What Makes Longonjo a Critical Rare Earth Development?

The global rare earth landscape is undergoing fundamental transformation as Western nations scramble to reduce dependence on Chinese supply chains. Against this backdrop, the Pensana Longonjo rare earth project in Angola emerges as a potential cornerstone of supply security, leveraging unique geological advantages and strategic infrastructure positioning to target unprecedented resource scales. Furthermore, understanding different drilling programs types becomes essential when evaluating the systematic approach required for such ambitious exploration targets.

Angola's Geological Advantage in Global Supply Chains

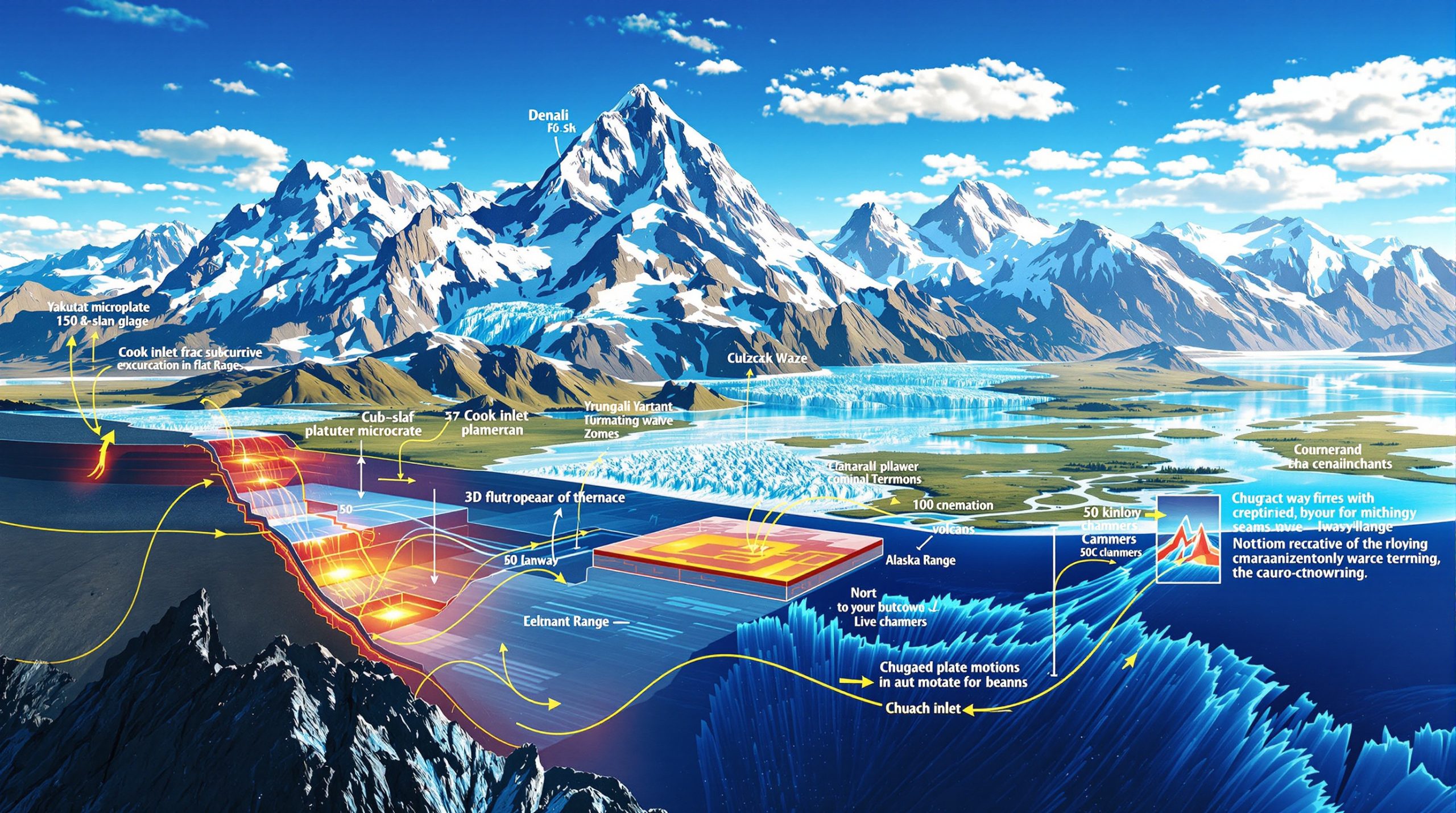

Longonjo's geological foundation rests on weathered carbonatite formations that create particularly favorable mining conditions. The deposit features a shallow, high-grade TREO blanket extending 20 to 30 meters thick across the surface, enabling lower-cost open-pit extraction methods compared to deeper underground operations.

Current JORC Resource Estimates reveal 313 Mt at 1.43% TREO, with proven reserves of 21.5 Mt at 3.04% TREO supporting over 20 years of mine life. The proven reserves contain approximately 139,457 tonnes of NdPr content, positioning Longonjo among significant global rare earth deposits by contained metal value.

The carbonatite host rock demonstrates consistent grade distribution patterns typical of weathered rare earth deposits. Surface oxidation processes have concentrated TREO minerals in accessible zones, while deeper extensions indicate potential for resource expansion through systematic drilling programs.

Comparative analysis with established deposits reveals Longonjo's competitive positioning. While Mountain Pass in California operates from carbonatite formations with similar geological characteristics, Longonjo's shallow geometry and extensive surface footprint suggest potentially lower strip ratios and extraction costs.

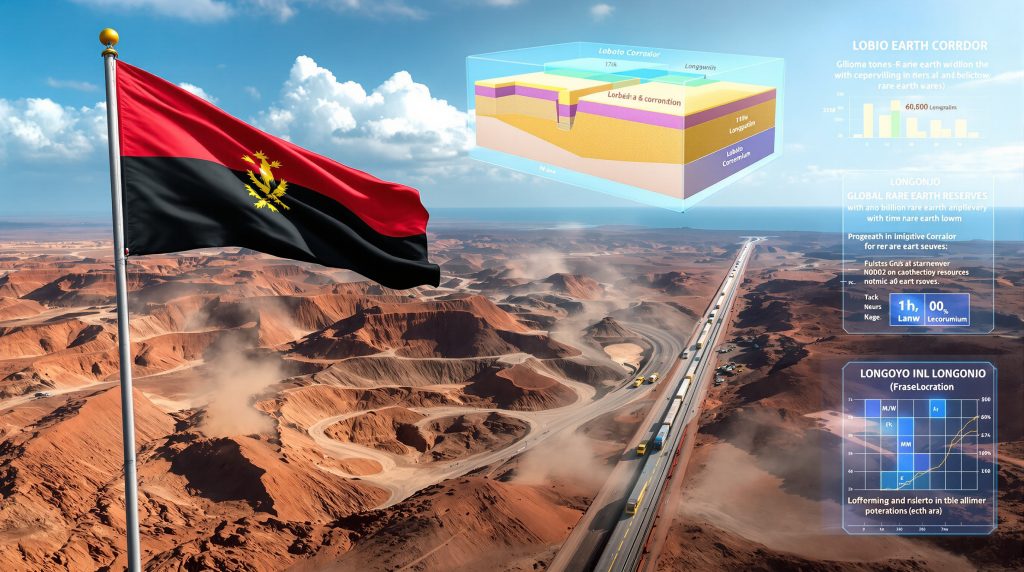

Infrastructure Convergence Through Lobito Corridor

The Pensana Longonjo rare earth project benefits significantly from Angola's strategic infrastructure development, particularly the revitalized Lobito Corridor connecting the Atlantic coast to mineral-rich interior regions. This railway system provides direct access to port facilities capable of handling bulk commodity exports.

Hydroelectric power availability through the Laúca scheme offers potential cost advantages for energy-intensive rare earth processing operations. Reliable electricity access addresses one of the critical operational challenges facing mineral projects in sub-Saharan Africa.

Geographic positioning for Western market access represents a fundamental advantage over Asian supply chains. Atlantic shipping routes to North American and European destinations reduce transportation costs and political risk compared to traditional Pacific routing through Chinese-controlled ports.

The infrastructure convergence creates what industry observers characterise as a "mine-to-market" integration opportunity, where geological resources align with transportation networks and power systems necessary for commercial-scale rare earth production.

How Does the Billion-Tonne Resource Target Compare Globally?

The ambitious billion-tonne exploration target announced by Pensana represents a dramatic scaling of Longonjo's resource potential, requiring careful analysis of geological probability and economic feasibility against established global deposits. In addition, this project exemplifies the importance of critical minerals energy security for Western nations seeking supply chain independence.

Current Resource Classification Breakdown

Table: Longonjo Resource Categories

| Category | Tonnage (Mt) | TREO Grade (%) | NdPr Content (tonnes) |

|---|---|---|---|

| Proven Reserves | 21.5 | 3.04 | 139,457 |

| Current Resources | 138 | 2.19 | 650,000 |

| Exploration Target | 1,000+ | 1.43 | TBD |

The progression from proven reserves to exploration target demonstrates typical grade-tonnage relationships in rare earth deposits. Higher-grade zones concentrate near surface weathered formations, while deeper extensions contain lower grades across larger volumes.

Resource confidence decreases significantly moving from proven reserves (highest certainty) to exploration targets (conceptual). The billion-tonne target requires extensive drilling validation and metallurgical testing before economic classification, following standard resource classification guide protocols.

A US$11 million drilling program comprising 25,000 meters of vertical core drilling aims to upgrade resource confidence levels throughout 2025-2026. This systematic approach follows JORC guidelines for resource estimation and mine planning optimisation.

Ranking Against Major Global Deposits

Global rare earth deposit comparisons reveal the scale significance of Longonjo's potential resource base. China's Bayan Obo complex contains an estimated 48 million tonnes of reserves, though exact figures remain state-controlled information with limited public disclosure.

Mountain Pass in the United States operates from carbonatite formations similar to Longonjo, with historical production demonstrating commercial viability of this deposit type. However, Mountain Pass resource tonnage remains significantly smaller than Longonjo's billion-tonne target.

Australia's Mount Weld deposit, operated by Lynas Corporation, processes approximately 10-15 million tonnes of ore annually from ion-adsorption clay formations. The processing methodologies differ substantially from carbonatite-hosted deposits like Longonjo.

Key Distinction: Resource tonnage alone does not determine commercial viability. Economic factors including grade distribution, processing costs, infrastructure access, and market pricing ultimately determine project success.

Industry analysis suggests that if validated, a billion-tonne resource would position Longonjo among the world's largest rare earth deposits by contained TREO tonnage, though economic extraction remains dependent on sustained commodity pricing and processing technology advancement.

What Are the Key Investment Risk Factors?

Investment evaluation of the Pensana Longonjo rare earth project reveals multiple risk categories spanning country-specific challenges, financing uncertainties, and technical execution requirements that investors must carefully assess. Moreover, the successful implementation of an effective critical minerals strategy becomes crucial for long-term project viability.

Country Risk Assessment Matrix

Angola's investment climate has undergone significant transition since 2017 political reforms, though institutional development continues evolving. The country's mining sector regulatory framework provides legal structures for foreign investment, while questions persist regarding long-term policy stability.

Political stability indicators show improvement since 2017 reforms, though infrastructure development timelines remain dependent on government execution capacity and international partnership continuity.

Currency convertibility and repatriation policies represent ongoing considerations for foreign investors. Angola's kwanza has experienced significant volatility, though mineral export revenues typically generate hard currency earnings.

Regional infrastructure development through the Lobito Corridor involves multiple stakeholders including international development banks and private partners. Execution timelines remain subject to coordination challenges and funding availability.

Financing Structure Dependencies

Pensana's current market capitalisation of £280-300 million (approximately US$375 million) reflects substantial investor optimism, with share price gains exceeding 250% over 12 months. However, the company maintains pre-revenue status with significant financing requirements ahead.

The planned US$160 million EXIM debt facility represents the primary construction financing component, though formal commitment remains pending. Export-Import Bank financing typically requires detailed technical and commercial due diligence before approval.

Going concern audit qualifications recorded in 2025 indicate auditor uncertainty regarding the company's operational continuity without additional funding. This formal notice signals material financing risk that requires investor attention, particularly when considering various capital raising methods available to mining companies.

Critical Risk Factors:

• Debt facility commitment timeline and conditions

• Equity funding requirements for project completion

• Working capital needs during construction phase

• Commodity price sensitivity affecting project economics

Technical Execution Challenges

Metallurgical processing optimisation represents a key technical challenge requiring extensive testwork and pilot plant validation. Carbonatite-hosted rare earth deposits often contain complex mineral assemblages requiring specialised separation techniques.

Mine planning for billion-tonne scale operations involves significant logistical considerations including waste rock management, water treatment, and environmental monitoring across expanded operational footprints.

Environmental compliance across expansion phases requires comprehensive impact assessments and stakeholder engagement processes. Large-scale rare earth operations generate tailings and process water requiring long-term management strategies.

Processing technology selection affects both capital expenditure and operating cost structures. The choice between different separation pathways influences project economics and operational complexity.

How Does the US Supply Chain Integration Work?

The strategic partnership between Pensana and eVAC Magnetics creates a vertically integrated pathway from Angola's Longonjo mine through to finished rare earth magnets in the United States, representing a novel approach to supply chain independence.

eVAC Magnetics Partnership Structure

The Sumter, South Carolina facility operates through a joint venture with Vacuumschmelze, a German rare earth magnet manufacturer with established technical expertise. Initial production targets 2,000 tonnes per annum of rare earth magnets, with planned expansion to 12,000 tpa by 2029.

This six-fold capacity increase over approximately four years represents an aggressive scaling timeline requiring substantial capital investment and market demand validation. The expansion pathway suggests confidence in U.S. market absorption capacity.

Vertical integration from mine to magnet manufacturing eliminates intermediate supply chain steps that traditionally route through Chinese processing facilities. This approach provides supply security benefits while potentially capturing higher value-added margins.

The partnership structure leverages Vacuumschmelze's established magnet production technology with Pensana's raw material supply security, creating complementary capabilities for U.S. market penetration.

Strategic Competition with Chinese Dominance

Table: Global Rare Earth Processing Capacity

| Region | Current Capacity (%) | Planned Additions | Longonjo Impact |

|---|---|---|---|

| China | 85 | Stable | -5% market share |

| USA | 8 | +15% by 2030 | +3% via Pensana |

| Australia | 4 | +8% by 2028 | Indirect benefit |

| Other | 3 | +5% by 2030 | +2% including Angola |

Chinese processing dominance reflects decades of investment in rare earth separation technology and industrial infrastructure. Competing facilities require substantial capital expenditure and technical expertise development.

U.S. capacity additions through Inflation Reduction Act incentives and Defense Production Act support create favourable policy environments for domestic rare earth processing. However, technical execution remains challenging.

The Pensana-eVAC partnership represents one of several initiatives aimed at establishing Western rare earth processing capabilities. Success depends on coordinated development across multiple projects and sustained policy support.

Market share projections assume successful project execution and competitive cost structures compared to established Chinese operations. Achieving these targets requires overcoming significant technical and economic hurdles.

Policy Alignment Timing Considerations

Inflation Reduction Act critical minerals provisions provide tax incentives and procurement preferences for domestic rare earth processing. These policies create favourable economics for U.S.-based operations.

Defense Production Act implications include potential government procurement commitments and strategic stockpiling programs. Military applications drive demand for secure rare earth magnet supplies.

Trade relationship stability between the United States and Angola affects long-term supply security. Bilateral investment treaties and trade agreements influence project risk assessments.

Policy timing alignment requires coordination between project development schedules and political support continuity. Changes in government priorities could affect incentive programs and procurement commitments.

What Does the US$11M Drilling Program Target?

The comprehensive drilling and metallurgical program represents Pensana's systematic approach to validating the billion-tonne resource target while optimising processing pathways for commercial-scale operations. Furthermore, this represents one of the most significant exploration investments in Angola's emerging rare earth sector.

Exploration Methodology and Scope

The 25,000-meter vertical core drilling program follows systematic grid patterns designed to upgrade resource confidence from exploration target status to indicated and measured resource categories under JORC guidelines.

Metallurgical testwork objectives focus on processing optimisation for mineplanning and cost reduction. Different ore zones require specific separation techniques and reagent consumption patterns.

Resource confidence upgrade pathways progress through multiple drilling phases with progressively tighter spacing. Initial drilling establishes geological continuity, while infill drilling provides grade control data.

Drilling Program Components:

• Geological mapping and structural interpretation

• Geochemical sampling across deposit extensions

• Metallurgical sample collection for testwork programs

• Hydrogeological assessment for water management planning

• Environmental baseline data collection

Economic Threshold Analysis

Cut-off grade assumptions for the billion-tonne target require validation against current rare earth pricing and processing cost projections. Economic thresholds determine which material qualifies as mineable ore versus waste rock.

Capital expenditure scaling requirements increase substantially when moving from the current 138-million-tonne resource base to billion-tonne operations. Infrastructure, processing facilities, and mine equipment must accommodate significantly higher throughput rates.

Operating cost projections across different deposit zones depend on grade distribution, processing requirements, and infrastructure access. Higher-grade zones generate better margins while bulk tonnage zones require higher processing volumes.

Current NdPr prices averaging US$65-75/kg represent 40% recovery from 2022 lows, though Pensana's project economics assume US$50/kg baseline pricing for conservative feasibility modelling.

Timeline for Results Publication

Phased disclosure strategy through 2025-2026 provides regular updates on drilling progress and metallurgical results. Early results focus on geological continuity while later phases address economic parameters.

JORC compliance upgrade requirements follow established protocols for resource estimation and reserve calculation. Independent qualified persons must validate all technical disclosures.

Market impact assessment protocols consider timing of announcements relative to commodity price cycles and investor sentiment. Results publication timing affects stock price volatility and financing opportunities.

The drilling program's success ultimately determines whether Longonjo advances toward construction or requires additional exploration investment. Results must demonstrate economic viability across expanded resource tonnage.

How Do Market Dynamics Affect Project Valuation?

Rare earth market fundamentals directly influence Pensana Longonjo project economics through commodity price volatility, demand growth projections, and supply security premium considerations that investors must evaluate. Consequently, understanding these dynamics becomes essential for assessing long-term project viability.

Rare Earth Price Volatility Impact

Current NdPr prices averaging US$65-75/kg represent 40% recovery from 2022 lows, though Pensana's project economics assume US$50/kg baseline pricing for conservative feasibility modelling.

Price volatility stems from concentrated Chinese supply control and demand fluctuations from electric vehicle and wind turbine manufacturing cycles. Supply disruptions create significant price spikes while oversupply periods generate extended downturns.

Project valuation sensitivity to commodity pricing requires stress testing across multiple price scenarios. Break-even analysis reveals minimum sustainable pricing levels for project economics.

Long-term price forecasting incorporates supply-demand balance projections, though rare earth markets demonstrate limited price transparency and frequent manipulation concerns.

Demand Growth Projections

Electric vehicle market expansion drives primary demand growth for NdPr-based permanent magnets. EV sales projections directly translate to rare earth consumption requirements for motor and battery applications.

Wind turbine installation forecasts indicate sustained demand for high-performance magnets in generator systems. Offshore wind development particularly favours permanent magnet generators requiring substantial rare earth content.

Industrial magnet application diversification includes robotics, automation equipment, and consumer electronics. These sectors demonstrate steady growth patterns less volatile than automotive cycles.

Demand Growth Drivers:

• Electric vehicle production scaling globally

• Renewable energy infrastructure investment

• Industrial automation adoption

• Defense and aerospace applications

• Consumer electronics advancement

Supply Security Premium Calculations

Western supply chain independence valuations incorporate risk premiums for secure rare earth access. Government agencies and defense contractors prioritise supply security over absolute cost minimisation.

Geopolitical risk mitigation benefits justify higher production costs for non-Chinese rare earth sources. Strategic considerations outweigh pure economic optimisation in critical applications.

Strategic stockpiling policy implications include government procurement commitments and inventory building programs. National security considerations drive demand premium pricing for secure suppliers.

Supply security premiums vary by end-user application and geographic location. Defense contractors demonstrate higher willingness to pay for secure supply chains compared to consumer electronics manufacturers.

What Are the Environmental and Social Governance Factors?

Environmental, social, and governance considerations increasingly influence rare earth project development as stakeholders demand sustainable mining practices and community benefit sharing across operational lifecycles.

Carbon Footprint Optimisation Strategy

Hydroelectric power integration from Angola's Laúca scheme provides renewable energy advantages compared to coal-powered Chinese rare earth operations. Clean electricity access reduces processing-related carbon emissions substantially.

Transportation emissions via Lobito rail corridor to Atlantic shipping create shorter routing distances to Western markets compared to traditional Pacific Ocean transport from Asian suppliers.

Processing efficiency improvements over Chinese alternatives stem from modern separation technology and environmental controls. New facilities incorporate best available technology for emissions reduction.

Carbon Reduction Strategies:

• Renewable electricity utilisation

• Efficient transportation routing

• Modern processing technology deployment

• Waste heat recovery systems

• Water recycling and treatment optimisation

Community Development Integration

Local employment generation targets focus on skills development and capacity building within Angola's mining sector. Training programs prepare local workforce for technical roles across mining and processing operations.

Skills development program implementation includes partnerships with technical institutions and international training providers. Workforce development creates sustainable employment opportunities beyond mine life.

Revenue sharing mechanisms with the Angolan government follow standard mining taxation frameworks including royalties, corporate income taxes, and local community development contributions.

Community benefit programs typically include infrastructure development, education support, and healthcare facility investment in mining-affected areas.

Tailings Management Compliance

Global Industry Standard adoption requirements follow international best practices for tailings storage facility design and monitoring. Recent industry disasters have elevated safety requirements substantially.

Long-term environmental monitoring protocols include groundwater quality assessment, air quality measurement, and ecosystem impact evaluation throughout operational phases.

Rehabilitation planning across operational phases incorporates progressive land restoration and post-closure monitoring requirements. Financial assurance provisions ensure adequate closure funding.

Tailings management represents one of the highest-risk aspects of rare earth operations due to processing chemical requirements and long-term storage needs.

What Investment Scenarios Should Analysts Consider?

Strategic scenario analysis provides framework for evaluating Pensana Longonjo rare earth project across multiple development pathways and market condition variations that could influence investment outcomes. However, each scenario requires careful consideration of both opportunities and challenges inherent in rare earth development.

Bull Case: Full Resource Realisation

Billion-tonne resource confirmation through the US$11 million drilling program drives major re-rating as Longonjo establishes itself among the world's largest rare earth deposits by tonnage.

US supply chain integration accelerates under supportive policy frameworks including sustained IRA incentives and Defense Production Act procurement commitments creating favourable demand dynamics.

Pensana evolves into the Western world's largest rare earth producer with integrated mine-to-magnet operations capturing premium margins across the value chain.

Bull Case Assumptions:

• Drilling program confirms billion-tonne resource target

• EXIM financing commitment secured on favourable terms

• eVAC partnership achieves 12,000 tpa magnet production

• Rare earth prices sustain above US$60/kg NdPr

• Angola infrastructure development proceeds on schedule

Base Case: Staged Development Success

Current reserves of 21.5 million tonnes at 3.04% TREO support planned 20-year mine life with consistent production and cash flow generation meeting initial development objectives.

Moderate resource expansion validates exploration investment through drilling program results, though billion-tonne target remains partially confirmed requiring additional exploration phases.

Market share gains in Western supply chains materialise gradually as eVAC Magnetics facility scales production and establishes customer relationships across target industries.

Base Case Characteristics:

• Resource expansion to 300-500 million tonnes confirmed

• Financing secured with standard commercial terms

• Magnet production reaches 6,000-8,000 tpa by 2029

• Commodity pricing remains volatile around US$50-70/kg

• Infrastructure development experiences typical delays

Bear Case: Execution and Market Challenges

Financing gaps delay construction timeline as EXIM facility commitment encounters bureaucratic obstacles and equity markets lose enthusiasm for pre-revenue rare earth developers.

Resource expansion fails to meet billion-tonne targets through drilling program results, revealing geological constraints that limit economic tonnage expansion potential.

Rare earth price volatility pressures project economics as oversupply conditions persist and Chinese producers respond aggressively to Western supply chain development initiatives.

Bear Case Risks:

• Drilling results disappoint on tonnage and grade

• Financing delays extend development timeline 2-3 years

• Magnet facility struggles with technical and market challenges

• NdPr pricing falls below US$45/kg sustained levels

• Angola country risks materialise affecting operations

How Does Longonjo Compare to Other Critical Mineral Projects?

Comparative analysis across global rare earth development projects reveals Longonjo's competitive positioning while highlighting unique risk-reward characteristics investors must evaluate. In addition, examining how different projects approach development strategies provides insight into optimal pathways forward.

Development Stage Peer Analysis

Table: Rare Earth Project Comparison

| Project | Location | Stage | Resource (Mt) | Key Advantage |

|---|---|---|---|---|

| Longonjo | Angola | Construction | 138-1000+ | Scale + Infrastructure |

| Kvanefjeld | Greenland | Permitting | 1,000+ | High grade uranium co-product |

| Norra Kärr | Sweden | Feasibility | 61 | HREE concentration |

| Round Top | Texas | Development | 337 | US domestic location |

Longonjo's construction stage development provides advancement over earlier-stage competitors, though execution risks remain substantial given pre-revenue status and financing requirements.

Resource tonnage positioning places Longonjo among the largest potential developments globally, though grade characteristics and processing requirements vary significantly across deposits.

Geographic diversification across different jurisdictions creates varied risk profiles with distinct regulatory frameworks, political stability factors, and infrastructure access considerations.

Strategic Positioning Assessment

First-mover advantage in Angola's rare earth sector provides regulatory relationship development and infrastructure access benefits compared to subsequent entrants in the jurisdiction.

Lobito Corridor infrastructure leverage creates transportation cost advantages and Atlantic market access unavailable to projects in other African jurisdictions without comparable logistics systems.

Western supply chain integration timing aligns with policy support cycles and market demand for Chinese supply alternatives, though sustained political commitment remains uncertain. The Longonjo rare earth project represents a strategic opportunity for Western rare earth supply chain development outside traditional Asian sources.

Competitive Advantages:

• Large-scale resource potential with expansion targets

• Established infrastructure access through rail and power systems

• Integrated downstream processing through eVAC partnership

• Atlantic shipping access to Western markets

• Supportive policy environment for supply chain security

Key Challenges:

• Angola country risk and institutional development needs

• Pre-revenue financing requirements and execution risks

• Commodity price volatility affecting project economics

• Technical complexity of billion-tonne resource validation

• Competition from established Chinese supply chains

Recent developments show Pensana progressing with exploration activities as the company advances multiple work streams simultaneously to validate resource expansion potential while maintaining construction momentum.

The Pensana Longonjo rare earth project represents a significant development opportunity within the global critical minerals sector, though success depends on coordinated execution across geological, technical, financial, and political dimensions. Investors must carefully evaluate risk-reward trade-offs while monitoring drilling results and financing developments throughout the coming development phases.

Looking for the Next Major Mineral Discovery?

Discovery Alert instantly alerts investors to significant ASX mineral discoveries using its proprietary Discovery IQ model, turning complex mineral data into actionable insights. Begin your 30-day free trial today to position yourself ahead of the market and explore historic discovery returns that showcase the potential of catching major mineral developments early.