Understanding the Structural Forces Behind Metal Price Surges

Global commodity markets are experiencing unprecedented volatility patterns that extend far beyond traditional cyclical movements. The intersection of supply chain fragility, geopolitical tensions, and technological transformation creates systemic pressures that fundamentally alter how industrial metals flow through interconnected global networks. These structural forces represent more than temporary market dislocations, revealing deeper vulnerabilities in the foundation of modern commodity distribution systems.

The copper price surge on global supply squeeze exemplifies this transformation, where price movements reflect complex interactions between physical supply constraints, policy uncertainty, and evolving demand patterns. Unlike previous commodity cycles driven primarily by economic growth correlations, current dynamics incorporate technological disruption, environmental regulations, and strategic resource positioning that operate independently from traditional macroeconomic indicators.

What Economic Factors Create Sustained Metal Price Pressure?

Supply Chain Disruption Amplification

Multiple geographic regions are experiencing simultaneous production challenges that compound global supply constraints. The Democratic Republic of Congo's Kamoa-Kakula complex faced production downgrades due to flooding, while operational disruptions across Chile, Indonesia, and Africa have collectively reduced available supply by significant margins.

Regional Production Impact Analysis:

| Region | Production Disruption | Contributing Factors | Global Supply Share |

|---|---|---|---|

| DRC | Kamoa-Kakula downgrade | Flooding, infrastructure challenges | 8-10% |

| Chile | Multiple mine constraints | Water scarcity, labour issues | 28% |

| Indonesia | Processing limitations | Environmental compliance | 3-4% |

| Africa (broader) | Infrastructure bottlenecks | Political instability, logistics | 15% |

Glencore's 40% production decline since 2018 demonstrates how operational challenges cascade through integrated mining systems. When major producers reduce output, the global supply base contracts faster than demand can adjust, creating sustained pricing pressure that persists beyond immediate disruption periods.

Furthermore, the Argentina copper system demonstrates how emerging markets face similar infrastructure challenges that compound global supply constraints.

Trade Flow Redistribution Dynamics

The emergence of geographic pricing arbitrage creates fundamental distortions in commodity flow patterns. US-European copper price differentials of $200-300 per tonne exceed transportation costs by substantial margins, indicating structural market imbalances rather than temporary inefficiencies.

Strategic stockpiling behaviour has intensified as market participants anticipate policy changes. US import volumes have reached 40% above historical averages, while European inventory levels approach critical drawdown thresholds. This redistribution concentrates supply in select geographic regions, creating scarcity in traditional demand centres.

Key Arbitrage Indicators:

- Asian market premiums: 15-20% above baseline pricing

- US port inventory accumulation: Unprecedented levels

- European supply tightening: Critical threshold approaching

- Processing queue extensions: Lead times expanding significantly

How Do Geopolitical Trade Policies Reshape Commodity Markets?

Anticipatory Market Positioning

Commodity markets increasingly price potential policy scenarios into immediate trading decisions, creating self-reinforcing cycles where speculation becomes market reality. The anticipation of US tariff implementation on primary copper forms has triggered record import volumes, fundamentally altering global supply distribution patterns.

Moreover, current US–China trade strategies continue to influence global commodity flows through strategic positioning and trade route modifications.

Market participants are positioning ahead of potential tariff implementation toward late 2026, creating front-loaded demand that redistributes global inventory pools. This anticipatory behaviour represents a structural shift from reactive to proactive commodity pricing mechanisms.

Policy-Driven Supply Chain Reallocation:

- Accelerated import scheduling ahead of duty imposition

- Metal flow redirection from global networks to US storage facilities

- Premium elevation in non-US markets due to supply withdrawal

- Extended inventory cycles suppressing future import demand

Regional Supply Security Imperatives

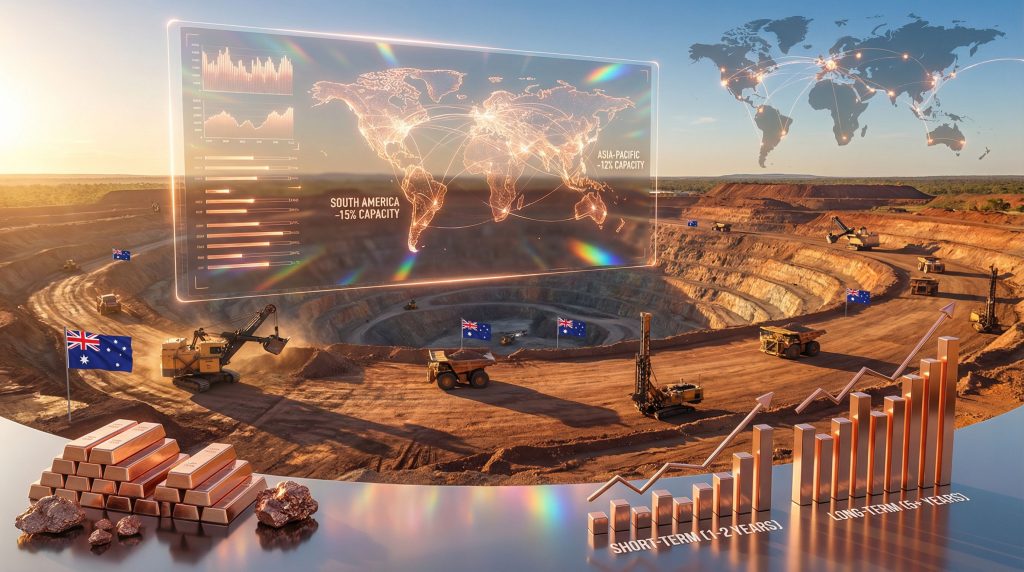

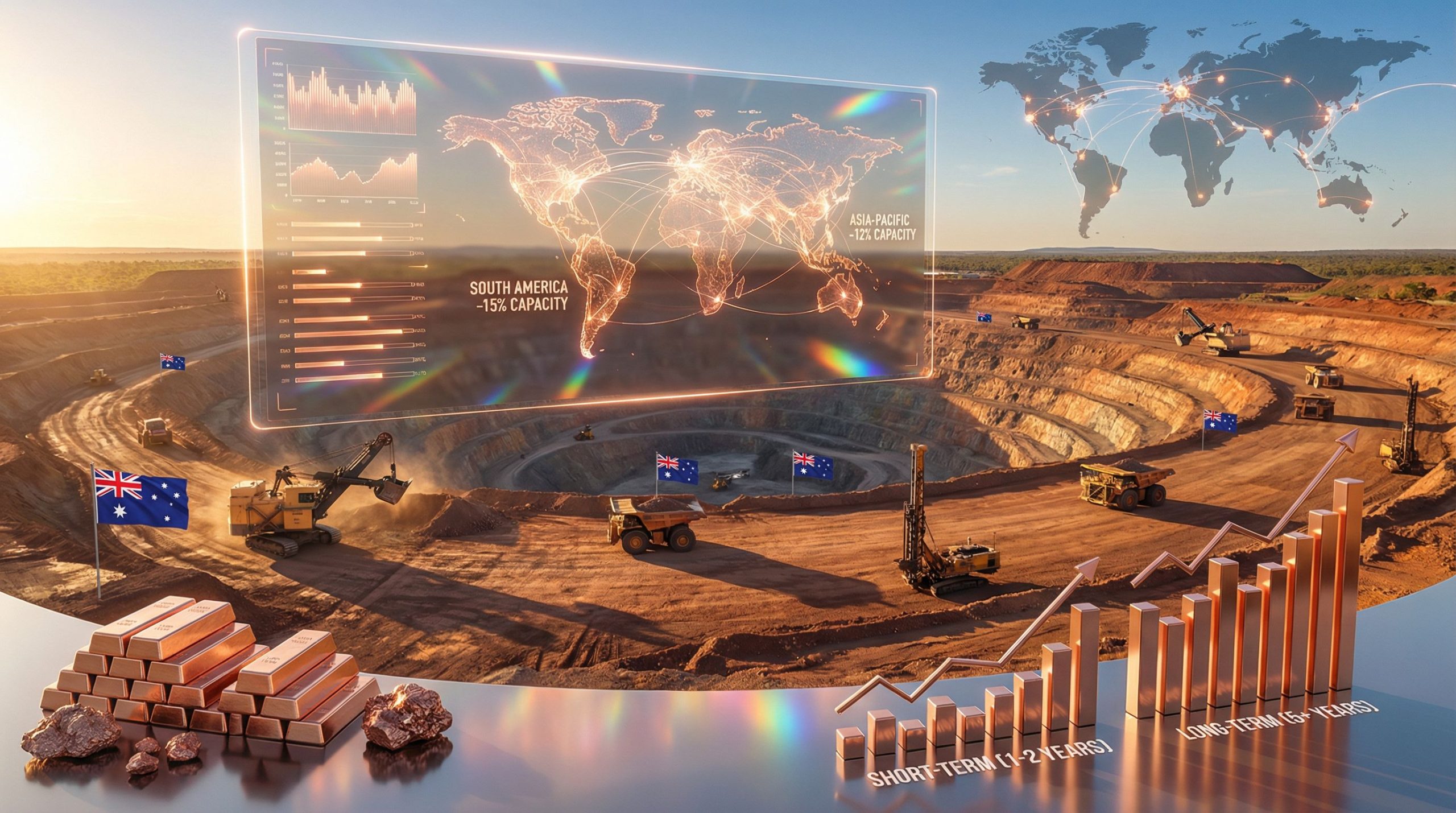

The movement toward supply chain regionalisation creates strategic advantages for geographically positioned producers. Australian copper operations benefit from proximity to Asian processing centres while maintaining Western regulatory frameworks, providing defensive characteristics during periods of global supply uncertainty.

Trade policy uncertainty has elevated the strategic value of politically stable resource jurisdictions. However, the impact of tariffs and investment markets extends beyond individual commodities to reshape entire investment allocation strategies.

Why Are Traditional Demand Forecasting Models Failing?

Structural Demand Transformation

Copper consumption patterns are fundamentally decoupling from GDP-correlated demand models. The transition toward electrification, renewable energy integration, and data infrastructure creates consumption profiles that operate independently from traditional economic cycles.

Demand Evolution by Sector:

| Sector | Traditional Driver | Emerging Driver | Growth Characteristic |

|---|---|---|---|

| Transportation | Vehicle production volume | Electric vehicle penetration rates | Exponential, technology-driven |

| Energy Infrastructure | Grid maintenance cycles | Renewable capacity additions | Policy-driven structural growth |

| Data Systems | Consumer electronics refresh | AI infrastructure expansion | Unprecedented scaling requirements |

| Construction | GDP growth correlation | Smart infrastructure integration | Accelerating independent of GDP |

Electric vehicles require 3-4 times more copper content than conventional vehicles, with approximately 40-50 kg of copper per electric vehicle. As global EV production scales toward projected 2030 targets, this represents demand growth that traditional forecasting models failed to anticipate adequately.

Technology-Driven Consumption Patterns

Data centre expansion for AI infrastructure has created unprecedented copper demand for electrical distribution, cooling systems, and transmission infrastructure. This demand segment was negligible in copper forecasts from 10-15 years ago but now represents a significant growth driver that operates independently from traditional industrial demand cycles.

Renewable energy installations require substantial copper content: solar installations demand 15-25 kg per kilowatt of capacity, while wind installations require 100-150 kg per megawatt. As global renewable capacity additions accelerate through policy mandates rather than purely economic drivers, the copper price surge on global supply squeeze continues to reflect these fundamental demand transformations.

What Supply-Side Bottlenecks Create Systemic Risk?

Processing Capacity Constraints

Global copper processing represents a critical infrastructure chokepoint where mine concentrate must convert to commercial-grade cathode. When treatment charges approach zero levels, this signals severe processing capacity constraints that create supply walls independent of mine production capacity.

Processing Bottleneck Indicators:

- Treatment charges near zero: Indicates acute concentrate shortage relative to smelting capacity

- Smelter utilisation rates: Operating at maximum sustainable levels

- Refining queue delays: Extended lead times for processed copper products

- Processing margin compression: Limited capacity driving cost inflation

The smelting and refining process chain creates multiple constraint points. Copper concentrate (30-40% copper content) requires smelting to produce blister copper (99% purity), followed by electrorefining to achieve 99.99% cathode copper. Each stage has finite capacity limitations, and overall throughput cannot exceed the slowest processing stage.

Capital Investment Timeline Lag

Mining project development cycles extend 5-10 years from investment decision to production output. Current supply availability reflects investment decisions made in 2015-2020, while today's investment choices determine supply availability through 2030-2035.

This extended timeline creates structural supply deficits when demand growth accelerates faster than production capacity expansion. Environmental permitting, infrastructure development, and technical commissioning cannot be accelerated significantly, creating inflexibility in supply response to demand surges.

In addition, the importance of gold–copper exploration becomes evident as companies seek diversified portfolios to mitigate single-commodity exposure risks.

How Should Investors Interpret Market Structure Changes?

Australian Copper Sector Performance

ASX-listed copper producers have demonstrated strong performance correlating with global supply constraints and pricing dynamics. The sector benefits from multiple structural advantages including political stability, established infrastructure, and proximity to Asian processing centres.

ASX Copper Producer Performance (Recent Period):

| Company | ASX Code | Primary Assets | Performance Metrics | Strategic Position |

|---|---|---|---|---|

| Sandfire Resources | SFR | Motheo (Botswana), DeGrussa (WA) | 25% share price increase (3 months) | Diversified production base |

| 29Metals | 29M | Golden Grove, Capricorn Copper | 18% rebound from September lows | Operational turnaround story |

| Aeris Resources | AIS | Tritton Operations (NSW) | 15% recent gains | Focused domestic operations |

Emerging exploration companies including Coda Minerals (COD) and AIC Mines (A1M) have attracted investor attention with 10-20% gains in recent weeks, reflecting market appetite for copper exposure across the development spectrum.

According to recent market analysis, copper prices have reached unprecedented levels as global supply concerns intensify across major producing regions.

Investment Strategy Framework

The copper price surge on global supply squeeze transition from cyclical commodity to strategic resource requires updated analytical frameworks incorporating geopolitical, technological, and environmental factors alongside traditional supply-demand metrics.

Portfolio Allocation Guidelines:

| Investment Horizon | Risk Profile | Recommended Strategy | Key Considerations |

|---|---|---|---|

| Short-term (1-2 years) | High volatility tolerance | Tactical overweight | Policy uncertainty, supply disruptions |

| Medium-term (3-5 years) | Structural theme exposure | Strategic allocation | Electrification transition |

| Long-term (5+ years) | Megatrend positioning | Core holding approach | Fundamental demand transformation |

Australian copper producers provide defensive characteristics through regulatory predictability, established export infrastructure, and currency hedging benefits. Resource quality supports long-term extraction economics even as global ore grades decline.

What Macro-Economic Indicators Signal Market Direction?

Leading Economic Framework

Copper market analysis requires monitoring frameworks that extend beyond traditional economic indicators to incorporate technological adoption rates, policy implementation timelines, and infrastructure development cycles.

Critical Monitoring Metrics:

- Global Manufacturing PMI: Near-term demand trend indicator

- Infrastructure spending commitments: Medium-term demand foundation

- Electric vehicle sales growth: Structural demand transformation metric

- Renewable energy capacity additions: Long-term demand baseline

- Central bank policy divergence: Currency and commodity flow impacts

Risk Assessment Matrix

Macro-Economic Risk Factors:

| Risk Category | Probability Assessment | Impact Level | Mitigation Approaches |

|---|---|---|---|

| Supply disruption escalation | High probability | Severe impact | Diversified sourcing, strategic reserves |

| Trade policy intensification | Medium probability | High impact | Regional supply agreements |

| Demand acceleration | High probability | Positive impact | Capacity expansion investment |

| Economic slowdown | Low probability | Moderate impact | Counter-cyclical positioning |

Current market structure suggests supply-side risks outweigh demand-side concerns. Global inventory drawdowns, processing capacity constraints, and extended development timelines create vulnerability to additional supply disruptions that could amplify pricing pressures.

Furthermore, copper-uranium investment opportunities have emerged as investors seek exposure to multiple strategic minerals through diversified resource companies.

How Do Currency Dynamics Affect Commodity Pricing?

Multi-Currency Analysis Framework

Copper pricing reflects complex interactions between USD strength, regional currency movements, and local cost structures. Australian producers benefit when AUD weakness coincides with strong copper prices, creating favourable margin expansion conditions.

Currency Impact Assessment:

- USD strength: Reduces competitive positioning for non-USD producers

- AUD weakness: Enhances Australian producer margin profiles

- Regional currency volatility: Creates arbitrage opportunities for flexible operators

- Hedging strategies: Risk management approaches for currency exposure

The commodity pricing in USD while many producers operate with local currency cost bases creates natural hedging mechanisms. Australian copper operations particularly benefit from this dynamic when global copper prices strengthen while the AUD remains relatively weak against the USD.

What Long-Term Structural Changes Are Emerging?

Supply Chain Regionalisation Trends

The movement toward regional supply chain resilience creates opportunities for geographically advantaged producers. Australian operations benefit from proximity to Asian processing and consumption centres while maintaining Western regulatory and political stability frameworks.

Supply chain regionalisation prioritises reliability and security over pure cost optimisation. This structural shift provides competitive advantages for producers in politically stable jurisdictions with established infrastructure and predictable regulatory environments.

Technology Integration in Mining Operations

Advanced mining technologies including automation, AI-driven optimisation, and data analytics provide competitive advantages extending beyond traditional cost metrics. These capabilities become increasingly valuable as ore grades decline and operational complexity increases.

Technology Adoption Impact:

- Operational efficiency: 15-25% productivity improvements through automation

- Safety performance: Enhanced through remote operations and predictive maintenance

- Environmental compliance: Meeting increasingly stringent standards through monitoring systems

- Resource optimisation: Data-driven decision making for extraction efficiency

Investment Implications and Strategic Considerations

Market Structure Evolution

The copper market evolution from cyclical commodity to strategic resource creates investment opportunities that extend beyond traditional commodity exposure. This transformation requires analytical frameworks incorporating technology adoption, policy implementation, and infrastructure development alongside conventional supply-demand analysis.

Despite forecasts indicating a global copper surplus of 500,000 tonnes, the concentration of surplus inventory in US markets rather than global distribution creates regional supply tensions. Financial analysts project copper prices could advance deeper into uncharted territory as trade dynamics continue draining global inventory pools.

Strategic Positioning for 2025-2026

Current market dynamics suggest the supply squeeze will intensify through early 2026 as inventory redistribution effects combine with ongoing production challenges. The copper price surge on global supply squeeze creates compelling opportunities for investors positioned in quality Australian copper producers with established operations and development projects.

Investment Focus Areas:

- Established producers with diversified asset bases providing operational stability

- Development-stage projects in stable jurisdictions offering growth exposure

- Technology-integrated operations demonstrating operational efficiency advantages

- Geographic positioning benefiting from supply chain regionalisation trends

Market participants should monitor processing capacity utilisation, treatment charge trends, and inventory distribution patterns as key indicators of sustained pricing pressure. The combination of supply-side constraints, demand transformation, and geopolitical positioning creates a compelling fundamental backdrop for copper exposure through quality Australian mining operations positioned to capitalise on these structural market changes.

Seeking Exposure to the Next Big ASX Copper Discovery?

Discovery Alert's proprietary Discovery IQ model provides instant alerts on significant copper and mineral discoveries across the ASX, helping investors capitalise on major announcements before the broader market reacts. Begin your 30-day free trial today to position yourself ahead of the structural copper shortage and secure access to actionable investment opportunities as they emerge.