Understanding India's Accelerated Gold Homecoming Initiative

India's central banking authority has implemented an unprecedented strategy to relocate precious metal reserves from international storage facilities back to domestic vaults. This systematic transfer represents one of the most significant sovereign asset movements in recent decades, fundamentally reshaping how emerging economies approach reserve management in an increasingly uncertain geopolitical landscape.

The Reserve Bank of India has dramatically accelerated its gold repatriation efforts, moving 64 tonnes of precious metal reserves back to domestic storage facilities during the first six months of the fiscal year that began in April 2024. This aggressive timeline demonstrates the urgency with which India repatriates gold reserves, reflecting broader strategic concerns about asset security and monetary sovereignty.

Defining Gold Repatriation in Modern Central Banking

Gold repatriation involves the systematic transfer of sovereign precious metal reserves from foreign depositories back to domestic storage facilities. This process requires complex logistics, diplomatic coordination, and substantial security arrangements to ensure safe transport across international borders.

Modern central banks traditionally stored gold reserves in established financial centres like London, New York, and Zurich to facilitate international transactions and reduce storage costs. However, recent geopolitical developments have prompted a fundamental reassessment of this approach, with institutions prioritising direct control over accessibility and convenience.

Scale and Timeline of India's Asset Relocation Program

India's repatriation program spans multiple years, with systematic phases designed to minimise market disruption while maximising operational efficiency. Over the past four years, India has successfully repatriated 280 tonnes of gold, representing a substantial portion of its total reserves.

The accelerated pace in 2024 demonstrates increased urgency, with monthly transfer volumes significantly exceeding historical averages. This intensification coincides with heightened global tensions and increased scrutiny of cross-border asset movements by major powers.

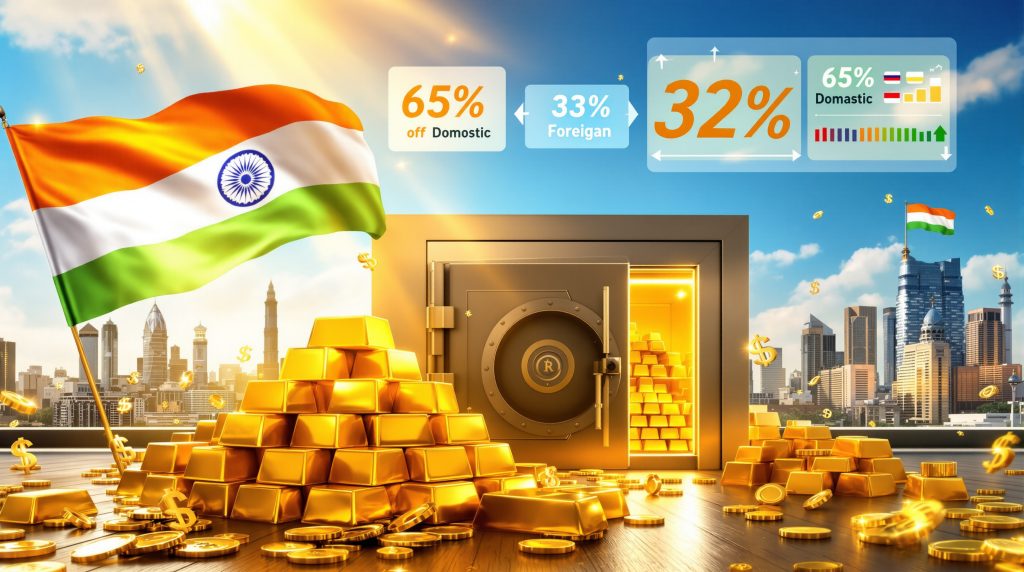

Current Reserve Distribution and Storage Statistics

| Storage Location | Gold Holdings (Tonnes) | Percentage of Total |

|---|---|---|

| Domestic Vaults | 576 | 65% |

| Foreign Depositories | 290 | 33% |

| Gold Deposits | 14 | 2% |

| Total Reserves | 880 | 100% |

Dramatic Shift from Foreign to Domestic Storage

The transformation in storage patterns reveals a strategic pivot from external dependency to sovereign control. Previously, only 38% of reserves remained within national borders in 2022, highlighting the rapid pace of this repatriation campaign.

This dramatic shift occurred primarily through large-scale transfers from London vaults, where India historically maintained significant precious metal holdings. The spring 2024 movement of 100 tonnes from UK facilities represented one of the largest single repatriation operations in recent memory.

Central bank officials emphasised the strategic nature of this decision, noting that domestic storage enhances operational flexibility while reducing exposure to external political pressures. The transition from foreign to domestic custody reflects broader concerns about asset vulnerability in international jurisdictions.

Monthly Transfer Volumes and Acceleration Patterns

The monthly repatriation rate has increased substantially since early 2024, with transfers occurring through secure transportation networks specifically designed for precious metal movements. Each transfer requires extensive coordination between domestic and foreign vault operators, insurance providers, and security services.

Transportation logistics involve specialised aircraft, armoured vehicles, and multi-layered security protocols to ensure asset protection throughout the journey. The Reserve Bank of India has developed standardised procedures for these operations, enabling more frequent and efficient transfers.

Geopolitical Catalysts Driving Global Asset Repatriation

The weaponisation of financial systems following international conflicts has fundamentally altered how nations perceive asset security. When major powers froze substantial foreign reserves belonging to sanctioned countries, central banks worldwide recognised the vulnerability of maintaining sovereign wealth in foreign jurisdictions.

The Russian Reserve Seizure Wake-Up Call

The freezing of nearly $650 billion in Russian gold and foreign exchange reserves following the Ukraine invasion created unprecedented concerns about asset security among central banks globally. This action demonstrated how geopolitical tensions could instantly render sovereign reserves inaccessible, regardless of their intended non-political nature.

Central banking institutions observed how traditional safe-haven gold dynamics could rapidly implement asset freezes based on foreign policy decisions. This realisation prompted immediate reviews of reserve storage strategies across emerging market economies.

The speed and scope of the Russian asset freeze exceeded previous sanctions regimes, creating new precedents for how economic pressure could be applied through financial system control. Central banks began reassessing the risks of maintaining reserves in jurisdictions that might implement similar measures.

Afghanistan's Frozen Assets as a Precedent

Earlier freezing of Afghan central bank assets provided another example of how political changes could affect reserve accessibility. These precedents collectively demonstrated that traditional assumptions about asset security in established financial centres required fundamental reconsideration.

The Afghan situation illustrated how domestic political changes could trigger international asset freezes, expanding the range of scenarios under which reserves might become inaccessible. This broadened risk assessment influenced subsequent repatriation decisions across multiple central banks.

Trust Erosion in Traditional Safe Haven Jurisdictions

According to World Gold Council surveys, 68% of central banks now plan to maintain gold reserves within domestic borders, compared to just 50% in 2020. This dramatic shift reflects eroded confidence in traditional storage arrangements and increased emphasis on direct sovereign control.

The trust erosion extends beyond immediate security concerns to encompass broader questions about the stability and predictability of international financial relationships. Central banks increasingly view domestic storage as essential for maintaining monetary policy independence.

Financial Advantages of Domestic Gold Storage

Elimination of Foreign Custody Fees

Domestic storage eliminates ongoing costs associated with international vault services, including:

- Annual storage fees charged by foreign depositories

- Insurance premiums for overseas holdings

- Transportation expenses for periodic audits and inspections

- Administrative costs for international custody arrangements

These recurring expenses accumulate significantly over time, making domestic storage increasingly cost-effective as reserve volumes grow. The elimination of foreign currency conversion requirements for fee payments also reduces operational complexity.

Enhanced Liquidity Management Capabilities

Domestic storage provides central banks with immediate access to physical gold for monetary policy operations, emergency liquidity provision, or international transaction settlement. This accessibility eliminates delays associated with requesting transfers from foreign depositories.

The enhanced liquidity management extends to crisis response capabilities, where rapid access to reserves may be critical for stabilising currency markets or supporting financial institutions. Domestic storage ensures that gold reserves remain available regardless of international political conditions.

Reduced Counterparty Risk Exposure

Foreign storage arrangements inherently involve counterparty risk through relationships with international vault operators, insurance providers, and transportation services. Domestic storage significantly reduces this exposure by minimising third-party dependencies.

The reduction in counterparty risk becomes particularly important during periods of international tension when foreign service providers might face pressure to restrict access or impose additional conditions on asset management services.

Strategic Advantages of Sovereign Asset Control

India's approach demonstrates how emerging economies can reduce dependency on traditional financial centres while maintaining robust reserve portfolios. This strategy provides insulation against external economic pressures and enhances monetary policy independence.

Protection Against Financial Sanctions

Domestic storage provides protection against potential sanctions that could restrict access to foreign-held reserves. This protection becomes increasingly valuable as economic sanctions become more prevalent in international relations.

The protection extends beyond direct sanctions to include secondary effects that might limit access to international financial services or create operational complications for reserve management activities.

Improved Crisis Response Capabilities

Domestic gold storage enhances crisis response capabilities by ensuring immediate access to reserves during financial emergencies or natural disasters. This accessibility proves crucial when rapid intervention is required to stabilise markets or provide emergency liquidity.

The improved response capabilities include the ability to physically deliver gold to domestic financial institutions or use reserves as collateral for emergency lending facilities without requiring international approvals or coordination.

Enhanced Negotiating Position in International Relations

Control over domestic gold reserves strengthens India's position in international economic negotiations by reducing vulnerability to external pressure. This enhanced position becomes particularly valuable during trade disputes or international monetary policy coordination discussions.

The strengthened negotiating position derives from reduced dependency on foreign financial infrastructure and increased flexibility in reserve deployment for strategic economic objectives.

India's Vault Modernisation and Security Enhancements

The successful repatriation required substantial investments in high-security storage infrastructure across multiple urban centres. These facilities incorporate advanced surveillance systems, climate control, and multi-layered access protocols to ensure asset protection.

Mumbai and Nagpur Facility Expansions

India has significantly expanded vault capacity in Mumbai and Nagpur to accommodate increased domestic gold storage requirements. These facilities feature state-of-the-art security systems, including biometric access controls, seismic monitoring, and redundant power systems.

The facility expansions required coordination with local security services, utility providers, and regulatory authorities to ensure compliance with international storage standards. Each location underwent extensive security assessments and infrastructure upgrades.

Technology Integration in Modern Vault Systems

Modern vault systems integrate multiple layers of security technology, including:

- Biometric authentication systems for personnel access

- Real-time monitoring with artificial intelligence analysis

- Seismic and vibration detection systems

- Climate control systems for optimal preservation conditions

- Redundant communication systems for emergency response

These technological systems provide comprehensive monitoring and protection while maintaining the secure environment necessary for long-term precious metal storage.

Staffing and Operational Security Protocols

Domestic vault operations require specialised personnel trained in precious metal handling, security procedures, and emergency response protocols. Staff members undergo extensive background checks and regular security training to maintain operational integrity.

The operational protocols include multiple verification procedures for asset access, regular inventory audits, and coordination with law enforcement agencies for additional security support when necessary.

Global Trends in Central Bank Asset Management

| Country | Repatriation Timeline | Volume (Tonnes) | Primary Motivation |

|---|---|---|---|

| Germany | 2013-2017 | 674 | Sovereignty concerns |

| Poland | 2019 | 100 | Geopolitical security |

| Hungary | 2018-2019 | 94.5 | National independence |

| Romania | 2019 | 103.7 | Asset security |

European Central Bank Repatriation Programs

Germany completed one of the most comprehensive repatriation programs, returning approximately half of its gold reserves to domestic storage between 2013 and 2017. This program established operational precedents for large-scale precious metal transfers while maintaining market stability.

Poland's 2019 repatriation of 100 tonnes demonstrated how smaller economies could efficiently execute significant asset transfers using established transportation and security networks. The success of this operation encouraged other European central banks to consider similar programs.

Emerging Market Strategies for Asset Sovereignty

Emerging market central banks increasingly prioritise asset sovereignty as a component of broader monetary independence strategies. These institutions recognise that reserve location affects their ability to implement independent monetary policies during international crises.

The strategies extend beyond gold repatriation to include diversification away from traditional reserve currencies and development of alternative payment systems that reduce dependency on established financial centres.

Lessons from Historical Gold Movement Precedents

Historical precedents demonstrate that successful repatriation programs require careful planning, diplomatic coordination, and substantial security investments. Early programs focused primarily on sovereignty concerns, while recent initiatives increasingly emphasise geopolitical risk management.

The lessons learned from previous repatriation efforts have enabled more efficient and cost-effective operations, with standardised procedures for transportation, insurance, and security coordination.

Market Implications of Sovereign Asset Restructuring

The systematic movement of gold reserves creates ripple effects across international precious metals markets, affecting trading patterns, storage demand, and pricing mechanisms in major financial centres.

London Gold Market Adjustments

London's position as a global gold trading hub faces challenges as major central banks reduce their reliance on UK storage facilities. The reduction in stored inventory affects market liquidity and may influence pricing mechanisms for international gold transactions.

Market participants have adapted to reduced central bank inventory by developing alternative liquidity sources and adjusting trading strategies to accommodate lower available supplies in traditional storage locations.

Vault Capacity Constraints and Pricing

Increased demand for domestic storage has created capacity constraints in some markets, leading to higher storage costs and longer waiting periods for vault space. These constraints have encouraged investment in new storage infrastructure across multiple countries.

Furthermore, gold market trends show pricing effects extending to insurance costs, transportation fees, and security services as demand for these specialised services increases alongside repatriation activities.

Impact on International Gold Trading Flows

Repatriation activities have altered traditional gold trading flows, with more transactions occurring between domestic storage facilities rather than through international hub locations. This shift affects market structure and may influence future trading patterns.

The trading flow changes require market participants to develop new relationships with domestic storage providers and adjust operational procedures to accommodate different geographic distribution patterns.

Operational Complexities and Risk Management

While domestic storage offers sovereignty benefits, it introduces new operational requirements and security considerations that central banks must carefully manage.

Insurance Coverage and Risk Assessment

Domestic storage requires comprehensive insurance coverage addressing multiple risk categories:

- Natural disaster protection including earthquake, flood, and fire coverage

- Security breach protection covering theft, fraud, and unauthorised access

- Business interruption insurance for operational disruptions

- Transit coverage for any future asset movements

Risk assessment involves regular security audits, vulnerability assessments, and coordination with local emergency services to ensure comprehensive protection.

Liquidity Constraints for International Transactions

Domestic storage may create liquidity constraints for certain international transactions that traditionally relied on gold held in major financial centres. Central banks must develop alternative arrangements for international settlements or gold-backed transactions.

The constraints require advance planning for international obligations and may necessitate maintaining smaller amounts of reserves in traditional storage locations for operational convenience.

Ongoing Maintenance and Security Costs

Domestic storage involves ongoing costs for facility maintenance, security personnel, insurance, and technological upgrades. These costs must be evaluated against the benefits of sovereign control and reduced counterparty risk.

The maintenance requirements include regular equipment updates, staff training, and compliance with evolving security standards to ensure continued protection of stored assets.

Reducing Dollar Dependency Through Diversified Reserves

India's gold accumulation strategy complements broader efforts to decrease reliance on dollar-denominated assets, creating a more balanced and resilient reserve portfolio that hedges against currency volatility.

The Reserve Bank of India has been actively building its gold reserves since 2017, adding over 270 tonnes during this period. In 2024, India emerged as the third-largest gold buyer globally, adding 73 tonnes to its reserves through consistent monthly purchases except for December.

Treasury Bond Reduction Patterns

India has demonstrated a preference for increasing gold reserves rather than U.S. Treasury bills, reflecting concerns about dollar volatility and interest rate risks. This strategy reduces exposure to U.S. monetary policy decisions while building reserves that maintain value across different economic conditions.

The reduction pattern involves gradual reallocation from dollar-denominated assets to gold, minimising market disruption while achieving strategic portfolio rebalancing objectives.

Alternative Reserve Asset Allocation

Gold reserves now account for 11% of India's total reserves, representing a strategic allocation designed to provide stability and diversification benefits. This percentage reflects careful balance between liquidity requirements and store-of-value objectives.

The allocation strategy considers gold investment insights regarding historical performance during periods of currency instability, inflation, and geopolitical uncertainty, providing portfolio insurance against various economic scenarios.

Impact on Bilateral Trade Settlement Mechanisms

Increased gold reserves provide India with additional options for bilateral trade settlements, potentially reducing reliance on dollar-based payment systems. This capability becomes particularly valuable for trade relationships where alternative settlement mechanisms offer advantages.

The trade settlement implications extend to regional economic relationships where gold-backed arrangements might facilitate commerce while reducing exposure to dollar fluctuations.

Long-Term Implications for Central Banking Practices

This comprehensive repatriation initiative establishes new precedents for how emerging economies approach sovereign wealth management in an era of increasing geopolitical fragmentation and financial weaponisation.

Evolution of Reserve Composition Standards

India's strategy demonstrates how central banks can maintain effective reserve management while prioritising asset security and sovereignty. This approach may influence international standards for reserve composition and storage practices.

The evolution affects recommendations from international monetary institutions and may lead to revised guidelines for optimal reserve management practices in uncertain geopolitical environments.

Influence on International Monetary System Architecture

Large-scale repatriation movements by major emerging economies could accelerate changes in international monetary system architecture, potentially reducing the dominance of traditional financial centres in global reserve management.

The architectural changes might include development of alternative settlement systems, regional reserve pools, and modified approaches to international monetary cooperation that reflect changing storage preferences.

Implications for Gold Market Structure and Pricing

Widespread adoption of domestic storage strategies could fundamentally alter gold market structure, affecting pricing mechanisms, liquidity patterns, and the role of traditional trading centres in international precious metals markets.

However, record-high gold prices in recent months suggest that structural changes may require development of new market mechanisms to accommodate distributed storage patterns while maintaining efficient price discovery and transaction settlement capabilities.

Impact on Future Monetary Policy Independence

The success of India's repatriation program demonstrates that India repatriates gold reserves as part of a broader strategy to enhance monetary policy independence. This comprehensive approach provides emerging economies with a blueprint for reducing dependency on traditional financial centres while maintaining effective reserve management capabilities.

The implications for future monetary policy extend to crisis management capabilities, international negotiating positions, and the ability to implement domestic economic policies without external constraints or vulnerabilities.

Furthermore, comprehensive gold price analysis indicates that these structural changes in reserve management could influence long-term precious metals market dynamics as more countries follow similar repatriation strategies.

Disclaimer: The information presented in this analysis is based on publicly available sources and should not be considered investment advice. Gold market dynamics and central bank policies can change rapidly, and readers should consult qualified financial professionals before making investment decisions. While efforts have been made to ensure accuracy, some data points may require verification from primary sources as market conditions evolve.

Looking to Capitalise on Gold Market Shifts?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries, instantly empowering subscribers to identify actionable opportunities ahead of the broader market as precious metals demand continues rising. Understand why historic discoveries can generate substantial returns by visiting Discovery Alert's dedicated discoveries page, and begin your 30-day free trial today to secure your market-leading advantage.