Strategic Investment Perspectives on India's Agricultural Security Framework

Complex supply chain dynamics in global agricultural markets increasingly influence sovereign food security strategies. Nations worldwide must balance domestic production capabilities against import dependencies while managing commodity price volatility across multiple economic cycles. This fundamental challenge becomes particularly acute for countries with large agricultural populations requiring consistent nutrient availability throughout seasonal planting periods.

Agricultural input security has evolved beyond traditional market mechanisms into comprehensive strategic frameworks encompassing production planning, inventory management, and geopolitical risk assessment. Modern fertilizer markets demonstrate these dynamics through sophisticated coordination between government policy, private sector procurement, and international trade relationships that collectively determine agricultural productivity outcomes.

Understanding India's Fertilizer Stockpiling Strategy

India's approach to urea inventory management demonstrates a sophisticated understanding of agricultural input security that extends beyond simple supply and demand mechanics. The country maintains strategic reserves as a cornerstone policy tool for ensuring consistent nutrient availability during critical planting seasons while managing market volatility hedging exposure across global commodity markets.

This strategic stockpiling approach reflects institutional learning from previous supply disruptions where insufficient buffer inventories created cascading effects on agricultural productivity. Furthermore, the framework balances multiple competing priorities including fiscal cost management, storage infrastructure capacity, and seasonal demand synchronization across India's dual cropping systems.

Current Strategic Position Analysis:

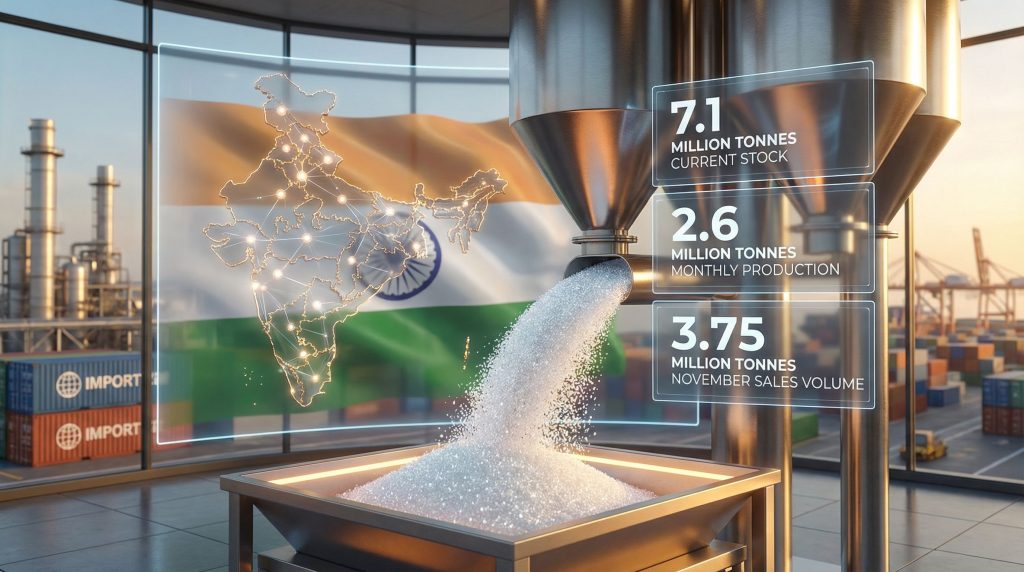

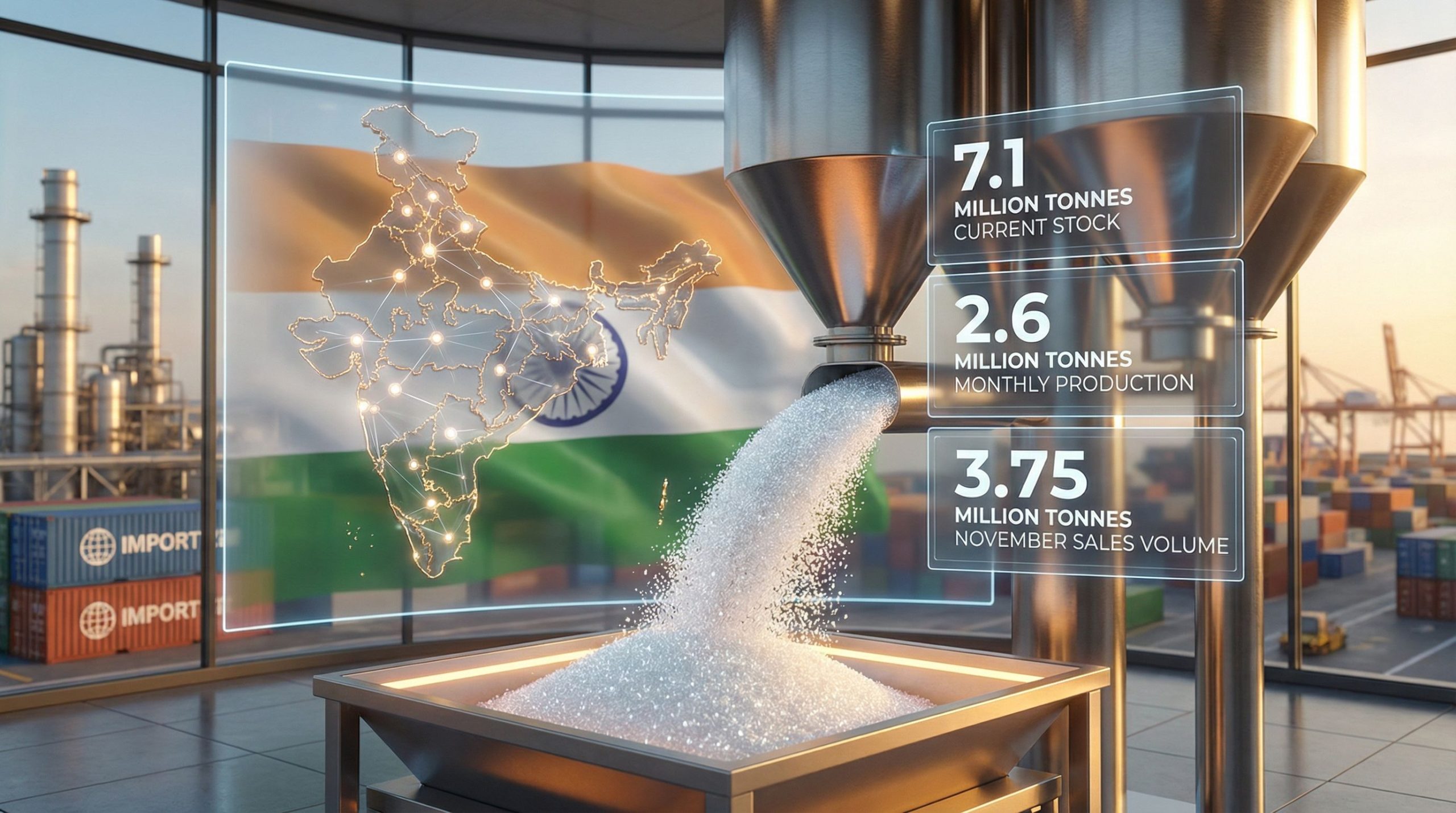

- Inventory Level (December 2025): 7.1 million tonnes

- Year-over-Year Consistency: Aligned with December 2024 levels of 7.3 million tonnes

- Six-Month Accumulation: Net increase of 1.34 million tonnes since April 2025

- Monthly Position Change: +260,000 tonnes in November 2025

The consistency between 2024 and 2025 year-end inventory levels suggests the government has established a sustainable equilibrium for strategic reserves that balances agricultural security requirements against financial and logistical constraints.

What Drives India's Current Urea Inventory Levels?

Multiple interconnected factors influence India's india urea stocks 2025 positioning, creating a complex optimization equation that government planners must continuously recalibrate. Production capacity recovery, import procurement strategies, and demand forecasting collectively determine optimal inventory positioning throughout agricultural cycles.

Supply Chain Components Analysis:

| Component | Volume (Million Tonnes) | Strategic Function |

|---|---|---|

| Current Inventory | 7.1 | Agricultural security buffer |

| Monthly Production | 2.62 | Domestic supply foundation |

| November Imports | 1.39 | Gap-filling procurement |

| November Sales | 3.75 | Peak season distribution |

| Six-Tender Procurement | 7.8 | Strategic accumulation |

November's sales performance reached 3.75 million tonnes, representing the second-highest monthly consumption on record and a 4.74% increase over November 2024 levels. This exceptional demand demonstrates the critical importance of adequate inventory positioning ahead of peak agricultural seasons.

The supply balance equation for November 2025 reveals intentional surplus positioning:

- Total Supply: 4.01 million tonnes (2.62 production + 1.39 imports)

- Total Sales: 3.75 million tonnes

- Net Inventory Expansion: +260,000 tonnes

This surplus accumulation during peak demand periods indicates strategic inventory building rather than passive market response, reflecting sophisticated coordination between procurement timing and agricultural calendar requirements.

How Do Production Dynamics Shape Stock Management?

India's domestic urea production has stabilized at approximately 2.62 million tonnes monthly, representing meaningful recovery from earlier capacity constraints and operational challenges. In addition, this production rate establishes a foundation for reducing import dependency while maintaining adequate supply security across seasonal demand cycles.

Production Trajectory Analysis:

- April-September 2025 Average: 2.4 million tonnes monthly

- October-December 2025 Level: 2.6 million tonnes monthly

- Quarterly Improvement: +8.3% capacity recovery

- Consistency Period: Three months at 2.6 million tonnes since October

The stabilization at 2.6 million tonnes monthly indicates this production rate reflects sustainable operational capacity rather than temporary performance spikes. Consequently, this consistency enhances supply chain reliability and reduces uncertainty in inventory planning calculations.

Technical Production Considerations:

Manufacturing constraints in urea production typically involve:

- Natural gas feedstock availability (60-70% of production costs)

- Synthesis reactor capacity utilization

- Ammonia plant operational efficiency

- Energy intensity optimization per tonne

- Distribution network coordination

The improvement from 2.4 to 2.6 million tonnes suggests systematic resolution of operational bottlenecks including maintenance scheduling, feedstock allocation, or process optimization initiatives across multiple production facilities.

Strategic Insight: India's production recovery to 2.6 million tonnes monthly provides approximately 31-32 million tonnes annual capacity, indicating 80-85% utilisation rates with available headroom for further expansion.

What Role Do Import Strategies Play in Stock Optimization?

India's systematic import procurement through monthly government tenders represents one of the world's largest regular commodity purchasing programs, materially influencing global urea pricing while ensuring domestic supply security. However, the approach demonstrates sophisticated coordination between market timing, supplier diversification, and strategic inventory accumulation that commodity trading giants closely monitor.

Import Tender Program Performance (June-November 2025):

- Total Procurement: 7.8 million tonnes across six monthly tenders

- Average Tender Size: Approximately 1.3 million tonnes

- Market Influence: Key driver supporting elevated international urea prices

- Procurement Strategy: Sequential monthly cycles for supply continuity

This structured procurement approach provides multiple strategic advantages:

Market Benefits:

- Price discovery across varying market conditions

- Diversified supplier relationship management

- Predictable market signalling to international producers

- Staged inventory buildups aligned with agricultural demand

Supply Security Elements:

- Multiple sourcing geographies reduce geopolitical concentration risk

- Regular procurement cycles ensure consistent material flow

- Large tender volumes provide negotiating leverage

- Flexible timing allows market opportunity optimisation

The systematic nature of India's import strategy reflects evolution from reactive crisis purchasing toward proactive supply security management, providing stability for both domestic agricultural planning and international market participants.

Long-Term Procurement Challenges:

Recent tender activity reveals market dynamics affecting long-term supply arrangements. RCF's December 2025 attempt to secure 2.5 million tonnes annually over three years attracted minimal supplier interest, with only one trading firm participating. This suggests major producers prefer shorter commitment periods, potentially due to pricing uncertainty or alternative market opportunities.

How Do Seasonal Demand Patterns Influence Inventory Planning?

India's agricultural calendar drives fundamental demand patterns that require sophisticated inventory positioning strategies coordinated months in advance of peak consumption periods. The dual cropping system creates predictable but intensive demand spikes during Kharif (monsoon) and Rabi (winter) planting seasons.

November 2025 Demand Analysis:

- Sales Volume: 3.75 million tonnes (second-highest November record)

- Year-over-Year Growth: +4.74% versus November 2024

- Seasonal Context: Peak Rabi season preparation period

- Agricultural Timing: Critical planting window synchronisation

The exceptional November demand demonstrates the operational reality of seasonal concentration in fertilizer consumption. Furthermore, agricultural productivity depends on nutrient availability precisely when farmers require it, creating inflexible demand windows that inventory planners must anticipate and prepare for months in advance.

Inventory Coverage Metrics:

- Current Coverage: Approximately 1.9 months based on recent consumption patterns

- Strategic Buffer: Protection against supply disruptions during peak periods

- Seasonal Flexibility: Adequate reserves for demand variability management

The inventory buildup from August lows (3.5 million tonnes) to December positioning (7.1 million tonnes) represents deliberate preparation for agricultural demand cycles rather than reactive market response. This 3.6 million tonne accumulation over four months demonstrates sophisticated coordination between procurement timing and agricultural calendar requirements.

What Are the Economic Implications of Current Stock Levels?

Maintaining above-7-million-tonne inventory levels requires substantial capital allocation across storage infrastructure, financing costs, and inventory carrying expenses. This strategic investment reflects government prioritisation of agricultural input security over short-term financial optimisation, creating complex economic trade-offs between fiscal efficiency and supply security.

Economic Impact Framework:

Direct Costs:

- Storage infrastructure maintenance and expansion

- Inventory financing at current interest rates

- Transportation and logistics coordination

- Quality preservation and handling systems

Policy Costs:

- Fertiliser subsidy expenditure management

- Price stabilisation mechanism funding

- Import duty and tax policy coordination

- Market intervention and support programs

Economic Benefits:

- Agricultural productivity stability and growth

- Price volatility protection for farmers

- Supply security reducing production risk

- Strategic autonomy in food security planning

The government's subsidy framework through the Nutrient Based Subsidy (NBS) system manages fiscal impact while maintaining Maximum Retail Price (MRP) controls that provide farmers with predictable input costs regardless of international market volatility.

How Does India's Stock Position Compare Globally?

India's inventory-to-consumption ratio positions the country among the most strategically prepared major agricultural economies globally. The current india urea stocks 2025 provide approximately 1.9 months of consumption coverage, representing a sophisticated balance between supply security and capital efficiency.

International Context:

- Global Market Share: India represents approximately 18-23% of international urea trade

- Strategic Reserves: Among highest inventory coverage ratios globally

- Market Influence: Price-setting capacity through procurement decisions

- Supply Security: Superior positioning relative to import-dependent peers

India's 9.23 million tonnes of calendar year 2025 imports represents a substantial portion of global seaborne urea trade, estimated at 40-50 million tonnes annually. This market position provides significant influence over international pricing while ensuring domestic supply security.

According to market analysts, India's record urea procurement continues to reshape global fertiliser markets. The country's consistent purchasing patterns have helped establish price floors across international markets whilst maintaining strategic inventory levels.

What Challenges Could Affect Future Stock Management?

Several interconnected risk factors could influence India's ability to maintain optimal urea inventory positioning, requiring adaptive strategies that address both traditional market variables and emerging structural challenges in global agricultural commodity systems. For instance, global trade war global impact continues to create uncertainty in commodity supply chains.

Supply Chain Vulnerabilities:

International Market Risks:

- Commodity price volatility affecting procurement costs

- Geopolitical disruptions impacting supplier relationships

- Currency exchange rate fluctuations influencing import economics

- Global production capacity constraints limiting availability

Domestic Operational Challenges:

- Production facility maintenance and upgrade requirements

- Natural gas feedstock allocation and pricing dynamics

- Transportation infrastructure capacity and efficiency

- Storage facility expansion and modernisation needs

Demand Side Pressures:

- Climate change impacts on agricultural patterns and timing

- Crop diversification trends affecting nutrient requirements

- Precision agriculture adoption altering application methods

- Alternative fertiliser technology development and implementation

These interconnected challenges require comprehensive risk management approaches that maintain flexibility while ensuring agricultural input security across multiple potential scenarios. Moreover, the impact of tariffs impact markets adds another layer of complexity to long-term planning.

How Might Policy Changes Impact Stock Strategies?

Government policy regarding fertiliser subsidies, import duties, domestic production incentives, and strategic reserve management significantly influences optimal inventory positioning strategies. However, future policy evolution could materially alter the economic calculus of stockpiling versus just-in-time procurement approaches.

Policy Framework Elements:

- Subsidy Structure: NBS system modifications affecting cost distribution

- Import Policy: Duty structures and procurement procedures

- Production Incentives: Support for domestic capacity expansion

- Strategic Reserves: Buffer stock policy and management guidelines

Policy continuity provides essential stability for long-term planning, while policy adaptation ensures responsiveness to changing market conditions and agricultural requirements. The balance between these considerations shapes strategic inventory management approaches.

Potential Policy Evolution Areas:

- Environmental regulations affecting production methods

- Trade policy changes influencing import procedures

- Agricultural productivity programmes requiring input coordination

- Food security policies mandating reserve maintenance

What Technology Trends Could Reshape Urea Demand?

Emerging agricultural technologies including precision application systems, alternative nutrient delivery methods, and digital farming platforms may influence long-term urea consumption patterns. These technological developments require adaptive inventory planning approaches that accommodate changing demand characteristics. Similarly, AI investment implications extend to agricultural technology and precision farming systems.

Technology Impact Considerations:

- Precision Agriculture: More efficient application reducing total volume requirements

- Alternative Nutrients: Enhanced efficiency fertilisers and biological systems

- Digital Integration: Data-driven application timing and dosage optimisation

- Sustainable Practices: Environmental considerations influencing product selection

While technological advancement may eventually modify traditional fertiliser consumption patterns, current agricultural practices and the scale of India's farming sector suggest conventional urea demand will remain substantial for the foreseeable planning horizon.

The fertilizer sector outlook remains positive despite technological evolution, as emerging technologies typically complement rather than replace conventional fertilisers in large-scale agricultural operations.

Strategic Outlook: Future Inventory Management Evolution

India's urea stock management approach reflects institutional maturity in agricultural input security planning that balances multiple competing priorities while maintaining operational flexibility. The current strategy provides a robust foundation for adapting to evolving market conditions and agricultural requirements.

Strategic Success Factors:

- Continued coordination between domestic production enhancement and strategic imports

- Adaptive procurement strategies responding to market opportunities and challenges

- Flexible inventory positioning accommodating seasonal demand variations

- Policy stability supporting long-term planning while enabling tactical adjustments

The sustainability of current inventory management approaches depends on maintaining coordination across production capacity development, import procurement optimisation, and evolving agricultural demand patterns. Furthermore, future success requires strategic frameworks that integrate traditional agricultural cycles with emerging technology trends and environmental considerations.

Key Strategic Priorities:

- Production Optimisation: Maximising domestic capacity utilisation and efficiency

- Supply Diversification: Reducing dependency concentration across sources and suppliers

- Demand Forecasting: Enhanced prediction capabilities for consumption patterns

- Technology Integration: Adapting to changing agricultural practices and requirements

India's experience demonstrates that strategic inventory management in agricultural inputs requires sophisticated coordination between policy frameworks, market mechanisms, and agricultural requirements. Consequently, the current india urea stocks 2025 positioning provides a valuable model for other nations developing agricultural input security strategies while highlighting the complexity of balancing multiple economic, operational, and strategic considerations in commodity market management.

Disclaimer: This analysis is based on available market data and industry reporting. Commodity markets involve significant price volatility and supply chain risks. Investment decisions should incorporate comprehensive due diligence and professional advisory consultation.

Looking to Capitalise on Agricultural Commodity Market Opportunities?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries, including companies with agricultural and fertiliser sector exposure, instantly empowering subscribers to identify actionable opportunities ahead of the broader market. Begin your 30-day free trial today and secure your market-leading advantage in resource and commodity-related investments.