The regulatory environment surrounding Mexico's mining sector has become a determining factor in international capital allocation decisions, particularly as regulatory speed to unlock grupo méxico investments becomes increasingly critical for maintaining competitiveness in global commodity markets. Large-scale mining operations increasingly concentrate their capital allocation strategies around jurisdictions offering predictable regulatory frameworks and streamlined approval processes. The global competition for mining investment has intensified as commodity demand surges, particularly for materials essential to energy transition technologies.

Investment decisions worth billions of dollars now pivot on regulatory efficiency metrics, environmental compliance timelines, and government agency coordination capabilities. Mexico's mining sector stands at a critical inflection point where regulatory processing speeds directly influence international competitiveness and capital deployment strategies. Furthermore, the relationship between administrative efficiency and investment attraction has become paramount as mining conglomerates evaluate portfolio diversification opportunities across Latin America.

Current Regulatory Framework Challenges in Mexican Mining

Mexico's mining investment landscape faces significant structural challenges rooted in complex regulatory coordination requirements and extended approval timelines. Environmental impact assessment processes under SEMARNAT (Secretaría de Medio Ambiente y Recursos Naturales) jurisdiction can extend beyond traditional industry benchmarks, creating substantial opportunity costs for large-scale mining operations.

The regulatory architecture requires coordination between multiple government agencies, including SEMARNAT for environmental assessments, CONAGUA (Comisión Nacional del Agua) for water-related permits, and various state-level authorities for local compliance requirements. This multi-agency approach, while comprehensive from an environmental protection standpoint, creates sequential dependency chains that compound project development timelines.

Critical Bottlenecks in the Current System:

• Environmental impact assessment documentation requirements often exceed 1,000 pages for major projects

• Inter-agency communication protocols lack standardised digital platforms

• Community consultation processes operate without unified timeline frameworks

• Technical review capacity constraints limit simultaneous project evaluations

• Appeals and revision cycles can extend approval processes indefinitely

Social licence requirements, while essential for sustainable mining development, lack standardised implementation protocols across different regions and Indigenous communities. The Free, Prior and Informed Consent (FPIC) framework, stemming from Mexico's ratification of ILO Convention 169 in 1990, creates necessary but complex consultation requirements that vary significantly by geographic location and community characteristics.

Technical Resource Limitations Within Regulatory Agencies

Government agencies responsible for mining project evaluations face significant capacity constraints that directly impact processing efficiency. SEMARNAT's environmental review departments manage increasing project volumes without proportional increases in technical staff or budget allocations. This resource imbalance creates systematic delays that affect the entire sector's investment attractiveness.

CONAGUA's water permit evaluation processes face similar constraints, particularly in water-scarce mining regions where detailed hydrological studies require extensive technical review. In addition, the agency must balance mining sector water requirements against agricultural, municipal, and industrial demands, creating complex approval scenarios.

The technical complexity of modern mining operations, including advanced extraction technologies, environmental monitoring systems, and mine closure planning, requires specialised expertise that may not be readily available within government review teams. Consequently, this expertise gap can extend technical evaluation periods and increase the likelihood of revision requests.

Economic Impact Analysis of Regulatory Delays

Extended regulatory approval timelines create measurable economic consequences that extend beyond individual mining projects. Capital costs escalate significantly during delay periods, as equipment procurement, contractor agreements, and financing arrangements face inflationary pressures and market volatility.

Cost Structure Impact of Extended Approval Timelines:

| Delay Duration | Direct Capital Impact | Financing Costs | Market Opportunity Loss |

|---|---|---|---|

| 6 months | $25-75M equipment escalation | $15-30M carrying costs | $100-200M production value |

| 12 months | $75-150M project escalation | $40-80M financing impacts | $300-500M revenue loss |

| 18+ months | $200-400M comprehensive costs | $100-200M financial restructuring | $800M+ market position loss |

Large mining conglomerates factor regulatory timeline uncertainty into their risk assessment models, often applying discount factors to Mexican projects that reduce their comparative attractiveness against operations in jurisdictions with more predictable approval processes. However, recent mining permitting insights suggest that strategic approaches to regulatory navigation can significantly mitigate these risks.

The opportunity cost extends beyond individual project economics to broader portfolio management strategies. For instance, mining companies with global operations may prioritise development capital toward jurisdictions offering faster regulatory certainty, particularly during periods of favourable commodity pricing cycles.

Supply Chain Integration Complications

Regulatory delays disrupt supply chain integration planning, particularly relevant as North American manufacturing increasingly seeks nearshored mineral supplies for electric vehicle and renewable energy technologies. Mexico's geographic advantages for serving U.S. and Canadian markets become diminished when regulatory unpredictability prevents reliable production timeline commitments.

Mining equipment suppliers, specialised contractors, and engineering firms factor regulatory uncertainty into their project bids, often adding premium pricing to compensate for schedule risks. This creates cascading cost impacts that reduce overall project economics and competitive positioning within the global mining landscape.

International Competitiveness Benchmarking

Comparative analysis of mining regulatory frameworks across major Latin American jurisdictions reveals significant performance disparities that influence investment allocation decisions. Chile's integrated environmental assessment system and Peru's streamlined permitting protocols offer reference points for potential reform approaches.

Australia's Environmental Protection and Biodiversity Conservation Act (EPBC Act) framework demonstrates how environmental rigour can coexist with processing efficiency through coordinated federal-state mechanisms and early stakeholder engagement protocols.

Regional Processing Timeline Comparisons:

• Australian Model: Coordinated federal assessment with state-level implementation reduces duplicative reviews

• Canadian Framework: Impact Assessment Act (2019) emphasises early engagement to identify issues before formal submission

• Chilean Approach: Integrated environmental evaluation through single-agency coordination

• Peruvian System: Risk-based assessment categories enabling expedited review for lower-impact projects

These international examples demonstrate that environmental protection standards need not compromise processing efficiency when supported by appropriate institutional frameworks and technological integration. Furthermore, the ongoing mining industry evolution shows that digital transformation and automation can enhance both efficiency and environmental compliance.

Technology Integration Opportunities in Regulatory Processes

Digital transformation of regulatory processes offers substantial opportunities for timeline reduction without compromising environmental protection standards. Real-time environmental monitoring systems, drone-based surveying technologies, and automated compliance reporting platforms can significantly enhance review efficiency.

Blockchain-based documentation systems could provide immutable records of environmental compliance data, reducing verification requirements during regulatory reviews. Geographic Information System (GIS) integration enables more sophisticated environmental impact modelling and faster technical evaluations.

Machine learning algorithms applied to historical project data could identify potential compliance issues early in the review process, enabling proactive resolution rather than reactive corrections that extend approval timelines.

Strategic Implications for Major Mining Operations

Regulatory efficiency improvements would fundamentally alter the investment calculus for major mining conglomerates evaluating Mexican opportunities. The implementation of regulatory speed to unlock grupo méxico investments has become a key consideration as the nation's largest mining operators publicly indicate that regulatory predictability significantly influences expansion investment decisions.

Capital Allocation Framework Adjustments:

• Project NPV Sensitivity: Regulatory timeline reductions of 30-50% can improve project net present values by 15-25%

• Portfolio Risk Management: Faster permitting enables simultaneous project development, reducing concentration risk

• Market Timing Optimisation: Predictable development cycles allow better alignment with commodity price cycles

• Financing Structure Benefits: Reduced regulatory uncertainty improves debt financing terms and equity investment attractiveness

Mining companies increasingly incorporate regulatory efficiency metrics into their jurisdiction selection criteria, often weighting approval predictability equally with geological potential and infrastructure accessibility.

What Impact Do Processing Delays Have on Investment Decisions?

The integration of regulatory speed as a key investment criterion particularly impacts companies like Grupo México, which maintains extensive Mexican operations while evaluating expansion opportunities across Latin America. Regulatory efficiency improvements could unlock significant capital deployment for modernisation projects, capacity expansions, and new mine development initiatives.

International mining conglomerates evaluating Mexican market entry often benchmark regulatory frameworks against their existing operations in other jurisdictions. Competitive regulatory processing could position Mexico more favourably against Chilean, Peruvian, and Brazilian alternatives for major investment decisions.

Advanced mining technologies, including automated extraction systems and sophisticated environmental monitoring platforms, require substantial capital investments that become more economically viable when regulatory approval timelines provide greater certainty for return on investment calculations.

Environmental Compliance Integration with Processing Efficiency

Regulatory efficiency improvements need not compromise environmental protection standards when properly structured around technological enhancement and process optimisation. Advanced environmental monitoring systems can provide real-time compliance verification, potentially reducing post-approval oversight requirements while maintaining environmental protection standards.

Contemporary mining operations increasingly deploy sophisticated environmental management systems that continuously monitor air quality, water usage, soil conditions, and biodiversity impacts. These systems generate comprehensive data streams that can support more efficient regulatory review processes.

Technology-Enhanced Environmental Management:

• Remote Sensing Integration: Satellite and drone monitoring provides continuous environmental compliance verification

• Automated Reporting Systems: Real-time data transmission to regulatory agencies reduces manual reporting requirements

• Predictive Environmental Modelling: Advanced algorithms identify potential environmental risks before they manifest

• Blockchain Documentation: Immutable compliance records enhance transparency and reduce verification costs

Indigenous consultation processes can benefit from digital platforms that facilitate communication, document sharing, and consensus building while maintaining cultural sensitivity and legal compliance with FPIC requirements.

Water Resource Management in Mining Regulatory Frameworks

Water permit approvals represent a critical component of mining project regulatory timelines, particularly in Mexico's arid mining regions where water scarcity creates complex allocation decisions. CONAGUA's evaluation processes must balance mining sector requirements against agricultural, municipal, and environmental needs.

Advanced water recycling technologies, closed-loop processing systems, and desalination capabilities can address water scarcity concerns while potentially expediting permit approvals by demonstrating reduced environmental impact. However, mining operations implementing these technologies may qualify for expedited regulatory review categories.

Regional water availability studies, when conducted collaboratively between mining companies and regulatory agencies, can identify sustainable water sourcing strategies that support both project approval and long-term environmental protection objectives.

Economic Multiplier Effects of Regulatory Reform

Regulatory efficiency improvements generate substantial economic multiplier effects extending beyond direct mining sector impacts. Infrastructure development, equipment supply chains, specialised services, and regional economic development all benefit from increased mining investment predictability.

Regional Economic Impact Categories:

• Direct Employment: Large mining projects typically create 1,500-3,000 direct positions during operational phases

• Indirect Employment: Supply chain activation generates 2-4 additional jobs per direct mining position

• Tax Revenue Generation: Mining operations contribute federal, state, and municipal tax revenues across multiple categories

• Infrastructure Development: Mining projects catalyse transportation, energy, and telecommunications infrastructure investments

• Technology Transfer: Advanced mining operations introduce sophisticated technologies that benefit broader regional industries

The economic benefits extend to equipment suppliers, engineering contractors, logistics providers, and financial services companies that support mining operations. Consequently, regulatory certainty enables these supporting industries to make corresponding investment commitments.

Supply Chain Integration with North American Manufacturing

Mexico's strategic geographic position for serving North American manufacturing supply chains becomes enhanced when regulatory predictability enables reliable mineral supply commitments. Electric vehicle manufacturers increasingly prioritise supply chain security and sustainability, creating opportunities for Mexican mining operations meeting these criteria.

Energy transition minerals, essential for electric vehicle manufacturing and renewable energy infrastructure, represent a particular opportunity area where regulatory efficiency could unlock substantial investment in capacity expansion and modernisation projects.

The USMCA trade framework provides preferential access for Mexican minerals serving North American manufacturing, but these advantages require reliable production schedules supported by predictable regulatory approval processes.

Policy Reform Pathways and Implementation Strategies

Regulatory reform implementation requires careful balance between processing efficiency improvements and environmental protection maintenance. Successful reform models from other jurisdictions demonstrate that environmental rigour and administrative efficiency can coexist through appropriate institutional design and technological integration.

Potential Reform Framework Components:

• Single-Window Processing: Coordinated multi-agency reviews through unified digital platforms

• Risk-Based Assessment Categories: Expedited processes for projects meeting specific environmental and technical criteria

• Early Stakeholder Engagement: Structured consultation processes identifying issues before formal review periods

• Performance-Based Oversight: Reduced monitoring requirements for operations demonstrating consistent compliance

• Technology Integration: Digital documentation, automated reporting, and real-time monitoring capabilities

Reform implementation should incorporate lessons learned from successful international examples while addressing Mexico-specific considerations including Indigenous consultation requirements, water scarcity challenges, and regional development priorities. Furthermore, data-driven mining operations are increasingly demonstrating how advanced analytics can support both operational efficiency and regulatory compliance.

Regulatory Capacity Building Requirements

Sustainable regulatory efficiency improvements require corresponding investments in government agency capacity, including technical training, technology infrastructure, and staffing adjustments. SEMARNAT and CONAGUA would benefit from specialised training programmes covering advanced mining technologies and environmental monitoring systems.

Digital platform development for regulatory processing requires initial capital investment but generates long-term efficiency gains through automated workflow management, standardised documentation requirements, and improved inter-agency communication capabilities.

International technical cooperation agreements with countries demonstrating successful regulatory frameworks could provide knowledge transfer opportunities and best practice implementation guidance.

Long-Term Strategic Benefits for Mexican Economic Development

Regulatory efficiency improvements position Mexico for enhanced competitiveness in global mining investment attraction while supporting broader economic development objectives including regional development, technology transfer, and export diversification.

Strategic Economic Development Outcomes:

• Export Competitiveness: Enhanced position in global commodity markets through reduced production costs

• Technology Leadership: Advanced mining operations introduce cutting-edge technologies supporting broader industrial development

• Regional Development: Mining investments catalyse infrastructure and economic development in historically underserved regions

• Energy Transition Support: Critical mineral production supporting global clean energy technology deployment

• North American Integration: Strengthened position as reliable supplier for North American manufacturing supply chains

The energy transition creates unprecedented demand for critical minerals including copper, lithium, silver, and rare earth elements. Mexico's geological endowments position the country for substantial participation in this global transformation when supported by efficient regulatory frameworks.

Integration with National Development Priorities

Mining sector development through regulatory efficiency improvements aligns with broader national objectives including infrastructure modernisation, regional economic development, and technology advancement. Mining operations often serve as catalysts for transportation, energy, and telecommunications infrastructure development in remote regions.

Educational partnerships between mining companies and Mexican universities can develop specialised technical expertise supporting both operational requirements and regulatory review capabilities within government agencies.

Environmental protection objectives remain paramount, but advanced mining technologies increasingly demonstrate that environmental stewardship and economic development can advance simultaneously through appropriate technological integration and regulatory oversight.

Implementation Considerations and Risk Management

Successful regulatory reform requires careful attention to implementation sequencing, stakeholder engagement, and performance monitoring. Reform initiatives should incorporate pilot programmes testing specific efficiency improvements while maintaining environmental protection standards.

Critical Success Factors:

• Stakeholder Alignment: Mining industry, environmental groups, Indigenous communities, and government agencies must participate in reform design

• Performance Metrics: Clear efficiency and environmental protection indicators enable progress monitoring

• Technology Integration: Digital platforms and automated systems require user training and change management

• Resource Allocation: Government agencies require adequate funding for capacity building and system upgrades

• Continuous Improvement: Regular review and adjustment based on implementation experience and performance outcomes

Risk management protocols should address potential challenges including technology implementation difficulties, stakeholder resistance, and unintended environmental consequences.

Recent developments suggest that regulatory agencies are recognising the need for streamlined approval processes to maintain Mexico's competitive position in global mining investment markets. Additionally, the Mexican government's investment climate initiatives indicate growing awareness of the importance of efficient regulatory frameworks for attracting international capital.

"Investment Perspective: Regulatory efficiency improvements represent a critical catalyst for unlocking Mexico's substantial mining sector potential while maintaining environmental protection standards essential for sustainable development and social licence preservation."

Disclaimer: This analysis presents scenario-based projections and comparative assessments for informational purposes. Actual regulatory reform outcomes depend on numerous variables including political priorities, budget allocations, stakeholder engagement, and implementation effectiveness. Investment decisions should incorporate comprehensive due diligence and risk assessment procedures.

Looking to Capitalise on Mining Sector Regulatory Developments?

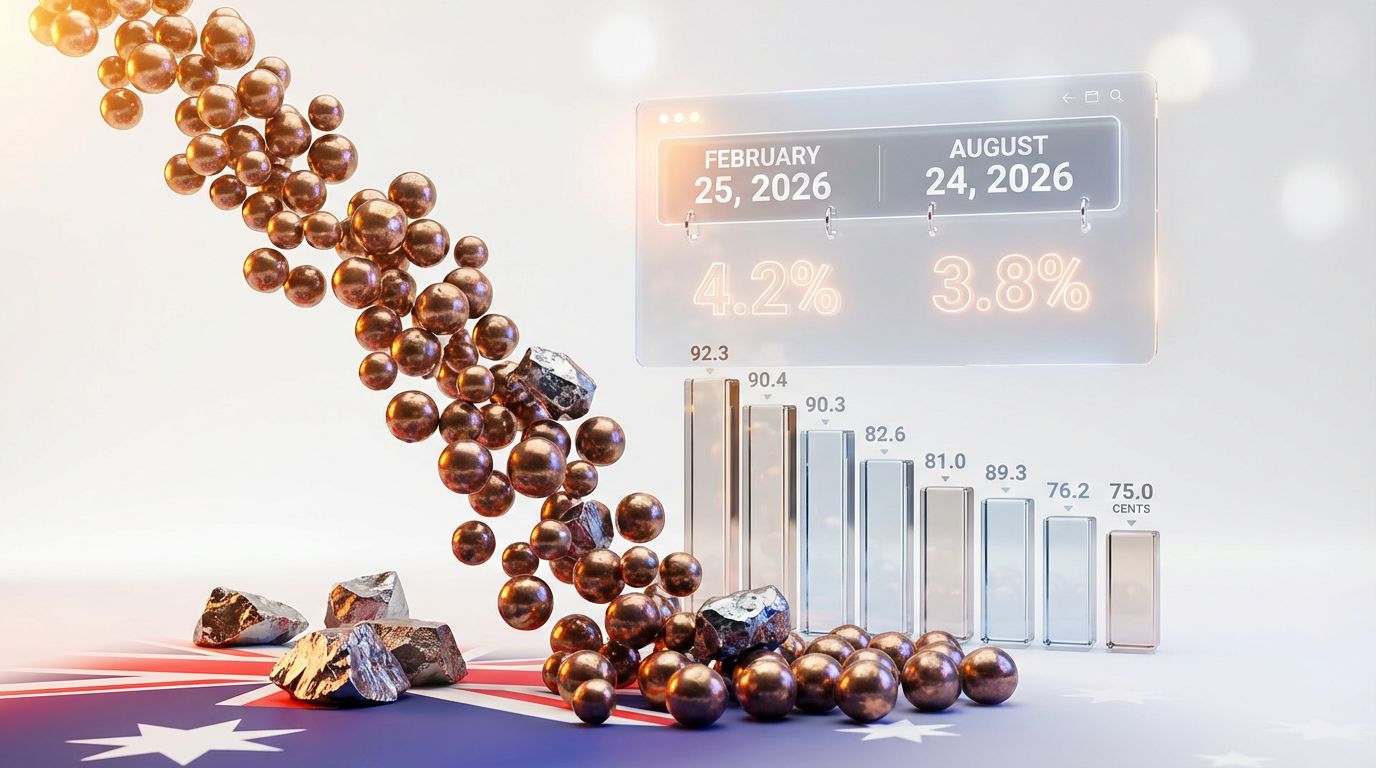

Discovery Alert's proprietary Discovery IQ model instantly identifies significant ASX mineral discoveries, helping investors spot opportunities as regulatory environments evolve globally and impact mining company valuations. Take advantage of actionable mining investment insights with a 30-day free trial to position yourself ahead of market movements driven by regulatory changes and policy developments.