Kenya's petroleum sector stands at a pivotal transformation point as the Kenya South Lokichar oil development emerges as the cornerstone of the nation's energy independence strategy. This remote basin in the Turkana region represents more than just an oil discovery; it embodies Kenya's evolution from a petroleum import-dependent economy to a regional energy producer capable of reshaping East Africa's hydrocarbon landscape.

The strategic significance extends beyond national borders, positioning Kenya within the broader East African energy corridor that includes Uganda's Lake Albert developments and Tanzania's offshore discoveries. Unlike its neighbours who have struggled with prolonged development timelines, Kenya's approach demonstrates how targeted fiscal policy can accelerate frontier basin commercialisation.

East Africa's Emerging Oil Landscape

The South Lokichar development occurs within a regional context where East African nations are simultaneously advancing their first major oil projects. Uganda's Tilenga and Kingfisher projects have faced extended timelines, while Tanzania's offshore developments remain in early stages, creating an opportunity for Kenya to establish first-mover advantage in regional petroleum markets.

Kenya's strategic position benefits from existing infrastructure connectivity and established trade relationships that can facilitate faster market entry compared to landlocked developments. Furthermore, current oil price trends suggest favourable market conditions for new producers entering international markets.

The project's proximity to the Indian Ocean through the planned Lamu corridor provides direct access to Asian markets, where demand for medium-gravity crude oil remains robust. This positioning contrasts with landlocked projects that face additional pipeline and transportation challenges.

The Economic Significance of Kenya's First Major Oil Project

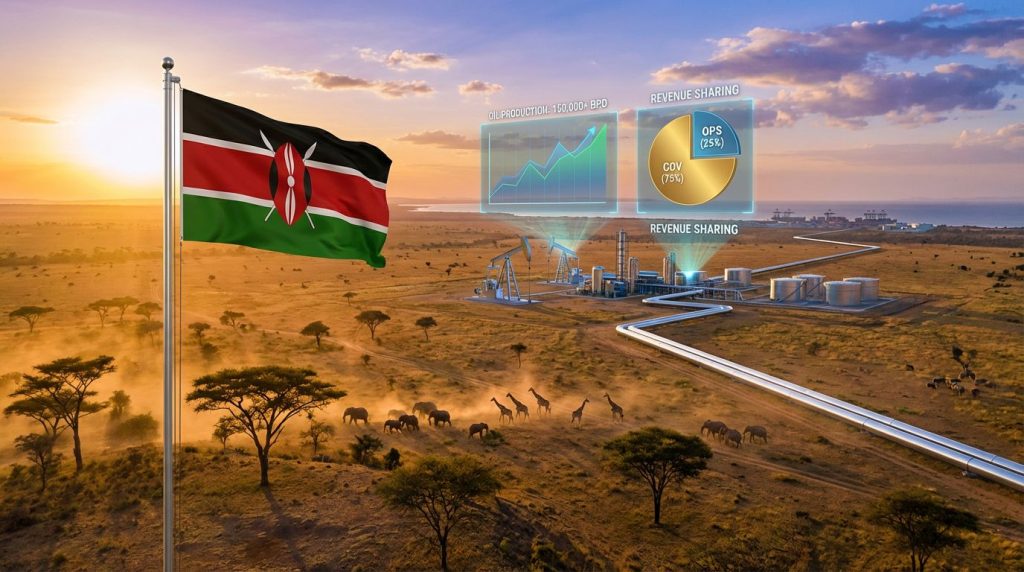

The $6.1 billion Kenya South Lokichar oil development represents Kenya's largest single industrial investment, with implications extending far beyond the petroleum sector. Production exceeding 150,000 barrels per day at peak output positions Kenya as a significant regional producer, capable of generating substantial foreign exchange earnings that could fundamentally alter the nation's economic trajectory.

Employment generation across the value chain encompasses direct drilling and production operations, pipeline construction and maintenance, port facility operations, and downstream service industries. The multiplier effect of petroleum development typically generates 3-5 indirect jobs for each direct position, suggesting potential employment creation exceeding 50,000 positions across the project lifecycle.

Infrastructure development spillover effects include road network improvements, power generation capacity expansion, and telecommunications infrastructure enhancement throughout the Turkana region. These developments create lasting economic benefits that extend well beyond the petroleum project's operational life.

What Makes This Development Different from Regional Projects?

Unlike other East African developments that have faced regulatory delays and financing challenges, the Kenya South Lokichar oil development benefits from streamlined local operator management and comprehensive government support. This approach addresses common challenges that have affected similar projects across the region.

Moreover, the current geopolitical environment, including oil prices and geopolitics considerations, creates favourable conditions for new producers to enter markets previously dominated by established suppliers.

How Does the South Lokichar Development Model Address Frontier Market Challenges?

Frontier market oil developments face unique challenges that traditional financing and operational models often cannot address effectively. The South Lokichar project demonstrates innovative approaches to overcoming remote location constraints, limited existing infrastructure, and elevated political and commercial risks that typically characterise frontier petroleum developments.

Risk mitigation strategies centre on comprehensive fiscal incentive structures designed to improve project economics during critical early-phase development. The elimination of multiple tax obligations creates cash flow improvements that enhance project viability during periods of elevated capital expenditure and limited revenue generation.

Innovative Financing Structures for Remote Basin Development

The South Lokichar financing model combines traditional petroleum industry structures with innovative risk-sharing mechanisms tailored to frontier market conditions. Gulf Energy's $120 million acquisition of Tullow Oil's assets demonstrates how local operators can provide development advantages through regulatory familiarity, stakeholder relationships, and reduced operational complexity.

Tax incentive structures serve as de facto government participation in project risk mitigation. By eliminating value-added tax obligations, withholding taxes, and import levies, the Kenyan government effectively assumes a portion of development risk in exchange for increased long-term revenue participation through production sharing arrangements.

Public-private partnership frameworks enable risk distribution across multiple stakeholders while maintaining government strategic control through the National Oil Corporation of Kenya's 20% back-in rights. This structure provides operational flexibility whilst ensuring state participation in project success.

Technical Solutions for Waxy Crude Extraction

The South Lokichar basin produces waxy crude oil requiring specialised production and transport technologies to maintain flow characteristics throughout the production system. Waxy crude oil solidifies at ambient temperatures, necessitating continuous heating systems from wellhead to export terminal to prevent pipeline blockages and maintain production efficiency.

Heat management systems for the 892-kilometre Lokichar-Lamu pipeline require approximately 50 MW of continuous power generation, representing a significant operational expense and technical complexity factor. These systems must maintain crude oil temperatures above the wax appearance temperature throughout the entire transport distance, requiring sophisticated monitoring and control systems.

Specialised production techniques include heated storage tanks, insulated pipeline infrastructure, and chemical wax inhibition programmes that prevent solid wax formation during production operations. The technical solutions require ongoing operational expertise and maintenance capabilities that influence long-term project costs and reliability.

What Are the Key Infrastructure Requirements Driving Project Economics?

Infrastructure development represents the largest single cost component of the Kenya South Lokichar oil development, with pipeline construction, power generation facilities, and export terminal development requiring integrated planning and execution. The remote location necessitates comprehensive infrastructure creation rather than modification of existing systems.

The infrastructure investment creates permanent regional development that extends beyond petroleum operations, providing transportation, power, and communication capabilities that support broader economic development in previously underserved regions. Additionally, the project faces broader energy export challenges similar to those experienced by other emerging energy producers globally.

The Lokichar-Lamu Pipeline: Engineering and Economic Analysis

| Parameter | Specification |

|---|---|

| Length | 892 kilometres |

| Capacity | 80,000-120,000 bpd |

| Power Requirements | 50 MW |

| Terrain Challenges | Multiple elevation changes |

| Environmental Considerations | Wildlife corridor crossings |

The pipeline engineering requirements reflect the challenging terrain between the Turkana production facilities and the Lamu export terminal. Multiple elevation changes require pump station installations that increase both construction costs and ongoing operational expenses whilst creating potential points of operational vulnerability.

Wildlife corridor crossings necessitate specialised construction techniques and ongoing monitoring systems to minimise environmental impact whilst maintaining operational integrity. These requirements add complexity to construction scheduling and increase long-term operational responsibilities.

Power requirements of 50 MW for continuous pipeline heating represent a substantial ongoing operational cost that directly affects project economics. The power generation infrastructure must provide highly reliable service to prevent production disruptions that could result from pipeline cooling and wax solidification.

Port Lamu Export Terminal Development

The Lamu export terminal serves as the critical interface between Kenya's petroleum production and international markets. Deep-water port infrastructure enables direct loading of crude oil tankers without the need for offshore loading systems, reducing operational complexity and weather-related disruptions.

Storage capacity and loading facilities must accommodate production variability whilst maintaining consistent export operations. The terminal design incorporates heated storage tanks and loading systems specifically designed for waxy crude handling requirements.

Regional export hub potential positions the Lamu terminal to serve not only Kenyan production but potentially Ugandan and South Sudanese crude oil exports, creating additional revenue opportunities and improved facility utilisation rates.

How Do Recent Tax Incentives Transform Project Viability?

Kenya's comprehensive tax reform package for the Kenya South Lokichar oil development represents one of Africa's most substantial petroleum development incentive programmes, with annual savings exceeding $400 million during peak development and production phases. These incentives fundamentally alter project economics by reducing cash flow burdens during capital-intensive development periods.

The tax amendments require parliamentary approval, reflecting the significance of the fiscal commitments and ensuring legislative oversight of the government's revenue sacrifice in exchange for accelerated development timelines. In contrast to other regions experiencing a policy shift in oil drilling, Kenya has moved towards more supportive frameworks for petroleum development.

Comprehensive Tax Reform Analysis

| Tax Component | Original Rate | Reformed Rate | Annual Savings |

|---|---|---|---|

| Value-Added Tax | 16% | 0% | $180-240 million |

| Withholding Tax (Local) | 5% | 0% | $75-100 million |

| Withholding Tax (Imports) | 5.625% | 0% | $85-115 million |

| Railway Development Levy | 2% | 0% | $30-40 million |

| Import Declaration Fee | 2.5% | 0% | $38-50 million |

The value-added tax elimination provides the largest single fiscal benefit, generating annual savings of $180-240 million during peak development and production phases. This reduction directly improves project cash flow during periods of highest capital expenditure, when traditional tax obligations would compete with development spending requirements.

Withholding tax eliminations address both local and imported goods and services, recognising that frontier developments require substantial imported equipment and expertise. The differentiated original rates reflected Kenya's attempt to encourage local content whilst acknowledging the necessity of international procurement for specialised petroleum equipment.

Railway development levy and import declaration fee eliminations represent targeted incentives for large-scale industrial projects requiring substantial equipment importation. These fees, whilst relatively modest in percentage terms, can represent significant absolute costs for multi-billion dollar development programmes.

Cost Recovery Ceiling Adjustments

The increase in cost recovery ceilings from 55-65% to 85% represents a fundamental shift in project economics that accelerates operator cash flow recovery during development phases. This adjustment brings Kenya's fiscal terms more closely in line with international petroleum development standards whilst maintaining government revenue participation through production sharing arrangements.

Enhanced cost recovery percentages reduce the time required for operators to recover initial investment, improving project internal rate of return calculations and making the development more attractive to international financing sources. The improved recovery terms also reduce financing costs by decreasing investor risk perceptions.

The harmonisation of cost recovery terms across both T6 and T7 blocks eliminates operational complexity that could have resulted from managing different fiscal regimes within the same integrated development project. Uniform terms simplify accounting, reporting, and operational procedures across the entire development area.

What Production Profiles and Revenue Sharing Models Define Success?

The South Lokichar project's production profile reflects careful reservoir management designed to optimise long-term recovery whilst generating near-term cash flow for both operators and government stakeholders. Peak production exceeding 150,000 barrels per day positions Kenya as a significant regional petroleum producer capable of meaningful export volumes.

Production commencement planned for 2026 represents an accelerated timeline compared to many East African developments, reflecting the impact of fiscal incentives and local operator expertise in navigating regulatory and operational requirements. However, global market conditions, including OPEC production impacts, will influence the project's market positioning.

Production Forecasting and Peak Output Analysis

The production ramp-up timeline balances reservoir development optimisation with cash flow generation requirements. Initial production phases focus on establishing operational systems and validating reservoir performance whilst building toward peak production rates that justify the substantial infrastructure investments.

Peak production targets exceeding 150,000 barrels per day require successful development of multiple reservoir zones across both T6 and T7 blocks. This production rate positions Kenya as a moderate-scale petroleum producer comparable to established African producers such as Equatorial Guinea and Gabon.

Field life economics extending through 2044 provide a nearly two-decade revenue generation period for both operators and government stakeholders. The extended production timeline justifies infrastructure investments whilst providing long-term economic benefits for regional development initiatives.

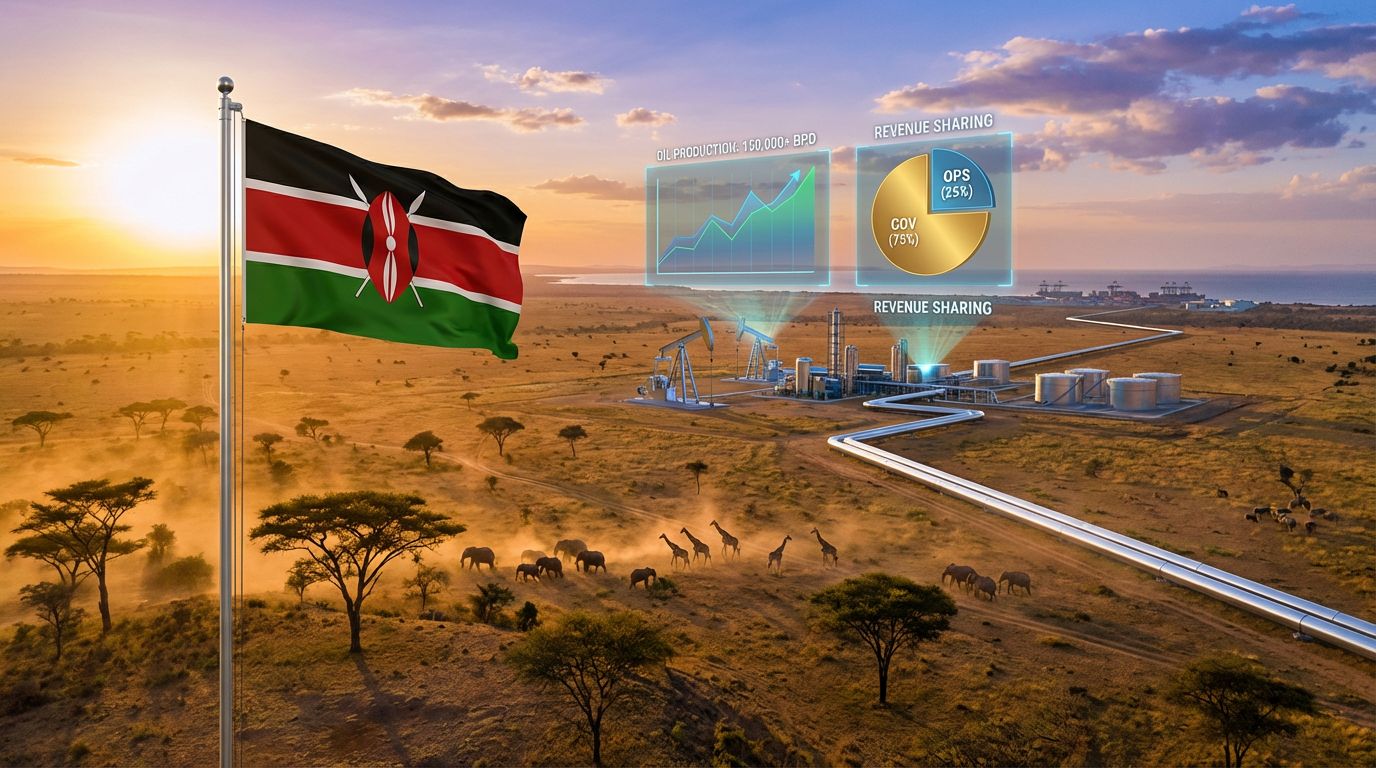

Government Revenue Participation Structure

| Production Phase | Government Share | Operator Share | Windfall Tax Trigger |

|---|---|---|---|

| Initial Production | 50% | 50% | $50/barrel (26% tax) |

| Peak Production | 75% | 25% | $50/barrel (26% tax) |

| Decline Phase | Variable | Variable | Price-dependent |

The graduated revenue sharing structure reflects Kenya's strategy to encourage development through equitable initial sharing whilst capturing increased value during peak production periods. The 50% initial government share provides substantial early revenue whilst maintaining operator incentives for efficient development.

Peak production government share escalation to 75% ensures that Kenya captures the majority of value during periods of maximum cash flow generation. This structure recognises that infrastructure investments and development risks are primarily borne during early phases, justifying increased government participation during peak production periods.

Windfall tax provisions at $50 per barrel with 26% tax rates provide additional government revenue during periods of elevated commodity prices. The trigger price reflects current global oil price expectations whilst ensuring that operators retain reasonable margins during high-price periods.

How Does Gulf Energy's Acquisition Strategy Impact Development Timeline?

Gulf Energy's acquisition of Tullow Oil's South Lokichar assets for $120 million represents a strategic shift toward local operator development of Kenya's petroleum resources. The transaction reflects Tullow Oil's strategic refocusing on debt reduction following years of unsuccessful development attempts, whilst positioning Gulf Energy as Kenya's primary petroleum development entity.

Local operator advantages include established regulatory relationships, stakeholder engagement capabilities, and operational familiarity with Kenyan business environments. These advantages can accelerate permitting processes, community engagement initiatives, and supply chain development compared to international operators less familiar with local conditions.

Furthermore, this Kenya approves plan to develop Lokichar oil basin reflects the government's confidence in local operator capabilities.

Asset Transfer Analysis and Strategic Rationale

The $120 million acquisition price represents significant value creation potential given the project's $6.1 billion total development cost and substantial production potential. The relatively modest acquisition cost reflects Tullow Oil's strategic priorities and Gulf Energy's willingness to assume development risks and operational responsibilities.

Tullow Oil's decision to exit after more than a decade of development efforts demonstrates the challenges facing international operators in frontier markets. Regulatory complexity, stakeholder management requirements, and infrastructure development costs can exceed the capabilities of companies focused on traditional exploration and production activities.

Gulf Energy's local market knowledge and established business relationships provide development advantages that can justify the asset transfer despite Tullow Oil's substantial prior investment. Local operators often demonstrate superior capability in navigating regulatory processes and community engagement requirements that are critical to successful project development.

Operational Transition and Capability Assessment

The operational transition requires transfer of technical data, regulatory approvals, and stakeholder relationships from Tullow Oil to Gulf Energy. Technical expertise transfer includes reservoir data, engineering studies, environmental assessments, and regulatory compliance documentation accumulated over Tullow Oil's development period.

Local content development opportunities expand under local operator management, with potential for increased Kenyan participation in supply chain activities, employment opportunities, and skills development programmes. Local operators typically demonstrate greater commitment to domestic content requirements and workforce development initiatives.

Supply chain localisation potential increases with local operator management through established relationships with Kenyan suppliers, service providers, and contractors. These relationships can reduce development costs whilst increasing local economic benefits and stakeholder support for project operations.

What Are the Broader Implications for Kenya's Energy Security?

The Kenya South Lokichar oil development fundamentally alters Kenya's energy security profile by transitioning from complete petroleum import dependence to domestic production capability exceeding internal consumption requirements. This transformation provides both economic and strategic benefits that extend well beyond the petroleum sector.

Energy independence reduces Kenya's vulnerability to global petroleum price volatility and supply chain disruptions that have historically impacted economic stability. Domestic production provides price stability and supply security that support broader economic development initiatives.

Domestic Energy Supply Transformation

Kenya's current petroleum consumption of approximately 120,000 barrels per day positions the South Lokichar production to meet and exceed domestic requirements at peak production rates. Surplus production capacity enables export revenue generation whilst maintaining domestic supply security through dedicated allocation of portion of production for local market supply.

Reduction in petroleum import expenditure could improve Kenya's trade balance by $2-3 billion annually at current consumption levels and commodity prices. These savings free foreign exchange resources for other development priorities whilst reducing dependence on international petroleum markets.

Regional energy hub development potential emerges through Kenya's transition from energy importer to potential supplier for neighbouring markets. East African regional integration initiatives could benefit from Kenyan petroleum supply diversity and competitive pricing compared to traditional import sources.

Long-term Economic Development Impact

Downstream industry development opportunities include petroleum refining capacity expansion, petrochemical manufacturing, and energy-intensive industrial development that benefits from secure domestic energy supply. These developments create additional employment and value-addition opportunities beyond primary petroleum production.

Petrochemical sector establishment becomes viable with secure domestic feedstock supply, enabling manufacturing of plastics, fertilisers, and chemical products that currently require importation. This development creates industrial diversification opportunities that reduce Kenya's reliance on primary commodity exports.

Technology transfer and skills development occur through petroleum industry operations, creating human capital development that supports broader industrial sector growth. Technical skills development in petroleum operations often transfers to other industrial sectors, supporting overall economic diversification.

How Does Environmental and Social Governance Shape Project Success?

Environmental and social governance considerations play critical roles in determining long-term project viability and community acceptance of petroleum development activities. The Kenya South Lokichar oil development location in the Turkana region requires careful attention to community relationships and environmental protection to maintain operational licence and stakeholder support.

Community benefit sharing mechanisms ensure that local populations receive direct benefits from petroleum development activities occurring in their traditional territories. These benefits include employment opportunities, infrastructure development, educational programmes, and direct revenue sharing that address historical marginalisation of remote regions.

Community Benefit Sharing Mechanisms

Local community participation frameworks establish formal mechanisms for ongoing consultation, benefit distribution, and grievance resolution throughout project operations. These frameworks ensure that community voices are heard in project decision-making whilst providing transparent processes for addressing concerns and distributing benefits.

Environmental impact mitigation strategies address potential effects on wildlife corridors, water resources, and traditional land use patterns. The Turkana region's unique ecological characteristics require specialised protection measures that balance development activities with conservation requirements.

Turkana region development initiatives leverage petroleum revenues to address infrastructure gaps, educational needs, and economic development opportunities that benefit local communities. These initiatives create lasting development benefits that extend beyond the petroleum project's operational life.

ESG Compliance and International Standards

Environmental monitoring and protection protocols ensure compliance with both Kenyan environmental regulations and international standards required by project financing sources. These protocols address air quality, water protection, soil conservation, and biodiversity preservation throughout all project phases.

Social licence to operate maintenance requires ongoing stakeholder engagement, transparent communication, and responsive management of community concerns. Social licence represents an unofficial but critical approval from local communities that can determine project success or failure regardless of formal regulatory approvals.

International financing ESG requirements typically exceed domestic regulatory standards, necessitating comprehensive environmental and social management systems that demonstrate best practice adherence. These requirements ensure that international development finance institutions and commercial lenders maintain confidence in project sustainability.

What Market Dynamics Will Influence Long-term Project Performance?

Global petroleum market integration represents both opportunity and risk for the Kenya South Lokichar oil development, with project economics dependent on international commodity prices, regional demand patterns, and competitive positioning relative to other crude oil sources. Market dynamics will ultimately determine project profitability and government revenue generation over the extended production period.

East African crude oil quality characteristics and regional market access advantages provide competitive positioning that could support premium pricing compared to some international crude sources. However, market acceptance requires consistent quality delivery and reliable supply chain performance.

The project's success will also depend on how well it adapts to global market changes, as evidenced by recent developments where Kenya's government approved the development with ambitious production targets.

Global Oil Market Integration Strategy

East African crude oil quality positioning benefits from medium gravity characteristics that match refinery requirements in key Asian markets where petroleum demand growth remains robust. The South Lokichar crude oil's properties provide flexibility for multiple end-market applications whilst avoiding the heavy crude discounts that affect some African producers.

Regional refinery supply opportunities exist through East African regional integration initiatives that could provide stable, premium-priced markets for Kenyan crude oil. Regional supply agreements often provide price stability advantages compared to volatile international spot markets.

International market access through the Lamu port positions Kenyan crude oil for direct export to Asian markets without transshipment requirements that add costs and complexity for other African producers. Direct shipping access improves project economics through reduced transportation costs and improved delivery reliability.

Price Risk Management and Market Outlook

Hedging strategies for volatile oil markets become critical for managing revenue predictability for both operators and government stakeholders. Financial instruments including forward contracts, options, and swaps can provide price protection during periods of market volatility whilst preserving upside potential during favourable price periods.

Long-term contract opportunities with regional refineries or international buyers provide revenue stability that supports project financing and government fiscal planning. These contracts typically trade current revenue certainty for some upside potential but provide crucial cash flow predictability for long-term planning purposes.

Investment Disclaimer: Petroleum development projects involve substantial risks including geological uncertainty, market volatility, regulatory changes, and operational challenges. Production estimates, revenue projections, and economic assessments are subject to numerous variables that may differ materially from actual results. Potential investors should conduct independent due diligence and consider all risk factors before making investment decisions.

Regional pricing dynamics and transportation costs will ultimately determine the competitiveness of Kenyan crude oil in international markets. The project's success depends on maintaining cost-effective operations whilst delivering consistent quality crude oil that meets buyer requirements across multiple market cycles.

Ready to capitalise on East Africa's emerging oil opportunities?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant resource discoveries across the ASX, helping investors identify actionable opportunities in the evolving energy and mining sectors. Explore how major discoveries like those transforming Kenya's energy landscape have historically delivered substantial returns by visiting Discovery Alert's discoveries page, then begin your 30-day free trial to position yourself ahead of the market.