Market Psychology and Risk Assessment in Current Energy Trading

Global oil markets face unprecedented complexity as geopolitical risk keeps oil prices elevated through persistent premium pricing structures that challenge traditional supply-demand fundamentals. Current market conditions reflect a sophisticated interplay between physical supply constraints, speculative positioning, and risk perception mechanisms that extend far beyond simple production disruptions.

Energy traders and institutional investors now operate within a framework where uncertainty itself becomes a tradeable commodity. The psychological components driving price volatility have evolved into systematic risk factors that require comprehensive analytical approaches for effective portfolio management.

What Drives Oil Price Volatility in Today's Geopolitical Climate?

Understanding the Risk Premium Framework

Modern oil pricing structures incorporate multiple layers of risk assessment that extend beyond traditional market fundamentals. The geopolitical risk premium represents the additional cost that market participants willingly pay to secure energy supplies amid uncertain political environments.

Market psychology amplifies supply disruption fears through mechanisms that create feedback loops between futures trading and spot market pricing. When geopolitical tensions escalate, traders often implement precautionary positioning strategies that can inflate prices by 20-30% beyond fundamental supply-demand factors, according to International Energy Agency analysis.

The mathematical framework for risk premium calculation involves probability assessments of supply disruption scenarios, weighted by potential impact magnitude and duration. This creates a complex pricing structure where perceived threats carry immediate market consequences regardless of actual supply availability.

Key Variables That Trigger Price Spikes

Supply chain vulnerability assessments focus on critical infrastructure dependencies that create systemic risks across global energy networks. Transportation chokepoint analysis reveals that approximately 20-21 million barrels per day transit through the Strait of Hormuz, representing roughly 20% of global oil consumption, according to U.S. Energy Information Administration data.

Strategic reserve utilisation patterns demonstrate government intervention capabilities during supply emergencies. The United States maintains approximately 370-380 million barrels in its Strategic Petroleum Reserve as of late 2024, representing 90-100 days of import coverage capacity.

Current market data shows WTI crude trading at $58.97 per barrel and Brent crude at $62.79 per barrel, with both benchmarks experiencing modest daily declines of approximately 0.60%, indicating relative stability amid ongoing regional tensions.

Which Regional Conflicts Create the Highest Oil Price Impact?

Middle East Tension Escalation Scenarios

Iran-Israel conflict implications extend beyond direct military engagement to encompass regional proxy networks and energy infrastructure vulnerability. The strategic importance of the Strait of Hormuz creates multiplier effects where even credible threats of disruption can generate significant price responses.

Regional proxy conflicts affecting production capacity include ongoing tensions involving Houthi forces in Yemen, whose attacks on commercial shipping in the Red Sea have diverted approximately 4-5 million barrels per day of oil traffic around the Cape of Good Hope since late 2023. This rerouting adds 10-14 days to transit times and increases shipping costs by 40-60%.

Saudi Arabia's strategic response mechanisms centre on its 2-3 million barrels per day of spare production capacity, positioning the kingdom as the primary swing producer capable of market stabilisation. However, recent policy statements from Saudi leadership indicate prioritisation of price support over automatic production increases during supply disruptions.

| Regional Conflict Zone | Daily Production Risk | Estimated Price Impact | Market Response Timeline |

|---|---|---|---|

| Strait of Hormuz Closure | 20-21 million bpd | $20-50/barrel increase | 6-48 hours |

| Red Sea Shipping Attacks | 4-5 million bpd | $5-15/barrel increase | 1-5 days |

| Russia-Ukraine Disruption | 3-4 million bpd | $8-20/barrel increase | Ongoing volatility |

| Saudi Infrastructure Attack | 5-6 million bpd | $15-40/barrel increase | 24-72 hours |

Eastern European Energy Security Dynamics

Russian export redirection strategies have fundamentally altered global trade flows since February 2022. Furthermore, the US oil production decline has compounded supply concerns, with Russian crude oil production declining from approximately 10.5 million barrels per day pre-conflict to 8.5-9 million barrels per day by late 2024 due to sanctions and logistical constraints.

European alternative supply development initiatives have accelerated diversification efforts, though infrastructure limitations constrain rapid transitions away from Russian energy dependence. Pipeline infrastructure vulnerabilities remain significant concern points for European energy security planning.

How Do Sanctions Reshape Global Oil Trade Flows?

Economic Warfare Through Energy Controls

Secondary sanctions impact on neutral traders creates chilling effects that extend beyond formal sanctions regimes. Financial institutions demonstrate heightened risk aversion toward any transactions involving sanctioned entities, forcing market participants toward alternative payment mechanisms and trade financing structures.

The shadow fleet operations have emerged as a significant market distortion factor, with vessels operating under obscured ownership structures transporting approximately $5.4 billion worth of Russian oil in 2024. This parallel trading system creates pricing inefficiencies and complicates traditional market analysis approaches.

Price cap mechanisms implemented by G7 nations have achieved partial effectiveness in constraining Russian federal revenues by an estimated $30-40 billion annually, while circumvention strategies have reduced overall impact over time.

Asian Market Reconfiguration Patterns

China and India's strategic purchasing behaviour demonstrates sophisticated arbitrage opportunities arising from sanctions-driven market fragmentation. India's Russian crude imports increased from approximately 0.5 million barrels per day in early 2022 to 1.5-2 million barrels per day by late 2024.

China's crude oil imports from Russia expanded from approximately 3 million barrels per day in 2020 to 4 million barrels per day by 2024, establishing Russia as China's largest crude supplier ahead of Saudi Arabia. However, US-China trade effects continue to complicate these arrangements.

Alternative payment systems development has accelerated adoption of yuan and ruble settlements for energy transactions, though these mechanisms carry increased transaction costs and reduced market liquidity compared to dollar-denominated trade.

What Role Do Strategic Petroleum Reserves Play in Price Stabilisation?

Government Intervention Mechanisms

Strategic reserve releases function as circuit breaker mechanisms rather than permanent price solutions. Their effectiveness depends critically on timing, coordination between major consuming nations, and market messaging strategies that signal government commitment to price stability.

The April-October 2022 U.S. Strategic Petroleum Reserve releases totalling 180 million barrels reduced crude oil prices by an estimated $5-10 per barrel relative to baseline projections, demonstrating measurable but limited impact during extended supply disruptions.

Reserve capacity limitations across major economies create constraints on sustained intervention capabilities:

| Country | Reserve Capacity | Days of Supply Coverage | Release Authority | Estimated Market Impact |

|---|---|---|---|---|

| United States | 714 million barrels | 90-100 days | Presidential directive | High ($5-15/barrel) |

| China | 400-500 million barrels | 80-90 days | State Council | Medium-High ($3-8/barrel) |

| Japan | 330+ million barrels | 200+ days | METI coordination | Medium ($2-5/barrel) |

| Germany | 90+ million barrels | 90 days | Federal ministry | Low-Medium ($1-3/barrel) |

Emergency Response Protocol Effectiveness

International Energy Agency coordinated releases demonstrate enhanced market impact through synchronised timing and messaging. The March 2022 coordinated release represented the largest such action in IEA history, involving 180 million barrels from member countries.

Reserve reconstitution requirements create secondary market support mechanisms, as governments must subsequently repurchase oil at market prices to restore strategic stockpile levels. Additionally, OPEC meeting insights reveal how producer coordination affects these strategic calculations.

How Do Transportation Chokepoints Amplify Geopolitical Risk?

Critical Maritime Passage Analysis

The Strait of Hormuz vulnerability assessment reveals extreme concentration risk in global energy transportation networks. At its narrowest point, the strait measures only 21 miles wide, with 2-mile-wide shipping lanes in each direction under international maritime law.

Suez Canal alternative routing through the Cape of Good Hope adds 10-14 days to transit times and increases shipping costs by 40-60% for Europe-bound crude shipments. Recent Red Sea shipping disruptions have forced approximately 4-5 million barrels per day to utilise longer routing options.

Malacca Strait security considerations affect approximately 15-16 million barrels per day of crude oil and petroleum products flowing between Middle Eastern suppliers and Asian consumers, creating additional concentration risk in global supply chains.

Pipeline Infrastructure as Geopolitical Weapons

Cross-border energy dependency risks create leverage opportunities for producer nations and transit countries. Pipeline sabotage and cyber-attack vulnerabilities have demonstrated capacity to disrupt regional energy supplies with minimal physical intervention requirements.

Alternative route development strategies require substantial capital investment and extended construction timelines, limiting short-term risk mitigation options for import-dependent nations. Consequently, geopolitical risks maintain upward pressure on energy markets.

What Market Psychology Factors Intensify Price Volatility?

Speculative Trading During Crisis Events

Algorithmic trading response patterns amplify initial price movements through rapid position adjustments based on news sentiment analysis and technical indicators. High-frequency trading systems can execute thousands of transactions within seconds of geopolitical event announcements.

Hedge fund positioning strategies often involve precautionary demand increases during tension escalations, where funds purchase oil futures contracts as hedges against broader portfolio risks rather than based on supply-demand fundamentals.

Retail investor panic-buying behaviour contributes to volatility spikes, particularly in energy sector equities and exchange-traded funds tracking oil prices.

Media Coverage Impact on Market Sentiment

News cycle acceleration effects create feedback loops where initial price movements generate additional media coverage, which subsequently influences further trading activity. Social media rumour amplification can trigger significant price swings based on unverified information.

Expert commentary influence patterns demonstrate correlation between respected analyst statements and subsequent market movements, indicating the psychological weight of authoritative opinions in uncertain environments.

Which Economic Indicators Signal Sustained Price Elevation?

Demand-Side Pressure Points

Industrial consumption resilience metrics reveal varying price sensitivity across different economic sectors. Transportation fuel demand demonstrates relatively low short-term elasticity, meaning consumption levels remain stable despite price increases.

Seasonal consumption pattern disruptions create additional complexity in demand forecasting, particularly when geopolitical events coincide with peak consumption periods such as winter heating seasons or summer driving periods.

Supply-Side Constraint Measurements

Global spare production capacity utilisation rates currently operate near historical averages, with OPEC+ maintaining approximately 3-4 million barrels per day of unused production capacity. This limited buffer constrains the industry's ability to respond to supply disruptions.

Production maintenance scheduling impacts create temporary supply reductions during planned facility upgrades and repairs. New field development delays compound long-term supply constraints as geopolitical uncertainties discourage capital investment in certain regions.

How Do Currency Fluctuations Compound Geopolitical Price Effects?

Dollar Strength and Oil Pricing Dynamics

The petrodollar system stability directly influences oil pricing mechanisms, as the majority of global crude oil transactions occur in U.S. dollars. Dollar strength creates affordability pressure for non-dollar economies, potentially reducing demand and creating downward price pressure.

Alternative currency settlement trends have accelerated amid geopolitical tensions, with Russia and China increasing yuan-denominated energy transactions. However, these alternatives currently represent a small fraction of global oil trade volumes.

Exchange rate volatility multiplier effects can amplify oil price impacts for importing nations, as currency devaluation increases the domestic cost of energy imports beyond the underlying commodity price changes. Moreover, US economy tariffs further complicate these dynamics.

Regional Currency Crisis Amplification

Emerging market import cost pressures intensify during periods of combined currency weakness and elevated oil prices. Central bank intervention strategies often involve foreign exchange reserve depletion to stabilise domestic fuel costs.

Trade balance disruption cascades occur when energy import costs consume increasing portions of foreign currency earnings, constraining other import activities and economic growth.

What Investment Strategies Respond to Geopolitical Oil Price Risk?

Portfolio Hedging Mechanisms

Energy sector equity positioning strategies focus on companies with strong balance sheets and operational flexibility to navigate volatile pricing environments. Integrated oil companies often demonstrate greater resilience than pure-play upstream producers during geopolitical crises.

Commodity futures diversification approaches include:

• Direct crude oil futures contracts for price exposure hedging

• Energy sector ETFs for broader industry participation

• Refined product futures (gasoline, heating oil) for downstream exposure

• Natural gas positions as complementary energy commodity exposure

Currency hedge implementation approaches protect against exchange rate risks that compound oil price volatility for international investors. Furthermore, gold safe haven dynamics offer alternative hedging opportunities.

Long-term Energy Security Investments

Renewable energy transition acceleration has gained momentum as energy independence strategies reduce exposure to geopolitical oil price volatility. Solar and wind energy investments provide portfolio diversification benefits during fossil fuel price spikes.

Strategic stockpile expansion justifications include both government-level reserve increases and corporate inventory management strategies that balance carrying costs against supply security benefits.

Alternative supply chain development priorities focus on domestic production capacity expansion and supplier diversification to reduce dependence on geopolitically sensitive regions.

How Will Geopolitical Risk Evolution Shape Future Oil Markets?

2025-2027 Scenario Planning Framework

Conflict resolution probability assessments suggest continued elevated risk premiums through mid-decade, as structural tensions between major powers show limited near-term resolution prospects. Middle East stabilisation remains contingent on multiple interconnected diplomatic processes.

New tension emergence likelihood analysis indicates expanding geographic scope of potential disruption events, including cyber warfare threats to energy infrastructure and climate-related extreme weather impacts on production facilities.

Technology disruption impact projections suggest gradual reduction in oil demand growth rates beginning in the late 2020s, though absolute demand levels may remain elevated for the current decade.

Strategic Adaptation Requirements

Supply chain resilience building imperatives include:

• Infrastructure hardening against physical and cyber threats

• Route diversification to reduce chokepoint dependencies

• Storage capacity expansion for strategic and commercial purposes

• Emergency response protocol development for rapid supply disruption management

Diplomatic engagement prioritisation focuses on multilateral cooperation mechanisms for energy security assurance and crisis management coordination between major consuming and producing nations.

Energy independence acceleration timelines vary significantly across different regions and economic development levels, with developed economies generally demonstrating faster transition capabilities than emerging markets.

Navigating the New Era of Energy Geopolitics

Risk Assessment Framework Implementation

Market participants must develop sophisticated analytical capabilities that integrate traditional supply-demand analysis with geopolitical risk modelling. This requires continuous monitoring of political developments, military tensions, and diplomatic initiatives that could affect energy supply chains.

Portfolio diversification strategies should account for correlation risks between different energy assets during crisis periods, as geopolitical risk keeps oil prices elevated through events that often affect multiple commodity markets simultaneously.

Monitoring system establishment priorities include:

• Real-time geopolitical intelligence from credible sources

• Supply chain vulnerability mapping for critical infrastructure assets

• Currency and commodity correlation analysis for comprehensive risk assessment

• Alternative scenario modelling for various conflict escalation pathways

Long-term Market Structure Evolution

Geopolitical risk keeps oil prices elevated as these premiums appear likely to become permanent structural features of oil pricing rather than temporary aberrations. This normalisation of elevated risk pricing creates both challenges and opportunities for energy market participants.

Alternative energy transition acceleration will gradually reduce the strategic importance of oil chokepoints and producer nation leverage, though this transition timeline extends over decades rather than years.

Global energy security redefinition requirements involve rethinking traditional assumptions about supply reliability, pricing stability, and international cooperation in energy markets. The integration of renewable energy sources, energy storage technologies, and demand management systems will create more resilient but also more complex energy systems.

The convergence of technological advancement, geopolitical realignment, and climate policy implementation suggests that current market dynamics represent transitional rather than permanent conditions. However, the persistence of geopolitical tensions indicates that geopolitical risk keeps oil prices elevated and will likely remain characteristic of global energy markets throughout the remainder of this decade.

This analysis is for informational purposes only and should not be considered as investment advice. Energy markets carry significant risks, and past performance does not guarantee future results. Investors should conduct their own research and consider consulting with qualified financial advisors before making investment decisions.

Looking for the Next Energy Sector Breakthrough?

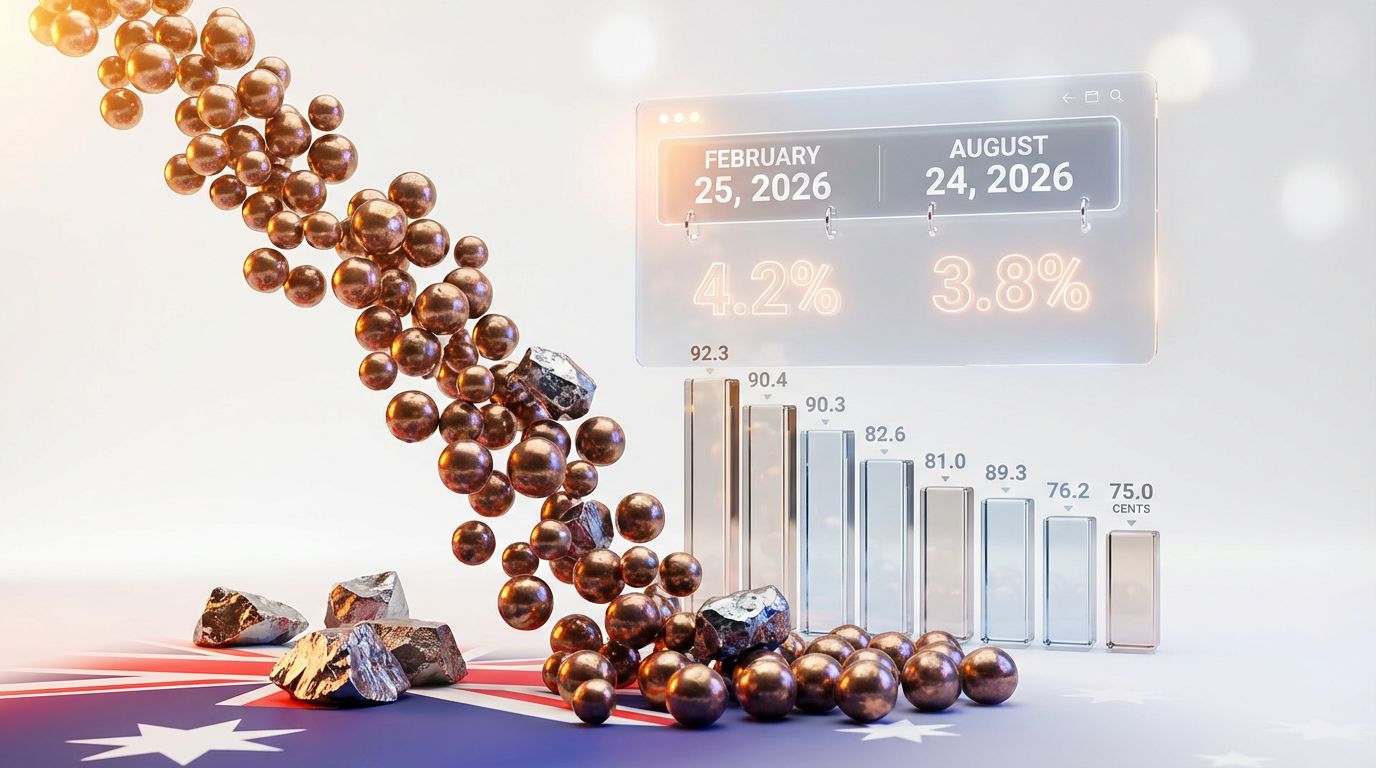

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries, instantly empowering subscribers to identify actionable opportunities ahead of the broader market. Understand why major mineral discoveries can lead to exceptional market returns by exploring Discovery Alert's dedicated discoveries page, then begin your 30-day free trial to position yourself ahead of the market.