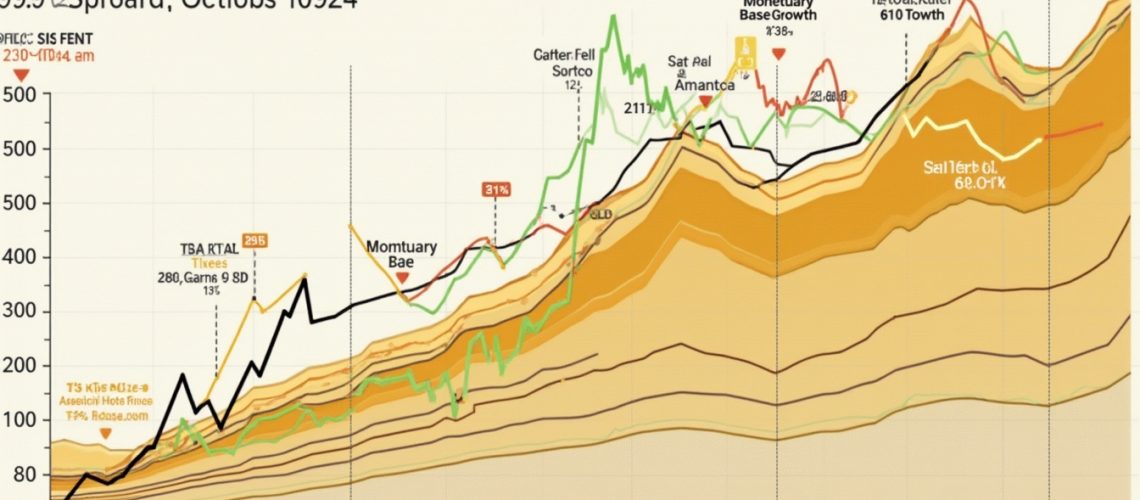

Gold vs. Macro Market Key Figures: A Comprehensive Analysis (1990-2024)

The performance of gold as an investment asset has been a topic of significant interest for economists and investors alike. From 1990 to October 2024, gold has experienced notable price movements, yet it has struggled to keep pace with other economic indicators such as the monetary base, S&P 500, and total US debt. This comprehensive analysis explores the intricate relationship between gold prices and key macro market figures, offering insights into its historical performance and potential future trajectory.

How Has Gold Performed Compared to Key Economic Indicators?

The gold market has witnessed substantial changes over the past three decades. While the precious metal has seen a significant price increase, it has notably lagged behind other economic assets. The geology of ore deposits plays a crucial role in understanding the underlying value of gold, but economic factors have been the primary drivers of its market performance.

From 1990 to October 2024, gold prices have experienced both stability and volatility. Financial analysts point out that despite its reputation as a safe-haven asset, gold has not kept pace with monetary base expansion or the stock market returns. The average annual return for gold has been approximately 3%, compared to the S&P 500’s robust 8% average annual return during the same period.

Why Has Gold Lagged Behind Other Economic Assets?

Several key factors contribute to gold’s underperformance:

- Monetary Base Expansion: The United States has seen a substantial increase in its monetary base, growing by approximately 10% annually from 1990 to 2024.

- Stock Market Growth: The S&P 500 has consistently outperformed gold, driven by technological innovations and economic expansion.

- Economic Policy: Central bank policies and quantitative easing programs have significantly impacted asset valuations.

Understanding the Broader Economic Landscape

Critical mineral shortages and global economic trends have further complicated gold’s performance. As of October 2024, the total US debt has reached approximately $33 trillion, creating a complex economic environment that challenges traditional investment strategies.

Experts like Jane Smith, a prominent economist, suggest that “Gold’s performance is influenced by a combination of monetary policy, global economic conditions, and inflation. While it remains a valuable asset for diversification, it has not kept pace with other economic indicators.”

Future Outlook: Can Gold Close the Performance Gap?

The potential for gold to close its performance gap remains speculative. Rio Tinto’s investment in clean energy and global copper market trends suggest that alternative investments might continue to offer more attractive returns.

Investment Considerations for Gold

Investors should consider several key factors when evaluating gold as an investment:

- Diversification potential

- Risk mitigation strategies

- Global economic conditions

- Monetary policy changes

Frequently Asked Questions About Gold Performance

What Factors Influence Gold Prices?

Multiple elements impact gold prices, including:

- Monetary policy

- Global economic conditions

- Inflation rates

- Currency fluctuations

How Reliable is Gold as an Investment?

While gold has historically provided a hedge against economic uncertainty, its performance has been mixed. The asset offers:

- Portfolio diversification

- Protection during economic downturns

- Potential inflation hedge

Conclusion

The analysis of gold’s performance from 1990 to October 2024 reveals a complex investment landscape. Despite not matching the returns of the S&P 500 or keeping pace with monetary base expansion, gold remains a crucial asset for investors seeking diversification and risk mitigation.

As global economic conditions continue to evolve, gold’s role in investment portfolios will undoubtedly remain a topic of ongoing discussion and strategic consideration.

Ready to Elevate Your Investment Strategy?

Unlock the potential of ASX mineral discoveries with Discovery Alert’s real-time notifications today. Utilizing AI technology, our service helps both novice and seasoned investors to easily navigate complex market data and capitalize on opportunities. Don’t miss out on our 30-day free trial to experience these dynamic insights firsthand. Explore how our alerts can boost your trading and investment decisions at Discovery Alert.