as an income investment faces scrutiny amid declining yield projections and evolving capital allocation strategies toward green energy initiatives.

Dividend Sustainability Strengths

Operational Foundation:

- Record Q1 FY26 shipments demonstrate production efficiency

- Maintained guidance within 195-205 million tonne range supports earnings predictability

- 65% FY25 payout ratio within policy parameters shows disciplined capital management

- Full franking credits enhance after-tax returns for Australian residents

Policy Framework Stability:

The 50-80% NPAT payout policy provides explicit boundaries for dividend distribution, offering shareholders clarity on minimum and maximum distribution expectations. This framework demonstrated resilience during the challenging FY25 period when the company maintained dividend support despite 41% profit decline.

Risk Factors and Concerns

Yield Compression Timeline:

The projected decline from 4.2% (FY26) to 3.4% (FY28) positions Fortescue below traditional income investment thresholds. This trajectory reflects structural challenges beyond cyclical commodity pricing fluctuations.

Capital Allocation Competition:

Investment in Future Industries division creates competing demands for cash flow generation. Green hydrogen and renewable energy projects require substantial capital commitment, potentially limiting traditional dividend growth capacity. However, mining industry innovation initiatives may present new opportunities.

Commodity Cycle Exposure:

Despite current iron ore pricing above US$100 per tonne, long-term demand uncertainty from Chinese infrastructure spending and global steel demand evolution creates dividend sustainability questions.

Comparative Yield Positioning

Peer Comparison Context:

- Major Australian banks typically yield 4.5-6% with dividend stability

- ASX 200 average yield approximately 3.8% provides benchmark reference

- Resources sector peers (BHP, Rio Tinto) face similar margin pressures

At the projected 4.2% FY26 yield, Fortescue maintains competitiveness with broad market averages while underperforming traditional high-yield sectors like banking and utilities.

Broker Recommendations and Price Target Analysis

Analyst opinion remains divided on Fortescue's investment merit, reflecting disagreement over commodity outlook assumptions and strategic execution capabilities. Consequently, understanding these varying perspectives becomes essential when evaluating Fortescue dividend dates and their implications.

Current Rating Distribution

Buy Recommendations:

- Ord Minnett: $20.00-$21.50 price target, citing strong operational performance and quarterly production records

Hold Positions:

- Bell Potter: $17.05-$19.30 target range following recent rating upgrade

- UBS: $20.00 target with neutral commodity outlook stance

Sell Ratings:

- Macquarie: $16.50-$18.50 target citing valuation concerns

- Jarden: $16.00 target emphasising structural headwinds

Investment Thesis Divergence

Bullish Arguments:

Ord Minnett's buy rating reflects confidence in operational execution capabilities, supported by consecutive quarterly shipping records and production guidance achievement. The broker views current valuation levels as providing adequate margin of safety for commodity cycle exposure.

Bearish Perspective:

Macquarie and Jarden's sell ratings focus on fundamental profit compression trends. The 41% NPAT decline in FY25, combined with projected dividend cuts through FY28, suggests structural rather than cyclical challenges requiring extended recovery periods.

Neutral Positioning:

Bell Potter's rating upgrade to hold indicates improving sentiment trajectory, potentially reflecting stabilising iron ore pricing or operational efficiency gains. UBS maintains balanced positioning with fair value assessment at current levels.

Price Target Implications

The $16.00-$21.50 price target range represents significant variation in analyst assumptions. Bulls anticipate minimal downside with modest upside potential, while bears project 20-25% correction from current levels near $21.80.

This dispersion reflects uncertainty over Chinese steel demand recovery, green energy project execution, and long-term iron ore pricing sustainability. Furthermore, Australian iron ore leadership remains a key factor in analyst evaluations.

Portfolio Strategy Considerations for Income Investors

Fortescue's evolving dividend profile requires strategic positioning adjustments for income-focused portfolios managing yield compression and total return optimisation.

Conservative Income Approach

Position Sizing Strategies:

- Reduce allocation ahead of projected yield decline

- Maintain exposure below 5% of total income portfolio

- Consider dividend reinvestment during weakness to accumulate shares at lower valuations

Risk Management Elements:

Conservative investors should acknowledge the 31.8% dividend decline projection through FY28 when establishing position limits. The full franking benefit partially offsets headline yield compression but cannot eliminate the income reduction impact.

Growth-Oriented Positioning

Total Return Focus:

Investors comfortable with commodity cycle exposure may emphasise capital appreciation potential through green energy diversification. Future Industries division success could support premium valuations offsetting near-term dividend weakness.

Monitoring Framework:

- Quarterly production reports for operational trend confirmation

- Iron ore price movements above/below US$100 per tonne threshold

- Future Industries project milestone achievements

- Management commentary on dividend policy evolution

Alternative Income Opportunities

Higher-Yield Sector Options:

- Major Banks: CBA, ANZ, NAB, WBC typically offering 4.5-6% fully franked yields

- Utilities: Regulated return structures provide defensive income characteristics

- REITs: Property-backed distributions with inflation linkage

- Infrastructure: Toll road and airport assets with monopolistic cash flows

Yield Comparison Analysis:

Income investors requiring 5%+ yields may find Fortescue's projected 4.2% (declining to 3.4%) insufficient compared to defensive alternatives offering similar or superior income with lower volatility profiles.

External Variables Impacting 2026 Dividend Performance

Multiple macroeconomic and company-specific factors will influence Fortescue's actual dividend outcomes relative to current analyst projections.

Macroeconomic Influences

Chinese Steel Demand Dynamics:

China's infrastructure spending policies and property sector recovery directly impact iron ore consumption patterns. Economic stimulus measures or construction activity acceleration could support pricing above current US$100+ per tonne levels.

Currency Exchange Considerations:

USD/AUD exchange rate fluctuations affect revenue conversion from USD-denominated iron ore sales. Australian dollar weakness enhances earnings translation, while strength compresses profit margins.

Global Infrastructure Investment:

Developed economy infrastructure spending programmes influence steel demand independent of Chinese consumption patterns. Green energy infrastructure development creates both opportunities and competition for traditional steel applications.

Company-Specific Catalysts

Future Industries Progress:

Green hydrogen project development milestones could justify premium valuations if execution demonstrates commercial viability. Successful partnerships or offtake agreements would provide earnings diversification reducing commodity cycle dependence.

Operational Efficiency Gains:

Technology adoption and process optimisation initiatives may reduce cost per tonne metrics, improving margins despite commodity pricing challenges. Autonomous mining equipment and logistics optimisation represent potential efficiency drivers.

Strategic Capital Management:

Management decisions regarding share buybacks versus dividend prioritisation will influence total shareholder returns. Current share price levels may present buyback opportunities if management assesses intrinsic value exceeds market pricing.

Investor Decision Framework: Key Considerations

Fortescue dividend dates represent predictable calendar events, but the underlying dividend sustainability requires comprehensive assessment of multiple investment variables.

Investment Suitability Assessment

Appropriate Investor Profiles:

- Moderate-risk tolerance accepting commodity cycle exposure

- Tax-effective investing through franking credit utilisation

- Portfolio diversification beyond traditional defensive income sectors

- Long-term investment horizons accommodating cyclical recovery potential

Unsuitable Characteristics:

- Requirement for stable or growing income streams

- Conservative risk profiles prioritising capital preservation

- Short-term liquidity needs from dividend income

- Preference for predictable distribution schedules

Risk-Adjusted Return Assessment

Volatility Considerations:

Resources sector shares typically exhibit higher price volatility than defensive income alternatives. Dividend coverage ratios during commodity downturns create distribution uncertainty beyond current analyst projections.

Tax Efficiency Benefits:

Full franking provides Australian residents with meaningful after-tax yield enhancement. Investors in higher tax brackets receive maximum benefit from franking credit utilisation, improving total return metrics. For detailed dividend information, investors can access Fortescue's official investor portal and review comprehensive dividend analysis from leading financial data providers.

Time Horizon Requirements:

Commodity cycle investments benefit from extended holding periods allowing multiple cycle participation. Short-term income requirements may be better served through defensive sector alternatives.

The February 25 interim and August 24 final dividend announcement dates provide predictable calendar events for 2026, though the underlying dividend amounts face projected declines through the medium term. Investors must balance current yield attraction against anticipated income compression when positioning Fortescue within income-focused portfolios.

Looking to Capitalise on ASX Mining Investment Opportunities?

Discovery Alert's proprietary Discovery IQ model delivers instant notifications on significant ASX mineral discoveries, transforming complex mining data into actionable insights for both short-term traders and long-term investors. Begin your 30-day free trial today and explore how major mineral discoveries can generate substantial market returns ahead of the broader investment community.