Strategic resource security has become a defining characteristic of modern geopolitical competition, with nations increasingly recognising that control over critical mineral supplies translates directly into technological sovereignty and defence capabilities. This reality has intensified focus on tungsten, a metal whose unique properties make it irreplaceable in advanced manufacturing yet whose global supply remains concentrated in the hands of a single dominant producer. The Mactung tungsten mine emerges as a potential game-changer in this strategic landscape, offering Western nations a pathway toward supply diversification and enhanced resource security.

Understanding Tungsten's Strategic Value in Defence Manufacturing

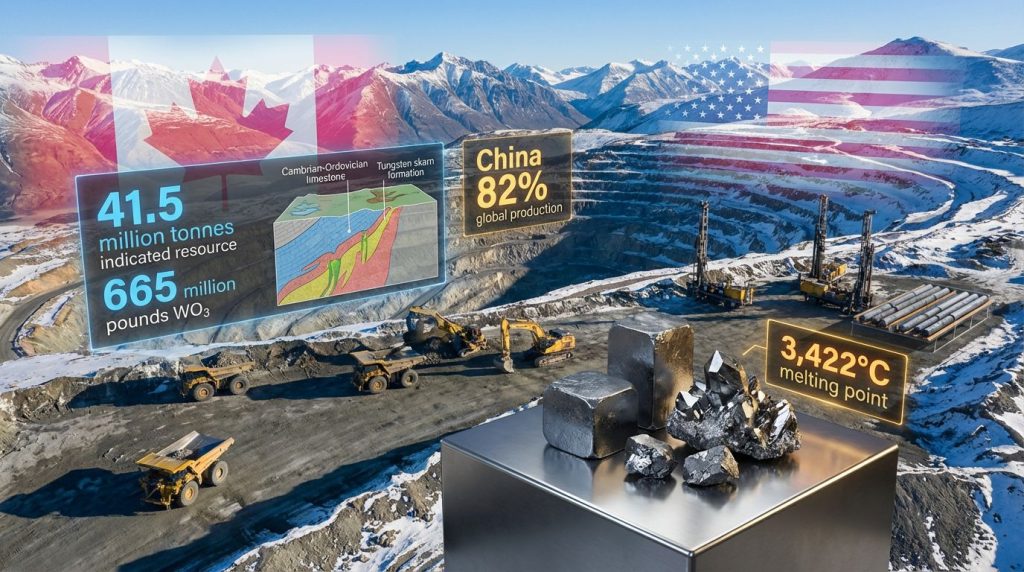

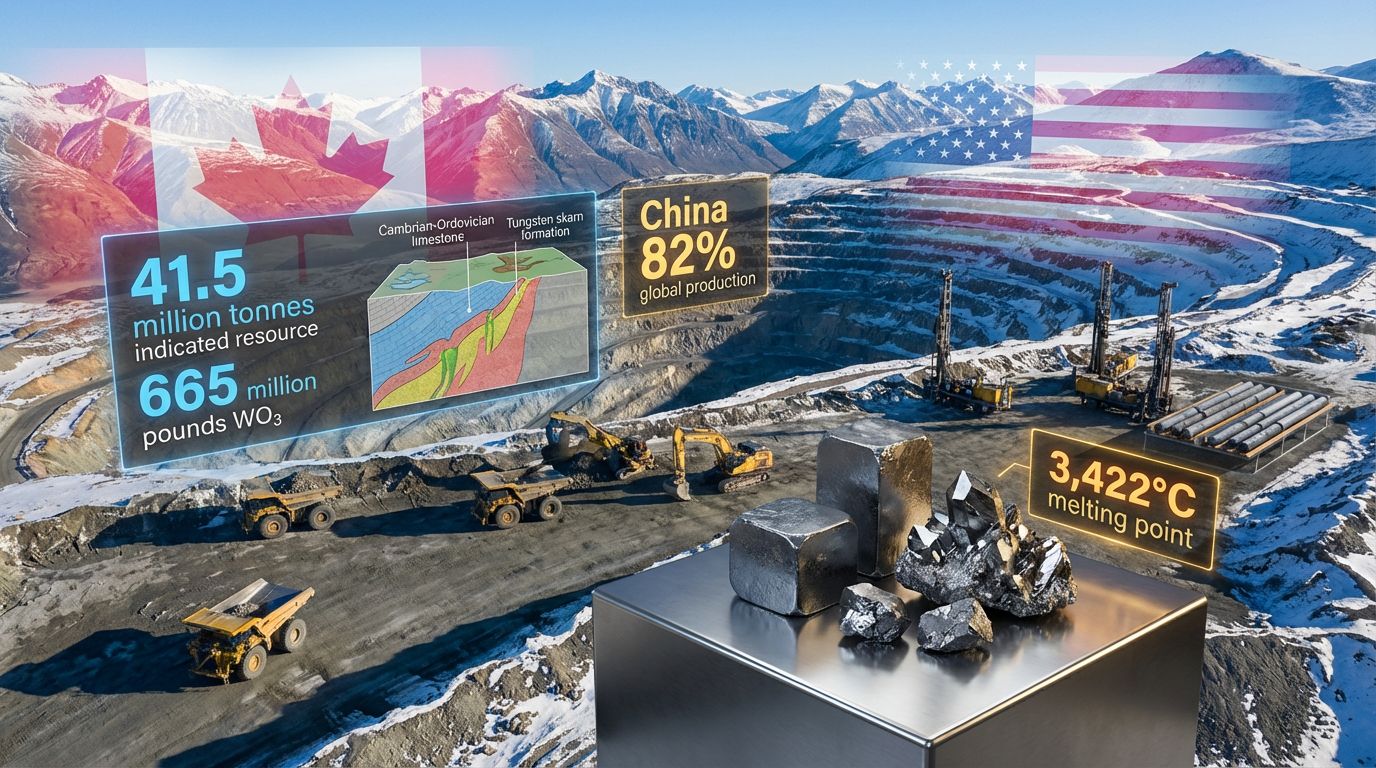

Tungsten's exceptional physical characteristics have established it as an indispensable component across multiple industrial sectors. With a melting point of 3,422°C, the highest among all metallic elements, tungsten enables applications that would be impossible with alternative materials. This extreme temperature resistance, combined with exceptional density and hardness, creates unique value propositions in aerospace, defence systems, and precision manufacturing.

The strategic importance of tungsten extends beyond its physical properties to its role in maintaining technological competitiveness. Furthermore, recent developments in defence critical materials strategies have highlighted tungsten's irreplaceable nature in modern warfare systems. Defence contractors rely heavily on tungsten-based alloys for armour-piercing ammunition, missile guidance systems, and high-temperature engine components.

Similarly, industrial manufacturers utilise tungsten carbide for cutting tools, mining equipment, and specialised electronics where durability under extreme conditions is paramount. The growing emphasis on energy transition security has further amplified demand as renewable energy systems require tungsten components for high-efficiency applications.

Supply Chain Vulnerabilities and Market Concentration

Global tungsten production demonstrates one of the most extreme examples of supply chain concentration among critical minerals. China controls approximately 82% of primary tungsten supply, with Russia contributing 4%, Vietnam 3%, and all other producers accounting for just 11% of global output. This concentration creates significant vulnerability for Western supply chains, particularly as geopolitical tensions continue to escalate.

Recent market developments have highlighted these vulnerabilities in stark terms. Ammonium paratungstate (APT), the industry standard tungsten product, has traded in the $580-$650 USD per metric ton unit range during late 2025. Each metric ton unit equals 10 kilograms of tungsten trioxide (WO3), representing prices well above typical levels observed over the past decade.

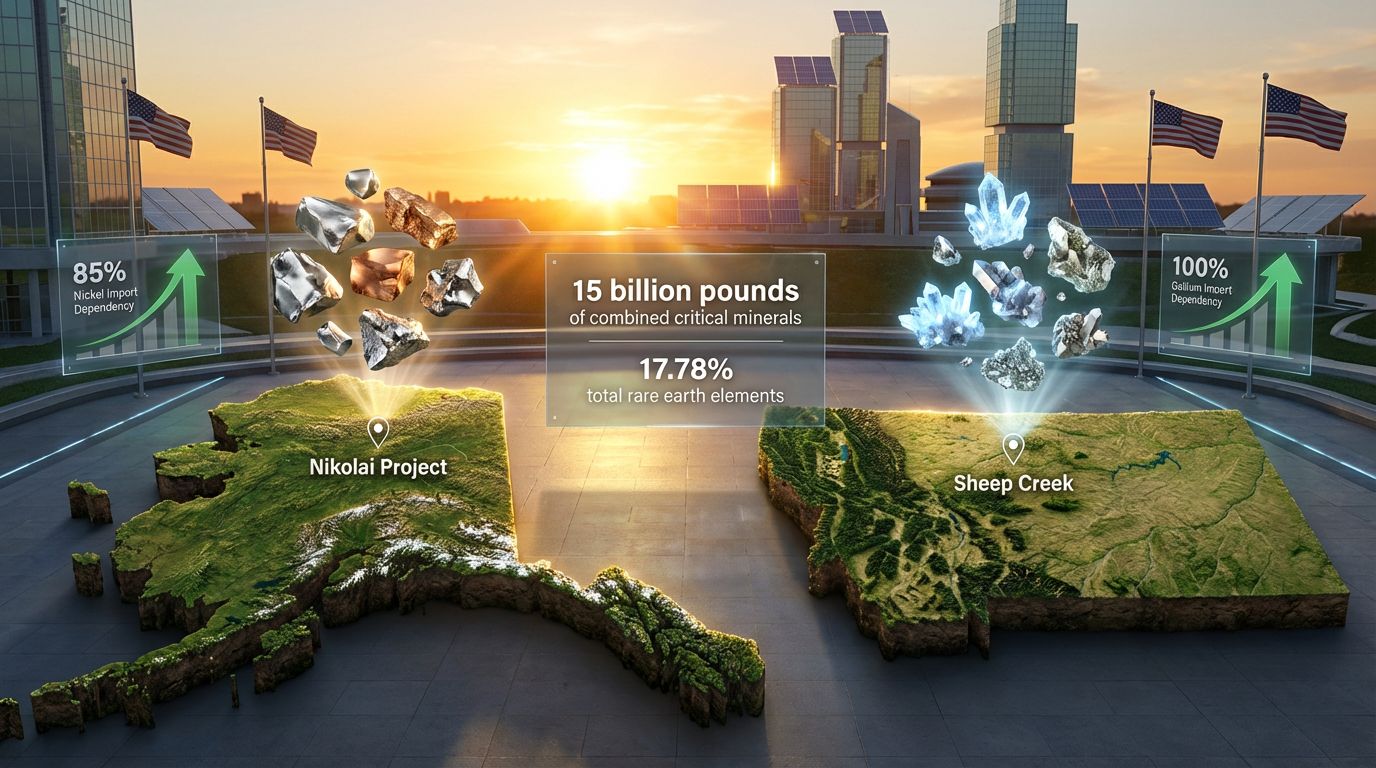

The emergence of new regulatory frameworks restricting defence-related purchases from China and Russia has further amplified concerns about supply security. In addition, recent executive order on minerals initiatives have created urgent demand for alternative supply sources among North American industrial and defence contractors.

Industrial Applications Driving Strategic Demand

Tungsten's unique properties make it essential across three primary application categories, each representing distinct but interconnected demand drivers. Defence applications leverage tungsten's density and temperature resistance in kinetic energy penetrators, missile components, and high-performance alloys that enable next-generation military systems.

Industrial tooling represents the largest consumption segment, utilising tungsten carbide in cutting tools, mining equipment, and wear-resistant components that enable precision manufacturing. However, electronics manufacturing, while representing a smaller volume segment, relies on tungsten for specialised applications where alternative materials cannot provide equivalent performance.

The interconnected nature of these applications means that supply disruptions in one sector can cascade across multiple industries. Consequently, when tungsten supplies become constrained, manufacturers must choose between reducing production, accepting lower-quality alternatives, or paying premium prices for available material.

Evaluating the Mactung Tungsten Mine Resource Base

The Mactung tungsten mine represents one of the most significant tungsten resources outside Chinese control, with geological characteristics that distinguish it from typical tungsten deposits worldwide. Located in the Selwyn Mountains along the Yukon-Northwest Territories border, the deposit contains 41.5 million metric tons of indicated resources averaging 0.73% WO3, equivalent to 665 million pounds of contained tungsten trioxide.

Additional inferred resources total 12.2 million metric tons at 0.59% WO3, contributing another 159 million pounds of contained tungsten trioxide to the project's total inventory. Combined, these resources establish Mactung as containing 824 million pounds WO3, making it one of the largest high-grade tungsten deposits globally.

Grade Quality and Geological Setting

Mactung's average grade of 0.73% WO3 in the indicated resource category significantly exceeds typical tungsten deposit grades, which commonly range between 0.1% and 0.5% WO3. This grade differential translates directly into economic advantages through reduced processing volumes, lower per-unit production costs, and improved concentrate quality.

The deposit's geological classification as a tungsten exoskarn provides additional technical advantages for extraction and processing. Exoskarns form through contact metamorphism between intrusive igneous rocks and carbonate host rocks, creating predictable mineralisation patterns and relatively consistent ore characteristics. At Mactung, tungsten occurs primarily as scheelite (CaWO4), a calcium tungstate mineral that responds well to conventional gravity concentration and flotation processing methods.

Recent drilling programmes have validated the deposit's exceptional characteristics through consistently high-grade intersections. 2025 drilling highlights include:

- 14.84 metres averaging 6.21% WO3 in hole MT25-048

- 29.27 metres averaging 2.56% WO3 in hole MT25-034

- 46.71 metres averaging 1.11% WO3 in hole MT25-035

These results demonstrate both the thickness and grade consistency that distinguish Mactung from typical tungsten deposits, where high-grade zones are often narrow and discontinuous. The combination of substantial thickness and exceptional grades creates opportunities for large-scale, mechanised mining operations that can achieve economies of scale difficult to attain at smaller deposits.

Resource Classification and Development Implications

The indicated resource classification at Mactung reflects a high level of geological confidence based on detailed drilling, sampling, and analysis. Indicated resources require sufficient drilling density and geological understanding to support reliable estimates of tonnage, grade, and mineral content. This classification level enables inclusion in feasibility studies and supports financing decisions for mine development.

Furthermore, the substantial inferred resource component provides additional expansion potential beyond the initial indicated resource base. Current mineral resource update work aims to convert significant portions of inferred material to the indicated category, potentially expanding the resource base available for mine planning and economic evaluation.

Infrastructure Development Challenges and Solutions

Mactung's location in the remote Selwyn Mountains, approximately 200-230 kilometres from Ross River settlement, presents significant infrastructure challenges that must be addressed for commercial development. The project's position along the Yukon-Northwest Territories border adds jurisdictional complexity, requiring coordination between territorial governments and federal agencies across both jurisdictions.

Access Infrastructure and Transportation Networks

Current access to the Mactung project relies on an existing road network that requires substantial upgrades to support commercial mining operations. The road system must accommodate year-round transportation of heavy equipment, supplies, and concentrate shipments while meeting environmental and safety standards across both territorial jurisdictions.

Power infrastructure represents another critical development requirement. Remote mining operations in Canada's North typically require substantial electrical capacity for processing operations, with options including diesel generation, hydroelectric development, or connections to existing power grids. The economic optimisation between power generation methods significantly impacts overall project economics and environmental footprint.

Regulatory Framework and Permitting Processes

The binational nature of the Mactung tungsten mine creates unique regulatory coordination requirements. Environmental assessments must satisfy requirements in both Yukon and Northwest Territories, with consultation processes involving Indigenous communities across territorial boundaries. The 2014 completion of environmental assessment work provided initial regulatory foundation, though updated studies will be required to support current development plans.

Recent technological advances have enabled more efficient baseline data collection and community engagement. LiDAR-equipped drone surveys of the historical Mactung adit captured detailed 3D imagery of underground workings, providing geotechnical data while minimising personnel exposure in remote underground conditions. This technology demonstrates how advanced tools can reduce costs and risks associated with remote site investigation.

Indigenous Community Engagement and Partnership Development

Sustainable mining development in Canada's North requires meaningful engagement with Indigenous communities whose traditional territories encompass project areas. The cross-border nature of Mactung necessitates consultation frameworks that respect traditional territories spanning both Yukon and Northwest Territories.

Effective community engagement extends beyond consultation requirements to encompass economic partnership opportunities, environmental protection protocols, and cultural heritage preservation. These partnerships can provide local knowledge essential for environmental management while creating employment and business opportunities that support regional economic development.

Technical Innovation and Mine Development Economics

The 2025 technical programme at Mactung demonstrates how advanced technologies can reduce development risks while improving economic outcomes. More than 10,000 metres of drilling completed during the 2025 field season provided data for resource validation, geotechnical assessment, and metallurgical testing programmes that will inform feasibility study development.

Advanced Geological Modelling and Resource Characterisation

Modern core scanning technology enables detailed characterisation of geological domains based on geochemistry and mineralogy without requiring extensive physical sampling. This approach provides comprehensive understanding of ore variability while reducing analysis costs and time requirements. The resulting geometallurgical model supports predictive approaches to recovery estimation and metallurgical performance optimisation.

The integration of multiple data streams from drilling, underground inspection, and core analysis creates comprehensive geological models that support mine design optimisation. These models enable identification of high-grade zones for prioritised extraction while minimising waste rock handling and processing costs.

Processing Technology and Recovery Optimisation

Tungsten processing typically involves gravity concentration followed by flotation to produce high-grade tungsten concentrates suitable for further refining. Moreover, this approach aligns with emerging raw materials facility insights that emphasise efficient processing methodologies. Mactung's scheelite mineralisation responds well to conventional processing methods, with gravity concentration effectively separating high-density tungsten minerals from lower-density gangue materials.

The geometallurgical modelling approach enables optimisation of processing parameters based on ore characteristics from specific geological domains. This detailed understanding supports efficient plant design, accurate recovery predictions, and identification of opportunities for process improvements that maximise tungsten extraction while minimising operating costs.

Government Support and Strategic Development Frameworks

The alignment of Canadian and U.S. government support for Mactung reflects broader strategic priorities related to critical mineral security and supply chain resilience. This coordinated approach addresses supply chain vulnerabilities while supporting domestic industrial capacity development, particularly as outlined in the broader critical minerals strategy initiatives across North America.

U.S. Defence Production Act Title III Investment

The U.S. Department of Defence's commitment of $15.8 million USD through the Defence Production Act Title III programme represents a 50% cost-sharing arrangement that reimburses eligible project expenditures. This funding structure enables acceleration of development activities while sharing financial risk between government and private sector participants.

DPA Title III funding specifically targets projects that strengthen domestic supply chains for materials essential to defence manufacturing. Tungsten qualifies for this support due to its critical role in defence applications and the strategic vulnerability created by current import dependence on potentially unreliable suppliers.

The reimbursement structure requires careful coordination between project activities and funding milestones, with expenditures validated against programme requirements before reimbursement. This framework ensures government funds support genuine development progress while maintaining accountability for public investment.

Canadian Critical Minerals Infrastructure Support

Canada's commitment of C$12.9 million through the Critical Minerals Infrastructure Fund addresses infrastructure requirements that extend beyond the immediate Mactung tungsten mine project. This funding targets road and power system upgrades that will support development across the broader Macmillan Pass district, creating regional development benefits that extend to potential future projects.

The infrastructure focus recognises that remote mining development often requires substantial upfront infrastructure investment that can challenge project economics. By providing targeted support for shared infrastructure, government funding can enable multiple projects while reducing individual project development costs.

Global Market Impact and Supply Chain Transformation

Mactung's potential production capacity could materially impact global tungsten supply dynamics, particularly for non-Chinese supply sources that currently total approximately 15,000 tonnes WO3 annually worldwide. The project's scale positions it to become a significant supplier to North American markets while reducing dependence on imports from potentially unreliable sources.

Production Capacity and Market Share Analysis

Preliminary assessments suggest Mactung could support 2,000 tonnes per day processing capacity, though final production targets will depend on feasibility study results and market conditions. At this scale, annual tungsten trioxide production could represent a substantial portion of current non-Chinese global supply, creating meaningful supply diversification for Western industrial consumers.

The timing of Mactung's potential market entry coincides with growing demand for supply chain diversification among aerospace, defence, and industrial manufacturers. Many companies are actively seeking alternative suppliers to reduce concentration risk, creating market opportunities for new production sources that can meet quality and reliability requirements.

Strategic Stockpiling and Supply Security Implications

Government strategic stockpiles of critical materials serve as buffer supplies during supply disruptions while providing price stability during market volatility. Domestic production sources like the Mactung mine development can support stockpile requirements while ensuring supply security during extended disruptions to international trade.

The development of North American tungsten production capacity also supports allied nations' supply security through established trade relationships and defence cooperation agreements. This broader strategic value extends beyond immediate economic returns to encompass long-term security and technological competitiveness considerations.

Environmental Management and Sustainable Development

Mining development in Canada's North requires comprehensive environmental management that addresses ecosystem protection, water quality maintenance, and climate considerations for year-round operations. The subarctic location of Mactung creates specific challenges related to seasonal weather patterns, permafrost conditions, and sensitive watershed management.

Water Quality Protection and Watershed Management

The Selwyn Mountains watershed requires careful protection during mining operations, with water quality monitoring protocols designed to detect and prevent contamination. Tungsten processing typically generates tailings that require secure containment and long-term management to prevent environmental impacts.

Modern mining technologies enable more precise waste management and water treatment compared to historical operations. Advanced tailings management systems, real-time water quality monitoring, and predictive environmental modelling support sustainable operations that minimise ecological impacts while maintaining operational efficiency.

Wildlife Habitat Conservation and Protection Measures

The remote location of Mactung encompasses important wildlife habitat that supports various species adapted to northern ecosystems. Mining operations must integrate habitat protection measures with operational requirements, often through seasonal scheduling, migration corridor protection, and habitat enhancement programmes.

Baseline environmental studies provide essential data for impact assessment and mitigation planning. These studies establish pre-development conditions against which operational impacts can be measured and management effectiveness evaluated throughout mine life.

Development Timeline and Commercial Production Pathway

The transition from exploration and development to commercial production requires completion of multiple interdependent activities, from feasibility studies and permitting to construction and commissioning. The timeline for these activities significantly impacts project economics through financing costs, market timing, and competitive positioning.

Feasibility Study Development and Engineering Parameters

The comprehensive 2025 technical programme provides the foundation for feasibility study development, with integrated data from drilling, metallurgical testing, geotechnical assessment, and environmental studies. The feasibility study will establish definitive production targets, capital requirements, operating costs, and economic projections that support final investment decisions.

Engineering design work encompasses mine planning, processing plant specification, infrastructure requirements, and environmental management systems. The integration of these elements determines overall project viability and optimisation opportunities that maximise economic returns while meeting environmental and social requirements.

Market Entry Strategy and Customer Development

Successful tungsten concentrate marketing requires customer qualification processes that demonstrate product quality and supply reliability. Defence and aerospace applications often require extensive qualification programmes that validate material properties and establish approved supplier status.

The development of long-term supply agreements provides revenue certainty that supports project financing while giving customers supply security. These relationships often develop during the pre-production phase through sample programmes, technical discussions, and commercial negotiations that establish terms for future supply.

Investment Implications and Economic Development Opportunities

The Mactung tungsten mine represents significant capital investment requirements balanced against long-term strategic value creation. Project economics must account for remote location challenges, infrastructure development costs, and market positioning within global supply chains.

Capital Requirements and Financing Considerations

Large-scale mining development typically requires substantial upfront capital investment for mine construction, processing facilities, and supporting infrastructure. Government funding commitments through DPA Title III and Canadian infrastructure programmes reduce financing requirements while providing development risk mitigation.

The strategic value of domestic tungsten production creates opportunities for government-backed financing programmes, strategic partnerships with industrial consumers, and investment from funds focused on critical materials supply chain security. These financing sources recognise value creation beyond traditional mining investment metrics.

Regional Economic Impact and Community Development

Mining development in Canada's North creates employment opportunities and economic activity that extend beyond direct project employment. Construction phases provide temporary employment for specialised trades, while operations generate sustained employment for local communities and service providers.

The infrastructure investments required for Mactung development create regional benefits that support broader economic development across the Macmillan Pass district. Road and power infrastructure improvements enable additional resource development while supporting community access and economic diversification.

Strategic Assessment of North American Critical Minerals Security

The development of domestic critical mineral production capacity represents a fundamental shift in strategic resource planning, moving from import dependence toward supply chain resilience and security. Mactung's role in this transition extends beyond tungsten supply to encompass broader critical minerals development capabilities and regional expertise.

Integration with Broader Critical Minerals Frameworks

National critical minerals strategies in both Canada and the United States prioritise domestic supply development, strategic stockpiling, and allied cooperation to reduce dependence on potentially unreliable suppliers. Mactung's development aligns with these strategic objectives while demonstrating commercial viability of domestic production.

The success of projects like Mactung creates precedents for government support, financing mechanisms, and regulatory frameworks that can accelerate development of additional critical mineral projects. This broader impact multiplies the strategic value of individual project development beyond immediate production contributions.

Investment and Policy Implications

The coordinated government support for Mactung demonstrates policy alignment between economic development objectives and strategic security requirements. This alignment creates investment opportunities that benefit from both commercial returns and strategic value recognition.

Please note: This analysis contains forward-looking statements and projections based on current development plans and market conditions. Actual results may differ materially from projections due to technical, market, regulatory, or other factors beyond current control or prediction. Investment decisions should consider comprehensive due diligence and professional advice appropriate to individual circumstances.

The evolution of critical minerals markets continues to create opportunities for strategic investment and policy development that balances commercial viability with long-term security objectives. Projects like the Mactung tungsten mine represent important steps toward supply chain resilience while demonstrating the potential for domestic resource development in challenging but strategically important locations.

Ready to Capitalise on Critical Minerals Before Major Market Movements?

Discovery Alert's proprietary Discovery IQ model delivers real-time notifications on significant ASX mineral discoveries, instantly identifying actionable opportunities in the critical minerals sector ahead of broader market recognition. Begin your 30-day free trial today and secure your market-leading advantage in this rapidly evolving strategic resource landscape.