Israel's approach to extracting value from its unique Dead Sea mineral deposits exemplifies the complex balance between maximising economic returns and maintaining environmental sustainability. The upcoming transformation of concession arrangements in 2030 positions Israel Dead Sea mineral revenues at a critical juncture, where competitive tendering could potentially reshape decades of established operational frameworks.

What Drives Israel's Dead Sea Mineral Revenue Strategy?

The foundation of Israel's approach to Dead Sea mineral extraction rests on the unique characteristics of hypersaline resource deposits that have supported industrial operations for decades. The Dead Sea's mineral composition provides access to potash and magnesium resources that serve critical roles in global agricultural and industrial supply chains. This geological advantage has enabled sustained extraction operations that generate substantial revenue streams for both private operators and government coffers, alongside comprehensive mining permitting insights that guide regulatory frameworks.

Economic Fundamentals of Hypersaline Resource Extraction

The economic model underlying Dead Sea operations reflects the specialised nature of hypersaline mineral processing, where traditional mining techniques give way to evaporation and concentration methods. These operations require significant capital investments in specialised infrastructure, including evaporation ponds, processing facilities, and transport networks designed to handle corrosive mineral-rich solutions.

Current extraction activities focus primarily on potash and magnesium compounds, materials that serve essential functions in fertiliser production and industrial applications. The concentrated nature of these minerals in Dead Sea brine provides cost advantages compared to conventional mining operations, though the specialised processing requirements create unique operational challenges.

The revenue generation model has historically relied on long-term concession agreements that provide operational certainty while sharing profits between private operators and the Israeli government. Under existing arrangements, the state currently receives 35% of concession profits, with this structure having provided stability for both parties over several decades of operations.

Market Position in Global Potash and Specialty Chemical Markets

Israel's Dead Sea operations occupy a significant position within global potash markets, with ICL Group having developed into one of the world's largest potash producers through its five-decade tenure. The company's operations extract primarily potash and magnesium from the Dead Sea concession, positioning it within supply chains that serve agricultural markets worldwide.

The strategic importance of these operations extends beyond domestic economic considerations, as potash serves as an essential input for fertiliser production supporting global food security. This market position has enabled sustained profitability despite the specialised infrastructure requirements and environmental challenges associated with hypersaline extraction.

The global specialty chemicals market provides additional revenue opportunities through bromine and other mineral derivatives extracted from Dead Sea brine. Furthermore, these products serve niche industrial applications where the unique mineral composition provides competitive advantages over synthetic alternatives, particularly within emerging brine market insights that demonstrate growing demand for sustainable extraction methods.

Revenue Concentration Risk and Diversification Challenges

The concentrated nature of Israel Dead Sea mineral revenues within a single concession agreement creates both opportunities and vulnerabilities for government fiscal planning. The substantial revenue streams generated by these operations represent a significant component of natural resource income, requiring careful management to ensure long-term sustainability.

Diversification challenges arise from the specialised nature of hypersaline mineral processing, which requires specific expertise and infrastructure investments that may limit the pool of potential operators. The government's strategy to attract international players through competitive tendering reflects recognition of these challenges while seeking to maintain operational continuity.

The transition from single-operator arrangements to competitive frameworks introduces new risk factors, including the need to ensure operational continuity during concession changeovers and the potential for market disruption during transition periods.

How Will the 2030 Concession Restructuring Transform Government Revenues?

The approaching 2030 expiration of current concession arrangements presents a fundamental restructuring opportunity for Israel Dead Sea mineral revenues. The government's decision to open these operations to competitive tendering rather than extend existing agreements reflects strategic objectives to maximise both economic returns and environmental protection while introducing market competition to historically monopolised operations.

Current Revenue Framework vs. Proposed 50% State Share Model

The transformation from the current 35% government share to the proposed 50% represents a significant shift in revenue allocation that could substantially increase state income from Dead Sea operations. This 15 percentage point increase would be achieved partly through royalties, creating a more direct government participation in extraction profits.

Under current arrangements, the state's share of concession profits generates substantial annual revenues through the existing 35% framework. The proposed increase to 50% represents the government's assessment that previous arrangements may not have captured the full economic value of these strategic natural resources for the public benefit.

The revenue enhancement strategy incorporates both direct profit-sharing increases and royalty mechanisms designed to ensure government participation across various operational scenarios. This dual approach provides flexibility for different competitive bidding structures whilst maintaining predictable revenue streams for fiscal planning purposes.

Competitive Tendering Process and International Player Attraction

The government's tendering framework explicitly emphasises promoting optimal competition, lowering entry barriers, and attracting leading international players to Dead Sea operations. This strategic approach represents a significant departure from the historical single-operator model that has characterised these operations for five decades.

ICL Group has waived its right of first refusal for the Dead Sea concession under the government plan to open operations to competitive bidding. Despite this waiver, ICL plans to participate in the future tender process and has stated its belief that it represents the most suitable candidate to operate the future concession.

The competitive framework aims to introduce market dynamics to operations that have historically operated under exclusive arrangements. Consequently, this approach could potentially drive operational efficiencies, technological innovation, and enhanced environmental performance through competitive pressures that align with broader industry evolution trends emerging globally.

Asset Valuation Methodology for Transfer Arrangements

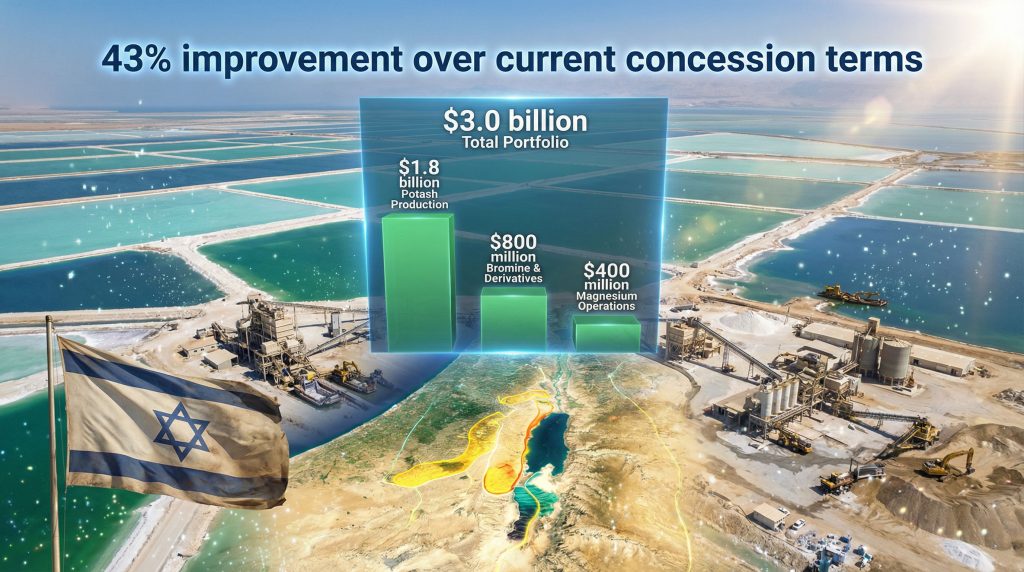

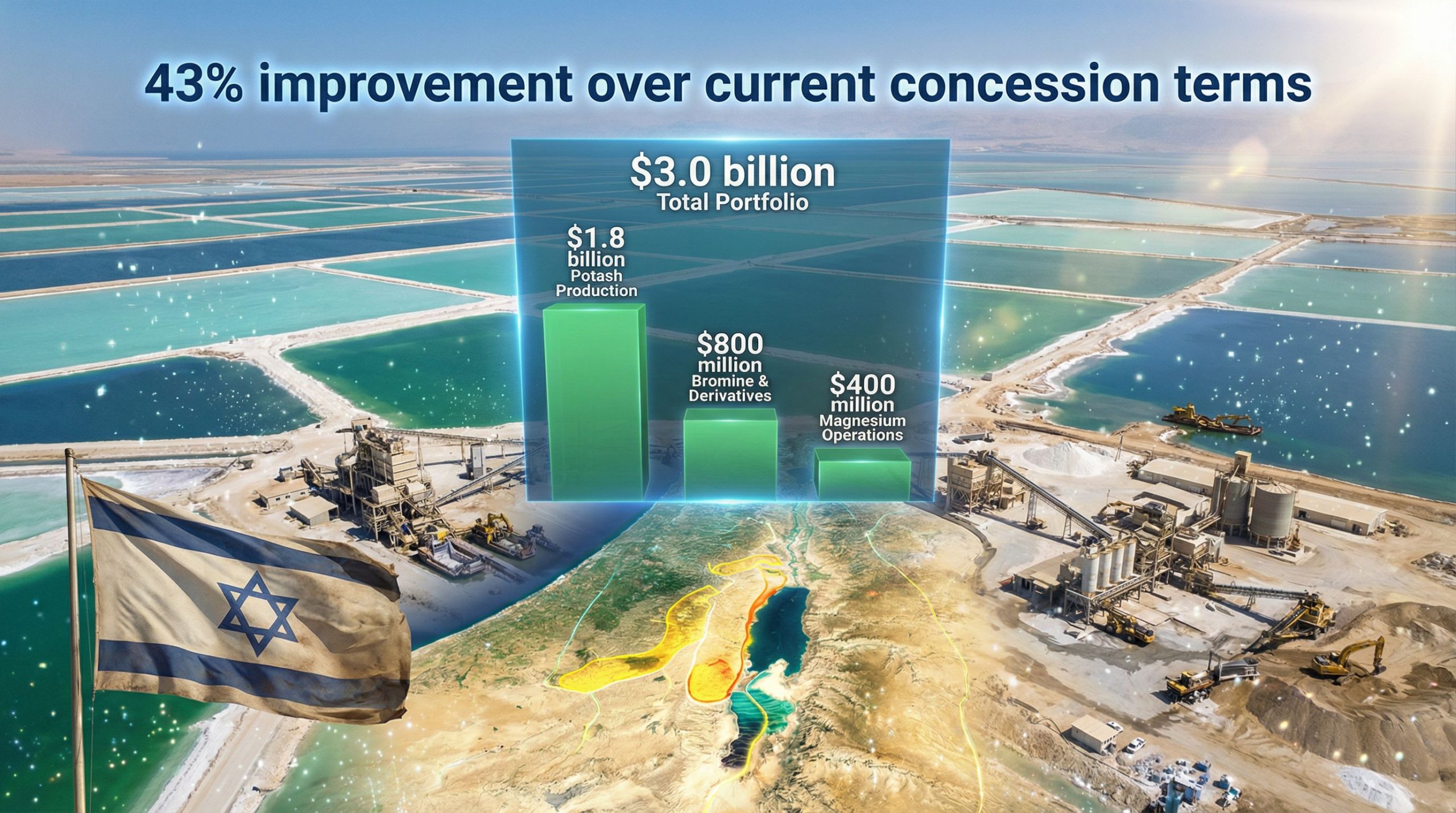

The financial arrangements surrounding the concession transition reflect complex asset valuation considerations that balance historical investments with future earning potential. ICL Group has previously stated that its Dead Sea assets were worth $6 billion, though the company would receive approximately $3 billion if it loses the permit when current arrangements expire in 2030.

This valuation differential suggests sophisticated asset transfer mechanisms that account for factors including infrastructure ownership, operational continuity requirements, and the value of established processing capabilities. The compensation framework appears designed to ensure fair treatment of existing operators whilst facilitating transition to new competitive arrangements.

The asset valuation process must account for specialised infrastructure including evaporation ponds, processing facilities, transport networks, and operational expertise that have been developed over decades of operations. These considerations create unique challenges for establishing fair market values during competitive tendering processes.

What Are the Key Financial Metrics Behind Dead Sea Operations?

The financial profile of Dead Sea mineral operations reflects the substantial scale and profitability of hypersaline resource extraction in one of the world's most unique geological environments. The revenue streams generated through these operations provide critical insights into the economic potential that drives both private investment and government policy decisions.

| Revenue Component | Operational Focus | Current Gov't Share | Proposed Share |

|---|---|---|---|

| Primary Operations | Potash & Magnesium | 35% | 50% |

| Specialty Chemicals | Bromine & Derivatives | 35% | 50% |

| Processing Operations | Mineral Concentration | 35% | 50% |

Production Capacity Analysis and Reserve Sustainability

The Dead Sea's mineral reserves support industrial-scale extraction operations that have maintained consistent production levels over multiple decades. The sustainability of these operations depends on both the availability of mineral-rich brine and the continued viability of evaporation-based processing methods in an environmentally challenging context.

ICL Group's position as one of the world's largest potash producers reflects the substantial production capacity that has been developed through decades of infrastructure investment and operational optimisation. The company's focus on potash and magnesium extraction has created specialised capabilities that serve global agricultural and industrial markets.

The longevity of extraction operations depends on careful management of both mineral availability and environmental impacts, particularly given concerns about Dead Sea water level decline that continues to affect the broader ecosystem. For instance, sustainable extraction practices become increasingly important as environmental pressures mount, requiring integration of sustainable mining transformation principles into operational frameworks.

Capital Investment Requirements and Infrastructure Development

The specialised nature of hypersaline mineral processing requires substantial capital investments in infrastructure designed to handle corrosive mineral-rich solutions over extended operating periods. These investments include evaporation pond systems, mineral processing facilities, transport infrastructure, and environmental management systems.

The transition to competitive tendering may require additional infrastructure investments as new operators establish their capabilities or upgrade existing systems to meet enhanced performance standards. The government's emphasis on attracting international players suggests recognition that significant capital commitments may be necessary to optimise operations.

Future infrastructure development must balance production efficiency with environmental stewardship requirements, particularly given the draft law's emphasis on tackling negative impacts of resource extraction activities in the Dead Sea region.

Comparative Framework with Global Mineral Concession Models

The Israeli approach to mineral concession restructuring reflects broader global trends toward more competitive and environmentally conscious resource extraction frameworks. The shift from exclusive long-term arrangements to competitive tendering mirrors similar transitions in other resource-dependent economies seeking to optimise public returns from natural resource assets.

The proposed 50% government share positions Israel's framework within the higher range of state participation models globally, reflecting the strategic importance of Dead Sea resources and the government's assessment of fair public value capture. This level of state participation requires careful balance with private sector incentives to maintain operational efficiency and investment attractiveness.

International best practices in mineral concession management increasingly emphasise environmental performance alongside economic returns, a dual focus that aligns with Israel's integrated approach to revenue maximisation and environmental protection in the Dead Sea region.

Which International Players Could Reshape the Dead Sea Mineral Landscape?

The government's explicit strategy to attract leading international players through competitive tendering opens possibilities for significant changes in operational approaches and technological capabilities within Dead Sea mineral extraction. The framework's emphasis on lowering entry barriers suggests recognition that international expertise could enhance both operational efficiency and environmental performance.

Strategic Advantages for Global Potash Producers

International potash producers may find strategic value in Dead Sea operations through several potential advantages including access to unique mineral compositions, established infrastructure networks, and proximity to key agricultural markets. The Dead Sea's mineral profile provides opportunities for specialty product development that may complement global producers' existing portfolios.

The competitive tendering process creates opportunities for international operators to introduce advanced extraction technologies, optimised processing methods, and enhanced environmental management practices developed through global operations. These capabilities could potentially improve both profitability and sustainability of Dead Sea operations.

Global producers with experience in challenging extraction environments may bring valuable expertise in managing operations under environmental constraints, particularly relevant given concerns about Dead Sea water level decline and ecosystem impacts.

Technology Transfer Opportunities and Operational Enhancement

International participation in Dead Sea operations could facilitate technology transfer opportunities that enhance extraction efficiency whilst reducing environmental impacts. Advanced processing technologies, environmental management systems, and operational optimisation methods developed in global markets could find application in the unique Dead Sea environment.

The government's framework emphasising optimal competition suggests expectation that international operators will bring innovative approaches that could improve overall sector performance. Technology transfer could encompass areas including mineral processing efficiency, environmental monitoring systems, and sustainable extraction practices.

Operational enhancement opportunities may include integration of digital technologies, advanced environmental management systems, and optimised logistics networks that could improve both economic performance and environmental outcomes.

Market Integration and Supply Chain Considerations

International operators may offer enhanced market integration opportunities through established global distribution networks, customer relationships, and supply chain capabilities. These advantages could potentially improve market access for Dead Sea mineral products whilst optimising logistics and distribution efficiency.

The strategic location of Dead Sea operations provides potential advantages for serving regional and global markets, particularly for specialty chemical applications where product quality and supply reliability are critical factors. International operators with established market positions could leverage these geographic advantages.

Supply chain resilience considerations may favour international operators with diversified operational portfolios and established risk management capabilities, particularly important given regional security considerations and the specialised nature of hypersaline mineral processing.

How Do Environmental Constraints Impact Long-Term Revenue Projections?

Environmental factors represent critical considerations for the long-term sustainability and revenue potential of Israel Dead Sea mineral revenues. The intersection of extraction operations with ecosystem conservation creates complex challenges that require integrated solutions balancing economic objectives with environmental stewardship.

Dead Sea Ecosystem Sustainability and Water Level Concerns

The Dead Sea continues to experience water level decline that affects both ecosystem sustainability and extraction operations viability. These environmental pressures create long-term operational challenges that must be addressed through sustainable extraction practices and environmental management strategies.

The government's draft law explicitly aims to tackle negative impacts of resource extraction activities in the Dead Sea, reflecting recognition that environmental sustainability directly affects long-term revenue potential. This integrated approach suggests that environmental performance will become an increasingly important factor in operational success.

Future extraction operations must balance production objectives with ecosystem conservation requirements, particularly as environmental constraints may affect operational methods, production capacity, and infrastructure requirements over time. Moreover, effective mine reclamation innovation becomes essential for long-term environmental stewardship.

Regulatory Framework Evolution and Compliance Requirements

The proposed legal framework integrates environmental protection objectives with revenue maximisation goals, suggesting that future operations will face enhanced regulatory requirements designed to ensure environmental compliance. The law's emphasis on preserving nature and environmental values indicates that regulatory compliance will become an increasingly significant operational factor.

Accountant General Yali Rothenberg stated that the law will protect the unique environment of the Dead Sea region for future generations whilst ensuring that the state maximises economic value for the public. This dual mandate creates operational requirements that must balance profitability with environmental stewardship.

The competitive tendering process may incorporate environmental performance criteria that affect both operator selection and ongoing operational requirements, potentially creating competitive advantages for operators with advanced environmental management capabilities.

Innovation Requirements for Sustainable Operations

Long-term revenue sustainability may require technological innovations that improve extraction efficiency whilst reducing environmental impacts. The competitive framework creates incentives for operators to develop and implement advanced technologies that address both economic and environmental objectives.

Innovation opportunities may include enhanced mineral processing methods, improved environmental monitoring systems, water conservation technologies, and ecosystem impact mitigation strategies. These technological developments could potentially improve both operational efficiency and environmental performance.

The government's emphasis on attracting leading international players suggests expectation that competitive pressures will drive innovation in sustainable extraction practices, potentially creating long-term advantages for environmentally superior operational approaches.

What Risk Factors Could Affect Future Dead Sea Mineral Revenues?

The transition to competitive concession arrangements introduces multiple risk factors that could affect the stability and growth potential of Israel Dead Sea mineral revenues. These risks span operational, market, environmental, and geopolitical dimensions that require careful assessment and mitigation strategies.

The successful transition to competitive tendering represents a critical juncture for Dead Sea mineral operations, with potential revenue enhancement dependent on effective risk management across multiple operational and market dimensions.

Market Volatility and Commodity Price Exposure

Global fertiliser and specialty chemical markets experience significant price volatility that directly affects the profitability of Dead Sea operations. Potash prices particularly reflect agricultural demand cycles, weather patterns, and global food security concerns that create inherent revenue uncertainty for extraction operations.

The government's increased revenue share through the proposed 50% framework creates greater state exposure to commodity price fluctuations, requiring enhanced fiscal planning capabilities to manage revenue variability. This increased exposure may necessitate development of revenue smoothing mechanisms or diversification strategies.

Specialty chemical markets served by Dead Sea operations may exhibit different volatility patterns than bulk fertiliser markets, potentially providing some revenue diversification benefits. However, overall market exposure remains a significant factor affecting long-term revenue projections.

Operational Transition Risks and Continuity Management

The transition from single-operator arrangements to competitive tendering introduces operational continuity risks that could affect production levels and revenue generation during changeover periods. The specialised nature of hypersaline mineral processing requires careful management of operational knowledge transfer and infrastructure transitions.

ICL Group's five-decade operational tenure represents substantial accumulated expertise in Dead Sea extraction methods, environmental management, and market relationships. The transition to new operators may require significant learning periods that could temporarily affect operational efficiency.

Infrastructure transfer considerations include ownership arrangements for specialised processing equipment, evaporation pond systems, and transport networks that are essential for continued operations. The complexity of these transfers creates potential sources of operational disruption during transition periods.

Regulatory and Environmental Compliance Challenges

Enhanced environmental requirements incorporated into the new legal framework may increase operational complexity and compliance costs for future concession operators. The law's emphasis on environmental protection creates new performance standards that could affect operational methods and profitability.

Environmental monitoring and remediation requirements may increase operational costs whilst creating new sources of regulatory risk for concession operators. These factors could affect bidding interest and operational margins under competitive arrangements.

Long-term environmental sustainability requirements may necessitate operational modifications or technological investments that could affect extraction capacity and revenue generation potential over time.

Strategic Implications for Israel's Natural Resource Portfolio

The restructuring of Dead Sea mineral concessions represents a significant component of Israel's broader natural resource management strategy, with implications extending beyond immediate revenue considerations to encompass long-term economic development objectives and environmental sustainability goals.

Integration with Economic Diversification Objectives

The government's approach to Dead Sea mineral revenues reflects broader economic diversification strategies that seek to maximise returns from finite natural resources whilst developing sustainable economic foundations. The emphasis on competitive tendering and international participation aligns with objectives to attract foreign investment and expertise.

Revenue enhancement through increased government participation provides additional fiscal resources that could support broader economic development initiatives, including technology development, infrastructure investment, and human capital formation. These multiplier effects extend the strategic value of mineral resource optimisation beyond direct revenue generation.

The integration of environmental protection with revenue maximisation objectives reflects recognition that sustainable resource management creates long-term economic value that exceeds short-term extraction profits.

Technology Development and Innovation Ecosystem

The competitive framework for Dead Sea operations creates opportunities for technology development and innovation that could benefit broader industrial sectors within Israel's economy. Advanced mineral processing technologies, environmental management systems, and sustainable extraction methods developed for Dead Sea applications may find broader commercial applications.

International collaboration through competitive tendering could facilitate technology transfer and knowledge sharing that enhances Israel's capabilities in specialised mineral processing and environmental management. These capabilities could support development of technology-based industries serving global markets.

Innovation in sustainable extraction practices could position Israel as a leader in environmentally responsible mineral processing, creating export opportunities for environmental technologies and consulting services developed through Dead Sea operations.

Long-Term Resource Management Framework

The transition to competitive arrangements establishes precedents for natural resource management that could influence approaches to other mineral resources and environmental assets within Israel's portfolio. The integration of economic and environmental objectives creates a framework applicable to broader resource management challenges.

The emphasis on public value maximisation whilst ensuring environmental protection reflects evolving approaches to natural resource stewardship that balance immediate economic returns with long-term sustainability requirements. This framework could guide policy development for other natural resource sectors.

Future resource development policies may incorporate lessons learned from the Dead Sea concession restructuring, including competitive tendering methods, environmental integration requirements, and international participation strategies that optimise both economic and environmental outcomes.

Disclaimer: This analysis contains forward-looking projections and assessments based on publicly available information and policy announcements. Actual revenue outcomes, operational performance, and market developments may vary significantly from projections due to factors including commodity price volatility, regulatory changes, environmental conditions, and competitive dynamics. Readers should conduct independent research and analysis before making investment or policy decisions based on this information.

Ready to Capitalise on Major Resource Discovery Opportunities?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries, instantly empowering subscribers to identify actionable opportunities ahead of the broader market. Understand why major mineral discoveries can lead to substantial returns by exploring historic examples of exceptional outcomes, then begin your 30-day free trial today to position yourself ahead of the market.