Global Landscape of Rare Earth Reserves: A Comprehensive Analysis

Rare earth elements (REEs) represent a critical cornerstone of modern technological infrastructure, powering advanced systems across multiple industries. These remarkable metallic elements play a fundamental role in electronics, green technology, and defence applications, driving global technological innovation. The strategic importance of rare earth reserves has never been more pronounced, with nations positioning themselves to control these essential resources.

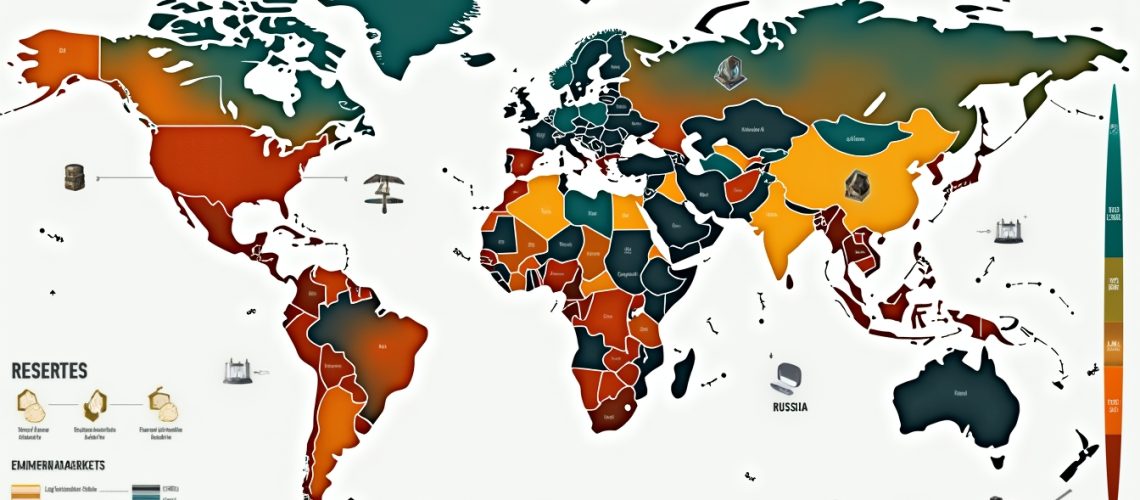

As of 2023, global rare earth reserves stand at an estimated 115.4 million metric tons, with geopolitical dynamics significantly influencing their distribution and accessibility. Understanding the complexities of rare earth element reserves requires a multifaceted examination of geological, economic, and strategic factors.

What Are Rare Earth Elements and Why Do They Matter?

Rare earth elements comprise a group of 17 metallic elements with extraordinary chemical properties that make them indispensable in contemporary technologies. These elements are categorised into two primary groups: light rare earth elements (LREEs) and heavy rare earth elements (HREEs), each presenting distinct extraction and utilisation challenges.

Light rare earth elements, such as lanthanum and cerium, are more abundant and relatively easier to extract. They are predominantly found in monazite sands and play crucial roles in electronic components and renewable energy technologies. In contrast, heavy rare earth elements like dysprosium and terbium are more complex to refine, often sourced from sophisticated ion-adsorption clay deposits.

The significance of these elements extends far beyond academic interest. They are fundamental to digital transformation in mining, enabling advanced technologies in electric vehicles, wind turbines, military systems, and sophisticated electronics.

Global Distribution of Rare Earth Reserves: Key Players and Strategies

China remains the undisputed leader in rare earth reserves, controlling approximately 44 million metric tons (38.12% of global reserves). The Bayan Obo mine in Inner Mongolia represents a critical asset, producing significant quantities of light rare earth elements. China's strategic dominance extends beyond mere reserve quantities, with the nation controlling over 80% of global rare earth refining capacity.

Vietnam emerges as a significant emerging player, holding approximately 22 million metric tons (19.06%) of rare earth reserves. The Dong Pao mine in Lai Chau Province represents a pivotal development in the country's rare earth industry strategy. Vietnamese authorities are actively developing an integrated rare earth ecosystem to capitalise on growing global demand.

Brazil presents another compelling narrative, with 21 million metric tons (18.20%) of rare earth reserves. The Serra Verde deposit in Goiás exemplifies the nation's potential, focusing on environmentally sustainable extraction methods. Brazilian rare earth projects are particularly attractive due to their emphasis on ecological considerations.

Geological Factors and Extraction Complexities

The geology of ore deposits plays a critical role in rare earth element extraction. Ion-adsorption clay deposits, prevalent in regions like China and Brazil, represent complex geological formations that require sophisticated processing techniques.

Extraction challenges vary significantly between light and heavy rare earth elements. While lighter elements can be extracted through relatively straightforward processes, heavy rare earths demand intricate refinement methods, increasing production costs and technological barriers.

Regulatory and Environmental Considerations

The rare earth industry faces substantial regulatory and environmental challenges. Geopolitical tensions, environmental sustainability concerns, and complex permitting processes significantly impact global rare earth production. Countries like Australia have pioneered environmentally responsible mining practices, setting new industry standards.

Addressing critical mineral shortages has become a strategic priority for many nations, driving investments in sustainable extraction technologies and diversified supply chains.

Investment Perspectives in Rare Earth Markets

Investors interested in rare earth elements must navigate a complex landscape. Short-term strategies might focus on established players like China, while long-term approaches could emphasise emerging markets such as Vietnam and Brazil.

Investing in mining stocks related to rare earth elements requires sophisticated analysis of geological potential, geopolitical risks, and technological innovation.

Conclusion

The global rare earth reserves landscape in 2023 reflects a dynamic and strategically significant sector. While China maintains its dominant position, emerging players are reshaping the global supply chain. Continued innovation, sustainable practices, and strategic investments will be critical in meeting the escalating demand for these essential technological elements.

For those seeking deeper insights, the original research can be found in the detailed report at Mining Visuals.

Ready to Capitalize on the Latest ASX Discoveries?

Unlock fast, real-time insights into crucial ASX mineral discoveries with Discovery Alert's AI-powered notifications. Whether you're a newbie or a seasoned investor, navigate the market confidently with our simplified analysis, tailored for short-term and long-term gains. Start your 30-day free trial today and transform your investment strategy.