What is Nickel and Why is it Important?

Nickel is the fifth-most common element on earth with a concentration of 80 parts per million in the earth's crust. Despite this relative abundance, economically viable nickel deposits are scarce and highly sought after. The earth's core consists mainly of a nickel-iron alloy, highlighting the element's fundamental importance to our planet's composition.

As a versatile transition metal, nickel possesses remarkable alloying properties, combining with most metals to increase hardness and durability. This versatility makes it indispensable in numerous industrial applications.

Nickel's key physical properties make it extraordinarily valuable:

- High melting point (1453°C) and boiling point (2730°C)

- Exceptional corrosion and oxidation resistance

- High ductility due to its face-centered cubic crystal structure

- Magnetic properties at room temperature

- Complete recyclability without quality degradation

Perhaps most impressive is nickel's sustainability profile—approximately 61% of all mined nickel remains in productive use today, up from 57% just a few years ago. This remarkable statistic stems from nickel products' extraordinarily long lifecycles and efficient recycling systems. The global nickel recycling rate has reached an impressive 72% in 2024, demonstrating significant improvement from the 68% recorded in 2010.

The nickel alloy market has expanded substantially, reaching a valuation of $58.3 billion in 2024, representing a 4.1% CAGR since 2020. Beyond traditional industrial applications, nickel's antimicrobial properties have made it essential in medical equipment manufacturing, particularly in hospital environments where pathogen control is critical.

What Are the Different Grades of Nickel?

Nickel is categorized into two primary grades, each with distinct characteristics, production methods, and applications:

High-Grade Nickel (Class 1):

Class 1 nickel contains at least 99.8% pure nickel content and serves premium applications. It's produced primarily from sulfide ores (70%) and limonite ores (30%), through sophisticated refining processes. This grade appears in various forms including cathodes, briquettes, carbonyl nickel, and compounds.

The main Class 1 producers as of 2020 included Nornickel, Jinchuan, Glencore, Vale, BHP, and Sumitomo Metal Mining. However, production dynamics have shifted notably in recent years. According to industry experts, "High-grade nickel demand will outstrip supply by 15% annually through 2030" (McKinsey Metals Report).

Production costs for Class 1 nickel range from $10,500 to $15,000 per ton, significantly higher than Class 2 alternatives. This premium reflects the intensive processing requirements and higher purity levels.

Low-Grade Nickel (Class 2):

Class 2 nickel, with less than 99.8% nickel content, is produced predominantly from saprolite and limonite ores. Its natural iron content makes it particularly suitable for the stainless steel industry, which remains the largest consumer of nickel globally.

Common forms include ferronickel pricing transformation, nickel pig iron (NPI), and nickel oxide. Indonesia has dramatically increased its Class 2 nickel production capacity, now accounting for 42% of global output—a substantial increase from 30% in 2020. Key producers include Chinese and Indonesian NPI smelters, along with ferronickel producers like Eramet, POSCO, Anglo American, Solway, and South32.

The cost structure for Class 2 production is substantially lower, typically ranging from $7,800 to $11,200 per ton, explaining its dominance in price-sensitive applications like stainless steel production.

How is Nickel Mined and Refined?

Nickel extraction and processing vary significantly depending on the ore type, with two predominant approaches:

Mining Methods:

Lateritic ore deposits, found primarily in tropical regions, are mined from various depths using specialized earth-moving equipment. These surface mining operations often involve extensive environmental management systems due to their larger physical footprint.

Sulfidic ore, typically found alongside copper deposits, requires underground mining techniques. These operations are more capital-intensive but often produce higher-grade ore with lower processing requirements.

Refining Process:

Lateritic ore processing begins with conventional roasting to remove moisture content, followed by reduction and smelting. The adoption of High Pressure Acid Leach (HPAL) technology has revolutionized lateritic ore processing, with implementation rates increasing 300% since 2020. This technology enables more efficient nickel extraction from lower-grade sources.

Sulfidic ore undergoes flash and electric smelting processes, followed by converting procedures to separate nickel from other metals. The final refining stage achieves approximately 95% purity through fluid bed roasting.

Modern electrical cell refining removes remaining impurities to produce high-quality nickel suitable for premium applications. Recent technological innovations include automated sorting systems that have improved ore recovery rates by 18%, significantly enhancing mining economics.

Global Production:

Indonesia led global mine production in 2020 and has since strengthened its position through aggressive capacity expansion. Other major producers include the Philippines, Russia, New Caledonia, and Australia, each with distinct advantages in either ore quality, processing capability, or logistical infrastructure.

What Drives Nickel Demand and Supply?

The nickel market is characterized by complex demand drivers and supply constraints that create significant trading opportunities:

Demand Drivers:

Electric vehicles (EVs) and battery technology represent the fastest-growing segment for nickel demand. EV batteries now consume approximately 15% of global nickel production—more than double the 7% figure from just a few years ago. Tesla's Nevada Gigafactory exemplifies this trend, having transitioned to 90% nickel-based battery chemistries for their high-performance vehicles.

The nickel sulfate market, critical for battery applications, is projected to grow at an exceptional 25.7% CAGR through 2030, far outpacing traditional nickel markets.

Other significant demand factors include:

- Increasing electricity utilization in developing economies

- Rising stainless steel adoption across industrial sectors

- Construction sector growth, particularly in Asia

- Consumer spending on household appliances

- Expanding renewable energy applications

Supply Factors:

Nickel supply remains geographically concentrated, creating inherent market vulnerabilities:

- Limited mining locations create dependency on relatively few countries

- Government regulations and international tensions frequently disrupt supply chains

- Recycling contributes significantly to market balance, with a global 72% end-of-life recycling rate

Market Statistics:

The global nickel market is expected to grow at a CAGR of approximately 5% during 2021-2026, though specific segments like battery-grade nickel are expanding much faster. China remains the world's leading importer of nickel and nickel products, though its domestic NPI production has declined as Indonesia captures more of the value chain.

Indonesia, Russia, and Canada maintain their positions as top exporters, with Indonesia's market share expanding dramatically through strategic downstream investments.

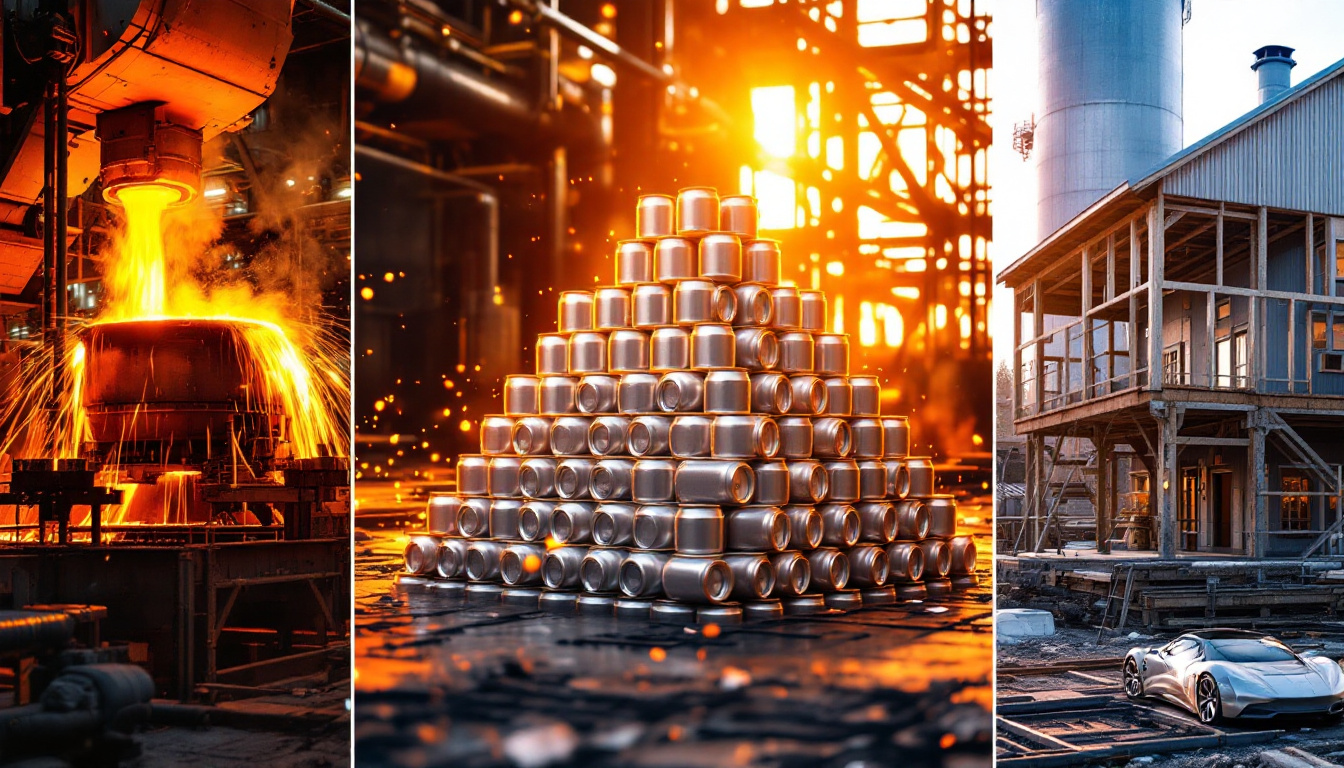

How is Nickel Used in Industry?

Nickel's versatile properties make it integral across numerous industrial applications, with a diverse distribution across sectors:

First Use of Nickel:

- 72% – Stainless steel production, where nickel enhances corrosion resistance

- 7% – Plating applications for decorative and functional surfaces

- 7% – Alloy steels & castings for specialized engineering applications

- 7% – Batteries, primarily for EVs and energy storage systems

- 6% – Nickel-base & copper-base alloys for extreme environments

- 1% – Other specialized applications including catalysts and coinage

End Use of Nickel:

- 33% – Engineering applications requiring durability and precision

- 23% – Metal goods for consumer and industrial markets

- 16% – Transportation sector, including aerospace and automotive

- 14% – Building & construction for structural and aesthetic elements

- 9% – Electronics, particularly in connectors and components

- 5% – Other diverse applications across industrial segments

This distribution illustrates nickel's remarkable versatility, spanning from everyday consumer products to critical infrastructure and cutting-edge technologies. The metal's role in driving the clean energy transition through battery technology represents a structural shift in consumption patterns that traders must monitor closely.

What Makes Nickel Environmentally Important?

Nickel stands out among industrial metals for its exceptional environmental credentials and circular economy potential:

Nickel is fully recyclable without quality degradation, serving as a model material for circular economy principles. This infinite recyclability significantly reduces the need for primary extraction, conserving natural resources and minimizing environmental impact.

Global nickel-related CO2 emissions have been reduced by approximately one-third thanks to efficient recycling systems. As climate concerns intensify, this carbon advantage has translated into tangible market premiums. The emergence of a "green nickel premium"—approximately $200 per ton surcharge for ESG-compliant material—demonstrates the market's willingness to value sustainable production.

The EU Nickel Sustainability Standard, implemented in 2024, now requires 40% recycled content in certain applications, creating regulatory pressure for enhanced sustainability. This trend is spreading globally as consumers and investors increasingly favor environmentally responsible materials.

Leading producers have responded aggressively to sustainability challenges, with three major miners achieving carbon-neutral nickel production in 2024 through a combination of renewable energy integration, process efficiency, and carbon offsets.

Sustainable factors increasingly scrutinized in nickel production include:

- Water management across the processing chain

- Tailings management using advanced containment systems

- Biodiversity protection in mining regions

- Energy efficiency optimization

- Carbon footprint reduction initiatives

- Community relations and social license to operate

The industry's proactive approach to decarbonisation efforts in mining has positioned nickel favorably compared to competing materials with higher environmental footprints or limited recyclability.

How to Trade Nickel on the London Metal Exchange?

The London Metal Exchange (LME) serves as the primary global platform for nickel trading, offering standardized futures contracts that facilitate price discovery and risk management:

LME Nickel Futures Contract Specifications:

- Product symbol: NI

- Contract size: 6 metric tons

- Price quotation: U.S. Dollars and Cents per ton

- Contract months: Monthly out to 27 months

- Tick size: $1.00 per ton

Trading activity on the LME has intensified significantly, with 2024 average daily nickel contracts reaching 15,742—representing a 22% increase from 2022 levels. Algorithmic trading now accounts for approximately 38% of LME nickel volume, highlighting the increasing sophistication of market participants.

Price Influencing Factors:

Successful nickel traders must monitor several key factors that drive price movements:

- Global economic growth, especially in manufacturing-intensive Asian economies

- Stainless steel demand fluctuations across key consuming sectors

- Globalization effects on integrated supply chains

- Government regulations and international tensions, particularly involving Indonesia

- Limited mining locations creating potential supply bottlenecks

- Potential substitute materials that become economically viable at high price points

According to the LME Market Report, "Nickel's 3-month volatility index remains 23% higher than copper," reflecting the metal's susceptibility to rapid price swings based on supply disruptions or demand shocks. This volatility creates both risks and opportunities for traders with sufficient market knowledge and risk management capabilities.

How Do You Become a Nickel Trader?

Entering the nickel trading profession requires a specialized skill set and comprehensive market knowledge:

Required Skills:

- Ability to work effectively in fast-moving market environments

- Quick and careful decision-making capabilities under pressure

- Building and maintaining customer relationships across the value chain

- Staying continuously informed about market events and developments

- Understanding physical commodity transport logistics and constraints

- Knowledge of dry bulk shipping dynamics and pricing structures

The demand for how to become a nickel trader has grown substantially, with related job opportunities increasing 41% since 2020. Compensation reflects this specialized knowledge, with average compensation packages reaching $127,000 base salary plus approximately 35% in performance bonuses as of 2024.

Career Path:

Aspiring nickel traders should pursue a structured development approach:

- Complete specialized courses in shipping and commodity operations

- Consider the CFA Institute's Commodity Specialist certification program

- Stay updated with daily market reports and industry publications

- Develop comprehensive understanding of the entire nickel value chain

- Build expertise in both physical and financial aspects of trading

Experienced traders emphasize the importance of understanding production economics across different regions and processes. The ability to evaluate cost structures enables traders to anticipate market movements based on producer behavior at various price points—a key competitive advantage in this specialized market.

Is Nickel Trading a Sustainable Career for the Future?

The prospects for nickel trading careers appear exceptionally promising, driven by structural market growth and increasing complexity:

Nickel demand is projected to expand significantly due to several converging factors:

- Growing infrastructure projects across developing economies

- Accelerating EV and battery technology adoption worldwide

- Nickel's irreplaceable role in critical applications like aerospace alloys

- Increasing price volatility attracting more sophisticated trading firms

The emergence of specialized market segments, particularly battery-grade nickel, has created new trading opportunities requiring specialized knowledge. Tesla's closed-loop battery recycling initiative exemplifies the type of circular economy model that is creating new market dynamics traders must understand.

Future trends that will shape nickel trading careers include:

- Development of high-density nickel-based battery chemistries

- Green mining procedures and expanding ESG initiatives

- Advanced recycling technologies improving secondary supply economics

- Increasing infrastructure investments across emerging markets

- Potential seabed mining operations, which could supply approximately 15% of demand by 2035 (though this remains controversial)

For traders willing to develop specialized expertise and adapt to evolving market structures, nickel trading offers exceptional career sustainability with growing demand for qualified professionals across physical and financial trading platforms.

Who Are the Key Players in the Nickel Industry?

The nickel industry landscape continues to evolve, with significant consolidation and geographic shifts in recent years:

Leading producers by volume in 2024:

- Tsingshan Holding Group (China) – 450,000 tonnes

- Norilsk Nickel (Russia) – 410,000 tonnes

- Vale (Brazil) – 380,000 tonnes

- Glencore (Switzerland)

- Jinchuan Group (China)

- BHP (Australia)

- Sumitomo Metal Mining (Japan)

- Eramet (France)

Indonesia's policy-driven rise in the nickel value chain has dramatically reshaped the competitive landscape, with Indonesian production increasingly shifting from ore exports to refined products and even battery precursors.

The countries with the largest nickel reserves remain:

- Indonesia – With massive laterite deposits

- Australia – Hosting world-class sulfide resources

- Brazil – Containing significant undeveloped potential

- Russia – With Norilsk's exceptional high-grade deposits

- New Caledonia – Holding premium nickel resources

- Philippines – Maintaining substantial laterite reserves

M&A activity has accelerated as companies position for the energy transition, exemplified by BHP's acquisition of OZ Minerals to strengthen its exposure to future-facing commodities including nickel.

The Cobalt Institute's nickel-cobalt price correlation study has highlighted the increasing interdependence of battery metals markets, creating new hedging challenges and opportunities for sophisticated traders.

Frequently Asked Questions About Nickel Trading

What qualifications do you need to become a nickel trader?

While there's no single mandatory qualification, successful nickel traders typically combine a financial or economics background with specialized commodity training. Many employers value the CFA Institute's Commodity Specialist certification, and practical experience in physical commodity logistics provides significant advantages when transitioning to trading roles.

How volatile is the nickel market compared to other metals?

Nickel consistently demonstrates higher price volatility than base metals like copper and aluminum. The LME's volatility metrics show nickel's 3-month volatility index remaining 23% higher than copper. This volatility stems from concentrated production, periodic supply disruptions, and the metal's strategic importance to both traditional and emerging technologies.

What are the main risks in nickel trading?

Key risks include regulatory changes in major producing countries (particularly Indonesia), rapid technological shifts in battery chemistry, logistics disruptions affecting physical delivery, and counterparty exposure in forward contracts. Successful traders employ sophisticated risk management techniques to mitigate these factors.

How does the growth of electric vehicles impact nickel trading?

EV manufacturing has fundamentally altered nickel market dynamics by creating premium demand for high-purity Class 1 nickel. Battery-grade nickel now commands significant premiums over standard LME material. Traders must navigate distinct markets for battery-grade versus standard nickel, requiring deeper technical knowledge than traditional base metal trading.

What role does China play in the global nickel market?

China remains the dominant global commodities market consumer of nickel, though its role has evolved from primarily stainless steel production to increasingly sophisticated battery manufacturing. Chinese companies have aggressively invested in Indonesian production,

Want to Spot the Next Major Nickel Discovery?

Stay ahead of the market with Discovery Alert's proprietary Discovery IQ model, which instantly notifies you of significant ASX nickel discoveries as they happen. Explore why major mineral discoveries lead to substantial market returns by visiting our dedicated discoveries page and begin your 30-day free trial today.